Professional Documents

Culture Documents

4 The International Monetary System: Chapter Objectives

Uploaded by

Jayant312002 ChhabraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 The International Monetary System: Chapter Objectives

Uploaded by

Jayant312002 ChhabraCopyright:

Available Formats

4

The International Monetary

System

Chapter Objectives

1. To provide an overview of a successful foreign exchange system.

2. To explain how currency demand and supply are determined to achieve

equilibrium in the foreign exchange market.

3. To present a history of the international monetary system, from the gold standard

of the late 19th century to the hybrid exchange system that prevails today.

4. To list major recent crises in the international monetary system, such as the

Mexican peso crisis in December 1994 and the Asian financial crisis in 1997.

5. To discuss the International Monetary Fund and its objectives.

6. To explain the system of special drawing rights and their uses.

7. To describe the purposes, operations, and consequences of the European

Monetary System.

8. To outline recent proposals for international monetary reform.

Chapter Outline

I. Overview

A. The international monetary system consists of laws, rules, institutions,

instruments, and procedures, all of which are involved in the international

transfers of money.

i. The elements above affect foreign exchange rates, international

trade and capital flows, and balance-of-payments adjustments.

B. The international monetary system plays a critical role in the financial

management of multinational businesses and the economic policies of

individual countries.

The Balance of Payments 41

II. A Successful Foreign Exchange System

A. A multinational company’s access to international capital markets and its

ability to move funds across boundaries are subject to national level

constraints.

i. These constraints are often there to meet international monetary

agreements in determining exchange rates.

ii. These constraints are often there to correct a balance-of-payments

deficit or to promote national economic goals.

B. A successful exchange system stabilizes the international payment system

and meets three conditions:

i. Balance-of-payments deficits or surpluses by individual countries

should not be too large or prolonged.

ii. Balance-of-payments deficits are corrected in ways that do not

cause intolerable inflation or physical restrictions on trade and

payments. This applies to individual countries and the world

market.

iii. Expansion of trade and other international economic activities

should be facilitated.

C. Theoretically, continuous balance-of-payments deficits and surpluses

cannot exist.

i. If a system of freely flexible exchange rates exists, the foreign

exchange market will clear itself in the same way a competitive

market for goods does.

ii. If exchange rates are fixed, central banks or other designated

agencies act to absorb surpluses and eliminate deficiencies, thereby

not allowing the exchange market to clear itself.

D. Foreign Exchange Rate Systems

i. A foreign exchange rate is the price of one currency expressed in

terms of another currency.

ii. A fixed exchange rate is an exchange rate which does not fluctuate

or which changes within a predetermined band.

1. “Par Value” is the rate at which a currency is fixed or

pegged.

iii. A flexible exchange rate (also called a floating exchange rate) is an

exchange rate that fluctuates according to market forces.

iv. Flexible Exchange Rate System Advantages

1. Countries can have independent monetary and fiscal

policies.

2. There is flexibility in the system to adjust to external

shocks.

3. Large international reserves do not need to be maintained

to defend the exchange system.

v. Flexible Exchange Rate System Disadvantages

1. Rates are highly unstable, discouraging world trade and

investment.

The Balance of Payments 42

2. This system is inherently inflationary because its removes

the need for discipline in government economic policy.

vi. Fixed Exchange Rate System Disadvantages

1. Rates may be too rigid to deal with major upheavals such

as wars, revolutions, and widespread disasters.

2. Large international reserves need to be maintained to

defend the fixed exchange rate.

3. Fixed exchange rates may result in destabilizing

speculation that causes the exchange rate to overshoot its

natural equilibrium level (e.g. Latin American crisis in the

1980s, Mexican pesos crisis of 1994, and Asian crisis of

1997).

E. Four concepts related to the changing value of a currency:

i. Appreciation is a rise in the value of a currency against other

currencies under a floating rate system.

ii. Depreciation is a decrease in the value of a currency against other

currencies under a floating rate system.

iii. Revaluation is an official increase in the par value of a currency by

the government of that currency under a fixed rate system.

iv. Devaluation is an official reduction in the par value of a currency

by the government of that currency under a fixed rate system.

F. Currency Boards

i. A currency board is a monetary institution that only issues

currency to the extent that it is fully backed by foreign reserves.

ii. This is an extreme version of the fixed exchange rate system.

iii. The exchange rate is fixed not just by policy but also by law.

iv. A country’s reserves are equal to 100 percent of its notes and coins

in circulation.

v. It contains a self-correcting balance of payments mechanism where

a payments deficit automatically contracts the money supply and

thus the amount of spending.

vi. There is no central bank.

vii. Good candidates for currency boards are countries with small,

open economies, countries with a desire to further integrate with a

neighbor or trading partner, or a country with a need to import

monetary stability.

viii. A currency board will not be successful without adequate reserves,

fiscal discipline, and a well-supervised financial system.

G. Dollarization

i. This is the strictest form of the fixed exchange rate system where

the U.S. dollar (or in other less common cases, another major

currency) is used as the official currency of the country.

H. Market Equilibrium

i. There is an inverse relationship between the exchange rate and the

quantity demanded and this explains why the demand curve is

downward sloping.

The Balance of Payments 43

1. When the exchange rate falls, the corresponding quantity

demanded rises.

2. When the exchange rate increases, the corresponding

quantity demanded falls.

ii. There is also a direct relationship between the foreign exchange

rate and the quantity of foreign exchange supplied. This

relationship explains why the supply curve for foreign exchange is

upward sloping.

iii. Where the downward-sloping demand curve and the upward-

sloping supply curve intersect is called the equilibrium exchange

rate (E1) and quantity (Q1).

iv. Demand and supply for foreign exchange change over time,

causing the demand and supply schedules to shift upward or

downward.

1. Factors that cause shifts include relative inflation rates,

relative interest rates, relative income levels, and

government intervention.

I. Prevailing Exchange Rate Arrangements

i. The IMF allows member countries to have an exchange rate

arrangement of their choice, but they must communicate their

arrangement to the IMF.

1. In 2003, 40 countries had exchange arrangements with no

separate legal tender, i.e. the currency of another country

circulates as the sole legal tender or the member belongs to

a monetary or currency union in which the members share

the same legal tender.

2. In 2003, 8 countries had currency board arrangements.

3. In 2003, 40 countries pegged their currency to a currency

basket or a major currency where the exchange rate

fluctuates within a narrow margin of at most plus or minus

1 percent around a central rate.

4. In 2003, 5 countries had a pegged exchange rate with

fluctuations wider than plus or minus one percent around a

central rate.

5. In 2003, 4 countries had crawling pegs whereby the

currency is adjusted periodically in small amounts at a

fixed, preannounced schedule or in response to changes in

selective indicators.

6. In 2003, 6 countries had exchange rates within crawling

bands, where the rate is maintained with a preset

fluctuation margin, and the rate is adjusted relative to the

central rate on a set schedule or in response to changes in

set indicators.

7. In 2003, 42 countries had a floating system where the

monetary authority influences the movements of the

The Balance of Payments 44

exchange rate through unannounced or precommitted

interventions in the foreign exchange markets.

8. In 2003, 41 countries had an independent float where the

exchange rate is market determined and any intervention is

aimed at moderating the rate of change and preventing

undue fluctuations, not at establishing an actual exchange

rate level.

III. The History of the International Monetary System

A. The Pre-1914 Gold Standard: A Fixed Exchange System

i. Pre-1914, most of the major trading nations accepted and

participated in an international monetary system called the gold

standard.

ii. Under this system gold was used as the medium of exchange and a

store of value.

iii. A nation’s monetary unit was defined as a certain weight of gold.

iv. This system worked due to London’s dominance in international

finance and the foundation of the system was the stability of the

British financial system.

B. Monetary Disorder from 1914 to 1945: A Flexible Exchange System

i. World War I disrupted trade patterns and ended the stability of

exchange rates for the major currencies.

ii. Exchange rates fluctuated greatly during this time period.

iii. The U.S. emerged as a leading creditor nation, beginning to

supplant the United Kingdom.

iv. Attempts to reestablish the gold standard failed due to the Great

Depression (1929-1931) and the international financial crisis of

1931.

1. These events prompted countries to devalue their

currencies to stimulate exports.

v. As World War II approached, hostile countries used foreign

exchange controls to finance their war effort.

C. Fixed Exchange Rates (1945-1973): The Bretton Woods Agreement

i. In response to the monetary disorder post WWI, the Bretton

Woods Agreement was signed by 44 countries in 1944.

ii. This agreement established a system of fixed exchange rates

relative to a currency of reference, typically the U.S. dollar.

iii. It also created the IMF and World Bank.

1. The IMF provides short-term balance-of-payments

adjustment loans.

2. The World Bank provides long-term development and

reconstruction loans.

iv. The purpose of the system was to expand world trade.

v. Under this system, the U.S. dollar became the standard of value.

1. It was convertible into gold at $35 per ounce.

The Balance of Payments 45

vi. A currency was permitted to fluctuate within plus or minus 1

percent of par value and it could be devalue up to 10 percent

without formal approval by the IMF.

D. Breakdown of the Bretton Woods System

i. Depreciation and appreciation rarely occurred under Bretton

Woods.

ii. In the 1960s and early 1970s, the U.S. balance-of-payments deficit

exploded. This depleted U.S. gold reserves.

iii. In 1971 the dollar had to be devalued and it was devalued again in

1973.

iv. In August of 1971, President Nixon stated four points regarding

U.S. monetary problems (without IMF consultation):

1. Suspended the conversion of dollars into gold.

2. Permitted the dollar to float relative to other currencies.

3. Imposed a 10% charge on most imports.

4. Imposed direct control on wages and prices.

E. The Smithsonian Agreement

i. The leading trading nations, the group of ten, introduced this

agreement on December 18, 1971 in response to increased trade

and exchange controls.

ii. The U.S. agreed to devalue the dollar from $35 per ounce to $38.

iii. In return, other countries agreed to revalue their currencies against

the dollar.

iv. The trading band was increased from 1% to 2.25%.

v. The agreement failed to reduce speculation or government control

of foreign exchange.

vi. The agreement collapsed in March of 1973 and this was the

practical end of the pegged rate system originating in Bretton

Woods in 1944.

F. Post 1973: The Dirty Floating System

i. In this system, daily exchange rates are the way of life.

ii. The system is marked by more volatile and less predictable

exchange rates.

iii. Since 1973, most industrial and many developing countries have

permitted their currencies to float with frequent government

intervention in the exchange market.

iv. This system is known as free float, managed float, dirty float,

partial float, etc.

G. Jamaica Agreement of 1976

i. This agreement formalized the system of floating exchange rates

by changing IMF articles to allow them.

ii. This officially ends the pegged system based on gold.

H. Plaza Agreement and Louvre Accord

i. The dollar had a spectacular rise from 1980 to 1985 and a

spectacular fall from 1985 to 1988.

The Balance of Payments 46

ii. This slide was caused by the Plaza Agreement of September 1985

where the group of five (US, France, Japan, UK, and West

Germany) announced that it would be desirable for major

currencies to appreciate against the US dollar.

iii. The Plaza Agreement worked too well and, in February 1987, the

countries met again at the Louvre in France and reached the

Louvre Accord.

iv. In this accord, they agreed that exchange rates had been

sufficiently realigned and pledged to support stable exchange rates.

I. September 1992 Currency Crisis in Europe

i. The European Monetary System (EMS) had been set up the Treaty

of Maastricht in December of 1991.

ii. By September of 1992, the EMS faced problems as Britain and

Italy both announced that they were withdrawing from the EMS

because their currencies had fallen below the floor set by the

system.

iii. Europe’s major central banks lost around $6 billion in their attempt

to support weak currencies. In the end, many analysts doubted that

the movement toward European integration would continue.

iv. The crisis was caused by Germany’s central bank raising short-

term interest rates to between 8 and 9 percent in response to

inflation problems generated by reunification. This tight-money

policy created problems for Europe’s weaker economies, which

were forced to impose similarly high, if inappropriate, interest

rates due to their linked currency.

J. July 1993 Currency Crisis in Europe.

i. High levels of currency selling forced European governments to

abandon their system of managing exchange rates.

ii. The crisis was triggered by Germany’s central bank’s decision not

to lower its discount rate.

iii. It was agreed to widen the bands within which member countries’

currencies could fluctuate against other member countries’

currencies from plus or minus 2.25% to a band of 15%.

iv. This was in effect a free float.

v. This solution worked fairly well and helped prepare Europe for the

Euro launch in 1999 and complete introduction in 2002.

K. Mexican Peso Crisis in December of 1994

i. In December of 1994, Mexico faced a balance-of-payment crisis.

ii. Investors lost confidence in the government’s ability to maintain

the exchange rate of the peso within its trading band.

iii. Mexico’s international reserves were threatened.

iv. Mexico devalued the peso against the dollar by 14 percent on

December 20th. This resulted in a panic situation and mass selling

of pesos.

v. This panic spread to other Latin American currencies – the

“tequila” effect.

The Balance of Payments 47

vi. This resulted in Mexico floating the peso.

vii. On Janaury 31st, 1995 the IMF and U.S. government put together a

$50 billion package to bail out Mexico.

L. Asian Financial Crisis in 1997

i. A currency crisis started in July 1997, first in Thailand, then

spreading to other countries in Asia and eventually to Latin

America.

ii. One third of the globe was pushed into recession and hundreds of

banks, builders, and manufacturers went bankrupt.

iii. The IMF arranged an emergency rescue packages for Thailand,

Indonesia, Korea, Russia, and Brazil.

IV. The International Monetary Fund (IMF)

A. It was created as a weak central banks’ central bank by the Bretton Woods

agreement.

B. It started with 30 countries but now has 180. It has five objectives:

i. To promote international monetary cooperation.

ii. To facilitate the balanced growth of international trade.

iii. To promote exchange stability.

iv. To eliminate exchange restrictions.

v. To create standby reserves.

C. Each member country can exchange their own currencies for the

convertible currencies of other member countries to meet short-term

payment difficulties.

i. The reserve is defined in relation to each member’s quota and the

amount is based on trade, national income, and international

payments.

ii. 100% of a member’s quota can be drawn at any time and this is

called the reserve tranche.

iii. An additional 100% of a member’s quota can be borrowed and this

is called the credit tranche.

D. Voting rights in the IMF start at 250 basic votes plus additional votes

determined by quota size.

i. The U.s. has the largest quota and therefore has close to 20 percent

of the total votes.

E. Special Drawing Rights are an artificial international reserve created in

1970.

i. A simplified basket of several major currencies is used to

determine the SDRs daily valuation.

ii. The IMF, member countries, and about 20 organizations are

official holders of SDRs. Each of these institutions can acquire

and use SDRs in transactions and operations with other prescribed

holders and IMF members.

iii. Holders and IMF members can buy and sell SDRs both spot and

forward; SDRs can be borrowed, lended, and pledged; SDRs can

be used in swaps; and SDRs can be used to make grants.

V. The European Monetary Union

The Balance of Payments 48

A. A monetary union is a formal arrangement in which two or more

independent countries agree to fix their exchange rates or to employ only

one currency to carry out all transactions.

i. Countries of the Central African France zone and the Eastern

Caribbean Currency Union both have a monetary union.

B. Europe has been moving toward a European Monetary Union (EMU)

since 1957. Full Union started on January 1, 2002, when the Euro was

introduced.

C. In May 1972, the EEC pegged their currencies and only allowed them to

fluctuate a maximum of 2.25% against one another. The Smithsonian

Agreement only allowed a 4.5% fluctuation band with currencies not in

the EEC.

i. This was referred to as a snake (2.25%) within a tunnel (4.5%).

ii. In 1972 a series of international monetary crises forced the end of

the tunnel. EEC countries tried to maintain the snake, but failed.

D. On December 5, 1978 the EEC adopted a resolution to establish the EMS

(European Monetary System).

i. This went into effect on March 13, 1979.

ii. The European Currency Unit (ECU) was the foundation of the

EMS.

1. The value of the ECU was a weighted average value of a

basket of all EEC currencies.

2. It was based on fixed, but adjustable, exchange rate system,

with each currency having a central rate in terms of ECUs.

iii. Most countries were allowed to fluctuate in a 2.25% band from

their central rates.

iv. A number of currency crises forced EU governments to drastically

widen the band in July 1993.

v. To facilitate compulsory intervention, EMS created short-term and

medium-term financing.

E. The former EEC, now the EU, began the process of switching from the

ECU to the Euro Zone in December 1991 with the signing of the

Maastricht Treaty.

i. The Maastricht Treaty specified a timetable to create a monetary

union and establish the Euro by January 1st of 1999.

ii. It also agreed to have an independent European central bank

responsible for a common monetary policy.

iii. Despite crises in September of 1992 and July of 1993, the EU staid

the course of financial and economic integration.

iv. To join the monetary union, five criteria had to be met:

1. An inflation rate no more than 1.5% above the average of

the lowest three inflation countries.

2. A long-term government bond rate that is no more than 2%

above the average bond rate of the lowest three inflation

countries.

3. A deficit that does not exceed 3% of its GDP.

The Balance of Payments 49

4. A government debt that does not exceed 60% of its GDP.

5. An exchange rate that has stayed within the plus or minus

2.25% band for at least the last two years.

v. The Euro Zone began on January 1, 199 with 11 of the EU’s 15

members qualifying and choosing to join.

F. The Introduction of the Euro

i. The Euro is considered the most important international monetary

system development since the Bretton Woods Agreement

collapsed in 1973.

ii. The Euro began being used by the European Central Bank (ECB),

national government, banks, and some businesses on January 1,

1999.

iii. On January 1, 2002 Euro bank notes and coins were issued and, by

February 2002, Europe had one single currency.

iv. The Euro eliminates exchange rate risk for Euro Zone countries

and increased price transparency.

v. The Euro encourages trade and eliminates currency costs.

vi. The ECB sets monetary policy for the Euro using countries.

1. The key aim of the ECB is price stability, as mandated by

the Maastricht Treaty.

vii. Since inception, the Euro first depreciated against the U.S. dollar,

but, since the beginning of 2002, the Euro has begun to appreciate

against the dollar.

VI. Proposals for Further International Monetary Reform

A. The Bretton Woods Agreement had three basic defects:

i. Pegged parities.

ii. Dollar disequilibrium

iii. In adequate international reserves.

iv. Special drawing rights, the Smithsonian Agreement, the snake

within a tunnel, and the EMS were introduced to solve these

defects, but they have been inadequate.

B. When the fixed exchange rate system was abandoned in 1973, economists

were hopeful that exchange rates would be stable under a flexible

exchange system due to market pressure.

i. The reality is that the flexible system resulted in more a more

volatile exchange rate market and higher trade balances.

ii. A consensus has grown that the world should return to stable but

flexible policy rules.

C. Freely Flexible Exchange Rates.

i. A return to a fixed exchange rate, such as the gold standard, is now

impossible.

ii. Fixed but adjustable exchange rates could not meet the needs of

the highly diversified modern world economies. There are too

many differences between countries.

iii. A freely flexible exchange rate system may help countries to solve

their payments problems.

The Balance of Payments 50

D. A Wider Band.

i. Some propose using a band that is greater than the 4.5% used

under the Smithsonian Agreement.

E. A Crawling Peg.

i. This would prove for regular movements of the par value upon an

agreed upon formula.

ii. A crawling peg would provide stability to the system and still

allow countries to move their currency instead of fighting to

protect a band around a par value.

F. A Crawling Band

i. This would combine a wider band and a crawling peg.

ii. This compromises between the inflexible exchange rates of the

gold standard and a system of completing fluctuating exchange

rates.

iii. Each parity level would be adjusted as a moving average of the

actual exchange rates that could fluctuate within a moving band.

G. Other Proposals:

i. Creation of a supercentral institution to perform the same function

for the international community as the commercial banking system

serves for a domestic economy.

ii. Creation of international reserves by an international institution

such s the IMF.

iii. Enlarging the number of reserve countries, thereby reducing the

exchange risk.

VII. Summary

Key Terms and Concepts

International monetary system consists of laws, rules, institutions, instruments, and

procedures which involve international transfers of money.

Foreign Exchange Rate is the price of one currency expressed in another currency.

Fixed Exchange Rate is an exchange rate which does not fluctuate or which changes

within a predetermined band.

Par Value is the rate at which the currency is fixed or pegged.

Flexible Exchange Rate is an exchange rate that fluctuates according to market forces.

Appreciation is a rise in the value of a currency against other currencies under a floating

rate system.

The Balance of Payments 51

Depreciation is a decrease in the value of a currency against other currencies under a

floating rate system.

Revaluation is an official increase in the value of a currency by the government of that

currency under a fixed rate system.

Devaluation is an official reduction in the par value of a currency by the government of

that currency under a fixed rate system.

Currency board is a monetary institution that only issues currency to the extent it is

fully backed by foreign reserves.

Gold standard is an international monetary system where countries use gold as a

medium of exchange and a store of value.

Bretton Woods Agreement is an agreement signed by the representatives of 44

countries at the Bretton Woods, New Hampshire, in 1994 to establish a system of fixed

exchange rates.

International Monetary Fund (IMF) was created as a weak kind of central banks'

central bank at the Bretton Woods conference to make the new monetary system feasible

and workable.

Special Drawing Rights (SDRs) became an international reserve asset on July 28, 1969,

when more than the required 85 percent of the IMF members approved the plan.

Monetary Union is a formal arrangement in which two or more independent countries

agree to fix their exchange rates or to employ only one currency to carry out all

transactions.

Euro is a new currency unit, which replaced the individual currencies of the European

Union, that was introduced over a three year period from 1999 to 2002.

Crawling Peg is a proposal that would provide for regular modification of par value

according to a agreed-upon formula.

Crawling Band or the gliding band is a proposal that combines a wider band and a

crawling peg.

Multiple Choice Questions

1. Which of the following is not one of advantages for a flexible exchange rate system?

A. countries can maintain independent monetary policy

B. exchange rates under a flexible system are unstable

C. countries can maintain independent fiscal policy

The Balance of Payments 52

D. flexible exchange rates permit a smooth adjustment

E. Central banks do not need to maintain large reserves

2. Under the purely fluctuating exchange rate system, the balance of payments

imbalances are automatically corrected by the following mechanism .

A. speculation

B. government intervention

C. interest rate changes

D. supply and demand in exchange markets

E. none of the above

3. Which of the following is not directly related to the Bretton Woods system?

A. 1944

B. the fixed exchange rate system

C. the bank of England

D. the International Monetary Fund

E. the World Bank

4. Which of the following is not directly attributable to the collapse of the fixed

exchange rate system?

A. U.S. balance of payments deficits

B. the decrease in the U.S. dollar value

C. the decline of international reserves

D. Japan's trade surplus

E. none of the above

5. The Group of Ten got together at the Smithsonian Institution to agree on a wider band

system so that exchange rates can fluctuate .

A. 5% above and below the central rate

B. 2.25% above and below the central rate

C. 2% above and below the central rate

D. 4% above and below the central rate

E. 10% above and below the central rate

6. The Jamaican Agreement was held to amend the Bretton Woods Agreement of the

fixed exchange rate system in .

A. 1973

B. 1975

C. 1976

D. 1978

E. 1979

7. Factors that cause demand and supply schedules for foreign exchange to shift include:

A. relative inflation rates

B. relative interest rates

C. different welfare systems

The Balance of Payments 53

D. relative income levels

E. government intervention

8. The July 1993 currency crisis in Europe caused the European Monetary System to

widen the bands within which member currencies could fluctuate against other

member currencies, to of a central value.

A. 14%

B. 15%

C. 16%

D. 17%

E. 18%

9. Which of the following countries is not a member of the G-7 Group?

A. the United States

B. Italy

C. the United Kingdom

D. Switzerland

E. Japan

10. The objectives of the International Monetary Fund (IMF) are .

A. to promote international monetary cooperation

B. to promote exchange stability

C. to create standby reserves

D. all of the above

E. none of the above

11. Since 1976, each member of the International Monetary Fund (IMF) has been

required to contribute % of its quota in its own currency and % in Special

Drawing Rights or convertible currencies.

A. 25; 75

B. 50; 50

C. 75; 25

D. 90; 10

E. 95; 5

12. The reserve tranche of the International Monetary Fund (IMF) means that by

exchanging their own currencies for convertible currencies, a member country may

draw % of its quota.

A. 25

B. 50

C. 75

D. 80

E. 100

13. Which of the following is not a SDR component currency?

The Balance of Payments 54

A. U.S. dollar

B. euro

C. Swiss franc

D. Japanese yen

E. British pound

14. Which of the following is not a rational for a regional, Asian Monetary Fund?

A. Any IMF support package is not sufficient in a case of currency crisis for middle-

income countries, such as the East Asian countries.

B. Contagions of currency crisis tend to be geographically concentrated.

C. East Asian countries are underrepresented in the quota formula of the IMF.

D. The IMF has grown to powerful and needs to have its influence limited.

E. Both regional surveillance and peer pressures are important in an attempt to

prevent a currency crisis.

15. Special drawing rights are used to settle payments by the following organizations

except

A. IMF member countries

B. prescribed organizations

C. central banks

D. multinational corporations

E. A, B, and C

16. SDR interest rates are the weighted average interest rate of .

A. given short-term rates

B. SDR countries

C. Treasury Bill rates

D. certificate of deposits (CD) rates

E. IMF member countries

17. The euro began public circulation in ____.

A. 1999

B. 2000

C. 2001

D. 2003

E. 2002

18. The positive effects of the introduction of the euro include:

A. It eliminates exchange rate risk between euro-zone countries.

B. It increases both inflation and government spending.

C. It facilitates cross-border prices comparisons.

D. A and C.

E. All of the above.

19. The managed floating exchange system was established in .

The Balance of Payments 55

A. 1969

B. 1973

C. 1976

D. 1979

E. 1980

20. The decline of the U.S. dollar value in the late 1980s was mainly attributable to the

following agreement .

A. Louvre Accord

B. Plaza Accord

C. Smithsonian Agreement

D. Jamaica Agreement

E. None of the above

21. The Asian currency crisis in 1997 started in .

A. Korea

B. Thailand

C. Indonesia

D. Hong Kong

E. Philippines

22. The September 1992 currency crisis in Europe was rooted in .

A. the British currency action

B. the increase in German interest rate

C. the Danish election

D. the French currency policy

E. all of the above

23. The proposal under which a par value of a currency is adjusted intermittently is

referred to as a .

A. wide band

B. narrow band

C. crawling peg

D. crawling band

E. gliding band

24. The quota allotted to a member country of the IMF, which it can borrow at will, is

known as tranche.

A. gold

B. basic

C. member

D. credit

E. reserve

25. Economists regard the creation of the Euro as a new European currency in the

international monetary system as the most important development since .

The Balance of Payments 56

A. 1953

B. 1963

C. 1973

D. 1983

E. 1993

26. A country may link its exchange rate to the value of a major currency, usually the

U.S. dollar or the French franc. This is called .

A. a currency par

B. a currency peg

C. a currency composite

D. a currency basket

E. none of the above

27. If and when the value of the Japanese yen against the U.S. dollar goes up 15%, it

affects the following items .

A. the price of imported Japanese cars

B. the price of Japanese cameras

C. the price of Japanese pearls sold in Troy, Ohio

D. the price of a Sharp copier in Detroit

E. all of the above

Answers

Multiple Choice Questions

1. B 10. D 19. B

2. D 11. C 20. B

3. C 12. E 21. B

4. D 13. C 22. B

5. B 14. D 23. C

6. C 15. D 24. E

7. C 16. B 25. C

8. B 17. E 26. D

9. D 18. D 27. E

The Balance of Payments 57

You might also like

- Chapter SummaryDocument4 pagesChapter SummaryIndri FitriatunNo ratings yet

- IMS (Last)Document29 pagesIMS (Last)Mehdi SamNo ratings yet

- Multinational Business Finance: Fifteenth EditionDocument55 pagesMultinational Business Finance: Fifteenth Editionmuhammad faraz channaNo ratings yet

- Chapter 11: The International Monetary System: True / False QuestionsDocument45 pagesChapter 11: The International Monetary System: True / False QuestionsQuốc PhúNo ratings yet

- FINS 3616 Tutorial Questions-Week 2 - AnswersDocument5 pagesFINS 3616 Tutorial Questions-Week 2 - AnswersJethro Eros Perez100% (1)

- CH 10Document43 pagesCH 10Abdulrahman AlotaibiNo ratings yet

- Fixed and Floating Exchange Rate.Document31 pagesFixed and Floating Exchange Rate.vikas0100% (1)

- Dwnload Full Multinational Business Finance 14th Edition Eiteman Solutions Manual PDFDocument36 pagesDwnload Full Multinational Business Finance 14th Edition Eiteman Solutions Manual PDFkerdonjawfarm100% (12)

- 5 The Foreign Exchange Market and Parity Conditions: Chapter ObjectivesDocument15 pages5 The Foreign Exchange Market and Parity Conditions: Chapter Objectiveslala loopsyNo ratings yet

- Module 8 Open Economy PDFDocument60 pagesModule 8 Open Economy PDFjay gargNo ratings yet

- Ffixed and Flexible RatesDocument3 pagesFfixed and Flexible RatesKhushi TrivediNo ratings yet

- What Are The Main Advantages and Disadvantages of Fixed Exchange RatesDocument4 pagesWhat Are The Main Advantages and Disadvantages of Fixed Exchange RatesGaurav Sikdar0% (1)

- Solution Manual For Multinational Business Finance 15th by EitemanDocument38 pagesSolution Manual For Multinational Business Finance 15th by Eitemanwarpingmustacqgmael89% (18)

- Currency Markets-2Document24 pagesCurrency Markets-2Nandini JaganNo ratings yet

- Solution Manual For Fundamentals of Multinational Finance 5Th Edition by Moffett Isbn 978020598975 Full Chapter PDFDocument30 pagesSolution Manual For Fundamentals of Multinational Finance 5Th Edition by Moffett Isbn 978020598975 Full Chapter PDFsusan.lemke155100% (11)

- Int Mo SystemDocument5 pagesInt Mo Systemdarla85nagarajuNo ratings yet

- Ch02 Questions and Problems AnswersDocument2 pagesCh02 Questions and Problems AnswersjwbkunNo ratings yet

- Advantages N Disadvantages of Fixed Xchange RateDocument3 pagesAdvantages N Disadvantages of Fixed Xchange RateMohammad FaizanNo ratings yet

- Micro and Macro Economics: Submitted By: Joshua J. ValeteDocument3 pagesMicro and Macro Economics: Submitted By: Joshua J. ValeteAloyNo ratings yet

- Unit 1Document19 pagesUnit 1VINAY BETHANo ratings yet

- FINS 3616 Tutorial Questions-Week 2Document7 pagesFINS 3616 Tutorial Questions-Week 2Alex WuNo ratings yet

- Foreign Exchange Markets RBI SEBIDocument8 pagesForeign Exchange Markets RBI SEBIDeepak ModiNo ratings yet

- Tutorial 5-SolutionsDocument4 pagesTutorial 5-SolutionsSruenNo ratings yet

- Chapter 2 - The International Monetary SystemDocument12 pagesChapter 2 - The International Monetary SystemVũ Trần Nhật ViNo ratings yet

- International Financial Management NotesDocument5 pagesInternational Financial Management NotesAditi SarangiNo ratings yet

- Adobe Scan 16 Nov 2022Document3 pagesAdobe Scan 16 Nov 2022Kuvam BansalNo ratings yet

- Unit 10 Merits and Demerits of Fixed and Flexible Foreign Exchange Rates. Merits of Fixed Exchange RateDocument2 pagesUnit 10 Merits and Demerits of Fixed and Flexible Foreign Exchange Rates. Merits of Fixed Exchange RateSenthil Kumar GanesanNo ratings yet

- History/ Stages On International Monetary SystemDocument9 pagesHistory/ Stages On International Monetary SystemsivakaranNo ratings yet

- Unit ViDocument13 pagesUnit VisudhanshuNo ratings yet

- International Monetary System: Unit HighlightsDocument24 pagesInternational Monetary System: Unit HighlightsBivas MukherjeeNo ratings yet

- Chap 29Document18 pagesChap 29Syed HamdanNo ratings yet

- Exchange Rate Movements: Changes in ExportsDocument11 pagesExchange Rate Movements: Changes in ExportsamitNo ratings yet

- Unit - 4: Exchange Rate and Its Economic Effects: Learning OutcomesDocument20 pagesUnit - 4: Exchange Rate and Its Economic Effects: Learning Outcomesganeshnavi2008No ratings yet

- Chapter 11 Foreign Exchnage RateDocument3 pagesChapter 11 Foreign Exchnage Rateayushsingh7173No ratings yet

- Corn Laws Class 10 Social Science Extremely Simple and DetailedDocument9 pagesCorn Laws Class 10 Social Science Extremely Simple and DetailedwinNo ratings yet

- UNIT-6: International Trade and Institutions: What Is A 'Closed Economy?'Document13 pagesUNIT-6: International Trade and Institutions: What Is A 'Closed Economy?'anushreeNo ratings yet

- Chap 10Document4 pagesChap 10khanhnguyenfgoNo ratings yet

- Foreign Exchange &Document13 pagesForeign Exchange &Amal JerryNo ratings yet

- Presentation 1Document16 pagesPresentation 1vincentlikongweNo ratings yet

- Aabss 49-57Document9 pagesAabss 49-57Martha MagallanesNo ratings yet

- Salvatore Study-Guide Ch21Document8 pagesSalvatore Study-Guide Ch21jesNo ratings yet

- Chap 11Document88 pagesChap 11NgơTiênSinhNo ratings yet

- International Business FunvtionsDocument52 pagesInternational Business FunvtionsJustine FigueroaNo ratings yet

- Module 5 Foreign Exchange MarketDocument19 pagesModule 5 Foreign Exchange MarketjinalNo ratings yet

- Unit 1Document31 pagesUnit 1PSBALARAMNo ratings yet

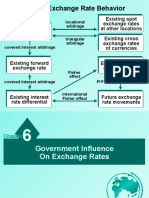

- Part II Exchange Rate Behavior: Locational Arbitrage Triangular Arbitrage Covered Interest ArbitrageDocument14 pagesPart II Exchange Rate Behavior: Locational Arbitrage Triangular Arbitrage Covered Interest Arbitragemajid aliNo ratings yet

- International Monetary SystemDocument16 pagesInternational Monetary Systemriyaskalpetta100% (2)

- Chapter 6 - Government Influences On Exchange RateDocument40 pagesChapter 6 - Government Influences On Exchange RatePháp NguyễnNo ratings yet

- The Exchange Rates and International Monetary EnvironmentDocument22 pagesThe Exchange Rates and International Monetary EnvironmentishaqNo ratings yet

- Flexible Versus Fixed Exchange Rates, The European Monetary System, and Macroeconomic Policy CoordinationDocument11 pagesFlexible Versus Fixed Exchange Rates, The European Monetary System, and Macroeconomic Policy CoordinationDeanNo ratings yet

- Foreign ExchangeDocument3 pagesForeign Exchangeatharva1760No ratings yet

- International Financial Management: by Jeff MaduraDocument32 pagesInternational Financial Management: by Jeff MaduraBe Like ComsianNo ratings yet

- International Finance Midterm TopicsDocument13 pagesInternational Finance Midterm TopicsAnisa TasnimNo ratings yet

- Measuring The Exchange RateDocument9 pagesMeasuring The Exchange Ratejoebloggs1888No ratings yet

- Module 3 The International Monetary SystemDocument37 pagesModule 3 The International Monetary SystemEirene VizcondeNo ratings yet

- International Monetary SystemsDocument23 pagesInternational Monetary SystemsTharshiNo ratings yet

- International BankingDocument62 pagesInternational BankingDjSunil SkyNo ratings yet

- BT Nhóm nhỏDocument4 pagesBT Nhóm nhỏMai AnhNo ratings yet

- International Finance Ass 2Document5 pagesInternational Finance Ass 2Sugen RajNo ratings yet

- Colgate-Palmolive (India) : Elevated Margins To SustainDocument7 pagesColgate-Palmolive (India) : Elevated Margins To SustainJayant312002 ChhabraNo ratings yet

- 12 International Banking Issues and Country Risk Analysis: Chapter ObjectivesDocument16 pages12 International Banking Issues and Country Risk Analysis: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- 12 International Banking Issues and Country Risk Analysis: Chapter ObjectivesDocument16 pages12 International Banking Issues and Country Risk Analysis: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- 11 International Financial Markets: Chapter ObjectivesDocument19 pages11 International Financial Markets: Chapter ObjectivesrohitkalidasNo ratings yet

- 10 Translation Exposure Management: Chapter ObjectivesDocument11 pages10 Translation Exposure Management: Chapter ObjectivesPradip RathiNo ratings yet

- The Hyderabadi Biryani House 2020Document12 pagesThe Hyderabadi Biryani House 2020Jayant312002 ChhabraNo ratings yet

- The Hyderabadi Biryani House 2020Document12 pagesThe Hyderabadi Biryani House 2020Jayant312002 ChhabraNo ratings yet

- Internationalcapitalbudgeting Slides 110216232856 Phpapp01Document23 pagesInternationalcapitalbudgeting Slides 110216232856 Phpapp01MadhurGuptaNo ratings yet

- 15 International Working Capital Management: Chapter ObjectivesDocument16 pages15 International Working Capital Management: Chapter ObjectivesNancy DsouzaNo ratings yet

- CH19 SguideDocument14 pagesCH19 Sguidezyra liam stylesNo ratings yet

- CH13 SguideDocument16 pagesCH13 SguidePreetam Edwin LakraNo ratings yet

- Currency OptionsDocument13 pagesCurrency OptionsKaren YungNo ratings yet

- 14 Financing Foreign Investment: Chapter ObjectivesDocument18 pages14 Financing Foreign Investment: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- Chapter 18Document21 pagesChapter 18BarakaNo ratings yet

- 17 Corporate Strategy and Foreign Direct Investment: Chapter ObjectivesDocument13 pages17 Corporate Strategy and Foreign Direct Investment: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- 20 Corporate Performance of Foreign Operations: Chapter ObjectivesDocument21 pages20 Corporate Performance of Foreign Operations: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- CH02 SguideDocument16 pagesCH02 Sguiderituraj8No ratings yet

- SSRN Id2869426 PDFDocument47 pagesSSRN Id2869426 PDFJayant312002 ChhabraNo ratings yet

- Itc Q2fy20Document9 pagesItc Q2fy20Jayant312002 ChhabraNo ratings yet

- Global Corporate Finance: Text and Cases: Study Guide To AccompanyDocument16 pagesGlobal Corporate Finance: Text and Cases: Study Guide To AccompanyJayant312002 ChhabraNo ratings yet

- 16 International Portfolio Investment: Chapter ObjectivesDocument14 pages16 International Portfolio Investment: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- 3 The Balance of Payments: Chapter ObjectivesDocument12 pages3 The Balance of Payments: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- RIBAF FulllegthpaperDocument16 pagesRIBAF FulllegthpaperJayant312002 ChhabraNo ratings yet

- IDFC First BankDocument10 pagesIDFC First BankJayant312002 ChhabraNo ratings yet

- 5 6077888918710124813Document5 pages5 6077888918710124813Jayant312002 ChhabraNo ratings yet

- ItcstockDocument7 pagesItcstockJayant312002 ChhabraNo ratings yet

- Tafersterm PDFDocument39 pagesTafersterm PDFJayant312002 ChhabraNo ratings yet

- Chava Kim and Weagley PDFDocument66 pagesChava Kim and Weagley PDFJayant312002 ChhabraNo ratings yet

- TimetechnostockDocument9 pagesTimetechnostockJayant312002 ChhabraNo ratings yet

- What To Remember in ForexDocument5 pagesWhat To Remember in ForexVola AriNo ratings yet

- CV Fifa Jaya Sport - Memorial JournalDocument6 pagesCV Fifa Jaya Sport - Memorial JournalMiskaNo ratings yet

- Macro LEC06Document45 pagesMacro LEC06Kc NgNo ratings yet

- CFAS Chapter 4 - Cash and Cash EquivalentsDocument3 pagesCFAS Chapter 4 - Cash and Cash EquivalentsAngelaMariePeñarandaNo ratings yet

- Indian Economic Development Qus With AnswerDocument8 pagesIndian Economic Development Qus With AnswerTanishka SoniNo ratings yet

- Canadian Payment Systems PowerpointDocument11 pagesCanadian Payment Systems PowerpointPrinting CommitteeNo ratings yet

- DIvya Agency Qpds AUGST 2023.Document33 pagesDIvya Agency Qpds AUGST 2023.Hanif ShaikhNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Sajine DNo ratings yet

- Bigdataeconomics EuropeanCommission LUX R Di Francesco 2015 01 08 Publish PDFDocument24 pagesBigdataeconomics EuropeanCommission LUX R Di Francesco 2015 01 08 Publish PDFYusi YosepNo ratings yet

- Foreign Trade Performance AnalysisDocument18 pagesForeign Trade Performance AnalysisSahil ChopraNo ratings yet

- A Self-Reliant and Independent Economic OrderDocument14 pagesA Self-Reliant and Independent Economic OrderJen DeeNo ratings yet

- ACCOUNTING 223n - Terminal OutputDocument6 pagesACCOUNTING 223n - Terminal OutputAys KopiNo ratings yet

- History of TaxationDocument12 pagesHistory of TaxationHai Bui thiNo ratings yet

- Mini Project - 230526 - 202710Document56 pagesMini Project - 230526 - 202710KIRTI BHASINNo ratings yet

- Clarity Inquiry #jqn39d08gqDocument15 pagesClarity Inquiry #jqn39d08gqChristopher IknerNo ratings yet

- IGCSE Economics Discuss Question NotesDocument12 pagesIGCSE Economics Discuss Question NotesAliya KNo ratings yet

- Anti-Dumping & Antisubsidy Measures: FaqsDocument6 pagesAnti-Dumping & Antisubsidy Measures: FaqsRaunak ChaudhuryNo ratings yet

- InvoiceDocument1 pageInvoicebshari93_918887308No ratings yet

- Ex 400-1 1ST BLDocument1 pageEx 400-1 1ST BLkeralainternationalNo ratings yet

- Effects of Inflation AlchianDocument18 pagesEffects of Inflation AlchianCoco 12No ratings yet

- Vasant Farm Fresh Reducing Food Wastage v2Document5 pagesVasant Farm Fresh Reducing Food Wastage v2smpbl12.afreensNo ratings yet

- Accounts r1201Document276 pagesAccounts r1201林和鋟No ratings yet

- 12th Balance of Payment MCQsDocument41 pages12th Balance of Payment MCQsrimjhim sahuNo ratings yet

- Regionalism vs. Multilateralism?Document10 pagesRegionalism vs. Multilateralism?hb1988No ratings yet

- Chapter 2Document11 pagesChapter 2Aanchal ParkerNo ratings yet

- Trade UnionsDocument28 pagesTrade Unionssimply_coool100% (5)

- Pondicherry Sunday Market: A Paradise For BibliophilesDocument4 pagesPondicherry Sunday Market: A Paradise For BibliophilesSuriya ArNo ratings yet

- If - Review MT - CompressedDocument24 pagesIf - Review MT - CompressedPhương AnhNo ratings yet

- ch14 ExercisesDocument10 pagesch14 ExercisesAriin TambunanNo ratings yet

- 國際快捷託運單Document3 pages國際快捷託運單Broundo ChungNo ratings yet