Professional Documents

Culture Documents

Classroom Exercises 1 - Statement of Financial Position and Comprehensive Income

Uploaded by

Bianca JovenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Classroom Exercises 1 - Statement of Financial Position and Comprehensive Income

Uploaded by

Bianca JovenCopyright:

Available Formats

Classroom Exercises 1 - Statement of Financial Position and Comprehensive Income

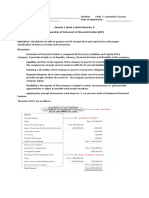

TRUE OR FALSE.

Classroom Exercise 1-1. (10 pts.)

1. Financial statements that are prepared in accordance to the standards issued by the IASB is

presumed to have fair representation.

2. A set of financial statement is complete if it has the Statement of Financial Position, Statement

of Comprehensive Income, Statement of Changes in Equity and Statement of Cash Flow.

3. All financial statements are applying the accrual accounting principle.

4. The primary users of the financial statements are management of the company and the

shareholders.

5. Comparing the company’s current financial information with the previous years is an example of

intra-comparability.

6. Financial statements represent both past and future financial information.

7. When assets are realized within normal operating cycle but more than 12 months after the

reporting period, it is considered as current assets.

8. According to IAS 1, non-current asset/liabilities may be presented before current

assets/liabilities.

9. Current and non-current portion of assets and liabilities shows the assumption of going concern

principle.

10. Service type of business may also use Multi-Step format of the income statement.

PROBLEM SOLVING

Classroom Exercise 1-2.

At the beginning of the year, the company have assets worth P700,000 while liabilities is 25% of its

equity. There was a decrease in liabilities worth P49,500 and a net increase of P152,780 for the equity.

1. How much is the equity at the beginning of the year? (2 pts.)

2. How much are the assets at the end of the year? (2 pts.)

3. How much was the change in asset? Indicate if it is a decrease or an increase. (2 pts.)

Classroom Exercise 1-3.

A company incurred a net loss of P49,000 for the current period. Assume that expenses are worth

P693,160.

4. How much was the revenue for the year? (2 pts)

Classroom Exercise 1-4.

The following are the accounts of Vela Merchandising for December 31, 2019:

Sales Php 3,000,000

Salaries Expense 80,000

Supplies Expense 120,000

Depreciation Expense 96,000

Utilities Expense 64,000

Insurance Expense 32,000

Rent Expense 144,000

Beginning Inventory 6,250

Purchases 187,500

Ending Inventory 12,500

Sales Discount 625

Accordingly, 25% of rent, depreciation and utility expenses pertain to the sales office while the rest

pertains to the corporate office.

5. How much is the net sales? (2 pts)

6. How much is the cost of goods sold? (2 pts)

7. How much is the gross profit for the year? (2 pts)

8. How much is general and administrative expenses? (2 pts)

Classroom Exercises 1 - Statement of Financial Position and Comprehensive Income

9. How much is the selling and distribution expenses? (2 pts)

10. How much is the net income? (2 pts)

Classroom Exercise 1-5.

Below are the accounts of Celestina Trading for the year ended December 31, 2019.

Accounts Payable 2,000,400

Accounts Receivables 2,000,000

Accumulated Amortization – Patents 100,000

Accumulated Amortization – Trademarks 100,000

Accumulated Depreciation - Fixtures 100,000

Accumulated Depreciation - Vehicles 200,000

Advances to Employees 23,000

Allowance for doubtful accounts 145,000

Cash Equivalents 100,000

Cash in Banco de Plata 8,000,000

Cash in Metro Pacific Bank 2,000,000

Celestina, Capital ?

Change Cash Fund 25,000

Due to suppliers 45,000

Finished Goods 1,000,000

Fixtures 1,000,000

Income Tax Payable 590,000

Interest Payable 145,000

Land 1,000,000

Land Held for fair value appreciation 8,900,000

Long-term Debt 2,300,000

Notes Payable (short-term) 890,000

Notes Receivables 200,000

Patents 1,000,000

Petty Cash Fund 50,000

Prepaid Expenses 14,500

Raw Materials 600,000

Trademarks 1,000,000

Vehicles 2,000,000

Work in Progress 400,000

11. How much is the total cash and cash equivalent? (2 pts)

12. How much is the total inventories? (2 pts.)

13. How much is the total property, plant and equipment? (2 pts.)

14. How much is the total intangible assets? (2 pts.)

15. How much is the total current assets? (2 pts).

16. How much is the total non-current assets? (2 pts)

17. How much is the total current liabilities? (2 pts)

18. How much is the total non-current liabilities? (2 pts)

19. How much is the total assets? (2 pts)

20. How much is the total equity? (2 pts)

You might also like

- UPCAT Complete Reviewer 2020 1st PDFDocument84 pagesUPCAT Complete Reviewer 2020 1st PDFJaypee Martin100% (2)

- Accounting 9th Canadian Edition Volume 1 Test BankDocument66 pagesAccounting 9th Canadian Edition Volume 1 Test BankgloriyaNo ratings yet

- Acctg1205 - Chapter 8Document48 pagesAcctg1205 - Chapter 8Elj Grace BaronNo ratings yet

- H3 Quality ControlDocument7 pagesH3 Quality ControlTrek ApostolNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Financial Reporting IIDocument478 pagesFinancial Reporting IIIrfan100% (3)

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- Fra Notes (Questions and Answers Format) : Financial Reporting: Meaning, Objectives and Importance UNIT-1Document74 pagesFra Notes (Questions and Answers Format) : Financial Reporting: Meaning, Objectives and Importance UNIT-1paras pant100% (1)

- Gov Acctg Solman MillanDocument68 pagesGov Acctg Solman MillanSymae Jung100% (1)

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- QuizDocument2 pagesQuizaprilbetito02No ratings yet

- AFM Q-BankDocument42 pagesAFM Q-Banks BNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Cindy Lota - Activity No. 3 - Statement of Financial PositionDocument6 pagesCindy Lota - Activity No. 3 - Statement of Financial PositionCindy LotaNo ratings yet

- Imp QuesDocument2 pagesImp QueskaveriNo ratings yet

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDocument2 pagesIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNo ratings yet

- Fsa Prac Ex PDFDocument3 pagesFsa Prac Ex PDFAngel Alejo AcobaNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Note 5: PPE: Acc. Dep. Book Value Acquisition CostDocument5 pagesNote 5: PPE: Acc. Dep. Book Value Acquisition CostSabel LagoNo ratings yet

- Updates in Philippine Accounting and Financial Reporting StandardsDocument4 pagesUpdates in Philippine Accounting and Financial Reporting StandardsWindie SisodNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- accouncting problemDocument3 pagesaccouncting problemShaneNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- WS 6 Preparation of SFPDocument5 pagesWS 6 Preparation of SFPEricel MonteverdeNo ratings yet

- MOJAKOE AK1 UTS 2012 GasalDocument15 pagesMOJAKOE AK1 UTS 2012 GasalVincenttio le CloudNo ratings yet

- Model Paper AnswersDocument12 pagesModel Paper AnswersShenali NupehewaNo ratings yet

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- Financial AnalysisDocument15 pagesFinancial AnalysisRONALD SSEKYANZINo ratings yet

- MBA Accounts2Document5 pagesMBA Accounts2Yojan PonnettiNo ratings yet

- Worksheet ProblemsDocument3 pagesWorksheet ProblemsClaren Sidnne MadridNo ratings yet

- Form6 Mock ExamDocument7 pagesForm6 Mock Examkya.pNo ratings yet

- Presentation of Properly Classified FSDocument9 pagesPresentation of Properly Classified FSpapa1No ratings yet

- Acctg 601Document2 pagesAcctg 601Maria Regina Javier100% (1)

- Suggested Answer CAP I June 2018Document40 pagesSuggested Answer CAP I June 2018alchemistNo ratings yet

- CA-Ipcc Old Course: Advanced AccountingDocument125 pagesCA-Ipcc Old Course: Advanced AccountingAruna Rajappa100% (1)

- Case 1.: Additional InformationDocument3 pagesCase 1.: Additional InformationPearl Jade YecyecNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Activity Part 1 Prepartion of Financial StatementsDocument4 pagesActivity Part 1 Prepartion of Financial Statementsjrmsu-3No ratings yet

- Please Review These Questions Before You Enter For Your Test and Final Examination Thank You AC405DDocument13 pagesPlease Review These Questions Before You Enter For Your Test and Final Examination Thank You AC405DELIZABETHNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- TUGAS Topik Bab 5Document2 pagesTUGAS Topik Bab 5Imanuel ChrisNo ratings yet

- Ia3 Prelim Exam - Set ADocument11 pagesIa3 Prelim Exam - Set AClara MacallingNo ratings yet

- Module-2 Equity Valuation Numerical For StudentsDocument11 pagesModule-2 Equity Valuation Numerical For Studentsgaurav supadeNo ratings yet

- ACCTBA1 - Quiz 3Document2 pagesACCTBA1 - Quiz 3Marie Beth BondestoNo ratings yet

- Lecture No 2Document4 pagesLecture No 2Avia Chelsy DeangNo ratings yet

- Basic Finance Exercice 2Document3 pagesBasic Finance Exercice 2Kazia PerinoNo ratings yet

- FABM 2 ProjectDocument14 pagesFABM 2 ProjectMilanie Rose Mendoza 11- ABMNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- Advanced AccountingDocument12 pagesAdvanced AccountingmayuriNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- CH 07 PPTsDocument30 pagesCH 07 PPTsAfifan Ahmad FaisalNo ratings yet

- Problem 12 Accounting PDFDocument3 pagesProblem 12 Accounting PDFErika RepedroNo ratings yet

- Exercise Chap 5Document9 pagesExercise Chap 5JF FNo ratings yet

- ACCT71210-Group Assignment - S20Document6 pagesACCT71210-Group Assignment - S20AmishaNo ratings yet

- Solution - B124 - FTHE - V2 Summer 2020-2021 2 - V1Document13 pagesSolution - B124 - FTHE - V2 Summer 2020-2021 2 - V1AhmEd GhayasNo ratings yet

- Ratio AnalysisDocument7 pagesRatio AnalysisDEEPA KUMARINo ratings yet

- Cash Flow Analysis: Mcgraw-Hill/Irwin © 2004 The Mcgraw-Hill Companies, Inc., All Rights ReservedDocument27 pagesCash Flow Analysis: Mcgraw-Hill/Irwin © 2004 The Mcgraw-Hill Companies, Inc., All Rights Reservedmabkhan_25No ratings yet

- Homework 1 - Statement of Financial PositionDocument2 pagesHomework 1 - Statement of Financial PositionBianca JovenNo ratings yet

- HOMEWORK 1. Statement of Financial PositionDocument2 pagesHOMEWORK 1. Statement of Financial PositionBianca JovenNo ratings yet

- Statement of Comprehensive Income for Shoe Capital TradingDocument2 pagesStatement of Comprehensive Income for Shoe Capital TradingBianca JovenNo ratings yet

- Lesson 3-Bus. MathDocument23 pagesLesson 3-Bus. MathBianca JovenNo ratings yet

- Grade 12 / ABM 2: Business FinanceDocument8 pagesGrade 12 / ABM 2: Business FinanceBianca JovenNo ratings yet

- Accounting Cycle Hacks (Pt. 3) Adjusted Trial BalanceDocument8 pagesAccounting Cycle Hacks (Pt. 3) Adjusted Trial BalanceKyla Mae EspecialNo ratings yet

- Time Value of Money Sample Problems With SolutionDocument13 pagesTime Value of Money Sample Problems With SolutionJEFFERSON CUTENo ratings yet

- 7 Financial MarketsDocument140 pages7 Financial MarketsLe Thuy Dung100% (1)

- Manacc Standard (April 2015)Document35 pagesManacc Standard (April 2015)CyrilNo ratings yet

- Guidance - Note On Division III of Co's Act, 2013Document186 pagesGuidance - Note On Division III of Co's Act, 2013rakhi100% (1)

- Cfas ReviewerDocument8 pagesCfas ReviewerSOFIA DOMINIQUE CORPUZNo ratings yet

- Vitrox q42022Document16 pagesVitrox q42022Dennis AngNo ratings yet

- Chief Financial Officer Manufacturing in Denver CO Resume Keith RandallDocument2 pagesChief Financial Officer Manufacturing in Denver CO Resume Keith RandallKeithRandallNo ratings yet

- Hany Mekky Finance Manager NewDocument4 pagesHany Mekky Finance Manager NewHany Ahmed MakyNo ratings yet

- Trafigura Beheer BV Annual Report 2013Document53 pagesTrafigura Beheer BV Annual Report 2013kr2983No ratings yet

- CEOs CFOs and Accounting Fraud PDFDocument5 pagesCEOs CFOs and Accounting Fraud PDFClaire Joy CadornaNo ratings yet

- Referensi Chapter 13Document20 pagesReferensi Chapter 13Vivii LayNo ratings yet

- Corporate Governance and Corporate Financial Reporting - Their Impact On The Performance of Large Firms of PakistanDocument3 pagesCorporate Governance and Corporate Financial Reporting - Their Impact On The Performance of Large Firms of PakistanMr. Nadeem BhuttaNo ratings yet

- Introduction to Auditing PrinciplesDocument309 pagesIntroduction to Auditing PrinciplesDixie Cheelo0% (1)

- BNB - OM BondDocument348 pagesBNB - OM BondTuany SabinoNo ratings yet

- Prospek Euro FLDocument234 pagesProspek Euro FLdjokouwmNo ratings yet

- Gramedia 2016 - 2015Document157 pagesGramedia 2016 - 2015KayrilnfNo ratings yet

- Topic 2 The Companies Act 2016Document22 pagesTopic 2 The Companies Act 2016NUR IMAN SHAHIDAH BINTI SHAHRUL RIZALNo ratings yet

- Dabur NepalDocument19 pagesDabur Nepalbajracharyasandeep100% (1)

- KCC Bank: Project Report ONDocument61 pagesKCC Bank: Project Report ONSunny KhushdilNo ratings yet

- 2011 Danone Annual ReportDocument304 pages2011 Danone Annual Reportyassine100% (1)

- Accounting 202 Chapter 15 TestansquestiDocument4 pagesAccounting 202 Chapter 15 TestansquestiSandra ReidNo ratings yet

- Annual Report 12-13Document55 pagesAnnual Report 12-13Venkat Narayan RavuriNo ratings yet

- PT Adi Sarana Armada Tbk 2020 Financial StatementsDocument152 pagesPT Adi Sarana Armada Tbk 2020 Financial StatementsIkhlas SadiminNo ratings yet

- IFRS A Briefing For Boards of DirectorsDocument60 pagesIFRS A Briefing For Boards of DirectorsJose Martin Castillo PatiñoNo ratings yet

- Review 4Document3 pagesReview 4Ciurila OvidiuNo ratings yet

- Jilna HiponiaDocument16 pagesJilna HiponiaJennifer HiponiaNo ratings yet

- Multiple-Choice QuestionsDocument75 pagesMultiple-Choice QuestionsJasmine LimNo ratings yet