Professional Documents

Culture Documents

Accounting Notes

Accounting Notes

Uploaded by

kc purgananCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Notes

Accounting Notes

Uploaded by

kc purgananCopyright:

Available Formats

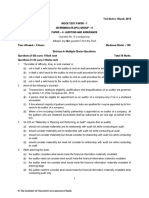

INTODUTION TO ACCOUNTING The Basic Skills in order for one to be a good

accountant

What is Accunting

Strong written and oral communication

Process in which the financial information

Organization and attention to detail

about a business or non-profit organization

Analytical and problem-solving skills

is recorded, classified, summarized,

interpreted, and communicated to owner’s, Time management

managers, investors, and other interested Systems analysis

parties in need of financial investors, and Matehmatical and deductive reasoning

other interested parties in need of financial Critical Thinking

information in order to make decisions Active learning

Accounting is often called “the Language Clerical knowledge

of Business” Profficiency with Microsoft Office Suite

A process of identifying, measuring, and

The Nature of Accounting

communicating economic information

(American Accounting Association or AAA) Art of recording, classifying, summarizig in a

The art of recording, classifying, and significat manner in terms of money,

summarizing in terms of money, transactions, and events

transactions, and events (American Institute The nature of accounting an be define in

of Certified Public Accountants or AICPA) two ways

A service activity; to provide quantitative 1. Quantitative Attributes of Accounting

information, primarily financial in nature and 2. Qualitative Attributes of Accounting

about economic entities (Accounting

Standards Council or ASC) 1. Quantitative Attributes of Accounting

Questions asked in need of financial informtion: a) Accounting is a process

b) Accounting is a Science

1. How much cash does the business have? c) Accounting is an art

2. How much money do customers owe the d) Accounting deals with financial informations

business? and transactions

3. What is the cost of the merchandise sold? e) Accounting is a means and not an end

4. What is the change in sales volume? f) Accounting is a service activitiy

5. How much money is owed to the suppliers? g) Accounting is a discipline

6. What is the profit or loss? h) Accounting as a Stewardship Function

Accounting System 2. Qualitative Attributes of Accounting

It is designed to accumulate data about a a) Comparability

firm’s financial affairs, classify data in a b) Reliable

meaninful way, and summarize it in periodic c) Faithful Representation

reports called Financial Statements d) Understandability

An efficient accounting system allows e) Relevance

managers to quickly obtain a wide range of

Scopes of Accouning

useful information

The Roles of an Accountant

1. Establishes the records and procedures that

make up the accounting system

2. Supervise the operations of the accounting

system

3. Interprets the resulting financial information

How Accounting Data is Prepared using

Various Accounting Methods (RJ Bull)

2. Cost Accounting

- Cost accounting is defined as "a

systematic set of procedures for

recording and reporting measurements

of the cost of manufacturing goods and

performing services in the aggregate

and in detail.

3. Tax accounting

- Tax accounting focuses on tax returns

and payments rather than the

preparation of public financial

statements.

4. Fund Accounting

- Fund accounting is a system of

accounting used by non-profit entities to

Main Areas of Accounting tracking the amount of cash assigned to

1. Public Accounting different purposes and the usage of that

- Public accounting refers to a business cash.

that provides accounting services to - Thus, the focus of fund accounting is on

other firms. accountability, rather than profitability.

- Public accountants provide accounting 5. Forensic Accounting

expertise, auditing, and tax services to - Forensic accounting utilizes accounting,

their clients auditing, and investigative skills to

2. Managerial Accounting conduct an examination into the

- In management accounting or finances of an individual or business.

managerial accounting, managers use - Forensic accounting is frequently used

the provisions of accounting information in fraud and embezzlement cases to

in order to better inform themselves explain the nature of a financial crime in

before they decide matters within their court.

organizations, which aids their 6. Auditing

management and performance of - Auditing typically refers to financial

control functions. statement audits or an objective

3. Governmental Accounting examination and evaluation of a

- Government accounting refers to the company's financial statements –

process of recording and the usually performed by an external third

management of all financial transactions party.

incurred by the government which - Audits can be performed by internal

includes its income and expenditures. parties and a government entity, such as

the Internal Revenue Service (IRS).

Other Branches of Accounting a. External Auditing

1. Financial Accounting - Can be defined as the review of

- Financial accounting is the field of financial statements. To be more to

accounting concerned with the be more specific, external auditing is

summary, analysis and reporting of the examination of a company's

financial transactions related to a financial statement to determine if it

business. is accurate and legal. External

- This involves the preparation of financial auditing is done to ensure that there

statements available for public use. is no fraud that is committed

b. Internal Auditing

- Involves the improvement of internal - Do not manage the business

- Interested in financial information

a) Banks

o Loans for businesses

o Banks use the financial statements to

assess the company’s ability to repay

the loan (+ interest)

(Chron Contributor, 2020)

Banks review company’s income

statement, cash flow, and balance

sheetto decide on the terms of the

loan, how much they will give, or if

they will provide a loan

b) Tax Authorities

o Provides information about taxes due

o Determines the tax bases (Price,

Haddock, & Farina, 2021)

accounting affair such as weakness Income Taxes -taxable income

is regarding their accounting policy Sales taxes -Sales income

and miss management. Property taxes

USERS OF ACCOUNTING INFORMATION o Assure accurate tax collection

Financial statements = verify

accuracy

1.Inside the Business c) Regulatory Agencies and Investors

“Internal Members” o Regulatory Agencies:

- Guide them in making good business Oversee the financial information

decisions and business activities of certain

- Managerial Accounting regulated industries

a) Owners and Managers o Investors:

o Sole Proprietors, Partners, and Major Base the investment of their capital

Stockholders on the financial

o Evaluation of the company’s health of an entity

performance Actual or Existing Investors

o Decision-making and Planning Potential Investor

o Responsibilities: d) Customers

Internal Control - procedures to o Buyers of goods and services.

safeguard assets and ensure Producers, manufacturers,

reliability of accounting data retailers, etc.

Prevention of fraud o Pay attention to the financial information

*Major Stockholders own the majority of the about the company.

shares of a company making them the Does the company offer useful

Board of Directors (BOD) products at fair prices? And will

*BOD are responsible in the company’s the company survive long

decision-making and planning. enough to honor its product

b) Employees warranties?

o Company’s financial results o Interested in knowing whether it’s

affect income of the employee capable of providing the customer’s

Has implications on their job security needs

e) Unions

2. Outside the Business o Employee Union

“External Members”

o Negotiate salary increases, benefits, profits among themselves.” (Art. 1767, Civil

profit-sharing Code of the Philippines)

Useful for deciding how much to Partnership as a contract:

negotiate for an increase in the o Consent- two or more persons bind

next contract themselves or voluntarily enter into an

agreement

o Object:

Money- legal tender, cash

Property:

Forms Of Business Organization Real property - immovable property;

I. As To Ownership land or anything attached to it

Sole Proprietorship Personal property - Tangible and

Partnership intangible

Corporation Industry - labor, skills

II. As to activity o Cause - to divide the profits among

Service themselves

Merchandising/Trading How long can partnerships exist?

Manufacturing o There is no limit to the life of a

partnership but the death of a partner

I. AS TO OWNERSHIP leads to the dissolution of the

a. SOLE PROPRIETORSHIP partnership.

A business entity that owns by an individual in Dissolution

his/her name, or under a recognized business o A partner can assign his interest to

name, who solely takes all business profits and

another person, the assignee, without

losses

the consent of the other partners and

Simplest form of business without causing dissolution in cases,

Number of Owner/s: 1 but only the rights to share in the profits

Business Life - Ends when the owner: and losses, rights to the remedies

o Decides to close the business against fraud in the management are

o Unable to carry on business operations assigned to the assignee (Art. 1813,

o Dies unless he/she appointed or Civil Code of the Philippines).

authorized some whom he/she trusts to o If it is clear that the intention of the

continue the operation of the business partner is to withdraw from the

The owner is solely responsible for all possible partnership, causing dissolution, then

debts that the company may face the withdrawing partner needs the

Advantages: consent of his otherpartners as to his

o Can establish a withdrawal and as to who his interest

o business instantly will be assigned to.

o Complete control over o “On dissolution, the partnership is not

o the business terminated, but continues until the

Disadvantages: winding up of partnership affairs is

o Unlimited liability completed.” (Art. 1828, Civil Code of

the Philippines)

o Limited capital

Partnership Liability

o Because business is done in the

b. PARTNERSHIP

name of the partnership, it is the

Legal Definition:

partnership that is liable for its

o “By the contract of partnership two or more

obligations, which in turn are the

persons bind themselves to contribute

obligations of the partners

money, property, or industry to a common

composing the partnership on a pro

fund, with the intention of dividing the

rata basis unless the partner entered

a contract which he is personally o Corporation is an entity of its own so it will

liable even if it benefits the not dissolve when ownership changes

partnership and the partnership o Flexibility in terms of raising capital through

alone. (Art. 1816, Civil Code of the the sales of stock

Philippines) o Easy transaction and transferring of

ownership

c. CORPORATION Disadvantages:

A legal entity that is doing business o Typically closely monitored by the

Has legal rights to own properties and do government

business with its own name o High organizational and operational costs

Can be taxed, sued, and/or enter into o Possibility if double taxation

contractual agreements

Public corporations are owned by shareholders

who elects board of directors to oversee

responsibilities II. AS TO ACTIVITY

a. SERVICE

Important Terms Related: Provides or offers professional skills,

Stock - represents the ownership of the expertise, advice, et cetera in exchange for a

corporation fee.

Privately owned corporations - also Examples

known as closely held corporations where o Schools, Law or Accounting Firms

ownership is usually limited to specific

individuals b. MERCHANDISING/TRADING

Publicly owned corporations - can be Merchandising/trading businesses are those

bought or sold in stock exchanges that sell finished products to consumers to

earn revenue.

Types Of Corporation: Merchandising/Trading businesses also

i. C-Corporation purchase goods to be

A corporation that is taxed separately from resold, and incur costs like labor and

its owners materials.

Gives owners limited liability, which These types of businesses sell

encourages risk-taking such as potential “merchandise” or “goods''.

investments. Examples of such are retail stores that sell

Shareholders can sell their own shares groceries, clothing, electronics, or any

ii. S-Corporation tangible goods.

Also known as Subchapter S-Corporation Wholesale

Offers the owners limited liability o Wholesalers refer to

Does not pay income taxes; earnings and merchandising/trading businesses

profits are treated as distributions that sell products in bulk to other

Shareholders must report income on their business which use the goods in the

ITR production of other products or to

iii. Limited Liability Company resell with added value.

A hybrid business structure that provides the Retail

limited legal liability of a o Retail refers to the final and direct to

corporation consumer sale of goods.

Specifically made for small businesses

Taxed as a sole proprietorship c. MANUFACTURING

Can have unlimited number of owners Is the combining of small parts to make a

whole finished product in a large production

Advantages: scale

Uses division of labor

o Division of labor is when work is - Unbiased in the analysis or

divided among many people to presentation of financial

increase production efficiency and information.

quality Free from error

According to Britannica, important - No mistakes or omissions in the

manufacturing industries include aircraft explanation of the phenomena

manufacturing, automobiles, chemicals and and the method used have been

clothing amongst others chosen and applied without

Manufacturing also uses different kinds of errors in the process.

processes throughout different industries

III. Materiality Constraint

o Refers to the “importance of the

amount or financial data of

amaterial/item that is linked with the

company’s financial data.”

QUALITATIVE CHARACTERISTICS OF USEFUL o Items with small value are considered to

FINANCIAL INFORMATION be immaterial which will “only

becharged as an expense in the

Qualitative Characteristics company’s financial data,”

Qualities that make accounting o While items with bigger value arecalled

information useful for decision making materials, which would be “heavily

by investors, creditors, and other users capitalized and depreciated”.

a) Fundamental / Primary o However materiality is “not just limited

b) Enhancing / Secondary to monetary amount.”

o “Professional Judgement is also

a) Fundamental (Primary) Qualitative needed” as a basis if an item is

Characteristics immaterial or material.

I. Relevance o Example:

o accounting information is capable of The CEO of a construction company

making a difference in a decision is deciding whether or not to

Confirmatory Value purchase a new bulldozer that cost

- helps in verifying fulfillment or around P250,000.

nonfulfillment of prior Since the CEO allocated P325,000

expectations or decisions funds for the purchase of the new

Predictive Value bulldozer, the price of the bulldozer

- helps in making predictions or is below the materiality level of the

forecasts about the meaning allocated funds..

and ultimate outcome of events The CEO decided to put the

*both components must be material in order purchase as an expense, since the

to be relevant value of the bulldozer which is

P250,000 is below the allocated

II. Faithful Representation funds of P325,000.

o Define economic phenomena in terms of However if the price is higher than

words and amounts. The substance of the funds, then the CEO can just put

the phenomenon it claims to reflect. the purchase as an asset, wherein

Completeness it’s value will be depreciated as time

- Necessary definitions and goes by.

examples

- Removing a portion of the Ms. Bautista’s Explanation

information could make it false or o Professional judgement is needed to

misleading. decide whether an amount is

Neutrality insignificant or immaterial

o Examples:

Rounding off – depends on how 2. VERIFIABILITY

small or how large a company is o Independent measures lead to the

Collection shortages – depends on same result

the amount of collectible or Verifiable = reaching a consensus

management decision Faithfully claims what it represents

o Practical Application (+Cost Benefit Supported by evidence

Analysis)

o Situation 5. You baked 50 pcs of 3. TIMELINESS

cupcakes and carefully arranged them in o Availability of information

5 boxes to be delivered to one Refers to how quick the accounting

restaurant. Upon delivery, your customer information is to the users

counted only 49 pcs of cupcakes. She - Information - must be available

therefore demanded that she will only early enough to be used in the

pay for 49 pcs. What will you do? decision making process

You will go back home and get one Information received competes with

piece of cupcake and deliver to the other info in the company

restaurant. - Ex: company issues financial

Fight with your customer and insist statements a year after

there are 50 pcs. accounting period, dfficult to

Just collect the value of 49 pcs and determine how the company is

apologize to your customer. doing in the present.

o Situation 6. Refer to situation 5. Upon

getting back to your kitchen, will you still 4. UNDERSTANDABILITY

look where the missing cupcake went? o Simple is key.

Information - clear, concise

Enhancing Qualitative Characteristics Avoid using jargon

Comparability “User-specific” - in terms of

o Comparison of data within and across interpreting The data

entities

Verifiability BASIC ASSUMPTIONS

o Measures -> same results 1. ECONOMIC ENTITY

Timeliness o Business Entitiy

o Information needed is available as early o Creates a distinction between the

as possible and need. owner’s personal transactions and the

Understandability business transactions

o Information – clear and concise o Example: Ellie owns a bakery and she

keeps track of all her transactions

1. COMPARABILITY Business Transactions

o Information compared within - Hired a baker

companies - Bought ingredients

Compared within different time - Purchase of machineries

eriods Owner Transactions

- Ex: Comparison of income - Bought a new phone

(2019-2021) - Vacation expenses

Helps draw conclusion about trends - Online Shopping

and performance o Practical Application:

Use of uniformity and consistency Situation 3. You need money to buy

principles books in school.

o Information compared across

companies

Identify similarities and ifferences

Should you ask money from your Situation 2. Your mother told you that

mother or get it from the Php10,000 you can report to her the results of

fund that your mother gave you? your business after you finish college.

Do you wait for two years before you

2. MONETARY UNIT PRINCIPLE prepare financial reports or would you

o Money Measurement Concept want to prepare them monthly or

o All items should be expressed in quarterly to monitor the progress of

monetary terms your business?

o Items with no monetary value will not be

included in the financial statements 4. GOING CONCERN

Examples: o Business can continue long enough to

- Employee skill level meet its goals and obligations

- Employee working conditions o Ability to make enough money to stay

- Expected resale value of a afloat or escape bankruptcy

patent o Importance:

- Quality of customer support Encourages a company to move

- Efficiency of the administration any of its prepaid payments to

future accounting periods

o Practical Application Serves as a guidance

o Examples:

Situation 4. You have a cousin who

lives in the USA and came here to Prepaymet and accrual expense

visit you. He loved your cupcakes and

he ordered one dozen. He did not o Ms. Bautista’s Explanation

have any Philippine pesos with him The business will continue in

so he paid you $8. operational existence for the

How will you record the sales for your forseeable future

transaction with your cousin? Example:

- “I’ll pick this up tomorrow,

3. PERIODICTY OF INCOME / TIME PERIOD when you will still be here as

o Report its financial statements within a always”

certain period of time o Practical Application:

o Periods can be monthly, quarterly, and Situation 9. You have an order from a

annual customer for one dozen of cupcakes

Importance: but she wants it to be delivered after

- Proper comparison and two weeks.

evaluation Do you decline the order because

- Allow stakeholders to monitor you may no longer be in business

after two weeks? Or do you accept

company and market it

the order and deliver on the specified

- Allow company intervene

date of the customer?

o Ms. Bautista’s Explanation

The indefinite life of a company can

THE BASIC PRINCIPLES OF ACCOUNTING

be divided into periods of equal

length for the preparation of financial 1. REVENUE RECOGNITION PRINCIPLE

reports

o One should only record revenue when it

Examples:

- Monthly report has been earned, not when it has been

collected.

- Quarter 1, 2, 3, 4

o An advanced cash payment prior to the

- 2018 Annual Report

service yet to be rendered is recorded

o Practical Application:

as deferred revenue.

o Although a service that is rendered prior o Revenues must be recorded with the period

to cash payment is yet to be paid, it is they were earned.

recorded as accrued revenue. o Expenses that have incurred along the

o Examples: same period must also match the

Pest extermination services whose corresponding revenue.

service cost is ₱2000, have rid one's o Example:

house of pests and the like is already Expenses recorded when used to

recorded as accrued revenue. Even generate revenues

if, there is no cash collected from the Rent for 12 months amounting to

rendered services. 36,000. The rent will only surface in the

House cleaning services are paid in books when it has generated revenue.

advance prior to the business Ms. Bautista’s example

rendering their services to the - Car sold: May 28, 2019

customer’s house will be recognized - Comission was paid: June 15, 2019

not as revenue but liability. o Practical Application:

o Ms. Bautista’s Explanation Situation 12. You sold 120 pcs of

The revenue recognition principal cupcakes in November. Your sales

states that revenue should be amounted to a total of Php3,600. You

recognized in the accounting period have computed that total cost of 100 pcs

in which it is earned of cupcakes is Php2,000. This means

In a service business, revenue is that cost per cupcake is Php20. How

usually considered to be earned at much should you record as cost

the time the service is performed (expense) of cupcakes in the month of

In merchandising business, revenue November?

is usually earned at the time the

goods are delivered 3. FULL DISCLOSURE PRINCIPLE

- “I’ll pick this up tomorrow, o “All material facts should be disclosed”

when you will still be here as o Requires the company to include all

always”

necessary information in their financial

o Practical Application (+Conservatism)

statements.

Your mother gave you the amount of o Stakeholders become more aware of the

Php10,000 which shall be used for

status and current operations of the

your small business to buy and sell

institution they are part of.

cupcakes.

o It serves as transparency for organizations

Situation 1. A potential customer

in the market and avoids the act of faking or

talked to you and told you that she

manipulating their records.

may order 100 pcs. Of cupcakes for a

o Example:

party. She said she will ask first her

friends if they want cupcakes for their Company X wants to purchase

Company Z. Company X is going into

party.

Should you record the revenues you bankruptcy and should give Company Z

the full disclosure of their financial

would possibly earn from the

cupcakes? statement.

This will give proof that they are in that

position.

2. MATCHING PRINCIPLES o Practical Application:

Situation 8. You are asking your mother

o This concept basically disregards the timing

for money because you need to bake

and the amount of actual cash inflow or

more cupcakes and your funds are

cash outflow and concentrates on the

running out.

occurrence (i.e. accrual and deferral) of

Your mother asked you to explain why

revenue and expenses.

you need more funds. What will you do?

4. HISTORICAL COST PRINCIPLE (HISTORICAL o Accruals are revenues earned or expenses

PRINCIPLE) incurred which impact a company’s net

income on the income statement, although

o All assets, liabilities, and equity must be

cash related to the transaction has not yet

recorded within the period it acquired or

changed hands.

received.

o The amount of the asset should not be

ACCRUAL ACCOUNTING

changed only if it “appreciates” or o “This means (in short) that all revenue and

depreciates”.

expenses are measured when they are

o Example:

earned (revenue) or incurred (expenses)

You bought a painting last year for 100k and this is NOT necessary when the

and now after a year, the value matching cash flows occur (“Accruals

increased to 150k. The 100k is still the Definition,” 2021)

recorded value not the current value. o Accounting reports should always try and

2016 – $50,000

reflect economic reality and not arbitrary

2017 – $100,000

choices of management or outside actors.

o Practical Application:

(“Financial Statement Basics: From

Situation 7. You bought a second hand Confusion to Comfort in Under 100 Pages,”

laptop for Php 2,000 so you can use it to 2015, p.78)

record your revenues and expenses for o “The recognition of income and expenses

your cupcake business. at the time they are earned or incurred,

After a year of successful operations,

regardless of when the cash for the

you discovered that you can sell your transaction is received or paid out.”

laptop for Php1,000 which you can now

(“Keeping the Books: Basic

use to buy a new laptop, do you change Recordkeeping and Accounting for Small

the recorded value of your laptop in your

Business,” 2014)

accounting records? o Miss Bautista’s Explanation:

“The effects of business

transactions should be recognized

5. CONSISTENCY PRINCIPLE (Ms. Bautista) in the period in which they

o A company should use the same accounting occurred. Income should be

policies and methods for recording similar recognized in the period when it is

events or transactions from one financial earned regardless of when the

period to another. payment is received. Expenses

o It is necessary that a company consistently should be recognized in the period

when it is incurred regardless of

apply its accounting methods and policies

when the expenses are paid.

from one financial year to another.

o Practical Application:

o Practical Application:

Situation 10. Your customer in

Situation 11. All your materials (flour,

Situation 9 will pay you three days

sugar, baking powder, etc.) are

after your delivery date. Your

measured in grams. And that was

delivery date is July 10.

how you have been recording your

When should you record your

inventory, in grams.

sales, July 10 or July 13?

One of your suppliers suddenly

delivered flour to you and it was

TYPES OF ACCRUALS

packed and labeled in ounces. What

1. Accrued Expenses / Expense Accruals

will you do?

o Accrued expense are costs that have been

incurred; it is recorded in a journal entry

OTHER RELATED CONCEPTS together with other liabilities. (Bragg, 2020)

o Accrued expenses are considered to be

ACCRUALS current liabilities because the payment is

usually due within one year of the date of o Practical Application (+Revenue

the transaction. (Tuovila, 2019) Recognition Principle)

o Current Liabilities - "Payable"

o Examples:

An expense you record now but is

payable at a later date

Utility expenses that won’t be billed

until the following month

Salaries/wages owed to employees

who work without having received

their full earned monthly salary.

2. Accrued Revenue / Revenue Accruals

o Accrued revenue is a sale recognized by

the seller but has not yet been billed to the

customer. (Bragg, 2020)

o Accrued revenues are either income or

assets (including non-cash assets) that are

yet to be received It is recorded as

receivables (current asset) on the balance

sheet to reflect the amount of money a

customer owes the business. (Tuovila,

2019)

o Current Asset - "Receivable"

Your mother gave you the amount of

Php10,000 which shall be used for

your small business to buy and sell

o Examples: cupcakes.

Billings delayed for several months or Situation 1. A potential customer talked

years to you and told you that she may order

- Long-term construction projects 100 pcs. Of cupcakes for a party. She

Loans - accrued interest revenue said she will ask first her friends if they

monthly want cupcakes for their party.

Should you record the revenues you

CONSERVATISM OR PRUDENCE would possibly earn from the

o Conservatism is an accounting principle cupcakes?

that comes to play when facing uncertainty

in recognizing the outcome of a financial COST/BENEFIT ANALYSIS PRINCIPLE

statement: gain or loss. o The cost-benefit principle holds that the

o A "play it safe action” wherein it anticipate cost of providing information via the

future losses; opting for a lesser asset financial statements should not exceed its

amount or a greater liability amount, and a utility to readers.

lesser amount of net income rather than o If accounting concepts suggest a particular

gain or revenue. accounting treatment for an item, but it

o Gains can only be recognized if it is certain appears that the theoretically correct

that it will be received. By recording the treatment would require an unreasonable

potential loss, less profit and less asset amount of work, the accountant may

amounts will be reported. analyze the benefits and costs of the

o Ms. Bautista’s Explanation: preferred treatment to see if the benefit

Provide – Liabilities, Expenses, Loss gained from its adoption is justified by the

Do not anticipate – Assets, Revenue, cost.

Income

o Practical Application (+Materiality)

o Situation 5. You baked 50 pcs of cupcakes

and carefully arranged them in 5 boxes to

be delivered to one restaurant. Upon

delivery, your customer counted only 49

pcs of cupcakes. She therefore demanded

that she will only pay for 49 pcs. What will

you do?

You will go back home and get one

piece of cupcake and deliver to the

restaurant.

Fight with your customer and insist

there are 50 pcs.

Just collect the value of 49 pcs and

apologize to your customer.

o Situation 6. Refer to situation 5. Upon

getting back to your kitchen, will you still

look where the missing cupcake went?

COST BENEFIT TEST

o You discover that one of your employee is

stealing from the cash register. The amount

is suspected to be over $1,000 but you are

not sure

o It is estimated that you will have to pay

$5,000 to your account attorney to dig

through his records and discover the exact

amount of theft

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Windows 10 Keyboard ShortcutsDocument3 pagesWindows 10 Keyboard Shortcutskc purgananNo ratings yet

- Quizzes - Chapter 2 - Accounting Concepts and PrinciplesDocument3 pagesQuizzes - Chapter 2 - Accounting Concepts and PrinciplesAmie Jane Miranda67% (9)

- Fundamentals of ABM 1 Q1W1Document62 pagesFundamentals of ABM 1 Q1W1giselleNo ratings yet

- Auditing Test Bank Chapter 9Document39 pagesAuditing Test Bank Chapter 9MohammadYaqoob100% (5)

- UntitledDocument10 pagesUntitledPrincesNo ratings yet

- Summary of CH 8 Auditing Planning and MaterialityDocument17 pagesSummary of CH 8 Auditing Planning and MaterialityMutia WardaniNo ratings yet

- AUD-FinPB 05.22Document14 pagesAUD-FinPB 05.22Luis Martin PunayNo ratings yet

- Ifrs S1Document48 pagesIfrs S1ComunicarSe-ArchivoNo ratings yet

- Chapter 10 - MCQ With AnswerDocument11 pagesChapter 10 - MCQ With AnswerGerlie0% (1)

- AT.2815 - Considering Work of Other Practitioners PDFDocument5 pagesAT.2815 - Considering Work of Other Practitioners PDFMaeNo ratings yet

- ADVANCED AUDITING Revision QNS, Check CoverageDocument21 pagesADVANCED AUDITING Revision QNS, Check CoverageRewardMaturure100% (2)

- 2016 CFA Level 1 Mock Exam Morning - Answers PDFDocument45 pages2016 CFA Level 1 Mock Exam Morning - Answers PDFIkimasukaNo ratings yet

- Analysis of Rizal's Poems (1st Five)Document6 pagesAnalysis of Rizal's Poems (1st Five)kc purganan100% (8)

- Pamantasan NG Lungsod NG Pasig: Test I - True or FalseDocument4 pagesPamantasan NG Lungsod NG Pasig: Test I - True or FalseJOHN PAUL DOROIN100% (1)

- Rizals Education (Mother-UST)Document6 pagesRizals Education (Mother-UST)kc purgananNo ratings yet

- Worksheet 1-Comic StripDocument1 pageWorksheet 1-Comic Stripkc purganan100% (11)

- W6-Nolis Orig. Coverw7-Nolis El Filis Venn-W8-2nd Trip To Europe Via U.SDocument4 pagesW6-Nolis Orig. Coverw7-Nolis El Filis Venn-W8-2nd Trip To Europe Via U.Skc purganan0% (1)

- First Philippine RepublicDocument1 pageFirst Philippine Republickc purgananNo ratings yet

- First Philippine RepublicDocument1 pageFirst Philippine Republickc purgananNo ratings yet

- Theories Conceptual Framework and Accouting Standards Answer KeyDocument7 pagesTheories Conceptual Framework and Accouting Standards Answer KeyEl AgricheNo ratings yet

- Practical Accounting 2 With AnswersDocument13 pagesPractical Accounting 2 With AnswersFlorence CuansoNo ratings yet

- Audit MCQ by IcaiDocument24 pagesAudit MCQ by IcaiRahulNo ratings yet

- PSA 520, Analytical Procedures: PSA 320 Revised and Redrafted Materiality in Planning and Performing An Audit, andDocument22 pagesPSA 520, Analytical Procedures: PSA 320 Revised and Redrafted Materiality in Planning and Performing An Audit, andGarcia Alizsandra L.No ratings yet

- CHAPTER 3 Answers To Review QuestionsDocument9 pagesCHAPTER 3 Answers To Review Questionswhagan167% (3)

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The RestDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The RestOscar CopierNo ratings yet

- International Financial Reporting A Practical Guide 8Th Edition Alan Melville Full ChapterDocument67 pagesInternational Financial Reporting A Practical Guide 8Th Edition Alan Melville Full Chapterjonathan.tarvin410No ratings yet

- Quiz 2 Finals Acctng 411N Sampling and Substantive TestsDocument5 pagesQuiz 2 Finals Acctng 411N Sampling and Substantive TestsJunhui WenNo ratings yet

- JohnstoneDocument33 pagesJohnstoneTri Astono ArifNo ratings yet

- Preface To International Standards and Philippine Standards Philippine Framework For Assurance Engagements Glossary of Terms (December 2002)Document7 pagesPreface To International Standards and Philippine Standards Philippine Framework For Assurance Engagements Glossary of Terms (December 2002)Kendall JennerNo ratings yet

- Chapter 8Document14 pagesChapter 8Farhan AriNo ratings yet

- The Relationship Between Materiality and Audit RiskDocument1 pageThe Relationship Between Materiality and Audit RiskAiniKhan100% (2)

- Part II - AppendixDocument73 pagesPart II - AppendixsamaanNo ratings yet

- AuditingDocument41 pagesAuditingTina NendongoNo ratings yet

- 13 Audit Notes For CA Final by CA Ashish GoyalDocument159 pages13 Audit Notes For CA Final by CA Ashish GoyalSuhag Patel100% (3)

- Auditing TheoryDocument103 pagesAuditing TheoryCristineJoyceMalubayIINo ratings yet

- Auditing and Assurance Services 14th e Chapter 3Document13 pagesAuditing and Assurance Services 14th e Chapter 3Test 37No ratings yet

- Agenda Item 7-C: International Standard On Review Engagements 2400 Engagements To Review Financial StatementsDocument6 pagesAgenda Item 7-C: International Standard On Review Engagements 2400 Engagements To Review Financial StatementsInnocent MakayaNo ratings yet