Professional Documents

Culture Documents

Starbucks SWOT

Starbucks SWOT

Uploaded by

Anjali SoniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Starbucks SWOT

Starbucks SWOT

Uploaded by

Anjali SoniCopyright:

Available Formats

A Progressive Digital Media business

COMPANY PROFILE

Starbucks Corporation

REFERENCE CODE: E86AFA79-07E1-4115-AA0C-0016416541FE

PUBLICATION DATE: 13 Jan 2020

www.marketline.com

COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED

Starbucks Corporation

TABLE OF CONTENTS

TABLE OF CONTENTS

Company Overview ........................................................................................................3

Key Facts ......................................................................................................................... 3

SWOT Analysis ...............................................................................................................4

Starbucks Corporation Page 2

© MarketLine

Starbucks Corporation

Company Overview

Company Overview

COMPANY OVERVIEW

Starbucks Corporation (Starbucks or ‘the company’) is a premier roaster, marketer and retailer of

specialty coffee. The company offers a range of coffee and tea beverages, tea and related products,

including packaged roasted whole bean and ground coffees, and food and snack offerings. It also

produces and sells a variety of ready-to-drink beverages, such as Frappuccino coffee drinks, Starbucks

Doubleshot espresso drinks, Starbucks Refreshers beverages, and chilled multi-serve beverages through

various channels including grocery stores, warehouse clubs, convenience stores, specialty retailers and

US foodservice accounts. The company operates in countries across North America, Asia Pacific, EMEA,

and Latin America. Starbucks is headquartered in Seattle, Washington, the US.

The company reported revenues of (US Dollars) US$24,719.5 million for the fiscal year ended September

2018 (FY2018), an increase of 10.4% over FY2017. In FY2018, the company’s operating margin was

23.3%, compared to an operating margin of 18.5% in FY2017. In FY2018, the company recorded a net

margin of 18.3%, compared to a net margin of 12.9% in FY2017.

Key Facts

KEY FACTS

Head Office Starbucks Corporation

2401 Utah Avenue South

Seattle

Washington

Seattle

Washington

USA

Phone 1 206 4471575

Fax

Web Address www.starbucks.com/

Revenue / turnover (USD Mn) 24,719.5

Financial Year End September

Employees 291,000

NASDAQ Ticker SBUX

Starbucks Corporation Page 3

© MarketLine

Starbucks Corporation

SWOT Analysis

SWOT Analysis

SWOT ANALYSIS

Starbucks Corporation (Starbucks or ‘the company’) is a premier roaster, marketer and retailer of

specialty coffee. Financial performance, strong customer connects through value-added services and

operational networks are major strengths of the company, whereas dependence on Americas for major

revenue remains a cause for concern. Foodservice Industry in the US, global hot drink market and focus

towards Asia Pacific are likely to provide growth opportunities to the company. However, competitive

market, compliance costs associated with government regulations and increase in raw material price

could affect its business operation.

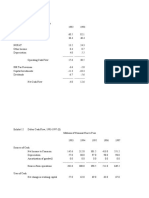

Strength Weakness

Strong financial performance Dependence on Americas for majority of revenue

Building Strong Customer Connect Through Value-

Added Services

Operational network strengthens strategic position

Opportunity Threat

Focus towards Asia Pacific to increase its revenue Increase in raw material costs

Global hot drink market Competitive market

Foodservice industry in the US Compliance Costs Associated With Government

Regulations

Strength

Strong financial performance

The financial performance of the company improved in FY2018, which enables it to provide higher returns

to its shareholders, and attract further investments. Growth in revenue and profitability also enhance the

company’s ability to allocate adequate funds for growth and expansion. In FY2018, Starbucks reported

revenue of US$24,719.5 million as compared to US$22,386.8 million in FY2017, which indicates annual

growth of 10.4%. The growth in revenue was due to increase sales in company-operates stores and

license stores, which grew by 11.6% and 12.6% respectively. Growth sales in company-operated store

was arises from incremental revenues from opening of around 816 net new Starbucks company-operated

store in last year, positive impact of ownership change in East China and a 2% increase in comparable

store sales. Licensed store revenue growth was primarily due to increased product and equipment sales

and royalty revenues from its licensees, opening of 1,181 net new Starbucks licensed stores in last year

and the conversions of both the Singapore and Taiwan markets. In FY2018, the company’s operating

margin was 23.3% as compared to 18.5% in FY2017. Improving operating performance indicates the

company’s focus on efficient cost management. Starbuck’s operating cost as a percentage of sales

declined from 81.5% in FY2017 to 76.7% in FY2018. Similarly, the company’s net profit margin grew from

12.9% in FY2017 to 18.3% in FY2018.

Starbucks Corporation Page 4

© MarketLine

Starbucks Corporation

SWOT Analysis

Building Strong Customer Connect Through Value-Added Services

Starbucks operates in the highly competitive foodservice retail space that demands consistent delivery of

quality service to either retain existing customers or to attract new ones. Apart from selling its world-

renowned coffee blends in a variety of flavors, the company is focused on providing a coffee-drinking

experience to its in-store customers. Starbucks offers free, instant and unlimited Wi-Fi connectivity at all

its company-owned stores across the US, Canada and certain other international markets to encourage

customers to spend more time inside the store through free access to internet. Starbucks has registered

numerous Internet domain names, including Starbucks.com, Starbucks.net, Starbucksreserve.com,

Seattlesbest.com and Teavana.com. Starbucks Digital Network, a news and entertainment web portal

offered in association with Yahoo.com. The Starbucks Digital Network also offers free access to

subscription editions of various premium news resources. It also offers other value added services, which

enhance the customer’s overall shopping experience. Starbucks is able to create a unique selling

proposition by combining its customized coffee blends with other value added services. All these

strategies are aiding the company in building its competitive advantage.

Operational network strengthens strategic position

Starbucks has a strong operational network to cater to its store needs efficiently. The company operates

through two types of stores, including company-operated stores and licensed stores. As of September

2018, iIt operated 29,324 stores across Americas, Europe, Middle East and Africa (EMEA), and

China/Asia Pacific (CAP). As of September 2018, the company operated 17,454 stores in Americas, in

which 9,684 company-operated stores and 7,770 licensed stores; 8,530 stores in CAP, which includes

5,159 company-operated and 3,371 licensed stores; 3,320 stores in EMEA, in which 490 company-

operated and 2,830 licensed stores; and 20 corporate and other stores, in which 8 company-operated

and 12 licensed stores.

Weakness

Dependence on Americas for majority of revenue

Geographic concentration is a cause for concern to the company. Though the company operates in Asia

Pacific, Europe, Middle East and Africa, it generates the majority of its revenue from Americas.

Dependence on one region could affect the company’s operational and financial performance and

increase its business risks by exposing it to the economic and geopolitical risks associated with the

region, which could affect the demand for its products or disrupt the supply chain, and reduce its market

share and growth opportunities in the future. It also hinders the company’s growth in international

markets. In FY2018, the company generated 67.7% of its revenue from Americas.

Opportunity

Focus towards Asia Pacific to increase its revenue

Starbucks Corporation Page 5

© MarketLine

Starbucks Corporation

SWOT Analysis

The company has taken several initiatives in the recent past that may enhance its food services business

and expand business network in countries across Asia Pacific, including Japan, Indonesia, India and

China. In February 2019, the company entered into a joint venture agreement with Tata Global Beverage.

Under the agreement, the company will open ten new stores in India. After the opening, the company

would manage 145 outlets in India. Furthermore, Tata-Starbucks also launched a food delivery through

online food aggregator apps like Swiggy. The joint-venture will help the company to expand its business

network in India. It may also enhance the company’s food services business. In 2018, Starbucks reported

approx. 30% growth of sales during the October-December quarter due to this initiative. In the same

month, the company opened Starbucks Reserve Roastery Tokyo, a new coffee store in Japan. The new

store will offers about 100 varieties of coffee and tea beverages, and artisanal Princi Italian fare in Japan.

In January 2019, the company entered into a partnership agreement with PT Sari Coffee Indonesia

Limited. Under the agreement, the company will open Starbucks Dewata Coffee Sanctuary, a new store

in Bali, Indonesia. The store will offer food and merchandise including the Lavender Latte and over 100

Dewata-exclusive handcrafted beverages. In May 2018, the company announced to open around 6,000

stores in China by 2021. Currently, Starbucks has 3,300 outlets in China. It is expected that opening new

stores may double its operating profit in the country by FY2022. In FY2018, the company generated

approx. 18.1% of its revenue from China. Such initiatives may increase the company’s revenue in Asia

Pacific.

Global hot drink market

Starbucks stands to benefit from the growing consumption of hot drinks as it offers tea, coffee and other

hot drinks globally. Growth in hot drink consumption is also expected to provide ample growth avenues to

the company. According to in-house research report, the global hot drinks consumption valued

US$156,516.4 million in 2017 and is expected to increase 5.8% CAGR over 2017-22 to reach

US$207,006 million by 2022. Similarly, in terms of volume, the global hot drinks consumption was

11,191.7 million liters in 2017 and is expected to increase 1.9% CAGR over 2017-22 to reach 12,299.5

million liters by 2022. This was attributed to growth of Chinese soft drinks market, which accounted for

45.5% of the Asia-Pacific hard drinks market.

Foodservice industry in the US

The restaurants industry in the US is forecast to have a strong growth. According to in-house research,

the food service in the US is expected to reach US$758,832 million by the end of 2020. This growth is

attributed to stronger economic growth in the US and the increase in demand from consumers during the

year. The company sells Starbucks and Seattle’s Best Coffee roasted whole bean and ground coffees, a

selection of premium Tazo teas, Starbucks VIA Ready Brew, and other coffee and tea-related products to

institutional foodservice companies that service business and industry, education, healthcare, office

coffee distributors, hotels, restaurants, airlines and other retailers. Therefore, Starbucks is well positioned

to tap the growing foodservice industry. As of September 2018, the company operated 17,454 stores in

Americas. The number of food service outlets is expected to reach 1.1 million in 2020.

Threat

Increase in raw material costs

Starbucks Corporation Page 6

© MarketLine

Starbucks Corporation

SWOT Analysis

Starbucks purchases, roasts, and sales of whole bean arabica coffee beans and related coffee products.

The price of coffee is subject to significant volatility and has undergone fluctuations in various instances in

the past. The price of arabica coffee beans procured by the company depends on a negotiated basis at a

premium above the "C" price. Depending upon the supply and demand of arabica coffee at the time of

purchase, the amount of the premium also varies significantly. Increase in the "C" coffee commodity price

leads to increase in the price of high-quality arabica coffee. This impacts Starbucks ability to enter into

fixed-price purchase commitments. Other factors that influence the availability and price of coffee beans

include weather, natural disasters, crop diseases, production costs, inventory levels and political and

economic conditions prevailing in the country where the product is sourced from. As coffee beans is the

primary raw material for Starbucks, price fluctuations in this commodity could affect the company’s

operations.

Competitive market

The specialty coffee market is intensely competitive. Competition in the global market is based on a

number of factors, including product quality, service, convenience and price. The company faces

significant competition in each of its channels and markets. In the US, Starbucks faces direct competition

from large competitors in the quick-service restaurant sector and ready-to-drink coffee beverage market.

For instance, it competes with Dunkin Brands in the US, which has strong presence in the northeastern

US. Its tea and coffee products sold through its channel development segment compete directly with

specialty coffees and teas sold through supermarkets, club stores and specialty retailers. It also faces

competition from well-established players like McDonald's in many international markets. McDonald's,

which sells specialty coffee through McCafe, has global presence and strong brand recognition in most

countries. This acts as a threat to Starbucks which is yet to build its brand and presence in these markets.

Starbucks also competes with other companies such as Nestle, Peet's Coffee & Tea, Jamba, The J.M.

Smucker Company, Krispy Kreme Doughnut, and Panera Bread Company. Therefore, increasing

competition may lead to price wars, which, in turn, could affect the market share of the company.

Compliance Costs Associated With Government Regulations

The company is subject to the regulations of the US Department of Agriculture, the Food and Drug

Administration and those of the Canadian equivalents. Similar regulations and requirements also exist in

the other countries in which the company operates. Future developments in the regulation of labeling of

foods could require Starbucks to further modify the labeling of its products, which could affect its product

sales. Additionally, new government laws and regulations could be introduced in the future that could

result in additional compliance costs. Thus, the company's inability to comply with requirements could

subject it to civil remedies, including fines, injunctions, recalls or seizures, as well as potential criminal

sanctions which may impact its business.

Starbucks Corporation Page 7

© MarketLine

Copyright of Starbucks Corporation SWOT Analysis is the property of MarketLine, a

Progressive Digital Media business and its content may not be copied or emailed to multiple

sites or posted to a listserv without the copyright holder's express written permission.

However, users may print, download, or email articles for individual use.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Full Download Ebook PDF The Powerscore Digital Lsat Logical Reasoning Bible 2020th Edition PDFDocument47 pagesFull Download Ebook PDF The Powerscore Digital Lsat Logical Reasoning Bible 2020th Edition PDFkaren.mcomber18295% (42)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BSRM SteelDocument3 pagesBSRM SteelKazi Shahazada Shahanewaz Hossain100% (1)

- McMullen - Giving Thanks With CheesecakeDocument3 pagesMcMullen - Giving Thanks With Cheesecakebalal_hossain_1No ratings yet

- Earthquake Lab PDFDocument8 pagesEarthquake Lab PDFbalal_hossain_1No ratings yet

- Test 2 Formula SheetDocument7 pagesTest 2 Formula Sheetbalal_hossain_1No ratings yet

- Masud Trading & Co 2017.07.19 BG (Payment Guarantee) Review New Sanction Tk.30.00 Lac PRODocument4 pagesMasud Trading & Co 2017.07.19 BG (Payment Guarantee) Review New Sanction Tk.30.00 Lac PRObalal_hossain_1No ratings yet

- Mock GMAT 4 SolDocument53 pagesMock GMAT 4 SolSushobhan SanyalNo ratings yet

- Preface: United Commercial Bank Limited M. Shahjahan Bhuiyan Head Office, Dhaka Managing DirectorDocument1 pagePreface: United Commercial Bank Limited M. Shahjahan Bhuiyan Head Office, Dhaka Managing Directorbalal_hossain_1No ratings yet

- M Faisal Riyad 2014Document3 pagesM Faisal Riyad 2014balal_hossain_1No ratings yet

- IKEA: Design and Pricing: CaseDocument3 pagesIKEA: Design and Pricing: Casebalal_hossain_1No ratings yet

- Raiyan's IeltsDocument3 pagesRaiyan's Ieltsbalal_hossain_1No ratings yet

- Identification of The Factors Impacting The Increase in Outstanding Claims at Melli and Mellat Banks in North Khorasan ProvinceDocument6 pagesIdentification of The Factors Impacting The Increase in Outstanding Claims at Melli and Mellat Banks in North Khorasan Provincebalal_hossain_1No ratings yet

- Executive SummaryDocument27 pagesExecutive Summarybalal_hossain_1No ratings yet

- Critical Reasoning HandoutDocument22 pagesCritical Reasoning HandoutGovardhanRNo ratings yet

- List of UniversitiesDocument6 pagesList of Universitiesbalal_hossain_1No ratings yet

- List of Sessions Top One PercentDocument1 pageList of Sessions Top One Percentbalal_hossain_1No ratings yet

- Pijush Roy CVDocument2 pagesPijush Roy CVbalal_hossain_1No ratings yet

- Working Capital Management: Navana Furniture LimitedDocument18 pagesWorking Capital Management: Navana Furniture Limitedbalal_hossain_1No ratings yet

- WCM of PBLDocument24 pagesWCM of PBLbalal_hossain_1No ratings yet

- Gardaí Never Investigated State Official's Destruction of Documents, Trial HearsDocument444 pagesGardaí Never Investigated State Official's Destruction of Documents, Trial HearsRita Cahill100% (1)

- Advanced Accounting 6th Edition Jeter Solutions ManualDocument35 pagesAdvanced Accounting 6th Edition Jeter Solutions Manuallanguor.shete0wkzrt100% (24)

- Napolcom ReviewerDocument23 pagesNapolcom ReviewerEms100% (1)

- ECSDocument53 pagesECSApurva MeshramNo ratings yet

- For, Harikrishna Concrete SolutionsDocument1 pageFor, Harikrishna Concrete SolutionsMaulik M RafaliyaNo ratings yet

- BIOETHICSDocument4 pagesBIOETHICSaira michaella libiran100% (1)

- World History ProjectDocument6 pagesWorld History ProjectEmily WilliamsNo ratings yet

- Close Reading Pericles' Funeral OrationDocument2 pagesClose Reading Pericles' Funeral OrationLorena Andreea Balas0% (1)

- Volume 42, Issue 49 - December 9, 2011Document52 pagesVolume 42, Issue 49 - December 9, 2011BladeNo ratings yet

- Faqs For Refugees and Asylum-SeekersDocument6 pagesFaqs For Refugees and Asylum-SeekersIMUNISASI DINKESNo ratings yet

- SVG ConcessionDocument16 pagesSVG ConcessionShanica Paul-RichardsNo ratings yet

- Life Insurance:: ST STDocument18 pagesLife Insurance:: ST STBAZINGA100% (1)

- DB2 For SAP MigrationDocument298 pagesDB2 For SAP MigrationJen Ni Yumz100% (1)

- Advisory: en BancDocument3 pagesAdvisory: en Bancvanessa mae riveraNo ratings yet

- Affidavit Sale Acquisition of A Motor Vehicle FillableDocument2 pagesAffidavit Sale Acquisition of A Motor Vehicle FillableVirnic FarmNo ratings yet

- Full Text Judiciary ConstiDocument130 pagesFull Text Judiciary ConstiAleah LS KimNo ratings yet

- Colonial Interpretation of Daniel DefoeDocument12 pagesColonial Interpretation of Daniel DefoeIan ChenNo ratings yet

- 02 B22 Form - Switch BL Updated (2 FM 2)Document2 pages02 B22 Form - Switch BL Updated (2 FM 2)McleanNo ratings yet

- Women Empowerment in Handeni District .bySALEHE TOBADocument129 pagesWomen Empowerment in Handeni District .bySALEHE TOBAGolden CoinNo ratings yet

- SVKM's Narsее Monjее Institutе of Managеmеnt Studiеs,: HydеrabadDocument16 pagesSVKM's Narsее Monjее Institutе of Managеmеnt Studiеs,: HydеrabadKritika MahalwalNo ratings yet

- Pepsi CoDocument6 pagesPepsi CoRyan Patrick GlennNo ratings yet

- Alasan Penghakiman Shah AlaamDocument17 pagesAlasan Penghakiman Shah AlaamofficiallydanialNo ratings yet

- Cancellation Report - Power of The CourtDocument28 pagesCancellation Report - Power of The CourtSudeep Sharma100% (1)

- Chief General Manager (Adm)Document3 pagesChief General Manager (Adm)penusilaNo ratings yet

- TRAIN LawDocument9 pagesTRAIN LawHanna LingatongNo ratings yet

- Project TrackingDocument5 pagesProject TrackingVladimir AtanasiuNo ratings yet

- Ispa in Romania enDocument12 pagesIspa in Romania enMila AndjelkovicNo ratings yet

- Group 6 - Special Rules of Court On Alternative Dispute ResolutionDocument30 pagesGroup 6 - Special Rules of Court On Alternative Dispute ResolutionHadjer MarirNo ratings yet