Professional Documents

Culture Documents

Webinar Error Correction

Webinar Error Correction

Uploaded by

King MercadoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Webinar Error Correction

Webinar Error Correction

Uploaded by

King MercadoCopyright:

Available Formats

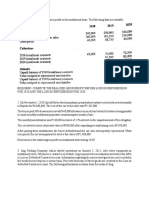

PROBLEM 1

MIRANA CO.’s net income for 2012, 2013 and 2014 were P100,000, P145,000 and

P185,000; respectively. The following items were not handled properly. The retained

earnings in 2012 has a beginning balance of P50,000

a) Rent of P6,500 for 2015 was received from a lessee on December 23, 2014 and

recorded as outright income in 2014.

b) Salaries payable at the end of the following years are omitted:

December 31, 2011 P2,500

December 31, 2012 5,500

December 31, 2013 7,500

December 31, 2014 4,700

c) The following unused office supplies were omitted in the accounting records:

December 31, 2011 3,500

December 31, 2012 6,500

December 31, 2013 3,700

December 31, 2014 7,100

d) On January 1, 2012, the company completed major repairs on the company’s

machinery and equipment totaling P220,000, which was expensed outright. The said

equipment is 5 years old as of January 1, 2012. As of December 31, 2014, the

equipment had an original cost of P500,000 and a carrying value of P250,000.

REQUIREMENTS:

1) What is the correct net income for 2012, 2013 and 2014?

2) What is the correct depreciation expense for 2014?

3) What is the adjusted retained earnings balance at the end of 2012, 2013 and 2014?

4) What is the net adjustments on the beginning balance of retained earnings in 2012,

2013 and 2014?

5) What is the effect of the above errors on 2012, 2013 and 2014 working capital?

PROBLEM 2

KGA Co., who started in 2018, made the following errors:

a) December 31, 2018 inventory was understated by P25,000.

b) December 31, 2019 inventory was overstated by P40,000.

c) Purchases on account in 2018 were understated by P100,000 (not included in physical

count).

d) Advances to suppliers in 2019 totaling P130,000 were inappropriately charged as purchases.

e) December 31, 2018 prepaid insurance was overstated by P5,000.

f) December 31, 2018 unearned rent income was overstated by P26,000.

g) December 31, 2019 interest receivable was understated by P17,000.

h) December 31, 2019 accrued salaries payable was understated by P30,000.

i) Advances from customers in 2019 totaling P60,000 were inappropriately recognized as sales

but the goods were delivered in 2020.

j) Depreciation expense in 2018 was overstated by P7,200.

k) In 2019, the acquisition cost of a delivery truck amounting to P90,000 was inappropriately

charged as expense. The delivery truck has a useful life of five years. KGA’s policy is to

provide a full year’s straight-line depreciation in the year of acquisition and none in the year

of disposal.

l) A fully depreciated equipment with no residual value was sold in 2020 for P50,000 but the

sale was recorded in the following year.

Profits before correction of errors were P123,000, P156,000 and P210,000 in 2018, 2019 and

2020, respectively.

REQUIREMENTS:

1) What is the correct net income for 2018, 2019 and 2020?

2) What is the adjusted retained earnings balance at the end of 2018, 2019 and 2020?

3) What is the effect of the above errors on 2018, 2019 and 2020 working capital?

You might also like

- FAR Preweek Lecture (B42)Document14 pagesFAR Preweek Lecture (B42)Ciarie Mae Salgado50% (4)

- Auditing Problems PDFDocument106 pagesAuditing Problems PDFCharla Suan100% (1)

- Auditing Problem ReviewerDocument12 pagesAuditing Problem ReviewerJan Amora Pueblo0% (4)

- Use The Following Information For The Next Two (2) QuestionsDocument15 pagesUse The Following Information For The Next Two (2) QuestionsAbdulmajed Unda Mimbantas100% (2)

- 4315 Written Project 4 Report Monte Carlo SimulationDocument9 pages4315 Written Project 4 Report Monte Carlo SimulationVictor Marcos Hyslop100% (1)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Testbank Correction of ErrorsDocument26 pagesTestbank Correction of Errors?????0% (1)

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With Answersaerwinde79% (34)

- AUDProb TEST BANKDocument28 pagesAUDProb TEST BANKFrancine HollerNo ratings yet

- I. Executive SummaryDocument11 pagesI. Executive SummaryFroilan Arlando BandulaNo ratings yet

- Meralco Action Plan Edited1Document2 pagesMeralco Action Plan Edited1Froilan Arlando BandulaNo ratings yet

- MPBF PresentationDocument28 pagesMPBF PresentationAbinash BiswalNo ratings yet

- Quizzer 1 - Pas 8 and Cash/accrual, Single EntryDocument10 pagesQuizzer 1 - Pas 8 and Cash/accrual, Single Entryjaleummein100% (1)

- Auditing ProblemsDocument5 pagesAuditing ProblemsJohn Paulo SamonteNo ratings yet

- Resa Oct 2012 Pract 1 First Preboard W Answers PDFDocument10 pagesResa Oct 2012 Pract 1 First Preboard W Answers PDFGuinevereNo ratings yet

- Hakdog PDFDocument18 pagesHakdog PDFJay Mark AbellarNo ratings yet

- Correction of ErrorsDocument4 pagesCorrection of ErrorsKris Van HalenNo ratings yet

- 2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFDocument25 pages2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFMae-shane SagayoNo ratings yet

- Error Correction Problem 1: Lord Gen A. Rilloraza, CPADocument5 pagesError Correction Problem 1: Lord Gen A. Rilloraza, CPAMae-shane SagayoNo ratings yet

- AP-PW 91: Review Problems-1Document9 pagesAP-PW 91: Review Problems-1Joris YapNo ratings yet

- Finac3 Quiz1 PrelimsDocument2 pagesFinac3 Quiz1 PrelimsGloria BeltranNo ratings yet

- Ap-100Q: Quizzer On Accounting Changes, Error Corrections, Cash/Accrual and Single EntryDocument8 pagesAp-100Q: Quizzer On Accounting Changes, Error Corrections, Cash/Accrual and Single EntryJohn Paulo SamonteNo ratings yet

- Auditing Problems Final Term Exam 3.14.2013Document10 pagesAuditing Problems Final Term Exam 3.14.2013Vel JuneNo ratings yet

- Auditing Problems Test Banks - PPE Part 2Document5 pagesAuditing Problems Test Banks - PPE Part 2Alliah Mae ArbastoNo ratings yet

- Aud ProbDocument9 pagesAud ProbKulet AkoNo ratings yet

- May 2020 Error SHE Intangibles Liabilities LeasesDocument14 pagesMay 2020 Error SHE Intangibles Liabilities Leasesiraleigh17No ratings yet

- Auditing Problems-Ppep1Document4 pagesAuditing Problems-Ppep1Par CorNo ratings yet

- Adjusting Entries ProblemsDocument5 pagesAdjusting Entries ProblemsDirck VerraNo ratings yet

- Single Entry & ErrorsDocument3 pagesSingle Entry & ErrorsAlellie Khay D JordanNo ratings yet

- Auditing Problems QaDocument12 pagesAuditing Problems QaSheena CalderonNo ratings yet

- Exercise 1 - HO and Branch (SET A)Document4 pagesExercise 1 - HO and Branch (SET A)Van TaeNo ratings yet

- Auditing Problem ReviewerDocument10 pagesAuditing Problem ReviewerTina Llorca83% (6)

- Acctg 205B Prelim ExamDocument1 pageAcctg 205B Prelim ExamBella AyabNo ratings yet

- ApatDocument10 pagesApatWilliam Leo GasconNo ratings yet

- ExtAud 3 Quiz 5 Wo AnswersDocument8 pagesExtAud 3 Quiz 5 Wo AnswersJANET ILLESESNo ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeMitzi CatemprateNo ratings yet

- BSA4A-Midterm Exam - Questions PDFDocument6 pagesBSA4A-Midterm Exam - Questions PDFRochelleDianRaymundoNo ratings yet

- Exercises For Adjusting EntriesDocument3 pagesExercises For Adjusting EntriesJunmirMalicVillanuevaNo ratings yet

- PA1 Mock ExamDocument18 pagesPA1 Mock Examyciamyr67% (3)

- Qa - Installment SalesDocument3 pagesQa - Installment SalesSittie Ainna Acmed UnteNo ratings yet

- Prelim ExamDocument6 pagesPrelim ExamJessie jorgeNo ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- Afar QuestionsDocument16 pagesAfar Questionspopsie tulalianNo ratings yet

- Compre2 ReviewerDocument6 pagesCompre2 ReviewerMark Joseph OlinoNo ratings yet

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- (Problems) - Audit of Prepayments and Intangible AssetsDocument13 pages(Problems) - Audit of Prepayments and Intangible Assetsapatos0% (1)

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With AnswersFlorie May HizoNo ratings yet

- Error Correction Sample ProblemsDocument42 pagesError Correction Sample ProblemsKatie BarnesNo ratings yet

- 7 Af 301 FaDocument4 pages7 Af 301 FaAsjad RehmanNo ratings yet

- (Problems) - Accounting Policies, Changes in Accounting Estimates, and Prior Period ErrorsDocument9 pages(Problems) - Accounting Policies, Changes in Accounting Estimates, and Prior Period Errorsapatos100% (1)

- UTS Pengantar Akutansi 2Document3 pagesUTS Pengantar Akutansi 2Pia panNo ratings yet

- 8901 Audit of Shareholders Equity Self TestDocument6 pages8901 Audit of Shareholders Equity Self TestYahlianah LeeNo ratings yet

- Quiz Audit of Shareholders Equity 2 PDF FreeDocument10 pagesQuiz Audit of Shareholders Equity 2 PDF FreeRio Cyrel CelleroNo ratings yet

- Problem 1-1 Effect of Counterbalancing and Non-Counterbalancing ErrorsDocument3 pagesProblem 1-1 Effect of Counterbalancing and Non-Counterbalancing ErrorsandreamrieNo ratings yet

- Q1. ProblemsDocument9 pagesQ1. ProblemsAldrin ZolinaNo ratings yet

- Module 5 - PpsDocument4 pagesModule 5 - PpsMIGUEL JOSHUA VILLANUEVANo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Economic Indicators for Eastern Asia: Input–Output TablesFrom EverandEconomic Indicators for Eastern Asia: Input–Output TablesNo ratings yet

- Technical and Vocational Education and Training in the Philippines in the Age of Industry 4.0From EverandTechnical and Vocational Education and Training in the Philippines in the Age of Industry 4.0No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Capturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021From EverandCapturing the Digital Economy—A Proposed Measurement Framework and Its Applications: A Special Supplement to Key Indicators for Asia and the Pacific 2021No ratings yet

- Audit of PPEDocument1 pageAudit of PPEFroilan Arlando BandulaNo ratings yet

- Perpetual Help: University of System DaltaDocument2 pagesPerpetual Help: University of System DaltaFroilan Arlando BandulaNo ratings yet

- Audtheoooo PDFDocument2 pagesAudtheoooo PDFFroilan Arlando BandulaNo ratings yet

- Begun and Held in Metro Manila, On Monday, The Twenty-Third Day of July, Two Thousand EighteenDocument35 pagesBegun and Held in Metro Manila, On Monday, The Twenty-Third Day of July, Two Thousand EighteenFroilan Arlando BandulaNo ratings yet

- Project Teams Are Most Often Challenged byDocument1 pageProject Teams Are Most Often Challenged byFroilan Arlando BandulaNo ratings yet

- Sales Cost of Sales Gross Margin Volume Variance Adjusted Gross MarginDocument1 pageSales Cost of Sales Gross Margin Volume Variance Adjusted Gross MarginFroilan Arlando BandulaNo ratings yet

- Accounting Estimates and JudgmentsDocument1 pageAccounting Estimates and JudgmentsFroilan Arlando BandulaNo ratings yet

- University Registrar: (02) 871-0639 Local 112Document2 pagesUniversity Registrar: (02) 871-0639 Local 112Froilan Arlando BandulaNo ratings yet

- Cash and Cash Equivalents Trade and Other Receivables Inventories Prepaid Expenses Total Current AssetsDocument4 pagesCash and Cash Equivalents Trade and Other Receivables Inventories Prepaid Expenses Total Current AssetsFroilan Arlando BandulaNo ratings yet

- Patria Foods Purchases JournalDocument2 pagesPatria Foods Purchases JournalFroilan Arlando BandulaNo ratings yet

- MidDocument4 pagesMidFroilan Arlando BandulaNo ratings yet

- Chapter IVDocument5 pagesChapter IVFroilan Arlando BandulaNo ratings yet

- Proposed StrategyDocument9 pagesProposed StrategyFroilan Arlando BandulaNo ratings yet

- Guidelines On How To Write A Project ReportDocument2 pagesGuidelines On How To Write A Project ReportFroilan Arlando BandulaNo ratings yet

- College of Business Administration and AccountancyDocument1 pageCollege of Business Administration and AccountancyFroilan Arlando BandulaNo ratings yet

- 7 Reasons Why Relevant Data Is Important To Your OrganizationDocument1 page7 Reasons Why Relevant Data Is Important To Your OrganizationFroilan Arlando BandulaNo ratings yet

- Project Report Semi FinalsDocument6 pagesProject Report Semi FinalsFroilan Arlando BandulaNo ratings yet

- University of Perpetual Help System DALTA: Statement of The ProblemDocument5 pagesUniversity of Perpetual Help System DALTA: Statement of The ProblemFroilan Arlando BandulaNo ratings yet

- Philippine Red Cross (Non-Government Organization) : University of Perpetual Help System DALTADocument15 pagesPhilippine Red Cross (Non-Government Organization) : University of Perpetual Help System DALTAFroilan Arlando BandulaNo ratings yet

- English 1Document2 pagesEnglish 1Froilan Arlando BandulaNo ratings yet

- University of Perpetual Help System DALTA: Las Piñas CampusDocument1 pageUniversity of Perpetual Help System DALTA: Las Piñas CampusFroilan Arlando BandulaNo ratings yet

- For Language UpdatedDocument29 pagesFor Language UpdatedFroilan Arlando BandulaNo ratings yet

- Demerger - An Indian Legal Perspective: Dipen Chatterjee, AdvocateDocument9 pagesDemerger - An Indian Legal Perspective: Dipen Chatterjee, AdvocateKashaf JunaidNo ratings yet

- Ebook On Pensionary Benifits - Indian Air ForceDocument258 pagesEbook On Pensionary Benifits - Indian Air ForceAmarrdiip KumaarrNo ratings yet

- CREDIT TRANS Voluntary Deposits PDIC V CA Et Al G.R. No. 126911. April 30 2003Document3 pagesCREDIT TRANS Voluntary Deposits PDIC V CA Et Al G.R. No. 126911. April 30 2003crystal100% (1)

- Financial Mathematics-NotesDocument40 pagesFinancial Mathematics-Notesfchemtai4966No ratings yet

- Letter of TransmittalDocument33 pagesLetter of TransmittalraselNo ratings yet

- Stages of Development: Dr. Shahid AliDocument37 pagesStages of Development: Dr. Shahid Alishahid aliNo ratings yet

- Correlation ExplainedDocument11 pagesCorrelation ExplainedAlvin Wong100% (1)

- Limitations and Decision of Capital BudgetingDocument10 pagesLimitations and Decision of Capital BudgetingAMAYA.K.P 18BCO406No ratings yet

- No - SO (G) SGA&CD/NBP Loan/2014 Government of Sindh Services, General Administration & Coordination DepartmentDocument8 pagesNo - SO (G) SGA&CD/NBP Loan/2014 Government of Sindh Services, General Administration & Coordination Departmentmus1974No ratings yet

- StudentDocument29 pagesStudentKhang LeNo ratings yet

- APEX AUTO LTD Final Report.Document81 pagesAPEX AUTO LTD Final Report.Vijay Sane0% (1)

- How To Achieve Financial FreedomDocument20 pagesHow To Achieve Financial FreedomDon Rafael100% (7)

- FM09-CH 21Document4 pagesFM09-CH 21Mukul KadyanNo ratings yet

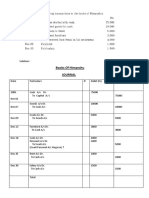

- Books of Himanshu JournalDocument4 pagesBooks of Himanshu Journalrakesh19865No ratings yet

- Chapter 14Document4 pagesChapter 14ks1043210No ratings yet

- QT32017 PDFDocument3 pagesQT32017 PDFMuthu Srinivasan Muthu Selvam0% (1)

- Homework Ch2Document19 pagesHomework Ch2salehin1969No ratings yet

- Forex Candlestick PatternDocument4 pagesForex Candlestick PatternalokNo ratings yet

- Mutual FundDocument14 pagesMutual FundSimmi KhuranaNo ratings yet

- SFM N RTP, MTP, EXAMDocument204 pagesSFM N RTP, MTP, EXAMKuperajahNo ratings yet

- LNG Liquefaction-Not All Plants Are Created EqualDocument19 pagesLNG Liquefaction-Not All Plants Are Created EqualthawdarNo ratings yet

- Ch03 PDFDocument49 pagesCh03 PDFBich VietNo ratings yet

- Why Does Andhra Pradesh Need Special Status?Document18 pagesWhy Does Andhra Pradesh Need Special Status?Sai KrishnaNo ratings yet

- Satyam CaseDocument11 pagesSatyam CaseAshit KelaNo ratings yet

- Ind AS - 21 The Effects of Changes in Foreign Exchange RatesDocument4 pagesInd AS - 21 The Effects of Changes in Foreign Exchange RatesManaswi TripathiNo ratings yet

- MSM Specification: Discrete TimeDocument5 pagesMSM Specification: Discrete TimeNicolas MarionNo ratings yet

- Fileinbox PDFDocument186 pagesFileinbox PDFGaurav GuptaNo ratings yet

- NRI Investments, Taxation and US Compliance - MR Jigar Patel - 2014-01-20Document20 pagesNRI Investments, Taxation and US Compliance - MR Jigar Patel - 2014-01-20AAPIUSANo ratings yet