Professional Documents

Culture Documents

Working Capital Management: © 2019 Pearson Education LTD

Working Capital Management: © 2019 Pearson Education LTD

Uploaded by

Leanne TehOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Working Capital Management: © 2019 Pearson Education LTD

Working Capital Management: © 2019 Pearson Education LTD

Uploaded by

Leanne TehCopyright:

Available Formats

Chapter 19

Working Capital Management

Note: All problems in this chapter are available in MyFinanceLab. An asterisk (*) indicates problems

with a higher level of difficulty.

1. Plan: Calculate Homer Boats operating cycle.

Execute: Operating Cycle inventory days receivable days 50 30 80 days.

Evaluate: Homer Boats turns over (i.e., sells) its inventory in 50 days and collects the cash

from the sale in 30 days. So, it takes Homer Boats 80 days to sell a boat and collect the cash

from the sale.

2. Plan: Calculate the cash conversion cycle for FastChips.

Execute: Cash Conversion Cycle inventory days receivable days – payables days 80

60 – 120 20 days

Evaluate: FastChips turns over (i.e., sells) its inventory in 80 days and collects the cash from

the sale in 60 days. So, it takes Fastchips 140 days to sell a computer chip and collect the cash

from the sale. But FastChips has to pay its own supplier in 120 days for the computer chip.

Hence at day 120, FastChipw has to come up with the cash to pay its supplier for the computer

chip and then wait 20 additional days (to day 140) before its customer pays it for the computer

chip.

3. Plan: Calculate the components (Inventory days, Receivable days, and Payable days) of the

Cash Conversion Cycle, and then calculate the cash conversion cycle.

Execute:

Inventory balance

Inventory days

Cost of goods sold/365

15,000

80,000/365

68.44 days

Accounts receivable balance

Receivable days

Sales/365

30,000

100,000/365

109.5 days

© 2019 Pearson Education Ltd.

218 Berk/DeMarzo/Harford • Fundamentals of Corporate Finance, Fourth Edition, Global Edition

Accounts payable balance

Payable days

Cost of goods sold/365

40

80,000/365

182.5 days

Evaluate: Cash Conversion Cycle inventory days receivable days – payables days 68.44

109.5 – 182.5 4.56 days

Westerly collects cash from its customers 4.56 days before it has to pay its suppliers.

4. Ignoring revenues and other expenses associated with the new plant, the NPV of the $2.11

million investment in net working capital is simply the present value of the $2.11 million that

the firm will recoup at the end of ten years minus the initial $2.11 million investment.

$2,110,000

NPV $2,110,000 $1,043,589.17.

(1.064)11

5. Plan: Calculate the Present Value of the working capital investment under a 3% and a 5% growth

rate assumption. Then compute the difference in Present Value.

Execute: The cost of the working capital is the present value of the future changes in the

working capital from year to year.

The PV of the cost of the working capital growing at 5% is:

111(1.05) 111(1.05)

PV 178.39285

0.12 0.05 (0.12 0.05) 1.12

The PV of the cost of working capital growing at 3% is:

111(1.03) 111(1.03)

PV 136.10714

0.12 0.03 (0.12 0.03) 1.12

Evaluate: The change from 5% to 3% growth in working capital reduces the present value of

the cost of investing in the working capital from $178,392.85 to $136,107.14, resulting in an

increase in firm value of $42,285.71.

6. a. Net working capital is current assets minus current liabilities. Using this definition, The

Greek Connection’s net working capital is $7,782 – $3,520 = $4,262. Some analysts

calculate the net operating working capital instead, which is the non-interest earning current

assets minus the non-interest bearing current liabilities. In this case, the notes payable would

not be included in the calculation since they are assumed to be interest bearing. Net

operating working capital for The Greek Connection is $7,782 – ($1,300 + $1,220) =

$5,262.

b. The cash conversion cycle (CCC) is equal to the inventory days plus the accounts receivable

days minus the accounts payable days. The Greek Connection’s cash conversion cycle for

2004 was 41.4 days.

© 2019 Pearson Education Ltd.

Chapter 19 Working Capital Management 219

inventory accounts receivable accounts payable

CCC

daily COGS daily sales daily COGS

1.414 4.414 1.3

40.32 50.35 37.07 53.60 days

12.8 32 12.8

365 365 365

c. If The Greek Connection accounts receivable days had been 30 days, its cash conversion

cycle would have been only

CCC = 40.32 + 30 – 37.07 = 33.25 days

7. Plan: Calculate the cost of the trade credit if your firm does not take the discount and pays on

day 60.

Execute: In this instance, the customer will have the use of $96 for an additional 45 days (60

15) if he chooses not to take the discount. It will cost him $4 to do so because he must pay $100

for the goods if he pays after the fifteen-day discount period. Thus, the interest rate per period

is:

$4

0.4166 4.167%

$96

The number of 45-day periods in a year is 365/45 8.1 periods. So, the effective annual cost of

the trade credit is:

EAR (1.04167)8.1 1

39.19%

Evaluate: As we have calculated, the annual cost of not taking the trade discount is 39.19%. If

the firm has other means of financing, such as a bank line of credit at 10% annually, it should

take the trade discount, avoid the 39.19% cost, and borrow from the bank.

8. Plan: Calculate the cost of not taking the trade discount.

Execute: If you were to pay within the 20-day discount period, you would pay $97 for $100

worth of goods. If you wait until day 30, you will owe $100. Thus, you are paying $3 in interest

for a 10-day (30 20) loan. The interest rate per period is:

$3

3.09%

$97

The number of 10-day periods in a year is 365/10 36.5 periods. So, the effective annual cost

of the trade credit is:

EAR (1.0309)36.5 1

203.97%

© 2019 Pearson Education Ltd.

220 Berk/DeMarzo/Harford • Fundamentals of Corporate Finance, Fourth Edition, Global Edition

Evaluate: As in Problem 18.7, the firm should look to its other sources of financing and only

pay 203.97% if it is the lowest rate financing available.

*9. Plan: Calculate the costs and benefits of outsourcing the billing and collection functions.

Outsource if benefits outweigh costs.

Execute: The benefit of outsourcing the billing and collection to the other firm is equal to what

Fast Reader can earn on the funds that are freed up. Because average daily collections are

$10,200 and float will be reduced by 17 days, Fast Reader will have an additional $173,400

($10,200 17). (Think about this as follows. Immediately after hiring the billing firm, its

collection float drops by 17 days, so all collections due within the next 17 days are immediately

available.) The billing firm charges $500 per month. At a 7.4% annual rate, the monthly

discount rate is 1.0741/12 – 1 0.596 5.96%, so the present value of these charges in perpetuity

is 500/0.00596 $83,795.64 8,389.26.

If additional cash is invested at the same rate in perpetuity, PV = 173,400 / 7.04% =

2,343,243.24

Evaluate: Thus, the costs ($83,795.64) are much lower than the benefits ($2,343,243.24), and

Fast Reader should employ the billing firm.

Another solution could be to simply compare for on a monthly basis:

Cost = $500, interest earned = 173,400 0.596% = $1033.46

*10. Plan: Calculate the costs and benefits of switching banks. Shift to the new bank if benefits

outweigh costs.

Execute: The electronic funds transfer system will free up $51,000 ( 5 $10,200). (Think about

this as follows. Immediately after switching banks, its collections due within the next five days

are immediately available.) On the other hand, Saban will have to pay a cost because it has to

hold $25,000 in a noninterest-earning account, which means it has essentially given up these

funds.

Evaluate: Because the benefits ($51,000) are larger than the costs ($25,000), it should switch

banks.

11. Plan: Calculate accounts receivables collection in days.

Execute: If we assume all the sales were made on credit, the average length of time it takes

Manana to collect on its sales is 37.64 days:

Accounts receivable

Accounts receivable days

Average daily sales

$5,600,000

$54,300,000

365

37.64 days

Evaluate: It takes Manana 37.64 days on average to collect its accounts receivable.

© 2019 Pearson Education Ltd.

Chapter 19 Working Capital Management 221

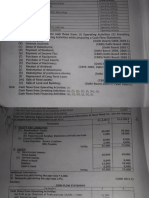

12. Plan: Compute an aging schedule for accounts receivable.

Execute: Mighty Power Tool Company Aging Schedule

Percent of Accounts

Days Outstanding Amount Owed Receivable

0–15 $ 68,000 19.3%

16–30 $ 75,000 21.2%

31–45 $ 92,000 26.1%

46–60 $ 82,000 23.2%

more than 60 $ 36,000 10.2%

$353,000 100.0%

Evaluate: $36,000 of accounts receivable are more than 60 days outstanding. If credit terms are

net 30 days, management should investigate.

13. Plan: Calculate the benefit of taking the discount. If it is more than the 10.8% cost of the loan,

then borrow from the bank and take the discount.

Execute: If Simple Simon’s takes the discount, it must pay $98.3 in 10 days for every $100 of

purchases. If it elects not to take the discount, it will owe the full $100 in 25 days. The interest

rate on the loan is:

$1.7

1.73%

$98.3

The loan period is 15 days ( 25 10). The effective annual cost of the trade credit is:

EAR (1.0173)365/15 – 1

51.79%

Evaluate: Because the bank loan is only 10.8%, Simple Simon’s should borrow the funds from

the bank in order to take advantage of the discount.

14. a. Your firm is paying $1.7 to borrow $98.3 for 20 days (= 35 – 15).

The interest rate per period is 1.7 / 98.3 = 1.73%.

The effective annual rate is (1.0173)365/20 – 1 = 36.74%.

b. In this case, your firm is stretching its accounts payable. You are still paying $3 to borrow

$97, so the interest rate per period is 3.09%. However, the loan period is now 30 days (= 45

– 15). The effective annual rate is reduced to 23.2% because your firm has use of the money

for a longer period of time:

EAR = (1.0173)365/30 – 1 = 23.2%.

© 2019 Pearson Education Ltd.

222 Berk/DeMarzo/Harford • Fundamentals of Corporate Finance, Fourth Edition, Global Edition

*15. Plan: Calculate the firm’s cash conversion cycle over two different years. Evaluate how well

the firm is managing it payables.

Evaluate:

a. The cash conversion cycle (CCC) is equal to the inventory days plus the accounts receivable

days minus the accounts payable days. IMC’s cash conversion cycle for 2015 was 35.2

days, and for 2016, it was 45.6 days.

Inventory Accounts receivable Accounts payable

CCC

Average daily COGS Average daily sales Average daily COGS

$6, 200 $2,800 $3,600

CCC 2015

$52,000 $60,000 $52,000

365 365 365

43.5 days 17.0 days 25.3 days

35.2 days

$6,600 $6,900 $4,600

CCC 2016

$61,000 $75,000 $61,000

365 365 365

39.5 days 33.6 days 27.5 days

45.6 days

IMC’s cash conversion cycle has lengthened in 2016, due to an increase in its accounts

receivable days. The number of days goods are held in inventory has decreased, and IMC is

taking longer to pay its suppliers, both of which would decrease the cash conversion cycle,

all else being equal. These changes were not enough to offset the increase in the time it is

taking IMC’s customers to pay for purchases made on credit. The lengthening of the cash

conversion cycle means that IMC will require more cash.

Execute:

b. If IMC’s suppliers are offering terms of net 30 days, IMC should consider waiting longer

to pay for its purchases. In 2012, it paid nearly five days earlier than necessary, and in 2013,

it paid 2.5 days earlier. IMC could, therefore, have kept the money working for it longer

because there was no discount offered for early payment. The early payment may give IMC a

preferred position with its suppliers, however, which may have benefits that are not

presented here. IMC’s decision on whether to extend its accounts payable days would have

to take these benefits into consideration.

16. Plan: Calculate the average days of inventory.

Execute:

Average inventory balance

Average days of inventory

Cost of goods sold/365

1,200,000

7,000,000/365

62.57 days

Evaluate: Items stay in inventory for 62.57 days.

© 2019 Pearson Education Ltd.

Chapter 19 Working Capital Management 223

17. Plan: Calculate inventory in days. Also, evaluate how much the firm would have to reduce its

inventory to get it inventory days to match the industry average.

Execute:

a. The inventory days ratio is equal to the inventory divided by average daily cost of goods

sold. This was 148.2 days for Happy Valley Homecare Suppliers in 2015:

$1,770,000

Inventory days 148.2 days

$4,360,000

365

Evaluate:

b. To reduce its inventory days to 73 days, HVHS must decrease its investment in inventory

turnover to $872,000:

Inventory

73 days Inventory $872,000

$4,360,000

365

This means HVHS could reduce its investment in inventory by $898,000 ( $1,770,000

$872,000).

© 2019 Pearson Education Ltd.

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Chapter 9 Real MortgageDocument6 pagesChapter 9 Real MortgageSteffany Roque100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Solution Manual For Financial and Managerial Accounting 8th by WildDocument45 pagesSolution Manual For Financial and Managerial Accounting 8th by WildTiffanyFowlercftzi100% (48)

- Contract of AntichresisDocument3 pagesContract of AntichresisPatrice Tan100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Stock Valuation: A Second Look: © 2019 Pearson Education LTDDocument12 pagesStock Valuation: A Second Look: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Unit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1Document5 pagesUnit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1MARK JHEN SALANGNo ratings yet

- Investment Decision Rules: © 2019 Pearson Education LTDDocument22 pagesInvestment Decision Rules: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Financial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDDocument10 pagesFinancial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Scheme of Work For 6 Weeks: Unfair World: Previous KnowledgeDocument4 pagesScheme of Work For 6 Weeks: Unfair World: Previous KnowledgeLeanne TehNo ratings yet

- Case Digest No. 3Document4 pagesCase Digest No. 3Meng DanNo ratings yet

- P9-3A Journalize Entries To Record Transactions Related To Bad DebtsDocument1 pageP9-3A Journalize Entries To Record Transactions Related To Bad DebtsDrenyar ScoutNo ratings yet

- Galicia-Module 2 Oblicon Ba11 PDFDocument3 pagesGalicia-Module 2 Oblicon Ba11 PDFJhonard GaliciaNo ratings yet

- First Language ChineseDocument22 pagesFirst Language ChineseLeanne TehNo ratings yet

- Cambridge International General Certificate of Secondary EducationDocument8 pagesCambridge International General Certificate of Secondary EducationlizhengpingNo ratings yet

- Raising Equity Capital: © 2019 Pearson Education LTDDocument7 pagesRaising Equity Capital: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Payout Policy: © 2019 Pearson Education LTDDocument7 pagesPayout Policy: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Option Applications and Corporate Finance: 1. A. The Contract With The Highest Volume Is 16 Aug 165 CallDocument4 pagesOption Applications and Corporate Finance: 1. A. The Contract With The Highest Volume Is 16 Aug 165 CallLeanne TehNo ratings yet

- International Corporate Finance: © 2019 Pearson Education LTDDocument8 pagesInternational Corporate Finance: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Capital Structure: © 2019 Pearson Education LTDDocument12 pagesCapital Structure: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Stock Valuation: Div PP R PDocument7 pagesStock Valuation: Div PP R PLeanne TehNo ratings yet

- The Cost of Capital: © 2019 Pearson Education LTDDocument8 pagesThe Cost of Capital: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- International Corporate Finance: © 2019 Pearson Education LTDDocument8 pagesInternational Corporate Finance: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Systematic Risk and The Equity Risk Premium: ER W ER W ERDocument12 pagesSystematic Risk and The Equity Risk Premium: ER W ER W ERLeanne TehNo ratings yet

- Option Applications and Corporate Finance: 1. A. The Contract With The Highest Volume Is 16 Aug 165 CallDocument4 pagesOption Applications and Corporate Finance: 1. A. The Contract With The Highest Volume Is 16 Aug 165 CallLeanne TehNo ratings yet

- Scheme of Work For 3 Weeks: You'll Be Hearing From Us ShortlyDocument3 pagesScheme of Work For 3 Weeks: You'll Be Hearing From Us ShortlyLeanne TehNo ratings yet

- Cambridge International Examinations Support For Cambridge Secondary 1 EnglishDocument4 pagesCambridge International Examinations Support For Cambridge Secondary 1 EnglishLeanne TehNo ratings yet

- Skills and Tasks: Cambridge University Press 2014Document6 pagesSkills and Tasks: Cambridge University Press 2014Leanne TehNo ratings yet

- Lesson Plan 2 (2 Hours) : News Versus Views: ActivitiesDocument2 pagesLesson Plan 2 (2 Hours) : News Versus Views: ActivitiesLeanne TehNo ratings yet

- ICT For Cambridge Secondary 1 English: AspectsDocument4 pagesICT For Cambridge Secondary 1 English: AspectsLeanne TehNo ratings yet

- Lesson Plan 1 (1 Hour 20 Minutes) : The Testing Debate: ActivitiesDocument2 pagesLesson Plan 1 (1 Hour 20 Minutes) : The Testing Debate: ActivitiesLeanne TehNo ratings yet

- You Can Download Professional Powerpoint Diagrams For Free: Content Here Content Here Content HereDocument1 pageYou Can Download Professional Powerpoint Diagrams For Free: Content Here Content Here Content HereLeanne TehNo ratings yet

- Https:api Schoology Comv1attachment1134962391sour0aDocument2 pagesHttps:api Schoology Comv1attachment1134962391sour0aLeanne TehNo ratings yet

- Overview of The Cambridge Secondary 1 English Curriculum Framework: Stage 9Document1 pageOverview of The Cambridge Secondary 1 English Curriculum Framework: Stage 9Leanne TehNo ratings yet

- Percentiles Concepts and DefinitionsDocument1 pagePercentiles Concepts and DefinitionsLeanne TehNo ratings yet

- BDO - BDO Unibank, IncDocument3 pagesBDO - BDO Unibank, Incmaria evangelistaNo ratings yet

- Topic 4 - EXERCISES6 - Capital Current Liabilities ManagementDocument36 pagesTopic 4 - EXERCISES6 - Capital Current Liabilities ManagementHazel Jane Esclamada100% (1)

- Partnership Dissolution and Liquidation DrillsDocument6 pagesPartnership Dissolution and Liquidation DrillsMa. Yelena Italia TalabocNo ratings yet

- Activity 3.4 Financial AssumptionsDocument9 pagesActivity 3.4 Financial AssumptionsRojin TingabngabNo ratings yet

- CFM - 29october Intimation PDFDocument1 pageCFM - 29october Intimation PDFLakshay SharmaNo ratings yet

- HPS 2201HBC 2202 Financial Accounting Ii Introduction To Account IiDocument5 pagesHPS 2201HBC 2202 Financial Accounting Ii Introduction To Account IiFRANCISCA AKOTHNo ratings yet

- ANNUITIESDocument16 pagesANNUITIESDina Jean SombrioNo ratings yet

- Hancock9e Testbank ch05Document17 pagesHancock9e Testbank ch05杨子偏No ratings yet

- Module 2-PledgeDocument26 pagesModule 2-PledgeRitesh AnandNo ratings yet

- Cash Flow Statement Important QuestionsDocument20 pagesCash Flow Statement Important QuestionsSatinder SinghNo ratings yet

- Paper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Document16 pagesPaper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Aleena Clare ThomasNo ratings yet

- Jordan ASCA IAASB GlossaryDocument15 pagesJordan ASCA IAASB GlossaryFACTURE TUNISIENo ratings yet

- Personal Finance For Canadians 9th Edition Currie Solutions ManualDocument6 pagesPersonal Finance For Canadians 9th Edition Currie Solutions Manualdipteralapparatusw54100% (31)

- Teodoro M. Luansing College of Rosario: Senior High School DepartmentDocument9 pagesTeodoro M. Luansing College of Rosario: Senior High School DepartmentSamantha Alice LysanderNo ratings yet

- Penalties Under Income Tax Act: SL No Section No and Description PenaltyDocument9 pagesPenalties Under Income Tax Act: SL No Section No and Description PenaltyShainaNo ratings yet

- Kotak Mahindra Bank Ltd. Performance Analysis For The Period 2016-2020Document15 pagesKotak Mahindra Bank Ltd. Performance Analysis For The Period 2016-2020Surbhî GuptaNo ratings yet

- Introduction To Final AccountsDocument38 pagesIntroduction To Final AccountsCA Deepak Ehn88% (8)

- Vargas v. Acsayan - Consideration ContractsDocument2 pagesVargas v. Acsayan - Consideration ContractsJc100% (1)

- Solution Aassignments CH 7Document5 pagesSolution Aassignments CH 7RuturajPatilNo ratings yet

- Recording Transactions: Using The Method of Journal EntriesDocument50 pagesRecording Transactions: Using The Method of Journal EntriesHasanAbdullah100% (1)

- Leverage SumsDocument2 pagesLeverage SumsAbhishek ThakurNo ratings yet

- Basic Accounting Terms & RulesDocument6 pagesBasic Accounting Terms & Rulesniraj jainNo ratings yet

- 6018-P1-Akuntansi-Lembar Kerja-Buku BesarDocument24 pages6018-P1-Akuntansi-Lembar Kerja-Buku BesarnarwanNo ratings yet