Professional Documents

Culture Documents

Global - Construction, December 2019

Uploaded by

Wafa' AtsabitaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Global - Construction, December 2019

Uploaded by

Wafa' AtsabitaCopyright:

Available Formats

Global - Construction

REFERENCE CODE: MLIP3038-0018

PUBLICATION DATE: Dec 2019

WWW.MARKETLINEINFO.COM

© MARKETLINE. THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

Global - Construction Page 1

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Executive Summary

Executive Summary

Market value

The global construction industry grew by 3.8% in 2018 to reach a value of $4,124.2 billion.

Market value forecast

In 2023, the global construction industry is forecast to have a value of $5,154.1 billion, an increase of 25%

since 2018.

Category segmentation

Non-residential construction is the largest segment of the global construction industry, accounting for 56.4%

of the industry's total value.

Geography segmentation

Asia-pacific accounts for 32.3% of the global construction industry value.

Market rivalry

Rivalry in the construction industry tends to be accumulated in segments and niche markets in which

players’ operations are similar. The industry is mainly fragmented in the residential construction segment,

while a few large players dominate in the non-residential segment.

Global - Construction Page 2

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Market Overview

Market Overview

Market definition

The construction industry is defined as the value of work put in place annually in the residential and non-

residential segments. Civil engineering work is excluded. Where possible data has not been seasonally

adjusted.

The residential construction market is defined as the value of work put in place annually for residential

buildings. This includes apartments, houses, and similar buildings, but not hotels etc. Market value includes

new build and also renovations and repair; it includes construction of buildings and also preparatory work

and completion (demolition, site preparation, electrical and plumbing installation, etc).

The non-residential construction market is defined as the value of non-residential buildings constructed.

These include, but are not restricted to, buildings intended for retail, commercial, manufacturing, and

educational purposes.

All currency conversions were calculated at constant average annual 2018 exchange rates.

For the purposes of this report, the global market consists of North America, South America, Europe, Asia-

Pacific, Middle East, South Africa and Nigeria.

North America consists of Canada, Mexico, and the United States.

South America comprises Argentina, Brazil, Chile, Colombia, and Peru.

Europe comprises Austria, Belgium, the Czech Republic, Denmark, Finland, France, Germany, Greece,

Ireland, Italy, Netherlands, Norway, Poland, Portugal, Russia, Spain, Sweden, Switzerland, Turkey, and the

United Kingdom.

Scandinavia comprises Denmark, Finland, Norway, and Sweden.

Asia-Pacific comprises Australia, China, Hong Kong, India, Indonesia, Kazakhstan, Japan, Malaysia, New

Zealand, Pakistan, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam.

Middle East comprises Egypt, Israel, Saudi Arabia, and United Arab Emirates.

Market analysis

The global construction industry saw revenue growth decelerate to a slow rate in 2018. In the forecast

period growth is expected to level out at a more moderate rate.

The industry had total revenues of $4,124.2bn in 2018, representing a compound annual growth rate

(CAGR) of 5.5% between 2014 and 2018. In comparison, the Asia-Pacific and US industries grew with

CAGRs of 6.2% and 6.5% respectively, over the same period, to reach respective values of $1,333.5bn and

$1,294.0bn in 2018.

Asia-Pacific had the largest share of the sector’s value in 2018. China, home to this region’s largest sector,

is refocusing its economic development on service industries, and whilst its manufacturing industries are

still growing, the non-residential construction pipeline generated by these industries showed the slowest

growth in 2018 versus office buildings. In Japan, the lifting of a ban on gambling resorts in July 2018 has

triggered massive investment in casinos in Japan, and the most valuable projects last year were in the

leisure and hospitality segments. India meanwhile has an emerging ecommerce sector, which over the next

several years will generate an increasing demand for storage and logistics buildings.

Global - Construction Page 3

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Although the US sector recovered from the slight decline of 2017, growth continued to be restricted in the

commercial segment. This in an ongoing trend and is particularly due to the decline of high street retail in

the face of ecommerce. However, the same companies which are arguably at the root of this trend – tech

companies like Google and Amazon – are generating a significant demand for data centers, which has

boosted the project pipeline.

The largest non-residential construction sector within Europe in 2018 was Germany, which saw major

growth following a slight slowdown the previous year. However, the two next-largest sectors, in the UK and

France, experienced slowing growth. This was the average trend of the top eight sectors; Turkey saw the

worst decline, although this did not drag significantly on other European sectors. Brexit was the leading

factor constraining UK construction, and uncertainty over the outcome of the process has been felt by its

trading partners as well.

Cities were the focal points of shifts in the European residential sector in 2018. The German housing

market is seeing a continuing housing shortage in major cities, as well as increases in housing prices.

Some parts of Berlin have experienced rent rises of as much as 10% annually over the last few years, with

the population increasing by around 40,000 people a year.

The performance of the industry is forecast to decelerate, with an anticipated CAGR of 4.6% for the five-

year period 2018 - 2023, which is expected to drive the industry to a value of $5,154.1bn by the end of

2023. Comparatively, the Asia-Pacific and US industries will grow with CAGRs of 4.5% and 4.6%

respectively, over the same period, to reach respective values of $1,663.3bn and $1,619.0bn in 2023.

China’s ongoing urbanization and positive developments in regional economic conditions are expected to

drive demand and growth for residential construction over the forecast period. Residential construction was

the largest segment of the Chinese construction industry in 2018, and the largest residential segment in the

world. It will definitely continue at these rankings, despite moderate fluctuations in growth and a continuing

drive for industrial and infrastructural development.

Global - Construction Page 4

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Market Data

Market Data

Market Value

The global construction industry grew by 3.8% in 2018 to reach a value of $4,124.2 billion.

The compound annual growth rate of the industry in the period 2014-18 was 5.5%.

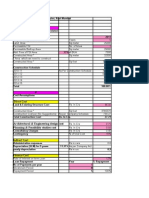

Table 1: Global construction industry value: $ billion, 2014–18

Year $ billion € billion % Growth

2014 3,329.2 2,818.9

2015 3,514.5 2,975.9 5.6%

2016 3,742.3 3,168.8 6.5%

2017 3,973.1 3,364.2 6.2%

2018 4,124.2 3,492.1 3.8%

CAGR: 2014–18 5.5%

Source: MARKETLINE

Figure 1: Global construction industry value: $ billion, 2014–18

Source: MARKETLINE

Global - Construction Page 5

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Market Segmentation

Market Segmentation

Category Segmentation

Non-residential construction is the largest segment of the global construction industry, accounting for 56.4%

of the industry's total value.

The Residential construction segment accounts for the remaining 43.6% of the industry.

Table 2: Global construction industry category segmentation: $ billion, 2018

Category 2018 %

Non-residential Construction 2,325.8 56.4

Residential Construction 1,798.3 43.6

Total 4,124.1 100%

Source: MARKETLINE

Figure 2: Global construction industry category segmentation: % share, by value, 2018

Source: MARKETLINE

Geography Segmentation

Asia-pacific accounts for 32.3% of the global construction industry value.

United States accounts for a further 31.4% of the global industry.

Global - Construction Page 6

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Table 3: Global construction industry geography segmentation: $ billion, 2018

Geography 2018 %

Asia-pacific 1,333.5 32.3

United States 1,294.0 31.4

Europe 1,248.2 30.3

Middle East 78.5 1.9

Rest Of The World 169.9 4.1

Total 4,124.1 100%

Source: MARKETLINE

Figure 3: Global construction industry geography segmentation: % share, by value, 2018

Source: MARKETLINE

Global - Construction Page 7

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Market Outlook

Market Outlook

Market Value Forecast

In 2023, the global construction industry is forecast to have a value of $5,154.1 billion, an increase of 25%

since 2018.

The compound annual growth rate of the industry in the period 2018-23 is predicted to be 4.6%.

Table 4: Global construction industry value forecast: $ billion, 2018–23

Year $ billion € billion % Growth

2018 4,124.2 3,492.1 3.8%

2019 4,332.6 3,668.6 5.1%

2020 4,539.3 3,843.5 4.8%

2021 4,730.1 4,005.1 4.2%

2022 4,943.2 4,185.5 4.5%

2023 5,154.1 4,364.1 4.3%

CAGR: 2018–23 4.6%

Source: MARKETLINE

Figure 4: Global construction industry value forecast: $ billion, 2018–23

Source: MARKETLINE

Global - Construction Page 8

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Five Forces Analysis

Five Forces Analysis

The construction market will be analyzed taking real estate developers and contractors as players. The key

buyers will be taken as property developers, businesses, governments and individuals, and producers of

building materials and sub-contractors as the key suppliers.

Summary

Figure 5: Forces driving competition in the global construction industry, 2018

Source: MARKETLINE

Rivalry in the construction industry tends to be accumulated in segments and niche markets in which

players’ operations are similar. The industry is mainly fragmented in the residential construction segment,

while a few large players dominate in the non-residential segment.

There are numerous buyers, ranging from governments to individual consumers. Many of these buyers will

be in a strong position, especially governments and firms that put construction projects out to tender,

although individuals will have much less buyer power.

Suppliers include sub-contractors and providers of construction materials. The former tend to be smaller

and more numerous than the latter, which have greater bargaining power as the construction materials

markets are highly concentrated.

Capital barriers to entry into the construction industry are related to significant capital outlay and economies

of scale. For competing with incumbents as prime contractors on large infrastructure and commercial

projects, a new entrant must be able to achieve large economies of scale, as well as offering a wide range

of competencies, such as design, procurement, and project management, which reduces the risk of new

entrants. On the other hand, the residential construction sector, which is less concentrated, is more

susceptible to small-scale players. Furthermore, the construction industry is highly sensitive to

macroeconomic performance, which means that the attractiveness of any particular country's market can

vary significantly from one year to another.

Global - Construction Page 9

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Substitutes in this market include opting for repair/remodeling rather than new build, or opting to rent or

lease a property rather than buying.

Buyer Power

Figure 6: Drivers of buyer power in the global construction industry, 2018

Source: MARKETLINE

There are a wide range of buyers in this market. From individuals that seek to buy residential property to

property developers, governments which may engage in big residential projects and civil engineering

(infrastructure) work. Property developers looking to generate income from leases and rents will focus on

residential and non-residential projects such as apartment blocks and retail spaces. Companies in many

verticals may wish to have industrial or commercial premises built, or civil engineering projects such as

airports constructed. Governments assign infrastructure projects (civil engineering) such as road

construction, transportation and utility infrastructure, and other large public works.

These different categories of buyer have widely-differing amounts of power. Government-funded

infrastructure and housing projects are usually put out to tender. The criteria for choosing the successful bid

vary from country to country, but price is usually the most important one. Construction contractors have

limited power in the tender procedures that are usually followed in government infrastructure and

commercial projects, as the power of buyers over price awareness is increased. Nevertheless, price-setting

by cartels of contractors is still possible, especially for large infrastructure projects.

Property developers also have great bargaining power since they leverage the size of their marketplace,

which comprises both corporate and individual clients searching for non-residential and residential

properties. A high concentration of real estate activities to a few large property developers dilutes the power

of construction contractors.

While property developers are the largest group of buyers of residential property, individual consumers can

buy houses from residential contractors, although they have limited power as buyers in this regard. What is

more, the relatively weak ability of individual consumers to evaluate and compare prices of residential

properties – as these are distorted by the different benefits and characteristics of them – enhances the

pricing power of construction companies. House prices obey the usual rules of supply and demand, and

with a large number of sellers and buyers it is difficult to exert much buyer power. Accordingly, the

affordability of housing within a country-market may indicate the power of buyers as that is captured by the

level of supply towards demand.

Furthermore, the urbanization rate of a country plays an important role for players in an industry.

Specifically, a high urbanization rate means that the services of construction contractors, especially in non-

residential construction, are less dispensable since there is strong demand for the development of new

Global - Construction Page 10

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

infrastructure and commercial projects, along with the maintenance of existing ones. Urbanization is high in

most countries within North and South America and Europe – according to the World Bank, many

developed economies are above 80% – but it has still grown in recent years. High urbanization rates

suggest greater demand for construction services. On the other hand, most countries within the Asia-Pacific

region and Africa are characterized by low but emerging urbanization – usually less than 55% of the total

population, contrasting Japan where 92% of the population lives in urban environments. These urbanization

rates suggest that there are many non-urban regions across the country, where large scale construction

services tend to be dispensable.

Backwards integration is an option for buyers in residential construction since housing is highly important,

although for different reasons. Individuals may opt to build their own houses by surpassing construction

contractors in the value chain of construction, but this task is a minority pursuit. Property developers may

have their own construction division, although that may only be the case for large firms. However, vertical

integration is not feasible for buyers (government and property developers) in large infrastructure and

industrial projects, in which the economies of scale and the expertise of construction contractors are

essential. Thus, the power of buyers is weaker in these respects.

Overall, the power of buyers is assessed as moderate.

Supplier Power

Figure 7: Drivers of supplier power in the global construction industry, 2018

Source: MARKETLINE

For prime contractors, suppliers include producers of building materials and also sub-contractors who offer

specialist construction competencies.

The construction materials sector is typically concentrated. Cement (and concrete), iron (and steel),

aluminum and similar materials are commoditized. The production of these materials benefits from large

economies of scale; there are additional gains if a supplier has a well-developed distribution system,

notably a network of ready-mix concrete facilities. In these circumstances, consolidation is favored, which

goes against the bargaining power of players. The presence of large suppliers, particularly of cement

companies such as Lafarge and Heidelberg in most developed industries, limits the bargaining power of

contractors. The extremely high concentration of cement companies – it is common for the top five cement

companies to hold 75% or more of the market in a country – increases the power of suppliers against a

greater number of construction companies. Nevertheless, supplier power is weakened by the fact the

construction industry is very important to supplier revenues, especially for cement companies, since there

are only a few other markets where they can generate their revenues.

It should also be noted that there are few substitute-inputs available. Thus, when the price of cement or iron

rises, construction activities become even more costly, affecting the output of the industry and the profit

Global - Construction Page 11

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

margins of players. Hedging instruments are used on large scale projects to prevent volatility to some

extent, but this case applies only to large players which have that scale-power. Higher prices of inputs give

suppliers higher power. The price of iron as a mineral commodity declined significantly during 2013–2015;

since then, prices have recovered to some extent but have far to climb to come close to the late 2013 peak.

The price of cement, which is the basic non-metallic mineral and material-input in construction, is more

localized – as it is less commoditized than metallic mineral construction materials such as iron – and thus

more dependent on (local) suppliers’ production volumes and costs.

Furthermore, the availability and cost of high and low-skilled and labor is also highly important since this

industry is labor-intensive. Notably, developed industries such as that of the US, Canada, and Germany

have faced labor shortage or lack of skilled labor. This condition leads to augmented labor power and

increasing labor costs.

Finally, there are no alternatives to the services offered by sub-contractors, which specialize in certain

construction activities, although there is the possibility of the vertical integration of players in spite of high

costs. However, prime contractors generally have a wide choice of competing sub-contractors for any part

of the project. Accordingly, the large number of subcontractors undermines their suppliers’ power, while

they are able to distinguish themselves only by their product specifications and their service quality.

Overall, supplier power is moderate.

New Entrants

Figure 8: Factors influencing the likelihood of new entrants in the global construction industry, 2018

Source: MARKETLINE

The economies of scale in the construction industry are usually the most significant barrier for the entry of

new players. Barriers to entry also include a significant capital outlay for the acquisition of capital items.

However, construction companies can be relatively asset-light as the work on site can be outsourced to

sub-contractors and equipment can be hired or leased rather than being purchased. A large number of

small specialized sub-contractors lower the capital barriers for entry of contractors in the construction

market.

Construction companies acting as prime contractors on large non-residential projects face somewhat higher

barriers, as larger economies of scale are required, especially in terms of big infrastructure projects where

only large firms can compete in tenders. In contrast, the residential construction segment is susceptible to

new small scale players.

The differentiation of construction companies by the range of services (vertical integration) provided, from

design to project management to specific building skills, allows the entrance of new players as the

Global - Construction Page 12

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

homogeneity of the construction-product is reduced under these terms. Moreover, the existence of different

segment-markets (horizontal differentiation), such as residential, commercial and industrial construction,

leaves room for new entrants in specialized niche markets.

Regulation is typically stringent and complex. It covers planning permission and zoning, building site health

and safety, and the safety and security of the buildings themselves. Compliance with this government

regulation increases costs. Building restrictions limit supply, having a devastating effect on housing

affordability and demand. These restrictions tend to be stricter in the most developed industries such as the

US and the European. What is more, in some countries in the Asia-Pacific region, such as China, foreign

contractors have limits to their operation, either through limited ownership or the funding requirements for a

project. However, many developing countries across this region, such as India, have sought to promote

public private partnership for infrastructure investment.

Government policies also affect the industry outside of the regulation framework. For example, tax

deductions for mortgage payments, tax incentives, subsidies and infrastructure development strategic plans

can positively affect demand in the construction industry. Affordable housing programs for low income

groups, as well as national infrastructure development plans, are common in developing industries in the

Asia-Pacific and South American regions, supporting construction activities.

Another aspect taken into account by construction companies for entering a particular industry is the

access to and cost of construction materials and machinery. Specifically, the scarcity of construction

materials and machinery within a country leads to imports, which increase the cost of production, while that

cost is also affected by fluctuations in the local currency. Furthermore, the likelihood of new entrants is

reliant on the macroeconomic outlook of the country-market as construction is one of the most vulnerable

industries to the macroeconomic environment, driving but also driven by economic growth. The growth of

construction activities in the Asia-Pacific region will revolve around infrastructure investment, as that is the

main trend in the largest industries of this region, namely China, India and Japan. This also applies in

relatively smaller Asian countries-industries which have an underdeveloped infrastructure, and therefore

plenty of room for growth. The improving macroeconomic environment in Europe also means an increase in

infrastructure investment, which has been limited in recent years amid austerity. Moreover, the projected

protraction of relaxed monetary policy in Europe over the next few years will continue to fuel demand in

residential construction. In contrast, stiffened lending in the US is to slow demand in residential

construction, but a series of infrastructure and commercial projects under development will compensate for

this.

The Asia-Pacific industry was the most lucrative in 2018, accounting for 32.3% of the global value, followed

by the US and Europe, with 31.4% and 30.3%, respectively. Non-residential construction accounted for

56.4% of the total value of the industry in 2018, with the other 43.6% comprised by the residential

construction segment.

Overall, the threat of new entrants is moderate.

Global - Construction Page 13

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Threat of substitutes

Figure 9: Factors influencing the threat of substitutes in the global construction industry, 2018

Source: MARKETLINE

The main substitute for some clients is to opt for buying, renting or leasing existing buildings rather than for

a new build. As a matter of fact, substitution in this industry is apparent between existing and new building

stock, as well as between renting/leasing and buying transactions. Only in times of economic uncertainty

are the options of leasing or renting an existing property over buying (or renting/leasing) a new one

enhanced. Overall, the value of the construction industry is negatively correlated with renting/leasing

existing properties, since demand for the latter has price-sensitive characteristics as the value of new

properties is usually higher than that of existing (similar) ones, while build-to-rent activities are not

prevalent. Moreover, the diversification of players in activities such as renovation and repairs that revolve

around substitutes is not sufficient, as these operations are supplemental to their core operations.

Assessing the relative costs and benefits of these substitutes is difficult. It will depend on factors such as

market rent levels, fitness for purpose of the available buildings, mortgage interest rates, and so on. In the

case of non-residential (commercial) construction, substitutes are less applicable since demand tends to be

inelastic in that segment on the grounds of searching for fitness for purpose buildings. In terms of

residential properties, the benefits of the option of leasing or renting a property are dictated by the

affordability of buying it.

Furthermore, switching costs that exist between buying and renting a residential property are determined by

the mortgage interest rates, which are a crucial demand-factor in residential construction. Additionally, it

should also be noted that in the residential sector, individuals may be dissuaded from renting if the law

favors landlords, or if landlords themselves are unwilling to offer long-term rental agreements.

Finally, the existing stock of properties within a country, and their affordability, dictate the substitutability of

new properties, especially in residential construction.

Overall, the threat of substitutes is assessed as moderate.

Global - Construction Page 14

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Degree of rivalry

Figure 10: Drivers of degree of rivalry in the global construction industry, 2018

Source: MARKETLINE

The construction industry comprises a large number of small companies alongside a few large players. The

reduced level of homogeneity of construction activities, through the means of offering different products for

the same service, alleviates rivalry among players. In fact, rivalry tends to be accumulated in segments and

niche markets, in which players’ operations are similar.

The non-residential construction segment tends to be more concentrated than the residential segment as

the former consists of a few large players, which mainly compete for tenders related to big infrastructure

and commercial projects. In this regard, economies of scale and specialization are even more crucial for

achieving a competitive advantage in this segment, which stands between monopolistic competition and

oligopoly. On the other hand, the residential construction segment tends to be fragmented by a relatively

large number of smaller players, since the scale of these projects does not demand expertise and

significant financial resources, while the standardization of these projects leads to cost efficiency. As a

result, players in the residential segment of the industry mainly compete on price-cost, inducing a near-

perfect competitive environment. Indeed, the residential segment of most of the European industries is

highly fragmented by small and medium-sized players.

Overall, domestic industries within Europe are less concentrated than their counterparts worldwide, while

competition is intensified as contactors tend to compete across the region. Moreover, the US is quite

fragmented according to locations and niche markets. In contrast, domestic industries within the Asia-

Pacific region are more concentrated than the developed markets in Europe and the US. This is mainly due

to the fact that many large contractors engaged in infrastructure projects are state-owned, preventing the

expansion of private players, while the presence of foreign players tends to be limited. Accordingly, leading

players in most of these industries are local and reliant on these domestic industries, avoiding competition.

Rivalry in the construction industry is dictated by the gap between demand and supply for new properties –

since renovations and repairs are a less lucrative source of revenue for players.

Rivalry is intensified by the fact that it is hard for players to expand as that expansion is entirely reliant on

demand rather than their own supply. What is more, the volatility of production costs, regarding the cost of

construction materials added to labor costs, can affect the profitability of industry players. This can

ultimately have an impact on their competition capacity and sustainability. The development of new

technologies and techniques in construction, particularly the adoption of building information modelling

(BIM) and design for manufacturing and assembly (DfMA), will favor concentration to largest players.

Specifically, the high cost of adoption of these technologies that lead to improved efficiency through

reduced costs in terms of designing and building, and a shorter operating cycle, is an impediment for

smaller players.

Global - Construction Page 15

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

The business model of players, in terms of operating on an own account, contract or project-fee basis, is

crucial for the terms of competition. In the first case, players need to adopt vertical integration, with an

asset-light based model being essential. Specifically, when construction companies operate on their own

account it means that they produce on their own premises, which extensively entails greater financial

leverage for funding these projects. Consequently, financial risks are greater through the ownership of

these projects (build-to-suit or build-to-sell), but so are profit margins since construction firms can fully-seize

the market-value of them.

In the case of contract and project fee basis operations, exposure to financial risks is reduced, similar to

profit margins, as construction firms are paid a specified fee for their services, so their income may be

guaranteed, irrespective of demand for that property.

Furthermore, the range of services offered, from design to project management to specific building skills,

enhances differentiation. For instance, vertically integrated contractors can compete for design-build

projects, which are one-stop-shop project delivery as the client assigns both the design and building of a

project to the same entity. Through this vertically integrated business model, a construction firm can

achieve cost-effective synergies on designing, while it can also attain a shorter operating cycle as the

delivery time of a project is faster. On the other hand, the design-bid-build construction delivery method,

which is the most prevalent, is less complex for construction firms as they undertake responsibility for the

building part of a project, specializing in this core operation.

Diversity is also essential to avoid negative demand shocks based on macroeconomic factors that may

affect certain segments or even the whole industry. Many companies have diversified in terms of the

industry segments they operate in, as similar competencies are required in building projects with different

end-uses. However, all segments tend to be affected in an economic downturn (there may be an exception

if a government responds to recession by increasing its spending on particular types of construction).

Geographic diversification can offer more protection against the vagaries of any one country-market, but

may be difficult for the typically small construction firm. These factors mean that when macroeconomic

conditions are tough, rivalry will tend to increase significantly.

It is fairly easy for industry players to ramp their output up and down in response to demand. Employees

may be taken on for individual projects, for example, rather than being retained permanently on the payroll,

but storage costs are significant regarding fixed assets. Accordingly, barriers to exit are usually high,

intensifying rivalry, but that depends on the asset-strategy (operating leverage) of a construction firm.

Overall, the degree of rivalry is assessed as strong.

Global - Construction Page 16

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Competitive Landscape

Competitive Landscape

Summary_Text

The US and Europe are home to some of the world’s largest multinational construction companies. Growth

in both these markets is being driven by mixed-use developments which provide opportunities for leading

players to compete for particularly high-value tenders. The US is also home to the world’s largest data

center construction market, which is a hotbed for innovation and competition. Europe, meanwhile, is

notable for its high adoption rates of building information modelling technology, and 2018 was a particularly

important year for regulation requiring companies to join the transition.

The landscape in China, home to Asia-Pacific’s largest construction industry, is dominated by a handful of

construction behemoths, most of which are subsidiaries of the same state-owned corporation. This level of

consolidation is contrasted by the other large markets in the region. China notably leads the region in the

burgeoning data center construction segment, but India is catching up. Another major driver of competition

in Asia-Pacific is the expansion of goods manufacturing and exports, which is driving demand for industrial

capacity. The situation is different in China, where a transition to service industries is driving demand for

office buildings.

Heading_1

Which leading players were particularly notable in 2018?

Body_Text_1

Bechtel Corp

As of 2019, Bechtel has ranked number one on the ENR Top 400 List of American contractors for 21 years

running. It leads the industrial segment of the non-residential segment, with approximately $3.5bn of its

$5bn total projects value in 2018 consisting of industrial projects. It is the main contractor or subcontractor

for several multi-billion dollar chemical facilities, the largest of which is a nuclear waste treatment center in

Washington worth $17bn and operating on a 20-year schedule. Its largest commercial project in recent

years has been the Bechtel Family National Scout Reserve, with an estimated value of around $440m.

Lennar Corp

Lennar Corp became the largest homebuilder in the US in 2018 through its acquisition of the CalAtlantic

Group. Its end-of-year revenues had risen 63% on 2017 to $20.6bn. The year also the saw the success of

Lennar’s ‘Everything Included’ initiative, reducing post-purchase costs for home-buyers and giving it a

competitive edge, particularly in the aspirational and first-time buyer markets.

Vinci SA

Vinci is one of the largest construction companies in Europe, and has been recovering from a financial

slump around 2016. Last year, its revenues grew by 8% year-on-year to $52bn. Most of its biggest projects

in the non-residential segment last year were hotels and office buildings, and the company followed the

popular strategy of incorporating these into mixed-use developments alongside residential units. However,

an industrial project currently in the planning phase is by far the most valuable project in the company’s

pipeline, set to begin construction in 2021. The Ivry-Paris XIII Waste Treatment Plant Reconstruction will be

worth an estimated $4bn.

Ferrovial SA

Ferrovial SA is a heavy infrastructure and building construction contractor with a major presence in Spain’s

non-residential segment. The company saw its revenues grow by 16.56% year-on-year in 2018, despite the

Global - Construction Page 17

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

cancellation in 2017 of the most valuable project to which it has recently been contracted. Work on the

Alhama Paramount Park development in Murcia was first delayed in 2016 for financial reasons, and was

then cancelled altogether the following year for financial reasons. The largest section of the development to

which Ferrovial had been assigned was worth an estimated $1.3bn. The company nevertheless has four

major commercial projects in the execution phase, mainly consisting of hospital complexes, which is

keeping its non-residential division stable.

China State Construction Corp Engineering Ltd (CSCEC)

CSCEC is a provider of construction contracting and real estate services, and in terms of its project

pipeline, it was the biggest player in China’s non-residential segment in 2018. The company continues to

see year-on-year revenue growth, boosted not only by projects in China but around the world, particularly in

Africa and Asia. CSCEC’s most valuable non-residential projects in 2018 were in the leisure and hospitality

segment, and included a $20.4bn amusement park in Danzhou. The growing middle class is one

explanation for the volume of massive non-residential developments such as this, and suggests that the

growth in demand will only continue.

Sun Hung Kai Properties Ltd

With revenues of almost $11bn in 2018, Sun Hung Kai is China’s largest real estate developer and the

second-largest in the world after an American shopping mall developer. Its revenues have been fairly

consistent since 2016, and whilst the profit margin fell in 2018 on the previous year, it was still just over

50%. The company has been planning to expand its assets in mainland China, having focused much of its

land bank in Hong Kong. 43% of this land bank consisted of properties still under construction in 2018,

demonstrating Sun Hung Kai’s huge ambitions for expansion. This balance of completed and under-

construction properties is impressive given the company’s sizeable and consistent profit margins.

Heading_2

Which residential markets were affected by new regulations or policies in 2018?

Body_Text_2

In January 2018, mortgage rules changed in Canada in such a major way that the change has been widely

blamed for the slowdown in the housing market and, consequently, the residential construction segment.

The central change was to the threshold for the so-called stress test, under which buyers have to qualify for

a mortgage at a rate either 2% above the negotiated rate or at the Bank of Canada’s five-year benchmark

rate, whichever is greater. Before the change, the stress test was only obligatory for buyers with a down

payment of less than 20%, but this has now been extended to all buyers. This has caused a dip in demand

in the housing market, since the stress test makes it difficult for many prospective buyers to secure a

mortgage.

The rollout of the Real Estate Regulation and Development act (RERA) in 2016 was still having major

consequences for Indian residential construction companies in 2018. RERA sets out new disclosure norms

between builders and buyers to safeguard the latter’s interests and calls for more efficient resolutions to

property disputes. These measures have made the industry more transparent, but have also resulted in

costly changes to business practices and adaptations which have floored some small- to medium-sized

businesses. One example of the many constraints RERA has put on traditional corrupt practices in the

industry is through the policing of amendments to property plans by rogue contractors, who in the past have

been notorious for forcing buyers’ consent to changes to suit their own needs.

The direct result of this on the structure of competition in the industry has been consolidation at the top,

with the leading players who managed to adapt sweeping up contracts which had before been distributed

more evenly across a wider playing field. This has good consequences for buyers, and since the market

remains diverse even with the consolidation, it will probably make the residential construction segment

more productive and prosperous after the short-term shock to the system.

The industry in Indonesia has been massively heated up in recent years through the government’s One

Million Homes program, which was introduced in 2015. The program takes steps to achieve one million

single-family residential units, either in the form of houses or apartments, every year. The government’s

2019 goal was to reduce the housing deficit from 11.4 million homes to 6.9 million, and it has managed to

Global - Construction Page 18

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

surpass that target. 2018 was the first year to see the target actually beaten, with 1.13 million new homes

being constructed. 70% of homes are earmarked for lower-income buyers, with the remaining 30% targeted

at the higher-income part of the market.

The impact on players in the residential construction segment comes mainly from more accessible

mortgages and financing options, which ensure a reliable stream of buyers for their properties, and from an

abundance of government construction contracts up for grabs through a competitive tendering system.

Whilst competitive, the tendering system is fueled by such huge demand that the benefits can be spread

quite widely through the construction industry. This has been the main source of growth in the industry in

recent years.

Heading_3

How far do governments influence the non-residential segment?

Body_Text_3

There were few major changes to government regulations in the non-residential construction segment in

2018, but there were other notable developments directed by governments. In Mexico, whilst growth in the

segment has largely been concentrated around Mexico City, the government is planning to decentralize its

various departments, moving 31 of these from the capital to smaller cities. This aim of this proposal is to

decongest the capital and to distribute employment opportunities around the country. The decentralization

process is set to begin with the Education Secretariat, which will be moved from the capital to Puebla, and

will result in the relocation of 17,000 employees by 2021. It has been estimated that $7.4bn in investment

will be required over the next six years for the necessary infrastructure, connectivity and housing capacity

to accommodate the influx of government employees. This is expected to also support non-residential

construction across the country, boosting business tourism and general prosperity in local economies.

Interestingly, the movement of government departments is also going to be a long-term growth driver in

Indonesia, where the capital is being moved from Jakarta to Borneo. Jakarta is one of the fastest-sinking

cities in the world due to overpopulation and urbanization, and a 10-year plan to relocate all of Indonesia’s

offices of state to Borneo is intended to avert an ecological disaster. Whether or not moving to one of the

world’s biggest rainforests is a sensible solution, it will certainly drive demand for new building projects.

Turkey is another country where government involvement boosts non-residential construction, largely

becuase President Erdogan commissions mega-projects which generate high-value tenders for contractors.

The government also issues public-private partnerships (PPP), which have been claimed to have resulted

in 242 construction projects worth $25.4bn during 2014–2018. This is an alternative financing option

intended especially for infrastructure construction projects, although its use in airport construction has

generated non-residential developments, particularly in retail. Another less direct benefit for non-residential

construction has been the impact of increased raw material prices on competition. PPPs have given energy

to the whole construction industry in Turkey, especially since the cross-segment expertise of leading

players such as Ronesans means that a stronger infrastructure portfolio can increase their ability to

compete for non-residential tenders.

Heading_4

Which countries are leading in emerging construction markets?

Body_Text_4

The US has come to lead the emerging market for data center construction by a phenomenal distance. As

Silicon Valley tech giants consolidate the web services industry further, IT infrastructure in almost every

industry is being moved to the cloud, with established firms investing billions in digital transformation. This

trend is still in its early stages, and the need to expand capacity to meet demand for cloud-based computing

will continue to be a growth driver in the construction industry.

China leads this emerging market in Asia-Pacific. The total value of data center projects in the country’s

non-residential project pipeline exceeded those of its competitor India by almost $5bn. It looks unlikely that

China will overtake the US in data center construction any time soon, with the total data centers in the US

pipeline around 75% more valuable. Still, two of the top five most valuable projects in the world in 2019 are

Global - Construction Page 19

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

located in China, demonstrating the country’s ambitions. The majority of China’s projects are also still only

in the planning phase, ensuring a guaranteed stream of value for several years to come. ZTE Energy

Company and China Telecom are behind the two largest projects. It is likely that given the relatively high

level of consolidation in the Chinese tech and web services industries, growth in data center projects will

continue to be driven by small numbers of high-value developments.

The UK leads the data center construction market in Europe. The total value of data center projects in the

UK’s non-residential project pipeline was just under $5bn in 2018, with slightly more projects in the planning

phase than in the execution phase. This is a healthy balance, ensuring a guaranteed stream of value for

several years to come.

Heading_5

Which countries are leading technological innovation?

Body_Text_5

Of all major European construction companies, the Swedish company Skanska is perhaps the most

competitive in technological innovation, with a high take-up of cutting-edge design and building solutions

across its operations. It uses automation and robotization in the construction process, with a particular

focus on building information modelling (BIM), an intelligent 3D model-based design process. Within

residential construction, other applicable technologies include drones for surveying sites and 3D printing for

efficiency and cost-effectiveness in the manufacturing of prefabricated parts.

Fellow Swedish company NCC also distinguishes itself with technology, digitalizing the construction

processes and architectural drawings to flag up design errors before construction begins. The company has

also begun using BIM to share information more precisely and just-in-time with its suppliers. Its Virtual

Design and Construction (VDC) program visualizes the progress of construction projects to allow dialog

with customers earlier in the process, offering overviews of quality, time and cost.

Meanwhile, the rise of solar in China has been meteoric, and as the technology gets cheaper and more

versatile it is likely to become a leading theme in the residential construction segment. The Hantile is just

one instance of an innovation which will increase the versatility of solar, enabling its cost-effective use in

construction. The Hantile is a pv-solar roof tile produced by the Hanergy company, and has been launched

to great acclaim in Europe. With massive government investment in both the solar power industry and

residential construction, a major trend for integrated energy efficiency solutions will come to be a

differentiator for early-adopter companies.

At the higher end of the housing market, there is also growing demand for ‘smart home’ projects, featuring

houses and apartments with Internet-of-Things devices built in, allowing homeowners and landlords to

monitor and manage energy consumption more accurately. Like innovations in solar, this will also have the

effect of making properties more attractive to price-conscious homebuyers, driving down the cost of

electricity bills.

Heading_6

Do leading players have any common strategies?

Body_Text_6

The construction of mixed-use developments is a strong trend in leading non-residential construction

markets, and most of the biggest players in this segment are involved in combined non-residential and

residential projects. For a long time, this has been a useful means of securing planning permission from

local councils for major new developments. Projects which are primarily non-residential in terms of their

initial motivation, such as office complexes, become a more sustainable and attractive proposition for

councils if they can provide their own solutions to the residential demand they create. The incorporation of

retail developments into these projects also offers to boost the local economy, helping to compensate

communities for disruption to the landscape and costs to local councils.

In the US, as in many other countries, increasingly dense urban centers and the changing needs of

homebuyers have become the key drivers of the new boom in mixed-use developments. Urbanization,

aging populations and concerns over environmental sustainability are leading to a demand for ‘smart cities’,

Global - Construction Page 20

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

which alongside technological innovation emphasizes economies of space. In mature economies such as

the US, smart cities are taking shape as smart developments within established metropolises. New York is

a leading example where mixed-use projects are facilitating ‘smart’ infrastructure by consolidating work,

living and leisure spaces into single close-knit developments.

Global - Construction Page 21

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Company Profiles

Company Profiles

Bechtel Corp

Company Overview

Bechtel Corp (Bechtel) is a provider of engineering, construction and project management services. The

company’s major services include construction, master planning, tunneling, finance, engineering,

procurement, sustainability solutions, feasibility studies, project and program management, testing and

commissioning, startup and operations, technology licensing and consulting and financing and equity

investments. It provides these services to energy, transportation, infrastructure, communications, mining

and metals, oil and gas, chemicals, water, defense and nuclear, and government customers across the

world. The company operates through its subsidiaries and regional offices across the Americas, Asia-

Pacific and Europe, the Middle East and Africa. Bechtel is headquartered in San Francisco, California, the

US.

Business Description

Bechtel Corp (Bechtel) is a global engineering, construction and project management company. It provides

engineering, procurement, construction and project management services to diverse industries including

energy, transportation, mining and metals, oil and gas, chemicals, nuclear and security and environment.

Its major services include construction, master planning, engineering, procurement, sustainability solutions,

startup and operations, modularization, tunneling, technology licensing and consulting, and financing and

equity investments. Since its inception, the company has completed over 25,000 projects in 160 countries

across seven continents.

In FY2018, the company received new order worth US$17.3 billion, as compared to US$11.8 billion in the

previous fiscal year. At the end of FY2018, its order backlog was US$46.9 billion, compared to US$51.0

billion at the end of FY2017.

Bechtel operates its business through four business segments, namely, Infrastructure; Mining & Metals

(M&M); Oil, Gas & Chemicals (OG&C); and Nuclear, Security & Environmental (NS&E). The company’s

Infrastructure segment provides engineering, procurement, and construction (EPC) and project

management and consultancy services for various heavy infrastructure projects globally. The segment also

offers a range of services comprising feasibility studies, master planning, sustainability planning and

development, environmental assessments, design, project management, construction management, testing

and commissioning, and risk management. It executes projects for rail systems, roads, bridges, aviation

facilities, power plants, and communications networks. It also develops, manages and constructs airports,

rail and highway systems, besides office buildings, theme parks and resorts. The company also carries out

public-private partnership projects for government and private sector clients. Under the civil sector, the

company carries out the reconstruction of existing systems, earthquake retrofitting, tunnel sections, material

and foundation studies and traffic engineering. For the Rail sector, the segment executes the construction

of high-speed rail systems; mass transit and light-rail systems; surface, underground and elevated

structures; stations, terminals, and platforms; Buildings, bridges, and tunnels; maintenance facilities, yards,

and terminals; signaling, communication, and electrification systems; operations and systems analysis; and

Testing and commissioning. Bechtel provides end-to-end deployment services including program

management, network planning and RF design, engineering, procurement, site acquisition, construction

management, and testing and optimization services in wireless, wireline and other telecommunications

facilities under communications sector.

Global - Construction Page 22

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Since its inception, it has completed 96 airports and airport systems, more than 17,400 miles of installed

wireline and fiber communications cable, over 17,200 miles of highways and roads, 50 hydroelectric power

plants, over 80 ports and harbors, more than 6,200 miles of railroads, 250 miles of tunnels, 300 subway

and railway projects, and 390 individual power plant projects. Major projects of the segment include

Edmonton Valley Line Light Rail Transit, Athens Metro, Toronto-York Spadina Subway Extension, London

City Airport, Keeyask Generating Station, Western Sydney Airport, Crossrail, Dulles Corridor Metrorail

Extension, Hummel Station Power Plant, Gatwick International Airport, Kosovo Motorway, Muscat

International Airport, and Riyadh Metro.

The M&M segment of the company worked on hundreds of mining and metals projects, and conducted

more than 1,000 studies on six continents. It has substantial experience in mineral exploration and geology,

hydrometallurgical processing, mine planning, pyrometallurgical processing, material handling, metal

forming, mineral processing, pollution control, electrometallurgy and environmental permitting. This

segment serves ferrous and non-ferrous metal markets focusing on copper, gold, iron ore and steel,

aluminum and alumina, nickel, and titanium; industrial minerals with focus on cement, glass, and gypsum;

and metal forming and finishing, in particular aluminum and steel. The company’s projects enabled

customers to produce 200 million metric tons of installed iron ore per annum. It also executed 44 major

copper projects; 30 aluminum smelter projects; 15 coal projects and eight alumina refinery projects. Key

projects include Alba Line 6 Expansion Project, Al Taweelah Alumina Refinery, Ras Al Khair aluminum

smelter project, Los Bronces mine development project, Fjardaal aluminum smelter project and Quebrada

Blanca Phase 2.

Through the OG&C segment, the company focuses on construction and other associated services for

chemical, petrochemical and LNG industries. Its service portfolio includes site development, process

design, project management, and engineering, procurement, construction, and start-up for LNG liquefaction

plants, LNG regasification terminals, LNG peak-shaving and transportation facilities, pipelines, offshore and

onshore facilities, and storage tanks. The company has built more than 380 petrochemical and chemical

projects, including grassroots refineries; more than 52,800 miles of pipeline systems; 50 major oil and gas

field developments; 275 refinery expansions and modernizations; and 110 gas processing plants. Bechtel

also handles refinery expansion and modernization projects; and undertakes gas processing plant, and

major oil and gas field development projects. Key projects include Beaumont Scanfining Refinery Upgrade,

Corpus Christi Liquefaction, Liwan 3-1 offshore development project, Jamnagar refinery project, Sabine

Pass Liquefaction, Nanhai Petrochemical Complex, PTTGC Petrochemical Complex, Ruwais refinery

expansion, Tahrir Petrochemicals Project, and West Nile Delta Gas Processing Terminal.

The NS&E business unit provides design and construction services to both renewable and non-renewable

sectors. The company is one of the leading design and construction companies for fossil and nuclear-fueled

power plants. Under fossil fuel powered plant sector, Bechtel undertakes projects ranging from combustion

turbine facilities to solid fuel and integrated gasification combined-cycle (IGCC) plants. The company

completed more than 400 facilities in the industry.

For nuclear fueled power plants, the company offers a comprehensive selection of services, including plant

recovery support, plant license renewal, steam generator replacement, and new nuclear generation. The

renewable power business offers services across solar thermal and photovoltaic, wind, carbon capture and

sequestration and desalination market sectors. The segment’s key projects comprise Lawrence Livermore

National Laboratory, Hanford Waste Treatment and Immobilization Plant, Pueblo Chemical

AgentDestruction Pilot Plant, Uranium Processing Facility, Savannah River Remediation, Arnold

Engineering Development Complex, and Horizon Wylfa Newydd Nuclear Power Plant. The company

provides a range of services to various departments and agencies of the US government. Its services

offering to government agencies include environmental cleanup and restoration at former nuclear weapon

production sites; designing, constructing, and operating complex, first-of-a-kind facilities to treat radioactive

waste safely or eliminate obsolete chemical weapons; engineering, construction and logistics services for

defense and homeland security; operating premier national laboratories to maintain the safety, security, and

reliability of the US nuclear weapons stockpile, and to promote scientific research; manage and operate

Global - Construction Page 23

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

laboratories and provide design and procurement management services to support the US navy nuclear

submarine and aircraft carrier fleet; providing engineering and construction management expertise to help

combat bio-terrorism and support the demilitarization of biological weapons facilities in allies of the US. The

company also manages and operates two national laboratories in Livermore, California and Los Alamos,

New Mexico, and atomic power laboratories in Pennsylvania and New York.

Bechtel Corp

Table 5: Bechtel Corp: key facts

DetailType Detail

Head office: 12011 Sunset Hills RoadReston, Virginia, United

States

Number of Employees: 50000

Website: www.bechtel.com

Financial year-end: December

Source: COMPANY WEBSITE

Lennar Corp

Company Overview

Lennar Corp (Lennar) is a homebuilder that constructs and sells single-family attached and detached

homes. The company also offers real estate related financial services including mortgage financing, title

insurance and closing services. Lennar carries out the purchase, development and sale of residential land.

It develops and constructs multifamily rental properties through its subsidiaries. As of November 2018, the

company owned 201,648 homesites and had access to an additional 68,623 homesites through option

contracts. The company operates its businesses in several US states such as Florida, North Carolina, New

Jersey, Georgia, Maryland, South Carolina, Arizona, Colorado, California, Nevada, Illinois, Minnesota,

Oregon, Tennessee and Washington. Lennar is headquartered in Miami, Florida, the US.The company

reported revenues of (US Dollars) US$20,571.6 million for the fiscal year ended November 2018 (FY2018),

an increase of 62.7% over FY2017. In FY2018, the company’s operating margin was 11%, compared to an

operating margin of 9.4% in FY2017. In FY2018, the company recorded a net margin of 8.2%, compared to

a net margin of 6.4% in FY2017.

The company reported revenues of US$5,562.9 million for the second quarter ended May 2019, an

increase of 43.8% over the previous quarter.

Business Description

Lennar Corp (Lennar) carries out homebuilding and real estate related financial services businesses. The

company's homebuilding operations include construction and sale of single-family attached and detached

homes. It also purchases, develops and sells residential land.

The company operates through eight reportable business segments: Homebuilding East, Homebuilding

West, Homebuilding Central, Homebuilding Texas, Homebuilding Other, Lennar Financial Services, Lennar

Multifamily, and Rialto Investments.

As of November 2018, the company had total backlog of US$6,600 million, as compared to US$3,600

million as of November 2017.

Global - Construction Page 24

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

As of November 2018, the company owned 201,648 homesites and had access to an additional 68,623

homesites through option contracts. During FY2018, the company delivered 45,627 homes, as compared to

29,394 homes in FY2017.

Lennar Corp

Table 6: Lennar Corp: key facts

DetailType Detail

Head office: Suite 400700 NW 107th Avenue, Miami, Florida,

United States

Telephone: 13055594000

Fax: 13026555049

Number of Employees: 11626

Website: www.lennar.com

Financial year-end: November

Ticker: LEN

Stock exchange: New York Stock Exchange

Source: COMPANY WEBSITE

China State Construction Engineering Corp Ltd

Company Overview

China State Construction Engineering Corp Ltd (CSCEC) is a provider of construction contracting and real

estate services. It offers a range of services such as engineering; building construction and contracting;

urban development; real estate development and investment; infrastructure construction and investment;

project management; design and survey; and equipment manufacturing. CSCEC executes various projects

such as construction of roads, municipal utilities, housing units, ports and waterways, railways, airports,

bridges, water conservancy, hydropower, mining, metallurgy and petrochemical plants. It also provides

construction financing services. The company has operations in Asia-Pacific, the Middle East, Africa,

Europe and North America. CSCEC is headquartered in Beijing, China.The company reported revenues of

(Renminbi) CNY1,199,324.5 million for the fiscal year ended December 2018 (FY2018), an increase of

13.8% over FY2017. In FY2018, the company’s operating margin was 6%, compared to an operating

margin of 5.7% in FY2017. In FY2018, the company recorded a net margin of 3.2%, compared to a net

margin of 3.1% in FY2017.

Company Overview

Company Overview

The company reported revenues of CNY297,576.8 million for the first quarter ended March 2019, a

decrease of 17.1% over the previous quarter.

Global - Construction Page 25

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

Business Description

China State Construction Engineering Corp Ltd (CSCEC) is one of the largest construction contractors in

the world. It carries out public construction works, construction of airports, office buildings, hotels, sports

facilities, educational institutions, housing facilities, industrial complexes, and healthcare facilities. The

company has operations in 100 countries and undertakes projects in various regions such as Africa, Asia,

the Americas and the Middle and Europe.

As of December 31, 2018, the company secured new contracts worth CNY2,627.1 billion, compared to

CNY 2,224.9 billion in FY2017. The company classifies its operations into five segments: Building

Construction; Infrastructure Construction and Investment; Real Estate Development and Investment;

Design and Survey; and Others.

China State Construction Engineering Corp Ltd

Table 7: China State Construction Engineering Corp Ltd: key facts

DetailType Detail

Head office: No.15 Sanlihe Road, Haidian District, Beijing ,

Beijing, China

Number of Employees: 302827

Website: www.cscec.com

Financial year-end: December

Ticker: 601668

Stock exchange: Shanghai Stock Exchange

Source: COMPANY WEBSITE

Vinci SA

Company Overview

Vinci SA (Vinci) is an integrated construction and concessions company. It carries out the design,

construction and management of infrastructure and facilities globally. The company’s portfolio of services

includes infrastructure development, civil and hydraulic engineering, upstream design and coordination,

consultancy, and maintenance and technical support services for transport infrastructure and public

facilities. The company carries out transport systems, public and private buildings, energy, airport and

urban development, and water, energy and communication network projects. Vinci is also involved in

transport infrastructure concession operations in the motorway, rail, airport, bridge and tunnel, stadium and

parking facility sectors. It operates through business units and has presence across Europe, the Americas,

Africa, Asia and the Middle East. Vinci is headquartered in Paris, France.The company reported revenues

of (Euro) EUR44,152 million for the fiscal year ended December 2018 (FY2018), an increase of 8% over

FY2017. In FY2018, the company’s operating margin was 11.1%, compared to an operating margin of

11.1% in FY2017. In FY2018, the company recorded a net margin of 6.8%, compared to a net margin of

6.7% in FY2017.

Business Description

Vinci SA (Vinci) is an integrated construction and engineering company. It designs, builds, finances and

manages facilities and infrastructure such as transport systems, public and private buildings and urban

developments, and water, energy and communication networks.

Global - Construction Page 26

MLIP3038-0018

© MARKETLINE THIS PROFILE IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED

EMISPDF us-eyintranet from 36.72.213.51 on 2020-07-21 07:37:17 BST. DownloadPDF.

Downloaded by us-eyintranet from 36.72.213.51 at 2020-07-21 07:37:17 BST. EMIS. Unauthorized Distribution Prohibited.

The company classifies its operations into three segments: Concessions, Contracting, and Immobilier and

Holding Companies.

Vinci operates through 3,200 business units in 100 countries across Europe, the Americas, Africa, Asia and

the Middle East.

Vinci SA

Table 8: Vinci SA: key facts

DetailType Detail

Telephone: 33147163500

Fax: 33147519102

Number of Employees: 194428

Website: www.vinci.com/

Financial year-end: December

Ticker: DG

Stock exchange: Euronext Paris

Source: COMPANY WEBSITE

Ferrovial, S.A.

Company Overview

Ferrovial S.A. (Ferrovial or "the company") is a provider of infrastructure and municipal services. It offers

commercial and residential construction, infrastructure, airport management and toll road services. The

company carries out building refurbishment; civil engineering; nonresidential, residential and industrial

construction projects for private and public sector clients. It also carries out other businesses that include

urban and environmental services; airports investment and operation; infrastructure and facilities