Professional Documents

Culture Documents

Company Law-Ii, Corporate Accountability-Accounts and Audit-2

Uploaded by

Ankit Kumar0 ratings0% found this document useful (0 votes)

67 views8 pagesOriginal Title

6. COMPANY LAW-II, CORPORATE ACCOUNTABILITY-ACCOUNTS AND AUDIT-2

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

67 views8 pagesCompany Law-Ii, Corporate Accountability-Accounts and Audit-2

Uploaded by

Ankit KumarCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

COMPANY LAW-II,

CORPORATE ACCOUNTABILITY:ACCOUNTS

AND AUDIT

THIS STUDY MATERIAL IS PREPARED BY

DR. PRADIP KUMAR DAS,

ASSOCIATE PROFESSOR,

DEPARTMENT OF LAW AND GOVERNANCE,

CUSB,

FOR THE STUDENTS

COMPANY LAW-II,

CORPORATE ACCOUNTABILITY:ACCOUNTS

AND AUDIT

ROTATION OPF AUDITORS[Section 139(3)]:

Members of a company can provide for following by passing a resolution:

(a). In the audit firm appointed by it, the auditing partner and his team shall

be rotated at such intervals as may be resolved by members; or

(b). The audit shall be conducted by more than one auditor.

ROTATION OF AUDITORS ON EXPIARY OF THEIR TERM[Section 139(3)

& Rule-6]:

In case of rotation of auditors on expiry of auditors term, same procedure will

be followed as required for appointment of auditors. The procedure is as

under:

COMPANY LAW-II,

CORPORATE ACCOUNTABILITY:ACCOUNTS

AND AUDIT

(i). The audit committee shall recommend to the board, the name of an

individual auditor or of an audit firm who may replace the incumbent auditor

on expiry of the term of such incumbent.

(ii). Where a company is required to constitute an audit committee, the board

shall consider the recommendation of such committee and in other cases, the

board shall itself consider the matter of rotation of auditors and make its

recommendation for appointment of the next auditor by the members in AGM.

REAPPOINTMENT OF RETIRING AUDITOR:[Section 139(9)]:

At any AGM, a retiring auditor shall be reappointed as auditor of the company

except under the following circumstances:

(a). He is not qualified for reappointment;

COMPANY LAW-II,

CORPORATE ACCOUNTABILITY:ACCOUNTS

AND AUDIT

(b). he has given the company a notice in writing of his unwillingness to be

reappointed;

(c). a special resolution has been passed at that meeting appointing somebody

else instead of him or providing expressly that retiring auditor shall not be re-

appointed.

CASUAL VACANCY IN THE OFFICE OF AUDITOR[section-139(8)]:

The provisions for filling of casual vacancy in the office of auditor are as

below:

(a). The board of the company shall have power to fill the casual vacancy in the

office of the auditor within 30 days;

COMPANY LAW-II,

CORPORATE ACCOUNTABILITY:ACCOUNTS

AND AUDIT

(b).In case casual vacancy has occurred due to resignation of auditor, such

appointment should also be approved by the company in general meeting

convened within 3 months of the recommendation of the board and auditor

shall hold the office till the conclusion of the next annual general meeting;

(c). In case of company whose accounts are subject to audit by an auditor

appointed by the Comptroller and Auditor General of India, such vacancy

should be filled by the CAG of India within 30 days. In case the CAG of India

does not fill the vacancy within the said period, the Board of Directors shal fill

the vacancy within next 30 days.

(d). Appointment of auditors to fill casual vacancy shall be made after taking

into account the recommendation of the audit committee.

COMPANY LAW-II,

CORPORATE ACCOUNTABILITY:ACCOUNTS

AND AUDIT

REMOVAL OF AUDITOR- Section 140(1) and Rule-7

The auditor appointed under section 139 may be removed from his office

before the expiry of the term only by-

(i) Obtaining the prior approval of the Central Government by filling an

application in form ADT-2 within 30 days of resolution passed by the

board;

(ii) The company shall hold the general meeting within 60 days of receipt of

approval of the Central Government for passing the special resolution.

(iii) The auditor concerned shall be given a reasonable opportunity of being

heard.

COMPANY LAW-II,

CORPORATE ACCOUNTABILITY:ACCOUNTS

AND AUDIT

POWERS AND DUTIES OF AUDITORS:

Section 143(1) provided that every auditor can access at all times to the books

of accounts, vouchers and seek such informations and explanation from the

company and enquire such matters as he considers necessary. On enquiry, if he

finds some adverse features, it is his duty to report the same. Besides, the

following specific enquiries are to be made by the auditor about:

(i).Loans and advances made by the company;

(ii).Transactions represented by book entries

(iii).Sale of investments;

(iv).Loans and advances shown as deposits;

(v).Charging of personal expenses to revenue account

COMPANY LAW-II,

CORPORATE ACCOUNTABILITY:ACCOUNTS

AND AUDIT

(vi). Allotment of shares for cash.

AUDIT REPORT:

Section 143(2) says that auditor shall make a report to the members of the

company on the accounts examined by him and on every financial statement

which is required to be laid in the general meeting of the company. The audit

report should state that to the best of his information and knowledge, the said

accounts and financial statements give a true and fair view of the state of the

company’s affairs at the end of the financial year and the profit and loss and

cash flow for the year and such other matters as may be prescribed.

You might also like

- Company Laws Basic Concepts-2-AuditDocument23 pagesCompany Laws Basic Concepts-2-Auditparimol r balsarafNo ratings yet

- Auditor Appointment, Qualification and RemovalDocument10 pagesAuditor Appointment, Qualification and RemovalAnkush KhyoriaNo ratings yet

- AUDITING UNIT-3Document11 pagesAUDITING UNIT-3swethaswetty06No ratings yet

- AUDITDocument24 pagesAUDITGEETHANo ratings yet

- AUDITDocument24 pagesAUDITmeahaNo ratings yet

- Lesson 2Document11 pagesLesson 2wambualucas74No ratings yet

- $RHTDB9PDocument33 pages$RHTDB9PSHAHIL SHARMANo ratings yet

- Company Audit MaterialDocument22 pagesCompany Audit Materialbipin papnoi100% (2)

- Companies Act Provisions Relating To AuditsDocument43 pagesCompanies Act Provisions Relating To Auditsshaleenpatni100% (1)

- Auditing BAC2664 (New), BAC2287 (Old) : Topic 2 The Requirements of Companies Act, 1965Document17 pagesAuditing BAC2664 (New), BAC2287 (Old) : Topic 2 The Requirements of Companies Act, 1965sueernNo ratings yet

- Chapter 10Document48 pagesChapter 10garimamittalNo ratings yet

- Auditors Qualification 2.1Document39 pagesAuditors Qualification 2.1Sayraj Siddiki AnikNo ratings yet

- Studdy Note 7Document42 pagesStuddy Note 7s4sahith100% (1)

- Companies Ordinance - Audit DutiesDocument5 pagesCompanies Ordinance - Audit DutiesassadNo ratings yet

- Audit Part 2 29Document5 pagesAudit Part 2 29Anshul RathiNo ratings yet

- 3 Advance AuditDocument4 pages3 Advance AuditKRISHNA Dev shuklaNo ratings yet

- AuditingDocument35 pagesAuditingramizrhrr6786No ratings yet

- Audit of Limited CompanyDocument6 pagesAudit of Limited CompanyNilesh RautNo ratings yet

- Amendments For CA (Final) Nov. 2016 Exams: 1. Section 143 (12) of The Companies Act, 2013Document9 pagesAmendments For CA (Final) Nov. 2016 Exams: 1. Section 143 (12) of The Companies Act, 2013RohitKujurNo ratings yet

- Appointment of AuditorDocument16 pagesAppointment of Auditorshahnawaz243No ratings yet

- Appointment, Removal and Resignation of An AuditorDocument8 pagesAppointment, Removal and Resignation of An AuditorDsp VarmaNo ratings yet

- Companies (Audit and Auditors) Rules, 2014 - MCA - 31-03-2014Document10 pagesCompanies (Audit and Auditors) Rules, 2014 - MCA - 31-03-2014dhuvadpratikNo ratings yet

- 20034ipcc Paper6 Vol3 cp7 PDFDocument42 pages20034ipcc Paper6 Vol3 cp7 PDFDhananjaySinghRajpootNo ratings yet

- Appointment and Position of Auditors: Corporate Law-IiDocument12 pagesAppointment and Position of Auditors: Corporate Law-Iivinay sharmaNo ratings yet

- audit reportDocument15 pagesaudit reportPapunNo ratings yet

- Section: 139 (Appointment of Auditors)Document19 pagesSection: 139 (Appointment of Auditors)Karan KhatriNo ratings yet

- Lecture 2 Company Audit Sec 140 141 142 and 144 2Document16 pagesLecture 2 Company Audit Sec 140 141 142 and 144 2Divya TehriaNo ratings yet

- An Overview Relating To Audit Under The Companies Act, 1956Document7 pagesAn Overview Relating To Audit Under The Companies Act, 1956Shreya RaoNo ratings yet

- The Legal and Professional Requirement For An AuditorDocument11 pagesThe Legal and Professional Requirement For An AuditorSenelwa AnayaNo ratings yet

- Vision College of Management: Submitted ToDocument6 pagesVision College of Management: Submitted ToAnam FatimaNo ratings yet

- Liquidation of Company: Important Points of Our Notes/BooksDocument20 pagesLiquidation of Company: Important Points of Our Notes/BooksBhavesh RathodNo ratings yet

- An Overview Relating To Audit Under The Companies Act, 1956Document8 pagesAn Overview Relating To Audit Under The Companies Act, 1956Siva KumarNo ratings yet

- Lecture 1 Company Audit Sec 139Document15 pagesLecture 1 Company Audit Sec 139Divya TehriaNo ratings yet

- Auditing&Assurance LL (Lesson2)Document13 pagesAuditing&Assurance LL (Lesson2)BRIAN KORIRNo ratings yet

- AuditorsDocument2 pagesAuditorsitsrahulmaheshwariNo ratings yet

- Appointment, Remunaration, Powers, Duties and Liabilities of The Auditor Appointmentand Audit of Share Capital and Pre-Incroparation ProfitDocument22 pagesAppointment, Remunaration, Powers, Duties and Liabilities of The Auditor Appointmentand Audit of Share Capital and Pre-Incroparation Profitirshad_cbNo ratings yet

- Auditors PPT FinalDocument31 pagesAuditors PPT FinalSri V N Prakash Sharma, Asst. Professor, Management & Commerce, SSSIHLNo ratings yet

- Audit and AssuranceDocument15 pagesAudit and AssuranceJones MaryNo ratings yet

- Appointment, Powers, Duties and Liabilities of The Auditor Appointment QualificationsDocument20 pagesAppointment, Powers, Duties and Liabilities of The Auditor Appointment QualificationsJawahar KumarNo ratings yet

- COMPANY AUDITOR DUTIESDocument3 pagesCOMPANY AUDITOR DUTIESJose FrancisNo ratings yet

- Revisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - ADocument48 pagesRevisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - Adeep_4uNo ratings yet

- Lecture 6Document3 pagesLecture 6Syed Ali Messam ShamsiNo ratings yet

- Companies ActDocument7 pagesCompanies ActSagarmakodeNo ratings yet

- Audit of Limited CompaniesDocument32 pagesAudit of Limited CompaniesAvi Narayan SinghNo ratings yet

- Winding Up of CompaniesDocument23 pagesWinding Up of CompaniesAkash GoyalNo ratings yet

- Auditors: DR - RajkumarDocument21 pagesAuditors: DR - Rajkumarjai rakshitaNo ratings yet

- The Institute of Chartered Accountants of Bangladesh Professional Stage: Knowledge Level Additional Sheet - Concept of and Need For AssuranceDocument4 pagesThe Institute of Chartered Accountants of Bangladesh Professional Stage: Knowledge Level Additional Sheet - Concept of and Need For AssuranceShahid MahmudNo ratings yet

- Auditing Limited CompaniesDocument42 pagesAuditing Limited Companieschethan jagadeeswaraNo ratings yet

- CA Final and PCC Company Audit Part IIDocument8 pagesCA Final and PCC Company Audit Part IIAkash GuptaNo ratings yet

- University of Jahangir Nagar Institute of Business AdministrationDocument12 pagesUniversity of Jahangir Nagar Institute of Business Administrationtabassum tasnim SinthyNo ratings yet

- Comapny QuestionsDocument36 pagesComapny QuestionsvinodNo ratings yet

- CA. Aseem Trivedi on Audit under Companies Act,1956Document22 pagesCA. Aseem Trivedi on Audit under Companies Act,1956Jigar MehtaNo ratings yet

- Audit of Limited Companies editedDocument17 pagesAudit of Limited Companies editednivesuresh30604No ratings yet

- Chapter 10 Audit and Auditors Lyst8195Document21 pagesChapter 10 Audit and Auditors Lyst8195Rambo HereNo ratings yet

- Who Is An Auditor?Document15 pagesWho Is An Auditor?Aman ChauhanNo ratings yet

- RTP Nov 2020Document30 pagesRTP Nov 2020Syamala GadupudiNo ratings yet

- Unit 3Document6 pagesUnit 3Saniya HashmiNo ratings yet

- Rtpfinalnew Nov20 p3Document30 pagesRtpfinalnew Nov20 p3cdNo ratings yet

- Chapter 10 Question BankDocument39 pagesChapter 10 Question BankVINUS DHANKHARNo ratings yet

- Jammu and Kashmir Reorganisation Act, 2019Document371 pagesJammu and Kashmir Reorganisation Act, 2019Ankit KumarNo ratings yet

- K.T. Thomas and S.N. Phukan, JJDocument4 pagesK.T. Thomas and S.N. Phukan, JJShwet KamalNo ratings yet

- Rape MatterDocument3 pagesRape MatterAnkit KumarNo ratings yet

- CNLU LLM 2021-2022 RegulationDocument12 pagesCNLU LLM 2021-2022 RegulationAbhinav PrasadNo ratings yet

- Common Prospectus EnglishDocument319 pagesCommon Prospectus EnglishAnkit KumarNo ratings yet

- BIGAMYDocument11 pagesBIGAMYAnkit KumarNo ratings yet

- Business and Human RightsDocument11 pagesBusiness and Human RightsTalha RiazNo ratings yet

- Project Topics On Conflict of LawsDocument3 pagesProject Topics On Conflict of Lawsalam amarNo ratings yet

- Human Rights Under Section 313 Cr.P.C.Document7 pagesHuman Rights Under Section 313 Cr.P.C.Ankit KumarNo ratings yet

- Central University of South Bihar: Attempt Any One Questions. Both The Questions Carry Equal MarksDocument130 pagesCentral University of South Bihar: Attempt Any One Questions. Both The Questions Carry Equal MarksAnkit KumarNo ratings yet

- UN Declaration Eliminates Violence Against WomenDocument4 pagesUN Declaration Eliminates Violence Against WomenAiman SheikhNo ratings yet

- Section 366, 366A, 366BDocument2 pagesSection 366, 366A, 366BAnkit KumarNo ratings yet

- 50 BPS53 2020110305274749Document35 pages50 BPS53 2020110305274749Ankit KumarNo ratings yet

- LAW 500 - Intellectual Property LawDocument1 pageLAW 500 - Intellectual Property LawAnkit KumarNo ratings yet

- Assignment - BALLB 9th Sem - IPRDocument2 pagesAssignment - BALLB 9th Sem - IPRAnkit KumarNo ratings yet

- Religions: Religious Minorities' Rights in International Law: Acknowledging Intersectionality, Enhancing SynergyDocument20 pagesReligions: Religious Minorities' Rights in International Law: Acknowledging Intersectionality, Enhancing SynergyAnkit KumarNo ratings yet

- Cat I Taxxation IIDocument2 pagesCat I Taxxation IIAnkit KumarNo ratings yet

- BiharDocument1 pageBiharsatyanand001No ratings yet

- Plea Bargaining: New Chapter - XXI-A (Sections 265A To 265L) Has Been Added W.E.F. 05 July, 2006Document5 pagesPlea Bargaining: New Chapter - XXI-A (Sections 265A To 265L) Has Been Added W.E.F. 05 July, 2006Ankit KumarNo ratings yet

- State of Bihar v. Arvind JeeDocument1 pageState of Bihar v. Arvind JeeAnkit KumarNo ratings yet

- Process of Trial Criminal ProcedureDocument3 pagesProcess of Trial Criminal ProcedureAniket PandeyNo ratings yet

- R.M. Sahai and B.L. Hansaria, JJDocument24 pagesR.M. Sahai and B.L. Hansaria, JJAnkit KumarNo ratings yet

- Rights of Arrested Person (Dr. Kalpna Sharma)Document6 pagesRights of Arrested Person (Dr. Kalpna Sharma)agkrishnanNo ratings yet

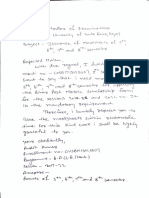

- Application For MarksheetsDocument1 pageApplication For MarksheetsAnkit KumarNo ratings yet

- PolliticalDocument19 pagesPolliticalPritam AnantaNo ratings yet

- Bandhua Mukti Morcha Vs Union of IndiaDocument56 pagesBandhua Mukti Morcha Vs Union of IndiaAnkit KumarNo ratings yet

- Assignment On Private International LAWDocument11 pagesAssignment On Private International LAWSubham Dey100% (2)

- Indira Nehru Gandhi Vs Raj Narain and OrsDocument10 pagesIndira Nehru Gandhi Vs Raj Narain and OrsAnkit KumarNo ratings yet

- H.J. Kania, C.J., Saiyid Fazl Ali, M. Patanjali Sastri, M.C. Mahajan, B.K. Mukherjea and Sudhi Ranjan Das, JJDocument6 pagesH.J. Kania, C.J., Saiyid Fazl Ali, M. Patanjali Sastri, M.C. Mahajan, B.K. Mukherjea and Sudhi Ranjan Das, JJAnkit KumarNo ratings yet

- Assignment On Private International LAWDocument11 pagesAssignment On Private International LAWSubham Dey100% (2)

- Unit-VII Parliamentary Committees DR Ravi Saxena IPS Sept 2023Document16 pagesUnit-VII Parliamentary Committees DR Ravi Saxena IPS Sept 2023saumyaa2101No ratings yet

- Financial Control of Public FundsDocument136 pagesFinancial Control of Public FundsDavid Abbam AdjeiNo ratings yet

- Mrunal Monthly CA Laptop Friendly 2021 11 NovDocument141 pagesMrunal Monthly CA Laptop Friendly 2021 11 Novlipsa jenaNo ratings yet

- CAG Report No. 8 of 2016-17Document85 pagesCAG Report No. 8 of 2016-17Ansu Kumar YadavNo ratings yet

- India S Coal Story Subhomoy Bhattacharjee 2017 Annas Archive Libgenrs NF 3207598Document287 pagesIndia S Coal Story Subhomoy Bhattacharjee 2017 Annas Archive Libgenrs NF 3207598Prashanth BangaloreNo ratings yet

- Consolidated Fund of India: Functions/dutiesDocument2 pagesConsolidated Fund of India: Functions/dutieszaya sarwarNo ratings yet

- Budget and Budgetary Process in The Parliament of IndiaDocument26 pagesBudget and Budgetary Process in The Parliament of IndiataniiNo ratings yet

- Ayakudi Notes eDocument15 pagesAyakudi Notes eNavin DasNo ratings yet

- Class Notes: Interpretation of StatutesDocument29 pagesClass Notes: Interpretation of StatutesSaurabh Kumar SinghNo ratings yet

- Report - No - 9 - of - 2017 - On - Compliance - Audit - Observations - Union - Government PDFDocument262 pagesReport - No - 9 - of - 2017 - On - Compliance - Audit - Observations - Union - Government PDFravindrarao_mNo ratings yet

- Arvind Subramanian of Counsel The PDFDocument357 pagesArvind Subramanian of Counsel The PDFManohar100% (1)

- Polity Class 3Document99 pagesPolity Class 3Mahipal Singh RathoreNo ratings yet

- Public Accounts CommitteeDocument2 pagesPublic Accounts CommitteeGaurav KumarNo ratings yet

- The Indian Journal of Projects, Infrastructure, and Energy LawDocument163 pagesThe Indian Journal of Projects, Infrastructure, and Energy LawPRATIM MAJUMDERNo ratings yet

- Varghese Committee 2Document72 pagesVarghese Committee 2Kumar ManojNo ratings yet

- CAG Audit of Donor Funded Projects 2012/2013Document239 pagesCAG Audit of Donor Funded Projects 2012/2013Maria Sarungi-TsehaiNo ratings yet

- Essay On CAG by Puja KumariDocument8 pagesEssay On CAG by Puja KumariAbhishek Jain0% (1)

- Detailed Training Program - HasibDocument10 pagesDetailed Training Program - HasibKaziRashidulAzamNo ratings yet

- Corporate Accountability in IndiaDocument30 pagesCorporate Accountability in India2nabls0% (1)

- DD Basu QuestionsDocument23 pagesDD Basu QuestionsKapil GargNo ratings yet

- 1 Audit of Central Autonomous Bodies 20210415103918Document44 pages1 Audit of Central Autonomous Bodies 20210415103918Abhishek Kumar SinghNo ratings yet

- Form AOC-4 HelpDocument30 pagesForm AOC-4 HelpAnandNo ratings yet

- IA&AD Allotment Rules 2021Document42 pagesIA&AD Allotment Rules 2021NagaraJu MalleyboinaNo ratings yet

- Indian Admin Systems & ReformsDocument7 pagesIndian Admin Systems & ReformsreadingthehinduNo ratings yet

- Public Accounts Audit by CAG Tanzania 2012/2013Document403 pagesPublic Accounts Audit by CAG Tanzania 2012/2013Maria Sarungi-TsehaiNo ratings yet

- Government Accounting Rules 1990Document74 pagesGovernment Accounting Rules 1990Aashish Kumar57% (7)

- TO Indian Government Accounts and Audit: (Fifth Edition)Document347 pagesTO Indian Government Accounts and Audit: (Fifth Edition)RananjaySinghNo ratings yet

- CAG Report On Antrix-Devas DealDocument76 pagesCAG Report On Antrix-Devas DealCanary Trap100% (1)

- 29th May 2013Document16 pages29th May 2013ArnabNo ratings yet

- Vision VAM 2020 (Governance) Government Policies in Various SectorsDocument32 pagesVision VAM 2020 (Governance) Government Policies in Various SectorsShivamNo ratings yet