Professional Documents

Culture Documents

Vol. 1, Chapter 5 - The Balance Sheet: Problem 1: Solution

Vol. 1, Chapter 5 - The Balance Sheet: Problem 1: Solution

Uploaded by

Lee TeukOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vol. 1, Chapter 5 - The Balance Sheet: Problem 1: Solution

Vol. 1, Chapter 5 - The Balance Sheet: Problem 1: Solution

Uploaded by

Lee TeukCopyright:

Available Formats

Vol.

1, Chapter 5 – The Balance Sheet

Problem 1: Solution

Assets Major Classification

Construction in progress Property and equipment

Cash advance to affiliated co. Noncurrent receivable

Petty cash Current assets

Trade receivables Current assets

Building Property and equipment

Cash surrender value of

life insurance Other assets

Notes receivable--long-term Noncurrent receivable

Office supplies Current assets

Land Property and equipment

Unamortized franchise costs Other assets

Organizational costs Other assets

Food inventory Current assets

Prepaid insurance Current assets

Leasehold improvements Property and equipment

Problem 2: Solution

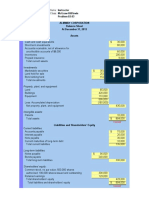

Daytime Café

Balance Sheet

December 31, 20X6

ASSETS

Current Assets:

Cash $ 15,000

Accounts Receivable 6,000

Inventories 30,000

Prepaid Insurance 10,000

Total Current Assets 61,000

Property and Equipment:

Land 600,000

Buildings 600,000

Equipment 300,000

Less: Accumulated Depreciation (100,000)

Net Property and Equipment 1,400,000

Total Assets $1,461,000

The Balance Sheet 1

Problem 2: Solution (continued)

LIABILITIES AND OWNERS' EQUITY

Current Liabilities:

Accounts Payable $ 12,000

Wages Payable 15,000

Mortgage Payable--current 50,000

Taxes Payable 7,000

Total Current Liabilities 84,000

Long-Term Liabilities:

Mortgage Payable--long-term 800,000

Total Long-Term Liabilities 800,000

Total Liabilities 884,000

Owners' Equity:

G. Day, Capital 577,000

Total Owners' Equity 577,000

Total Liabilities and Owners' Equity $1,461,000

Problem 3: Solution

1. Retained Earnings decreases by $50,000. Dividends Payable

increases $50,000.

2. Cash increases $10,000. Accounts Receivable decreases

$10,000.

3. Equipment increases $30,000. Cash decreases $5,000. Notes

Payable increases $25,000.

4. Cash increases $20,000. Inventory decreases. Retained

Earnings increases.

5. Food Inventory increases $2,000. Accounts Payable increases

$2,000.

6. Cash decreases $10,000. Wages Payable decreases $10,000.

7. Supplies (inventory) increases $2,000. Accounts Payable

increases $2,000.

8. Cash decreases $20,000. Treasury Stock increases $20,000.

Common Stock decreases $10,000.

9. Long-term Debt decreases $40,000. Current maturities of long

term debt increases $40,000.

10. Cash decreases $1,000. Accounts Payable decreases $1,000.

The Balance Sheet 2

Problem 4: Solution

OWNERS' EQUITY

5% Cumulative Preferred Stock, $1 par

value, authorized 50,000 shares;

issued and outstanding 10,000 shares $ 500,000 (1)

Common Stock, $1 par value, authorized

100,000 shares; issued and outstanding

20,000 shares 500,000 (2)

Retained Earnings 175,000 (3)

Total Owners' Equity $1,175,000

(1) 10,000 shares × $50 per share = $500,000

(2) 20,000 shares × $25 per share = $500,000

(3) Dividends declared:

$500,000 × 5% = $25,000

Net income - dividends declared = retained earnings

$200,000 - $25,000 = $175,000

The Balance Sheet 3

Problem 5: Solution

Damitio Inn

Balance Sheet for year ended

December 31, 20X3

Assets

Current Assets

Cash $ 10,000

Accounts Receivable 150,000

Allowance for Doubtful Accts. (10,000)

Food Inventory 50,000

Prepaid Insurance 12,000

Total Current Assets $212,000

Noncurrent Receivables

Investments 100,000

Property and Equipment

Land 300,000

Building 14,000,000

Equipment 800,000

Less: Accumulated depr.

Accumulated depr.—Building (2,500,000)

Accumulated depr.—Equipment (200,000)

Total Property and Equipment 12,400,000

Other Assets

Deferred Income Taxes 50,000

Organization Costs 50,000

Total Other Assets 100,000

Total Assets $12,812,000

Liabilities

Current Liabilities

Accounts Payable 50,000

Wages Payable 20,000

Income Taxes Payable 30,000

Current Matur. of Long Term Debt 80,000

Total Current Liabilities 180,000

Long Term Debt

Net of current maturities 9,920,000

Other Long Term Liabilities

Deferred Income Taxes 150,000

Total Liabilities $10,250,000

Owners' Equity

Common Stock 500,000

Paid-in Capital in

Excess of Par 1,000,000

Retained Earnings 1,062,000

Total Owners' Equity 2,562,000

Total Liabilities and Equity $12,812,000

The Balance Sheet 4

Problem 6: Solution

Red Mountain Motel

Common-Size Balance Sheet

December 31, 20X1

ASSETS

Current Assets:

Cash $ 12,500 1.4%

Accounts Receivable 15,000 1.7%

Cleaning Supplies 2,500 0.3%

Total Current Assets 30,000 3.4%

Property and Equipment:

Land 120,000 13.7%

Building 800,000 91.4%

Furnishings and Equipment 50,000 5.7%

Less: Accumulated Depreciation (125,000) –14.3%

Net Property and Equipment 845,000 96.6%

Total Assets $ 875,000 100.0%

LIABILITIES AND OWNERS' EQUITY

Current Liabilities:

Notes Payable $ 23,700 2.7%

Accounts Payable 8,000 0.9%

Wages Payable 300 0.1%

Total Current Liabilities 32,000 3.7%

Long-Term Liabilities:

Mortgage Payable 420,000 48.0%

Total Liabilities 452,000 51.7%

Owners' Equity:

R. Mountain, Capital

at January 1, 20X1 384,500 43.9%

Net Income for 20X1 38,500 4.4%

R. Mountain, Capital

at December 31, 20X1 423,000 48.3%

Total Liabilities

and Owners' Equity $ 875,000 100.0%

Problem 7: Solution

1. Accounts Receivable $100,000

Less: Allowance for Doubtful Accounts (3,000)

Beverage Inventory 15,000

Cash 15,000

Food Inventory 25,000

Prepaid Insurance 6,000

Notes Receivable 35,000

Short-Term Investments 50,000

Total Current Assets $243,000

The Balance Sheet 5

Problem 7: Solution (continued)

2. Accounts Payable $ 30,000

Accrued Expenses 15,000

Advanced Deposits 12,000

Current Maturities--LTD 40,000

Income Taxes Payable 4,000

Notes Payable 25,000

Total Current Liabilities $126,000

3. Current Assets - Current Liabilities = Net Working Capital

$243,000 - $126,000 = $117,000

4. Current Assets / Current Liabilities = Current Ratio

$243,000 / $126,000 = 1.93 times

Problem 8: Solution

1. (Cost - Salvage Value) / Life = Straight-Line Depreciation

Expense per Year

($2,000,000 - 0) / 5 = $400,000

1 / Life = Annual Depreciation Rate

1 / 5 = .2

2. Net Book Value × 2 (Straight-Line Rate) = Double Declining

Depreciation Expense

$2,000,000 × 2(.2) = $800,000

3. Income Tax Expense $120,000 (1)

Deferred Income Taxes $120,000

(1) $800,000 - $400,000 = $400,000

$400,000 × 30% = $120,000

The Balance Sheet 6

Problem 9: Solution

Spartan Inn

Balance Sheet

December 31, 20X4

Assets

Current Assets

Cash $ 5,000

Marketable securities 25,000

Accounts receivable 80,000

Inventories 15,000

Prepaid expenses 8,000

Total Current Assets $133,000

Property and Equipment

Land 80,000

Building 500,000

Furnishings and equipment 200,000

Less: Accumulated depreciation 150,000

Net property and equipment 630,000

Other Assets

Other—franchise fees 15,000

Total Assets $778,000

Liabilities and Owner's Equity

Current Liabilities

Accounts payable $ 20,000

Income taxes payable 10,000

Accrued expenses 10,000

Total Current Liabilities 40,000

Long-Term Debt

Bonds payable 300,000

Deferred Income Taxes 20,000

Owner's Equity

Jerry Spartan, Capital (12/31/X4) $418,000

Total Liabilities and Owner's Equity $778,000

Problem 10: Solution

Singh Park Hotel

Statement of Retained Earnings

For the year ended December 31 20X2

Retained Earnings, Jan. 1, 20X2 $300,000

Net Income for 20X2 280,000

Dividends declared during 20X2 (230,000)

Retained Earnings, Dec. 31, 20X2 $350,000

The Balance Sheet 7

Problem 11: Solution

KRS, Inc.

Comparative Balance Sheets

December 31, 20X2 and 20X1

Change from 20X1 to

20X2

20X2 20X1 Amount Percentage

Assets

Current Assets

Cash $ 20,768 $ 16,634 $ 4,134 24.85%

Marketable Securities 10,496 10,396 100 0.96

Accounts Receivable 11,618 16,105 (4,487) -27.86

Inventories 18,554 14,554 4,000 27.48

Prepaid Expenses 3,874 4,158 (284) -6.83

Total 65,310 61,847 3,463 5.60

Property and Equipment

Land 116,435 116,435 -0- 0.00

Building 1,007,090 1,007,090 -0- 0.00

Operating Equipment 284,934 269,25515,679 5.82

Less: Accumulated

Depreciation (537,849) (453,263) (84,586) 18.66

Total 870,610 939,517 (68,907) -7.33

Total Assets $ 935,920 $1,001,364 $(65,444) -6.54%

Liabilities

Current Liabilities

Accounts Payable $ 12,945 $ 13,265 $ (320) -2.41%

Accrued Expenses 1,039 2,047 (1,008) -49.24

Current Portion of

Long-Term Debt 20,060 20,407 (347) -1.70

Total 34,044 35,719 (1,675) -4.69

Long-Term Debt 533,369 553,429 (20,060) -3.62

Deferred Income Taxes 7,927 8,163 (236) -2.89

Total Liabilities 575,340 597,311 (21,971) -3.68

Owners' Equity

Common Stock 211,200 211,200 -0- 0.00

Retained Earnings 149,380 192,853 (43,473) -22.54

Total Owners' Equity 360,580 404,053 (43,473) -10.76

Total Liabilities and

Owners' Equity $ 935,920 $1,001,364 $(65,444) -6.54%

The Balance Sheet 8

Problem 12: Solution

1. $51,000

2. $30,500

3. $30,500 - $51,000 = ($20,500)

4. $8,000

5. $8,000

6. $325,000 - $64,000 = $261,000

7. $8,000 + $80,500 = $88,500

Problem 13: Solution

1. There is not enough information to determine this.

2. Current Assets = Cash + Receivables $136,500

3. Net working capital = Current assets – Current Liab.

$136,500 - ($18,000 + $25,000 + $5,000) = $88,500

4. Beginning Accounts Payable is $18,000. Ending

A/P is $21,000. Therefore, cash increases by: $3,000

5. Net book value = Equipment - Depreciation

$925,000 - $64,000 = $861,000

6. Net Earnings = Change in RE + Dividends payable

$27,000 + $6,000 = $33,000

7. Change in common stock $5,000

Change in paid-in capital $25,000

($20,000 + $5,000)/10,000 $2.50/share

8. Note payable beginning X2 $675,000

Note payable X2 (reclassified to current) 42,000

Note payable ending X2 690,000

$675,000 - $42,000 = $633,000

$633,000 + new LTD = $690,000

New long-term debt = $690,000 - $633,000 = $57,000

9. Gain on sale = selling price - NBV

$12,000 - $10,000 = $2,000

10. Equipment beginning X2 $800,000

Equipment ending X2 925,000

Cost of equipment sold during 20X2 25,000

New purchases = $925,000 - ($800,000 - $25,000) = $150,000

11. Depreciation Expense in X2 = change in Depr. for X2

Accumulated depreciation beginning X2 $20,000

Accumulated depreciation ending X2 64,000

Written off depreciation 15,000

Depreciation Expense X2 = $59,000

The Balance Sheet 9

Problem 14: Solution

1. Current assets = current liabilities × current ratio

= 1.2 × $105,380

= $126,456

2. Cash + Inventory + Accounts Receivable = Current Assets

$49,765 + $36,072 + $15,491 + Accounts Receivable = $126,456

Accounts Receivable = $126,456 - ($49,765 + $36,072 + $15,491)

= $25,128

3. .3 × Total assets = current assets

.3 × Total assets = $126,456

Total assets = $126,456 ÷ .3 = $421,520

4. Owners' Equity = Assets - Current Liabilities - Long-Term Debt

= $421,520 - $105,380 - $60,000

= $256,140

Problem 15: Solution

1. -$2,000

2. $20,000

3. $140,000

4. $180,000

5. $5,000

6. $18,700

7. $11,700

8. $8,700

The Balance Sheet 10

Problem 16: Solution

Lancer's Balance Sheet

December 31, 20X3

Assets

Current Assets:

Cash $ 5,000

Marketable securities 10,000

Accounts receivable (net) 90,000

Food inventory 15,000

Prepaid expenses 9,000

Total current assets 129,000

Investments 50,000

Property and Equipment

Land 80,000

Building 420,000

Equipment 100,000

Less Accumulated depreciation (141,000)

Net property and equipment 459,000

Total Assets $638,000

Liabilities and Owners' Equity

Current Liabilities:

Accounts payable $ 15,000

Income taxes payable 20,000

Current maturities of

long-term debt 50,000

Dividends payable 10,000

Accrued expenses 25,000

Total current liabilities 120,000

Long-term debt 250,000

Owners' Equity:

Capital stock 89,000

Paid-in capital in excess of par 68,000

Retained earnings 111,000

Total Owners’ Equity 268,000

Total Liabilities and

Owners' Equity $638,000

The Balance Sheet 11

Problem 17: Solution

Martin's Motel

Dollar Common-Size

20X1 20X2 Differences Dec. 31, 20X2

Current Assets

Cash

House Bank $ 50 $ 40 $(10) .4%

Demand Deposit 60 60 0 .6

Total Cash 110 100 (10) 1.0

Accounts Receivable 1,241 1,400 159 14.0

Inventories 68 120 52 1.2

Total Current Assets 1,419 1,620 201 16.2

Investments 175 200 25 2.0

Property and Equipment (net)

Land 957 1,030 73 10.3

Building 4,350 4,600 250 46.0

Furniture 2,575 2,500 (75) 25.0

Other Assets 49 50 1 .5

Total Assets $9,525 $10,000 $475 100.0

Key: Notice that the demand deposit of $60 is .6% of total assets;

therefore, total assets equals $10,000.

Problem 18: Solution

Gordon Lodge

Balance Sheet

December 31, 20X1 and 20X2

December 31 Dollar Common-Size

20X1 20X2 Difference Dec. 31, 20X2

Current Liabilities:

Notes Payable $ 5,000 $ 500 $ (4,500) 1.0%

Accounts Payable 7,000 8,000 1,000 1.4

Taxes Payable 3,000 3,500 500 0.6

Wages Payable 5,000 6,000 1,000 1.0

Total 20,000 18,000 (2,000) 4.0

LTD:

Mortgage Payable $ 200,000 $ 180,000 $(20,000) 40.0%

Deferred Taxes 80,000 80,000 - 16.0

Total 280,000 260,000 (20,000) 56.0

Owners’ Equity:

Common Stock $ 150,000 $ 160,000 $ 10,000 30.0%

Retained Earnings 60,000 80,000 20,000 12.0

Treasury Stock (10,000) (10,000) -0- (2.0)

Total 200,000 230,000 30,000 40.0

Total Liabilities

and Owners’ Equity $ 500,000 $ 508,000 $ 8,000 100.0%

The Balance Sheet 12

Problem 19: Solution

Longstreth Lodge

Balance Sheet

December 31, 20X1 and 20X2

Common-

December 31 Percentage Size

20X1 20X2 Difference 12/31/X2

Current Assets:

Cash $ 800 $ 1,000 25.0% 0.2%

Accounts Receivable 30,000 27,500 -8.3% 5.0%

Inventories 500 550 10.0% 0.1%

Prepaid Expenses 5,000 5,500 10.0% 1.0%

Total Current

Assets 36,300 34,550 -4.8% 6.3%

Property & Equipment:

Land 100,000 100,000 0.0% 18.2%

Building 400,000 400,000 0.0% 72.7%

Equipment 55,000 55,000 0.0% 10.0%

Accumulated Depr. (35,000) (44,000) 25.7% -8.0%

Net Property & Eq. 520,000 511,000 -1.7% 92.9%

Other Assets 5,700 4,450 -21.9% 0.8%

Total Assets $562,000 $ 550,000 -2.1% 100.0%

Problem 20: Solution

Base-Year Comparisons

Current Assets

Wyoming Inn

20X1 20X2 20X3

Cash 100.00% 110.00% 120.00%

Marketable Securities 100.00% 75.00% 62.50%

Accounts Receivable 100.00% 105.71% 111.43%

Allowance for Doubtful Accounts 100.00% 83.33% 133.33%

Food Inventory 100.00% 108.33% 116.67%

Prepaid Insurance 100.00% 125.00% 150.00%

Total Current Assets 100.00% 104.31% 106.90%

The Balance Sheet 13

You might also like

- Chapter 2Document33 pagesChapter 2jake doinog93% (14)

- Asset Recovery Handbook: A Guide for Practitioners, Second EditionFrom EverandAsset Recovery Handbook: A Guide for Practitioners, Second EditionNo ratings yet

- Chapter 2Document34 pagesChapter 2Marjorie PalmaNo ratings yet

- Chapter 10 Exercise 6Document11 pagesChapter 10 Exercise 6Tri HartonoNo ratings yet

- Quiz 1 - Corporate Liquidation ReorganizationDocument4 pagesQuiz 1 - Corporate Liquidation ReorganizationJane GavinoNo ratings yet

- Corporate Liquidation & ReorganizationDocument6 pagesCorporate Liquidation & ReorganizationNahwi KimpaNo ratings yet

- Audit of Stockholders' EquityDocument32 pagesAudit of Stockholders' EquityReverie Sevilla100% (3)

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- Statement of Financial Position: Quiz 1: Multiple ChoiceDocument6 pagesStatement of Financial Position: Quiz 1: Multiple Choicedanica dimaculanganNo ratings yet

- Intermediate Accounting By: Valix SOLUTION MANUAL 2020 EditionDocument19 pagesIntermediate Accounting By: Valix SOLUTION MANUAL 2020 EditionJoyce Anne Garduque100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- PRESENTATION OF FS Problems Answer KeyDocument20 pagesPRESENTATION OF FS Problems Answer KeyJazie CadelinaNo ratings yet

- Allapacan Company Bought 20Document18 pagesAllapacan Company Bought 20Carl Yry BitzNo ratings yet

- Corporate Liquidation QuizDocument4 pagesCorporate Liquidation QuizMarinoNo ratings yet

- Beams10e Ch04 Consolidation Techniques and ProceduresDocument48 pagesBeams10e Ch04 Consolidation Techniques and ProceduresLeini TanNo ratings yet

- AFAR 04 Business CombinationDocument9 pagesAFAR 04 Business CombinationPym-Kaytitinga St. Joseph ParishNo ratings yet

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- Chap8 QuizDocument5 pagesChap8 QuizGracey DoyuganNo ratings yet

- John NapierDocument1 pageJohn NapierReverie SevillaNo ratings yet

- AC213 Ch03 ExerciseSolutionsDocument24 pagesAC213 Ch03 ExerciseSolutionsJoshua Miguel R. SevillaNo ratings yet

- ABM 14 - Casañas - BALANCE SHEETDocument1 pageABM 14 - Casañas - BALANCE SHEETCasañas, Gillian DrakeNo ratings yet

- Please Refer To Table 4-1 For The Following Questions. Table 4-1Document1 pagePlease Refer To Table 4-1 For The Following Questions. Table 4-1Megana PunithNo ratings yet

- Answer Step by Step SolutionDocument3 pagesAnswer Step by Step SolutionkomalNo ratings yet

- Acefmgt Assignment 1Document7 pagesAcefmgt Assignment 1Michael SanchezNo ratings yet

- Analysis of Financial State MentDocument13 pagesAnalysis of Financial State MentAbdul RehmanNo ratings yet

- Cash FlowDocument1 pageCash FlowJannatul IsfaqNo ratings yet

- Module+2+-+Assignment+on+SFP+and+Notes+to+FS Bettina+Flores 3A8Document5 pagesModule+2+-+Assignment+on+SFP+and+Notes+to+FS Bettina+Flores 3A8Bettina Alec Francesca FloresNo ratings yet

- Act130: Accounting For Special Transactions Assignment Topic: Corporate Liquidation Problem 1Document3 pagesAct130: Accounting For Special Transactions Assignment Topic: Corporate Liquidation Problem 1Aldrin ZolinaNo ratings yet

- Chapter 15Document9 pagesChapter 15Coleen Joy Sebastian PagalingNo ratings yet

- Preperation of SFP (Alemany)Document3 pagesPreperation of SFP (Alemany)Thrisha AlemanyNo ratings yet

- Mid Term ExamDocument6 pagesMid Term ExamWaizin KyawNo ratings yet

- Chapter 3 - Excel SolutionsDocument8 pagesChapter 3 - Excel SolutionsHalt DougNo ratings yet

- First Grading Examination - Key AnswersDocument12 pagesFirst Grading Examination - Key AnswersAmie Jane MirandaNo ratings yet

- Group 8-SW Income Statement & Balance SheetDocument2 pagesGroup 8-SW Income Statement & Balance SheetDiễm Quỳnh QuáchNo ratings yet

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- Full Financial Accounting Course in One Video (10 Hours)Document24 pagesFull Financial Accounting Course in One Video (10 Hours)Zubair GhaznaviNo ratings yet

- Api SFPDocument1 pageApi SFPBoston wardNo ratings yet

- Statement of Financial Position: 1. True 6. True 2. False 7. True 3. True 8. False 4. False 9. True 5. True 10. FALSEDocument10 pagesStatement of Financial Position: 1. True 6. True 2. False 7. True 3. True 8. False 4. False 9. True 5. True 10. FALSEMcy CaniedoNo ratings yet

- ch04 HWDocument13 pagesch04 HWHạnh Nguyễn NguyễnNo ratings yet

- Chapter 11 WorksheetDocument5 pagesChapter 11 Worksheet오가영No ratings yet

- Final Exam Practice - Comprehensive (With Answers)Document22 pagesFinal Exam Practice - Comprehensive (With Answers)Brandon ErbNo ratings yet

- 1001 Practice QuestionsDocument95 pages1001 Practice QuestionsMohamad El-JadayelNo ratings yet

- 2020 Valix Answer Key Acounting 3 - CompressDocument19 pages2020 Valix Answer Key Acounting 3 - Compressrandomfinds864No ratings yet

- How To Read, Analyze, and Interpret Financial ReportsDocument23 pagesHow To Read, Analyze, and Interpret Financial ReportspotatookunNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- 2 - BuscomDocument9 pages2 - BuscomDeryl GalveNo ratings yet

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- Pengantar Akuntansi (Tugas Kelompok)Document2 pagesPengantar Akuntansi (Tugas Kelompok)pekka19981No ratings yet

- Problem 3 Page 41Document8 pagesProblem 3 Page 41MAG MAGNo ratings yet

- Tutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityDocument5 pagesTutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Corporate LiquidationDocument73 pagesCorporate LiquidationCasper John Nanas MuñozNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- 2008-03-07 181349 Linda 4Document2 pages2008-03-07 181349 Linda 4gianghoanganh79No ratings yet

- Toaz - Info Statement of Financial Position Required PRDocument33 pagesToaz - Info Statement of Financial Position Required PRDaniella Mae ElipNo ratings yet

- AFA Questions - Students HandoutDocument51 pagesAFA Questions - Students HandoutDusabamahoro JoniveNo ratings yet

- Silmon Charlesa Unit2 AssignmentGB550Document4 pagesSilmon Charlesa Unit2 AssignmentGB550charlesasi94No ratings yet

- Instructions: Submit Within Due DateDocument4 pagesInstructions: Submit Within Due DateDanish SajjadNo ratings yet

- CH 05Document10 pagesCH 05Antonios Fahed0% (1)

- Net Company Statement of Financial Position As of December 31, 2017 Assets Current AssetsDocument13 pagesNet Company Statement of Financial Position As of December 31, 2017 Assets Current AssetsSarah Nelle PasaoNo ratings yet

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Discussion Problems - Corporate LiquidationDocument3 pagesDiscussion Problems - Corporate LiquidationMikee CincoNo ratings yet

- Soal Uts Lab Ak. KeuanganDocument3 pagesSoal Uts Lab Ak. KeuanganAltaf HauzanNo ratings yet

- CORPORATION LIQUIDATION - AcctnfDocument2 pagesCORPORATION LIQUIDATION - AcctnfJewel CabigonNo ratings yet

- Dai Zhen: Wade-Giles RomanizationDocument2 pagesDai Zhen: Wade-Giles RomanizationReverie SevillaNo ratings yet

- London Clubs: Rhythm and BluesDocument1 pageLondon Clubs: Rhythm and BluesReverie SevillaNo ratings yet

- Outgoing OfficersDocument2 pagesOutgoing OfficersReverie SevillaNo ratings yet

- John NapierDocument1 pageJohn NapierReverie SevillaNo ratings yet

- Palace: Palatine Hill Building CastleDocument1 pagePalace: Palatine Hill Building CastleReverie SevillaNo ratings yet

- Hattusilis III: Hittite Mursilis III King'sDocument1 pageHattusilis III: Hittite Mursilis III King'sReverie SevillaNo ratings yet

- Council of TrentDocument2 pagesCouncil of TrentReverie SevillaNo ratings yet

- Period IIDocument1 pagePeriod IIReverie SevillaNo ratings yet

- Valdemar I: Valdemar I, Byname Valdemar The Great, Danish Valdemar Den StoreDocument1 pageValdemar I: Valdemar I, Byname Valdemar The Great, Danish Valdemar Den StoreReverie SevillaNo ratings yet

- SchismDocument1 pageSchismReverie SevillaNo ratings yet

- Skåne Sweden Malmö Scandinavia: Lund, CityDocument1 pageSkåne Sweden Malmö Scandinavia: Lund, CityReverie SevillaNo ratings yet

- Trento: Trento, Latin Tridentum, German Trient, English Trent, CityDocument1 pageTrento: Trento, Latin Tridentum, German Trient, English Trent, CityReverie SevillaNo ratings yet

- Eskil: Clairvaux Archbishop LundDocument1 pageEskil: Clairvaux Archbishop LundReverie SevillaNo ratings yet

- Munich: Bavaria Germany Berlin Hamburg Alps Isar RiverDocument1 pageMunich: Bavaria Germany Berlin Hamburg Alps Isar RiverReverie SevillaNo ratings yet

- Bartolomé de CarranzaDocument1 pageBartolomé de CarranzaReverie SevillaNo ratings yet

- Intermediate Acctg Vol 1 (Answer Key) PDFDocument231 pagesIntermediate Acctg Vol 1 (Answer Key) PDFReverie SevillaNo ratings yet

- Henry III: Early YearsDocument2 pagesHenry III: Early YearsReverie SevillaNo ratings yet

- ArchbishopDocument1 pageArchbishopReverie SevillaNo ratings yet

- Valdemar I: Valdemar I, Byname Valdemar The Great, Danish Valdemar Den StoreDocument1 pageValdemar I: Valdemar I, Byname Valdemar The Great, Danish Valdemar Den StoreReverie SevillaNo ratings yet

- TheUniformChartOfAccounts For Companies PDFDocument135 pagesTheUniformChartOfAccounts For Companies PDFJoebin Corporal LopezNo ratings yet

- IA Vol 2 Answer Key PDFDocument216 pagesIA Vol 2 Answer Key PDFReverie SevillaNo ratings yet

- IA Vol 1 PDFDocument232 pagesIA Vol 1 PDFReverie SevillaNo ratings yet

- Topic 5 & 6 Current Liabilities, Provisions, and ContingenciesDocument75 pagesTopic 5 & 6 Current Liabilities, Provisions, and ContingenciesReverie SevillaNo ratings yet

- Fa11 14Document48 pagesFa11 14adisty astrianiNo ratings yet

- C04 Instr PPT Mowen4CeDocument83 pagesC04 Instr PPT Mowen4Cepiker.trance.0uNo ratings yet

- Workbook2Ans (ConsolnEA)Document14 pagesWorkbook2Ans (ConsolnEA)chuaxinniNo ratings yet

- 10 1108 - MF 06 2020 0300Document20 pages10 1108 - MF 06 2020 0300fenny maryandiNo ratings yet

- Introduction To Accounting Afe4005-B Semester 1Document6 pagesIntroduction To Accounting Afe4005-B Semester 1tahiraNo ratings yet

- Chap002 RWJDocument50 pagesChap002 RWJmohamed ashorNo ratings yet

- Partnership AccountsDocument4 pagesPartnership AccountsnathanrengaNo ratings yet

- ID Analisis Rasio Keuangan Dan Metode EconoDocument9 pagesID Analisis Rasio Keuangan Dan Metode Econo1878 saiful 1927 bonek red devilNo ratings yet

- Kontni Okvir - Layout of Chart of AccountsDocument9 pagesKontni Okvir - Layout of Chart of Accountszgorescribid100% (1)

- What Do We Achive? Interpretation: Other PointsDocument3 pagesWhat Do We Achive? Interpretation: Other PointsDibyaranjan SahooNo ratings yet

- Edoc - Pub Problems Solving Masdocx PDFDocument6 pagesEdoc - Pub Problems Solving Masdocx PDFReznakNo ratings yet

- Finacc 8-3Document5 pagesFinacc 8-3FakerPlaymakerNo ratings yet

- Bar and Tavern Business PlanDocument36 pagesBar and Tavern Business PlanTarta CatalinNo ratings yet

- Industry: Full List of Nifty 50 CompaniesDocument6 pagesIndustry: Full List of Nifty 50 CompaniesDeepak RahejaNo ratings yet

- Balance Sheet of Kansai Nerolac PaintsDocument5 pagesBalance Sheet of Kansai Nerolac Paintssunilkumar978No ratings yet

- Chapter 8 VDocument28 pagesChapter 8 VAdd AllNo ratings yet

- Maruti Suzuki India Limited: Unsecured LoanDocument45 pagesMaruti Suzuki India Limited: Unsecured LoanMithilesh Singh0% (1)

- Google Inc. (GOOG) : Balance SheetDocument8 pagesGoogle Inc. (GOOG) : Balance SheetarimarcNo ratings yet

- Assignment Brief BA (Hons.) International Business & Finance Academic Year 2018-19Document11 pagesAssignment Brief BA (Hons.) International Business & Finance Academic Year 2018-19MinhajNo ratings yet

- Rovio Financial Reports Q3 2019Document35 pagesRovio Financial Reports Q3 2019Phillip MoyerNo ratings yet

- A Study On Ratio Analysis in Heritage: Vol 11, Issue 5, May/ 2020 ISSN NO: 0377-9254Document7 pagesA Study On Ratio Analysis in Heritage: Vol 11, Issue 5, May/ 2020 ISSN NO: 0377-9254DedipyaNo ratings yet

- CH 15Document46 pagesCH 15Indah SucitraNo ratings yet

- Basic AccountingDocument5 pagesBasic AccountingDummy GoogleNo ratings yet

- Non-Integrated, Integrated & Reconciliation of Cost and Financial AccountsDocument107 pagesNon-Integrated, Integrated & Reconciliation of Cost and Financial Accountsanon_67206536267% (3)

- Travel Agency PlanDocument20 pagesTravel Agency PlanGregsyNo ratings yet

- Financial Acc. Ch-1.1 InventoryDocument45 pagesFinancial Acc. Ch-1.1 InventoryTIZITAW MASRESHANo ratings yet