Professional Documents

Culture Documents

Chapter 2 #15

Chapter 2 #15

Uploaded by

spp0 ratings0% found this document useful (0 votes)

191 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

191 views2 pagesChapter 2 #15

Chapter 2 #15

Uploaded by

sppCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

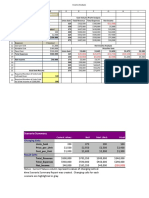

Problem #15

Distribution of Profits or Losses Based on Partners’ Agreement

A summary of changes in the capital accounts of the Rialubin, Rabena and Dela Cruz partnership for 2018, before

closing, follows:

Rialubin Rabena Dela Cruz Total

Balance, Jan 1,2018 P80000 P80000 P90000 P250000

Investment, Apr 1 20000 20000

Withdrawal, May 1 (15000) (15000)

Withdrawal, July 1 (10000) (10000)

Withdrawal, Sept 1 (30000) (30000)

P90000 P65000 P60000 P215000

Required:

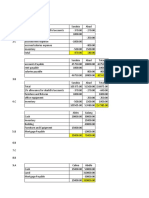

Determine the allocation of the 2018 profit to the partners under each of the following independent assumptions:

1. Profit is P48000 and profit is divided on the basis of average capital balances.

2. Profit is P50000. Rialubin receives a bonus of 10% of profit for managing the business, and the balance to be

divided on the basis of beginning capital balances.

3. Loss is P35000, each partner is allowed 10% interest on beginning capital balances, and the balance to be

divided equally.

Rialubin Rabena Dela Cruz Total

Average Capital Balances 90000.00 70000.00 80000.00 240000.00

Remainder -72000.00 -56000.00 -64000.00 -192000.00

Profit 18000.00 14000.00 16000.00 48000.00

Rialubin Rabena Dela Cruz Total

Beginning Capital Balances 80000.00 80000.00 90000.00 250000.00

Bonus 10% 5000.00 5000.00

Remainder -65600.00 -65600.00 -73800.00 -205000.00

Profit 19400.00 14400.00 16200.00 50000.00

Rialubin Rabena Dela Cruz Total

Beginning Capital Balances 80000.00 80000.00 90000.00 250000.00

Interest 10% 8000.00 8000.00 9000.00 25000.00

103333.3 103333.3

Remainder 3 3 103333.33 -310000.00

Profit -15333.33 -15333.33 -4333.33 -35000.00

AVERAGE CAPITAL BALANCES

Dela

Rialubin Rabena Cruz

1/1/201 80000.0 1/1/201 80000.0 1/1/201 90000.0

8 0 8 0 8 0

4/1/201 15000.0 5/1/201 10000.0 9/1/201 10000.0

8 0 8 0 8 0

7/1/201 -

8 5000.00

90000.0 70000.0 80000.0

Total 0 Total 0 Total 0

Ratio Total

Dela 240000.0

Rialubin 0.38 Rabena 0.29 Cruz 0.33 0

You might also like

- IWTYTBR The-Journal Chapter1Document29 pagesIWTYTBR The-Journal Chapter1Bruna JennyferNo ratings yet

- Problem #6 A Sole Proprietorship and An Individual With No Business Form A PartnershipDocument1 pageProblem #6 A Sole Proprietorship and An Individual With No Business Form A Partnershipstudentone93% (15)

- Problem #7 A Sole Proprietorship and An Individual With No Business Form A PartnershipDocument2 pagesProblem #7 A Sole Proprietorship and An Individual With No Business Form A Partnershipspp78% (9)

- Problem #8 Two Sole Proprietors Form A PartnershipDocument2 pagesProblem #8 Two Sole Proprietors Form A Partnershipstudentone87% (15)

- Problem #9 Two Sole Proprietorship Form A PartnershipDocument3 pagesProblem #9 Two Sole Proprietorship Form A Partnershipstudentone60% (15)

- Problem #21 Preparation of Financial StatementsDocument4 pagesProblem #21 Preparation of Financial Statementsspp33% (3)

- Problem #21 Preparation of Financial StatementsDocument4 pagesProblem #21 Preparation of Financial Statementsspp33% (3)

- (Phan Vu) AYK Income AnalysisDocument2 pages(Phan Vu) AYK Income AnalysisPhan VuNo ratings yet

- Chapter 2 #13Document1 pageChapter 2 #13spp100% (3)

- Chapter 2 #2Document2 pagesChapter 2 #2spp75% (4)

- Ch29 The Birdie GloveDocument8 pagesCh29 The Birdie GloveSiska Kurniawan0% (1)

- Problem #15 Distribution of Profits or Losses Based On Partners' AgreementDocument2 pagesProblem #15 Distribution of Profits or Losses Based On Partners' Agreementspp71% (7)

- Chapter 2 #2Document2 pagesChapter 2 #2spp75% (4)

- Chapter 2 #13Document1 pageChapter 2 #13spp100% (3)

- ParCor Chapter3 BuenaventuraDocument19 pagesParCor Chapter3 BuenaventuraAnonn100% (3)

- Problem #16 Distribution of Profits or Losses Based On Partner's AgreementDocument2 pagesProblem #16 Distribution of Profits or Losses Based On Partner's Agreementspp50% (2)

- Chapter 2 ParcorDocument17 pagesChapter 2 Parcornikki sy100% (4)

- Multiple Choice PracticeDocument3 pagesMultiple Choice Practicespp100% (2)

- Chapter 2 #11Document2 pagesChapter 2 #11spp100% (3)

- Chapter 2 #17Document1 pageChapter 2 #17sppNo ratings yet

- Chapter 2 #9Document2 pagesChapter 2 #9spp75% (4)

- Problem #5 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #5 Distribution of Profits or Losses Based On Partners' Agreementspp100% (2)

- Part 5Document2 pagesPart 5PRETTYKO0% (1)

- Problem #1 Establishing Profit and Loss Sharing MethodDocument1 pageProblem #1 Establishing Profit and Loss Sharing Methodspp100% (1)

- Problem #16 Distribution of Profits or Losses Based On Partner's AgreementDocument2 pagesProblem #16 Distribution of Profits or Losses Based On Partner's Agreementspp50% (2)

- Multiple Choice PracticeDocument3 pagesMultiple Choice Practicespp100% (2)

- Chapter 2 #17Document1 pageChapter 2 #17sppNo ratings yet

- Chapter 2 #9Document2 pagesChapter 2 #9spp75% (4)

- Chapter 2 #11Document2 pagesChapter 2 #11spp100% (3)

- Problem #1 Establishing Profit and Loss Sharing MethodDocument1 pageProblem #1 Establishing Profit and Loss Sharing Methodspp100% (1)

- Problem #5 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #5 Distribution of Profits or Losses Based On Partners' Agreementspp100% (2)

- Problem #12 Distribution of Profits or Losses Based On Partners' AgreementDocument3 pagesProblem #12 Distribution of Profits or Losses Based On Partners' Agreementspp0% (1)

- Problem #14 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #14 Distribution of Profits or Losses Based On Partners' AgreementsppNo ratings yet

- Chapter 2 10Document2 pagesChapter 2 10graceNo ratings yet

- Problem #19 Distribution of Profits or Losses Based On Partners' AgreementDocument2 pagesProblem #19 Distribution of Profits or Losses Based On Partners' Agreementspp75% (4)

- Problem #6 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #6 Distribution of Profits or Losses Based On Partners' AgreementsppNo ratings yet

- Problem #3 Rules For The Distribution of Profits or LossesDocument1 pageProblem #3 Rules For The Distribution of Profits or LossessppNo ratings yet

- Chapter 2 # 8 NsDocument1 pageChapter 2 # 8 Nsspp100% (2)

- DocxDocument1 pageDocxJannah FateNo ratings yet

- Part 3Document6 pagesPart 3PRETTYKO100% (1)

- Problem #4 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #4 Distribution of Profits or Losses Based On Partners' Agreementspp100% (1)

- Problem #7 Rules For The Distribution of Profits or LossesDocument1 pageProblem #7 Rules For The Distribution of Profits or Lossesspp100% (3)

- ParCor Chapter3 Part2 BuenaventuraDocument17 pagesParCor Chapter3 Part2 BuenaventuraAnonn100% (4)

- Assignment Bsma 1a April 6Document27 pagesAssignment Bsma 1a April 6Maeca Angela Serrano100% (1)

- CcountsingDocument32 pagesCcountsingJannah Fate67% (9)

- Books of Espanol Books of The Partnership ( (1) ) : Fish R Us Post Closing Trial Balance December 31, 2007Document3 pagesBooks of Espanol Books of The Partnership ( (1) ) : Fish R Us Post Closing Trial Balance December 31, 2007April Naida100% (1)

- BA 2 Discussion Chapter 2Document10 pagesBA 2 Discussion Chapter 2iamamayNo ratings yet

- Chapter 3 ProblemsDocument11 pagesChapter 3 Problemsahmed arfan100% (1)

- Partnership LiquidationDocument4 pagesPartnership LiquidationHerlyn Juvelle Sevilla100% (3)

- Prob 3 Ch. 1 ParcorDocument2 pagesProb 3 Ch. 1 Parcorstudentone100% (1)

- Multiple Choice Practice 1Document3 pagesMultiple Choice Practice 1sppNo ratings yet

- Problem #15 Distribution of Profits or Losses Based On Partners' AgreementDocument2 pagesProblem #15 Distribution of Profits or Losses Based On Partners' AgreementMary Ingrid Arellano RabulanNo ratings yet

- Achas, Ashley - Chapter 2 Assignment 1Document8 pagesAchas, Ashley - Chapter 2 Assignment 1Gwen Stefani DaugdaugNo ratings yet

- ProblemDocument8 pagesProblemCORES LYRICSNo ratings yet

- Lecture October 17Document20 pagesLecture October 17RanielMBarbosaNo ratings yet

- ch14 ExercisesDocument10 pagesch14 ExercisesAriin TambunanNo ratings yet

- Jurnal: 2. Pengakuan Realisasi Home Office Branch OfficeDocument2 pagesJurnal: 2. Pengakuan Realisasi Home Office Branch OfficefaldyNo ratings yet

- MaDocument6 pagesMaAashayNo ratings yet

- Balance Sheet 1st Year 2nd Year Rs. RsDocument1 pageBalance Sheet 1st Year 2nd Year Rs. Rsjayesh janiNo ratings yet

- Notes CA Int GMDocument51 pagesNotes CA Int GMDharmateja ChakriNo ratings yet

- Midterms Sa2 FARDocument6 pagesMidterms Sa2 FAREloiNo ratings yet

- Operations Exercise 6Document2 pagesOperations Exercise 6Alleya. Jane AliNo ratings yet

- Semi Final AccountingDocument8 pagesSemi Final AccountingSherryl DumagpiNo ratings yet

- Cash Flow QN 3Document4 pagesCash Flow QN 3Takudzwa LanceNo ratings yet

- Acct6005 Company Accounting: Assessment 2 Case StudyDocument8 pagesAcct6005 Company Accounting: Assessment 2 Case StudyRuhan SinghNo ratings yet

- Cfas AssigmentDocument8 pagesCfas AssigmentChristen HerceNo ratings yet

- PPS DissolutionDocument13 pagesPPS DissolutionAireen Shelvie BermudezNo ratings yet

- Chapter 2 #20Document3 pagesChapter 2 #20spp50% (2)

- Waterfall ModelDocument6 pagesWaterfall Modelpriyal patelNo ratings yet

- Multiple Choice Short Problem Midterm Exams SolutionsDocument13 pagesMultiple Choice Short Problem Midterm Exams SolutionsTrisha Mae BrazaNo ratings yet

- Financial Decision Making: Module Code: UMADFJ-15-MDocument9 pagesFinancial Decision Making: Module Code: UMADFJ-15-MFaraz BakhshNo ratings yet

- Chapter 5 Installment Liquidation Graded Problem SolutionDocument24 pagesChapter 5 Installment Liquidation Graded Problem SolutionChris Jobert AlmacenNo ratings yet

- Case 1: Purhase of Interest - Goodwill To Old PartnersDocument12 pagesCase 1: Purhase of Interest - Goodwill To Old PartnersAEDRIAN LEE DERECHONo ratings yet

- 11170189-Tugas AKL 2 11170189 - Eki AmosDocument17 pages11170189-Tugas AKL 2 11170189 - Eki AmosAmouse ManaluNo ratings yet

- Financial Plan General Description Amount JustificationDocument5 pagesFinancial Plan General Description Amount JustificationClaudio LaCervaNo ratings yet

- Ots 24 24009366 Annexure AmlaDocument17 pagesOts 24 24009366 Annexure Amlaapi-3774915No ratings yet

- Assignment 9Document10 pagesAssignment 9Jerickho JNo ratings yet

- DocxDocument1 pageDocxJannah FateNo ratings yet

- PracticeDocument2 pagesPracticesppNo ratings yet

- Multiple Choice Practice 1Document3 pagesMultiple Choice Practice 1sppNo ratings yet

- Multiple ChoiceDocument2 pagesMultiple ChoicesppNo ratings yet

- Problem #3 Rules For The Distribution of Profits or LossesDocument1 pageProblem #3 Rules For The Distribution of Profits or LossessppNo ratings yet

- Problem #19 Distribution of Profits or Losses Based On Partners' AgreementDocument2 pagesProblem #19 Distribution of Profits or Losses Based On Partners' Agreementspp75% (4)

- Chapter 2 #20Document3 pagesChapter 2 #20spp50% (2)

- Chapter 2 10Document2 pagesChapter 2 10graceNo ratings yet

- Problem #14 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #14 Distribution of Profits or Losses Based On Partners' AgreementsppNo ratings yet

- Problem #12 Distribution of Profits or Losses Based On Partners' AgreementDocument3 pagesProblem #12 Distribution of Profits or Losses Based On Partners' Agreementspp0% (1)

- Problem #4 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #4 Distribution of Profits or Losses Based On Partners' Agreementspp100% (1)

- Problem #6 Distribution of Profits or Losses Based On Partners' AgreementDocument1 pageProblem #6 Distribution of Profits or Losses Based On Partners' AgreementsppNo ratings yet

- Chapter 2 # 8 NsDocument1 pageChapter 2 # 8 Nsspp100% (2)

- Problem #10 Two Sole Proprietorship Form A PartnershipDocument2 pagesProblem #10 Two Sole Proprietorship Form A Partnershipstudentone83% (6)

- Problem #7 Rules For The Distribution of Profits or LossesDocument1 pageProblem #7 Rules For The Distribution of Profits or Lossesspp100% (3)

- Cha 7 SDocument63 pagesCha 7 SRekik TeferaNo ratings yet

- Trends in Management AccountingDocument2 pagesTrends in Management AccountingRishi ShibdatNo ratings yet

- Chapter 4Document15 pagesChapter 4Nur Adilah AdibahNo ratings yet

- Customer Story - Siebel TPM - Case Study - Pernod 2006 2Document4 pagesCustomer Story - Siebel TPM - Case Study - Pernod 2006 2nitinmanoharanNo ratings yet

- Example of Chapter 2Document18 pagesExample of Chapter 2Gilmar BaunNo ratings yet

- Introduction To Marketing - MBADocument43 pagesIntroduction To Marketing - MBAmeleseNo ratings yet

- Contract Agreement With Compass Group USA, Inc. Chartwells DivisionDocument5 pagesContract Agreement With Compass Group USA, Inc. Chartwells DivisionMcKenna LeavensNo ratings yet

- Business Plan Template PDFDocument24 pagesBusiness Plan Template PDFHARLEY L. TANNo ratings yet

- The Market Planning GuideDocument257 pagesThe Market Planning GuideCosmin RaducanuNo ratings yet

- NRUPANDocument6 pagesNRUPANRahulSekharNo ratings yet

- FIN202 Chap-8 Selected-ExercisesDocument1 pageFIN202 Chap-8 Selected-ExercisesT L K LyNo ratings yet

- 1561 3896 1 SMDocument8 pages1561 3896 1 SMAlfi SyahrinNo ratings yet

- Red Flags Checklist For PractitionersDocument29 pagesRed Flags Checklist For PractitionersBernadette Martínez HernándezNo ratings yet

- ICC Trade Register Report 2022 Summary VfiiDocument47 pagesICC Trade Register Report 2022 Summary VfiiAashi VashistaNo ratings yet

- Innovating Social Housing Tracing The Social in SoDocument15 pagesInnovating Social Housing Tracing The Social in SoHicham LakhdariNo ratings yet

- Leadership On Change and Innovation (Part-Two)Document29 pagesLeadership On Change and Innovation (Part-Two)HaileNo ratings yet

- A Study On Funds Flow Analysis With Reference To GAIL (India) Limited, RajahmundryDocument31 pagesA Study On Funds Flow Analysis With Reference To GAIL (India) Limited, RajahmundryZASXANo ratings yet

- Sardauna Abdul-Sobur Dembo 20204075.FIN301Document10 pagesSardauna Abdul-Sobur Dembo 20204075.FIN301Neong GhalleyNo ratings yet

- Global Marketing StrategyDocument3 pagesGlobal Marketing StrategySabin ShresthaNo ratings yet

- Project Selection Journal 5 PDFDocument16 pagesProject Selection Journal 5 PDFHappy BenNo ratings yet

- Sustainability Report 2020 Siemens EnergyDocument80 pagesSustainability Report 2020 Siemens EnergyEnergy 2GreenNo ratings yet

- Corporate Valuation & Financial Modelling - 2020: A Co. B CoDocument3 pagesCorporate Valuation & Financial Modelling - 2020: A Co. B CoRakshith PsNo ratings yet

- Implementation of Marketing Strategies in Improving Marketing Performance at CV. Tio Craft IndonesiaDocument11 pagesImplementation of Marketing Strategies in Improving Marketing Performance at CV. Tio Craft IndonesiaJana ristia ningsihNo ratings yet

- BS Jan Monthly Paper Grade 10 NewDocument16 pagesBS Jan Monthly Paper Grade 10 Newharitha prasanNo ratings yet

- Acor Environmental Labelling Claims Final Report 28july20 1 1Document42 pagesAcor Environmental Labelling Claims Final Report 28july20 1 1Mohd RafiNo ratings yet

- Key Responsibilities of A Retail Sales MerchandiserDocument11 pagesKey Responsibilities of A Retail Sales MerchandiserchandNo ratings yet

- Fundamentals of Management For EngineersDocument162 pagesFundamentals of Management For EngineersSai SrinuNo ratings yet

- Nestle Digital Acceleration Team Q&ADocument2 pagesNestle Digital Acceleration Team Q&AMustafa Mian0% (1)