Professional Documents

Culture Documents

Types of Cheque

Uploaded by

Aaliyah BayleyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Types of Cheque

Uploaded by

Aaliyah BayleyCopyright:

Available Formats

Cheques

A cheques is a written order to a bank requesting them to pay the sum of money stated on the cheques

from an account to a person or company named.

The following parts of a cheques must be completed:

The date the cheques was written.

The person/company o whom the cheques was made out (payee)

The amount the cheques was made out or- this should be written in words and figures.

The signature of the person authorized to write the cheques.

Types of cheques

a) Open cheques- this is a cheques on which no amount of money is shown but which has been

signed and may or may not have the payee’s name completed. The amount is left blank for the

payee to complete.

b) Crossed cheques- has two parallel lines drawn across the face with or without the words ‘& Co’

or ‘Account payee’ within the lines. The cheques may only be paid into a bank account and may

not be presented for cash.

c) Certified cheques- is one which is issued by the bank upon the request of the customer. The

customer purchases the cheques just as he would buy a money order. The bank charges the

customer a fee for this service.

d) Post-dated cheques- is one that is dated ahead of the current date. A bank will not honor he

cheques if it is presented before the due date.

e) Counter/ personal cheques- these are made out to the payee. On presentation for payment the

payee must show some form of identification and is required to endorse the cheques in front of

the teller before the cheques is honored.

Identification and interpretation of entries in a bank statement

A bank statement is prepared at agreed intervals, usually weekly or monthly, by the bank for its

customers. The statement will shoe all the receipts and payments which have been processed through the

account during the period.

Bank statement show the following information

The name and address of the bank

The name and address of the account holder

The account number

The date of the statement

The beginning and end dates of the period covered by the statement

The previous balance, i.e. the balance at the end of the previous statement

The dates and descriptions, including the amounts, of every debit and credit entry during the

period.

The amount of any interest or service charges during the period

A running total in the final column

The balance at the end of the period.

Debit and credit entries

Debit entries- shows that money has been taken out of the account, by cheques or by standing order.

Credit entries- shows that money has been paid into the account, this may be done by depositing cheques

or cash or by a direct transfer from another account.

You might also like

- FABM - Basic DocumentsDocument4 pagesFABM - Basic DocumentsKaye LozanoNo ratings yet

- ChequeDocument3 pagesChequeRischa SoebrotoNo ratings yet

- Cheque: Apex Institute of Technology-MBADocument8 pagesCheque: Apex Institute of Technology-MBAShubham SharmaNo ratings yet

- Basic Documents and Transactions Related To Bank DepositsDocument15 pagesBasic Documents and Transactions Related To Bank DepositsJessica80% (5)

- 23 April Grade8 Source DocumentsDocument4 pages23 April Grade8 Source DocumentsoloratosephiphiNo ratings yet

- Paying BankerDocument2 pagesPaying BankerwubeNo ratings yet

- Basic Documents and Transactions Related To Bank Deposits: Fabm IiDocument20 pagesBasic Documents and Transactions Related To Bank Deposits: Fabm IiAlyssa Nikki VersozaNo ratings yet

- Bank Document and Bank Transaction Related To Bank Chapter 7 12 Abm BDocument18 pagesBank Document and Bank Transaction Related To Bank Chapter 7 12 Abm BRichard Yap100% (1)

- Module 2 - Negotiable Instrument ActDocument62 pagesModule 2 - Negotiable Instrument ActVK GamerNo ratings yet

- Basic Documents and Transactions Related To Banks DepositsDocument3 pagesBasic Documents and Transactions Related To Banks DepositsAngelica Omilla50% (2)

- Negotiable Instruments Act 1881: Difference Between Promissory Note, Bills of Exchange and ChequeDocument20 pagesNegotiable Instruments Act 1881: Difference Between Promissory Note, Bills of Exchange and ChequeJuhi JethaniNo ratings yet

- Crossing of ChequesDocument3 pagesCrossing of ChequesS K MahapatraNo ratings yet

- NI Act Cheque, Endorsement, CrossingDocument6 pagesNI Act Cheque, Endorsement, CrossingJAS 0313No ratings yet

- Wahid SirDocument6 pagesWahid SirJobayet HossainNo ratings yet

- Basic Documents and Transactions Related To Bank DepositsDocument18 pagesBasic Documents and Transactions Related To Bank DepositsSophia NicoleNo ratings yet

- Name:-Meet Shailesh Rathod Class: - Sybcom Division: - B ROLL NO: - 45 Title: - ChequeDocument12 pagesName:-Meet Shailesh Rathod Class: - Sybcom Division: - B ROLL NO: - 45 Title: - ChequeMeet RathodNo ratings yet

- Types of Cheque and Types of Corss ChequesDocument8 pagesTypes of Cheque and Types of Corss Chequesprahalakash Reg 113No ratings yet

- FABM2 Wk8Document6 pagesFABM2 Wk8john lester pangilinanNo ratings yet

- Chapter 2 - Basic Documents and TransactionsDocument33 pagesChapter 2 - Basic Documents and Transactionsmarissa casareno almuete100% (1)

- Banking Operations: Cheques & EndorsementsDocument12 pagesBanking Operations: Cheques & EndorsementsSharath SaunshiNo ratings yet

- Customary Business Documents and Their UseDocument4 pagesCustomary Business Documents and Their Usejosephinemusopelo1No ratings yet

- Unit 2 LPBDocument9 pagesUnit 2 LPBVeena ReddyNo ratings yet

- Remittances: Pay Order / Cashier's Cheque / Banker's ChequeDocument12 pagesRemittances: Pay Order / Cashier's Cheque / Banker's ChequeHussnain NaneNo ratings yet

- BankingDocument14 pagesBankingFahmi AbdullaNo ratings yet

- Stale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixDocument3 pagesStale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixAlexanderJacobVielMartinezNo ratings yet

- Stale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixDocument3 pagesStale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixAlexanderJacobVielMartinezNo ratings yet

- Stale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixDocument3 pagesStale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixAlexanderJacobVielMartinezNo ratings yet

- Chapter 4 - Cash ControlDocument16 pagesChapter 4 - Cash ControlNigussie BerhanuNo ratings yet

- Report in EthicsDocument6 pagesReport in EthicscecdeveraNo ratings yet

- F.2. Basic Bank Documents and Terminologies Related To BankDocument28 pagesF.2. Basic Bank Documents and Terminologies Related To BankSecret DeityNo ratings yet

- Cheques PDFDocument4 pagesCheques PDFJosé BurgeiroNo ratings yet

- Basic Banking TransactionDocument30 pagesBasic Banking TransactionJennifer Dela Rosa100% (1)

- Bank DepositDocument5 pagesBank Depositlit af100% (2)

- 9negotiableinstruments 120527122657 Phpapp01Document33 pages9negotiableinstruments 120527122657 Phpapp01Amila SampathNo ratings yet

- CHEQUESDocument5 pagesCHEQUESParthNo ratings yet

- BANK Documents and ReconciliationDocument47 pagesBANK Documents and ReconciliationGlenn Altar100% (1)

- English at The Bank L2 s3Document4 pagesEnglish at The Bank L2 s3Chaimaa Lakhder BennaceurNo ratings yet

- Abm Basic DocumentsDocument6 pagesAbm Basic DocumentsAmimah Balt GuroNo ratings yet

- Quarter 2 Modified Module 2Document10 pagesQuarter 2 Modified Module 2erica lamsenNo ratings yet

- Source DocumentsDocument3 pagesSource DocumentsNurudeen JiomhNo ratings yet

- Cheque and TypesDocument2 pagesCheque and TypesDoorga SatpathyNo ratings yet

- Cheque Objectives: Unit - V Chapter - IXDocument14 pagesCheque Objectives: Unit - V Chapter - IXritika sharmaNo ratings yet

- Fia Fa1 Authorizing and Making PaymentsDocument29 pagesFia Fa1 Authorizing and Making PaymentsKj Nayee100% (1)

- Accounting IG Section 2.2 Business DocumentsDocument9 pagesAccounting IG Section 2.2 Business DocumentsJuné MaraisNo ratings yet

- Deposit SlipDocument1 pageDeposit SlipSameer Khan NiaziNo ratings yet

- LESSON 3.1 - Bank Accounts and Related DocumentsDocument5 pagesLESSON 3.1 - Bank Accounts and Related DocumentsIshi MaxineNo ratings yet

- Stale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixDocument3 pagesStale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixAlexanderJacobVielMartinezNo ratings yet

- Document 9Document3 pagesDocument 9AlexanderJacobVielMartinezNo ratings yet

- Stale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixDocument3 pagesStale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixAlexanderJacobVielMartinezNo ratings yet

- Stale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixDocument3 pagesStale Check Is A Check That Is Presented To Be Cashed or Deposited at A Bank SixAlexanderJacobVielMartinezNo ratings yet

- RB Chapter 2A-Current Account-MITCDocument9 pagesRB Chapter 2A-Current Account-MITCRohit KumarNo ratings yet

- Document 9Document3 pagesDocument 9AlexanderJacobVielMartinezNo ratings yet

- AbmDocument10 pagesAbmMark AndrewNo ratings yet

- Deposit SlipDocument1 pageDeposit SlipMABALE Jeremy RancellNo ratings yet

- Deposit SlipDocument1 pageDeposit SlipMABALE Jeremy RancellNo ratings yet

- Abm LecDocument6 pagesAbm LecSheanne GuerreroNo ratings yet

- Do You Have A: SavingsDocument34 pagesDo You Have A: SavingsLee TeukNo ratings yet

- CHEQUEDocument7 pagesCHEQUEAnimesh BawejaNo ratings yet

- SerenaDocument1 pageSerenaAaliyah BayleyNo ratings yet

- Tea Blend Speciality TestDocument2 pagesTea Blend Speciality TestAaliyah BayleyNo ratings yet

- C o N V e y A N C eDocument2 pagesC o N V e y A N C eAaliyah BayleyNo ratings yet

- Grammer Is Incorrect Because of TheyDocument3 pagesGrammer Is Incorrect Because of TheyAaliyah BayleyNo ratings yet

- A Leader Is Someone Who Can See How Things Can Be Improved and Who Rallies People To Move Toward That Better VisionDocument1 pageA Leader Is Someone Who Can See How Things Can Be Improved and Who Rallies People To Move Toward That Better VisionAaliyah BayleyNo ratings yet

- A Leader Is Someone Who Can See How Things Can Be Improved and Who Rallies People To Move Toward That Better VisionDocument1 pageA Leader Is Someone Who Can See How Things Can Be Improved and Who Rallies People To Move Toward That Better VisionAaliyah BayleyNo ratings yet

- Past Paper 2005edpmDocument4 pagesPast Paper 2005edpmAaliyah BayleyNo ratings yet

- Christmas Party: Eat, Drink and Be MERRY!Document2 pagesChristmas Party: Eat, Drink and Be MERRY!Aaliyah BayleyNo ratings yet

- Aaliyah Bayley Alvin Jones &: TogetherDocument1 pageAaliyah Bayley Alvin Jones &: TogetherAaliyah BayleyNo ratings yet

- An A G R e e M e N TDocument2 pagesAn A G R e e M e N TAaliyah BayleyNo ratings yet

- C o N V e y A N C eDocument2 pagesC o N V e y A N C eAaliyah BayleyNo ratings yet

- National Environmental Agency. ST James Branch: 21 January 2021Document2 pagesNational Environmental Agency. ST James Branch: 21 January 2021Aaliyah BayleyNo ratings yet

- 2fully Blocked LetterDocument1 page2fully Blocked LetterAaliyah BayleyNo ratings yet

- Blocked Letter With Table 1Document2 pagesBlocked Letter With Table 1Aaliyah BayleyNo ratings yet

- Questionnaire OaDocument3 pagesQuestionnaire OaAaliyah BayleyNo ratings yet

- Use and Misuse of Public Sector Resources - Tip Sheet For ManagersDocument6 pagesUse and Misuse of Public Sector Resources - Tip Sheet For ManagersAaliyah BayleyNo ratings yet

- Questionnaire OaDocument3 pagesQuestionnaire OaAaliyah BayleyNo ratings yet

- Sba Research CyberbullyingDocument13 pagesSba Research CyberbullyingAaliyah BayleyNo ratings yet

- Anak Mami PenangDocument1 pageAnak Mami PenangAnonymous fE2l3DzlNo ratings yet

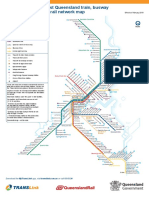

- Train Busway Ferry Tram Network MapDocument1 pageTrain Busway Ferry Tram Network MapAntonius Fran Yannu PramudyoNo ratings yet

- Handout 3Document51 pagesHandout 3Jilian Kate Alpapara Bustamante100% (1)

- Finals Assignment 1Document1 pageFinals Assignment 1Mary Kris CaparosoNo ratings yet

- Documentation Assistant (Theory Exam) : Signature of The CandidateDocument4 pagesDocumentation Assistant (Theory Exam) : Signature of The CandidateOsmania MbaNo ratings yet

- BSNL BillDocument3 pagesBSNL BillTakpire DrMadhukar50% (2)

- Disadvantages of A LockboxesDocument2 pagesDisadvantages of A LockboxesTk KimNo ratings yet

- 214 Heritage PDFDocument1 page214 Heritage PDFkapilNo ratings yet

- Chetan Jain - Exp. - Sheet - Sep 2020Document7 pagesChetan Jain - Exp. - Sheet - Sep 2020rishichauhan25No ratings yet

- JS Bank Soc 2021 Revised3Document40 pagesJS Bank Soc 2021 Revised3Moiz AhmedNo ratings yet

- IQJxjk EFTy Ua 5 G KTDocument8 pagesIQJxjk EFTy Ua 5 G KTAbhishek KeshariNo ratings yet

- Amazon - in - Order 404-8396296-3125127Document1 pageAmazon - in - Order 404-8396296-3125127Zohaib MirzaNo ratings yet

- RID 3141 District Dues Form 2019 - 20Document2 pagesRID 3141 District Dues Form 2019 - 20priyanka desaiNo ratings yet

- 2023 02 23 12 53 06jan 23 - 410501Document5 pages2023 02 23 12 53 06jan 23 - 410501bibhuti bhusan routNo ratings yet

- FA1 NotesDocument270 pagesFA1 Notesdaneq80% (10)

- Shikher - Mscu9891530Document1 pageShikher - Mscu9891530Ravi kantNo ratings yet

- Ura Internship Shortlist For JuneDocument14 pagesUra Internship Shortlist For JuneThe Independent Magazine100% (2)

- CTA Case EB For ReferenceDocument29 pagesCTA Case EB For Referencepatricia_arpilledaNo ratings yet

- PDF-Logistics & Supply Chain ManagementDocument34 pagesPDF-Logistics & Supply Chain ManagementShyam Khamniwala73% (15)

- Statement 20200901 20200910Document15 pagesStatement 20200901 20200910Dika MongkolNo ratings yet

- Consumer Pricing Information BrochureDocument5 pagesConsumer Pricing Information BrochureKristian LNo ratings yet

- Narayan College Fee Structure 2021 22 Residential FeeDocument1 pageNarayan College Fee Structure 2021 22 Residential Feeankur agarwalNo ratings yet

- MLTC CATRAM Market Study Container Terminals West and Central AfricaDocument133 pagesMLTC CATRAM Market Study Container Terminals West and Central AfricazymiscNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsMurugan AyyaswamyNo ratings yet

- Payslip For September 2019 - LIANGCHOW (Closed Payroll) : Uniteam Marine LimitedDocument1 pagePayslip For September 2019 - LIANGCHOW (Closed Payroll) : Uniteam Marine LimitedThet NaingNo ratings yet

- B.M Pharmaceuticals.Document3 pagesB.M Pharmaceuticals.LoveSahilSharmaNo ratings yet

- Aqil Zizov MUhasibat U Otu Imtahan SuallarDocument23 pagesAqil Zizov MUhasibat U Otu Imtahan SuallarKamran AslanNo ratings yet

- Vanapalli Sumalatha Account StatementDocument2 pagesVanapalli Sumalatha Account StatementSumalatha VanapalliNo ratings yet

- Description From Currency To Currency Recipient Receive Exchange Rate Amount DueDocument1 pageDescription From Currency To Currency Recipient Receive Exchange Rate Amount DueJOMBANG TIMOERNo ratings yet

- Bank StatementDocument3 pagesBank StatementVikas a chhabraNo ratings yet