Professional Documents

Culture Documents

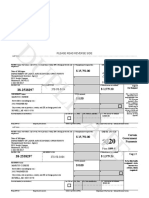

CORRECTED (If Checked) : Nonemployee Compensation

Uploaded by

Olga PopazuOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CORRECTED (If Checked) : Nonemployee Compensation

Uploaded by

Olga PopazuCopyright:

Available Formats

Form Reference ID

US_2020_1099NEC_1009720073_0

AMAZON.COM, INC.

PO BOX 80683

SEATTLE, WA 98108-0683

OLGA VALENTIN POPAZU

14351 SE SUMMERFIELD WAY

HAPPY VALLEY, OR 97086

CORRECTED (if checked)

PAYER’S name, street address, city or town, state or province, country, ZIP OMB No. 1545-0116

or foreign postal code, and telephone no.

Nonemployee

AMAZON.COM, INC.

PO BOX 80683

SEATTLE, WA 98108-0683

2020 Compensation

1-425-697-9440

Form 1099-NEC

1 Nonemployee compensation

Copy B

$ 2,181.00

For Recipient

PAYER’S TIN RECIPIENT’S TIN 2

91-1646860 XXX-XX-0980

RECIPIENT’S name and address 3

This is important tax

OLGA VALENTIN POPAZU information and is

14351 SE SUMMERFIELD WAY being furnished to

HAPPY VALLEY, OR 97086 the IRS. If you are

4 Federal income tax withheld required to file a

return, a negligence

penalty or other

$ 0.00

sanction may be

imposed on you if

this income is taxable

and the IRS

determines that it has

not been reported.

FATCA filing

requirement

Account number (see instructions) 5 State tax withheld 6 State/Payer’s state no. 7 State income

1099NEC_1009720073

$ OR $

$ $

Form 1099-NEC (keep for your records) www.irs.gov/Form1099NEC Department of the Treasury - Internal Revenue Service

Instructions for Recipient You must also complete Form 8919 and attach it to your return. If you are not an employee

but the amount in this box is not SE income (for example, it is income from a sporadic activity

Recipient’s taxpayer identification number (TIN). For your protection, this form may show or a hobby), report this amount on the “Other income” line (on Schedule 1 (Form 1040 or

only the last four digits of your TIN (social security number (SSN), individual taxpayer 1040-SR); or on Form 1040-NR).

identification number (ITIN), adoption taxpayer identification number (ATIN), or employer The amounts being reported as NQDC are includible in gross income for failure to meet the

identification number (EIN)). However, the issuer has reported your complete TIN to the IRS. requirements under section 409A. This amount is also reported on Form 1099-MISC for

FATCA filing requirement. If the FATCA filing requirement box is checked, the payer is additional tax calculation. See the Instructions for Forms 1040 and 1040-SR, or the

reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement. You may Instructions for Form 1040-NR.

also have a filing requirement. See the Instructions for Form 8938. Box 2. Reserved.

Account number. May show an account or other unique number the payer assigned to Box 3. Reserved.

distinguish your account.

Box 4. Shows backup withholding. A payer must backup withhold on certain payments if you

Box 1. Shows nonemployee compensation and/or nonqualified deferred compensation did not give your TIN to the payer. See Form W-9, Request for Taxpayer Identification

(NQDC). If you are in the trade or business of catching fish, box 1 may show cash you received Number and Certification, for information on backup withholding. Include this amount on your

for the sale of fish. If the amount in this box is self-employment (SE) income, report it on income tax return as tax withheld.

Schedule C or F (Form 1040 or 1040-SR), and complete Schedule SE (Form 1040 or 1040-SR).

You received this form instead of Form W-2 because the payer did not consider you an Boxes 5–7. State income tax withheld reporting boxes.

employee and did not withhold income tax or social security and Medicare tax. If you believe Future developments. For the latest information about developments related to Form 1099-

you are an employee and cannot get the payer to correct this form, report this amount on the NEC and its instructions, such as legislation enacted after they were published, go to

line for “Wages, salaries, tips, etc.” of Form 1040, 1040-SR, or 1040-NR. www.irs.gov/Form1099NEC.

Printed On Feb 18, 2021

Amazon has included the below supplemental payment details to help identify the source of reportable

payments. This statement is for information purposes only and is not provided to the IRS.

Box 1 Box 4

Payment Source (Nonemployee (Federal income

compensation) tax withheld)

Amazon Flex 2,181.00

Total 2,181.00

All values in the table above are USD ($).

Form 1099-NEC: Nonemployee Compensation

What’s a 1099-NEC?

Form 1099-NEC is used to report nonemployee compensation (e.g. service income) to U.S. payees. Form 1099-NEC is replacing the use of Form 1099-MISC.

If you are a U.S. payee and received nonemployee compensation totaling $600 or more, Amazon is required to provide you a 1099-NEC form as well as report

these amounts to the IRS.

Will I also get a 1099-MISC?

If you are a U.S. payee and earn income reportable on Form 1099-MISC (e.g. royalty or rent income) by participating in one or more Amazon programs, you

may be eligible to receive a 1099-MISC if you meet the reporting threshold ($10 for royalties and $600 for all other payments). To make sure you have all your

year-end reporting forms, go to taxcentral.amazon.com.

What’s represented in the table?

Your form is a summary of the payments you received from Amazon in 2020. This table is for informational purposes only and is not provided to the IRS. For

specifics on the earning amounts, reference the earning statements within your Flex app.

How are the payment amounts calculated?

For the breakdown of your payments, you can access your payment dashboard within the Flex app. Note the “Deposit” line for confirmation of payments.

Need to update your name, address, or other tax information?

Amazon cannot reissue a tax form for previous years due to an updated name, address or Tax ID. To ensure your information is updated for subsequent forms,

you can retake the Tax Interview through your Flex app.

Have a question about your 1099-NEC?

- Email us at amazonflex-support@amazon.com

- OR Login to https://taxcentral.amazon.com and click 'Contact us'.

Printed On Feb 18, 2021

You might also like

- 2020 1099necDocument2 pages2020 1099necgi silNo ratings yet

- CORRECTED (If Checked) : Nonemployee CompensationDocument2 pagesCORRECTED (If Checked) : Nonemployee CompensationNathalin De IsoldiNo ratings yet

- 2020 1099NECkDocument2 pages2020 1099NECkJessica ZhicayNo ratings yet

- MABOTRUCKINGLLC22Document2 pagesMABOTRUCKINGLLC22Alex RojasNo ratings yet

- Miscellaneous Income: US - 2019 - 1099MISC - 1003104696 - 0Document2 pagesMiscellaneous Income: US - 2019 - 1099MISC - 1003104696 - 0Mark JamesNo ratings yet

- Maplebear, Inc. 50 Beale Street, 6th Floor San Francisco, CA 94105 1,604.65Document2 pagesMaplebear, Inc. 50 Beale Street, 6th Floor San Francisco, CA 94105 1,604.65YoSoyOscarMesaNo ratings yet

- My 1099 NecDocument1 pageMy 1099 Nectomiwande6No ratings yet

- Date: Jan 13 2021 Letter ID: L0031761089 Claimant ID: FMGGKWDocument2 pagesDate: Jan 13 2021 Letter ID: L0031761089 Claimant ID: FMGGKWJoshua PrimacioNo ratings yet

- 2022 1099necDocument2 pages2022 1099necShirley MazariegosNo ratings yet

- View FileDocument2 pagesView FilejpneebNo ratings yet

- Lindsay 1099Document1 pageLindsay 1099Thomas SheffieldNo ratings yet

- 2023 1099necDocument2 pages2023 1099necjose.oliverosflacNo ratings yet

- Instructions For Recipient: Copy BDocument2 pagesInstructions For Recipient: Copy Bjohana150218No ratings yet

- SomewhereinBangkokThaiRestaurantofAvon256 Payee'sDocument4 pagesSomewhereinBangkokThaiRestaurantofAvon256 Payee'sChanya SiboribounNo ratings yet

- DocumentsDocument2 pagesDocumentstracyreneejonesemailNo ratings yet

- Form 1099GDocument2 pagesForm 1099GMarcus KreseNo ratings yet

- WandaDocument1 pageWandaJuegos DebeNo ratings yet

- Eddie Cisneros IRS Form 1099-NECDocument1 pageEddie Cisneros IRS Form 1099-NECEddie CisnerosNo ratings yet

- Amado Fernandez MartinezDocument1 pageAmado Fernandez MartinezJuegos DebeNo ratings yet

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDocument1 pageMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNo ratings yet

- Nonemployee Compensation: Copy B For RecipientDocument1 pageNonemployee Compensation: Copy B For RecipientNubia LisboaNo ratings yet

- 1099 HsuxixfkrDocument1 page1099 HsuxixfkrhayyandaiNo ratings yet

- $0 Copy B: Miscellaneous InformationDocument2 pages$0 Copy B: Miscellaneous InformationGustavo BonillaNo ratings yet

- Optavia LLC 100 International Drive Baltimore, MD 21202-1099Document1 pageOptavia LLC 100 International Drive Baltimore, MD 21202-1099Kristin ThorntonNo ratings yet

- ShowDocument2 pagesShowDavid GouiranNo ratings yet

- DocumentsDocument2 pagesDocumentsswanbernard56No ratings yet

- Oji 2Document2 pagesOji 2brent_barthanyNo ratings yet

- Tax 10986Document2 pagesTax 10986Maikeru ShogunnateMusa MNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMJackson kaylaNo ratings yet

- Documents (942,202212311058, F99NEE)Document2 pagesDocuments (942,202212311058, F99NEE)LertoraNo ratings yet

- 1099-R Copy B: CORRECTED (If Checked)Document6 pages1099-R Copy B: CORRECTED (If Checked)Dave MNo ratings yet

- 2022 Uber 1099-NECDocument2 pages2022 Uber 1099-NECmwgageNo ratings yet

- Student's 1098T Form PDFDocument1 pageStudent's 1098T Form PDFVexel 22No ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- UICAnnual1099 2010 01 09 00.32.54.009000Document1 pageUICAnnual1099 2010 01 09 00.32.54.009000Paul Michael WiremanNo ratings yet

- Walmart Inc. 850 Cherry Ave., San Bruno, CA 94066: CORRECTED (If Checked)Document1 pageWalmart Inc. 850 Cherry Ave., San Bruno, CA 94066: CORRECTED (If Checked)maria rodriguezNo ratings yet

- QRFS Olden WerldeDocument2 pagesQRFS Olden Werldespartalives75No ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementJonathan EllisNo ratings yet

- ShowDocument2 pagesShowPaige BurgosNo ratings yet

- Fed ReserveDocument2 pagesFed Reservepenelope feitNo ratings yet

- Duplicate: Certain Government PaymentsDocument2 pagesDuplicate: Certain Government PaymentsPrincewill OdenigboNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- Kansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869Document4 pagesKansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869ChuckNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementVampire LadyNo ratings yet

- Uber Misc PDFDocument2 pagesUber Misc PDFWaleed A ElTahanNo ratings yet

- Tax Form 1099nec 20230121Document2 pagesTax Form 1099nec 20230121God Is GreatNo ratings yet

- 1099 G 2018documentdownloadDocument1 page1099 G 2018documentdownloadKristine McVeighNo ratings yet

- Swe Win 2022 1099 PDFDocument2 pagesSwe Win 2022 1099 PDFKuka Win50% (2)

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- Kansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869Document4 pagesKansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869ChuckNo ratings yet

- Form 1099 IntDocument1 pageForm 1099 IntEdeke0% (1)

- Statement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GDocument1 pageStatement For Recipients of Pandemic Unemployment Assistance (Pua) Payments PUA-1099GClifton WilsonNo ratings yet

- CORRECTED (If Checked) : Payment Card and Third Party Network TransactionsDocument2 pagesCORRECTED (If Checked) : Payment Card and Third Party Network TransactionsROCIO menjivarNo ratings yet

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- ShowDocument2 pagesShowBrianna Jean-BaptisteNo ratings yet

- CORRECTED (If Checked) : Payment Card and Third Party Network TransactionsDocument2 pagesCORRECTED (If Checked) : Payment Card and Third Party Network TransactionsCarter NiselyNo ratings yet

- Interest Income: For Questions Please Call: 1-888-464-0727Document2 pagesInterest Income: For Questions Please Call: 1-888-464-0727Lisa Nielsen-SmithNo ratings yet

- UI Online - Doc - 20210110165828Document2 pagesUI Online - Doc - 20210110165828Mark ThomasNo ratings yet

- 1099-r FREEDocument11 pages1099-r FREEItzFire2kNo ratings yet

- United States v. Yoan Alvarez-Hernandez, 11th Cir. (2016)Document4 pagesUnited States v. Yoan Alvarez-Hernandez, 11th Cir. (2016)Scribd Government DocsNo ratings yet

- The Internal Revenue Service, A Private CorporationDocument7 pagesThe Internal Revenue Service, A Private Corporationnakan103No ratings yet

- United States v. Tyrone Roberson, 991 F.2d 627, 10th Cir. (1993)Document2 pagesUnited States v. Tyrone Roberson, 991 F.2d 627, 10th Cir. (1993)Scribd Government DocsNo ratings yet

- Extension of Continuing Appropriations and Other Matters Act, 2024Document6 pagesExtension of Continuing Appropriations and Other Matters Act, 2024Daily Caller News FoundationNo ratings yet

- Forgett v. United States, 390 U.S. 203 (1968)Document1 pageForgett v. United States, 390 U.S. 203 (1968)Scribd Government DocsNo ratings yet

- Jones, Collector of Internal Revenue v. Kyle, 190 F.2d 353, 10th Cir. (1951)Document8 pagesJones, Collector of Internal Revenue v. Kyle, 190 F.2d 353, 10th Cir. (1951)Scribd Government DocsNo ratings yet

- Notice: Sanctions, blocked persons, specially-designated nationals, terrorists, narcotics traffickers, and foreign terrorist organizations: Narcotics-related blocked persons and entities; additional designationsDocument3 pagesNotice: Sanctions, blocked persons, specially-designated nationals, terrorists, narcotics traffickers, and foreign terrorist organizations: Narcotics-related blocked persons and entities; additional designationsJustia.comNo ratings yet

- How To Live Without Social Security NumberDocument227 pagesHow To Live Without Social Security NumberCarolNo ratings yet

- Notice of Appeal - Citizens United II - Tenth CircuitDocument3 pagesNotice of Appeal - Citizens United II - Tenth CircuitColorado Ethics WatchNo ratings yet

- Gonder IndictmentDocument9 pagesGonder IndictmentChris GothnerNo ratings yet

- River Road Alliance, Inc. v. Corps of Engineers of The United States Army, 475 U.S. 1055 (1986)Document3 pagesRiver Road Alliance, Inc. v. Corps of Engineers of The United States Army, 475 U.S. 1055 (1986)Scribd Government DocsNo ratings yet

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument1 pageNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNo ratings yet

- United States v. Daryon Sharp, 11th Cir. (2009)Document4 pagesUnited States v. Daryon Sharp, 11th Cir. (2009)Scribd Government DocsNo ratings yet

- IRS Notice 1446Document1 pageIRS Notice 1446Courier JournalNo ratings yet

- Executive Order 12291 PDFDocument2 pagesExecutive Order 12291 PDFAdam0% (1)

- Doane, AKA Harig v. Educational Credit Management Corp, 543 U.S. 1147 (2005)Document1 pageDoane, AKA Harig v. Educational Credit Management Corp, 543 U.S. 1147 (2005)Scribd Government DocsNo ratings yet

- Description: Tags: ColoradoDocument4 pagesDescription: Tags: Coloradoanon-131843No ratings yet

- Executive Branch PowerPoint 1Document15 pagesExecutive Branch PowerPoint 1Jordan RidenourNo ratings yet

- Cadman v. Johansen, Judge, Seventh District Juvenile Court of Utah, 544 U.S. 924 (2005)Document1 pageCadman v. Johansen, Judge, Seventh District Juvenile Court of Utah, 544 U.S. 924 (2005)Scribd Government DocsNo ratings yet

- 07 BpqyDocument1 page07 BpqyMichael Van EssenNo ratings yet

- (HC) Pijenko v. Mukasey Et Al - Document No. 6Document1 page(HC) Pijenko v. Mukasey Et Al - Document No. 6Justia.comNo ratings yet

- 94 Non Resident Alien ChartDocument1 page94 Non Resident Alien Chartsabiont100% (5)

- Alan K. Lauckner v. United States v. John Hug Paul E. Costello Thomas J. Giacomaro Umberto J. Guido, Jr. William McGlynn Leonard A. Pellulo, Counterclaim, 68 F.3d 69, 3rd Cir. (1995)Document2 pagesAlan K. Lauckner v. United States v. John Hug Paul E. Costello Thomas J. Giacomaro Umberto J. Guido, Jr. William McGlynn Leonard A. Pellulo, Counterclaim, 68 F.3d 69, 3rd Cir. (1995)Scribd Government DocsNo ratings yet

- Notice: Census 2010: Geographically Updated Population Certification Program SuspensionDocument1 pageNotice: Census 2010: Geographically Updated Population Certification Program SuspensionJustia.comNo ratings yet

- McFarland v. Buss - Document No. 2Document1 pageMcFarland v. Buss - Document No. 2Justia.comNo ratings yet

- 4506-T FormDocument1 page4506-T FormStephen J. O'MalleyNo ratings yet

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipNo ratings yet

- Cole Creighton - Reconstruction DBQDocument1 pageCole Creighton - Reconstruction DBQtica1118No ratings yet

- Court OrderDocument2 pagesCourt OrderHarold HugginsNo ratings yet

- NICS Firearm Checks - Month Year by StateDocument25 pagesNICS Firearm Checks - Month Year by StateScott McClallenNo ratings yet