Professional Documents

Culture Documents

Claim Management Life Insurance - Docs

Claim Management Life Insurance - Docs

Uploaded by

Shubham Namdev0 ratings0% found this document useful (0 votes)

15 views3 pagesOriginal Title

Claim Management Life Insurance.docs

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views3 pagesClaim Management Life Insurance - Docs

Claim Management Life Insurance - Docs

Uploaded by

Shubham NamdevCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

INSTITUTE OF MANAGEMENT STUDIES DAVV INDORE

MBA (FA) IIIRD SEMESTER - FA303C

INSURANCE AND BANK MANAGEMENT

CLAIM MANAGEMENT IN LIFE INSURANCE

When making a decision on buying the life insurance, customer consider large number of

factors like pricing of the product, its features, likely return, tax benefit etc.

Though all these factors are important, one very important aspect is how insurance company

handles and settle the claim

If the nominee is not able to receive the claim amount in a reasonable time and with ease, the

very purpose of taking insurance is defeated

Though IRDA has laid down broad guidelines on claim settlement , how quickly and efficiently

the staff handle the proposal is equally important.

What is claim

A claim is a demand that the insurer redeem the promise made in the contract. Insurer now

has to perform its part of contract by settling the claim, after satisfying that all the terms and

conditions of policy are being met

There are 3 main types of claim – maturity claim, survival benefit payment and death claims.

IRDA Guidelines on claim settlement

A life policy shall state the documents which are normally required to be submitted with by

claimant

Life insurance Company to process the claim without delay. Any query or requirement of

additional documents to be raised at one time and not in peace meals, within a period of 15

days from the receipt of claim

Claim shall be paid or disputed giving reasons, within a period of 30 days from the receipt of

claim. If investigation is required to be conducted by insurance company , it should be

completed within 6 months.

Where claim is ready for payment but it cannot be made due to reason of no proper

identification of payee, the insurance company shall hold the amount and will pay interest at

savings bank rate.

Where delay is on part of company in processing the claim form, interest will be paid at 2%

above prevailing bank rate.

Maturity claims

Some life insurance plans, such as endowment plan and whole life plans, promise to pay

insured a specific amount at the end of plan if they survive for entire term. This is known as

maturity benefit amount or maturity claim.

Amount payable on maturity is sum insured + any accumulated bonus – outstanding premium

and interest thereon.

In some term policies at the completion of term premium is returned “return of premium (ROP)

“ plans

In case of ULIPs the insurance company pays fund value as maturity claim at the end of term

plan.

In money back policies, maturity amount minus survival benefits received during the term of

policy.

Action on maturity claim is normally initiated by the insurance company itself.

Insurance company knows from its own record which policy is maturing each month.

Insurance company normally sends an advance notification to the person insured.

Insurance company will than take necessary steps and asks for documents from the

concerned policy holder.

Insurer is expected to make the payment on maturity date by post dated cheque or obtaining

mandate and directly credited bank account of customer.

If the policy is reported lost, then payment can be made on the basis of indemnity.

If the policy is assigned, it is prudent on the part of insurance company to first check that the

assignee has no outstanding claim.

Survival benefit payments

The process of survival benefit payments is similar to payment of maturity claims.

Action here also will be initiated by the insurer

A post dated cheque on direct credit to bank account through mandate is followed.

Death claims

The process unlike maturity and survival benefit payment, is started by the claimant.

The claimant will advise the insurance company about the death of insured.

Insurance company will then wait for relevant documentation, check the documents and will

further investigate if deemed necessary.

Once the insurance company is satisfied about claim, he will settle the claim and will send the

sum insured to nominee or beneficiary within a reasonable time.

Procedure for settlement of death claim

After the death of the insured, the intimation about his death to reach insurance company

through nominee, assignee, relative, agent or employer.

Notification of death is not enough; the insurance company need proof – death certificate.

The claimants statement is recorded

Proof of identity of nominee

Claimant should inform – his relationship with deceased, original policy and details of policy,

date and place of death, cause of death, sum assured etc.

All premium has been paid

Discharge form from nominee

If assignment is done, proof that nothing is payable to assignee.

Presumption of death

Proof of death is essential for a claim to be settled. However, sometimes a person is reported

missing without information and whereabouts are not known. As per Indian Evidence act 1872,

it is presumed that if individual has not been heard of for 7 years is presumed to be dead.

Insurance company in case of doubt may ask nominee or heirs to approach court for decree

Insurance company should be more cautious if

- The notification of death is received from a stranger and not from family members

- Too many enquiries about progress in settlement of claim

- If notification of death is received 3 years after the death.

Early Death claim

If claim occurs within 3 years from the date of risk is classified as an early death claim.

Additional requirements are:

- A statement from last medical attendant of deceased

- Statement from hospital if admitted before death

- Statement from person who last attended the deceased and who sent dead body

- If the life insured had an unnatural death, such as an accident, by suicide or by unknown

cause – copy of First Information report (FIR) should be obtained.

- Post Mortem (PM) report and forensic report depending on, if taken out.

Rider Benefits

Payment is made under a rider on occurrence of specified event which may be

Accidental death benefit

Critical illness

Hospital care

Valid and invalid claims

Claim is considered a valid claim when following things satisfy:

- Insurance policy is in force

- Insured event has taken place

- Original policy document, other valid documents and a completed claim form has been

submitted

- Has the policy holder performed their part as to age admission, disclosure of all material

facts etc.

- Claim has been received from right persons (can be nominee or legal heirs)

Invalid claim

After investigation insurance company may conclude that it does not need to make payment

because the claim in invalid. There can be 3 main circumstances in which this condition may

arise.

- The policy is not in force

- Excluded condition applies – if the death is caused by something excluded from cover

under the policy for example death due to suicide.

- The claim is fraudulent

Void contracts

A contract if found to be void will not be required to be honored. For example

The contract was done by a drunken person and was not capable entering the contract at that

point of time or person was of unsound mind.

Insurance has been taken out in support of some Unlawful activity

If there is no insurable interest attached to policy.

Prepared by:

Arvind Paranjape, CAIIB

paranjape.arvind@yahoo.com 9425067026

You might also like

- Lecture 3 App 403-Professional Practice 3Document44 pagesLecture 3 App 403-Professional Practice 3Rucild SurrigaNo ratings yet

- Contingent Contract, IdemnityDocument21 pagesContingent Contract, IdemnityAkshay Kumar0% (1)

- Life Insurance Claims & COPRA 1986Document34 pagesLife Insurance Claims & COPRA 1986Samhitha KandlakuntaNo ratings yet

- Claim Settlement Life InsuranceDocument5 pagesClaim Settlement Life InsuranceTanmayi kambleNo ratings yet

- Liability of SuretyDocument8 pagesLiability of SuretyLucy RajNo ratings yet

- Topic: Hiba: Hiba:-Hiba (Tamlik Al Ain) Is "An Act of Bounty by Which A Right ofDocument10 pagesTopic: Hiba: Hiba:-Hiba (Tamlik Al Ain) Is "An Act of Bounty by Which A Right ofsparsh lalNo ratings yet

- Insurance Law in IndiaDocument44 pagesInsurance Law in IndiaVaibhav AhujaNo ratings yet

- Definition (S.172 Indian Contract Act)Document3 pagesDefinition (S.172 Indian Contract Act)welcome2jungleNo ratings yet

- Performance of Contract: Prepared By: Shrota Baral Roll - No. 89 BALLB Fourth SemesterDocument24 pagesPerformance of Contract: Prepared By: Shrota Baral Roll - No. 89 BALLB Fourth SemesterShrota BaralNo ratings yet

- Miscellaneous InsuranceDocument27 pagesMiscellaneous InsuranceRavneet KaurNo ratings yet

- Insurance Act 1938 IIBSDocument23 pagesInsurance Act 1938 IIBSbapparoyNo ratings yet

- Position and Rights of A Minor in Partnership Firm PDFDocument4 pagesPosition and Rights of A Minor in Partnership Firm PDFamritam yadavNo ratings yet

- Insurance Act, 1938Document22 pagesInsurance Act, 1938Kareem ChoudhuryNo ratings yet

- Principles of InsuranceDocument17 pagesPrinciples of Insurancekirthi nairNo ratings yet

- Insurance Related CrimesDocument18 pagesInsurance Related CrimesHitarth SharmaNo ratings yet

- Contract of Indemnity and GuaranteeDocument13 pagesContract of Indemnity and GuaranteeSudipta Bhuyan100% (1)

- Chapter 1-What Is Insurance?Document20 pagesChapter 1-What Is Insurance?Akshada Chitnis100% (2)

- Contract of Bailment: Under Indian Contract Act, 1872Document24 pagesContract of Bailment: Under Indian Contract Act, 1872sagarNo ratings yet

- General Principles of Insurance LawDocument12 pagesGeneral Principles of Insurance LawCarina Amor ClaveriaNo ratings yet

- What Is Banking Ombudsman?Document5 pagesWhat Is Banking Ombudsman?Tushar SaxenaNo ratings yet

- Rishi Project BookDocument93 pagesRishi Project BookAnvesh Pulishetty -B100% (1)

- Contract II - Extent of LiabilitiesDocument8 pagesContract II - Extent of LiabilitiesAbhijith AUNo ratings yet

- Aligarh Muslim University Malappuram Centre, Kerala: TopicDocument10 pagesAligarh Muslim University Malappuram Centre, Kerala: Topicsadhvi singhNo ratings yet

- Class - LL.B (HONS.) II SEM. Subject - Insurance Law: Unit I:IntroductionDocument26 pagesClass - LL.B (HONS.) II SEM. Subject - Insurance Law: Unit I:IntroductionVineet ShahNo ratings yet

- Contract of GuaranteeDocument9 pagesContract of Guarantee78 Harpreet SinghNo ratings yet

- Insurance ProjectDocument9 pagesInsurance ProjectVineeth ReddyNo ratings yet

- WHAT IS DOCTRINE OF GOOD FAITH Insurance LawDocument14 pagesWHAT IS DOCTRINE OF GOOD FAITH Insurance LawKarishma RajputNo ratings yet

- Contract of IndemnityDocument32 pagesContract of Indemnityshubham agarwalNo ratings yet

- Unit 3 Contract of Indemnity and Guarantee: StructureDocument15 pagesUnit 3 Contract of Indemnity and Guarantee: StructuregaardiNo ratings yet

- Chapter - 1 Introduction To Insurance in India: Vivek College of CommerceDocument69 pagesChapter - 1 Introduction To Insurance in India: Vivek College of CommerceRutu_Ko_7037No ratings yet

- Social Security Concept of Social SecurityDocument4 pagesSocial Security Concept of Social SecurityvengataraajaneNo ratings yet

- Sale Deed AssignmentDocument8 pagesSale Deed Assignmentkhushi sharmaNo ratings yet

- DISABLEMENT Under WCADocument6 pagesDISABLEMENT Under WCAAniket MishraNo ratings yet

- Government SubsidiesDocument6 pagesGovernment Subsidiessamy7541No ratings yet

- Sale of GoodsDocument23 pagesSale of Goodsjamesjulia567No ratings yet

- Capacity of Parties in Law of TortsDocument8 pagesCapacity of Parties in Law of TortsUtkarsh SachoraNo ratings yet

- L.3 (Indemnity & Guarantee, Bailment & Pledge)Document16 pagesL.3 (Indemnity & Guarantee, Bailment & Pledge)nomanashrafNo ratings yet

- Contracts IIDocument8 pagesContracts IISushmaSuresh100% (1)

- Doctrine of Consideration - FacetsDocument15 pagesDoctrine of Consideration - FacetsSHEENANo ratings yet

- Transport Law ProjectDocument27 pagesTransport Law Projectharsha jeswaniNo ratings yet

- Indian Contract Act 1872Document31 pagesIndian Contract Act 1872MITRA SIMRAN ANEEL 2010331No ratings yet

- Declaration and Payment On DividendDocument12 pagesDeclaration and Payment On DividendChiranjeev RoutrayNo ratings yet

- Legal Terms: Rewant Mehra Roll No. - 73/16 B. A. Llb. Section - BDocument6 pagesLegal Terms: Rewant Mehra Roll No. - 73/16 B. A. Llb. Section - BRewant MehraNo ratings yet

- Creation of AgencyDocument3 pagesCreation of AgencyMeenal Pachory Pandey100% (1)

- Dissolution of FirmDocument3 pagesDissolution of FirmAqeel AhmadNo ratings yet

- Unfair Labour PracticesDocument3 pagesUnfair Labour PracticesNauman Mohammed S100% (1)

- Contractual Liability of The State in IndiaDocument10 pagesContractual Liability of The State in IndiaSatyam KhandelwalNo ratings yet

- Life Insurance RawDocument33 pagesLife Insurance RawDevesh MestryNo ratings yet

- PLEDGE (Sec. 172-179) 1. Concept and Definition:: in Lallan Prasad v. Rahmat AliDocument5 pagesPLEDGE (Sec. 172-179) 1. Concept and Definition:: in Lallan Prasad v. Rahmat AliKrishna AhujaNo ratings yet

- Insurance Act, 1938Document2 pagesInsurance Act, 1938Aashna JainNo ratings yet

- The Law of Contract NotesDocument64 pagesThe Law of Contract NotesDerrick OketchoNo ratings yet

- Insurance LawDocument23 pagesInsurance LawVicky KumarNo ratings yet

- Dishonour of ChequeDocument4 pagesDishonour of ChequeRaj Kumar100% (1)

- Liability Is of Two KindsDocument3 pagesLiability Is of Two Kindszainabhaider567 zainabhaider567No ratings yet

- ContractDocument17 pagesContractsimplejimrossNo ratings yet

- Zainab Contract Sem 2 PDFDocument15 pagesZainab Contract Sem 2 PDFSaima GousNo ratings yet

- Utmost Good Faith in Insurance ContractsDocument8 pagesUtmost Good Faith in Insurance ContractsParth ChowdheryNo ratings yet

- Princilples of Insurance LawDocument10 pagesPrincilples of Insurance LawPrashant MeenaNo ratings yet

- Contract of Indemnity and InsuranceDocument10 pagesContract of Indemnity and InsuranceSaniya SharmaNo ratings yet

- Industrial Project On Reliance Life Insurance Company LimitedDocument116 pagesIndustrial Project On Reliance Life Insurance Company LimitedTimothy Brown100% (1)

- Investigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorFrom EverandInvestigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorNo ratings yet

- FA-III Internal 2020 Format For MarksDocument8 pagesFA-III Internal 2020 Format For MarksShubham NamdevNo ratings yet

- Indirect Taxation Finals Question PaperDocument3 pagesIndirect Taxation Finals Question PaperShubham NamdevNo ratings yet

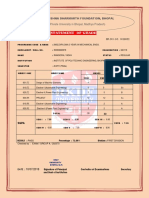

- Axis Bank Application Form PDFDocument4 pagesAxis Bank Application Form PDFShubham NamdevNo ratings yet

- Unit Test 1 March 2021Document1 pageUnit Test 1 March 2021Shubham NamdevNo ratings yet

- SFM Assignment ListDocument4 pagesSFM Assignment ListShubham NamdevNo ratings yet

- Sale 250 02-04-2021Document1 pageSale 250 02-04-2021Shubham NamdevNo ratings yet

- Apply Code: Y169 Offer Price - 1425Document23 pagesApply Code: Y169 Offer Price - 1425Shubham NamdevNo ratings yet

- Invoice OD121558906887153000Document1 pageInvoice OD121558906887153000Shubham NamdevNo ratings yet

- Order FL0200682072: Mode of Payment: NONCODDocument1 pageOrder FL0200682072: Mode of Payment: NONCODShubham NamdevNo ratings yet

- 5 - Annual Report 2016-17Document284 pages5 - Annual Report 2016-17Shubham NamdevNo ratings yet

- Rajat Mehta - IMS PDFDocument5 pagesRajat Mehta - IMS PDFShubham NamdevNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Term Life Insurance PolicyDocument4 pagesTerm Life Insurance PolicyShubham NamdevNo ratings yet

- Analysis of Option Combination Strategies: February 2018Document11 pagesAnalysis of Option Combination Strategies: February 2018Shubham NamdevNo ratings yet

- Unit 6 Module 10 Standard Costing: Practical ProblemsDocument14 pagesUnit 6 Module 10 Standard Costing: Practical ProblemsShubham NamdevNo ratings yet

- Sweden Bilateral Brief 201930Document8 pagesSweden Bilateral Brief 201930Shubham NamdevNo ratings yet

- RKDF 6TH SemesterDocument2 pagesRKDF 6TH SemesterShubham NamdevNo ratings yet

- ST04 - Project FinanceDocument4 pagesST04 - Project FinanceShubham Namdev50% (2)

- VCE Summer Internship Program 2020: Project Topic: Project Finance - Modeling and AnalysisDocument1 pageVCE Summer Internship Program 2020: Project Topic: Project Finance - Modeling and AnalysisShubham Namdev100% (1)

- India - Sweden RelationsDocument5 pagesIndia - Sweden RelationsShubham NamdevNo ratings yet

- Account Statement From 1 Apr 2020 To 25 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument1 pageAccount Statement From 1 Apr 2020 To 25 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceShubham NamdevNo ratings yet

- Canada Goose - 1 - Everest - Underwriting Agreement - SEDAR Version (060820) (Quercus)Document54 pagesCanada Goose - 1 - Everest - Underwriting Agreement - SEDAR Version (060820) (Quercus)Daniel GaoNo ratings yet

- The Gist APRIL 2020 - IAS EXAM PORTAL PDFDocument142 pagesThe Gist APRIL 2020 - IAS EXAM PORTAL PDFbalajiNo ratings yet

- Kin 423 Assignment 5Document3 pagesKin 423 Assignment 5api-309989323No ratings yet

- Pre-Licensing Test Info 17.03.2022Document1 pagePre-Licensing Test Info 17.03.2022Fear G9No ratings yet

- Most Important Terms and Conditions: Home LoanDocument1 pageMost Important Terms and Conditions: Home LoanNeeraj DubeyNo ratings yet

- Pinoy Paarazzi Vol 8 Issue 84 July 08 - 09, 2015Document12 pagesPinoy Paarazzi Vol 8 Issue 84 July 08 - 09, 2015pinoyparazziNo ratings yet

- GSISDocument56 pagesGSISGilbert Gabrillo JoyosaNo ratings yet

- Mint Article Unclaimed 13 July 2023Document9 pagesMint Article Unclaimed 13 July 2023cosoxal118No ratings yet

- EE SIGN OFF - Summative Assessment Brief DDDB - CW2 AJW 1402241Document16 pagesEE SIGN OFF - Summative Assessment Brief DDDB - CW2 AJW 1402241iqra ilyasNo ratings yet

- 2018 07 14 18 04 09 892 - 1041233281Document6 pages2018 07 14 18 04 09 892 - 1041233281nibeditapompy7314No ratings yet

- Format of E-Employee ProfileDocument5 pagesFormat of E-Employee Profilethilaga2009No ratings yet

- Standard Tender Document For Supply, Installation and Commissioning of Plant and EquipmentDocument85 pagesStandard Tender Document For Supply, Installation and Commissioning of Plant and EquipmentAccess to Government Procurement Opportunities100% (1)

- Lu Digital Banking BenchmarkDocument42 pagesLu Digital Banking BenchmarkNitish KingNo ratings yet

- E Bussiness AssignmentDocument40 pagesE Bussiness Assignmentsateesh_ims09100% (3)

- Insurance Commision Variable Insurance ContractsDocument11 pagesInsurance Commision Variable Insurance ContractsPetRe Biong PamaNo ratings yet

- Insurance CD 7.marques Maxilite Vs FEBTC Makati InsuranceDocument4 pagesInsurance CD 7.marques Maxilite Vs FEBTC Makati InsuranceEANo ratings yet

- Reinsurance: January 1998Document28 pagesReinsurance: January 1998Sudhakar GuntukaNo ratings yet

- Tower InspectionDocument72 pagesTower InspectionPravin HireNo ratings yet

- Tollbrothersinc10q 20100310Document323 pagesTollbrothersinc10q 20100310matthewphenry1951No ratings yet

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithlawrenziNo ratings yet

- Untitled Form - Google FormsDocument5 pagesUntitled Form - Google Formsmanoj kumar DasNo ratings yet

- Book 2013Document42 pagesBook 2013viewsfgsfonic125100% (1)

- IM - Chapter 1 AnswersDocument4 pagesIM - Chapter 1 AnswersEileen Wong100% (1)

- Investment Pattern of Salaried Individual PDFDocument62 pagesInvestment Pattern of Salaried Individual PDFVighnesh Kurup100% (1)

- Edna M Guzman: 1570 Thousand Oaks DR APT 201 SAN ANTONIO, TX 78232-2395Document8 pagesEdna M Guzman: 1570 Thousand Oaks DR APT 201 SAN ANTONIO, TX 78232-2395Edna GuzmanNo ratings yet

- Vicente Vergara vs. The Court of Appealsg.R. No. 77679, Sept. 30 1987 FactsDocument4 pagesVicente Vergara vs. The Court of Appealsg.R. No. 77679, Sept. 30 1987 FactsNyx PerezNo ratings yet

- United States Bankruptcy Court District of Delaware: Mervyn'S Holdings, LLC, Et Al. 08-11586 Debtor: Case NoDocument4,267 pagesUnited States Bankruptcy Court District of Delaware: Mervyn'S Holdings, LLC, Et Al. 08-11586 Debtor: Case NoChapter 11 DocketsNo ratings yet

- Bill of Lading ClausesDocument23 pagesBill of Lading Clauses11202035No ratings yet

- OfferLetterDocument27 pagesOfferLetterNikhil KumarNo ratings yet