Professional Documents

Culture Documents

MB3 - Operating A Mortgage Broking Business PA 14072016

MB3 - Operating A Mortgage Broking Business PA 14072016

Uploaded by

Dale StephensOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MB3 - Operating A Mortgage Broking Business PA 14072016

MB3 - Operating A Mortgage Broking Business PA 14072016

Uploaded by

Dale StephensCopyright:

Available Formats

MORTGAGE BROKING

Operating a Mortgage Broking

Business

BY PETER ANDREWS, MBA, CPA, B.ECONOMICS, B.ARTS

Former lecturer at Macquarie University

M

ortgage brokers are becoming the number one choice for

consumers who are seeking a home loan or to refinance their

existing loan. They work with clients to determine their

borrowing needs and ability, select a loan suited to their circumstances

and manage the process through to settlement. This requires a

relationship with a mortgage aggregator to provide access to lenders as

well as a close working knowledge of the lending products the aggregator

is able to provide.

Working as a mortgage broker, however, involves more than technical

knowledge and competence. Successful mortgage brokers have a solid

marketing program. They are also prepared to learn from others in the

industry.

Peter Andrews is a specialist trainer in

Financial Planning.

CONTENTS

INTRODUCTION TO MORTGAGE BROKING ...................................................2

After an early career in corporate finance THE FUNCTIONS OF A MORTGAGE BROKER .........................................................2

and banking, Peter became a lecturer at THE ADVANTAGES OF USING A MORTGAGE BROKER .............................................2

Macquarie University. THE ROLE OF AGGREGATORS ............................................................................3

REQUIREMENTS TO BE A MORTGAGE BROKER .....................................................3

He has also taught in the Graduate

School of Management at the University

MORTGAGE BROKER TRAINING REQUIREMENTS ...................................................4

of Sydney and the School of Banking and HOW MORTGAGE BROKERS ARE PAID ................................................................4

Finance at the University of New South MORTGAGE LENDING BASICS........................................................................4

Wales.

BASIC TERMINOLOGY ......................................................................................4

Peter has a Bachelor of Arts and a

LOAN TO VALUE RATIO....................................................................................5

Bachelor of Economics from the LENDERS MORTGAGE INSURANCE......................................................................5

University of Sydney and a Master of ASSISTANCE TO FIRST HOME BUYERS .................................................................6

Business Administration from the

University of Florida. He is also a MORTGAGE LOAN PRODUCTS.......................................................................6

Certified Practicing Accountant. OTHER FORMS OF CONSUMER CREDIT .........................................................8

OTHER FINANCIAL SERVICES .......................................................................10

COMPARISON INTEREST RATES ...................................................................11

GROWING A MORTGAGE BROKING BUSINESS ............................................12

MARKET SEGMENTATION ..............................................................................12

DEVELOP STRATEGIES ....................................................................................13

PREPARE A POSITION STATEMENT ...................................................................13

PERFORM SITUATION ANALYSIS ......................................................................13

PROVIDE QUALITY SERVICE .............................................................................14

OBTAIN REFERRALS ......................................................................................14

REACHING OUT TO NEW CLIENTS ...................................................................14

APPROACHING CENTRES OF INFLUENCE ............................................................15

LEARNING FROM OTHER BROKERS ..................................................................15

SECURITY OF CLIENT RECORDS ....................................................................16

ACCESS TO CLIENT RECORDS ...........................................................................16

DISCLOSURE OF CLIENT INFORMATION ..............................................................16

ENVIRONMENT SUSTAINABILITY .................................................................16

Copyright 2014 © Mentor Education Group Pty Ltd

MB3 – Operating a Mortgage Broking Business PA 010615

2 3. MORTGAGE BROKING

2

INTRODUCTION TO MORTGAGE THE FUNCTIONS OF A MORTGAGE

BROKER

BROKING

The functions of a mortgage broker may be summarised

Mortgage brokers began around twenty years ago and as:

are now involved in setting up 43% of home loans.

Membership of the peak professional body, the find a lender;

Mortgage and Finance Association of Australia, was complete the loan application; and

12,553 in June 2014, with 5,740 separate mortgage

broking businesses.1 submit the loan application to the bank or other

loan provider, and wait for them to approve it.

The industry thrived in the pre-GFC period through the

growth of securitisation. However, as Figure 1 indicates, These services are provided without cost to the

the securitised debt market has only been half its pre- borrower. As a general rule, a mortgage broker receives

GFC level in recent years, and this has made it more a once-only upfront fee from the loan provider on

difficult for mortgage brokers to compete with the settlement of the loan and an ongoing ‘trail’ income (on

major banks. average 0.20% p.a.) until the loan is repaid in full.

Figure 1: Australian Residential Mortgage-backed Once the loan has settled, the broker has little more to

Securities, May 2004 – April 20142 do with it, with the borrower’s on-going relationship

with the lender.

250.0

200.0 THE ADVANTAGES OF USING A

150.0 MORTGAGE BROKER

100.0 Five arguments can be put forward for using a qualified

mortgage broker when trying to obtain property

50.0 finance:

0.0

1. Choice

Sep-2007

Jan-2006

Jul-2008

Jan-2011

Sep-2012

Jul-2013

Nov-2006

Nov-2011

May-2004

May-2009

Mar-2005

Mar-2010

The biggest advantage of a broker over a bank or other

lender is choice. A client sitting in front of a broker is

sitting in front of 10+ banks and 50+ products as against

visiting a banker who has access to only one of the

In its submission to the Financial System Inquiry (the bank’s products. This is more likely to lead to the most

Murray Committee) the Mortgage and Finance suitable lending product being chosen. Also, now that

Association of Australia advocated the taking of steps to the banks are more cautious because of the responsible

revive the market for residential mortgage-backed lending provisions (discussed in a later chapter), there

securities to enable mortgage brokers to compete more may be increased likelihood of a successful outcome

effectively with the major banks once again. Its with more specialised lending proposals such as loans

argument for this approach was that this would bring for borrowers with a low credit rating. This is because

about a return to more innovative lending for housing mortgage brokers often become specialised in different

that would, amongst other things, assist first-time market segments, and in doing this they can predict the

homebuyers. probability of a successful outcome.

However, even with the reduced level of loan Prospective borrowers should therefore recognise what

securitisation, the mortgage broking industry is making services they need first and then look for an

progress. For example, between 2009 and 2014, experienced mortgage broker who can assist.

industry revenue grew by an average of 4.1% a year. 3

1 Source: IBIS World report, June 2014

2 Source: RBA

3 Source: IBIS World report, June 2014

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

3 3. MORTGAGE BROKING

3

2. Experience THE ROLE OF AGGREGATORS

Mortgage brokers often own their own businesses and Mortgage brokers need to have access to a wide variety

are committed to their clients in the long term, with of lenders and products. While many brokers maintain

many years of industry experience. This contrasts with direct accreditations with lenders, the major lenders

bank staff, who may not be experienced with property often have volume and compliance standards that a

lending, and may be promoted away from their broker might have difficulty in achieving by themselves.

customers. For this reason, most brokers will use the services of an

aggregator (a wholesaler for the finance industry) in

3. Specialisation

order to have access to major lenders and maintain

Bank staff handling property loans normally do not have their accreditations. There are over fifty mortgage

specialised training and experience in one area. aggregators operating in Australia.

Mortgage brokers can be chosen according to their

specialisation, such as investment property loans. The aggregators come in various forms from discount

Another example of specialisation being important is ‘warehouses’ to fully branded franchise groups. All of

the area of lending to borrowers with a poor credit the aggregators offer additional services other than just

history. Specialised mortgage brokers can provide maintaining access to lenders. Some of the extra

assistance that may not be available through a bank by services could possibly include: loan comparison

making a more careful credit appraisal and a more software, compliance support, Credit Licence support,

successful packaging of the lending proposal. providing leads, customer relationship, administration,

training, mentoring and many other services. Most

Other areas of specialisation include ‘low doc’ loans for aggregators also provide access to other non-finance

the self-employed and ‘SMSF loans’ (investment loans products services that their members can provide for

for self-managed superannuation funds). their clients in return for commissions or fees. Examples

of these products are commercial finance and insurance

4. Follow Up products.

Following up the progress of a loan application is time

A list of aggregators affiliated with the Mortgage and

consuming and frustrating. A good mortgage broker will

Finance Association of Australia may be found at:

have a system for chasing the proposal up, keeping the

borrower informed and saving time. http://www.mfaa.com.au/default.asp?artID=2028

5. Personal Banker REQUIREMENTS TO BE A MORTGAGE

A mortgage broker is like ‘the perfect personal banker.’ BROKER

This is because it is their own business and they are in

for the long haul. If they are successful in building a Australian Credit License

relationship with their client, after facilitating a The National Consumer Credit Protection Act 2009

borrower’s home loan they may then be available for (NCCP Act) requires a mortgage broker to either hold an

investment loans or specialised business finance and, Australian Credit Licence (ACL) or be authorised under a

possible once again, further housing finance as their licence (normally by the aggregator or the groups they

clients upgrade. work with).

This contrasts to the situation with banks, with staff Before ASIC grants a credit licence, the applicant must

changes making it difficult to have continuing demonstrate adequate arrangements to:

relationships.

supervise and monitor the activities of any

representatives and ensure that any breaches are

identified and remedied; and

ensure that any representatives are adequately

trained, and are competent, to engage in the credit

activities covered by the credit licence.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

4 3. MORTGAGE BROKING

4

An ACL holder must show its ACL number on prescribed Another useful source of articles and video interviews is

documents.4 Regulation 13 of the Regulations issued Australian Broker Online, which may be found at:

under the NCCP Act prescribes the following

http://www.brokernews.com.au

documents:

The documents required by Chapter 3 of the NCCP MORTGAGE BROKER TRAINING

Act (Credit Guides, Quotes, and Proposal Disclosure

Documents). REQUIREMENTS

Printed advertisements that relate to the provision ASIC requires credit licensees to conduct formal training

of regulated credit. programs for their brokers. They must also have a

written policy regarding training, as well as maintain a

Documents required to be created, produced, given training register detailing the training undertaken by

or published under the National Credit Code5 (e.g. each representative.6

NCC notices, credit contracts, mortgages,

guarantees).

HOW MORTGAGE BROKERS ARE PAID

Documents lodged with ASIC that relate to the

provision of regulated credit. Mortgage brokers are not paid directly by their clients.

Training Requirement Instead they receive commissions from the credit

provider they have selected in the form of:

Brokers and their representatives are required by ASIC

to have completed a Certificate 4 in Financial Services – A front-end fee (i.e. a once-off payment when the

Mortgage Finance. loan is taken out; and

A ‘trail commission’, i.e. an annual fee from the

Membership of a Professional Association credit provider,

Although it is not a formal requirement, some credit

providers such as banks require mortgage brokers and Typical fees in these forms are:

their representatives to be a member of a mortgage Upfront fee: between 0.55% to 0.70% of the loan

industry professional association. amount

Trail fee: from 0.00% to 0.275% of the loan amount

There are two mortgage industry professional

associations: Having fees paid by the credit provider may appear

the Mortgage and Finance Association of Australia convenient as far as the client is concerned, but it may

(MFAA); and give rise to what lawyers call a ‘conflict of interest’ in

that it may cause brokers to lean towards the credit

the Finance Brokers Association of Australia (FBAA) provider that pays the highest fees. Although brokers

(The MFAA requires a Diploma in Financial Services are required to disclose how they are remunerated,

(Mortgage Management) for membership.) they are not required to disclose the fees they receive

from different credit providers. Disclosure of fees from

Industry Knowledge individual credit providers is, however, a ‘best practice’

for brokers to follow.

Although not specifically required by ASIC, a broker

needs knowledge of the industry. Some of this can be

obtained by talking to aggregators and other brokers. MORTGAGE LENDING BASICS

Also, anyone intending to move into mortgage broking BASIC TERMINOLOGY

needs to conduct research. This means reading as much

as possible about mortgages, sales, and finance. A good There is some basic terminology that you should fix in

starting point is the numerous publications such as Your your mind at the outset in case you become confused

Mortgage Magazine, Mortgage Professional Australia, later on.

and Australian Broker that are available from most

newsagents. The word “mortgage” actually means “pledge”. With a

mortgage the borrower pledges to give the property to

4 NCCP Act, s.51.

5 Schedule 1 of the NCCP Act. 6 ASIC Regulatory Guide 204.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

5 3. MORTGAGE BROKING

5

the borrower if the borrower cannot pay back the loan LENDERS MORTGAGE INSURANCE

in full.

An LVR of 80% is generally considered to be the ‘safe’

Now consider the distinction between “mortgagor”

limit, with lenders requiring Lenders Mortgage

and “mortgagee”. In English, the suffix (i.e. word

Insurance (LMI) above that limit. This protects the

extension) "or" is used to denote the person who

lender in the event of default, and with it in place some

performs an action; while the suffix "ee" is used to

lenders are prepared to accept LVRs as high as 95%.

denote the recipient of that action. Since the

buyer/borrower is pledging the property, he/she is

LMI is paid by the borrower. The premium is

"mortgaging" the property and in known as the

determined upfront, but there is no need to pay it that

"mortgagor". The lender is the recipient of the pledge,

way. The premium may, as an alternative, be

and therefore is the "mortgagee".

‘capitalised’. Capitalising the LMI premium essentially

means adding it to the total loan amount, and paying it

An easy way to remember the difference between the

off in regular instalments with the home loan. Most

"mortgagor" and the “mortgagee” is:

borrowers opt for the capitalisation option, which is

The "o" in "mortgagor" comes from the "o" in commonly put forward as costing no more than a cups

"borrower". The "e" in "mortgagee" comes from the "e" of coffee or so a week.

in "lender":

Example – Lender’s Mortgage Insurance

Likewise, although you may not be concerned

with lease finance, there is a similar distinction

(LMI)7

between “lessor” and “lessee”. A lessor is a person Newlyweds Tim and Erica are battling to save a deposit

or organization that owns an asset, such as real estate, for their home, and currently spend approximately 32%

and a lessee is a person or organization that makes of their combined monthly salary on rent.

instalment payments to use the asset. In real estate

rentals, the lessor is the landlord and the lessee is the Paying rent is putting a real strain on their ability to

renter. save a deposit and after speaking with their mortgage

broker, Tim and Erica learn they can secure a mortgage

So in the case of real estate transactions involving real for up to 95% of the value of the property they hope to

estate, both the mortgagor and the lessor have buy if they take out Lenders Mortgage Insurance.

ownership of the property.

Tim and Erica have saved $20,000 for a deposit and

LOAN TO VALUE RATIO additional funds to comfortably meet the other

commitments associated with their mortgage – such as

A term that you will need to be used to when you look

solicitor and application fees. They have learnt they can

at home lending products is the Loan to Value Ratio

secure a mortgage with an LVR of 95% if they take out

(LVR). This is the amount of the loan divided by the

Lenders Mortgage Insurance (LMI). However, it took

value of the property being acquired. As such it

them long enough to save their deposit of $20,000.

represents the maximum percentage that the bank is

Having to save $12,426 for the required LMI will take

prepared to lend.

too long.

Example - Loan to value ratio (LVR) Keen to help Tim and Erica to buy the property they

have set their hearts on, their mortgage broker advises

Matthew is buying a house for $1,000,000. With careful

that they can capitalise their LMI – which means adding

saving, he and his wife have accumulated $200,000.

the cost of the premium to their mortgage.

They will therefore require a loan of $800,000.

Buying their new home for $400,000 with a home loan

Their LVR will be:

of $380,000 the monthly repayments on their 30-year

$800,000/$1,000,000 = 80% mortgage (rate 6.82%) comes to approximately $2,482.

7 Based on an example from Gemworth.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

6 3. MORTGAGE BROKING

6

The Lenders Mortgage Insurance premium on their New products are introduced from time to time, and

$380,000 home loan comes to approximately $12,426. features of existing products may change. Mortgage

If Tim and Erica capitalise their Lenders Mortgage brokers need to be alert to any information regarding

Insurance premium, it will increase their monthly change from product providers, with information being

mortgage repayments by $81, taking the total monthly disseminated through such means as team meetings

mortgage repayment to $2,563. and seminars. Also, if necessary, training programs

should be put in place to ensure that changes are

ASSISTANCE TO FIRST HOME BUYERS properly understood.

Government grants and stamp duty exemptions can Brokers should also be prepared to discuss the different

provide first home buyers with significant concessions. products with theirs clients and point out their different

features so that an informed choice can be made.

1. The First Home Owners Grant

The First Home Owners Grant (FHOG) is given in the Variable home loan interest rates

form of cash to add to the borrower’s deposit and it

is usually paid at the time of property settlement. Most Australian home loans are variable rate loans,

Eligible applicants are Australian citizens or with interest rates fluctuating approximately in parallel

permanent residents buying their first home. A with the Reserve Bank of Australia’s ‘cash rate’. The

means test is not applied. Reserve Bank uses the cash rate as a blunt instrument

to try to control inflation – when inflation is becoming

The Australian government provides a base amount too high (typically when the economy is doing well) the

of $7,000, but various states impose a cap on cost cash rate goes up; when the economy is perceived as

price above which the FHOG is not payable. For being weaker (inflation usually is lower) the cash rate

example, in NSW, first homeowners purchasing a often comes down.

first home above $650,000 cost price will not

receive the first home owners’ grant. If variable interest rates increase, loan repayments

State governments have their own rules on increase. This, however, creates an addition burden on

qualification for the grants and also the amount for borrower. When an interest rate increase is unusually

the grant. In NSW, the state government provides a large, banks may be prepared to lengthen the term to

bonus $8,000 (additional to the base $7,000) to maturity, thereby lessening the term to maturity by

make total first home buyers grant equal to lowering repayments.

$15,000, but to qualify the property being

purchased must be a brand new property. More If, instead, interest rates decrease, loan repayments are

states have, or plan to soon introduce, similar usually allowed to remain the same, although

policy. borrowers may be able to negotiate lower repayments

2. Stamp Duty Exemption Pros: If interest rates drop, repayments also

Stamp duty exemption may apply, depending on the drop

state. For example, NSW provides eligible

purchasers with exemptions from transfer duty on Cons: If interest rates rise, repayments also rise

new homes valued up to $550,000 and concessions

for new homes valued between $550,000 and

$650,000. Fixed home loan interest rates

The exemption is normally applied for by the lending A fixed rate loan is a loan that has a fixed interest rate

institution, with the amount being debited to the and therefore fixed loan repayments. The time period

applicant’s loan account. of these loans can vary, but lenders can usually ‘lock in’

their repayments for between 1-5 years. Although the

As with the FHOG, a means test is not applied. fixed rate period may be, say, 3 years, the total length

of the loan itself may be 25 or 30 years. At the end of

MORTGAGE LOAN PRODUCTS the fixed loan period the lender can decide whether to

fix the loan again for another period at the current

Although there are differences between the individual market rates or convert the loan to a variable interest

products of different lenders, including in some cases rate for the remaining term of the loan.

the names of the products, there are still core

characteristics that allow the products to be discussed

in general terms.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

7 3. MORTGAGE BROKING

7

In general, if lenders expect the cash rate to rise, the The authorities have also been concerned about the

fixed rate will usually be higher than the variable rate; volume of investment loans. In May 2015, APRA wrote

on the other hand, if they expect the cash rate to fall, to the banks on the matter and suggested that their

the fixed rate will tend to be lower than the current annual growth in investment loans should be limited to

variable rate. 10%. The 10% figure was put forward as guidance

rather than a regulatory requirement, but this is

Lenders may offer fixed terms between 1 and 15 years, another reason why the banks will make less money

although most fixed term loans are for less than 5 available for investing in real estate.

years.

Introductory loans

Pros: Repayments do not rise if the official

With an introductory loan, the interest rate is usually

interest rate rises

low to attract borrowers. Also known as a honeymoon

Provides peace of mind for borrowers rate, this rate generally lasts only for around 12 months

concerned about rate rises before it rises. Rates can be fixed or capped. Most

Allows more precise budgeting revert to the standard rates at the end of the

Cons: Repayments do not fall if rates fall honeymoon period.

Financial penalties may apply if there is

any early return to variable rate, or early Pros: These loans usually provide the lowest

repayment of the loan repayment rates

Payments are usually lower during the

Interest-only home Loans introductory period

Only interest is paid during an interest only period – Cons: Payments usually increase after the

usually one to five years. Principal repayments are then introductory period

paid with interest payments over the remaining term of

the loan.

Split rate (principal and interest) loans

Pros: Lower repayments initially, more money

to renovate/improve the property A split rate loan is a loan that has one portion of the

loan fixed and one portion variable. The borrower can

Cuts the cost of buying a residential select how much to allocate to each.

investment property in the short-term,

thereby allowing the borrower to make Pros: Provides some protection against rising

which could allow you to make greater interest rates. This gives a blend of

contributions to their principal place of repayment flexibility and interest rate

residence security

Cons: If interest rates rise, repayments also rise Cons: Repayments will still increase if interest

There will be sudden increase in rates rise

repayments at the end of the interest

only period when the loan converts to

principal and interest repayments Home equity loans (line of credit)

A home equity loan is a line of credit secured by a

Interest only loans are used primarily for property mortgage over the owner’s property. Borrowers can

investment, the argument for them being that there is draw down up to their approved limit, reduce the

likely to have been realisable capital gain by the end of amount outstanding and then redraw if they want to –

the interest-free period. APRA and the Reserve Bank, the only commitment is to make interest payments.

however, are concerned that the percentage of

homeowners taking them out is increasing. Their Funds drawn from the facility can be used for lifestyle

argument against them is that by the end of the and investment purposes.

interest-free period homeowner borrowers will not only

have the burden of principal repayments, but higher Pros: Borrowers can use the money for

interest rates as well. whatever purpose they choose.

Interest rates are lower than for many

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

8 3. MORTGAGE BROKING

8

other forms of credit Non-conforming loans

Cons: No formal commitment to reduce debt People with poor credit ratings often have trouble

over time sourcing a home loan. Many lenders now offer what are

known as “non-conforming loans” – also known as

credit-impaired loans’ – for people in this type of

Low-doc loans situation. While lenders are willing to overlook prior

credit problems, they will want to see some evidence of

Low doc (or ‘lo doc’) home loans are designed for ability to repay the loan. A larger deposit than is

borrowers, chiefly the self-employed, who fail to qualify required for traditional loans will generally be required

for a normal home loan because they may not have all as well.

the necessary paper work for proof of income, such as

payslips. Instead, the borrower is typically able to sign a Pros: Overlooks poor credit rating

declaration of income with no or little proof. For this

reason they may also be known as self-declared income Cons: A higher interest rate than traditional

loans.

loans

A larger deposit is likely to be required

The Financial Ombudsman Service has indicated that a

mortgage broker’s responsible lending obligations are

Reverse mortgages

not met if a client’s self declaration is relied on without

making further inquiries. A reverse mortgage allows people to borrow money

using the equity in their home as security without a

Additional documentation that may be required need to make while they live in the home. The loan can

includes one or more of the following: be taken as a lump sum, a regular income stream, a line

of credit or a combination of these options.

Proof of ABN and/or GST registration

Business Activity Statements (BAS) The loan must be repaid in full (including interest and

fees) when the borrower sells their home or dies or, in

Business account transaction statements

most cases, move into aged care.

Accountant’s letter

This type of loan is increasing in popularity with retirees

Personal tax return.

who no longer have a sufficient income stream to

maintain their lifestyle.

Pros:

Simple income declaration form

Pros: Borrowers are able to maintain their

No tax return or financial records lifestyle

required Cons: Interest rates are generally higher than

average home loans

Fully serviceable loan options, redraws,

line of credit, variable or fixed rates The loan may affect pension eligibility

The borrower may not have enough

Principal & Interest or Interest-only money left for aged care or other future

loans needs

Cons: Generally a higher interest rate because

the risk to the lender is greater OTHER FORMS OF CONSUMER

More limitations in terms of the CREDIT

maximum Loan to Valuation Ratio (LVR),

available loan features and package Different types of credit are better suited to some

discounts situations than others, and choosing the appropriate

form of credit can help the borrower to minimise

Misused by some credit providers with

interest payments and manage money better. A

false income details and falsely

personal loan, for example, with fixed repayments and

declaration low credit borrowers to be

a set term is better suited to large purchases than, say,

self employed

a credit card.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

9 3. MORTGAGE BROKING

9

Credit Cards Personal Loans

Credit cards are an ongoing ‘line of credit’ that can be These loans are useful for buying one-off big-ticket

used for purchases and cash advances. The full amount items such as a computer, a car or even a holiday as

borrowed can be paid each month or, after a part well as for consolidating multiple debts into one regular

payment that can be a small fraction of the amount repayment. They are for amounts ranging from just a

owing, be carried over to the next month, with interest few thousand dollars up to $50,000 or more. They are

charged on the amount outstanding. repayable over one to seven years, usually with fixed

monthly repayments, which make them easy to budget

Credit cards tend to come in two varieties: ‘No frills’ for.

cards and those offering reward programs. Basic, ‘no

frills’ cards often have a low rate of interest, making The interest rates, fees and charges on personal loans

them ideal for card users who continually carry an can vary considerably between lenders. Loans with a

outstanding debt. lower rate may come at the cost of higher fees.

The convenience of credit cards comes at a price. In When comparisons are made between loans, they

addition to paying interest of up to 20% or more on any should be based on the ‘comparison’ rate.8 A

outstanding balance, the following charges may apply: comparison rate is a tool to help consumers identify the

true cost of a loan. It is a rate that includes both the

Annual card fees – these may be waived if annual

interest rate and fees and charges relating to a loan,

card spending exceeds a certain limit. On cards

reduced to a single percentage figure.

with a low credit limit, a high annual fee can really

boost the overall cost. For example, on a credit

For example, a loan with an interest rate of 8.75% and

card with a limit of $1,000, an annual fee of $30 is

an initial application fee of $65 might have a

the equivalent of an extra 3% in interest.

comparison rate of 8.93%. A loan with a higher interest

Reward program fees. rate but no fees and charges may turn out to be

cheaper.

Late payments fees.

Cash advance fees – cash advances involve a one- Line of Credit

off fee, e.g. 1.75% of the amount, as well as

A new type of personal loan - a line of credit, combines

interest on the outstanding balance.

flexibility with the potential to save on interest.

Some merchants may impose a surcharge for

accepting payment with a credit card. The Instead of drawing all the funds on day one, just the

merchant should advise, but it is always wise to amount needed can be drawdown - usually via ATM or

enquire before making a purchase, especially on cheque book.

larger-ticket items.

They have been available in the past in the form of

Some credit cards offer a zero interest rate on balances housing loan redraw facilities, but some banks are now

transferred over from an existing card. These offers can offering unsecured lines of credit. The main advantage

sound tempting, but the ongoing interest rate applied is a lower rate of interest, and the loan may be made

to new purchases should be looked at. If it is far higher without account keeping charges. However, there may

than the rate being paid on the consumer’s current be an ‘establishment fee’, but it may be less than $100.

card, a zero rate card may not be such a good deal. Also to be considered is that the term is much longer

than the term of a personal loan. That may seem like an

The key to managing credit card debt is to pay off the advantage, but it may lead to much slower debt

outstanding balance at the end of each month. That reduction unless strong discipline is exercised.

way, the comparatively high interest rates can be

avoided. The Nielsen survey referred to earlier found

that almost two-thirds (63%) of Australian consumers Example – Different forms of consumer credit

repay their credit card bill in full each month. However, compared 9

one-quarter (24%) of Australians repay less than that. Let’s say for example that you want to buy new

With some only paying the minimum repayment each furniture costing $3,000. What it will cost you using

month

8 This is a National Credit Code requirement.

9 The example is from CitiBank

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

10 3. MORTGAGE BROKING

10

three different types of credit is shown below. The Because the lease payments do not provide for full

personal loan is the cheapest option for this type of recovery of the purchase cost of the equipment, they

purchase because it combines a relatively low rate are usually lower than the equivalent payments on a

with a short term. personal loan.

Type of Interest Monthly repayments Time Total

credit rate taken to interest At the end of the lease period, the consumer has three

repay charge options:

credit

i. acquire ownership by paying the residual value;

Credit 15% Minimum repayment 26 years $4,456

card of 2% of outstanding ii. hand the item back to the finance provider; or

balance

iii. begin a new lease with an upgraded model of

Personal 10% $63 monthly 5 years $824 the equipment.

loan

The lack of ownership that goes with a lease may not be

Home 7.25% An extra $23 a 20 years $2,691 a problem if payments are made on time, but it can

loan month when $3,000

redraw is added to an certainly be a problem if there is a default on lease

existing mortgage of payments. That is because the finance provider, as

$200,000 payable owner of the equipment, can retake possession

over 20 years. immediately.

The first lesson on the responsible use of credit is

therefore to choose a suitable form of credit for the

OTHER FINANCIAL SERVICES

purpose, with credit card debt being the least suitable Although mortgage brokers are normally associated in

for any term that goes beyond the end-of-month the public’s mind with lending, they may also provide

balance. financial planning services. Considering that most

Australians:

Consumer Leases

do not have adequate life insurance; and

Leasing is an option that can be a useful alternative to a

personal loan, and the financing costs can be roughly do not exercise their right to choose their own

equivalent. With a lease, the finance provider owns the superannuation fund, this may be a useful service to

equipment, with the consumer paying a regular lease clients.

payment – for instance monthly – for use of the

equipment. They need to operate under another license to operate

as a financial planner – an Australian Financial Services

ASIC has warned that this can be an expensive form of They also need more information. In particular they

finance for smaller consumer items such as TV sets and need to determine the client’s risk profile – broadly

home computers, with other alternatives such as a no whether they have a conservative, balanced or

interest loan being a better alternative. aggressive risk profile. A clients risk profile is found by

using a specially designed questionnaire.

However, with large ticket items such as motor vehicles,

a lease may be obtained for a financing cost equivalent Mortgage brokers who offer financial planning services

to a personal loan, with many advantages. usually bring the matter up once the client’s credit

application has been forwarded to the credit provider.

The main advantage for many consumers is that, unlike That provides the time between completion of the

personal loans, the consumer does not have to make an credit application and the loan settlement, which may

up-front payment such as a deposit. A lease is therefore be up to four weeks, to provide financial advice to the

a ‘100%’ from of finance. The lease payments, which client.

are constant for the period of the lease, take into

account the finance cost and the depreciation of the

equipment. At the end of the lease period there is a

residual value, which is roughly equivalent to – although

usually slightly more than – the value of the vehicle.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

11 3. MORTGAGE BROKING

11

There are two advantages in doing this. The first and

most obvious is that it provides an opportunity to earn HANDLING CLIENTS

extra income without the need to prospect for financial A later chapter will discuss various aspects of a

planning clients. The second advantage is that, since mortgage broker’s handling of clients, but a matter that

financial planning clients normally meet their planner is worth considering now is the way client’s should be

for an “annual review”, it maintains client contact and handled. In particular, should a broker attempt to be an

provides an opportunity for more mortgage broking expert on all matters, or should the client be referred to

business. members of a “team” or some members – consisting of

other members of staff or even external advisers – or

COMPARISON INTEREST RATES even referred to a more suitable source of finance?

When a comparison is made between finance offered It can be hard to admit that we are not a source of all

by different providers, the comparison should be knowledge and advice, but that is something

between all the features if the finance, including professionals such as accountants and lawyers do every

interest rates and charges. Even a small difference in day. They let clients know when they have to research a

the interest rate can make a big difference to matter, and when required they refer clients to

payments over time. professionals who have greater expertise. That is

something that mortgage brokers need to learn to do if

It is difficult to compare loans that have different they are going to be proper professionals. It is also a

interest rates and fees. To overcome this, lenders are matter of acting in the best interest of clients, which is

required to must give a comparison rate when they what the duty of care is about.

advertise a rate or a weekly payment for loans. The

comparison rate includes the interest rate, plus most This is indicated in the following example.

fees and charges.

Example – Acting in the interests of clients

A comparison rate is made up of the following:

“Reminiscing about the duty of care mortgage brokers

the amount of the loan;

owed their clients, a retired mortgage broker asked his

the term of the loan; audience to consider two matters.

the repayment frequency;

Firstly what industry did they consider they were in? The

the interest rate; and audience suggested the loan industry. He replied that

they were in the property industry, which he broke down

the fees and charges connected with the loan.

into:

Example – Comparison interest rates the home buying industry;

Interest rate Fees & Comparison rate

the investment property industry; and

charges10 the commercial property industry.

Home 8% 0.5% 8.5%

loan A He then asked them to consider their “mindset”, when

Home 8.25% 0.1% 8.35% they made property loans. He suggested that three

loan B were possible:

In this example, home loan A has a lower interest rate but it has

higher fees and charges. When a comparison is made between the

1. The Novice: I know nothing! Whatever kind of loan

comparison rates, which lenders are required to provide, home loan B you want for whatever kind of property you want is

will cost less than home loan A because it has lower fees and charges. fine by me. I will do what I can to get you the loan,

otherwise leave me out of it.

2. The Protector: I care about your success and would

rather turn down a loan than have you buy a bad

property on my watch. I only have some

fundamental knowledge on property investing but I

have access to a team of experts that I trust that I

can refer you to (and not just because they are

paying me to do so).

10 Fees and charges are usually expressed in dollar terms.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

12 3. MORTGAGE BROKING

12

3. The Expert: I will not only organise your loan I will Once as many characteristics as possible have been

make sure you invest wisely, because I know plenty listed, they should be grouped together to provide a

about property investing. picture of the types of clients the business has, what

motivates them and how they came to be a client. If it

He stressed that the mindset that was most consistent appears that there is more than one type of client, a

with the duty of care was the “Protector mindset”, with desirable approach to take is to choose the business’s

the worst one being “the Expert” mindset. He stated his “ideal” client.

case in the following words:

For David Maistre, an American expert on professional

‘The Novice is not a lot of help, but at least you are

relationships, choosing the ideal client is a matter of

under no illusions that you are on your own and that

choosing the type of client the firm prefers to work

may lead you to finding someone who can help you

with. Maister refers to such clients as a “I like these

invest wisely.

people” type of client.12 By working with ideal clients,

brokers are more likely to have the level of concern that

The Expert is the most dangerous because they are

is an essential quality of professionalism. They are also

promoting themselves as a property expert and odds

more likely to develop the communication with clients

are that they aren’t.

that leads to “engagement” – that is, a longer-term

The Protector admits they are not an expert on property relationship that comes from personal connection. The

investing and only have a basic knowledge, but they “picture” of the ideal client then becomes the basis of a

have sourced a trusted team they can refer you to and marketing plan designed to attract and capture more of

they do have your best interests at heart. the same clients.

He conclude his talk with the following challenge:

Who are your own “ideal” clients. Look at your own

“Are you a protector, an expert, or a novice? And when ethnic and social background, the types of people you

it comes to your clients, do you really care?”11 grew up with and the types of people you went to

school with. Considerations such as this should lead you

to the types of people you prefer to deal with. Likewise,

GROWING A MORTGAGE BROKING it may be that you are the sort of professional that they

BUSINESS prefer to deal with.

Although there is a range of mortgage lending products Maistre indicates that as well as assisting in the

that is common to most mortgage brokers, a common formation of relationships, the development of a target

recommendation for mortgage brokers is to select a market segment leads to efficiencies in marketing. He

target market segment to concentrate on. The selection calls this the “Raspberry Jam Rule”:

may not be made at the outset – it may take time and

“…the wider you spread it, the thinner it gets”.13

industry experience for a broker to decide on his/her

preferred segment. However, industry writers suggest In other words, marketing is more effective and more

that this is the best approach to take. cost-efficient if it is focussed on a target market.

Market segmentation may also lead to specialisation in

MARKET SEGMENTATION

different types of loans. A few come to mind:

For a broker who is already in business, market

first homebuyer loans

segmenting does not need to be difficult. In fact, it’s

often as simple as sitting down and starting to write out refinance loans

a list of similar characteristics of the business’s clients:

low-doc loans

age, marital status, first home buyers, investors, how

they heard about the business, size of deal, why they credit-impaired loans

chose the broker over another broker.

construction loans

Some brokers try to do everything. When someone

comes to them for a particular loan, they will say that

12

Maister, D. (1997), True Professionalism, Free Press, New York,

page 24.

11 Michael Sloane, ‘What is the Duty of Care’, The Adviser, 5 Feb. 13 Maister, D. (1997), Managing the Professional Service Firm , Free

2014. Press, New York, page 121.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

13 3. MORTGAGE BROKING

13

they can do it, and then find out how. In contrast, “High performing people cutting through complexity to

brokers who concentrate on a market segment find a deliver clear solutions that our clients value”.15

niche that they feel comfortable in and then dominate

it. A position statement describes the benefits derived

from using the firm’s services and invites a response. It

Correctly applied, market segmentation is about a

says why you should be using us instead of our

company understanding the needs of its clients and

competitors. It also assists in the development of a

therefore understanding how its clients decide between

marketing strategy.

one product and another.

Segmentation also attracts business. As an American PERFORM SITUATION ANALYSIS

textbook on mortgage broking puts it: Once a target market has been established and at least

“The most successful brokers find a niche they feel preliminary thought has been given to appropriate

comfortable with, and then dominate that niche. If strategies, the business should put itself through a

someone in your town is regarded as the expert in situation analysis. This begins with description of the

financing homes of over $1 million, then the people target market and the practice’s experience with that

buying these homes, the builders building them, and the market.

Realtors selling them will all come to this broker so that A SWOT analysis should then be carried out. This

the deal goes through.”14 involves drawing up separate lists of the Strengths,

Segmentation, however, should not prevent a broking Weaknesses, Opportunities and Threats facing the

firm from straying out of their preferred niche at times, business. Strengths and weaknesses cover factors

even if specialist help is required. Nor should it prevent internal to the company, while opportunities and

broking firms from directing clients to firms that threats cover external factors.

provide more specialist expertise. The list of opportunities and threats should be

attempted first. This is because a list of the

DEVELOP STRATEGIES opportunities and threats highlights the strengths that

may be made use of (and perhaps further

When the most desirable market segment has been

strengthened) and the weaknesses that need to be

identified and its important characteristics are known,

corrected. For example, the main competitor may have

attention can be turned to the more difficult task of

set up effective web pages for selling its products or

developing strategies. For example, a business that

services. That may identify a weakness that requires

positions itself as providing a streamlined form of

early attention.

service is likely to adopt this as a strategy for reaching

the target market. Examples of other strategies that

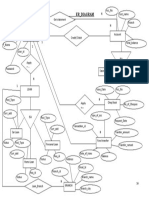

SWOT analysis is illustrated in Figure 2 (over the page).

might be adopted include having a wide product range

and being able to match client requirements with the

most appropriate loan.

Ideally, strategies should be based on strengths that are

difficult for competitors to replicate.

PREPARE A POSITION STATEMENT

A position statement describes one or more benefits

that will be received if the firm’s products or services

are utilised rather than those of its competitors.

As an example of the difference between a mission

statement and a position statement, first consider the

mission statement of the international accounting firm

KPMG:

14 Ameen Kamadia, So You Want to Be a Mortgage Broker, Kamrock

Publishing, Houston, Texas (2005), p.100. 15 From KPMG website.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

14 3. MORTGAGE BROKING

14

Figure 2: SWOT analysis 16 A basic requirement for excellence in quality of service

is that the client’s expectations must be exceeded.

Strengths Opportunities

Excellence in quality of service assists in retaining

Your specialist marketing A developing medium such as

expertise the internet existing clients as well as the extension of existing client

A new, innovative product or Mergers, joint ventures or business. It also leads to referrals. In a survey on the

service strategic alliances reasons for referrals conducted by Maister, only 10%

Location of your business Moving into new market were due to the quality of technical work. The

Quality processes and segments

procedures A new international market remaining 90% of referrals were due to the quality of

Any other aspect of your A market vacated by an service.18

business that adds value to your ineffective competitor

product or service

OBTAIN REFERRALS

Weaknesses Threats Quality of service leads to referrals, but they generally

Lack of expertise A new competitor do not happen on their own. As important as quality of

Products or services not Price wars with competitors service is, referrals are more likely to happen if they are

differentiated from Competitor product/service asked for.

competitors’ offerings innovation

Location of your business Competitors have superior As a relatively passive approach, a line about referrals

Damaged reputation access to channels of

distribution

can be included in all letters to clients. It is, however,

Taxation introduced on product possible to take more positive control of the word-of-

or service mouth process. A broker who has developed a sound

relationship with ideal clients, and obviously enjoys that

relationship, can let them know that he/she wants

PROVIDE QUALITY SERVICE other clients just like them. Each ideal client can then

be asked to suggest people they know through work,

Identifying a target market and developing appropriate social networks, etc. Some brokers go further by

strategies, however, do not lead to success on their schooling their ideal clients in what to say when they

own. An essential final ingredient is a caring attitude spread word of mouth about them.

that leads to quality of service. David Maistre, who was

referred to earlier, points out that when people A point to remember is that clients who are truly

approach a professional such as a mortgage broker, satisfied are likely to be eager to provide referrals

they usually do so over a matter of high value with, because this is a way of benefiting social contacts and

long-term consequences or significant risk. They family. Asking then to provide referrals does more than

therefore feel vulnerable and, as Maister points out, prompt them. It provides them with permission to go

“almost by definition in a state of anxiety and ahead.

nervousness”, so “they need to be confident they are in

good hands”.17 They need, in other words, to be assured The needs of referrals should be obtained promptly,

that the broker will put their interests first from the with relevant organization products being presented to

beginning of the relationship. the client. Mostly, this is a matter of finding out why

they were referred to you. If you cannot assist, you

This means demonstrating a caring attitude from the should be able to suggest someone who can, even if

beginning of the relationship. The demonstration begins that means referring them to another mortgage broking

with simple courtesies, such as the way telephones are business. Remember your name was mentioned as

answered. It then extends to the way a prospect is someone who would be able to help meet a need, so

treated when a meeting takes place. In particular, the you should be as helpful and courteous as possible.

broker must demonstrate a sincere interest in clients

and their problems. This leads to client relationships.

REACHING OUT TO NEW CLIENTS

Once a client relationship has been established, a

broker is judged by the quality of service being As well gaining referrals from clients, the business

provided. This exists apart from technical competence should have an active networking program so that

and covers the client’s whole experience with the firm. further business is gained through networking. This

involves reaching out to a market segment made up of

the practice’s ideal clients.

16

From Deena Katz, Deena Katz’s Complete Guide to Practice

Management (2009), page 39.

17 Maister, D. (1997), Managing the Professional Service Firm, page

73. 18 Maister (1997), Managing the Professional Service Firm, page 81.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

15 3. MORTGAGE BROKING

15

David Maister lists different marketing techniques in evidence of a caring attitude, not only to clients but also

different tiers with diminishing order of effectiveness, to the COI. This means finding ways to add value to

as illustrated in Figure 3.19 their business at no cost to them. They might, for

example, be provided with relevant articles or

Figure 3: Marketing techniques

information, websites, or relevant knowledge that the

adviser discovers in the normal course of business.

The first tier: These are all more effective Another way of helping COIs is to invite them to a

Seminars (small-scale) techniques that are worth

attempting because workshop, seminar or function where they can make

Speeches at client industry competence is demonstrated valuable new contacts themselves. They should also be

meetings rather than asserted. They also provided with referrals. An adviser cannot expect

Articles in client-oriented all involve giving something to

referrals from a COI without providing them in turn.

(trade) press the prospective client, but no

one tactic will work alone. While recognising COIs as being potentially powerful as

Proprietary research on

matters of interest to sources of referrals, Maister relegates them to his

prospective clients (this also second tier of marketing techniques because of the

provides useful material for time required to develop the relationship.20 He sees it as

speeches and articles)

a matter of long-term courtship that is valuable, but not

likely to provide results within the timeframe of a

The second tier: While these may be powerful, marketing plan.

Community/civic activities the time investment is higher –

the payoff may take many

Networking with potential

referral sources such as

patient years LEARNING FROM OTHER BROKERS

“centres of influence” (see

A final point about growing a mortgage broking

below)

business is that the main competition for mortgage

Newsletters brokers is not other mortgage brokers. Mortgage

brokers only have 45% of the total home lending

“Clutching at straws”: market.21 They therefore have room to expand.

These are all more directed to

Publicity, brochures, seminars a very wide target market and It is with the banks and other lenders. Mortgage

(ballroom scale), direct mail, are limited in their effect

brokers should therefore be prepared to help each

cold calls, sponsorship of

sporting/cultural events, other.

advertising, video brochures.

An Australian broker has made the following

suggestions:

APPROACHING CENTRES OF INFLUENCE “Ask/demand your aggregator to get the most

successful broker to speak at your next PD day –

The term “Centre of Influence” or COI is used often in

this could be the most successful broker in terms of

business networking, especially in the financial services

settlements, or most successful with social media,

sector.

or referrals and so forth – doesn’t just have to be

A COI is a person who is in a position or business that volume

tends to have great influence with prospects in a target

Organise a broker forum of 4 to 8 like-minded

market. These people are “movers and shakers” in

brokers in your area that meets monthly to talk

complimentary but non-competing area. For mortgage

about their business challenges and experiences

brokers, COIs are likely to be other professionals such as

solicitors and real estate agents who have developed a Publish your experiences, tips and advice in a

loyal client case and have influence in the target blog/article. I’d very much welcome contribution to

market. They also understand the unique needs of the my site (blog) but equally I know the broker

members of the target market, what their preferences industry magazines would love to receive some

are, and how they can be approached. content too

Other COIs may be professionals such as accountants, Approach colleagues’ you respect and beg them to

solicitors and financial planners. share their knowledge (e.g. article or

Centres of influence need to be “wooed” in the same

way that clients need to be wooed. An essential start is 20 Maister (1997), Managing the Professional Service Firm, page

128.

19 Maister (1997) Managing the Professional Service Firm, page 122. 21 Source: Mortgage and Finance Association of Australia

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

16 3. MORTGAGE BROKING

16

presentation).22 Financial institutions also consider the impact of their

work practices on the environment. Westpac, for

example, claims to have reduced greenhouse gas

SECURITY OF CLIENT RECORDS emissions by 40% since 1996. It has also sought to

The privacy legislation, which is reviewed in the reduce water and paper consumption. It also has

following article, places obligations on mortgage energy plans for each worksite and reports its emissions

brokers in relation to the security of client records. performance in its Annual Report.

Normal guidelines are set out below. Businesses are not on their own in environmental

sustainability issues. In particular, an important source

ACCESS TO CLIENT RECORDS of information and assistance is provided by

environmental protection agencies in all states and

As all client information is confidential, all client records territories:

will be stored in a secure environment at all times.

The NSW Environment Protection Authority

Only authorised staff will have controlled access to

client information/records. The Victorian Environment Protection Authority

Client records are the property of the organisation, but The Queensland Department of Environment and

clients may have supervised access to their own records Heritage Protection

following written a request, either by mail or The Tasmanian Environment Protection Authority

electronically, and authorisation by the general

manager, independent living services. The Western Australian Environment Protection

Authority

DISCLOSURE OF CLIENT INFORMATION The Northern Territory Environment Protection

Authority

Information contained in a client's record will only be

disclosed with the written consent of the client, parent

or legal guardian specifying the information that is to be

released, except for non-identifying data required by

funding bodies and by government departments for

planning purposes.

The organisation is obliged to disclose information

about a client, with or without the client's consent,

where prescribed as a legal requirement (e.g. breaches

of legislation and criminal activities such as fraud.)

ENVIRONMENT SUSTAINABILITY

Environment sustainability is a growing issue with most

businesses, including mortgage broking and other

businesses operating in the financial services sector.

The pressure is from client and community expectations

rather than legislation.23

Lenders, for example, consider the environmental

impact of their lending and have lists of activities they

will not support through their lending activities. They

also consider the environmental impact of their

suppliers and seek to operate green offices.

22 Blog by Stuart Wemyss, 17 July 2014.

23

Legislative pressure ceased with the repeal of The Energy

Efficiency Opportunities (EEO) Act 2006. The EOO Act, which

required larger businesses to identify and report on

environmental issues, was repealed in 2014.

Copyright 2014 © Mentor Education Group Pty Ltd

MB2 – Operating a Mortgage Broking Business PA 010615

You might also like

- High Yield Bond Basics USDocument4 pagesHigh Yield Bond Basics USJDNo ratings yet

- Guide For Private Wealth ManagementDocument248 pagesGuide For Private Wealth Managementvotchen2008No ratings yet

- How To Check Client or Fullz Credit Score@BaddestupdateDocument7 pagesHow To Check Client or Fullz Credit Score@Baddestupdatecolton gallahar100% (2)

- IDC Direct Lender HandbookDocument17 pagesIDC Direct Lender HandbookDirectorNo ratings yet

- A Guide To Establishing A Hedge FundDocument44 pagesA Guide To Establishing A Hedge FundwhackzNo ratings yet

- How Do You Start An Investment Fund?: 6 AnswersDocument6 pagesHow Do You Start An Investment Fund?: 6 AnswersX1ComCcqqLleNo ratings yet

- Underwriting GuidelinesDocument6 pagesUnderwriting GuidelinesHitkaran Singh RanawatNo ratings yet

- Financing and Raising Capital PDFDocument258 pagesFinancing and Raising Capital PDFbaxterNo ratings yet

- Series 6 ReviewDocument202 pagesSeries 6 ReviewAnthony McnicholsNo ratings yet

- Guide To SIE Exam EbookDocument4 pagesGuide To SIE Exam EbookShiva ShivNo ratings yet

- Mortgage Backed SecuritiesDocument57 pagesMortgage Backed SecuritiesRimpy SondhNo ratings yet

- Loan Commitment-Conditions of Qualifications 02.20.2006 Bates (SCHNEIDERS 00158-00163Document6 pagesLoan Commitment-Conditions of Qualifications 02.20.2006 Bates (SCHNEIDERS 00158-00163larry-612445No ratings yet

- ABL Asset-Based Lending Guide April 2015Document20 pagesABL Asset-Based Lending Guide April 2015Venp PeNo ratings yet

- Credit Derivatives: Techniques to Manage Credit Risk for Financial ProfessionalsFrom EverandCredit Derivatives: Techniques to Manage Credit Risk for Financial ProfessionalsNo ratings yet

- TD Margin HandbookDocument17 pagesTD Margin Handbookkaush23No ratings yet

- IIB Recruiting Lies ReportDocument19 pagesIIB Recruiting Lies ReportSwapnil KumarNo ratings yet

- Pass The 66 Study SheetDocument4 pagesPass The 66 Study SheetEmmanuelDasiNo ratings yet

- CMB S Borrower GuideDocument14 pagesCMB S Borrower Guideboobravi85No ratings yet

- Financial Statements Analysis SRKDocument19 pagesFinancial Statements Analysis SRKAman Machra100% (1)

- What Industry Trends You Will Look at When You Are Looking For A Potential Investment?Document7 pagesWhat Industry Trends You Will Look at When You Are Looking For A Potential Investment?helloNo ratings yet

- KKR Private Equity Intership Opportunity - Spring 2016 - v1Document2 pagesKKR Private Equity Intership Opportunity - Spring 2016 - v1greenpostitNo ratings yet

- Real Estate Investment TrustsDocument39 pagesReal Estate Investment TrustsBrahmam GuruNo ratings yet

- The Pocket Mortgage Guide: 56 of the Most Important Questions and Answers About Your Home Loan - Plus Interest Amortization TabFrom EverandThe Pocket Mortgage Guide: 56 of the Most Important Questions and Answers About Your Home Loan - Plus Interest Amortization TabNo ratings yet

- CMBS Basic Overview enDocument79 pagesCMBS Basic Overview enEd HuNo ratings yet

- Vault Career Guide To Private Wealth Management (2007)Document248 pagesVault Career Guide To Private Wealth Management (2007)Christopher KingNo ratings yet

- The Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachFrom EverandThe Executive Guide to Boosting Cash Flow and Shareholder Value: The Profit Pool ApproachNo ratings yet

- Private Real Estate Financing OverviewDocument13 pagesPrivate Real Estate Financing OverviewJoseph McDonald100% (1)

- CREFC CMBS 2 - 0 Best Practices Principles-Based Loan Underwriting GuidelinesDocument33 pagesCREFC CMBS 2 - 0 Best Practices Principles-Based Loan Underwriting Guidelinesmerlin7474No ratings yet

- Performance of Private Credit Funds A First LookDocument37 pagesPerformance of Private Credit Funds A First LookIván WdiNo ratings yet

- Investment ChecklistDocument4 pagesInvestment ChecklistlowbankNo ratings yet

- Hedge Fund Intelligence 4Q11Document60 pagesHedge Fund Intelligence 4Q11StreetofWalls100% (1)

- Property Investment Secrets - Rent to Rent: A Complete Rental Property Investing Guide: Using HMO's and Sub-Letting to Build a Passive Income and Achieve Financial Freedom from Real Estate, UKFrom EverandProperty Investment Secrets - Rent to Rent: A Complete Rental Property Investing Guide: Using HMO's and Sub-Letting to Build a Passive Income and Achieve Financial Freedom from Real Estate, UKNo ratings yet

- Vault Guide To Actuarial Careers (2007)Document232 pagesVault Guide To Actuarial Careers (2007)Christopher KingNo ratings yet

- Empower B1 - Student's BookDocument180 pagesEmpower B1 - Student's BookEma MezaNo ratings yet

- CAIA Prerequisite Diagnostic Review BOctober07Document30 pagesCAIA Prerequisite Diagnostic Review BOctober07minsusung9368100% (1)

- Marketing Strategies For Mortgage Lenders and BrokersDocument2 pagesMarketing Strategies For Mortgage Lenders and BrokersTodd Lake100% (7)

- Acct Statement XX7039 12062023Document34 pagesAcct Statement XX7039 12062023Siyaram MeenaNo ratings yet

- Report 20200907194859 PDFDocument7 pagesReport 20200907194859 PDFKeshav SinghNo ratings yet

- Why Businesses Fail... and the journey through our irrational mindsFrom EverandWhy Businesses Fail... and the journey through our irrational mindsNo ratings yet

- CIVMB LP T3-2 v3Document39 pagesCIVMB LP T3-2 v3Forin NeimNo ratings yet

- Finance and Mortgage Broking: Useful WebsitesDocument6 pagesFinance and Mortgage Broking: Useful WebsitesForin NeimNo ratings yet

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyFrom EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNo ratings yet

- Private Equity Fund Of Funds A Complete Guide - 2020 EditionFrom EverandPrivate Equity Fund Of Funds A Complete Guide - 2020 EditionNo ratings yet

- SRZ PIF 2018 Permanent Capital Investment Vehicles PDFDocument19 pagesSRZ PIF 2018 Permanent Capital Investment Vehicles PDFRegis e Fabiela Vargas e AndrighiNo ratings yet

- Credit Derivatives Basics 1Document34 pagesCredit Derivatives Basics 1madhu3698No ratings yet

- 52955515Document133 pages52955515mohamedNo ratings yet

- Mode of SecurityDocument5 pagesMode of SecurityFazle MahmudNo ratings yet

- SERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- Adms 4551 PDFDocument50 pagesAdms 4551 PDFjorNo ratings yet

- Financial Institutions LendingDocument8 pagesFinancial Institutions LendingJoy BiswasNo ratings yet

- CBRE Multifamily Client Call - 112718Document29 pagesCBRE Multifamily Client Call - 112718SukkMidickNo ratings yet

- Chap 002Document100 pagesChap 002Duy AAnhNo ratings yet

- Types of Financing: Learning OutcomesDocument31 pagesTypes of Financing: Learning Outcomesravi sharma0% (1)

- Ira and 401(K) Investment in Real Estate: For Syndicators, Other Real Estate Professionals, and the Rest of UsFrom EverandIra and 401(K) Investment in Real Estate: For Syndicators, Other Real Estate Professionals, and the Rest of UsNo ratings yet

- Wiley - How To Be A Billionaire - Proven Strategies From The Titans of Wealth - 978-0-471-33202-2Document3 pagesWiley - How To Be A Billionaire - Proven Strategies From The Titans of Wealth - 978-0-471-33202-2Pavan KumarNo ratings yet

- RepoDocument7 pagesRepoMonil VisariyaNo ratings yet

- Toastmasters InternationalDocument1 pageToastmasters Internationalninja980117No ratings yet

- MB7 Principles of Professional Management PA 5072016Document13 pagesMB7 Principles of Professional Management PA 5072016ninja980117No ratings yet

- MB4 - Compliance Requirements 010615Document12 pagesMB4 - Compliance Requirements 010615ninja980117No ratings yet

- MB6The Five C S of Credit Analysis PA18072016Document6 pagesMB6The Five C S of Credit Analysis PA18072016ninja980117No ratings yet

- MB5 - The Credit Approval Process PA 010615Document13 pagesMB5 - The Credit Approval Process PA 010615ninja980117No ratings yet

- MB2 - The Australian Financial System PA 010615Document12 pagesMB2 - The Australian Financial System PA 010615ninja980117No ratings yet

- MB1 - The Australian Economy PA 7092016Document8 pagesMB1 - The Australian Economy PA 7092016ninja980117No ratings yet

- GIMP Essential TrainingDocument1 pageGIMP Essential Trainingninja980117No ratings yet

- Exam TimetableDocument17 pagesExam Timetableninja980117No ratings yet

- Chemistry: Written Examination 1Document21 pagesChemistry: Written Examination 1ninja980117No ratings yet

- General Comments: Chemistry GA 1: Written Examination 1Document4 pagesGeneral Comments: Chemistry GA 1: Written Examination 1ninja980117No ratings yet

- Form 510Document6 pagesForm 510Cor LeonisNo ratings yet

- D6.1 - LawDocument2 pagesD6.1 - LawAngelica DeniseNo ratings yet

- APGLIDocument7 pagesAPGLIskssahul59No ratings yet

- Estatement20230531 000379719Document2 pagesEstatement20230531 000379719Budak NakalNo ratings yet

- Given:: Starbucks Company (20 PTS.)Document7 pagesGiven:: Starbucks Company (20 PTS.)Del ArisNo ratings yet

- BF Di Pa TaposDocument8 pagesBF Di Pa TaposKierstin Kyle RiegoNo ratings yet

- My Bill 299947034353Document1 pageMy Bill 299947034353praphullshareNo ratings yet

- Paycheck 020123 8D730ADocument1 pagePaycheck 020123 8D730A7cdqt5g66sNo ratings yet

- Deferred AnnuityDocument19 pagesDeferred AnnuityAllaine BenitezNo ratings yet

- Deepak Bank StatementDocument25 pagesDeepak Bank StatementHemant BhattNo ratings yet

- Pension Schemes: CC-HR Pension GroupDocument31 pagesPension Schemes: CC-HR Pension GroupeenagpurcongNo ratings yet

- H. Mgt.Document284 pagesH. Mgt.sahoogayatri719No ratings yet

- JimaDocument30 pagesJimatalilaNo ratings yet

- Current LiabilitiesDocument40 pagesCurrent Liabilitieswarsima100% (1)

- Accounting Plus Second ExamDocument7 pagesAccounting Plus Second ExamEva LumantaNo ratings yet

- ICP Receipt - ICP 384036Document2 pagesICP Receipt - ICP 384036Salman TamboliNo ratings yet

- 2023 03 02 20 32 56nov 22 - 486001Document6 pages2023 03 02 20 32 56nov 22 - 486001Nagendra Singh PariharNo ratings yet

- Lecture 9 - Life Insurance Contractual Provisions (FULL)Document31 pagesLecture 9 - Life Insurance Contractual Provisions (FULL)Ziyi YinNo ratings yet

- Banking Endsems NotesDocument42 pagesBanking Endsems Notesmahiya sNo ratings yet

- CBO ReportDocument6 pagesCBO Reportdharmesh1986No ratings yet