Professional Documents

Culture Documents

Vat Taxpayers Non-Vat Taxpayers

Uploaded by

my mi0 ratings0% found this document useful (0 votes)

14 views1 pageThe document outlines rules for VAT taxation of various goods. It specifies that the importation of livestock, poultry, and their feeds are VATable, while the importation of pet foods and feed ingredients are also VATable. It provides details on the types of business tax returns that must be filed by VAT and non-VAT taxpayers, including the deadlines for monthly and quarterly tax returns. The summary at the end recaps that VAT-registered businesses pay 12% VAT on vatable sales, while non-VAT businesses pay a 3% percentage tax.

Original Description:

Original Title

CHAP3 TAX

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines rules for VAT taxation of various goods. It specifies that the importation of livestock, poultry, and their feeds are VATable, while the importation of pet foods and feed ingredients are also VATable. It provides details on the types of business tax returns that must be filed by VAT and non-VAT taxpayers, including the deadlines for monthly and quarterly tax returns. The summary at the end recaps that VAT-registered businesses pay 12% VAT on vatable sales, while non-VAT businesses pay a 3% percentage tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views1 pageVat Taxpayers Non-Vat Taxpayers

Uploaded by

my miThe document outlines rules for VAT taxation of various goods. It specifies that the importation of livestock, poultry, and their feeds are VATable, while the importation of pet foods and feed ingredients are also VATable. It provides details on the types of business tax returns that must be filed by VAT and non-VAT taxpayers, including the deadlines for monthly and quarterly tax returns. The summary at the end recaps that VAT-registered businesses pay 12% VAT on vatable sales, while non-VAT businesses pay a 3% percentage tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

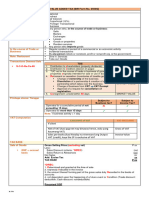

RULES ON VAT TAXATION OF POULTRY AND FEEDS

LIVESTOCK POULTRY PETS

IMPORTATION OF X X ✓

IMPORTATION OF FEEDS FOR X X ✓

IMPORTATION OF FEED INGREDIENTS FOR X X ✓

NOTE: The importation of ingredients for the processing of foods for human consumption is VATABLE because

processed human foods are vatable

CUSTOM DUTIES IS COMPUTED

DUTIABLE VALUE P XX

MULTIPLY EXCHANGE RATE XX

MULTIPLY RATE OF DUTY P XX

TYPES OF BUSINESS TAX RETURNS

VAT TAXPAYERS NON-VAT TAXPAYERS

MONTHLY TAX RETURN BIR FORM 2550 M BIR FORM 2551 M

QUARTERLY TAX RETURN BIR FORM 2550 Q BIR FORM 2551 Q

DEADLINE OF BUSINESS TAX RETURNS

VAT TAXPAYERS NON-VAT TAXPAYERS

MONTHLY TAX RETURN within 20 day from the end of month within 20 days from the end of the month

QUARTERLY TAX within 25 days from the end of the

within 20 days from the end of the quarter

RETURN quarter

IN SUMMARY: SCOPE of VAT amd PERCENTAGE TAX

VAT-REGISTERED BUSINESS NON-VAT BUSINESS

Exempt sales of goods and

NO TAX NO TAX

services

Sales of service specifically PERCENTAGE TAX OF VARIOUS PERCENTAGE TAX OF VARIOUS

subject to percentage tax TAX RATES TAX RATES

Vatable sales of goods or

12% VAT 3% PERCENTAGE TAX

service

You might also like

- Bus Tax Notes 2Document44 pagesBus Tax Notes 2Zhaneah Rhej SaradNo ratings yet

- UAE Comprehensive VAT GuideDocument19 pagesUAE Comprehensive VAT GuidefasmekbakerNo ratings yet

- Revenue From Contracts With CustomersDocument4 pagesRevenue From Contracts With Customersmy miNo ratings yet

- Introduction To Business Taxation Nature of Business TaxDocument24 pagesIntroduction To Business Taxation Nature of Business Taxmy miNo ratings yet

- Chapter 7 The Regular Output VatDocument22 pagesChapter 7 The Regular Output VatChristian PelimcoNo ratings yet

- SGV and Co Presentation On TRAIN LawDocument48 pagesSGV and Co Presentation On TRAIN LawPortCalls100% (8)

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- Module 04 - Income Tax ComplianceDocument21 pagesModule 04 - Income Tax ComplianceMark Emil BaritNo ratings yet

- AP 01 - Cash To Accrual BasisDocument11 pagesAP 01 - Cash To Accrual BasisGabriel OrolfoNo ratings yet

- Strategic Tax Management (Final Period Assignment Quiz)Document4 pagesStrategic Tax Management (Final Period Assignment Quiz)Nelia AbellanoNo ratings yet

- Notes On VATDocument15 pagesNotes On VATRica BlancaNo ratings yet

- Comprehensive VAT TaxationDocument172 pagesComprehensive VAT TaxationIan JameroNo ratings yet

- Lecture Chapter 6 Introduction To The Value Added TaxDocument16 pagesLecture Chapter 6 Introduction To The Value Added TaxChristian PelimcoNo ratings yet

- 03 Vat Subject TransactionsDocument5 pages03 Vat Subject TransactionsJaneLayugCabacungan100% (1)

- UiTM SST Talk 2022 - SlidesDocument112 pagesUiTM SST Talk 2022 - SlidesNik Syarizal Nik MahadhirNo ratings yet

- RR 9-89Document6 pagesRR 9-89papepipupoNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- Chapter 5 Percentage TaxDocument11 pagesChapter 5 Percentage Taxmy miNo ratings yet

- Notes in Value-Added TAXDocument9 pagesNotes in Value-Added TAXESTRADA, Angelica T.No ratings yet

- (P 1) Income Tax Schemes, Accounting Periods, Accounting Methods and ReportingDocument4 pages(P 1) Income Tax Schemes, Accounting Periods, Accounting Methods and Reportinghunter kimNo ratings yet

- Tax.3213-7 Output Input and Vat PayableDocument11 pagesTax.3213-7 Output Input and Vat PayableMira Louise HernandezNo ratings yet

- Tax 301 - Midterm Activity 1Document4 pagesTax 301 - Midterm Activity 1Nicole TeruelNo ratings yet

- Return For Remittance of Value Added TaxDocument2 pagesReturn For Remittance of Value Added TaxDSM DRIVING SCHOOLNo ratings yet

- Module 7 - Introduction To Business TaxesDocument6 pagesModule 7 - Introduction To Business TaxesKyrah Angelica DionglayNo ratings yet

- Module 1 - Cherry Alfuerte - Train LawDocument41 pagesModule 1 - Cherry Alfuerte - Train Lawgerry dacerNo ratings yet

- Computation On Income Tax ReportDocument5 pagesComputation On Income Tax ReportJeane Mae BooNo ratings yet

- SEssion 05 - PPTDocument19 pagesSEssion 05 - PPTsamal.arabinda25No ratings yet

- ICAEW Principles of Taxation CH 11-13Document30 pagesICAEW Principles of Taxation CH 11-13ITALIANO hohNo ratings yet

- Republic Act No. 11976 (EOPT) - Infographics - SGVDocument3 pagesRepublic Act No. 11976 (EOPT) - Infographics - SGVAlbert SantiagoNo ratings yet

- WTS Dhruva VAT Handbook PDFDocument40 pagesWTS Dhruva VAT Handbook PDFFaraz AkhtarNo ratings yet

- Concept and Nature of Vat: Input Tax Carry Over Vat and Discount For Senior Citizen and PWDDocument29 pagesConcept and Nature of Vat: Input Tax Carry Over Vat and Discount For Senior Citizen and PWDNIKKI JOY FRANCISQUETENo ratings yet

- Over Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Document2 pagesOver Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Juliana ChengNo ratings yet

- Quick Notes - Business TaxDocument20 pagesQuick Notes - Business TaxClaire GumasingNo ratings yet

- Tax Impact - 11.10.2022Document12 pagesTax Impact - 11.10.2022ajith garNo ratings yet

- Tax Changes You Need To Know Under RA 10963Document20 pagesTax Changes You Need To Know Under RA 10963Rosanno DavidNo ratings yet

- Sale To Government (TRAIN LAW)Document8 pagesSale To Government (TRAIN LAW)June Mariel ArroyoNo ratings yet

- VAT Outline: Shashi Jayatissa Acca, Mba (Uk)Document23 pagesVAT Outline: Shashi Jayatissa Acca, Mba (Uk)ashfaqNo ratings yet

- Corporate Income TaxDocument70 pagesCorporate Income TaxNhung HồngNo ratings yet

- PM 01 TAX2 VAT Part 1Document45 pagesPM 01 TAX2 VAT Part 1Angel SisonNo ratings yet

- Tax317 Topic 2 Company TaxationDocument14 pagesTax317 Topic 2 Company Taxationhizzat firdausNo ratings yet

- Business Tax Chapter 1Document3 pagesBusiness Tax Chapter 1Mamin ChanNo ratings yet

- Return For Remittance of Value Added TaxDocument2 pagesReturn For Remittance of Value Added TaxTendai ZamangweNo ratings yet

- Tax 01 Introduction To Consumption TaxesDocument3 pagesTax 01 Introduction To Consumption TaxesShiela LlenaNo ratings yet

- Chap 16 AitDocument26 pagesChap 16 AitLawrence NarvaezNo ratings yet

- VAT Powerpoint - 2022 - Tax2ABDocument47 pagesVAT Powerpoint - 2022 - Tax2ABNande JongaNo ratings yet

- Declaration Form FY. 23-24Document3 pagesDeclaration Form FY. 23-24SourabhNo ratings yet

- Vat Zero Rated SuppliesDocument2 pagesVat Zero Rated SuppliesPrecy B BinwagNo ratings yet

- VAT Powerpoint - 2023 - Tax2ABDocument43 pagesVAT Powerpoint - 2023 - Tax2ABPitso VingerNo ratings yet

- MODULE TAX 1 MCIT March 242020Document6 pagesMODULE TAX 1 MCIT March 242020Rene LopezNo ratings yet

- Notes On Value Added TaxDocument7 pagesNotes On Value Added TaxPines MacapagalNo ratings yet

- Basic Accounting Tutorial P3 ESSDocument36 pagesBasic Accounting Tutorial P3 ESSFrances Mikayla EnriquezNo ratings yet

- Module 07 - Overview of Regular Income TaxationDocument32 pagesModule 07 - Overview of Regular Income TaxationTrixie OnglaoNo ratings yet

- GST Nov22Document263 pagesGST Nov22MonikaNo ratings yet

- Input Vat On Capital Goods, Transitional Vat, and Presumptive TaxDocument4 pagesInput Vat On Capital Goods, Transitional Vat, and Presumptive Taxyes it's kaiNo ratings yet

- VAT Presentation - Staff.Document36 pagesVAT Presentation - Staff.zubairNo ratings yet

- Value-Added Tax: Pro-FormaDocument10 pagesValue-Added Tax: Pro-FormaGabrielle Joshebed AbaricoNo ratings yet

- VAT Manual 1Document16 pagesVAT Manual 1Pradeep JagirdarNo ratings yet

- Current and Deferred Tax AssignmentsDocument12 pagesCurrent and Deferred Tax AssignmentsAftab AliNo ratings yet

- Case Studies in MAT 2021Document5 pagesCase Studies in MAT 2021kanchan palNo ratings yet

- Lecture Slides - Lecture 01 - VAT (Part 1)Document6 pagesLecture Slides - Lecture 01 - VAT (Part 1)nkosinathiNo ratings yet

- Pinnacle IPCC Value Added TaxDocument44 pagesPinnacle IPCC Value Added TaxSneh ShahNo ratings yet

- IncomeTax IAS 12 Revised Edited GD 2020Document46 pagesIncomeTax IAS 12 Revised Edited GD 2020yonas alemuNo ratings yet

- Barry CompanyDocument3 pagesBarry Companymy miNo ratings yet

- Chapter 8Document6 pagesChapter 8my miNo ratings yet

- Chapter 4 ReviewDocument5 pagesChapter 4 Reviewmy miNo ratings yet

- Chap 5Document23 pagesChap 5my miNo ratings yet

- Chapter 3 ReviewDocument6 pagesChapter 3 Reviewmy miNo ratings yet

- Rationale of Consumption TaxDocument3 pagesRationale of Consumption Taxmy miNo ratings yet

- What Is Percentage TaxDocument4 pagesWhat Is Percentage Taxmy miNo ratings yet

- Chapter 7Document5 pagesChapter 7my miNo ratings yet