Professional Documents

Culture Documents

Analysing Historical Performance: Total Income 180 200 240

Uploaded by

rohitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysing Historical Performance: Total Income 180 200 240

Uploaded by

rohitCopyright:

Available Formats

Analysing historical Performance

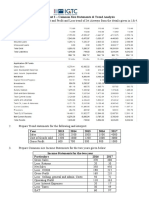

Financial statements of matrix Limited for the Preceding three Years

Three Years (years 1-3)

In Million

Profit and Loss Accounts

1 2 3

Net sales 180 200 229

Income from Marketable securities - - 3

Non – operating income - - 8

Total Income 180 200 240

Cost of goods sold 100 200 240

Selling and General Administrative 30 35 45

expenses

Depreciation 12 15 18

Interest expenses 12 15 16

Total cost and expenses 154 170 204

PBT 26 30 36

Taxes 8 9 12

PAT 18 21 24

Dividend 11 12 12

Retained Earnings 7 9 12

Balance Sheet

1 2 3

Equity Capital 60 90 90

Reserves and Surplus 40 49 61

Debt 100 119 134

Total 200 258 285

Fixed Assets 150 175 190

Investments - 20 25

Net current assets 50 63 70

Total 200 258 285

Reorganising the financial statement handles over the following parameters:

a. Operating Invested Capital:

Total assets in the balance sheet

Net operating fixed assets like surplus fund

Excess cash & marketable securities

b. NOPLAT: Net operating profit less adjusted taxes

NOPLAT= EBIT- taxes on EBIT

While calculating EBIT the following parameters like interest expenses, interest

income and non operating income (or loss)

Taxes on EBIT represents the taxes the firm would pay if it has no debt, excess

marketable securities or non operating income (or loss): attributable to interest

expenses, interest and dividend income, non operating income.

c. Return on invested capital:

ROIC= NOPLAT/Invested capital

ROIC focuses on the true operating performance of the firm.

d. Net investment: Difference between gross investment and depreciation

Net investment = Gross Investment – Depreciation

Gross investment: sum of incremental outlays on capital expenditure and net

current assets

GI= (net fixed assets at the end of year+ Net current assets at the end of year)- (net

fixed assets at the beginning of the year+ Net current assets at the end of the year)

e. Free cash flows: it is the post tax cash flow generated from the operations of the firm after

providing for investments in Fixed assets and net current assets required for the operations

of the firm.

FCF: NOPLAT- Net Investment

FCF: (NOPLAT+ Depreciation)- (Net Investment + Depreciation)

FCF: Gross cash flow- gross Investment

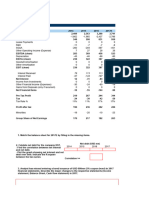

S. No Particulars Year 2 Year3

1. Invested capital

2. NOPLAT

3. ROIC

4. Net Investment

5. Growth rate

6. FCF

You might also like

- Option Trading StrategiesDocument0 pagesOption Trading StrategiesGarvit Garg100% (1)

- Finance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCDocument11 pagesFinance For Non Financial Managers: Avingtrans and Flowtech Fluid Power PWCThanapas Buranapichet100% (2)

- MANG6296 AssignmentDocument28 pagesMANG6296 Assignmentxu zhenchuanNo ratings yet

- National Alcohol & Liquor Factory Financial Statements for FY 2021Document74 pagesNational Alcohol & Liquor Factory Financial Statements for FY 2021Amanuel TewoldeNo ratings yet

- How To Think Like An Officer: A Prospectus: Reed Bonadonna SEPTEMBER 11, 2018Document5 pagesHow To Think Like An Officer: A Prospectus: Reed Bonadonna SEPTEMBER 11, 2018rohit100% (1)

- Financial Statement Analysis of SbiDocument61 pagesFinancial Statement Analysis of SbiGayatri Chiliveri100% (1)

- Corporate ValuationDocument9 pagesCorporate ValuationPRACHI DASNo ratings yet

- To Revel in Gods Sunshine PDFDocument119 pagesTo Revel in Gods Sunshine PDFrohitNo ratings yet

- Ditta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Document36 pagesDitta Shierlly Novierra - Minicase Conch Republic Electronics, Part 2Ummaya MalikNo ratings yet

- Situational Analisys HBODocument22 pagesSituational Analisys HBOVilma KörtvélyesiNo ratings yet

- Analysis of Laxmi Bank's financial performanceDocument22 pagesAnalysis of Laxmi Bank's financial performanceBijaya Dhakal0% (1)

- Additional ExcelSpreadsheetsDocument35 pagesAdditional ExcelSpreadsheetsbipin kumarNo ratings yet

- Matrix Ltd. financial statements analysisDocument9 pagesMatrix Ltd. financial statements analysisbipin kumarNo ratings yet

- DCF Valuation SolvedDocument13 pagesDCF Valuation Solvedhimanshi sharmaNo ratings yet

- Financial Reports: SBI AMC and Fund PerformanceTITLE Detailed Fund Reports: SBI AMC Fund 1 and Fund 2 Stats TITLE SBI AMC and Funds Data: Balance Sheets and Revenue StatementsDocument10 pagesFinancial Reports: SBI AMC and Fund PerformanceTITLE Detailed Fund Reports: SBI AMC Fund 1 and Fund 2 Stats TITLE SBI AMC and Funds Data: Balance Sheets and Revenue StatementsPuneet GargNo ratings yet

- India Ratings Assigns Vishal Infraglobal IND BB-' Outlook StableDocument4 pagesIndia Ratings Assigns Vishal Infraglobal IND BB-' Outlook StableKishan PatelNo ratings yet

- A - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Document7 pagesA - Case Study: Dreaming Corp.: The Financial Statements of Dreaming Corp. Are The Following (In K )Mohamed Lamine SanohNo ratings yet

- Just Dial Financial Model Projections CompleteDocument13 pagesJust Dial Financial Model Projections Completerakhi narulaNo ratings yet

- Just Dial's financial performance over 8 yearsDocument16 pagesJust Dial's financial performance over 8 yearsDaksh MehraNo ratings yet

- Problem Sheet 2 - Common Size Statements & Trend AnalysisDocument3 pagesProblem Sheet 2 - Common Size Statements & Trend AnalysisAkshita KapoorNo ratings yet

- Cash Flows Tutorial QuestionsDocument6 pagesCash Flows Tutorial Questionssmlingwa100% (1)

- Practice FMDocument14 pagesPractice FMАндрій ХмиренкоNo ratings yet

- Financial Analysis - HomeworkDocument7 pagesFinancial Analysis - HomeworkTuan Anh LeeNo ratings yet

- Ey Aarsrapport 2021 22Document40 pagesEy Aarsrapport 2021 22IrinaElenaCososchiNo ratings yet

- Reading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsDocument5 pagesReading Financial Statements: Balance Sheet of Burns Ltd. (In TEUR) 31 Dec 20X5 31 Dec 20X4 Non-Current AssetsSaransh ReuNo ratings yet

- AR Ali 102Document1 pageAR Ali 102Lieder CLNo ratings yet

- Chapter 2 Discussion Questions Rev 0Document6 pagesChapter 2 Discussion Questions Rev 0Hayley SNo ratings yet

- JHM 1Qtr21 Financial Report (Amendment)Document13 pagesJHM 1Qtr21 Financial Report (Amendment)Ooi Gim SengNo ratings yet

- Annual Financial Statements 2020 WebDocument42 pagesAnnual Financial Statements 2020 WebNiyati TiwariNo ratings yet

- FAWCM - Cash Flow 2Document29 pagesFAWCM - Cash Flow 2Jake RoosenbloomNo ratings yet

- Management Accounting - I: - Dr. Sandeep GoelDocument109 pagesManagement Accounting - I: - Dr. Sandeep GoelRajat Jawa100% (1)

- Lyon Corporation Cash Forecast For July, Year 6 Beginning Cash Balance 20Document9 pagesLyon Corporation Cash Forecast For July, Year 6 Beginning Cash Balance 20leniNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- Interpretation / Analysis: Profit & Loss Statement / Account AND Balance SheetDocument4 pagesInterpretation / Analysis: Profit & Loss Statement / Account AND Balance SheetRishabh ThakkarNo ratings yet

- New Data Provided - : Millions of US DollarsDocument1 pageNew Data Provided - : Millions of US DollarsEngr ShahzadNo ratings yet

- Superhero Corporation Inc: Financial Statements For The Year Ended 31 December 2009Document9 pagesSuperhero Corporation Inc: Financial Statements For The Year Ended 31 December 2009shazNo ratings yet

- Analysis of Financial StatementDocument8 pagesAnalysis of Financial StatementMuhammad IrfanNo ratings yet

- cpr03 Lesechos 16165 964001 Consolidated Financial Statements SE 2020Document66 pagescpr03 Lesechos 16165 964001 Consolidated Financial Statements SE 2020kjbewdjNo ratings yet

- Tempest Accounting and AnalysisDocument10 pagesTempest Accounting and AnalysisSIXIAN JIANGNo ratings yet

- ABC Corporation Annual ReportDocument9 pagesABC Corporation Annual ReportCuong LyNo ratings yet

- Cases Topic 1 2021 Intl Fin RepDocument10 pagesCases Topic 1 2021 Intl Fin Repyingqiao.panNo ratings yet

- Particulars: Report FinalDocument12 pagesParticulars: Report FinaldananjNo ratings yet

- Owners' Equity and Liabilities As On 31.3.20X6 (Rs. in Million) As On 31.3.20X7Document3 pagesOwners' Equity and Liabilities As On 31.3.20X6 (Rs. in Million) As On 31.3.20X7Nithin Duke2499No ratings yet

- Afm Paper DalmiaDocument5 pagesAfm Paper DalmiaasheetakapadiaNo ratings yet

- WBSLive Lecture 5 Slides Pres VevoxDocument25 pagesWBSLive Lecture 5 Slides Pres VevoxabhirejanilNo ratings yet

- 20 03 12 Financial Statements of RWE AG 2019Document66 pages20 03 12 Financial Statements of RWE AG 2019HoangNo ratings yet

- I. Below Are The Abridged Financials of SBI AMC Ltd. and Two Mutual Funds From Their Stable - Fund 1 and Fund 2. All Figures Are in Rs. CroreDocument4 pagesI. Below Are The Abridged Financials of SBI AMC Ltd. and Two Mutual Funds From Their Stable - Fund 1 and Fund 2. All Figures Are in Rs. CroreRahul GargNo ratings yet

- Statement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020Document11 pagesStatement of Profit and Loss: Particulars Notes For The Year Ending On 31st March 2020dineshkumar1234No ratings yet

- Financial Mod Ch-4Document37 pagesFinancial Mod Ch-4zigale matebieNo ratings yet

- Cash Flow Questions RucuDocument5 pagesCash Flow Questions RucuWalton Jr Kobe TZNo ratings yet

- REVISION Qs FADocument12 pagesREVISION Qs FAhannah ispandiNo ratings yet

- Part EDocument2 pagesPart EKristin GomezNo ratings yet

- Aarsrapport09 UkDocument78 pagesAarsrapport09 Ukanon_198895No ratings yet

- Ey Aarsrapport 2021 22 4Document1 pageEy Aarsrapport 2021 22 4Ronald RunruilNo ratings yet

- ESCP International Financial Reporting CasesDocument6 pagesESCP International Financial Reporting CasesAnmol SinghNo ratings yet

- Corporate Reporting: Professional 1 Examination - August 2020Document21 pagesCorporate Reporting: Professional 1 Examination - August 2020Issa BoyNo ratings yet

- Ifrs (Usd) (En)Document49 pagesIfrs (Usd) (En)Ameya KulkarniNo ratings yet

- Eramet Annual Consolidated Financial Statements at 31december2020Document90 pagesEramet Annual Consolidated Financial Statements at 31december2020hyenadogNo ratings yet

- Updated Excel Case StudyDocument4 pagesUpdated Excel Case Studydheerajvish1995No ratings yet

- IAS1 Financial Statement AnalysisDocument11 pagesIAS1 Financial Statement AnalysisJamil KamaraNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Chap 2 Enterprise DCFModelDocument98 pagesChap 2 Enterprise DCFModelsoumyaviyer@gmail.comNo ratings yet

- Consolidated Financial Statements As of December 31 2020Document86 pagesConsolidated Financial Statements As of December 31 2020Raka AryawanNo ratings yet

- BF 12 Worksheet 2 2023Document2 pagesBF 12 Worksheet 2 2023John Dreed PorrasNo ratings yet

- Evaluating Financial PerformanceDocument31 pagesEvaluating Financial PerformanceShahruk AnwarNo ratings yet

- Report Q1 2010Document24 pagesReport Q1 2010Frode HaukenesNo ratings yet

- P&L PDFDocument1 pageP&L PDFinfo skynexNo ratings yet

- Problem of DerivativesDocument18 pagesProblem of DerivativesrohitNo ratings yet

- Artificial Intelligence and The Future of DefenseDocument140 pagesArtificial Intelligence and The Future of DefenserohitNo ratings yet

- LOWA Size ChartDocument2 pagesLOWA Size ChartrohitNo ratings yet

- The Future of Banking 2Document180 pagesThe Future of Banking 2rohitNo ratings yet

- Micro Megaguide Chapter 5 CompleteDocument16 pagesMicro Megaguide Chapter 5 CompleteLogan FoltzNo ratings yet

- Economic For ManagersDocument4 pagesEconomic For ManagersrohitNo ratings yet

- AfmDocument45 pagesAfmShaiksha SyedNo ratings yet

- Kmat Syllabus: Syllabus For Verbal Ability and Reading Comprehension (VARC)Document2 pagesKmat Syllabus: Syllabus For Verbal Ability and Reading Comprehension (VARC)rohitNo ratings yet

- Financial Analysis of FMCG SectorDocument19 pagesFinancial Analysis of FMCG SectorSatyam SharmaNo ratings yet

- KPITTECH 03082020160338 KPITInvestorUpdateSEuploadDocument28 pagesKPITTECH 03082020160338 KPITInvestorUpdateSEuploadSreenivasulu Reddy SanamNo ratings yet

- Valuation - Azul Linhas Aéreas BrasileirasDocument12 pagesValuation - Azul Linhas Aéreas BrasileirasMattheus FaracoNo ratings yet

- Ch02 Tool KitDocument16 pagesCh02 Tool KitAdamNo ratings yet

- White Paper - Replicating Private Equity With Value InvestingDocument51 pagesWhite Paper - Replicating Private Equity With Value InvestingAndrew FlatteryNo ratings yet

- Warren Buffet Investing WisdomDocument15 pagesWarren Buffet Investing Wisdomroy_kohinoorNo ratings yet

- JF Tech Annual Report Summary for 2020Document136 pagesJF Tech Annual Report Summary for 2020Brendon SoongNo ratings yet

- 3 Statement Modeling With Iterations SummaryDocument7 pages3 Statement Modeling With Iterations SummaryEmperor OverwatchNo ratings yet

- Phillip Cap Delhivery IPO Note 10th MayDocument14 pagesPhillip Cap Delhivery IPO Note 10th MayTariq HussainNo ratings yet

- BusiAna_6e_Ch05_PowerPointDocument37 pagesBusiAna_6e_Ch05_PowerPointanhdtn21405cNo ratings yet

- BIM 2020 Annual ReportDocument79 pagesBIM 2020 Annual ReportBERKAN CATALNo ratings yet

- Damodaran - Estimating Cash FlowDocument36 pagesDamodaran - Estimating Cash FlowYến NhiNo ratings yet

- 2-DCF Valuation PDFDocument25 pages2-DCF Valuation PDFFlovgrNo ratings yet

- Colgate Financial Model UnsolvedDocument27 pagesColgate Financial Model Unsolvedrsfgfgn fhhsdzfgv100% (1)

- TRIAL E Commerce Financial Model Excel Template v.4.0.122020Document68 pagesTRIAL E Commerce Financial Model Excel Template v.4.0.122020DIDINo ratings yet

- Module 2 - Topic 4Document8 pagesModule 2 - Topic 4Moon LightNo ratings yet

- Real Estate Dictionary - A Glossary of Indian RE TermsDocument34 pagesReal Estate Dictionary - A Glossary of Indian RE TermsHarsh Shah100% (1)

- Reliance Petroleum Project ReportDocument52 pagesReliance Petroleum Project ReportDNYANKUMAR SHENDENo ratings yet

- NIB Financial ModelDocument229 pagesNIB Financial ModelMilin RaijadaNo ratings yet

- Fact-Sheet SyngeneDocument4 pagesFact-Sheet SyngeneRahul SharmaNo ratings yet

- Western Investment Club | THC Undervalued Healthcare PlayDocument1 pageWestern Investment Club | THC Undervalued Healthcare PlayRonit MirchandaniNo ratings yet

- IOL Chemicals Q2FY23 Investor Presentation InsightsDocument31 pagesIOL Chemicals Q2FY23 Investor Presentation InsightsamsukdNo ratings yet

- IS4228 Lecture 1 Fall 2021Document43 pagesIS4228 Lecture 1 Fall 2021dgfsdfgsdfgsdfgNo ratings yet

- Capital Budgeting Cash FlowsDocument37 pagesCapital Budgeting Cash FlowsMofdy MinaNo ratings yet

- UntitledDocument39 pagesUntitledManuel CeciNo ratings yet