Professional Documents

Culture Documents

Weber Flanagan Returns 2019-2021 Redacted

Uploaded by

Tim Walz for Governor0 ratings0% found this document useful (0 votes)

264 views12 pagesLt. Gov. Peggy Flanagan's 2019-2021 tax returns

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentLt. Gov. Peggy Flanagan's 2019-2021 tax returns

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

264 views12 pagesWeber Flanagan Returns 2019-2021 Redacted

Uploaded by

Tim Walz for GovernorLt. Gov. Peggy Flanagan's 2019-2021 tax returns

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 12

Ceo Taney ~ nes Ren x9

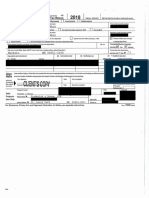

rom 1040 U's. inividual income Tax Return \2021 | cme a 115.074 | ms Us ny — 00 rot wo stn ps.

ing Status [_] Single [XJ ore ting ty [_] Marie og sparen 3) [ [Hood oftovaehla GH [_]Qalipng widower (0

heer only you chechd the MS bos er thrame olour soce. you cheched te HOM GHB he i's name he ual ng

person weet a oe depen»

Toa tO ta Tana Sn

‘THOMAS WEBER |

set arena inane i tea Spun’ sec cy mabe

MARGARET FLANAGAN a

re var po awn sii «Pa eso ae ra ton Capo

(oe om

Oly own toon you av 9 roa Tee wees ele heapretsn pools

ST LOUIS PARK, MN 55416-1822 roan yout ean

Fore ey ne Fagn Baa Fag oaal Or fe Ces

1 ay ie rng 22, dou ace, al eachange oon dapoe oe fascist any wl oorney? Jv

‘Standard Someone can dims You 85 dapendent |] Var pause asa dependent

Beier Flpunn onan btenb teas arabe

Aowindness “vou: []Were tom ttore Jon 21957 [Jae bine Spouse: [] Was bom bots onunya, We? [] bind

Dependents (2ee instructions} ‘Deealary | Wheaten 7 tase (ae Haron)

ime Cet nme Lost ne — eee nda cnt [est oor Spenser

cova E Plas

a H

1 Wages, salaries, tos, ete. Atach Forme) 2 1 148, 683.

Tey 2 Taxcexerp intrest 2a b Taxable intrest 2b 56.

temtes. 38. Qualiedcvidends 3a ordinary dividends. a» 40.

aa RA strewn jaa Taxable amount ao

a Pensions and annuities... 5a b Taxable amount

6a Sic ser bis, b Toxable amount e

7 cont gine dst Ach ere Dif a ot pe ek re

8 Other income from Schedule 1, line 10. 8 -786.

Fine 9 Add lines 1, 2b, 3 8, Sb, 6, 7, and 8. Thief your total income. -[s 147,993.

Reecion tor Io acjustrents to income from Schedule 1 ine 26 70 4,543

Moreatieg, 4g, [11 Subtract line 10 fom ine 9, Ths is your adjusted gross income >in 143, 450

Js "T2m Sad ddan lied debit Si |rza 25,100.

Ronen $2000 |B Chaitable coetibutons if you take the standard detuction (se instructions)... [12b| 600

Heme enn} € ACS neS 120 ane 12 ze 25,700.

|isocesecam 13 Qualified business income dedution from Form 6995 or Ferm 8955-8 13

Boascton "I14 Add tines 12c and 13 ‘ 14 25,700.

Sevnsneter*_]15 Taxable income. Sublract line 14 from line 11. If zero o less, enter -0 5 117,750.

BAA For Disclosure, Privacy Act, nd Paperwork Reduction het Wale, sae separa nsrucins Form 1080 aD)

Fowovia. tana

Form 1040 (2021) THOMAS WEBER AND MARGARET FLANAGAN Page 2

6 Tax se instructions). Check Wany form Form(y. tL] 6874

2Qre sO. 16 17,402

17 Amrount from Schedie 2, te 3 7

18 Add lines 16 an 17 [re | 7402,

19 Nomefundable child tox crestor cel for olner dependents rom Senedue 8312 rn

20 Amount fom Schedule 3, Ie 8 20

21. Add lines 19 nd 20 a 0

22 Subract ine 21 tom ine 18.1 Zero or es, enter 2 T7402.

23. Other taxes, including seremeloyment tax, om Schedule 2, line 2 2 1,585

24 Add ines 22 end 23. Tis Is your total tax aa 18,987.

25. Federal income tex withed from

a Forms) W.2 250 21, 468.

Forms) 1098 ese |

€ Other forms (eee instructions). se |

4 Aad tines 25a through 2 asa 21, 468.

SEUBEE 2% 2021 estimated tx payments and amount applies fom 2020 return 6

| sualitweg chad, “27a Earned income credit (EIC) {27a}

saver Sem ECF check here if you were born afer January 1,199, and belore January 2,204,

andy sty al eae renames xe woe tes 9

‘peli Ee ee etter “Oo

b nontaxeDie combat pay election... 270

€ Prior year (2019) earned income . [27

28 Refundable child tax creditor additional child tax credit from Schedule 8812. 28 |

23. Amercan opportunity cre tom Form 8363, ne & 2

30 Recovery rebate credit, See instructions 2

31 Amount trom Schedule 3, line 15. FT T5i7

32 es 27 nd 28 rough 31 These a or tl oar payrments le Lt

33 Add lines 254, 25, and 32, Thase are you total payments - [ss 22,9

‘34 Wine 31s rr tan ine 7, sree 2 i Tne neu overpaid 3 3,998

352 Amount of ine 34 you want retunded io you, I Form 8886 is attached, check here...» ] [850 3/998

> Routing number =e Type: [El checking —L] sovings

> d Account number

[36 _ Amount o ne 3 you want applied to your 2022 estimated tax.. > | 36| er

Amount '37 Amount you owe, Suc! ne $8 fom ine 24, Fr deals on tow to pa, se istucns 7

You Owe 38_Estimated tax penalty (see instructions) > | 38! J

Third Party you want to allow anoter person edi srt wh th IRS?

Designee” See instuctons > [i] Yes. complete bo!

Sign ei. Cane Capit: Grearabon ol eopue” oberon tansnje) based te oF omotan al whch rear has sy roweage,

non seins ¥ ‘

eet PUBLIC REALTIONS [a twcay «

Serato. ones opeire Walertain balm an Seow’ acon ae tree

oe ™ MINNESOTA LT GOVEN |fiecteiaiie

Paid

Preparer

Use Only

(Goto wn. rs govFormi060 tor instructors and the latest informatn, Form 1080 (2021)

DEPARTMENT |

Wann Beene nat

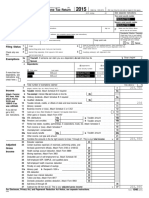

2021 Form M1, Individual Income Tax

Donat se apes syhig you submit

THOMAS weper a Le:

eee a Vertes Rete Ter boet TENT

MARGARET ELANAGAN Seerereen seen Na

ST LOUIS PARK MN

rts at os ‘ae

2021 Federal Fi

1g Status (place an X in one box):

Tiseae ceymaractingsoaty L] (ay naros rng sepsy Ci eavescornossnca 1 (oxen sone

Spouse have

spouse sox

Dependents (see instructions):

apes Fre NSTe DeparaberT ame Depa SEN Deparaat Ramioranp Yoo

aRSRSATEaINSS —————_ apes TCRTNRT RATS — DaPREATTRUSANG TST

Daparaerea Fare Departs an Rae Depa SSN Depreee SRemIoRRp Yor

State Elections Campaign Fund

Tout sStote he, onurra cna epay lyr he Nur cannes es oct fy ang eens Ts Wiel nee a eeu Whe

Polis Party Cade Numbers: Osnsoaaramaite... 12 Gamwetlgsee Combe 4 Lagden Nw

apn. 1) pone 13 Ueto 18 Gowalconeapn Find... ob

From Your Federal Return (see instructions)

148683 117750

‘Rage, sas, 6.0 RA parm, an as Urano a Fedwar sie come

1 Federal adjusted gross income (rom ine 11 of federe Form 1040 and 1040-SR). 1m ____ 143450

2 Addons to income from ine 19 of Schedule MIM and ine 9 of Schedule MIN (286 nstitions)

‘3 Add lines 1 and 2 3 143450

4 Itemized deduetions (frm Schedule MISA) or your standard deduction (see instructions), 4m ___ 25050

‘5 Exemptions (determine from instructions). -

6 State inca ax fund om ne federal Schedule.

7 Suactons rm ne 2 of Schedule MIM and ne 2 of Schedule MIMB (se istucns). 1 447

1 Total swvactors, Addn 4 tough 7 3

9 Minnesota taxable income. Subtract line 8 from line . I zero o: less, leave blank 9 ___117953,

40° Textromthe tbe inthe Form Mt insnctions we ___ 744d

L: sro, ran 112 a}

fz 2021 M1, page 2

414 Aternative minimum tex nciose Schedule MINT)

oo

“0

12. Add ies 10and 11 2

413. Fuliyearresidnts: Ener the aroun’ om Ine 200 Ie 13. Skip es 138 and 13

Partyoaresdons and nonresident: From Scneul MINR. ene te arnt fom 3.00

ine 13, fom ine 28 one 13, an tem ne 29 on ne 13 (enlse Schedule MN). 1 ——

10 ‘30m

14 Otertoxes, su a5 ecaplure mous od the axon ipsum Ssaton (check asp boxes)

Tearserwase stone [])scnesvomisea ()cessteave ms, “0

18. Toxbetor reds, Addins 19 and 8

16. Amount tom ne 8 of Schetle MIC, Narrundoble Cros ercaze Schedule) ‘ea

17 sutbact ine 15 tom in 15 resus 0 rls nave Bk). free to 9z32

18. Nongame Wile Fund conrovtion (ee nstnctons) af

This wit eee your refun rineeas the amour you owe em

19. keane 17 na 18 19 ___1232

20. Minnesca income tax wth. Compl ard ents Scheda MW repo 3

Mneseawtoking Kom Fors W-2, 1099, nd W-26 (20 ot en) 200 1596

21 Minnesota estimated tax and extension payments made for 2021, 21m —___800

22 Amount rom ine 11 of Schedule MIREF, Refundable Ces (ee nsctons ences Schedule MIRER).... 22 Es

23. Toa payments. Add res 20 brow 22 23 __ 8396

24 REFUND. ine 23 more tan ln 1, stat Ine 1 tom ne 23 (26 instuctons)

For direct deposit, complete line 25. wm 1164

25 rec deposi of your lund (ou mst ue an account ol ssid with feign bar

KJerecing [Tsevnge

rovong Hamer Recor

26 AMOUNT YOU OWE. ine 19 more than ne 23, ubactne 23 fom ne 1 (Se isbucons) 28

277 Panaty amount om Scheie MIS (se suction) Ala stat

this amount em ne 24 fat ine 28 fncose Schedule Mt). ae

IF YOU PAY ESTIMATED TAX and want par of your rend cea estntedo, col es 2rd 2

28. Amare: re 26 you want sno ou 20 =

28. Ameunt tom re 26 you wan spl to you 222 estate ax 20

Texpoyer: decir tha i ret scarect end completo heb fy cw andl rower, ra

[F seoresntmypateera atom reneeteey GT savmerae ne monet Deprinertt Reve asus he ren

Include a copy of your 202 federal return and schedules.

one al Station 0910, 800N. Rober St, St. Pau, MN 55145-0010

1112

wn paren bs-pany cere iat on my feral rh

com 1O4Q ttre tener inert nese om

USS. Individual Income Tax Return |2020| vere 82076 _| RSL ry —con we esspe nna ee

Fling SatS [J secn

tisomy [recta sawan os) [Jvetarmeas 9 |] Otte cone

SER you checked the MFS box, ener the mare of your spouse, If you checked the HOH or CN ox, ere he childs name he cualifyng

Berson is a ll but not our depenet

Toure em Tato ‘esc cayman

THOMAS WEBER, a

Ween pn sna an me Rl ttre Spx’ soc scarab

MARGARET FLANAGAN ——

ame sce (abr

Wout a PO. toc tv wars abe ‘Present cecton Compl

ean fen oyu sme

eg ony wot $38 gs

‘Cy wr ast en. Heute a fen ates, a compen ce Bow aos eh me 8 oo

ST LOUIS PARK, MN 55416-1822 ekcharg rat red

Fest cory re Tag pasa Fac ase Lv Diva

‘A ay ire auing 220, you reesv, sl, send,

ae ennai ay tarda nea ay valor? [Je

Be

seetinres “Yor [Jee tntee may? tt []aetind Spm []varton ite anay2, m8 [tes

Dependents (ee aeons. Peay] _anueae 10 7 tes Gn ot

ewe ()Frarane ata i ttn cat [edt ober pene

>) ME D2uctter ci Hi

11 Wages, salaries, tis, ete. Attach Form(s) W2. ee 1 132,424.

oy “Fa Tox-oxempt interest. 2a b Taxable interest 2» 52.

cur 38 Qualified dividends 3a 40. b Ordinary dividends sb 40.

an 4a IRA drut... [a b Texable amounts

Sa Pensions and annuities... 5a b Texable amount

6 Sordi bts a b Taxable amount

Cent gino Gor). tah Sec Dil ei nt ee ck ee.

ter inezme trom Schedule 1, ine 9 24,497,

— 9 Adslines 1, 2,3, 4b, 5,6, 7, and 8 This is your total income [a 157,013

Frsetente =o Achstnents to ixome.

eos | a From Schedule I ine 2 {ro 6,731.

cra orn au te sod ete Snir... [10 300.

arsed | ¢ Ad ines 108 and 105 These ae you total adjustments to Income > de 7,031,

‘ne #880 [47 Subtract ine 10> om ln 9. Tis you austed gross income in 149, 982

ow $6559 72 Standard deduction or itemized deductions (om Schedule A). ne 24, 800

| e2rundr Sons 13 Qualified business income deduction Attach Form 8995 or Form 8995°A : 13 4,553

eiaion [14 Add ines 12 and 13 sone Lal 29, 353

18 _Taxabeincome. Subet ne 18 tom ine 1120 oles, ener ns 120, 629

BAK For Disclosure, Privacy ct nd Paperwork Reduction Act Notice, ee separate Instructions Fer TaD (2020)

roworia, eazeza

Fo 0 2) _THOAS WEBER AND NARGARED FLANAGAN a.

TS Tax (see instructions). Check f ny rom Forms): YL] @8Te

2Qer 30 . 6 16,116.

17 Amount rom Schedule 2 ine 3 br

18 Aa lines 16 and 17. , 18 16,116

19 chidtax cet or credit for oer dependents hs 2, 000.

20 Amount rom Schedule 3, ne 7 20

21 Ads ines 19 and 20... Zz 2,000.

2 Subtract ine 21 from ine 18. I 220 less, eter 2 16,116.

23 Oter taxes, ncuing selemplayment tx, om Schedule 2 ne 10 23 3,461.

24 Ad ines 22 and 28, This is your total tax > [as 19,577

25. Federal come tx wil rom

4 Fox) W.2. asa 21,472

Fonts) 1038 bat

€ Other forms (Se instars). Pel

4 Red ines 2 tough 25¢ sa 21,472

2020 estimated tax payments and amount applied from 2019 return, 25 10,040.

Earned income credit (EIC). 2

geome

Seoshree

[28 Additional child tax credit, Attach Schedule 8812 28

23. Anetican opprteiy ered rom Form BBE, ine 8. 2

30 Recovery rebate credit. See instructions. 30)

31. Amount trom Schedule 3, line 13 xt

$2 Ad ines 27 ough 3, These ae your tt eer payments

fe reunesole cet. » (se

$38_ Add ines 25,25, and 3. Tose ae you ol payments - [ss

Refund Bnet re a ie 2st em ne 3. Ts baa os ep a

Sis entt tns pi ar oid volves ba ooo aaa

omen? > BRang ruber -eype: Bl checing L] Sovings

estes decent number

Xe boca dine ys taped yr een eee 138]

‘Jrroant 37 Sub n 3 om ne 28-THS Ts aan a =p

You Owe Note: Schedule H and Schedule SE filers, line 37 may not represent all of the taxes you

reas ‘eit 2588 See Schedles ine toe, so bs rabcons be daa

(ometow. "38 Estimated tax penalty (see instructions)... .* [38] ae |

Third Party D2 You wont to alow note person toss is rtum wih RS 7

Degree’ See inracions Hl ves.complete below. [Jo

2p supe an Pte my gow a elt, ey

Sign SER AL ENT EGR ey SET Ps a

Here “Your signature oa our acapation pets pouty tn

pounce [MINNESOTA LT GOVEN |ihow se ite

Paid

Preparer

Use Only

(Goto wens. gouFomIO40 for instruction ans the aes infomation, Form 1040 (2020)

IM cree ine

2020 Form M1, Individual Income Tax

THOMAS WEBER

‘Your FirstName and Fay ‘YourLast Name ‘Your Socal Seculy Number (SBN) a

MARGARET FLANAGAN a mz.

RGR ms SRSA Se —

ST LOUIS PARK MN 55416-1822 ait

enone ase ee Betas Ate

2020 Federal Filing Status (place an X in one box):

[

Citisne Tra ecrin sey oy wae rina ssa Leaeasartonents asin wconen

‘yout Nae

spe 554

Dependents (see instructions):

Lp a

ee Seen een corer! Sa Res EYET

pa FTN ep NTS DapmEATESSN— _Dapansea 7 RESESTAND IW YoF

Daperaens Farnam Doe ETS Depraea SSE Dapanaents Resins You

State Elections Campaign Fund

Tepe ets ewrbecaakrbe py ac ln eden tc Fe np eT eo ae

Pais Pay Cod Number:

12 12 paren peewee 18 come 15 pi 97

Tarte inet pera

(nmacaicFurariabo= 12 GawsolayaseCamabe 4 Liwirar= 18 Grd Cansin Rd 8

From Your Federal Return (soe insitons)

132424 120629

I Wiages, sires, ts, et. BRA pensions, andannater © Urenplopment UD Facraliaeaeinoome

1 Federal adjusted gross income (rom line 1 of federal Form 1040 and 1040-SR)........-. : . 149982

12 Addons to Minnescta income from line 17 of Schedule MIM (see instructions; enclose Schedule M1M). = 300

3 Add ines 1 and 2. 3 150282

4 Itemized deductions (rom Schedule MSA) or your standard deduction (see instructions). 7 24800

5 Exemptions (determine from instructions). om 4300

6 State income tax refund from ne 1 of federal Schedule om

7 Other subtractions from Minnesota income ftom line 47 of Schedule MIM

{ee instructions; enclose Schedule Mi). ™! 365

{8 Total subtractions. Add nes 4 through 7. 8 29465

9 Minnesota taxable income, Subtract ine 8 fom ine 3. zero or less, leave blank 8 120817

410. Tax om the table in the Form Mt instructions 10 7644

11 Atemative minimum tax (enciose Schedule MtBN). 1”

ee 2 ra

one, wn 7

7

42 Addis end 11 : 2 1644 |

43. Fllyar sions; Eth aunt rom 1209 ine 13. Skip nes 180 ad 135 }

Part ya sins and nonresidents: From Schce MINR enh amount om ne 3208 tga

Ine 15, tomlin 28 on ne 1a, nda ie 26 on re 13 (nce Sched MINA. 43 ——16t

to 430m

414 other tae, sha ecantre amounts and taxon lump-sum dstbtons chek eppropte boxes)

Taseneaie mstione CJeseneavenises (Trepsceauie mus fam

15: Taxbetoe creda. Add ines 19 and 14 15 ___1644

16 Amour tom ne 17 of Schedule MIC, Norefundable Cress ertse Schedule MIC). tom 210

47. Sutactoe 16 fame 1 resus zo ors, ov bln 7434 I

18 Nongame Wise Fund catioun (see instructions) a |

“Ts wl ede yur find or cease he oun you one 108

419. Adatoes 17 and 18. 19 7434

20. Minnescta income tx wil. Complete and enclose Schedule MIW to epot

Minentawibatig tom Farms W.2, 1099, nd 2G (ats ne 6615

24, Minnesota estimated tax and extension payments made for 2020 a. 2000

22. pmount tom ne 9 of Schedule MIREF, Refundable Cras (so stutons encose Schedule MIREF}... 22

23. Tol payments, Ad ines 20 tough 22 Py 8615

24 REFUND. ne 23s moe fan 19, Dat ne 19am ine 23 (26 Ison}

For eet depot, comet ine 25, ue a1

25 rect depost of your rfund you must Us an zou ot ssoced we erign bart

eee

2 AMOUNT YOU OWE: Ine 191s mote ban Ine 23, sect ne 23 om ne 19 (28 nsttons). 28

27 Penaty aunt tom Schedule M5 (se istuetons). ARO svat

this amour mln 24 or adit ine 25 enclose Schedule MI5) ue }

IF YOUPAY ESTIMATED TAX and want part of your refund erated to eatimaiod tn, ebmplets ines 28 and 2, |

28 Amount from line 24 you want sent to you, 23m 581

29 Amount en ine 24 you want ppd to yout 2021 exited tx ny 00

‘Taxpayer! deca that rtum is corec and complet tote besto my knowledg and ble

Taree Feaars Spates ar amare

PING VTATCE (wed

[1 tecratny pds oe my eum ccc,

of your 2020federalretum and schedules. Milto; Minnesota India Income Ta, SL Pau, MN 55145-0010,

12 4

rom 1040 (individual Income Tax Retum”” [2019 | cw isss0

Filing Status Vores ba paly —[] Warns ting sepwaay urs) [_] ead etrecanas 0 [_] Ours wide (ND

es eee ry aoe

THOMAS WEBER | ___

ener 7 ie ea ars

ARGARET FLANAGAN

ee Se scoala a | pomcerereneee

Semmens

repre SEGRE oe pe

MIWNEAPOLIS, MN 55416-1822 Dre Lise

a ae reeraiea.ci| penshnsaman

eevee io

ed ae

Debion “Tlemcen Ducane meee salDaar ae

‘oindness Your [Jere om inte arn 2.1868 [Jawvine spouns [Jwartorn ive oman 21555 [Jibs

Dosen Gov raid a ee

ODFistoane Utne = tn ent Clot ener ese

1 Wooes, salaries, tis, ee. Altach Form(s) W.2 1 68, 683.

2a Tectenpt ites, 2s Toten ied... [2 45.

30° Qualfed dividends | 3a AO. b ordinary dy. at Sch. Bf reed 3b 40

4a RA distributions Taxable amount... cose

Pensions and annuities... [4 4 Taxable amount a

S50. Sc scny bets [5a] b Taxable arount sb

= Cos ins) Mach ed ace. et age ck re 6

[esncem.” |7a Other income from Schedule 1, tne 9, . Ja 63,342.

Lee tases | b Ads lines 1, 20, 3, 4,4, 8, 6, ans 7a. Ths is your total neome > 132,110.

erty” Joa Adjustments to ircome trom Schedule 1, ne 22 aa 9,405.

Ionen 501-0 | ty Subtract ne Ga trom line To. This fs your adjusted gross income > |e 122,705.

Jetset, $18,250 9 Standard deduction o itemized deductions (rom Schedule A) 2 24,400.

eseucreces=ry 9° quai business Income eduction Ach For £95 o Form 535.8 10 11,588.

lasts” [1a Add lines 9 and 10... . . 1a] 35,988.

bb Taxable income, Subtract line Ta fom line 6. Zoo or lees, enter 0. ine 85,717.

BAA For Bsclosure, Privacy Act, and Paperwork Reduction Act Wolice, se separate Instruction. Ferm 1080 15)

form 1040 @019)_HOMAS WEBER AND MARGARET FLANAGAN a ...:

Tae Tax (90 inst) Chock any rom Formiah: 1 |] Se

2Qler aL) os 29 10,792.

ee S222. paatonal child tax credit, Altch Schedule 6512 ray

4 sewade Ine, hea, 600

© At ins i ou Ths ne tl poet chad aed

19 Add lines 17 and 18e. These are your total payments. > 19 24,195.

2.a Amount of line 20 you want refunded to you. If Form 8888 is attached, check here.» [] taf 0.

Direct deposit? > b Routing number » etyoe: L] checking [] Savings

22 hes ne opr ioe TE | 4,594,

Amount “23 Amount you owe. Subtract line 19 from line 16. For details on how to pay, see instructions. = [23

You Owe __24 Estimated tax penally (see instructions) [2a |

Third Party 0200 arti alow aor person (te tan eur pad prea) zs hs return wih he AS? Sensis. [] Yes. Complete below.

Designee no

Sign BeRara Rr eee Ran at we

aie poszre reatrions [MES

Seen. & ae jo — ae

race iimivesoraut_coven [fe

Prone ro [era oaoress

Paid

Preparer

Use Only

{3516 woes gowlForm1040 fr instructions and the latest information,

oem 1080 (2019)

DEPARTMENT

a ea tu

2019 Form M1, Individual Income Tax

emer: bs Does on rg yo et

eet eat tanner Bs Ra) Yorn

THOMAS WEBER >

ie it oo TTF Spc To Syne to eri ie Spent Dao BH

MARGARET ELANAGAN ; a:

arvations Ako Cue Nona Fewer

[

MINNEAPOLIS MW 416-1822

2019 Federal Fling Stata (place an Xin one Boxe

Cinseoe KJeynaicsrire ety [Jee nrestng spay Carneasernusnas Ts cust weouen

‘Sposa and SH

State Elections Campaign Fund

cote nmr payee chcn Tew ester We

Pata Pry Coe ae

mn et meee, | Phin 4 eigen 13 Geer 15 pda 17

12 12 cemenaramnstoe 12 canola ambi attr 18 Gdeanafnd—

From Your Federal Return soc) oe

‘Rage, ars 8,6 OFA BSE, ETRE Tae 0 Fea Se HERE

68683 Oo 96717

1 Federal adjusted gross income (rom ne ab of federal Form 1040 and 1040-SR)

(a regative numba, place an X nthe bo. td 122705

2 _Acdtions to Minneseta income from Ine 17 of Schedule MIM (se Instructions; enclose Schedse MIM),

3. Add ines 1 and 2 (fa negative umber, place an Xin the bo).

4. Momized deductions (fom Schedule M1SA) or your standard deduction (se insintons).

‘5 Exomptions (determine from instructions)...

6 State income tx fund from ine tof federal Scheuie 1,

7 Other svbrations from Minnesota income fom lie 48 of Schedule MIM

(s0e instructions; enclose Schedule M1M) ma

8 Total eubtactions, Add ines 4 through 7 8 24483

{Minnesota taxable income, Subtract ine 8 rom ine 3. zero or ess, leave lank ° 98222,

40 Tax rom he table in the Mt Instructions. #0 —__6117

11 Atemative minimum tx (enclose Schedule MMT). 10,

42 Addtines 10 and 11 2 6117

18 Fullyear residents: Enter the amount from fre 12 online 13. Skip nes 138 and 130.

Part yoar residents and nonresidents: From Schodule MINR, enor the amount from line 26.00

Ine 13, fom tie 22 online 13a, and from ine 23 one 130 (onciose Schedule INR). 8

a 8 (Pacem intestate

6117

14 Other taxes such the taxon ump sum distbutons and tecture amounts tom check appropiate box

Schedule mtHOME [__|Schedule 1829 [_|schedue tats “

L vorra, racar 1112 a]

Pde mn

15 Tax before credits, Add lines 13 and 14, 6 ___ 6117

46 Marriage Creifor ont return when bath spouses hve arabe earned Income

‘or taxable retirement income (enclose Schedule MiMA). wm 207

47 Creat for ongterm care insurance premiums paldfenelose Schedule MILT).

48 Cre for tae pal to another sat encinca Schedule) ICR and MERC) ‘om

49 Other nonrefundable credits (enclose Schedule MYC) 19m,

20 Total nonrefundable credits, Add lines 16 trough 19. 2 207

21. Subtract ine 20 from ine 15 (i esut is 210 or oss, lave bla)

22 Nongame Wiki Fund contribution (see insructons)

‘This wil ec your refund or increase the aunt you owe

23 Ade lines 21 and 22

24 Minnesota income tax withheld. Complete and enclose Schedule MW to reper

Minnesota witnotig trom Forms W-2, 1089, end W:2G (do nt send)

25 Minnesota estate tax and exension payments made fr 2019.

26 Refundable credits trom line 9 of Schedule MIREF (see iniuctons; enclose Schedule MIREF). 25 w.

27 Total payments, Add ines 26 though 26. a

28 REFUND. fine 27 is more than ne 23, subtract ine 23 from kre 27 (866 insinucons)

Foret deposit, complete line 29 2m

29 Direct deposit of your refund (you must uso an account na associated wih @fregn bank)

unt Type Routing Number ‘Account Numbor

Checking [] savings

30 AMOUNT YOU OWE. Ine 23 1s more thane 27, subtract Ine 27 Kom Ine 28 (se nsructons)

‘St Peraity amount from Schedule MIS (se insructors). Aso subtract

this amount ftom ine 28 or add itt line 30 (enclose Schedule M5). at.

| YOU PAY ESTIMATED TAX and want arto you fund ceded to estimated tax, compl Ines 32 and 39

32 Amount fom Ine 28 you want sett you

33 Amount fom tne 28 you want applied to your 2020 estimated tae

Include a copy of our 209 federal return and schedules, 1] sawn ne Opt

Maite: Minnesota Individual Income Tax

St Paul, MN 55146-0010

ae ro

cor = i _!

1112 THOMAS

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Gov. Walz 2021 Tax Returns - RedactedDocument22 pagesGov. Walz 2021 Tax Returns - RedactedTim Walz for Governor0% (1)

- Gov. Walz 2022 Tax Returns - RedactedDocument21 pagesGov. Walz 2022 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2019 Federal Tax Return - RedactedDocument11 pagesGov. Walz 2019 Federal Tax Return - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2020 Tax Returns - RedactedDocument19 pagesGov. Walz 2020 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2018 Federal Tax Return - RedactedDocument20 pagesGov. Walz 2018 Federal Tax Return - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2014 Tax Returns - RedactedDocument15 pagesGov. Walz 2014 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2020 Tax Returns - RedactedDocument19 pagesGov. Walz 2020 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2015 Tax Returns - RedactedDocument13 pagesGov. Walz 2015 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz Tim 2009 2010 2011 Tax Returns - RedactedDocument67 pagesGov. Walz Tim 2009 2010 2011 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2019 Federal Tax Return - RedactedDocument11 pagesGov. Walz 2019 Federal Tax Return - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz Tim 2017 Tax Returns - RedactedDocument12 pagesGov. Walz Tim 2017 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2019 MN Tax Return - RedactedDocument6 pagesGov. Walz 2019 MN Tax Return - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2012 Tax Returns - RedactedDocument17 pagesGov. Walz 2012 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2013 Tax Returns - RedactedDocument17 pagesGov. Walz 2013 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Gov. Walz 2008 Tax Returns - RedactedDocument16 pagesGov. Walz 2008 Tax Returns - RedactedTim Walz for GovernorNo ratings yet