Professional Documents

Culture Documents

A Study On Foreign Direct Investment in Nepal

A Study On Foreign Direct Investment in Nepal

Uploaded by

BhuwanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On Foreign Direct Investment in Nepal

A Study On Foreign Direct Investment in Nepal

Uploaded by

BhuwanCopyright:

Available Formats

48

NJ: NUTA

Foreign Direct Investment in Nepal

Biraj Pyakurel, PhD

Reader, Nepal Commerce Campus,

Minbhawan, Kathmandu, Tribhuvan University

Email for correspondence: ritiriwaj@gmail.com

Abstract

Foreign Direct Investment (FDI) is an important source of capital for economic growth in developing

countries. It provides a package which constitutes new technologies, management techniques, finance

and market access for the production and movement of goods and services. However, attracting

FDI is a major challenge for host countries as it faces the challenge of identifying the major factors

that motivate and affect the FDI location decision. The main FDI location factors are cost, market

infrastructure, and technological, political, legal and socio-cultural factors. Despite several conflicting

circumstances, Nepal is attempting to sort out overarching issues of FDI concerning with economic

development. That’s why Nepal is at a point where from it can excel for economic goals via FDI. The

set trends illustrate that various indicators pertaining to FDI in the country has been improving since

peace process was begun in 2006. This analysis comes to conclusions that the country owns unique

advantages and, thereby, opportunities of FDI useful for the country’s prosperity. Yet FDI in the country

is not free of challenges, thus, that need to be timely addressed with prudent measures.

Key words: Foreign direct investment, developing countries, economic goals and economic growth.

Setting the Scene

The home of mountains, sheltering the world biggest mountain “Mount Everest”, with Birth place of

Light of Asia “Siddhartha Gautama Buddha” is a typical introduction to Nepal. Despite of acquiring

world eight out of tenth biggest mountains; filled with plenty of medicinal herbs; it has failed to attract

enormous foreign investors. A country equipped with enormous natural beauties, and all-time favorable

climate is desperately lacking a term, Foreign Direct Investment. The investment made in any country

by foreign investors, that is, entrepreneurs and institution is known as foreign direct investment (FDI).

FDI is rapidly growing in developing countries. The theoretical study highlights the perfect market

theory and imperfect market theories of FDI. FDI is an important source for the developing countries,

which has plenty of resources but is economically weak with a deficiency in finance, technology

and competitive management. FDI introduces new technology, knowledge, skills, new management

practices, etc. to the recipient economy. Based on Investment across Borders Reports (2010), World

Bank points the benefits of FDI as a global network of 80,000 multinational corporations and 800,000

foreign affiliates have helped create millions of jobs, transferred technology, modern skills, fostered

NUTA JOURNAL, 5 (1&2), 2074 : ISSN: 2616 - 017x

Foreign Direct Investment in Nepal 49

competition, and contributed to the fiscal standing of many economies. Normally investment is regarded

as imperative factors of aggregate demand, which eventually affects the level of aggregate supply in the

economy. An investment is usually done to accelerate the available resources aiming a future returns.

The benefits of foreign direct investment to both host and investor economies are generally

recongnised, and there is a wide demand for reducing or eliminating barriers to global FDI integration.

In the past few decades, continuous effort in multilateral trade negotiations, regional trade agreements,

bilateral and multilateral investment accords have, to some extent, reduced obstacles to FDI. The World

Trade Organization (WTO) has made trade negotiations aims at continuing this trend. Thus, it is not

surprising to see that FDI flows have increased dramatically in recent decades.

Foreign direct investment plays vital role in developing countries for foster national economic

growth. FDI creates employment opportunities, raise the level of domestic wages, faster economic

growth and improve the distribution of income. FDI has not been widely practiced in Nepal. With the

settlement of political conflicts, a growing number of international projects are willing to assure in

Nepalese economy. FDI tends to increase in the near future in Nepal. Nepal needs FDI to have very

good infrastructural development like road network, waterways, and airways. The domestic capital

is inadequate since this sector needs very huge investments. FDI is needed for Nepal to boost the

industrialization process from running stage to take off stage. Government of Nepal is incapable to

attract the foreign investors to invest in Nepal. There are various factors create a substantial problem

in the inflow of FDI in Nepal that directly affect the economy preventing a growth of production,

employment and income. Even though, the country is bountiful of numerous positive attributes. Trade

policy and trade strategy has succinctly identified sectors having comparative advantages. Prudent

monetary, fiscal and trade policies have created a modern and stable macroeconomic framework with

the potential to create a dynamic, competitive, and investment attracting economy in the decade ahead.

Above all, conclusion of political settlement, labor unrest and power crisis are the critical factors.

However, political agenda and economic agenda have to move in a best synchronized way. Provided

the conditions, a potential influx of FDI is at the country’s door step but due to knock its door

In recent years, Government of Nepal has accorded a top priority to attract foreign direct

investment. Especial emphasis had been given since Ninth Plan to mobilize foreign investment. For

this purposes the government have adopted various policies. The FDI in Nepal is not at the peak, as

it needs to be. The flow of inward FDI was at peak during mid-1990s and thereafter declined due to

country’s civil war of Maoist insurgency. However, as Maoist ended up the decade’s civil war and joined

the Government, presently Nepal is creating a peaceful environment for the Foreign Investors. The

political disputes are cooling, and several foreign investors are keeping an eye to Nepal. Nepal’s FDI

projects include mostly in manufacturing, hydropower, mineral exploitation, construction, agro based,

chemicals, tourists hotels and restaurants, specialized services and in food and beverage industries. By

the year 2005, Hotel & Resorts undertook 440 projects under manufacturing industries followed by 227

projects. In context to approved FDI projects, more than 40 percent of investment comes from India;

and the rest comes from USA, Norway, Japan, Singapore, Bermuda, China, U.K., South Korea, Italy,

Netherlands, Thailand, Philippines, Germany, Switzer-land, France, Taiwan, Bangladesh, Pakistan,

Australia, British Virgin Island, Canada, Malaysia, Finland, etc. Nepal has been widely entertaining

most of its FDI in Manufacturing industries. The low labor cost might have pursued it. More than 32

NUTA JOURNAL, 5 (1&2), 2074 : ISSN: 2616 - 017x

50 Biraj Pyakurel, PhD

percent of its total investment has been only in Manufacturing projects. Some of globally renowned

companies operating are British American Tobacco (BAT), Unilever and Coca-Cola.

Methods

The objectives of the study was to assess volume and status of FDI (i.e. sectr wise, country

wise and district wise) and to analyze contributions of FDI on employment genereations. In this respect,

based on secondary data, the study followed descriptive/explainatory research approach. Financial

reports and policies published by government of Nepal and other authors have been reviewed. The

online articles and news concerning FDI, trends of FDI, are also reviewed. More specifically, FDI data

up to 2011 has been used. In this study simple bar diagram and tables are used to analyse the collected

data.

Finding I: Volume of FDI

The volume of FDI inflows to Nepal has historically been very low. During 1980-1989, FDI

flows to Nepal were minimal or even negative, with an annual average of Rs.45 million. There was a

distinct acceleration during the 1990s, although total flows remained small: averaging Rs.18 billion per

annum during 1990-2000. One factor explaining the increased FDI in the 1990s is Nepal’s more liberal

trade policy. For example, the unweighted average rate of import tariff was drastically reduced from

111 percent in 1989 to 16 percent by 1992; and the number of tariff slabs fell from more than 100 in the

1980s to only 5 in 1996 (Research and Information System [RIS], 2002). In addition, the establishment

of bonded warehouses and the introduction of a duty drawback scheme reduced the previous trade

policy’s anti-export bias. Complementing this overall trade reform programme was a bilateral trade

treaty with India concluded in 1996, which allowed India to import goods from Nepal free of import

duty and quantitative restrictions if the goods were manufactured in Nepal (except those on the negative

list). This has been cited as an explanation of the considerable expansion of Indian investment in Nepal

after 1996 (RIS, 2002). Another factor was the liberalization of the exchange rate regime. The currency

was made partially convertible in the current account in March 1992 and fully convertible in February

1993. Since 1994 all individuals and firms have been allowed to open accounts in major convertible

currencies with domestic banks after showing evidence of the source of foreign exchange. However,

in spite of these policy measures, Nepal’s receipt of FDI remained low (United Nations Conference on

Trade and Development [UNCTAD], 2003). Foreign investment projects can be seen in table 1.

Table 1. Foreign Investment Projects in Nepal

(From beginning to FY 2010/11, NRs in million)

Total Project Total Fixed Foreign

Fiscal Year Number Employment

Cost Cost Investment

Up to 1988/89 58 5102.8 4271.6 449.56 10586

1989/90 30 2438.19 2139.6 398.51 9515

1990/91 23 863.56 690.74 406.28 2974

1991/92 38 3508.17 2902.1 597.84 5615

1992/93 64 17886.22 16210.81 3083.67 13873

1993/94 38 3733.23 3175.66 1378.76 4734

1994/95 19 1627.28 1247.85 477.59 2386

(Continued...)

NUTA JOURNAL, 5 (1&2), 2074 : ISSN: 2616 - 017x

Foreign Direct Investment in Nepal 51

(Table 1. continued...)

1995/96 47 10047.47 9398.54 2219.86 8032

1996/97 77 8559.25 6692.15 2395.54 9347

1997/98 77 5569.38 5142.32 2000.28 4336

1998/99 50 5324.42 4380.17 1666.42 2146

1999/00 71 2669.09 1910.24 1417.61 4703

2000/01 96 7917.62 6122.49 3102.56 6880

2001/02 77 3318.53 1559.59 1209.65 3731

2002/03 74 4921.82 3608.25 1793.77 3572

2003/04 78 4323.74 3775.86 2764.8 2144

2004/05 63 1796.1 1149.49 1635.77 5559

2005/06 116 4121.08 3296.95 2606.31 7358

2006/07 188 3425.57 2650.56 3226.79 7389

2007/08 213 20406.38 16897.97 9812.6 10709

2008/09 231 9417.89 7530.02 6255.09 11108

2009/10 171 13953.78 14987.98 9100 7848

2010/11 209 11250.19 9375.46 10050.71 10887

Total 2108 152181.75 129116.39 68049.97 155432

(Department of Industry, 2011).

The above table reflects that total 2108 projects have been registered in Nepal comprising

seven categories of industries, worth a total of investment equal to Rs.152 billion. The total fixed cost

is estimated to be Rs.129 billion while the total foreign direct investment (FDI) is estimated to be Rs.68

billion as of July 2011. The registered projects provided employment to 155,432 people.

Finding II: Sector Wise Distribution of FDI

The distribution of FDI in Nepal shows that there is investment in various sectors. But some

sector has got more priority while the other one has given less priority. The distribution of foreign

investment is shown in table 2.

Table 2. Sectorial Distribution of Foreign Investment Projects

(From beginning to FY 2010/11, NRs in million)

Total

Types of Total Foreign Share Share in Share in

No. Project Employment

Industries Fixed Cost Investment in FDI projects Employment.

Cost

Agriculture 60 1674.42 1095.61 893.29 3497 1.31 2.85 2.25

Construction 42 3605.34 2683.10 2762.81 3016 4.06 1.99 1.94

Energy Based 47 40759.24 40381.02 14518.77 7947 21.34 2.23 5.11

Manufacturing 712 54611.18 40355.50 25595.87 78409 37.61 33.78 50.45

Mineral 36 5162.62 4223.60 2904.24 5574 4.27 1.71 3.59

Service 650 25955.40 21220.18 12974.65 32127 19.07 30.83 20.67

Tourism 561 20413.55 19157.38 8400.34 24862 12.34 26.61 16.00

Total 2108 152181.75 129116.39 68049.97 155432 100.00 100.00 100.00

(Department of Industry, 2011).

NUTA JOURNAL, 5 (1&2), 2074 : ISSN: 2616 - 017x

52 Biraj Pyakurel, PhD

The above table reflects that FDI is highly concentrated in the manufacturing sector, which

accounted for 33.78 percent of approved FDI projects, 37.61 percent of foreign investment. It is followed

by service sector with over 30.83 percent of approved projects, 19.07 percent of foreign investment.

Tourism stands in third position with 26.61 percent of approved projects, 12.34 percent of foreign

investment. The energy based sector, though comes at fourth position by share in approved projects, it

is second highest to attract the FDI with 21.34 percent of total foreign investment. The mineral sector

stands at last with 1.71 percent of approved projects, 4.27 percent of foreign investment. In sector wise

FDI it is found that on agriculture there is only NRs. 893.29 million investments, which is the lowest

investment area. On construction sector also the foreign investment is only NRs. 2762.81 million.

In mineral and tourism sector also the investment is very low. In service and energy based sector the

foreign investment is 12974.65 and 14518.77 million respectively. Looking at the potentiality of these

sectors the foreign investment is very low. The investment on manufacturing seems to be the highest,

which is NRs. 25595.87 million.

Finding III: Country Wise Distribution of FDI

In country-wise distribution, five countries accounts for about 65% of cumulative FDI, shown

in table 3.

Table 3. Country Wise Distribution of FDI

(From beginning to FY 2010/11, NRs in million)

No. of Total Project Share in

S.N. Top Countries Total Fixed Cost FDI Employment

Projects Cost FDI

1 India 501 62725.01 51118.64 32390.31 56407 47.60

2 China 401 13547.54 10899.31 7036.17 23325 10.34

3 Canada 25 5081.87 4892.78 2166.54 1926 3.18

4 Japan 154 3195.03 2713.48 1171.24 6683 1.72

5 Norway 12 8116.59 6766.8 1135.83 726 1.67

Gross Total 2108 152181.75 129116.4 68049.97 155432 100.00

(Department of Industry, July 2011).

The above table reflects that India alone accounts for 47.6 percent, followed by China with

10.34 percent, Canada with 3.18 percent, Japan with 1.72 percent and Norway with 1.67 percent. In

total, investors from 70 different countries have invested in Nepal, but the scale and number of projects

in most cases is small.

Finding IV: District Wise Distributions of FDI

According to the data up to FY 2010/2011 derived from the government source geographical

distribution of FDI within Nepal is strongly concentrated in the Kathmandu Valley, which includes the

capital city, Kathmandu, and offers the best infrastructure (transportation, power and telecommunications)

and proximity to administrative decision centers. More so, 34 percent of total FDI-related projects are

located in this region. Little FDI is found in Nepal’s hilly and mountainous region, although it is

inhabited by more than half of Nepal’s population. The FDI projects are located in the Terai region

NUTA JOURNAL, 5 (1&2), 2074 : ISSN: 2616 - 017x

Foreign Direct Investment in Nepal 53

is also in a very low percentage. It shows that FDI in Nepal in various sectors is concentrated in the

capital. The table 4 shows the district hosting foreign Direct Investment.

Table 4. Districts Hosting FDI up to 2010/2011

No District Amount in (million) Percentage

1 Kathmandu 23477.00 34.49%

2 Lalitpur 7101.97 10.44%

3 Kaski 4130.58 6.06%

4 Rupandehi 2958.59 4.34%

5 Parsa 2052.85 3.41%

6 Makawanpur 2321.73 3.41 %

7 Dhading 2171.00 3.19 %

8 Bara 2072.08 3.04 %

9 Others 21,764.17 31.62%

Total 68,049.97 100%

(Department of Industry, 2011).

The above table reflects that FDI in Nepal varies district wise. The table of up to fiscal year

2-10/2011 depicts a very uneven picture of FDI hosted by various administrative districts. In a case of

hosting FDI above NRs 2000 million, Kathmandu is the front-runner which is followed by seven other

countries. The others include Lalitpur, Kaski, Rupandehi, Parsa, Makawanpur, Dhading and Bara. In

quantum, a huge variance was observed between the districts located in the Kathmandu Valley and the

other districts. Out of the total FDI alone Kathmandu based two districts scores 44.93 percent, while

the later group possesses only 55.07 percent. Likewise, the stated eight districts invited 68.38 percent

whereas the rest 11 other districts could attract the remaining 31.62 percent of the total FDI. By and

large, the FDI is glued with a certain urban centers that cater a huge number of customers.

Finding V: Sector Wise Employment Generated by FDI

Foreign direct investment is providing the opportunities of employment for the Nepalese people.

The people are engaged in various sectors. This has been possible only due to FDI. To increase the

employment rate FDI has to be increased. For this government has to make various policies to attract

the foreign investment. From the beginning to fiscal year 2010-11 the sector wise employment is shown

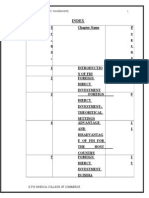

in figure1.

Figure 1. Sector Wise Employment Generated by FDI

NUTA JOURNAL, 5 (1&2), 2074 : ISSN: 2616 - 017x

54 Biraj Pyakurel, PhD

(Department of Industry, 2011).

The above figure reflects that the number of employment from FDI in different sectors is

not in same rate. Total employment is 155432 which are engaged in various sectors. The employment

from high rate to low rate is shown in the above chart. According to the bar diagram employment

from foreign direct investment is highly concentrated in the manufacturing sector, where 78409 people

are employed in this sector, which accounted over 50 percent of total employment. It is followed by

service sector where 32127 numbers is employed, with 20.67 percent of total employment. Tourism

stands in third position with 24862, which becomes 16 percent of total employment. In energy based

sector total employment is 7947 which contributes 5.11 percent of total employment. Agriculture sector

is the second last sector where only 3497 employment is contributed which is 2.25 percent of total

employment and construction sector is the last sector which gives employment to only 3016 which is

only 1.94 percent of the total employment.

Conclusion

The political instability, resultant policy and legal uncertainty do not seem to offer a hospitable

investment climate to the foreign investors in Nepal. Militancy of trade unions, which have become

emboldened particularly in the aftermath of the declaration of Nepal as a republic, has created havoc

for the overall business climate of the country. Despite various inter-locked issues, controversies and

transitional political circumstances, Nepal is well positioned among low-income economies to move

emphatically on development policy and spending priorities during the next decade. However, there

isn’t much investment, neither by the foreign countries, nor by neighboring country. And rate of FDI is

not increasing at a required rate. Towards end this, political, business, bureaucratic leaders are required

to come closer and act in a business-friendly chorus. The whole gambit of course ends with aggressive

marketing that Nepal is ripe for hosting FDI. The employment rate in various sectors has to be increased

to generate employment situation in Nepal.

References

Agrawal, J. P. (2000). Economic impact of foreign direct investment in south Asia. Indira Gandhi

Institute of Development Research, Gen. A. K. Bombay: India.

Agarwal, J. P. (1980). Determinants of Foreign Direct Investment. Weltwirst schaftliches Achieve,

116.

Balasubramanyam, V. N., Salisu, M. & Spas, D. F. (1996). Foreign direct investment and economic

growth in EP an IS countries. Economics Journal, 106, 92-105.

Magnus, B., Ari, K. & Zejan, M. (2000). Determinants of Foreign Direct Investment: firm and

Hostcountry strategies. Basingstoke, Hampshire RG21 6XS and New York, N.Y. 10010

Palgrave Publisher Ltd (p.1-20,101-105,177-179,221- 225).

Bijit, B. (2002). Determinants of Foreign Direct Investment: Research Issues, 11, 28-30. London: New

Fetter Lane, EC4P 4EE. Rutledge.

Buckley, P. J. (1988). The limits of explanation: Testing the internalization theory of the multinational

enterprise. Journal of International Business Studies, 19.

Buckley, P. J. & Casson, M. C. (1996). The future of multinational enterprise. London: Palgrave

Macmillan.

Caves, R. E. (1982). Multinational enterprise and economic analysis. Cambridge University Press.

NUTA JOURNAL, 5 (1&2), 2074 : ISSN: 2616 - 017x

Foreign Direct Investment in Nepal 55

Choe, J. I. (2003). Do foreign direct investment and gross domestic investment promote economic

growth? Revision of Development Economics,7, 44-57.

Dale, R., Weigel, N. F., Gregory, D. & Wagle, M. (1997). Foreign Direct Investment. Washington DC:

IFC and Foreign Investment Advisory Service.

Joshi, S. K. (2066). Macroeconomics. Kathmandu: Taleju Prakashan, Bhotahity.

Ministry of Industry (MOI) (2009). Nepal: Foreign Investment Opportunities. Government of Nepal.

Ministry of Commerce and Supply (MOCS). (2009). Nepal: Foreign Investment Opportunities.

Government of Nepal.

Research and Information System (RIS). (2002). South Asian Development and Cooperation Report

2001/02. New Delhi: India.

United Nations Conference on Trade and Development (UNCTAD). (2003). World Investment Report:

FDI Policies for Development: National and International Perspectives. New York: Author.

NUTA JOURNAL, 5 (1&2), 2074 : ISSN: 2616 - 017x

You might also like

- M&A Opportunity: Gamma Pharmaceutical Manufacturer VietnamDocument7 pagesM&A Opportunity: Gamma Pharmaceutical Manufacturer VietnampkneonacciNo ratings yet

- Foreign Direct InvestmentDocument11 pagesForeign Direct InvestmentRachmat FhatuerNo ratings yet

- Real Estate Project Final PDFDocument56 pagesReal Estate Project Final PDFSheel NagdaNo ratings yet

- Proposal Bhalubang Community Hospital 20110326Document41 pagesProposal Bhalubang Community Hospital 20110326Senapati Prabhupada Das100% (1)

- A Study On Foreign Direct Investment Specialization (Repaired)Document65 pagesA Study On Foreign Direct Investment Specialization (Repaired)yatinNo ratings yet

- Analysis of Foreign Direct Investment Environment in MalaysiaDocument15 pagesAnalysis of Foreign Direct Investment Environment in MalaysiaThe IjbmtNo ratings yet

- Tax Incentives and FDI in NigeriaDocument12 pagesTax Incentives and FDI in NigeriaSony AxleNo ratings yet

- Retail ManagementDocument80 pagesRetail Managementsheemankhan75% (4)

- An Impact of Fdi On Indian Economy NewDocument58 pagesAn Impact of Fdi On Indian Economy NewUrvashi SharmaNo ratings yet

- FDI and Indian EconomyDocument47 pagesFDI and Indian EconomyParul Gupta0% (1)

- Foreign Direct Investment in NepalDocument3 pagesForeign Direct Investment in NepalRajx5x100% (1)

- Foreign Direct Investment (Fdi) : Nature and ScopeDocument4 pagesForeign Direct Investment (Fdi) : Nature and ScopeMaithili DicholkarNo ratings yet

- Impact of Investment Activities On Economic Growth of PakistanDocument9 pagesImpact of Investment Activities On Economic Growth of PakistanMuhammad ImranNo ratings yet

- Kathmandu University School of Management: Individual Policy Review-3: Foreign Investment and One Window PolicyDocument20 pagesKathmandu University School of Management: Individual Policy Review-3: Foreign Investment and One Window PolicyYash AgrawalNo ratings yet

- Viva Project FileDocument25 pagesViva Project FileGyany KiddaNo ratings yet

- Final Essay - U7596796 - JoeDocument5 pagesFinal Essay - U7596796 - JoeRobert JoeNo ratings yet

- Trends and Patterns of Fdi in IndiaDocument10 pagesTrends and Patterns of Fdi in IndiaSakshi GuptaNo ratings yet

- Foreign Direct Investment Cohesion To EmploymentDocument25 pagesForeign Direct Investment Cohesion To EmploymentChandan SrivastavaNo ratings yet

- The Impact of FDI On Economic Growth Under Foreign Trade Regimes: A Case Study of PakistanDocument10 pagesThe Impact of FDI On Economic Growth Under Foreign Trade Regimes: A Case Study of PakistanAmnaMalikNo ratings yet

- Foreign Direct Investment Bharth Cohesion To EmploymentDocument24 pagesForeign Direct Investment Bharth Cohesion To EmploymentBharath GudiNo ratings yet

- The Impact of Foreign Direct Investment For Economic Growth: A Case Study in Sri LankaDocument21 pagesThe Impact of Foreign Direct Investment For Economic Growth: A Case Study in Sri LankaTanay SoniNo ratings yet

- 19305c0003 RM Project SakibDocument11 pages19305c0003 RM Project SakibMohd sakib hasan qadriNo ratings yet

- An Empirical Study On Fdi Inflows in Indian It and Ites SectorDocument8 pagesAn Empirical Study On Fdi Inflows in Indian It and Ites SectorTJPRC PublicationsNo ratings yet

- Final Essay U7596796 JoeDocument5 pagesFinal Essay U7596796 JoeRobert JoeNo ratings yet

- Vol22 Art2 PDFDocument21 pagesVol22 Art2 PDFIsmith PokhrelNo ratings yet

- 16-219-237 A Study On The Effects of FDI On Cambodia's Economic Growth by HUON Sophanara-FinalDocument19 pages16-219-237 A Study On The Effects of FDI On Cambodia's Economic Growth by HUON Sophanara-Finalphang brostouchNo ratings yet

- An Overview of Foreign Direct Investment in IndiaDocument15 pagesAn Overview of Foreign Direct Investment in IndiaParmila JhajhriaNo ratings yet

- Impact of Foreign Direct Investment (FDI) On The Growth of The Indian EconomyDocument5 pagesImpact of Foreign Direct Investment (FDI) On The Growth of The Indian EconomyDylan WilcoxNo ratings yet

- Fdi in India: Determinants And: ITS Comparison With ChinaDocument5 pagesFdi in India: Determinants And: ITS Comparison With ChinaManoj Kumar SinghNo ratings yet

- Foreign Direct Investment Scenario Bangladesh Perspective - 93287Document17 pagesForeign Direct Investment Scenario Bangladesh Perspective - 93287rashed_8929685No ratings yet

- Full Paper 1Document20 pagesFull Paper 1Inara JayasooriyaNo ratings yet

- AbstractDocument8 pagesAbstractsheenakrishNo ratings yet

- 6.determinants of Foreign Direct Investment and Its Impact On Economic Growth Evidence From South Asian Association For Regional CorporationDocument25 pages6.determinants of Foreign Direct Investment and Its Impact On Economic Growth Evidence From South Asian Association For Regional Corporationsuja nembangNo ratings yet

- Ocrif261012 SN1 PDFDocument29 pagesOcrif261012 SN1 PDFYash MehraNo ratings yet

- Impact of FdiDocument41 pagesImpact of FdiBarunNo ratings yet

- Advantages & Disadvantages of FDI in India: INCON - X 2015 E-ISSN-2320-0065Document10 pagesAdvantages & Disadvantages of FDI in India: INCON - X 2015 E-ISSN-2320-0065Anonymous 9XYG68vqNo ratings yet

- Fdi in Canadas EconomyDocument11 pagesFdi in Canadas EconomyRosaline MainaNo ratings yet

- Submited By: Shaikh Umair Saleem Registration:1735132 (MBA Ev 36 E) Submited To: DR - ManzoorDocument11 pagesSubmited By: Shaikh Umair Saleem Registration:1735132 (MBA Ev 36 E) Submited To: DR - ManzoorShaikh Mamoon HameedNo ratings yet

- Foreign Direct Investments and Economic Growth: The Primary DriversDocument14 pagesForeign Direct Investments and Economic Growth: The Primary DriversAmmara NawazNo ratings yet

- A Granger-Causal Examination of The Relationship Between Foreign Direct Investment and Economic Growth IN NIGERIA (1981 - 2007)Document19 pagesA Granger-Causal Examination of The Relationship Between Foreign Direct Investment and Economic Growth IN NIGERIA (1981 - 2007)Mustapha MuktarNo ratings yet

- Foreign Direct Investment: A Study On BangladeshDocument10 pagesForeign Direct Investment: A Study On BangladeshArittro ChakmaNo ratings yet

- New FdiDocument6 pagesNew FdiBhanu TejaNo ratings yet

- Study of Impact of Fdi On Indian Economy: Dr. D.B. Bhanagade Dr. Pallavi A. ShahDocument4 pagesStudy of Impact of Fdi On Indian Economy: Dr. D.B. Bhanagade Dr. Pallavi A. ShahDeepti GyanchandaniNo ratings yet

- SECTORWISEINFLOWOFFOREIGNDIRECTINVESTMENTININDIA1Document9 pagesSECTORWISEINFLOWOFFOREIGNDIRECTINVESTMENTININDIA1Aditi KulkarniNo ratings yet

- Trade Liberalization, Economic Reforms and Foreign Direct Investment - A Critical Analysis of The Political Transformation in VietnamDocument14 pagesTrade Liberalization, Economic Reforms and Foreign Direct Investment - A Critical Analysis of The Political Transformation in VietnamTRn JasonNo ratings yet

- Determinants of Foreign Direct Investment in India by Laxmi NarayanDocument9 pagesDeterminants of Foreign Direct Investment in India by Laxmi Narayanijr_journalNo ratings yet

- Strength LegalDocument29 pagesStrength Legal23321gauravNo ratings yet

- Impact of Fdi On Economic Growth in Pakistan ThesisDocument8 pagesImpact of Fdi On Economic Growth in Pakistan ThesisWriteMyPaperReviewsOverlandPark100% (2)

- FDI in IndiaDocument7 pagesFDI in IndiaROHITH S 22MIB051No ratings yet

- Research Paper On FdiDocument6 pagesResearch Paper On FdiShweta ShrivastavaNo ratings yet

- Foreign Direct Investment and Economic Growth: BVIMSR's Journal of Management Research 4Document31 pagesForeign Direct Investment and Economic Growth: BVIMSR's Journal of Management Research 4Azan RasheedNo ratings yet

- Policy Review 3 PDFDocument19 pagesPolicy Review 3 PDFYash AgrawalNo ratings yet

- Foreign Direct Investment and Its Effect On The Manufacturing Sector in NigeriaDocument9 pagesForeign Direct Investment and Its Effect On The Manufacturing Sector in NigeriaJASH MATHEW100% (1)

- Impact of Foreign Direct Investment (Fdi) On Export Performance in Nigeria (1970-2018)Document17 pagesImpact of Foreign Direct Investment (Fdi) On Export Performance in Nigeria (1970-2018)chi1311No ratings yet

- Index: FDI (Foreign Direct Investement)Document73 pagesIndex: FDI (Foreign Direct Investement)Arvind Sanu MisraNo ratings yet

- Project Report Fdi FinalDocument68 pagesProject Report Fdi FinalKarann ValechaNo ratings yet

- Foreign Direct Investment FDI in Bangladesh Trends Challenges and RecommendationsDocument11 pagesForeign Direct Investment FDI in Bangladesh Trends Challenges and RecommendationsAdib AkibNo ratings yet

- Essential and Proposal of Foreign Direct PDFDocument4 pagesEssential and Proposal of Foreign Direct PDFlawha mahfuz auntuNo ratings yet

- Essential and Proposal of Foreign Direct PDFDocument4 pagesEssential and Proposal of Foreign Direct PDFlawha mahfuz auntuNo ratings yet

- Fdi in Indian Retail - and Its Implications: Policies, Employment, Infrastructure DevelopmentDocument13 pagesFdi in Indian Retail - and Its Implications: Policies, Employment, Infrastructure DevelopmentkushalNo ratings yet

- Fdi Impact Iferp Ext - 14273Document4 pagesFdi Impact Iferp Ext - 14273Naresh GuduruNo ratings yet

- Shaping Globalization: New Trends in Foreign Direct InvestmentFrom EverandShaping Globalization: New Trends in Foreign Direct InvestmentNo ratings yet

- ILS02156Y20: Sanjiv Kumar GuptaDocument1 pageILS02156Y20: Sanjiv Kumar GuptaSenapati Prabhupada DasNo ratings yet

- VaikuntaChildren Second EditionDocument636 pagesVaikuntaChildren Second EditionSenapati Prabhupada DasNo ratings yet

- Rental Property Statement Tax Year: Physical Address (Street, Suburb) : Property TypeDocument14 pagesRental Property Statement Tax Year: Physical Address (Street, Suburb) : Property TypeSenapati Prabhupada DasNo ratings yet

- Dr. Anu Duwal: Without Protective GearDocument3 pagesDr. Anu Duwal: Without Protective GearSenapati Prabhupada DasNo ratings yet

- Project Telehealth - Health at Home: Equipment InformationDocument1 pageProject Telehealth - Health at Home: Equipment InformationSenapati Prabhupada DasNo ratings yet

- Project Timeline: Q1 January FebruaryDocument21 pagesProject Timeline: Q1 January FebruarySenapati Prabhupada DasNo ratings yet

- Health Technology Product and Equipment Directive - Nepal - 27.11.2020 PDFDocument15 pagesHealth Technology Product and Equipment Directive - Nepal - 27.11.2020 PDFSenapati Prabhupada Das100% (1)

- IC Project Charter 9126Document4 pagesIC Project Charter 9126Senapati Prabhupada DasNo ratings yet

- IC Excel Gantt Chart Full 9126Document4 pagesIC Excel Gantt Chart Full 9126Senapati Prabhupada DasNo ratings yet

- Action Plan Template: Action Responsible Priority StatusDocument3 pagesAction Plan Template: Action Responsible Priority StatusSenapati Prabhupada DasNo ratings yet

- Real Estate ResearchPaperDocument53 pagesReal Estate ResearchPapermuhammad afaqNo ratings yet

- International Finance - An Overview 1Document19 pagesInternational Finance - An Overview 1vishalsapmNo ratings yet

- Master Direction On Liberilised Remittance Scheme Jan 1, 2016Document20 pagesMaster Direction On Liberilised Remittance Scheme Jan 1, 2016patrodeskNo ratings yet

- Final ArticleDocument12 pagesFinal ArticlesahulreddyNo ratings yet

- Sectarianismin PakistanDocument11 pagesSectarianismin PakistanLaraib ShahidNo ratings yet

- Industrial Policies in IndiaDocument10 pagesIndustrial Policies in IndiaketanNo ratings yet

- Globalization and The International Working Class - A Marxist Assessment - Icfi StatementDocument124 pagesGlobalization and The International Working Class - A Marxist Assessment - Icfi StatementSanjaya Wilson JayasekeraNo ratings yet

- Current AccountDocument12 pagesCurrent Accountdorathy raniNo ratings yet

- NepalDocument25 pagesNepalPrabhat BaralNo ratings yet

- Case 2 VODAFONE INDIA LTD CP 407-2017 NCLT ON 17.5.2018 FINALDocument9 pagesCase 2 VODAFONE INDIA LTD CP 407-2017 NCLT ON 17.5.2018 FINALShubham PhophaliaNo ratings yet

- 2021 H2 Economics CSQ2 AnswerDocument4 pages2021 H2 Economics CSQ2 AnswerDurai Manickam NizanthNo ratings yet

- Print MediaDocument17 pagesPrint MediaRyan Rohit BarbozaNo ratings yet

- 2007-0207 Libya EDB BlueprintDocument40 pages2007-0207 Libya EDB BlueprintLibyatruth MediatruthNo ratings yet

- In - Indias Real Estate Milestones A 20 Year Narrative PDFDocument96 pagesIn - Indias Real Estate Milestones A 20 Year Narrative PDFVivek KumarNo ratings yet

- Eiteman 0321408926 IM ITC2 C16Document15 pagesEiteman 0321408926 IM ITC2 C16Ulfa Hawaliah HamzahNo ratings yet

- Article Arpan MahapatraDocument11 pagesArticle Arpan MahapatraarpanmahapatraNo ratings yet

- Modes of International Business...Document7 pagesModes of International Business...atikurrahmanNo ratings yet

- A Project On Store Operation of Big BazaarDocument25 pagesA Project On Store Operation of Big BazaarSalman AghaNo ratings yet

- Fdi & FpiDocument32 pagesFdi & FpirubysewornooNo ratings yet

- India'S Economic Reforms: An AppraisalDocument24 pagesIndia'S Economic Reforms: An AppraisalAabhash TiwariNo ratings yet

- Department Ofmanagement StudiesDocument10 pagesDepartment Ofmanagement StudiesHarihara PuthiranNo ratings yet

- Creating New Productive Capacity For The Leather Industry - National Leather RoadmapDocument208 pagesCreating New Productive Capacity For The Leather Industry - National Leather RoadmapTarekegn BEKELENo ratings yet

- Chapter-2 Theories of Foreign Direct Investment and Multinational EnterprisesDocument17 pagesChapter-2 Theories of Foreign Direct Investment and Multinational Enterprisesnandkishore patankarNo ratings yet

- One97 Annual Report 2018-19Document234 pagesOne97 Annual Report 2018-19Anonymous TQF9haAIDpNo ratings yet

- Ibo 3 em PDFDocument9 pagesIbo 3 em PDFFirdosh Khan75% (4)

- INDIAN TEXTILES INDUSTRY Corporate Catalyst India A Report On Indian Textiles IndustryDocument26 pagesINDIAN TEXTILES INDUSTRY Corporate Catalyst India A Report On Indian Textiles IndustryJyoti Kanoi BhimsariaNo ratings yet