Professional Documents

Culture Documents

Jawaban Tugas Ke-11 SOAL-1: Jurnal: Depreciation Expense $ 12.500 Accum Depre Machine $ 12.500

Uploaded by

Anisa Siti WahyuniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jawaban Tugas Ke-11 SOAL-1: Jurnal: Depreciation Expense $ 12.500 Accum Depre Machine $ 12.500

Uploaded by

Anisa Siti WahyuniCopyright:

Available Formats

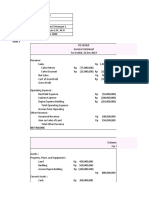

JAWABAN TUGAS KE-11

SOAL-1

(a) 1 Oktober-31 Des = 3 bulan

2019 = 25% x 3/12 x $ 200.000 = $12.500

Tabel Sama dengan di Akeu-1

(b) Jurnal :

Depreciation expense … $ 12.500

Accum Depre Machine… $ 12.500

SOAL-2

(a) January 1, 2009

Equipment........................................................................ 60,000

Cash........................................................................... 60,000

December 31, 2009

Depreciation Expense....................................................... 10,000

Accumulated Depreciation––Equipment..................... 10,000

(b) December 31, 2010

Depreciation Expense........................................................ 10,000

Accumulated Depreciation––Equipment...................... 10,000

Accumulated Depreciation––Equipment............................. 20,000

Loss on Impairment............................................................. 5,000

Equipment (€60,000 – €35,000).................................... 25,000

(c) Depreciation expense––2011: (€60,000 – €25,000) ÷ 4 = €8,750

SOAL-3

(a) Sum-of-the-Years'-Digits 2010 2011

Accumulated Depreciation $ 345,000 $ 966,000

Book Value 1,815,000 1,194,000

Depreciation Expense 345,000 621,000

Double-Declining Balance

Accumulated Depreciation $ 432,000 $1,123,200

Book Value 1,728,000 1,036,800

Depreciation Expense 432,000 691,200

(b) Cost $2,160,000

Depreciation (621,000)

Residual (120,000)

$1,419,000 × 1/2 = $709,500, 2012 depreciation

You might also like

- Solution Case 1Document2 pagesSolution Case 1Ario LintangNo ratings yet

- CH9 SolutionsDocument11 pagesCH9 SolutionsGhadeer MohammedNo ratings yet

- (IFA 13) - Rendy Filiang - 1402210324Document10 pages(IFA 13) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- ITFA Solution June 2018 ExamDocument7 pagesITFA Solution June 2018 ExamF A Saffat RahmanNo ratings yet

- Chapter 9 Assigned Question SOLUTIONSDocument31 pagesChapter 9 Assigned Question SOLUTIONSDang ThanhNo ratings yet

- PA1 Group1 Week8Document8 pagesPA1 Group1 Week8Phuong Nguyen MinhNo ratings yet

- Depn Ch11IDocument3 pagesDepn Ch11Isamia.aliNo ratings yet

- Final Exam AnsDocument8 pagesFinal Exam AnsTien NguyenNo ratings yet

- PA1 Group1 P10Document8 pagesPA1 Group1 P10Phuong Nguyen MinhNo ratings yet

- Jawaban Tugas Ke-10 SOAL-1Document2 pagesJawaban Tugas Ke-10 SOAL-1Anisa Siti WahyuniNo ratings yet

- Assigment Principle of Accounting 2 Natural ResourceDocument10 pagesAssigment Principle of Accounting 2 Natural ResourceKasihNo ratings yet

- 2009-12-06 064119 StarkeyDocument5 pages2009-12-06 064119 StarkeyAnne KatNo ratings yet

- Model Solution: Solution To The Question No. 1 (B) Required (I)Document4 pagesModel Solution: Solution To The Question No. 1 (B) Required (I)HossainNo ratings yet

- SM 9Document12 pagesSM 9wtfNo ratings yet

- Acquisition and Disposition of Property, Plant, and EquipmentDocument2 pagesAcquisition and Disposition of Property, Plant, and EquipmentDiane Askew NealNo ratings yet

- Intermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDocument43 pagesIntermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDebraWhitecxgn100% (10)

- Intermediate Accounting 17th Edition Kieso Solutions ManualDocument22 pagesIntermediate Accounting 17th Edition Kieso Solutions Manualdilysiristtes5100% (31)

- ACCT336 Solved Exercises - Chapters 14 and 15Document5 pagesACCT336 Solved Exercises - Chapters 14 and 15kareemrawwadNo ratings yet

- Final Exam AnswerDocument5 pagesFinal Exam AnswerPham Ngoc AnhNo ratings yet

- 3512 Chapter 23 Cash Flows HW Exercises ProblemsDocument12 pages3512 Chapter 23 Cash Flows HW Exercises ProblemsM MustafaNo ratings yet

- CH 12Document8 pagesCH 12Sree Mathi SuntheriNo ratings yet

- PPE SolutionDocument6 pagesPPE SolutionHuỳnh Thị Thu BaNo ratings yet

- This Study Resource Was: SolutionDocument5 pagesThis Study Resource Was: SolutionTien NguyenNo ratings yet

- Weygandt Acctg Princ 9eDocument4 pagesWeygandt Acctg Princ 9e劉亮宏No ratings yet

- Harrison FA IFRS 11e CH07 SMDocument85 pagesHarrison FA IFRS 11e CH07 SMJingjing Zhu0% (1)

- Prepare Financial StatementsDocument17 pagesPrepare Financial StatementsHayat AliNo ratings yet

- ACCT 551 Week2 PracticeQuestions SolutionsDocument5 pagesACCT 551 Week2 PracticeQuestions SolutionsMD SomratNo ratings yet

- Depreciation Expense, Rp. 25.000.000Document12 pagesDepreciation Expense, Rp. 25.000.000Roni SinagaNo ratings yet

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Final F09 SolutionDocument5 pagesFinal F09 SolutionWyatt Niblett-wilsonNo ratings yet

- Property, Plant and Equipment DepreciationDocument13 pagesProperty, Plant and Equipment DepreciationJannelle SalacNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- Genuime Company Required 1 Debit CreditDocument15 pagesGenuime Company Required 1 Debit CreditAnonnNo ratings yet

- (W4) ANS - PPE Subsequent MeasurementDocument3 pages(W4) ANS - PPE Subsequent MeasurementMUHAMMAD ADAM MOHD DEFIHAZRINo ratings yet

- Izzatul Isma (Tugas PA Chapter 10)Document3 pagesIzzatul Isma (Tugas PA Chapter 10)IzzaNo ratings yet

- Capital Expenditure TutorialDocument8 pagesCapital Expenditure Tutorialfira azmiNo ratings yet

- Pup-Ppe5-Src 2-1Document15 pagesPup-Ppe5-Src 2-1Jerome BaluseroNo ratings yet

- Class Exercise CH 10Document5 pagesClass Exercise CH 10Iftekhar AhmedNo ratings yet

- Quiz 3solutionDocument5 pagesQuiz 3solutionAhsan IqbalNo ratings yet

- UntitledDocument22 pagesUntitledWild PlatycodonNo ratings yet

- BE Chap 10Document4 pagesBE Chap 10TIÊN NGUYỄN LÊ MỸNo ratings yet

- BUSI 353 S18 Assignment 6 SOLUTIONDocument4 pagesBUSI 353 S18 Assignment 6 SOLUTIONTanNo ratings yet

- Akm 2Document10 pagesAkm 2Putu DenyNo ratings yet

- ACY3002___2021_S2_Test___Solutions_for_Students.pdfDocument2 pagesACY3002___2021_S2_Test___Solutions_for_Students.pdfzuimaoNo ratings yet

- Halaman 470 (P9-3B)Document4 pagesHalaman 470 (P9-3B)anon_21838122No ratings yet

- Jawaban 10 - Accounting For PensionDocument2 pagesJawaban 10 - Accounting For PensionBie SapuluhNo ratings yet

- Kic02 Nhóm9 Topic2 Ktqt1enDocument10 pagesKic02 Nhóm9 Topic2 Ktqt1enLy BùiNo ratings yet

- Microsoft Word - WEY - SM.cp13.vpdfDocument11 pagesMicrosoft Word - WEY - SM.cp13.vpdfDa HorseNo ratings yet

- Practice Test E 1: Xercise (Ron Chemicals) 1. Physical Units Method Product: A-1 B-3 C-2 Q-9 TotalDocument2 pagesPractice Test E 1: Xercise (Ron Chemicals) 1. Physical Units Method Product: A-1 B-3 C-2 Q-9 TotalKaren Joyce SinsayNo ratings yet

- Tugas Akm Ii Pertemuan 11Document5 pagesTugas Akm Ii Pertemuan 11Alisya UmariNo ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- Fix Asset Intangible AssetDocument7 pagesFix Asset Intangible AssetMichelleNo ratings yet

- Unit Test 1 2021Document2 pagesUnit Test 1 2021Nicolas ErnestoNo ratings yet

- CMA JUNE 2020 EXAMDocument5 pagesCMA JUNE 2020 EXAMTameemmahmud rokibNo ratings yet

- Tutorial 01 - SolutionsDocument4 pagesTutorial 01 - Solutionsraygains23No ratings yet

- AF210 Unit 4 Tutorial SolutionsDocument5 pagesAF210 Unit 4 Tutorial SolutionsChand DivneshNo ratings yet

- 4 2010 Dec ADocument5 pages4 2010 Dec ALai Hui IngNo ratings yet

- PR Week 10Document8 pagesPR Week 10Rifda AmaliaNo ratings yet

- MINI-CASE 3 Intangible Assets AnswerDocument5 pagesMINI-CASE 3 Intangible Assets Answeryu choongNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Tabel PvafDocument1 pageTabel PvafAnisa Siti Wahyuni100% (1)

- Jawaban Tugas Ke-10 SOAL-1Document2 pagesJawaban Tugas Ke-10 SOAL-1Anisa Siti WahyuniNo ratings yet

- Jawaban Tugas Ke-11 SOAL-1: Years Tarif Cost Dep Exp Acc Depre Book ValueDocument2 pagesJawaban Tugas Ke-11 SOAL-1: Years Tarif Cost Dep Exp Acc Depre Book ValueAnisa Siti WahyuniNo ratings yet

- Format Jurnal Khusus PT XXXDocument5 pagesFormat Jurnal Khusus PT XXXAnisa Siti WahyuniNo ratings yet

- Anisa Siti Wahyuni - C00190032 (UTS Prak. Akkeu 1)Document6 pagesAnisa Siti Wahyuni - C00190032 (UTS Prak. Akkeu 1)Anisa Siti WahyuniNo ratings yet

- Anisa Siti Wahyuni - C00190032 (UTS PABK)Document6 pagesAnisa Siti Wahyuni - C00190032 (UTS PABK)Anisa Siti WahyuniNo ratings yet

- Anisa Siti Wahyuni - C00190032 (Akkeu Asdos 1) - DikonversiDocument2 pagesAnisa Siti Wahyuni - C00190032 (Akkeu Asdos 1) - DikonversiAnisa Siti WahyuniNo ratings yet

- Anisa Siti Wahyuni - C00190032 (Akkeu Asdos 1) - DikonversiDocument2 pagesAnisa Siti Wahyuni - C00190032 (Akkeu Asdos 1) - DikonversiAnisa Siti WahyuniNo ratings yet

- Assessment of Asset Liability Management Practices A Case Study of The Oromia International Bank Chapter One: IntroductionDocument12 pagesAssessment of Asset Liability Management Practices A Case Study of The Oromia International Bank Chapter One: IntroductionabrehamNo ratings yet

- EarlyRetirementNow Side Hustle SWR ToolboxDocument375 pagesEarlyRetirementNow Side Hustle SWR ToolboxJaredNo ratings yet

- Cost AccountingDocument17 pagesCost AccountingFaisal RafiqNo ratings yet

- Invoice 26Document2 pagesInvoice 26asim khanNo ratings yet

- CAE 14 - RevalidaDocument4 pagesCAE 14 - RevalidaTifanny MallariNo ratings yet

- MBC - 307 - Session 1Document15 pagesMBC - 307 - Session 1Devina DevNo ratings yet

- FIN5FMA Tutorial 2 SolutionsDocument7 pagesFIN5FMA Tutorial 2 SolutionsSanthiya MogenNo ratings yet

- G.R. No. 217411 - PHILIPPINE BANK OF COMMUNICATIONS, PETITIONER, VS. RIA DE GUZMAN RIVERA, RESPONDENT.D E C I S I O N - Supreme Court E-LibraryDocument10 pagesG.R. No. 217411 - PHILIPPINE BANK OF COMMUNICATIONS, PETITIONER, VS. RIA DE GUZMAN RIVERA, RESPONDENT.D E C I S I O N - Supreme Court E-Librarymarvinnino888No ratings yet

- MKT301 Project: Presented To Dr. Mohamed Asfoury Mr. Ahmad BakirDocument13 pagesMKT301 Project: Presented To Dr. Mohamed Asfoury Mr. Ahmad BakirAmir MenesyNo ratings yet

- VietnamRBCCFTraining EN forQRDocument145 pagesVietnamRBCCFTraining EN forQRHoang TraNo ratings yet

- Description of Research InterestsDocument6 pagesDescription of Research InterestsManas DimriNo ratings yet

- SBR INT SD21 AsDocument9 pagesSBR INT SD21 AsCheng Chin HwaNo ratings yet

- Checkout - Y-StrapDocument3 pagesCheckout - Y-Strapsup nessNo ratings yet

- Quiz Leases Part 1Document2 pagesQuiz Leases Part 1Jhanelle Marquez75% (4)

- E-ZPass New York Service Center ApplicationDocument3 pagesE-ZPass New York Service Center ApplicationChristopher BrownNo ratings yet

- Chapter 8 Emba 503Document6 pagesChapter 8 Emba 503Arifur NayeemNo ratings yet

- Sabrina SultanaDocument64 pagesSabrina SultanaMohib Ullah YousafzaiNo ratings yet

- Purchases and Sales Exercises (Accounting)Document27 pagesPurchases and Sales Exercises (Accounting)ScribdTranslationsNo ratings yet

- WS - Submarine Cable 1 - Neilson-Watts - BruceDocument7 pagesWS - Submarine Cable 1 - Neilson-Watts - BruceJason GuthrieNo ratings yet

- SEO-Optimized Title for Document on Definitions and Scheme for Startup SupportDocument1 pageSEO-Optimized Title for Document on Definitions and Scheme for Startup SupportyibungoNo ratings yet

- Consumers' Perceptions of Reliance Life Insurance Health PlansDocument105 pagesConsumers' Perceptions of Reliance Life Insurance Health Plans2014rajpointNo ratings yet

- Debt Management in IndiaDocument3 pagesDebt Management in IndiaSarbartho MukherjeeNo ratings yet

- Test PDFDocument9 pagesTest PDFJessica TurnerNo ratings yet

- Stochastic Financial Mathematics SeminarDocument47 pagesStochastic Financial Mathematics SeminarMaxim KapinNo ratings yet

- FAQ's by ICAI RVO - 8.07.2020Document20 pagesFAQ's by ICAI RVO - 8.07.2020SiddNo ratings yet

- FMDocument45 pagesFMSaumya GoelNo ratings yet

- Springwell V JPMDocument80 pagesSpringwell V JPMSaqib AlamNo ratings yet

- 16.internal Reconstruction PDFDocument7 pages16.internal Reconstruction PDFkamal_potter1707100% (2)

- CMBS 101 Slides (All Sessions)Document41 pagesCMBS 101 Slides (All Sessions)Karan MalhotraNo ratings yet

- Bank Winter BG MT760 - GuaranteeDocument2 pagesBank Winter BG MT760 - GuaranteeLaz Cozetat100% (2)