Professional Documents

Culture Documents

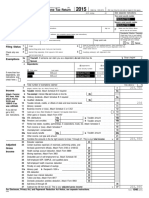

Gov. Walz 2018 Federal Tax Return - Redacted

Uploaded by

Tim Walz for Governor0 ratings0% found this document useful (0 votes)

172 views20 pagesGov. 2018 Federal Tax Return_Redacted

Original Title

Gov. Walz 2018 Federal Tax Return_Redacted

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

172 views20 pagesGov. Walz 2018 Federal Tax Return - Redacted

Uploaded by

Tim Walz for GovernorYou are on page 1of 20

inet Batman eal sacs (8)

£1040 ieerinaivtitarincome fae Fotun PUT E deers

cn pan el dea garter TT career came

IU Gp nti rato pe

‘esha tae Tomcat

ners WALZ a

[eens odin yovesadeendet [| von woo ten bows Janey. 1054 — [[ yov a bint

(Tome coumanpraraineaner dt

‘enous cae a hie tetra “Spouse soca occu naar

SHEN _[wann _ — Tl

‘Season can dan yeurapauee na depenrt —_—__] Spano wer bom bate Jmuny2 1084 ‘algal on comrge

sropl ea ba

‘by tnccpnalin im Be or ree

Mankato sect

eps oo won @ contseotrane |) Reiipnse (6 testa roto

i

I

Sign rast oatow eth wins opiate fa olen dba

Fiat. cnn Din dpi styen ented ot pg or

nian "OG we | Yocepton ent

=p CLENESCORY. pater

Koveeg 7 es Te eT

pen 7 mt kat pa rast

ie ta [ J

Petras 7m

Paid thomas J Rosen

Proparer finns Frederick @ Rosen, LU

oy men

Fiveasiee St. Louis Park ty 55416-2011 [rowers

For Disclosure, Privacy Act, nd Paperwork Reduction Act Nolic, see separate instructions,

Da

Fam 1040 pa)

fontoogo TIMOTHY J & GWEN L WALZ con?

“Wie lp eA Fa? . 1 206,673

2 Tecoxampt intrest as i Toorak 2

{28 Quod dvidend aa Db Ordary ond [a |

4a Rha, peers and annitios [4a » Toxbieanoun, ab

AYERS, Sa oksocuty beets a 1b Taxable amount ‘Sb

FeROR22H# 6 Tolatincome, Add Ines {ivugh. Ad any amount tom Sched 1, te 22 5, 586 6 212,259

tne 7 Adjusted gross Income. Ifyou have no adjustments to Income, enter the amount from line 6; otherwise

sublet Sed 1, no 35, fom a6 z 211,864

‘Standard deduction or itemized deductions (Irom Schedule A) 8 25, 898

{ual business come deco 65a) 2

Tax ere. stds Bogen. xen 3 10 185, 966

‘tt |11 aioe) 33,211 (ecto tmes Fai C] ali

‘owe 3 )

eae tb Aang ancin am Schuh 2a eae >ln 33,211

HE [rz a cntmteomenteoneiset 2, 500" hoa Sebo 2,500

Sosviedea 13. Subtractlno 12 trom no 11, I zero oles, enter -0- 30,711

miei" 44 Other ws. Altach Schedule + 789.

tedtn |18 Total tex Addlines 13 and 14 ems 9177500)

“116 Federal income tex withheld trom Forms Wand 1099 : 27,213

47 Relundblcras: a Hope, iat ”

eres,

‘Ad eny arnt rom Sohedle 8 2

16 _ Addin 16 an 17. Tazo wo your eal paren 8 27,213

“19 If Ene 18s more than tne 15, subrac ne 15 from ne 18. This ls the amount you overpaid ..,,....._ | 19 |

Refund 20a Amountf ine 19 you want refunded to you. If Form 6888s efached, check here > O Poos

cman > B Radi mber enti Cl ona LI See

‘see leiwotone, Pd Account number

21 _ Amount fn 19 you wari applied o your 2010 estimated tex,..... > | 24 |

Tesouni vou Owe” 22” Amount you owe. Seat 1 on iw 15 Far etalon how toe, eeirawuaons 4,287

23 _Ealimated tax ponally (eee insructions) » | 23

{oto wns goFormt040 fr Insc ae ett orn. rem 1040 or)

rom 1040__| Form 1040 Reconciliation Worksheet | poe |

eer TI scxntvng tint

targus: TT veiae TE sunasimnoney— [Tomicntowenmay [Tete

Mrs scoe ame “cut pon at tt ae

Tete — Tegal

TIMOTHY. J WALZ = —

Tapamm pendetecaneccana | Utne raat cat

GWEN I WALZ.

Tats aaah ar

X teoant

yeep

Mankato. MN 56001-2500

Fr Fale oy oe Ll

Ga [El teeters a apie te Doesnt —2

— z Z Cotes =

L mien etennttie

nel atten

‘ ov teat

cut enter | tometer

IX] | depen

i vo

I

7 feos inne PORE 2 We eT

Income ta Turable ra ch Sod : ; a

Ben) Tarexomptrs Dottie Ba la

fa Orca cen, ta Soha Bree . oa

> Gud dene. Us

0° Tanbloreluds, is dial i si ails ai

41 Ara rece neecune

{2 leiees ican i is Aah Sabokio ar 2

13 itn fn nt india ienteain

4 Ober oi or een). tat Fm 4707

te RAdstbune tsa 5 sai i

ttn Ponsoneand aris” on ] © Tete encnt

47 Rr texto, rts, Scapa, aa, Aach Seale 5

18 Farmincomecr (oss). Ath Schedule F

18 Unomplyment compensation

2a Sel ety als, (ata i isa 200

24 Otho neame, Let ype and eur See, Sch, 4,.Jn. 21, stmt fat

{22 Combine tha emcunt Inthe far gh coun fares trough 2. Theis your total income | 22 22,259

‘23 Erluclor expences ees 2

Adjusted 24 Cortan business expanse o resents, paroring esis, and

Grose feobasls government ffi. Atach Form 2108 o 2108-EZ.

Income 25 Heath savings account deduction tach Form 8869

(Sindle\) 28 Moving expenses Alta Form 900 z

27 Daduolbl pat of sol-omployment tae Aiach Soha ELE

20 Salt-employed SEP, SIMPLE, and qulfe plans

29 Selt-employed heat Insurance deduction

20 Penalty on oxy ulhaws of savings —

‘31a Almony paid Reolplonte SSN [s1a[———

2 IRAdeduclln 8 2 _|

33 Student loan rireat deduction 38

4 Rosorved . oe 34

95 Reserved as]

98 Ade oes 23 ctigh 36 3 395

{37 _Suleeotine 36 rom ta 32. hia a your adjusted gross income [sr 211,864

Fam 1040} Form 1040 Reconciliation Worksheot, Page 2

Name “Tepaye oiealon Nunber

TIMOTHY J_& GWEN L WALZ

38 Arunt ran ne (usted goa acono) : 28 211, 864

ae ‘88a Check ¢ [_] Youwore bor btore January 2.1864, Are | els

alee te Spouse was born beer erway, t964, [Jota J checked soa

Feandasy L__® yo opteotoizes ona separa rom oryou neo duncan checkhere> —38b

Standard a} tomized deductions (rom Sehedla A) or your standard deduction (ssl mega) 40 25,898

fo ‘81 Sublract ne 4 rmfine 98 : : a1] 185, 966

spas | 42 Quaid business Inco deco (oe tats) ” fe]

Secon. 43 Taal Income, Stal 42 fom. Mine 42 fan el coos LA 185,966

Miocene” | 44 Taxjtcoksts.chocktetom: « [) fen) of] fg of] _ “as | 33,211

ieoedes® | 45 _ltonatvo minimum tx (es srctng),Alach Ferm 657 ee Gag

Ferme, | 48. Etcess advance pranium ix crest repayment Aiach Form 8962 : [ae

satatons | 47 Aeklnes 4 4, and 46 ar 33,211

rower | 48. Fatignoxcredh tach Fam 116i reqited “fas

49. Oredtfor hid are depondant car expnces. iach Fann 24”

{50° Etuoaon ees em Form 998,99 18 a. 20

51 teron savings conrstons ered tach Frm 8860 1

52 Child taxcodlred for oboe dependent aa 7,500

153 asda onary eres, toch Fam 698 3

54 Ober cesfemFoma [| $000 b L] ee 36

{55 Addins 48 heugh St, Tha ar your total ret 55 2,500

£58 _sublactine 6 tomlin 7. 5 sare than eer 0S Dae 30,711

‘iherTaxce 57 Saemplomenl tx. Aath Sco SE e o7 789

Gin) 56 Urreptd sell sour and Medosoiaxitom Fm’ (] #4876] eat” Po

59 Adda on IAs, ether quate alent pans, lo. Atach Ferm 5920 eed 50

608 Heusceld employe ts tam Scheu — [ena]

_Firstme homebuyar cet repayment. Alach Farm 6408 I roqitod 6s

(61 Hod caro: indual responsi (ee Instructions) Fu-yar coverage o exept st

62 Toston a [| romeo b [| romaseo ¢ [| orton onerous 2

163 Secon 965 nat x bly sabe rom Ferm 85-, 63

4_Ad.nes 8 trough 62 Ths your toa tx

05

ne | 31,500

Federale tac tld om Fe Wan 000 ‘s 7213

Paymonts 66. 2Bcaled tx ponas and anc pd ton 201 os

(sredta 6) 67a Eamed income credit (EIC) bese STa, :

> Nortable carta py esto” [ais Z

68 Adhere. Mth Sad B2___ a

68. Aarcaneppruniy oad rm Ferm 8863 a8 ©

70. Netromiam xc Atach Form 962 FA

77x pad vith eqs er enon i 2000"

72 Eros collect nd ort RATA tw 7

7a Gre err ion fa. Atos Fam 488 FA

74 onto tom'a -} 20 » [Arent of oat a CT" Ere ‘

75 _ had tines 6, 66,6, sod 68 ong 74. These ve you total payments, >| 5 27,213

Rotana "76 Hl 761s mere tan ine 64, subtract Ino 64 ran Hino 76, This fs tho amount you overpaid 76 a

‘77a Amount of ne 76 you want refunded to you. I Frm 8888 s attached, check here +) [ie

> Rang mania ee be toe [] chucking L] Saige

> Accont uber

peace orey eee ance eels

79 Amount you owe. Sie ne 75am eo tte nov py, ep lealow| 4,287

0__Estnsed axpanaly (esate) 2

a he Peers inet atm om

“hr Pary BE) Pa Prparere Od Pry Beles, Tid Pay Desqoo hora nol roqied

Designos” Boyou'vn'toafor anther pxaen coors oun th ioIR ecoinetntonay?[] Yeo. Compo. [] Wo

Cn Pound ein ote 8)

retatS wre >

Other info Meaver Davie phere seme - {RS Lonthy Poleaon PIN

spouse Soa ns usa teen 2

SCHEDULE 1 Additional Income and Adjustments to Income OMB No, t6at-cor4

(Form 1040) 2018

‘Depaitmart of the Tesssuny > Atinch to Form 1040, “Nachman

cures > oto wna goutomitsteristustans ad th net oration, sotto

et em Fie 08 ‘ae

TIMOTHY J-& GWEN 1. WALZ —,

Raditional — 1-ab Reserved : [sb

Income 10. Teer, i or cl ns dil noome tas “0

14 Alony raed " Gel

12 Bunboss neon is) lush Sbohio CaGEZ ra]

1c Ahad eye os

44 eraser onset ch Fam 707 fe

46a Roserved i 780] BE

{a Rwued : [eb]

47 Rnltel iia ais, pata, capa, Wk Ath aE Fa o

1 Fam isamocr Gx) Ach Stee F : “8

{9 Unoplomet camper mn

20a osoned : 2b

A Obwrhoona ilipeademani S08. Statement. i

22 Conte aoa nei chin you dat ve yess io

‘nooo enor har ei inca on Ferm 1040, fe 6. Otherwise, oto ne 23

Adjustments 25

toIncome 24

25

28

a

23

20

20

sta

2

3

28

35

6

Educator expenses

‘Caran buslness expanses of reserva, prferming art,

and footasle goverment offi Attach Form 2106 on\et

Hosa svings socount deduction. lash Form 8689 25

Moving expenses fr members of the Armed Forces,

‘Asta FOAM 908... .

Deetutble part of ca snployment ta ita Seda SE

335

‘Solt-employed health Insurance doduton

Penally on ont wihtaual savings... z

'b Reciponte ss [ate

26

2

‘Sal-employed SEP, SIMPLE, and auld plans 28

29

30

‘Almony ald

TRA deduction

‘Student loan intrest dacucton|

Reserved ee

Reserved oe , oo Gs

Ads nos 23 trough 3

2

395

For Paperwork Reduetfon Act Noli,

aa

Your tax rourn instructions.

‘Schedule 1 (Form 1040) 2018,

SCHEDULE 4 Other Taxes ue ne. se4score

(Form 1080)

= eee eure

‘orator fe > Goto wmnniregoviForm{040 tor Instructions and the lates information. Sram 04

ame) on ce Frm 180

TIMOTHY J_&

GWEN L WALZ

aii

Other 37 Sul-onploymant tax Aach Schod SE ; Ler

Taxes ‘58 Unreported social securly and Medicare tax from: Form a] 4197 b[ | 8918 so]

59 Addon taxon RAs, ter quad eterna plans re air actor

sccouns. Aah Form 6820 rege

604 Hower orplynont ous. Ata Sculi ieee

1 Repryrant les hamsbiyer rect rom Fr 8. Aah Fm 64

‘equ a eo»

1 Heat cae nhl espns aco} st

62 Taxes from: a[_] 8969 b{_] e900

eL} instructions; enter code(s) 62

63 Sean 965 ret oc tbity rset rom Fam

BOE cae ' esl

(64 Add aos aright San Tas ott tor tno. Er

to an on Form 1040, fo 14 oo 789

For Paperwork Reduction Act Notice, see your tx relutn Instructions,

‘Schedule 4 (Fore 1040) 2016

SCHEDULE A Itemized Deductions | cura. ssscor

(Form 1040) > Goto mmirgowSchediod or ietrustons adh et rato, 2018

pet a DF aaoh to Form esse

Foalfowmetee” gx Gautlon: Kyou are oalming ano quali cease loss on Form 484, ooo the netuotonefortno 16. _| festa O°

Nano) nF “es a ome

TIMOTAY J & GWEN L WALZ

Medical ‘Cautlon: Do nna pans abuTeoT opal by Oa

and 41 Meola devel opens (oe nstuctone) Lt |)

Dental 2 Fo ancntom Fam 100,072 211/864

Expenses 3 Mitpy nea by 75% (0078) 3 15,890

4 Subtat nw 3 am oN sr tha ins fit 0 4

Taxes Vou & Suicandbcd iow.

Pald a Stal anda income tas organelles ts, You may

Incid eer Incas tees or general sales tx on ne 6a, |

but ot bth yu oles neue goa elo la stead

‘oflncome tax, chock ths box ed

by Sinton cal cl axe tes (ee inion).

¢ Stl and el persona popry tes

4 A esa tough Bo

« Ener te snare ie $0066 86001 mac ing

space)

6 hor tows Listy ad amour

1 fait Bo and 7 10,000

Interest Vou @ Hone merge inert ee ports you det uso all your 1

Pad tn merge ans) toby, bul, grove yur nama, :

maton Yo 590 nstructons end check is box >O |

aitach to Form i040, 1H0NR, or Form 104.

iéeaifimce mse” oe) > Go to wnwits.goulSoheduleE tor Instruotions and the latest information, 43

ano rio sen Yearsooa cay nt

TIMOTHY J _& GWEN L WALZ

BRIT]: Income or Loss From Rental Real Estate and Royalties Noto: you aroln to bus

‘Schedule G or C-EZ (sa instvtons, I you

an fava, repo arm ena incom oe rom Form 4898 on page 2, tao 40.

ness of ening personal property, use

"Ryu ak ny payents 2016 hat woud equ yo tole Frm) 1087 ee nace) L] vos fx} wo

id yur il you fb requ Fors 10852 ves [| no

yl acs of cad ropa koa ly aa Z ca ~

Tipe of Pepe 2 For ea rerio etl propery ted Farkonal | Ponltne | oy

(rom et bond oe opr ha rumba a rent and Day ae

2 porsonal ue day, Crack the QV ba ra

ni you moat ho reqreens oh

a qi ja vente. See ret ustns fe{ —

e e -

Type of ropery:

1 Single Farty Residence 3. Vaclan/shot-TernFlnit 5 Land 7S Raia

2_MulFamiy Resterce 4 Commerc &_fojlos 8 Othe (esc)

come: Frperes: A B c

3 ents rested a 2,040

4 oylis roodved - 4 —

Exponees:

5 Advi 5 |

6 Ao and reel (es nstctons) 6

7 Clarina aitnarc 7 700)

8 ammissions ®

© trsurace 8

410 Legal arr pesto ‘0 — -

11. Managoront fxs eve tt

12 etapa pi ks, oso) 2

18 Otrinoes 18

18 Reps “4

15 Supplee 16

10 Toss 16

17 Utes 17

18 epreclatn expanse or epon 1 rE

419 others), 18

20 nels ia 0 | —___2, 675)

21 Subrect ne 20 tom nes (ns) ne Goya.

rovuts a ose), a fatto tind out i yeu mast

{io Form 6198 2 ~635|

22. Daca rent ea eta lar an, any,

Form 0502 (20 Instructor) PA o _

25a Toa oll amu opr en no al ntl propos Za 2,040

‘Tela al amount repre on in fr al yay properties Zio

¢ Tolle al enous repaid ent 12 a poperios zo|

Tot cal amounts repartee no 18 el poprion zd 3

6 Tolf al amounts opr eno 20 al popes. 230 2,675]

24 Incom Ad postv aunts shown cnn 21. Do not inde ny nses 26

‘kd opty loa frm ine 2 and eral oa att ses ro a 22 Err lies ara [2s

and royalty Icom or ose). Cabin tes 2¢ an 25. nr th rest

‘nw. Pas Van 40 en page 2 donc apply, ao enter out an

‘She (Fem 040), he 17, Fam YOAONR, Be 1, Oise neti ts aunt the

ol nt 4 on pags 2 2

For Paperwork Reduction Act Notice, sve the suparate instructions.

Taiie Farm TOTS

(a No, 1546-074

2018

achat

Soquenes Wo. 17,

SCHEDULE SE

(Form 1040)

Depaiment the Treasury

trum Fone Sani

Nama of peo wh eel-amplo yet nea (0 Show on Fe 040 or Form 10408)

GWEN WALZ

‘Before you bap: To determina t you must le Schedule SE, so tho Insitutions.

May | Use Short Schedule SE or Must | Use Long Schedule SE?

10 ts Hlanohart only you must fle Schedule SE. unsure, see Who Must Fle Schedule Sin the hstuolons,

Self-Employment Tax

> Goto wnniregovScedio Stor insrustons ad tho atest tration,

Def Form 04 or Frm YN

‘eckalsoauiy nuribe of parson

employment nome

Notes

Did you acevo wages oF pan 20107

Yoo

"Na you esa, rarbo of aralious od, of tin

ane ealtoner who raed FS approval eto ba acd

‘on earinge om hoe eourens, bul you ovo sel. oployment

{acon aber earings?

Was th ot ofyour wages ar pe subject ocl seculy | Yas

‘ond rte (lr) ox pl your el arn tom

fatkemploymont oc than $128,400?

I No y*

{rs yung one ote cporal moto ote ycurnat | YO ‘id you resive dp ajc owl pcr or Medlare tax | YO8

mings fee nto? thot ou tant rpet to our employer? |

id you repr ey wages on Farm 8010, Uneatcied Scion

Sealy and Madeare Taxon Wages? feat]

‘Di you roalve cure erpaje namo (onal) Ad

‘epatodon Fon Wo! $10828 or ma?

te

[Yeuimay uso Sor Schedule SE bow =] {

Younus use Long Schedule SE on page?

Section A— Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE.

“fa Net farm pci cr (88) rom Schedule F, ine 9, and arm panarchips, Schedulo Kt (Ferm

1005), bak 14, cod0 A... — ta

'b- Ifyoursoeved socal secu relrement ar sity bane, enter th amount of Conservation Reser

Program paymen included on Sched F, ln Ab, ated on Schedule Kt (Form 1065), bax 20, cado AK . Lb )

‘2 Netprott or laa) fram SoheduleG no; SoheduleC-EZ, fro; Schedule Kt (Form 1088),

14, cade A othor than farming) and Schedulo Kt (Form 1085-8), box 9, code It.

Nirstore are mobo of retgous orders, co instructions fr ypes of neomo to repet on

thee, See netuons for ator inooma report . 7 2 5,586

3 conbomne i hand? . : 3 5,586

‘A Mulipy ne 3 by 92.26% (0.8385) ees thar $400, you dort one sal employment tax; don't

‘this schedule unless you have an amcunt one tb = 7 La 5,159

Noto: in 4s es than $400 i to Coneevton Reserve Program payments on ne fb,

90 hatusons.

5 Soltomployment tax I tho ancunt en ne is

+ $126,400 less, multpy In by 18.9% (0.159) rer the rsul har and on Schedule 4 (Form

1040), ine 87, Form 1O40NR, line 85

+ Mere than $28,400, muy Ine 4 by 2.0% (0.028). Then, add $18,924.60 to tho rsa

Enir tho tll here and on Schedule (Form 1040), ine 87, of Form TOAONR, ino 65 5 7189

5 Deduction for one-half of se-employment tax.

‘Muti 5 by 60% (0.0), Ener ho rout here and on | |

Schedule 4 (Form 1040, ine 27, cc Form 1040NR, line 27 eee 395] :

‘For Paperwork Reduction Act Notice, see your tax roturn instructions, ‘Schule SE (Form 1040) 2048

Passive Activity Loss Limitations mw

v= 8582 aa sate

reel Frets Sante) >-Go to www.irs.gov/Formé582 for instructions and the latest Information, Seaumnceti 8B.

TIMOTHY J_& GWEN 1 WALZ

WAIT! 2018 Passive Actvlly Loss

Caton: Conoin Worhoos 2, nd 9 bla empltng Pa

antl oa Estat Atos Wih Activ Parclplon Fx hdl ct sv priapale, se

Special llowanco for ental Real Estate Activities in the insictons.)

“1 Aaltins with at ncomo (one the aunt from Worksheet 1, .

column (@) ja :

Acts wih tise ene tho anetntrom Wrst ein

Oo) : [1

«Proc yous union iaies (nro meant em Wake ,

column (9). - - Je

4 Gambine bes ii ane 1, ia =635

‘Gommercial Revitalization Deduetions From Rental Real Estate Actives

2a, Commer rvtaeaton deductions from Warkshet 2, column (8) nen [28

bloc yar unaowed comarca revilzaton daduetons from

Workshest2, column ®) - = 2

Add lnes 2a and 2

{i Otho Passive Aetvitas

‘38 Actes with nt Inca (ster the amcunt eam Werkshes 3,

coh 3a

bb Actos wht los (eer the aroun ram Werkshoat’, cain

w) 3b

«Prior yar une laos ona tho aca rn Wiss,

‘alu (0), a

Combine i 3 ane

“Combis 1, 2, and 9 tis ns zr or more top eo and noo fam wh

your eu lnse re we cing ery rr yer nated loses ered on net,

2020 Report th fses on tho forms and sheds normaly ubed 4 635

We sie ales and: + Line teas, goto Par

+ Unw2's alas (and oo 14 20 or mre), skp Pa Wand goto Pat

{ unesdie ats (anes Ida ar zero mre}, ip Pars an and goto 15

Ccauston: your file tai Is marie Wn sepa rd you ed wth you spouse at ny Sve dg th ar, do noteample

Patt Pt nsed, go oe 5.

"PALE, Speclal Allowance for Rental Ral Estate Activities With Active Parlleipation

Noto: Erte lubes in Pais pk amouris, Se nsiuetns fr an exam

' Erle tho amallr of tho loa on tno tor tho loss on ine 4 /E 635

Enlor $150,000. mart tng sparta, soo netllons mi 1507 000)

7. Enlerodiled adjusted gross income, but not ss than zea (ao isinuions) [7 212, 259|

Note: tino 7 Ie grater than or equal ono 6 kp tes 8 and 8,

ntr-0-cn tho 10, Othervis, goto ina 8 :

‘Subratno 7 fram ne 6 . 8

8

Mut no by 50% (0.56. Boot eis mar tan $8,00 maid ing sopra, se stustons

410° Erle the smater ane So nes

if no 20% goss, ote Pat It. Oberle, goto tine 8.

BARI Special Allowance for Commercial Revitalization Deductions From Rental Real Estato Activities

Noto: Entr all rumor in Pat las poste amour. 86 the example for Par in th tnstucons.

“Fier 25,000 educa by he aroun, ey, on ne 10 i mare ig separa so ntctans a =

12 Ener thoes ame at saneateoaai Hanes 2

48. eucolne12by th aman on io 0, 2

14 _ Enter the smallest of line 20 (troatod as a positive amount), line 14, or line 13. = 4

‘BANIV! Total Losses Allowed

48. Adhere ny, on les an aad anor fo el e

418 Total losses allowed trom al passive aves for 210, i ines 1, 14 an 8, Sao ry

Insert tnd aul hoo ope ho oss outer . _. Ls 0

For Paperwork Reduction Act Notice, see instructions. Fem 8582201

TIMOTHY J & GWEN L WALZ

Fmssez 0) ago 2

Cauti “The worksheets must be flled with your tax return. Keep a copy for your records.

‘Worksheet 1 — For Form 8582, Lines 1a, 1b, and 1c (See Instructions. _—

Cure yor Prior yors Overall ortas (

Tations | Unaowed

‘uno) (eosin te) | _(2Sen (o)bows

625] 635

Tea Err on Form 52 as TT

and 1o > 635] i

‘Worksheet 2— For Form 8582, Lines 2a and 2b (See Instructions.)

Name of activity (@) Current year (b) Prior yoar (c) Overall loss

sede nn 2) | unalowad dedton (he 2)

Z

‘Toxa re on Form 0 esa ed

2 a, sss >

Worksheet 3 — For Form 8582, Lines 3a, 3b, and 3c (See instructions.)

ccurentyor tr yura ver gun or fxs

Namwotaciviy atincone | — GyNetione

: a) “ine 3b) tos (line 8c) (a) Gain (@) Loss

Tosa Ete on For 60, esa,

anise >

Worksheet 4 — Use this worksheet if an amount Is shown on Form 8582, line 10 or 14 (See instructions.)

Former sched ‘ewan

and line number (c) Special trae

van vty tenn | gion | eynato | | estan (3 tom

{coo nstctions) column (o)

rot! > 100

Worksheet 5 — Allocation of Unallowed Losses (See instructions.)

Formorsche

ama fat od tne eer

Tea] tobereportedon| (6) Loss (@)Ratio |) Unallowod toss

(see Instructions)

a 335] 70009 335

rota > 635] uo 635

Ton B52 in

TIMOTHY J & GWEN L WALZ

Form 8682 2018)

Worksheet 6 — Allowed Losses (See insiruotions)

Pago 3

Form or sched]

Name of activity and line nurbor

to bereported on

(so Instructions)

(e) Loss

(6) Unaltowed toss | (0) lowed loss

‘Sch El

635]

635)

Total

>

635)

635]

Worksheet 7— Activitios With Losses Reported on Two or Moro Forms or Schedules (See Insiructions)

amo of activi: @

®)

(Ratio

(@ Unallowed | (6) Allowed loss

Joss.

Form or schedule and tine number

tbo roported on (soe

Insts) cen

‘Net oes pis price year unalowed

los ro frm or ached

'bNetInoome fom fom or

schedule,

Subtet no 1b rom tne 1a. zero as, enter 0 >

Form or schedule and tine number

tobe reported om (see

Instructions):

‘Netioss pis prio year unalowed

Jags fram form or sehodulo >

bb Net income fe form or

sohodulo >

© Subtract no 1b rom no 4a. zero ores, ener »

Form or schedule and Ine uraber

tobe reported on (soe

Instruction

‘4a Notlbss plas por yar unliwad

loss rom formor schedule >

'b Netiaoom from form of

schedule

6 Subtract ino 1 rom tno 10 M200 1686, 010 ssasss DE

Total >

1.00

Fen 8582 p16)

ram 8283 Noncash Charitable Contributions nee

(rac Dseombr zor > attach to your tx rotur you claimed a total deduction

‘rntnetatataesay ‘of avor $500 fr al eanrbuted property. 7

nerd avr eos > Information about Form 8269 and is eeparate instructtons lest wwwiregovitormezes. | semseatin 155,

‘Namet)shon on our ome tt en | seuiog aan

TIMOTAY J_& GWEN L WALZ

‘Not. Fut the snount cf your contibulon deduction belore comping his er, Son your lx rolu nattons

Section A. Donated Property of $5,000 or Less and Publicly Traded Securities—List In this section only [tems (or

‘groups of similar items) for which you claimed a deduction of $5,000 or less Also list publlely traded

‘securities even ifthe deduction is more than $5,000 (see Instructions).

TREREE Information on Donated Property-If you need more space, attach a statement

eyes hener bones tien] erase ur boye at mam tan et

tame tear rn 100.08 sched Ss artic ane eer a

Minnesota Valley Action Counc)

A] 105. victory neive clothing and Hlovashold Tene

—[oentato sot__s6001

Misnesota Valley Action Gounctl

B| 105 victory Drive Oo auto

—[itankate so1__s6002

Minnesota Valley Action Counc)

©| 706m. victory Be, ® }2010 podge Grand caravan

Mankato s91_s6002 TT iacxco aati

‘Note. tie areunt dedcton fr ano $500 or le, you do nat havo oomplae columns (9) (, 2nd (a.

po aioandtea | Gloacsoytee | len cod oan yma Wisteria arate

ois | Secon) ras Frain ies ‘sre ‘nowrewtatae

‘A | Various | Various | Purchase 8,500 $50| Thrift Shop Value

p| 11/19/18] 05/29/10, Purchase 18, 500| 7,108) 1098-C.

e{ 11/19/14 Sales, comparative

D | a

E.

BALL Partial Interests and Restricted Use Property-Complete lines 2a through 2e if you gave less than an

ent nest ina propei lite in Patt. Complete nos 9a trough Sf condone were placed on

contribution listed In Part | also attach the requlred statement (see instructions),

2a. Ertrtho ate fom Paz | tht rifles th propor fr whih yu gaveless than an eno nest » _

I Par pps to more than ovo propary,stiach a separate slaement

bb Total amount cae sa deutinfr tho property std in Pat (1) Fortis txjoar >

(@) Focany portoxyoars

‘Nam and erese of ech erganizato to wich ay such enon was mason ptr yet cots ny erent

ftom the ones xgrization ovo

ane caa counens)

‘ae ants a oda 8)

yer om ane se

<4. For tangible property, enter the place whore the property is loosed or kept

‘©. Namo of any peean, lhe than the donee argarizao, having actual possessin ofthe property

‘28 her a etn, altho emperary or paianent, onthe doneds right to use or dspase af the donate ves | No

propery? ; a

bb Didyou gol anja (thar han he dares ergardzalon of aha’ crgarzaion paca with to donee

‘gantzaon in eogprave funding) the ight othe near fem th denaled propa a fo tho possession of

th prepay, inclung th right ovte donated socio, lo aca tho property by purchase or atherws, ero a

cdalgnats th preon have such income, possession, o ih acquire? ee _

le hero a roan tnling to donated propery fr apatolar se? :

For Paperwork Reduction Act Notlc, see soparate Instructions, Form 8263 fies 12010

_ Federal Statements

Statement 4 - Schedule 1 (1040), Line 21 - Other Income

_ Description = Amount __

1099/Hogan Lovells US LLP $ 2, 686

Norton Rose Fulbright 2/800

Total

nn Be wun

2018 Form M1, Individual Income Tax

{et tows Do ole pe en ng Yh,

Saetiniecant ana ‘Ta UST THERES Tar Ta

fimorny J_____ WALZ. a dLdLULUL

Test een, Suse Fat ae anda ‘pe aie peter ea See Waar

GWEN_L. WALZ —

iis f I

2 ar oor

MANKATO Ma 56001 -

2018 Federal

Filing status [1 silo [Je met tng ity [ee rtd ting separately:

(place an x Enlo apa name and Sell Soulyrumbar

Ione box): [T]4)Mecdothenssnks [Joy tyra won

‘Stole Elections Campaign Fund

Tuvan 5099p arise Poi party an code umber

ienpy sean penn eno reaces Hl Cnweae-Aapts Carat 14 Leta 1 2

sero bmpartelyar cic Tt. 12 Gaon sssseeeens 18 Goal Canpaoe

atozese parc roc urabnd MO es STITT 8 se sotto ade

From Your Federal Return A Wagoe,sslaa,tps,ce, SB FAponsors,andannulles CUnanployment Fara abioincomo

(620 instructions) 066 oO 195966

Reser ton gave amber

41 Fedora alusted gross inoome rom tno 7 of federal Farm 1040) (a napatve number, place an Xin the box)... 1 211864

2 Other alons to income including non Mnesois bond inte, and an austen

‘tom Schedule MINC (e09tnstuctons; enose Schadule MM)

a 211864

8 Adding { and 2 (2 negative number, pcs an Xn the box)

4 Nemized deductions (rom Sohedil MSA) or you standard deduction (seston)... a 18185

15 Exomplons(deteme ram nstoctons) . a 16600

{Stet Income txrfund tram na 10 ado Schedule t

7 Of subtons, sch a eins or ml tad end rom US. bond ta 1 try

retement pay, or K-12 educatlon expanses (so Instuctons;enaose Schedule MIM) —

{8 Toa ublractons, Adlnes 4 though 7 8 34705

15 Minnesota taxable income, Subtao ne 8 fram ln If zero cess, eave bla, ° 377079

40 Taxfam the tale nthe Mt nstcons 12054

+14. Aternalvo minimus tax (onelose Schade MMT)

12 Add toes 10 and 14 a nr) 12054

48. Falyear teins: Eth nt ano 20 ne 19, pn 18 an 4.

Paros teldonts snd nonosdent: Frm Schedule MIN, alr aotet om ne 2.08

12054

no 1, ome 2 one 18, ad re 25.0 Be 1 orefose Scheie MIN) os rncen ese 8

on 0 wl rcr an xitexitaante nt

1 broach the axon su dtfoutone anceps Fo (check eo

[eseteadowitowe [_Jocntlontscn[_—]Sshedin its

L 2015 |

a

Tr 2018 M1, page 2

1 Taxbelow credits, Adnes #9 an 14

18 Mariage Creer orn ven bth spa a tabled coe

taxable retrement income (areloso Schodule MMA)

47 Crect fo long-erm care surance pees pld(onelose Schecle MALTY)

18 Croc for tas aldo acter sto (onlose Sched) MCR are! MIAICA)

19 Other nonrtundable ods (onclase Soheduil MIC)

‘20, Total nowelundable ered, Adnas 16 trough 19.

24 Subract ine 20 tem ne 15 fi esl zor o ss, eav blank)

‘22 Nongamo Wife Fund cotibuton (se lntrutons)

This wil educe your relunde inreasethe arent you ove

28 Addins 2t and 2. e z

24 Minnesota Income tax withheld. Completa a enclase Schedule MAW fo report.

Minnasoa withing frm Forme W-2, 1099, and W-26 (do nol soed)

innescia estimate tax and edenslon payments mad for 2018

Relundebo credits fonabso Schodule MIRE}: Child end Dependent Care Cre,

BB

wv

15 12054

tom 126

7m a

tom

Py 126

Py 11928

2m

23 11928

2 11849

2m

Waring arly Cr

K-12 Edcaton Cred Cros fr Parents of Stlbon Children, Cro fr Tex Pad Yo Wisconsin,

Cred for istrs structure rohan, and Enterpise Zone Cre

27 Total payments Ad nes 2 through 26

28 REFUND. Iino 27s more tan ne 23, subtest ne 2 rm ne 27 (600 instuctons).

For rect depos, complete Ino 23

29 iret depot ol your relund (ou must uve an account net sect warty bak

eco pe out water as

CJohesking [7] eavrgs .

vant Nmber

90 AMOUNT YOU OWE. Ino 23 exo than ne 27, subtract

‘bho 27 trom ine 28 (sae Instructions) a:

1 Penalty ameunt fom Schodule M5 00 Instuctne). Also subiact

‘hl amecunt frm tne 28 or ad to no 30 (oncoeo Schade M16)... am

|IF YOU PAY ESTIMATED TAX and want par of your rlund credited to ostniod tax, completelines 82 and 99

2 Amount from ne 28 you want geno yu. ve on

38. Amounl fom ine 28 yeu want applied fo your 2018 estate tax som

as uns conden ot oy ol ela spon Yuet 408

‘Yer Sante tale aid epee Sgn oa

‘ovat as Wea “ira ina Ps Papa Dap Pass Fi ATOR paet)

Include a copy of your 2018 fedora return and schedul

Malt: Minnesota Indualncome Tax

a

store MmelatoateattRowns's [ido

St Pau, MN 55445-0010 tus an hey pare bo poe oy

“Tochoskcn those of your ein, vk wawovenuestatomn.us ne dan cy lr em dase

L 1015

=|

WAND BERARTMENT i 4

erent uuu

2018 Schedule M1W, Minnesota Income Tax Withheld

Complete tis sched to eporWnneole noone txt ue ts chee when yu le your tu.

‘YourFrat Wao na ol Toate Your Gociel Sanya

TIMOTHY J WALZ zl

‘fa Joint Return, Spouse's Firat Nom and nial — Spouse's Last Namo: ‘Spouse's Socal Security Number

GHEN 1 WALZ

I you ected federal Form W-2, 098, W-26, or MinnsaclaSchodulo KPI, KS, or KF tht shaw Minnesciancome tax was wield,

‘complete this schedule to delerine Hine 24 of Form Mt ist only ho forms thet report Monascta Income tax wild, Round doar

‘mounts oho nearest whl dlr. You must include tis schedule when you fla your return. DO NOT gend In your Forms W.2, 1080,

1-20; hoep them wih your ex recor. Al nstuctne aro included on tis shed

41 Minnsta egos and Ninnesota ax wild on Forms W.2, ther thn rom Fors W2G. if you have mor than fe Forte W2,

compet ne Son tho bask.

nFom-2b be: ARatlectPan Elan eens Ba ate. Moras xt

syoheries ‘exited, Tub Noe (earn! tlt) (ranatorenet ul de

ey A as050a 0s

2 Ce wo 5616 2798

. nN 7

= OO wo

ww

‘Subota foralonal Forms W-2 (kom tho & an tho bak).

“otal Minnosota tax withhold on all Forms W2 (add amounts Ith 7, comin) 11849

2 Minnesca tx wield on Forms 1089 and W-20. you have mre than fou farms, complete in 6 onthe back.

ne Fe 090-201 Pantset Mevsan Tac nn aoa i so nt ek

+ venir ora onl par bask ora ay) feud reve tt dtr,

MN

= MN

MN

Ne —__—

Sut frelon Ferme 1099 and W-26 (rm na 6c the back) a

‘otal Minnesota tax withhold on all Forms 1099 and W-26 fadt/ amounts nn 2, column D). 2

8. Total Minnesota tax withheld by partnerships, S corporations, and lductarios

{term tho 7 on ho back) =

4 Total Ad tho Minnesota axle on nes 1, 2, and.

Erlor ho tel her are on ne 24 of Frm Mt

11849

Imolude ths schedule with your Form

roqultod, include Schedules KPI, KS, and KF.

L 1015 a

rm DEPARTMENT

OF REVENUE

2018 Schedule M1SA, Minnesota Itemized Deductions

wunagnl

‘Yor Fa ams a TT Taste

qIMoTAY J WALZ

Modal and dental expanses (se instructions)

2 Minnesota Adjusted Gross Income (soo nstrotons).

Mata Sno 2b 10% (10)

‘Subiractlne romne .nef math rt entar0.

‘State nd alco tos or gnarl aes tats (600 nso).

Real eott tes (oe stators)

Personal propery and otter tases (see stuctons).

‘Adi ns 5 tough 7

9 Home mexigag intaretand polis on federal For 1008

"

12

0

“

6

16

7

Home marigage interest and pants nt repre oyu on Frm 1098,

se Fee wa) pean tacnaenaena nen

“This noltenonaly lt banc

Investment terest expanse

‘Ad ines 8,10, and 12

(Charlo contabulons by cash o check (se nsiruotons).

CChaitabocontutone by cher than cash or check eee etuctons)

Cnryovr of cara conttouttns trem apa your .

Ac ings 14 ugh 16

Casual thet lass foneose Schade MICAT}.

Unrlmbursed empleo expenses (enclose Schodkie MIUE)

Oar panes sch ep eo cc (68 toe)

{Ad in 19 nd 20 en

Minnesota Austad Gross Inoame (S60 ott

Muti ne 22 by 246 (02)

‘saract no 22 em Ine 2. I 210 os, ener

Cher miscelaneous decuolons (408 eter). Uist ypo and amncunt

‘edb ins 4 8, 18,17, 18,24, and 25

‘Stet and lool Income oes fx addon (detain fam insrctons)

Complete workohet nthe netrutone If your Monesota Adjusted Goss Income

s oco then $190,050 ($85 26 your ling stats Is aed ling separ).

‘a ins 27 and 28

_Subtact He 29 ram no 28. rer the result ero acon ne of Frm Mt

1015

Your Goal Seri Nambor

. 2

™ —__

} aie

: 21186

an

oe 12069

om 2941

™

fa 15010

: 40

10 =

"

2

rom 770

a 3200

ie, seems

6

7m —_8158

tom

‘om =

mom

a Le

3 7231

ue =

am

au

me

a 654

ne

on reiss

IM Bee mu 7

2018 Schedule M1MA, Marriage Credit

‘Your it Nama and aT Tatts oll Sar Wambor

TIMOTHY J WALZ,

“Spousa's Fat Namo and iad Lae Nama ‘edlal sacl Nuri

GWEN _L _ WALZ

a e

Taxpayer Spouse

1 Wenes, ssa tps, et. (rom In tof ederal Farm 1040) . feet e050 een s69|

2 Sel-employment income (tom tno 3 of fedora Sched SE

os the se-empioyment tax dedueon fom tha 6 of Sahadul SE) «.o.ree (_— 519

8 Tatabloponsion income (600 Istuctons) oss om ag

44 Tarabo Social Seouty Income (Hom dhe &bof federal Form 1040) eee ‘

5 ty fied Schedule MING, 529 nsinons

Ityou dd not fle Shodule MING, entre sseesenes = 5

© Adin 1 trough for each coum ss 6 ___150504 _.__61360.

7 Amount fremline 6, Colma Ar B, whichever is ass

(less tan $23,000, STOP HERE, You donot qual) 7 eet GA 360)

{8 dont taxis ncomo trem no 8 of Form Mt. (iss than $8,000, STOP HERE. You dona qual) 8 177079

9 ttn 7s tess than $1010, determine the emcunt f your reusing lines 7 and 8 onthe

labo th nstuctons. Full-year residents: Enter tha rest hare andan ne 18 of Ferm MA

Part-year residents and nonresidents: Cerne with no 24 - 8 ___iz6.

Itine 7 1s $104,000 oF more, complete Hines 40 trough 20,

10 Enter the amu tam ine 7 e 10

10,850

‘11 Value of one personal xenon plus oneal ofthe marten elandard deduction

12 Siblect ine 11 rom tina 10 a rs

48 Using tho ax tabo fr single parsons in tha Mt Instructions,

‘compte the for tho aru on ne 12. 8

14 Amount fem fn 8 we

48 Amount tom no 12 Eee a 1

18 Subtract ine 1 rom tno 14 fer ors, you do not quay). 6

17 Using the tox abo fr single parsons in tho Mt inevuctn,

‘comput the tor ho aru cn te 18.

”

18 Tax tom ne 10 of Form sesso = we

18° Addlings 19 ane 17 . sects 10

20 Sublect ine 1 rom ina 16. tho resus mare han $1,482, ener $4

results zero ores, you do not quay, Fllyoarresdent: Eni the rest

lng 1 of Form Mt, Part-yearrosidonte and nonresidents: Contos wth ne 24... oe

Part-Year Residents and Nonresidents

2 Partyear residents and nonresidents: Ener tio porconage tram ne 26 of Schedula MAN... 2)

22 Multiply in 9 one 20, whichever is applloaa, by ne 2, Ener the eau hos and

enti 16 Form Mt... oe 2

Iie ede won ol Fam Kap acon or yuo

L t0r8 =|

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Gov. Walz 2021 Tax Returns - RedactedDocument22 pagesGov. Walz 2021 Tax Returns - RedactedTim Walz for Governor0% (1)

- 7 21 Rivera V Del Rosario Cadwallader v. Smith BellDocument3 pages7 21 Rivera V Del Rosario Cadwallader v. Smith Bellcassandra leeNo ratings yet

- Examiners Report NSSCO 2023Document687 pagesExaminers Report NSSCO 2023jacobinaiipinge050% (2)

- MMW - Mathematics of FinanceDocument11 pagesMMW - Mathematics of FinanceJovelle DasallaNo ratings yet

- Gov. Walz 2022 Tax Returns - RedactedDocument21 pagesGov. Walz 2022 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2020 Tax Returns - RedactedDocument19 pagesGov. Walz 2020 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Weber Flanagan Returns 2019-2021 RedactedDocument12 pagesWeber Flanagan Returns 2019-2021 RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2019 Federal Tax Return - RedactedDocument11 pagesGov. Walz 2019 Federal Tax Return - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2014 Tax Returns - RedactedDocument15 pagesGov. Walz 2014 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2020 Tax Returns - RedactedDocument19 pagesGov. Walz 2020 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2015 Tax Returns - RedactedDocument13 pagesGov. Walz 2015 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz Tim 2009 2010 2011 Tax Returns - RedactedDocument67 pagesGov. Walz Tim 2009 2010 2011 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2019 Federal Tax Return - RedactedDocument11 pagesGov. Walz 2019 Federal Tax Return - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz Tim 2017 Tax Returns - RedactedDocument12 pagesGov. Walz Tim 2017 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2019 MN Tax Return - RedactedDocument6 pagesGov. Walz 2019 MN Tax Return - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2012 Tax Returns - RedactedDocument17 pagesGov. Walz 2012 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2013 Tax Returns - RedactedDocument17 pagesGov. Walz 2013 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2008 Tax Returns - RedactedDocument16 pagesGov. Walz 2008 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Summer Exam-2018 Pakistan Institute of Public Finance AccountantsDocument19 pagesSummer Exam-2018 Pakistan Institute of Public Finance Accountantsfareha riazNo ratings yet

- MTP 2 AccountsDocument8 pagesMTP 2 AccountssuzalaggarwalllNo ratings yet

- CBSE Accountancy 12th Term 2 CH 3Document5 pagesCBSE Accountancy 12th Term 2 CH 3AadasNo ratings yet

- Finacle 10 Menu OptionsDocument96 pagesFinacle 10 Menu OptionsSatyajeet Chowdhury100% (5)

- Vdocuments - MX - Advanced Financial Accounting 1Document11 pagesVdocuments - MX - Advanced Financial Accounting 1Sweet EmmeNo ratings yet

- Quiz 1: D) 16.8 YearsDocument2 pagesQuiz 1: D) 16.8 YearsSauban AhmedNo ratings yet

- Chapter 9 - Discounting of Note ReceivableDocument5 pagesChapter 9 - Discounting of Note ReceivableLorence IbañezNo ratings yet

- Preparing The Financial Statements of A PartnershipDocument7 pagesPreparing The Financial Statements of A PartnershipMachelMDotAlexanderNo ratings yet

- Statement of Cash Flows: Powerpoint Presentation by Gail B. WrightDocument22 pagesStatement of Cash Flows: Powerpoint Presentation by Gail B. WrightMARY ACOSTANo ratings yet

- Debt Restructuring SummaryDocument5 pagesDebt Restructuring SummaryLady PilaNo ratings yet

- عسکری بینکDocument39 pagesعسکری بینکNain TechnicalNo ratings yet

- Final Demand NoticeDocument2 pagesFinal Demand Noticesarge18No ratings yet

- Stud Illustration HaikalDocument4 pagesStud Illustration HaikalHannah SaizNo ratings yet

- Bachelor in Business Administration Semester 3: Prepared For: Lecturer's NameDocument3 pagesBachelor in Business Administration Semester 3: Prepared For: Lecturer's NameBrute1989No ratings yet

- Dept. A Dept.BDocument14 pagesDept. A Dept.BB. Srini VasanNo ratings yet

- Adjusting Entries ProblemsDocument5 pagesAdjusting Entries ProblemsDirck VerraNo ratings yet

- K-W-L Chart: (Financial Accounts) Bba - Semester 1Document9 pagesK-W-L Chart: (Financial Accounts) Bba - Semester 1Rabeeka SiddiquiNo ratings yet

- Govt & NFP Accounting - Ch4Document29 pagesGovt & NFP Accounting - Ch4Yoseph KassaNo ratings yet

- The Garden Spot: Year One: Financial Statements and AnalysisDocument4 pagesThe Garden Spot: Year One: Financial Statements and AnalysisMayank TiwariNo ratings yet

- This Study Resource Was Shared Via: Types of Annuity Types of AnnuityDocument8 pagesThis Study Resource Was Shared Via: Types of Annuity Types of AnnuityMarcial Jr. MilitanteNo ratings yet

- Gr11 Acc P1 (English) November 2019 Marking GuidelinesDocument8 pagesGr11 Acc P1 (English) November 2019 Marking GuidelinesShriddhi MaharajNo ratings yet

- Unit 3 PDFDocument13 pagesUnit 3 PDFganaNo ratings yet

- Ware House 3Document13 pagesWare House 3Sanjay&Co. NoidaNo ratings yet

- Problem 1: True or False 1. False (Government) 2. True 3. False (Intangible Assets) 4. True 5. False (Intangible AssetsDocument3 pagesProblem 1: True or False 1. False (Government) 2. True 3. False (Intangible Assets) 4. True 5. False (Intangible AssetsLove FreddyNo ratings yet

- Ratio Analysis of Fuel Company-3Document21 pagesRatio Analysis of Fuel Company-3Zakaria ShuvoNo ratings yet

- Ce303 HW2 PDFDocument2 pagesCe303 HW2 PDFالبرت آينشتاينNo ratings yet

- Cheque and Debit Card Outstanding Authorisation Reversal Form v2 30102013Document1 pageCheque and Debit Card Outstanding Authorisation Reversal Form v2 30102013Sasha-Lee KrielNo ratings yet