Professional Documents

Culture Documents

Types of Saving Accounts PAIR & SHARE

Uploaded by

diya pCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Types of Saving Accounts PAIR & SHARE

Uploaded by

diya pCopyright:

Available Formats

NGPF Activity Bank

Saving

COMPARE: Types of Savings Accounts

Part I: Research Savings Accounts

1. TEAMWORK: Create small teams of 4-6 students per group. Your teacher will assign you one of the four types of savings accounts to research:

a. (1) Traditional Savings Account,

b. (2) Online Savings Account

c. (3) Certificate of Deposit (CD),

d. (4) Money Market Account

With your teammates, conduct online research on your assigned savings account type. Complete each field below.

Type of Saving Account: Traditional Savings Accounts

Describe how it works Typical Interest Rate: Typical Minimum Balance:

0.01% - 0.25% Varies, can be zero, but usually $25-$100

Money put into an account, that earns interest.

The banks make more money so they give you

interest. Used for infrequent transactions.

Can you add to balance regularly? Is it FDIC insured?

Yes Yes

Can you write checks / pay bills directly Is your money “stuck” for a set time?

from it? No, but there may be monthly transaction

No limits

www.ngpf.org Last updated: 5/6/20

1

2. SHARE OUT: After each group has finished their research, go around the classroom and each team will share their research from each savings account type.

Assign each teammate in your group different parts of your research to share to the class. When another group is presenting on a savings account type that

you did NOT research with your team, follow along with their presentation by completing the main points in the table below.

Can you Write

Typically Money

Type of Typical Add to Is it FDIC checks /

Description Minimum stuck for a

Account Interest Rate balance insured? pay bills

Balance set time?

regularly? directly?

Traditional

Savings

Account

Online Functions as a traditional savings account, but has an No, but

Savings entirely online platform. there may

Yes, No check,

Account .5% (Chime) be monthly

none electronic YES you can

.1-.4% transaction

transfers pay bills.

limits.

Certificate Low-risk savings tool with higher interest rates than Currently: Ranges from Yes, CD’s

of Deposit savings accounts but you have to keep your money in .2%-.4% $500-$1000. last 3

No Yes No

that account for a period of time without a penalty 2019: Some even months-5

2.5%-3% $10000. years

Money A hybrid between a checking and savings account - Currently: Limited

Varies, can be

Market Higher interest rate, comes with limited transactions .01%-.08% check and

zero, but usually Yes Yes No

Account with some checking features. 2019: debit card

$100

1%-1.5% features.

www.ngpf.org Last updated: 5/6/20

2

Part II: Research A Bank or Credit Union

Now that you know the basics of how these four types of savings accounts work, let’s take a closer look at how these accounts compare

against each other at your favorite bank or credit union. Select one bank or credit union (it can be one that you or your parents / guardians

currently use, or one that you are interested in learning more about). Then, research the bank or credit union’s options for savings

accounts. NOTE: If the bank offers multiple products in the same category (ex: two tiers of MMA or CDs at 10 different time intervals) just

record answers for ONE of the options.

3. What bank or credit union do you want to explore? Include the name, website link and indicate if this bank / credit union is an ONLINE or a TRADITIONAL

brick & mortar institution.

4. Research information for a savings account, a CD, and an MMA for this bank / credit union. Record your findings in the table below.

Savings Account CD MMA

Interest rate

Minimum

deposit or

balance

Fee

Time period for

your deposit

www.ngpf.org Last updated: 5/6/20

3

You might also like

- Julia Feldman - INTERACTIVE - How Much Will Your College Actually CostDocument2 pagesJulia Feldman - INTERACTIVE - How Much Will Your College Actually CostJulia FeldmanNo ratings yet

- RESEARCH: Person-to-Person Payments: NGPF Activity Bank CheckingDocument5 pagesRESEARCH: Person-to-Person Payments: NGPF Activity Bank CheckingSav Fields3No ratings yet

- 1098 T UWM 2017 PDFDocument2 pages1098 T UWM 2017 PDFsolrak9113No ratings yet

- Cars1dav 21i CCDocument25 pagesCars1dav 21i CCDavid CarsonNo ratings yet

- 2023 q1 Earnings Results PresentationDocument14 pages2023 q1 Earnings Results PresentationZerohedgeNo ratings yet

- COMPARE Types of Saving AccountsDocument5 pagesCOMPARE Types of Saving AccountsDustin DelkNo ratings yet

- Reconcilling AccountsDocument8 pagesReconcilling AccountsMaimai DuranoNo ratings yet

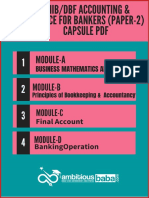

- JAIIB Paper 2 CAPSULE PDF Accounting Finance For BankersDocument168 pagesJAIIB Paper 2 CAPSULE PDF Accounting Finance For BankerspraveenampilliNo ratings yet

- Listening Log 1 (Banking Transaction)Document4 pagesListening Log 1 (Banking Transaction)Gitaaf AFNo ratings yet

- 07 Line-Of-CreditDocument8 pages07 Line-Of-Creditvijay sainiNo ratings yet

- Commercial Banking System: Services & InnovationsDocument19 pagesCommercial Banking System: Services & InnovationsbharatNo ratings yet

- Types of Bank Accounts and Check PartiesDocument5 pagesTypes of Bank Accounts and Check PartiesNelson B. Porcioncula Jr.No ratings yet

- How To Do Bank ReconciliationDocument5 pagesHow To Do Bank ReconciliationYassi CurtisNo ratings yet

- How To Do Bank ReconciliationDocument5 pagesHow To Do Bank ReconciliationYassi CurtisNo ratings yet

- English Learning Guide Competency 1 Unit 6: Financial Education Workshop 1 Centro de Servicios Financieros-CSFDocument11 pagesEnglish Learning Guide Competency 1 Unit 6: Financial Education Workshop 1 Centro de Servicios Financieros-CSFTatiana BolivarNo ratings yet

- GMoney Winter 2010Document2 pagesGMoney Winter 2010Peter MastersonNo ratings yet

- Money and Youth Module 13Document22 pagesMoney and Youth Module 13Jan JayNo ratings yet

- Normal Balance For AssetsDocument2 pagesNormal Balance For AssetsAshhyyNo ratings yet

- 4.1 [PPT] Time Value of MoneyDocument40 pages4.1 [PPT] Time Value of MoneyblueredashbirdsNo ratings yet

- BIFFPP-Step 6 CPA BermudaDocument11 pagesBIFFPP-Step 6 CPA BermudaRG-eviewerNo ratings yet

- David Bach Tam DiagramDocument1 pageDavid Bach Tam DiagramdeepanshugabbaNo ratings yet

- Theme: Detecting Accounting Errors: ACCOUNTING TERM: Transposition ErrorDocument7 pagesTheme: Detecting Accounting Errors: ACCOUNTING TERM: Transposition Errorashish8605No ratings yet

- Personal Finance For Mentors: 17 November 2015Document43 pagesPersonal Finance For Mentors: 17 November 2015MaryroseNo ratings yet

- CHP 1 and 2 BbaDocument73 pagesCHP 1 and 2 BbaBarkkha MakhijaNo ratings yet

- Preparing For The Next Normal FINALDocument16 pagesPreparing For The Next Normal FINALCarlos SilvaNo ratings yet

- Journal and LedgerDocument15 pagesJournal and LedgerTophe ProvidoNo ratings yet

- Bank Accounts ExplainedDocument23 pagesBank Accounts ExplainedShiella PimentelNo ratings yet

- Entrepreneurship Quarter 2: Module 8Document19 pagesEntrepreneurship Quarter 2: Module 8Adiel Seraphim100% (1)

- How To Save Money - 8 Simple Ways To Start Saving Money PDFDocument6 pagesHow To Save Money - 8 Simple Ways To Start Saving Money PDFMark ANo ratings yet

- CDRD Revised Tariff Guide 2020Document11 pagesCDRD Revised Tariff Guide 2020Atlas Microfinance LtdNo ratings yet

- P&L Balance and CFDocument13 pagesP&L Balance and CFAhmad Ibrahim Makki MarufNo ratings yet

- Accounting in A Nutshell 1: Accounts ReceivableDocument3 pagesAccounting in A Nutshell 1: Accounts ReceivableBusiness Expert PressNo ratings yet

- Calculate Your Financial RatiosDocument1 pageCalculate Your Financial RatiosJerry liuNo ratings yet

- Make your savings go further with FNB's affordable optionsDocument38 pagesMake your savings go further with FNB's affordable optionsmoveee2No ratings yet

- Chapter 3 Compelete Acct CycleDocument83 pagesChapter 3 Compelete Acct CycleSisay DeresaNo ratings yet

- ExcerptDocument10 pagesExcerptamytombix547No ratings yet

- Importance of Savings - Where To SaveDocument2 pagesImportance of Savings - Where To Saveykbharti101No ratings yet

- Bean Counter's Accounting and Bookkeeping "Cheat Sheet": Provided byDocument6 pagesBean Counter's Accounting and Bookkeeping "Cheat Sheet": Provided byJoannah SalamatNo ratings yet

- Learning Module In: Grade 11Document14 pagesLearning Module In: Grade 11Esvee TyNo ratings yet

- Chapter 4 AccountingDocument22 pagesChapter 4 AccountingChan Man SeongNo ratings yet

- David Bach Automatic Millionaire Starter KitDocument19 pagesDavid Bach Automatic Millionaire Starter KitKarolis KauneckasNo ratings yet

- Screenshot 2022-11-08 at 11.27.48 AMDocument1 pageScreenshot 2022-11-08 at 11.27.48 AMKyla LacadinNo ratings yet

- The Discovery Gold Transaction Account PDFDocument6 pagesThe Discovery Gold Transaction Account PDFJoshNo ratings yet

- EntrepreneurshipHandout Week 5Document6 pagesEntrepreneurshipHandout Week 5Pio GuiretNo ratings yet

- Personal Finance BudgetingDocument34 pagesPersonal Finance BudgetingDonne EstocadaNo ratings yet

- 10 BankingDocument33 pages10 BankingOak KittiratanakhunNo ratings yet

- Radical AccountingDocument13 pagesRadical AccountingHost_PaulNo ratings yet

- Accountancy MaterialDocument11 pagesAccountancy MaterialAfzal KuttyNo ratings yet

- Accounting Cycle: The 7 Steps ExplainedDocument3 pagesAccounting Cycle: The 7 Steps ExplainedDavid John MoralesNo ratings yet

- 7 Steps Budgeting Workbook FillableDocument14 pages7 Steps Budgeting Workbook FillableRaúl SalaverryNo ratings yet

- I Will Teach You To Be Rich by Ramit Sethi Book Summary PDFDocument8 pagesI Will Teach You To Be Rich by Ramit Sethi Book Summary PDFOnnoSaikatNo ratings yet

- Community project FI flowchart for r/singaporefiDocument1 pageCommunity project FI flowchart for r/singaporefiAlvin YeoNo ratings yet

- FICO Guide From ExperianDocument7 pagesFICO Guide From ExperianAlex Kazmarck100% (1)

- Finance - Unit 9 - Using MoneyDocument29 pagesFinance - Unit 9 - Using MoneyToàn NguyễnNo ratings yet

- General Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementDocument11 pagesGeneral Ledger Debits and Credits Normal Account Balances Journal Entries The Income Statementpri_dulkar4679No ratings yet

- C2 Bank ReconciliationDocument22 pagesC2 Bank ReconciliationKenzel lawasNo ratings yet

- Everyday Saver BarclaysDocument1 pageEveryday Saver BarclaysantonyNo ratings yet

- Checking Savings InvestmentsDocument25 pagesChecking Savings InvestmentsAlyssa SophiaNo ratings yet

- Desarrollo Guia 10Document16 pagesDesarrollo Guia 10Ibeth DahanaNo ratings yet

- Namma Kalvi Accountancy Unit 1 and 2 Sura Guide em 214853Document71 pagesNamma Kalvi Accountancy Unit 1 and 2 Sura Guide em 214853Aakaash C.K.100% (2)

- Combining PCR With IV Is A Clever Way of Viewing ItDocument17 pagesCombining PCR With IV Is A Clever Way of Viewing ItKamNo ratings yet

- The Pizza Theory of Business ValuationDocument3 pagesThe Pizza Theory of Business ValuationBharat SahniNo ratings yet

- RHB Growth and Income Focus Trust - ADocument65 pagesRHB Growth and Income Focus Trust - AHadi AdiNo ratings yet

- 07 RPB Vs CADocument2 pages07 RPB Vs CAArahbells100% (1)

- Hiew Min ChungDocument9 pagesHiew Min ChungChin Kuen YeiNo ratings yet

- Bailment and PledgeDocument9 pagesBailment and PledgeSaanvi LuniaNo ratings yet

- D - Salvatore Ch14 UneditedDocument46 pagesD - Salvatore Ch14 UneditedLihle SetiNo ratings yet

- Motilal OswalDocument49 pagesMotilal OswalsandeepNo ratings yet

- Fin Mar Prelim ReviewerDocument4 pagesFin Mar Prelim ReviewerGhillian Mae GuiangNo ratings yet

- Harrisburg Strong PlanDocument115 pagesHarrisburg Strong PlanPennLiveNo ratings yet

- Education Should Be FreeDocument6 pagesEducation Should Be Freefebty kuswantiNo ratings yet

- List AccountDocument6 pagesList AccountBerkah CahayaNo ratings yet

- TOP 5 TDI StrategiesDocument15 pagesTOP 5 TDI Strategiesramesh100% (4)

- 1.Management-Financial Literacy of Himachal Pradesh-Karan GuptaDocument14 pages1.Management-Financial Literacy of Himachal Pradesh-Karan GuptaImpact JournalsNo ratings yet

- This Study Resource Was: RequiredDocument2 pagesThis Study Resource Was: RequiredJean MaeNo ratings yet

- Ratio Tell A StoryDocument6 pagesRatio Tell A StoryHeru MuskitaNo ratings yet

- Api 2201Document13 pagesApi 2201Cesar Kv RangelNo ratings yet

- RAY Guidelines citywideSlum-freePlanning PDFDocument32 pagesRAY Guidelines citywideSlum-freePlanning PDFDanish JavedNo ratings yet

- BNZ FTR Quiz PDFDocument3 pagesBNZ FTR Quiz PDFDamanjot KaurNo ratings yet

- Etude Avolta-VC-MA-Tech-Trends-France-2022Document26 pagesEtude Avolta-VC-MA-Tech-Trends-France-2022Thibaud CombeNo ratings yet

- Understanding The BCG Model Limitations / Problems of BCG ModelDocument13 pagesUnderstanding The BCG Model Limitations / Problems of BCG Modelshovit singhNo ratings yet

- Chapter 7a PDFDocument22 pagesChapter 7a PDFRoydadNo ratings yet

- 05 Chapter 1Document49 pages05 Chapter 1Ankit GodreNo ratings yet

- MTB Yaqeen Hire Purchase Under Shirkatul Milk (HPSM) : (In The Name of Allah, The Merciful, The Compassionate)Document25 pagesMTB Yaqeen Hire Purchase Under Shirkatul Milk (HPSM) : (In The Name of Allah, The Merciful, The Compassionate)ovifinNo ratings yet

- Offering Letter Rakernas Federasi Karate Traditional IndonesiaDocument7 pagesOffering Letter Rakernas Federasi Karate Traditional Indonesiadicky gustiandiNo ratings yet

- 2020-02-29 IFR Asia - UnknownDocument42 pages2020-02-29 IFR Asia - UnknownqbichNo ratings yet

- Critical Analysis of India's EXIM BankDocument63 pagesCritical Analysis of India's EXIM BankAikya GandhiNo ratings yet

- Hilton CH 15 Select SolutionsDocument11 pagesHilton CH 15 Select SolutionsPiyushSharmaNo ratings yet

- Sabmiller: Aidan Mcquade and Gerry JohnsonDocument9 pagesSabmiller: Aidan Mcquade and Gerry JohnsonDim SumNo ratings yet

- TCQT ÔN TẬPDocument11 pagesTCQT ÔN TẬPPhước Đinh TriệuNo ratings yet

![4.1 [PPT] Time Value of Money](https://imgv2-1-f.scribdassets.com/img/document/720268125/149x198/e17519d295/1712309812?v=1)