Professional Documents

Culture Documents

ACC00724 (Accounting For Managers) S2, 2016 Assignment 1 (20 Marks)

Uploaded by

Asfawosen DingamaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACC00724 (Accounting For Managers) S2, 2016 Assignment 1 (20 Marks)

Uploaded by

Asfawosen DingamaCopyright:

Available Formats

ACC00724 (Accounting for Managers) S2, 2016

ASSIGNMENT 1 (20 MARKS)

Question 1 Total marks for Q1. (10 marks)

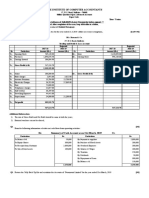

Financial statements of Nimbin Pty Ltd are presented below:

Nimbin P/L

Statement of Financial Position

As at 30 June 2015 and 2016

($000)

2016 2015

Current assets

Cash and cash equivalents $1,645 $2,110

Accounts receivables (all trades) 4,100 3,675

Inventories 7,000 6,930

______ _____

Total current assets 12,745 12,715

______ ______

Non-current assets

Property, plant and equipment 17,190 15,330

_______ ______

Total non-current assets 17,190 15,330

_______ _______

Total assets $29,935 $28,045

======= ======

Current liabilities

Payables $5,780 $5,990

_______ ______

Total current liabilities 5,780 5,990

_______ ______

Non-current liabilities

Interest-bearing liabilities 9,940 9,450

_______ _____

Total non-current liabilities 9,940 9,450

_______ _______

Total liabilities $15,720 $15,440

====== ======

Equity

Share capital $7,700 $7,700

Retained earnings 6,515 4,905

_______ _______

Total equity $14,215 $12,605

====== ======

Nimbin P/L

ACC00724 Accounting for Managers, Assignment 1, S2 2016 Page 1 of 4

Income Statement

As at 30 June 2016

($000)

Revenues (net sales) $55,000

Less: cost of sales 35,100

_______

Gross profit 19,900

_______

Less: Expenses

Selling and distribution expenses 7,100

Administrative expenses 4,970

Finance costs 1,560

______

Total expenses 13,630

______

Profit before income tax 6,270

Income tax expense 1,908

______

Profit $4,362

=====

Nimbin P/L

Statement of changes in Equity

For the year ended 30 June 2016

($000)

Share capital

Ordinary (7,200.000 shares)

Balance at start of period $7,200

______

Balance at end of period 7,200

_______

Preference (250,000 shares)

Balance at start of period 500

______

Balance at end of period 500

______

Total share capital $7,700

======

Retained Earnings

Balance at start of period $4,905

Total income for the period 4,362

Dividends paid – ordinary (2,702)

Dividends paid – preference (50)

______

Balance at end of period $6,515

======

Additional information:

ACC00724 Accounting for Managers, Assignment 1, S2 2016 Page 2 of 4

Payables include $5,620 (2016) and $5,730 (2015) trade accounts payable; the

remainder is accrued expenses. Market prices of issued shares at year-end (2016):

Ordinary $12; Preference $6.70.

Required:

A. Calculate the following ratios for 2016. The industry average for similar

businesses is shown. (6 marks)

Industry average

1. Rate of return on total assets 22%

2. Rate of return on ordinary equity 20%

3. Profit margin 4%

4. Earnings per share 45c

5. Price-earnings ratio 12.0

6. Dividend yield 5%

7. Dividend payout 70%

8. Current ratio 2.5:1

9. Quick ratio (acid ratio) 1.3:1

10. Receivables turnover 13

11. Inventory turnover 6

12. Debt ratio 40%

13. Times interest earned 6

14. Assets turnover 1.8

B. Given the above industry averages, comment on the company’s profitability,

liquidity and use of financial gearing. (4 marks)

Question 2 Total marks for Q5. (10 marks)

a) A local restaurant is noted for its fine food, as evidenced by the large number of

customers. A customer was heard to remark that the secret of the restaurant’s success

was its fine chef. Would you regard the chef as an asset of the business? If so, would

you include the chef on the balance sheet of the business and at what value? Discuss.

(2 MARKS)

b) Accounting provides much information to help managers make economic

decisions in their various workplaces. You are required to provide examples of

economic decisions that the following people would need to make with the use of

accounting information: (3 MARKS)

□ A manager of human resources

□ A factory manager

□ The management team of an Australian Football League (AFL) club

□ The manager of a second-hand clothing charity

ACC00724 Accounting for Managers, Assignment 1, S2 2016 Page 3 of 4

c) Indicate the effect of each of the following transactions on any or all of the three

financial statements of a business: (5 MARKS)

1. Statement of financial position

2. Statement of financial performance

3. Statement of cash flows

Apart from indicating the financial statements (s) involved, use appropriate phrases

such as ‘increase total asset’, ‘decrease equity’, ‘increase income’, ‘decrease cash

flow’ to describe the transaction concerned.

1. Purchase equipment for cash.

2. Provide services to a client, with payment to be received within 40 days.

3. Pay a liability.

4. Invest additional cash into the business by the owner.

5. Collect an account receivable in cash.

6. Pay wages to employees.

7. Receive the electricity bill in the mail, to be paid within 30 days.

8. Sell a piece of equipment for cash.

9. Withdraw cash by the owner for private use.

10. Borrow money on a long-term basis from a bank.

THE END

ACC00724 Accounting for Managers, Assignment 1, S2 2016 Page 4 of 4

You might also like

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- International Strategic Management A Complete Guide - 2020 EditionFrom EverandInternational Strategic Management A Complete Guide - 2020 EditionNo ratings yet

- The Statement of Financial Position of Ninety LTD For The Last Two Years AreDocument2 pagesThe Statement of Financial Position of Ninety LTD For The Last Two Years Arenjoroge mwangiNo ratings yet

- Final Exam Accounting & Finance For Managers 13th March 2021Document4 pagesFinal Exam Accounting & Finance For Managers 13th March 2021Belidet Girma100% (1)

- Maryland International College: School of Graduate StudiesDocument3 pagesMaryland International College: School of Graduate StudiesMulgetaNo ratings yet

- Sample ProblemsDocument17 pagesSample ProblemsAizhan BaimukhamedovaNo ratings yet

- MARGINAL COSTING ExamplesDocument10 pagesMARGINAL COSTING ExamplesLaljo VargheseNo ratings yet

- 11 Financial Forecasting and Planning (Session 24)Document23 pages11 Financial Forecasting and Planning (Session 24)creamellzNo ratings yet

- Agricultural Project Chapter 4Document73 pagesAgricultural Project Chapter 4Milkessa SeyoumNo ratings yet

- Sample Test Questions For EOQDocument5 pagesSample Test Questions For EOQSharina Mhyca SamonteNo ratings yet

- 04 Marginal CostingDocument67 pages04 Marginal CostingAyushNo ratings yet

- Accounting Seminar Paper Lecture NotesDocument10 pagesAccounting Seminar Paper Lecture NoteschumbefredNo ratings yet

- Decisions Involving Alternative ChoicesDocument3 pagesDecisions Involving Alternative ChoicesHimani Meet JadavNo ratings yet

- Management Theories & PracticeDocument50 pagesManagement Theories & Practicelemlem sisayNo ratings yet

- Effect of Organizational StructureDocument6 pagesEffect of Organizational Structurebayissa biratuNo ratings yet

- File 3Document77 pagesFile 3Othow Cham AballaNo ratings yet

- The Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)Document67 pagesThe Impact of Financial Management System On Human Resource Utilization (A Case in Gondar Municipality)meseret sisayNo ratings yet

- Cost and Management Accounting 2 CHAPTER 3Document34 pagesCost and Management Accounting 2 CHAPTER 3Abebe GosuNo ratings yet

- Concept NoteDocument3 pagesConcept NoteKaushal DhakanNo ratings yet

- CHAPTER 3 - Systems Concepts & AccountingDocument35 pagesCHAPTER 3 - Systems Concepts & AccountingHendriMaulanaNo ratings yet

- CHAPTER 1 - A Model For Processing Accounting InformationDocument27 pagesCHAPTER 1 - A Model For Processing Accounting InformationSISCA DKNo ratings yet

- Accounting Assignment (Question Number 1)Document4 pagesAccounting Assignment (Question Number 1)wasifNo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Chapter 05 - (The Accounting Cycle. Reporting Financial Results)Document22 pagesChapter 05 - (The Accounting Cycle. Reporting Financial Results)Hafiz SherazNo ratings yet

- CHAPTER 4 - System ToolsDocument24 pagesCHAPTER 4 - System ToolsEfriyendiNo ratings yet

- QUESTION 1 (25 Marks) : Probability & Statistical Modelling Assignment Page 1 of 5Document5 pagesQUESTION 1 (25 Marks) : Probability & Statistical Modelling Assignment Page 1 of 5Jayaletchumi Moorthy0% (1)

- Chapter 1 Over ViewDocument25 pagesChapter 1 Over ViewAgatNo ratings yet

- CHAPTER 3 Measure of Centeral TendencyDocument20 pagesCHAPTER 3 Measure of Centeral TendencyyonasNo ratings yet

- Course Outline 03Document6 pagesCourse Outline 03Tewodros TadesseNo ratings yet

- Accounting Information SystemDocument3 pagesAccounting Information SystemTadesseNo ratings yet

- Or Assignment FinalDocument15 pagesOr Assignment Finalwendosen seife100% (1)

- Quantitative Individual Assignment Answer AsegidDocument8 pagesQuantitative Individual Assignment Answer AsegidAsegid H/meskelNo ratings yet

- Management AccountingDocument8 pagesManagement AccountingTeresa TanNo ratings yet

- AdmasDocument170 pagesAdmasHMichael AbeNo ratings yet

- Measuring St George Brewery's Outbound LogisticsDocument24 pagesMeasuring St George Brewery's Outbound LogisticsZinashbizu LemmaNo ratings yet

- OM MBA Chap 1Document34 pagesOM MBA Chap 1Asmish EthiopiaNo ratings yet

- ProblemDocument2 pagesProblemAbdii Dhufeera80% (5)

- The Effect of Working Capital Management On The Manufacturing Firms' ProfitabilityDocument20 pagesThe Effect of Working Capital Management On The Manufacturing Firms' ProfitabilityAbdii DhufeeraNo ratings yet

- Sorry Company Financial Analysis Warns of BankruptcyDocument5 pagesSorry Company Financial Analysis Warns of BankruptcyRevatee HurilNo ratings yet

- Human Resource Management: Short Answer Questions / 2 Mark Question With AnswersDocument3 pagesHuman Resource Management: Short Answer Questions / 2 Mark Question With AnswersANSHID PNo ratings yet

- Faculty of Management: Barkatullah University, BhopalDocument50 pagesFaculty of Management: Barkatullah University, BhopalA vyasNo ratings yet

- Exit Exam New 2016Document205 pagesExit Exam New 2016naolmeseret22No ratings yet

- Assignment-I EditedDocument3 pagesAssignment-I EditedHussein Dahir100% (1)

- Wogagen BankDocument42 pagesWogagen Bankያል ተፈተነ አያልፍምNo ratings yet

- Range For The Coefficients of Basic Decision VariablesDocument5 pagesRange For The Coefficients of Basic Decision Variablessami damtew0% (1)

- Assignment 1Document3 pagesAssignment 1Abebe Nigatu100% (1)

- Part 1 Final Management Accounting Assignment BriefDocument6 pagesPart 1 Final Management Accounting Assignment BriefMohammad Tanvir Rahman67% (3)

- Mathematics Worksheet for Management DecisionsDocument3 pagesMathematics Worksheet for Management Decisionsabel shimeles100% (1)

- Zeru ResearchDocument42 pagesZeru ResearchMohammed AbduNo ratings yet

- @4 Auditing and Assurance Services - WSUDocument125 pages@4 Auditing and Assurance Services - WSUOUSMAN SEIDNo ratings yet

- Chapter1 - Statistics For Managerial DecisionsDocument26 pagesChapter1 - Statistics For Managerial DecisionsRanjan Raj UrsNo ratings yet

- Financial Statement AnalysisDocument20 pagesFinancial Statement AnalysisBezawit Tesfaye100% (1)

- Eyu ProjectDocument38 pagesEyu ProjectTEWODROS ASFAWNo ratings yet

- Ang STA230Document62 pagesAng STA230Ibnu Noval100% (1)

- Managment Assignment 1Document5 pagesManagment Assignment 1Fasika AbebeNo ratings yet

- Assessment of Product CostingDocument53 pagesAssessment of Product CostingMeklit Alem100% (1)

- Tutorial QuestionsDocument2 pagesTutorial QuestionsLoreen MayaNo ratings yet

- Question Bank For Statistics Management 1 MarksDocument28 pagesQuestion Bank For Statistics Management 1 MarkslakkuMSNo ratings yet

- MBA 631 Quantitative Analysis for Management Decision MakingDocument6 pagesMBA 631 Quantitative Analysis for Management Decision Makingwondimu teshomeNo ratings yet

- Ifrs D7105118419Document7 pagesIfrs D7105118419Asfawosen DingamaNo ratings yet

- BooksDocument15 pagesBooksAsfawosen DingamaNo ratings yet

- HabteDocument5 pagesHabteAsfawosen DingamaNo ratings yet

- Financial Acct For MBA - IfRS BasicsDocument75 pagesFinancial Acct For MBA - IfRS BasicsAsfawosen DingamaNo ratings yet

- Benefits and Challenges of International FinancialDocument25 pagesBenefits and Challenges of International FinancialAsfawosen DingamaNo ratings yet

- Ifrs Article 9463Document6 pagesIfrs Article 9463Asfawosen DingamaNo ratings yet

- Ifrs Iyoha F (Acct) 3Document10 pagesIfrs Iyoha F (Acct) 3Asfawosen DingamaNo ratings yet

- Charles W. L. Hill / Gareth R. JonesDocument24 pagesCharles W. L. Hill / Gareth R. JonesAsfawosen DingamaNo ratings yet

- Ifrs MSL - 2019 - 277Document14 pagesIfrs MSL - 2019 - 277Asfawosen DingamaNo ratings yet

- Managerial Economics: Problem Set 1Document1 pageManagerial Economics: Problem Set 1Asfawosen Dingama100% (2)

- Ifrs AFC 2017 02 ParvathyDocument7 pagesIfrs AFC 2017 02 ParvathyAsfawosen DingamaNo ratings yet

- Ifrs 947-1-926-1-10-20130410Document7 pagesIfrs 947-1-926-1-10-20130410Asfawosen DingamaNo ratings yet

- Section One 1.1 Backgroud of The StudyDocument10 pagesSection One 1.1 Backgroud of The StudyAsfawosen DingamaNo ratings yet

- Ifrs The Challenges and Prospects of IFRS Adoption in Ethiopian Commercial BanksDocument20 pagesIfrs The Challenges and Prospects of IFRS Adoption in Ethiopian Commercial BanksAsfawosen DingamaNo ratings yet

- Problem Set 2Document2 pagesProblem Set 2Asfawosen DingamaNo ratings yet

- Ifrs Literature ReviewDocument4 pagesIfrs Literature ReviewAsfawosen DingamaNo ratings yet

- Problem Set IIIDocument2 pagesProblem Set IIIAsfawosen DingamaNo ratings yet

- Branson Airport ExperimentDocument10 pagesBranson Airport ExperimentAsfawosen DingamaNo ratings yet

- Case Study 2.1 and 2.2Document3 pagesCase Study 2.1 and 2.2Asfawosen DingamaNo ratings yet

- Flexible UN treaty key to climate change progressDocument3 pagesFlexible UN treaty key to climate change progressAsfawosen DingamaNo ratings yet

- 1 Organizational Culture and Employees PerformanceDocument11 pages1 Organizational Culture and Employees PerformanceSyed Habib SultanNo ratings yet

- Managerial Economics: Problem Set 1Document1 pageManagerial Economics: Problem Set 1Asfawosen Dingama100% (2)

- School of Business and Economics ASTUDocument1 pageSchool of Business and Economics ASTUAsfawosen DingamaNo ratings yet

- META ANALYSIS ON BPR APPROACHESDocument12 pagesMETA ANALYSIS ON BPR APPROACHESAsfawosen DingamaNo ratings yet

- School of Business and Economics ASTUDocument1 pageSchool of Business and Economics ASTUAsfawosen DingamaNo ratings yet

- Bank Service Quality, Customer Satisfaction and Loyalty in Ethiopian Banking SectorDocument10 pagesBank Service Quality, Customer Satisfaction and Loyalty in Ethiopian Banking SectorAsfawosen DingamaNo ratings yet

- Organizational Culture Impacts Employee PerformanceDocument17 pagesOrganizational Culture Impacts Employee PerformanceAsfawosen DingamaNo ratings yet

- Measuring Service Quality in The Banking Industry: A Hong Kong Based StudyDocument20 pagesMeasuring Service Quality in The Banking Industry: A Hong Kong Based StudyJayD77No ratings yet

- Term Paper SolutionDocument27 pagesTerm Paper SolutionAsfawosen DingamaNo ratings yet

- Group II SolutionDocument4 pagesGroup II SolutionAsfawosen DingamaNo ratings yet

- Collector of Internal Revenue Vs Club Filipino, Inc. de Cebu 5 SCRA 321 (1962)Document4 pagesCollector of Internal Revenue Vs Club Filipino, Inc. de Cebu 5 SCRA 321 (1962)KarlNo ratings yet

- E 00636ar 20220428 WebDocument103 pagesE 00636ar 20220428 WebYIM MINNIENo ratings yet

- Profitabilityand Asset Qualityof Private Banksin India AComparative Studyof HDFCand ICICIBankDocument96 pagesProfitabilityand Asset Qualityof Private Banksin India AComparative Studyof HDFCand ICICIBankRohit ChauhanNo ratings yet

- Book Solutions Ch2 To Ch11Document45 pagesBook Solutions Ch2 To Ch11FayzanAhmedKhanNo ratings yet

- Q3 2023 Earnings ReleaseDocument12 pagesQ3 2023 Earnings ReleaseFalsa CuentaNo ratings yet

- IGCSE-OL - Bus - CH - 21 - Answers To CB ActivitiesDocument3 pagesIGCSE-OL - Bus - CH - 21 - Answers To CB ActivitiesOscar WilliamsNo ratings yet

- CH 4 Brief Exercises 16th PDFDocument18 pagesCH 4 Brief Exercises 16th PDFNiken PurwantyNo ratings yet

- F7 FR Jun21 Mock QuestionDocument19 pagesF7 FR Jun21 Mock QuestionAnuj ShethNo ratings yet

- Business Finance NotesDocument6 pagesBusiness Finance Notesclaire juarezNo ratings yet

- Verification and Valuation of Assets and Liabilities - Chapter-8Document8 pagesVerification and Valuation of Assets and Liabilities - Chapter-8Tareq90% (10)

- TNT Annual Report 2008Document165 pagesTNT Annual Report 2008Depositado.100% (1)

- RELEVANT DIVIDEND THEORIESDocument18 pagesRELEVANT DIVIDEND THEORIESSridhar KodaliNo ratings yet

- Ind AS 110Document37 pagesInd AS 110cgaurav50No ratings yet

- "Financial Analysis of Kilburn Chemicals": Case Study OnDocument20 pages"Financial Analysis of Kilburn Chemicals": Case Study Onshraddha mehtaNo ratings yet

- FAR Quiz 3 Biological Assets and Investments With AnswersDocument6 pagesFAR Quiz 3 Biological Assets and Investments With AnswersRezzan Joy Camara MejiaNo ratings yet

- Chapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)Document18 pagesChapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)XNo ratings yet

- Classification of Taxes: A. Domestic CorporationDocument5 pagesClassification of Taxes: A. Domestic CorporationWenjunNo ratings yet

- Personal Finance AppendixDocument27 pagesPersonal Finance AppendixBara DanielNo ratings yet

- Application LevelDocument45 pagesApplication LevelMinhajul Haque SajalNo ratings yet

- LECTURE 4 PROBLEMS BOND AND STOCK VALUATIONDocument4 pagesLECTURE 4 PROBLEMS BOND AND STOCK VALUATIONDahniar AmalinaNo ratings yet

- Savings and Credit Co-Operative League of South Africa Limited (Saccol)Document16 pagesSavings and Credit Co-Operative League of South Africa Limited (Saccol)astig79No ratings yet

- The Institute of Computer AccountantsDocument1 pageThe Institute of Computer AccountantsankitNo ratings yet

- A Dissertation Report: "Critical Analysis of Reliance Power Ipo Failure Submitted byDocument23 pagesA Dissertation Report: "Critical Analysis of Reliance Power Ipo Failure Submitted byVarsha PaygudeNo ratings yet

- 23014Document114 pages23014Anshul MishraNo ratings yet

- Budget Calculator BNMDocument25 pagesBudget Calculator BNMSah RizalNo ratings yet

- Dividend Discount Model - Commercial Bank Valuation (FIG)Document2 pagesDividend Discount Model - Commercial Bank Valuation (FIG)Sanjay RathiNo ratings yet

- CH 2-FMI HandoutDocument15 pagesCH 2-FMI HandoutabebeMBANo ratings yet

- M3P2Document8 pagesM3P2Vincent BusacayNo ratings yet

- Project ReportDocument41 pagesProject ReportJassar Gursharan67% (3)

- Stocks and Their Valuation ExerciseDocument42 pagesStocks and Their Valuation ExerciseLee Wong100% (2)