Professional Documents

Culture Documents

Please Refer To Table 4-1 For The Following Questions. Table 4-1

Uploaded by

Megana PunithOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Please Refer To Table 4-1 For The Following Questions. Table 4-1

Uploaded by

Megana PunithCopyright:

Available Formats

Question 1

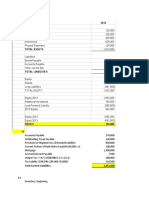

Please refer to Table 4-1 for the following questions.

Table 4-1

Stewart Company

Balance Sheet

Assets:

Cash and marketable securities $600,000

Accounts receivable 900,000

Inventories 1,500,000

Prepaid expenses 75,000

Total current assets $3,075,000

Fixed assets 8,000,000

Less: accum. depr. (2,075,000)

Net fixed assets $5,925,000

Total assets $9,000,000

Liabilities:

Accounts payable $800,000

Notes payable 700,000

Accrued taxes 50,000

Total current liabilities $1,550,000

Long-term debt 2,500,000

Owner's equity (1 million shares of

common stock outstanding) 4,950,000

Total liabilities and owner's equity $9,000,000

Net sales (all credit) $10,000,000

Less: Cost of goods sold (3,000,000)

Selling and administrative expense (2,000,000)

Depreciation expense (250,000)

Interest expense (200,000)

Earnings before taxes 4,550,000

Income taxes (1,820,000)

Net income $2,730,000

Based on the information in Table 4-1, the debt ratio is

Selected 45.0%.

Answer:

Answers: 55.2%.

24.1%.

32.6%.

45.0%.

You might also like

- Quiz IntAccDocument12 pagesQuiz IntAccTrixie HicaldeNo ratings yet

- Study Unit Three Activity Ratios and Special IssuesDocument11 pagesStudy Unit Three Activity Ratios and Special IssuessimarjeetNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- 2020 Valix Answer Key Acounting 3 - CompressDocument19 pages2020 Valix Answer Key Acounting 3 - Compressrandomfinds864No ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowTang De MelanciaNo ratings yet

- Chapter 2: Accounting Statements and Cash FlowDocument4 pagesChapter 2: Accounting Statements and Cash FlowBarbara H.CNo ratings yet

- Study Unit Eight Activity Measures and FinancingDocument15 pagesStudy Unit Eight Activity Measures and FinancingPaul LteifNo ratings yet

- Intermediate Accounting By: Valix SOLUTION MANUAL 2020 EditionDocument19 pagesIntermediate Accounting By: Valix SOLUTION MANUAL 2020 EditionJoyce Anne Garduque100% (1)

- AnalysisDocument6 pagesAnalysisMariane Joy Valdez BatalonaNo ratings yet

- Table 1: (A) Some Recent Smith Company Balance Sheet and Selected Income Statement Data in TableDocument2 pagesTable 1: (A) Some Recent Smith Company Balance Sheet and Selected Income Statement Data in TableMasrinie P.RNo ratings yet

- Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)Document36 pagesSolutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)sunnyauliaNo ratings yet

- Chapter 2 Team ProjectDocument2 pagesChapter 2 Team ProjectRaisa TasnimNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Intacc Number 234567Document2 pagesIntacc Number 234567L LawlietNo ratings yet

- Intacc Number 2Document2 pagesIntacc Number 2L LawlietNo ratings yet

- Intacc Number 234567890Document2 pagesIntacc Number 234567890L LawlietNo ratings yet

- Intacc Number 234Document2 pagesIntacc Number 234L LawlietNo ratings yet

- Intacc Number 23456789Document2 pagesIntacc Number 23456789L LawlietNo ratings yet

- Intacc Number 234567890Document2 pagesIntacc Number 234567890L LawlietNo ratings yet

- Intacc Number 1Document2 pagesIntacc Number 1L LawlietNo ratings yet

- Unit 3Document13 pagesUnit 3hassan19951996hNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Group 8-SW Income Statement & Balance SheetDocument2 pagesGroup 8-SW Income Statement & Balance SheetDiễm Quỳnh QuáchNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Cfas ComputationDocument4 pagesCfas ComputationSherica VirayNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (28)

- Dilemma Company SFPDocument1 pageDilemma Company SFPTish ViennaNo ratings yet

- Basic Finance Exercice 2Document3 pagesBasic Finance Exercice 2Kazia PerinoNo ratings yet

- PRESENTATION OF FS Problems Answer KeyDocument20 pagesPRESENTATION OF FS Problems Answer KeyJazie CadelinaNo ratings yet

- Illustrative Problem 2.1-2Document3 pagesIllustrative Problem 2.1-2Chincel G. ANINo ratings yet

- Solutions Test BankDocument26 pagesSolutions Test Bankshanaya valezaNo ratings yet

- Ia Vol 3 Valix 2019 Solman 2 PDF FreeDocument105 pagesIa Vol 3 Valix 2019 Solman 2 PDF FreeLJNo ratings yet

- Chapter 2 ProblemDocument18 pagesChapter 2 ProblemJudielyn M GonzalesNo ratings yet

- Ia Vol 3 Valix Solman 2019Document105 pagesIa Vol 3 Valix Solman 2019Pipz G. CastroNo ratings yet

- Ia Vol 3 Valix Solman 2019Document105 pagesIa Vol 3 Valix Solman 2019Janel dela Cruz100% (1)

- Exhibit 17. Goodwill Calculation and The Consolidated Balance SheetDocument4 pagesExhibit 17. Goodwill Calculation and The Consolidated Balance SheetЭниЭ.No ratings yet

- Peoria COperation - Cash Flow StatementDocument8 pagesPeoria COperation - Cash Flow StatementcbarajNo ratings yet

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- Scenario Summary: Changing CellsDocument10 pagesScenario Summary: Changing CellsLệ NguyễnNo ratings yet

- ABC FinancialPosition1Document4 pagesABC FinancialPosition1paulineNo ratings yet

- P 1Document3 pagesP 1Thea Kimberly Oamil0% (1)

- New Microsoft Excel WorksheetDocument2 pagesNew Microsoft Excel WorksheetKeresha WilliamsNo ratings yet

- 8810 Lecture 6Document28 pages8810 Lecture 6pmanikNo ratings yet

- Case - Monte CarloDocument2 pagesCase - Monte Carloh0ngtrangNo ratings yet

- Accounting (08-09-2018) Set-2Document2 pagesAccounting (08-09-2018) Set-2Shakil ShekhNo ratings yet

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniNo ratings yet

- Fa3 PDF LongDocument1 pageFa3 PDF LongAmir LMNo ratings yet

- Bài 4 - CMBCTC2Document2 pagesBài 4 - CMBCTC2Phan Thị Mỹ DuyênNo ratings yet

- Use The Following Information To Answer Items 5 - 7Document4 pagesUse The Following Information To Answer Items 5 - 7acctg2012No ratings yet

- Liquidity RatiosDocument3 pagesLiquidity RatiosMckenzie PalaganasNo ratings yet

- Sol. Man. - Chapter 5 - Corporate Liquidation Reorganization - 2020 EditionDocument22 pagesSol. Man. - Chapter 5 - Corporate Liquidation Reorganization - 2020 Editiondianel villarico100% (1)

- Financial Ratios QuizDocument4 pagesFinancial Ratios QuizHamieWave TVNo ratings yet

- Impairment Loss 1,200,000Document8 pagesImpairment Loss 1,200,000Clint RoblesNo ratings yet

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Java Developer: Adventure WebDocument2 pagesJava Developer: Adventure WebMegana PunithNo ratings yet

- D1Document2 pagesD1Megana PunithNo ratings yet

- D3Document2 pagesD3Megana PunithNo ratings yet

- D2Document2 pagesD2Megana PunithNo ratings yet

- D4Document2 pagesD4Megana PunithNo ratings yet

- D5Document2 pagesD5Megana PunithNo ratings yet

- Docs 11Document3 pagesDocs 11Megana PunithNo ratings yet

- F 5Document1 pageF 5Megana PunithNo ratings yet

- CpiDocument1 pageCpiMegana PunithNo ratings yet

- F 4Document2 pagesF 4Megana PunithNo ratings yet

- F 3Document1 pageF 3Megana PunithNo ratings yet

- Change Control ProcedureDocument16 pagesChange Control ProcedureNigel CharlesNo ratings yet

- $96 Per Share: Selected Answer: AnswersDocument1 page$96 Per Share: Selected Answer: AnswersMegana PunithNo ratings yet

- ParametricDocument2 pagesParametricMegana PunithNo ratings yet

- Regression StatisticsDocument2 pagesRegression StatisticsAntonache FlorinNo ratings yet

- Resource OverviewDocument1 pageResource OverviewMegana PunithNo ratings yet

- Future ValueDocument1 pageFuture ValueMegana PunithNo ratings yet

- Regression StatisticsDocument2 pagesRegression StatisticsAntonache FlorinNo ratings yet

- Regression StatisticsDocument2 pagesRegression StatisticsAntonache FlorinNo ratings yet

- Regression StatisticsDocument2 pagesRegression StatisticsAntonache FlorinNo ratings yet

- David - sm16 - ppt08Document36 pagesDavid - sm16 - ppt08Megana PunithNo ratings yet

- David - sm16 - ppt08Document36 pagesDavid - sm16 - ppt08Megana PunithNo ratings yet

- Regression StatisticsDocument2 pagesRegression StatisticsAntonache FlorinNo ratings yet

- ProblemsDocument3 pagesProblemsMegana PunithNo ratings yet

- Strategic Management Final ExamDocument32 pagesStrategic Management Final ExamMegana PunithNo ratings yet

- Quality Management Plan Template and Guide For Large ProjectsDocument17 pagesQuality Management Plan Template and Guide For Large ProjectsMegana PunithNo ratings yet

- Project Quality PlanDocument10 pagesProject Quality PlanUbuntu Linux83% (6)

- Template-Version-16 0 15Document89 pagesTemplate-Version-16 0 15Megana PunithNo ratings yet

- Template-Version-16 0 15Document89 pagesTemplate-Version-16 0 15Megana PunithNo ratings yet

- Student Application Form BCIS - 2077Document2 pagesStudent Application Form BCIS - 2077Raaz Key Run ChhatkuliNo ratings yet

- Chinaware - Zen PDFDocument111 pagesChinaware - Zen PDFMixo LogiNo ratings yet

- Galanz - Galaxy 7-9-12K - SPLIT PDFDocument42 pagesGalanz - Galaxy 7-9-12K - SPLIT PDFUbaldo BritoNo ratings yet

- 3D Archicad Training - Module 1Document3 pages3D Archicad Training - Module 1Brahmantia Iskandar MudaNo ratings yet

- Telstra InterviewsDocument3 pagesTelstra InterviewsDaxShenNo ratings yet

- Astm A 478 - 97Document2 pagesAstm A 478 - 97neno2405No ratings yet

- Summative-Test-3-5 Tve ExploratoryDocument3 pagesSummative-Test-3-5 Tve ExploratoryMjnicole MartejaNo ratings yet

- Finman General Assurance Corporation Vs - The Honorable Court of AppealsDocument2 pagesFinman General Assurance Corporation Vs - The Honorable Court of AppealsNorie De los ReyesNo ratings yet

- Advanced Excel Training ManualDocument6 pagesAdvanced Excel Training ManualAnkush RedhuNo ratings yet

- What Is EBSD ? Why Use EBSD ? Why Measure Microstructure ? What Does EBSD Do That Cannot Already Be Done ?Document5 pagesWhat Is EBSD ? Why Use EBSD ? Why Measure Microstructure ? What Does EBSD Do That Cannot Already Be Done ?Zahir Rayhan JhonNo ratings yet

- 3.1-7 Printer Deployment - Copy (Full Permission)Document18 pages3.1-7 Printer Deployment - Copy (Full Permission)Hanzel NietesNo ratings yet

- Transportation Problem VAMDocument16 pagesTransportation Problem VAMLia AmmuNo ratings yet

- 14 DETEMINANTS & MATRICES PART 3 of 6 PDFDocument10 pages14 DETEMINANTS & MATRICES PART 3 of 6 PDFsabhari_ramNo ratings yet

- Indian Consumer - Goldman Sachs ReportDocument22 pagesIndian Consumer - Goldman Sachs Reporthvsboua100% (1)

- Organization of Brigada Eskwela Steering and Working CommitteesDocument2 pagesOrganization of Brigada Eskwela Steering and Working CommitteesCherry Lou RiofrirNo ratings yet

- GGSB MibDocument4 pagesGGSB MibShrey BudhirajaNo ratings yet

- NOS 65-200-90x60-30KWD PDFDocument2 pagesNOS 65-200-90x60-30KWD PDFDao The ThangNo ratings yet

- Road To Recovery: Moving To A New NormalDocument10 pagesRoad To Recovery: Moving To A New NormalFOX5 VegasNo ratings yet

- Vacuum Dehydrator & Oil Purification System: A Filter Focus Technical Publication D1-14Document1 pageVacuum Dehydrator & Oil Purification System: A Filter Focus Technical Publication D1-14Drew LeibbrandtNo ratings yet

- Transportation and Academic Performance of Students in The Academic TrackDocument3 pagesTransportation and Academic Performance of Students in The Academic TrackMary-Jay TolentinoNo ratings yet

- Non-Hazardous Areas Adjustable Pressure Switch: 6900P - Piston SensorDocument2 pagesNon-Hazardous Areas Adjustable Pressure Switch: 6900P - Piston SensorDiana ArredondoNo ratings yet

- Resume (Suyash Garg)Document1 pageResume (Suyash Garg)Suyash GargNo ratings yet

- Che 342 Practice Set I IDocument4 pagesChe 342 Practice Set I IDan McNo ratings yet

- Year Warranty: 1575 - 90 Ave Edmonton, AB Canada T6P 0E2Document2 pagesYear Warranty: 1575 - 90 Ave Edmonton, AB Canada T6P 0E2juanchingarNo ratings yet

- Statics: Vector Mechanics For EngineersDocument25 pagesStatics: Vector Mechanics For EngineersProkopyo BalagbagNo ratings yet

- Business Mathematics and Statistics: Fundamentals ofDocument468 pagesBusiness Mathematics and Statistics: Fundamentals ofSamirNo ratings yet

- Engineering Materials-Istanbul .Technical UniversityDocument40 pagesEngineering Materials-Istanbul .Technical UniversitybuggrraaNo ratings yet

- Corporate Restructuring Companies Amendment Act 2021Document9 pagesCorporate Restructuring Companies Amendment Act 2021Najeebullah KardaarNo ratings yet

- Newton Gauss MethodDocument37 pagesNewton Gauss MethodLucas WeaverNo ratings yet

- Top Ten Helicopter Checkride TipsDocument35 pagesTop Ten Helicopter Checkride TipsAbhiraj Singh SandhuNo ratings yet