Professional Documents

Culture Documents

1019 PRTC Afar PW

1019 PRTC Afar PW

Uploaded by

King MercadoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1019 PRTC Afar PW

1019 PRTC Afar PW

Uploaded by

King MercadoCopyright:

Available Formats

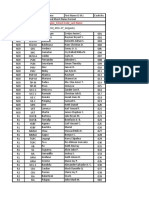

Jobs 102, 103, and 106 were started during February,

2017.

> Direct materials requisitioned for February totaled

20,800

> Direct labor cost of P16,000 was incurred for February

Actual factory overhead was P25,600 for February

The only job still in process at February 26, 2017 was

Job 104 with costs of P2,240 for direct materials anc

4,440 for direct labor.

Over- oF under -applied factory overhead should be

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- AFAR Self Test - 9005Document6 pagesAFAR Self Test - 9005King MercadoNo ratings yet

- Practical Research 1: Quarter 3 - Module 2: Characteristics, Processes and Ethics of ResearchDocument26 pagesPractical Research 1: Quarter 3 - Module 2: Characteristics, Processes and Ethics of ResearchKing MercadoNo ratings yet

- AFAR Self Test - 9001Document5 pagesAFAR Self Test - 9001King MercadoNo ratings yet

- AFAR Self Test - 9004Document4 pagesAFAR Self Test - 9004King MercadoNo ratings yet

- AFAR Self Test - 9003Document6 pagesAFAR Self Test - 9003King MercadoNo ratings yet

- 1.TRUE 2.TRUE 3.TRUE 4.false 5.TRUE 6.TRUE 7.false 8.TRUE 9.TRUE 10. FalseDocument5 pages1.TRUE 2.TRUE 3.TRUE 4.false 5.TRUE 6.TRUE 7.false 8.TRUE 9.TRUE 10. FalseKing MercadoNo ratings yet

- AT.03-06 - Transaction CyclesDocument5 pagesAT.03-06 - Transaction CyclesKing MercadoNo ratings yet

- Cpar b86 Preweek - ApDocument12 pagesCpar b86 Preweek - ApKing MercadoNo ratings yet

- MAS-07 Standard Costing (Answers)Document1 pageMAS-07 Standard Costing (Answers)King MercadoNo ratings yet

- Practical Research 1: Quarter 3 - Module 1: Importance of Research in Daily LivesDocument20 pagesPractical Research 1: Quarter 3 - Module 1: Importance of Research in Daily LivesKing Mercado100% (5)

- AT.03-03 - The Accountancy ProfessionDocument4 pagesAT.03-03 - The Accountancy ProfessionKing MercadoNo ratings yet

- Practical Research 1: Quarter 3 - Module 3: Quantitative and Qualitative ResearchDocument24 pagesPractical Research 1: Quarter 3 - Module 3: Quantitative and Qualitative ResearchKing Mercado100% (8)

- Code No. Region School Code Last Name: (001 - R10 - MSU-IIT - Delgado)Document4 pagesCode No. Region School Code Last Name: (001 - R10 - MSU-IIT - Delgado)King MercadoNo ratings yet

- Cpar b86 Preweek - at 2Document12 pagesCpar b86 Preweek - at 2King MercadoNo ratings yet

- Cpar b86 Preweek - FarDocument16 pagesCpar b86 Preweek - FarKing MercadoNo ratings yet

- CPAR B86 Preweek - AP Answer KeyDocument6 pagesCPAR B86 Preweek - AP Answer KeyKing MercadoNo ratings yet

- Reasonable Reasonable Assurance AssuranceDocument26 pagesReasonable Reasonable Assurance AssuranceKing MercadoNo ratings yet

- CPAR B86 Preweek - FAR Theories 1Document10 pagesCPAR B86 Preweek - FAR Theories 1King MercadoNo ratings yet

- Aicpa Aud Moderate2015Document25 pagesAicpa Aud Moderate2015King MercadoNo ratings yet

- CPAR B86 Preweek - MAS Answer KeyDocument1 pageCPAR B86 Preweek - MAS Answer KeyKing MercadoNo ratings yet

- Cpar b86 Preweek - AfarDocument14 pagesCpar b86 Preweek - AfarKing MercadoNo ratings yet

- NOLOLDocument11 pagesNOLOLPaula VillarubiaNo ratings yet

- FAR 6704 (Bullet Review)Document8 pagesFAR 6704 (Bullet Review)King MercadoNo ratings yet

- Multiple Choice Questions: 44 Hilton, Managerial Accounting, Seventh EditionDocument36 pagesMultiple Choice Questions: 44 Hilton, Managerial Accounting, Seventh EditionKing MercadoNo ratings yet

- FAR Final PB SolutionDocument4 pagesFAR Final PB SolutionKing MercadoNo ratings yet