Professional Documents

Culture Documents

Accounting 15

Uploaded by

Ma. Alexandra Teddy BuenCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting 15

Uploaded by

Ma. Alexandra Teddy BuenCopyright:

Available Formats

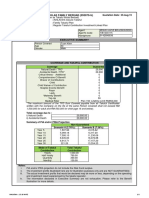

***Problem 14:***

On Jan. 1, 2009, X and Y agreed to combine their talents and capital and form XY Partnership. X

contributed P 60,000 cash, merchandise with a book value of P 120,000; a current market value of P

145,000; and an average value of P 132,000 and equipment (net) with a book value of P 171,000; a

discounted value of P 173,500; fair value of P 185,000 and a dissolution value of P 140,000. Y gave P

90,000 cash and Land with a book value of P 300,000; an assessed value for tax purposes of P

286,000; an appraised value of P 330,000; and original value of P 290,000. The partners agreed to

invest or withdraw cash in order their capital to be at par with each other. On Dec. 31, 2009, before the

books are closed, the drawing account of X shows a debit balance of P 6,636; and for Y, debit balance,

P 1,604. The partnership agreement with regards to division of profits and losses provides that X and Y

is to be allowed of 7% and 6% interest on capital balance (at the inception of the partnership) in excess

of P 300,000; each partner is to be allowed of an annual salary of P 30,000; X is to receive bonus of

15% and Y, 25% of the income after allowance for interests, salaries, and bonuses; and the remainder

is to be divided to X and Y in the ratio of 65:35, respectively. The income summary account on Dec. 31,

has a credit balance of P 88,150 before any entry for the allowance of interests, salaries, and bonuses,

and this balance is closed into the partners’ capital account. The balances of the drawing accounts are

also closed into the capital accounts. On Jan. 3, 2010, Z is admitted as a partner upon investment of P

360,000 in the firm. X and Y sharing in the ratio 65:35 give a bonus to Z so that Z may have a 30%

interest in the firm. The new agreement provides that profits and losses are to be distributed as follows:

X, 35%; Y, 25%; Z, 40%. Interests, salaries, and bonuses are not allowed. On Dec. 31, 2010, the

partners’ drawing accounts have debit balance as follows: X, P 4,118; Y, P 3,509; Z, P 4,173. The

income summary account has a P 115,000 debit balance. Accounts are closed. In Jan. 2011, the

partners decide to liquidate. The assets are realized on a piece-meal basis and the partners decided to

distribute cash as it becomes available. In Feb., after creditors are fully paid, cash of P 142,000 remains

available for partners. This is distributed to the proper parties. In Apr., cash realized from sale of non

cash assets is P 135,600 and this is distributed to the partners. In May, cash realized from the sale of

non cash assets is P 169,500. The remaining non cash assets were unrealizable and were written off as

a complete loss.

Questions to answer:

1. What is the balance of X, capital upon formation?

2. How much is the share of X in the 2009 net income?

3. How much is the bonus of Y in the net income?

4. What is the capital balance of X immediately after the admission of Z?

5. How much is the share of Z in the 2010 loss?

6. What is the capital balance of Y prior to liquidation?

7. Who among the partners is the most invulnerable to losses?

8. How much cash did Y received from the February distribution?

9. What is the capital balance of X after the first distribution?

10. How much cash did Z received from the April distribution?

11. How much cash did X received from the April distribution?

12. How much cash did Y received from the final distribution?

13. How much cash did Z received from the final distribution?

14. How much was left in X’s capital after the final distribution?

15. How much must have been the total loss on realization?

You might also like

- ACCT 2A&B: Accounting For Partnership & Corporation BCSVDocument1 pageACCT 2A&B: Accounting For Partnership & Corporation BCSVMa. Alexandra Teddy BuenNo ratings yet

- Accounting 20Document1 pageAccounting 20Ma. Alexandra Teddy BuenNo ratings yet

- Accounting 12Document1 pageAccounting 12Ma. Alexandra Teddy BuenNo ratings yet

- Multiple Choice: P2.06 P1.96 P2.00 P2.058Document10 pagesMultiple Choice: P2.06 P1.96 P2.00 P2.058Ma. Alexandra Teddy BuenNo ratings yet

- Accounting 5Document1 pageAccounting 5Ma. Alexandra Teddy BuenNo ratings yet

- Accounting 8Document1 pageAccounting 8Ma. Alexandra Teddy BuenNo ratings yet

- Determine The Following: 1. The Loss On Realization. 2. The Amount of Cash Received by PiaDocument1 pageDetermine The Following: 1. The Loss On Realization. 2. The Amount of Cash Received by PiaMa. Alexandra Teddy BuenNo ratings yet

- Accounting 2Document1 pageAccounting 2Ma. Alexandra Teddy BuenNo ratings yet

- Accounting 3Document1 pageAccounting 3Ma. Alexandra Teddy BuenNo ratings yet

- A. Multiple ChoicesDocument2 pagesA. Multiple ChoicesMa. Alexandra Teddy BuenNo ratings yet

- Cost-Volume-Profit (CVP) Analysis Examines The Behavior of Total Revenues, TotalDocument1 pageCost-Volume-Profit (CVP) Analysis Examines The Behavior of Total Revenues, TotalMa. Alexandra Teddy BuenNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Module 1 - AccountingDocument9 pagesModule 1 - AccountingWonnNo ratings yet

- Money SupplyDocument12 pagesMoney SupplyAppan Kandala VasudevacharyNo ratings yet

- Seabank Statement GiselaDocument4 pagesSeabank Statement Giseladeajohn093No ratings yet

- Credit Risk Management of South East Bank Limited PDFDocument56 pagesCredit Risk Management of South East Bank Limited PDFSanket LakdeNo ratings yet

- WQU Financial Engineering M4 SolutionDocument2 pagesWQU Financial Engineering M4 SolutionÜlkem KasapogluNo ratings yet

- The Pearl Prospectus EnglishDocument108 pagesThe Pearl Prospectus EnglishMoosa NaseerNo ratings yet

- ACCA AA Planner Sep 22 - FinalDocument2 pagesACCA AA Planner Sep 22 - FinalSyed HamzaNo ratings yet

- SCRPT PatDocument1 pageSCRPT PatAzfar YaminNo ratings yet

- A Brief History of Money PDFDocument52 pagesA Brief History of Money PDFCristian CambiazoNo ratings yet

- Indian Financial SystemDocument91 pagesIndian Financial SystemAnkit Sablok100% (2)

- DSR FormatDocument1 pageDSR FormatFat ChefNo ratings yet

- Fixed Assets72Document102 pagesFixed Assets72Sumanth AmbatiNo ratings yet

- CH 03Document51 pagesCH 03Lộc PhúcNo ratings yet

- Takaful Ikhlas Family Berhad (593075-U) : Takaful Participant Azan Age 35 Gender Female 1 0Document1 pageTakaful Ikhlas Family Berhad (593075-U) : Takaful Participant Azan Age 35 Gender Female 1 0Mohd Hafiz ZakiuddinNo ratings yet

- Guide For Credinet WebDocument58 pagesGuide For Credinet WebVladimir Ramos MachacaNo ratings yet

- Human Resource Department: by J.A.V.R.N.V.PRASADDocument28 pagesHuman Resource Department: by J.A.V.R.N.V.PRASADAmarnath VuyyuriNo ratings yet

- Aud Inv PracticeDocument3 pagesAud Inv PracticePrin CessNo ratings yet

- Ch13 (Man)Document44 pagesCh13 (Man)kevin echiverriNo ratings yet

- GENERAL FEE GUIDE - Dexter Daniels - 8 April 2020Document2 pagesGENERAL FEE GUIDE - Dexter Daniels - 8 April 2020Dexter Van AvondaleNo ratings yet

- Preparing The Feasibility Study - FInancialDocument33 pagesPreparing The Feasibility Study - FInancialMaria Aries PoliquitNo ratings yet

- ChallanDocument2 pagesChallanArbaaz ShaikhNo ratings yet

- Personal Banking General Fees ChargesDocument20 pagesPersonal Banking General Fees ChargesmikeNo ratings yet

- What Is Insurance and Why You Need It!Document2 pagesWhat Is Insurance and Why You Need It!FACTS- WORLDNo ratings yet

- List of Automatic Crossover Trading Partner (Insurers) in Production Do Not Include Number Shown Below On Incoming ClaimsDocument23 pagesList of Automatic Crossover Trading Partner (Insurers) in Production Do Not Include Number Shown Below On Incoming Claimsspicypoova_899586184No ratings yet

- Financial Accounting and Reporting Session 1,2 and 3Document15 pagesFinancial Accounting and Reporting Session 1,2 and 3auro auroNo ratings yet

- PidiliteDocument21 pagesPidiliteMandeep BatraNo ratings yet

- Acct Statement XX7166 12062023Document5 pagesAcct Statement XX7166 12062023Save EnvironmentNo ratings yet

- OBU & FactoringDocument16 pagesOBU & FactoringSha D ManNo ratings yet

- Hotel InvoiceDocument3 pagesHotel InvoiceMuhammad Amirul MazaniNo ratings yet

- Receivable-Financing-Quizbowl DONE For CpaDocument30 pagesReceivable-Financing-Quizbowl DONE For CpaKae Abegail GarciaNo ratings yet