Professional Documents

Culture Documents

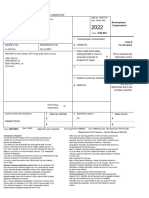

Student's 1098T Form PDF

Uploaded by

Vexel 220 ratings0% found this document useful (0 votes)

64 views1 pageTo revoke a previous consent to receive a 1098-T electronically, select 'Revoke Consent' and update your delivery preference, or contact your school. If you need a duplicate copy of the 1098-T, have questions about corrections to it, or questions regarding it, please contact your school directly. The document provides instructions for students on using the 1098-T form to claim education credits.

Original Description:

Original Title

Student's 1098T Form.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTo revoke a previous consent to receive a 1098-T electronically, select 'Revoke Consent' and update your delivery preference, or contact your school. If you need a duplicate copy of the 1098-T, have questions about corrections to it, or questions regarding it, please contact your school directly. The document provides instructions for students on using the 1098-T form to claim education credits.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

64 views1 pageStudent's 1098T Form PDF

Uploaded by

Vexel 22To revoke a previous consent to receive a 1098-T electronically, select 'Revoke Consent' and update your delivery preference, or contact your school. If you need a duplicate copy of the 1098-T, have questions about corrections to it, or questions regarding it, please contact your school directly. The document provides instructions for students on using the 1098-T form to claim education credits.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

To revoke a previous consent to receive the 1098-T electronically,

select ‘Revoke Consent’ to update the delivery preference, or

contact your school.

To receive a duplicate copy of the 1098-T, or for any corrections or

questions regarding the 1098-T, please contact your school.

Current Selected Delivery Method: Paper

CORRECTED

FILER’S name, street address, city or town, state or province, country, ZIP or 1 Payments received for OMB No. 1545-1574

foreign postal code, and telephone number qualified tuition and related

NUC University - IBC Institute - Fajardo expenses

Carretera #3 km.44.0 Bo Quebrada

Fajardo, PR 00738

$

3,499.00 22 Tuition

2 Statement

787-860-6262

Form 1098-T

FILER'S employer identification no. STUDENT'S TIN 3 Copy B

66-0328632 ***-**-6228 For Student

STUDENT'S name This is important

4 Adjustments made for a 5 Scholarships or grants

Kevin A Garcia Claudio prior year tax information

and is being

$ 0.00 $ 3972.50 furnished to the

Street address (including apt. no.) 6 Adjustments to 7 Checked if the amount IRS. This form

Bo Mariana sector el banco 1313 in box 1 includes must be used to

scholarships or grants

amounts for an complete Form

City or town, state or province, country, and ZIP or foreign postal code for a prior year

academic period 8863

Naguabo, PR, 00718 beginning January - to claim education

$ 0.00 March 2023 credits. Give it to

Service Provider/Acct. No. (see instr.) 8 Checked if at least 9 Checked if a graduate 10 Ins. contract reimb./refund the

2112970981 half-time student student $ tax preparer or use

it

to prepare the tax

return.

Form 1098-T (keep for your records) www.irs.gov/Form1098T Department of the Treasury - Internal Revenue Service

Instructions for Student

Box 4. Shows any adjustment made by an eligible educational institution for a

You, or the person who can claim you as a dependent, may be able to prior year for qualified tuition and related expenses that were reported on a prior

claim an education credit on Form 1040 or 1040-SR. This statement has year Form 1098-T. This amount may reduce any allowable education credit that

been furnished to you by an eligible educational institution in which you you claimed for the prior year (may result in an increase in tax liability for the year

are enrolled, or by an insurer who makes reimbursements or refunds of of the refund). See “recapture” in the index to Pub. 970 to report a reduction in

qualified tuition and related expenses to you. This statement is required your education credit or tuition and fees deduction.

to support any claim for an education credit. Retain this statement for

your records. To see if you qualify for a credit, and for help in calculating Box 5. Shows the total of all scholarships or grants administered and processed

the amount of your credit, see Pub. 970, Form 8863, and the Instructions by the eligible educational institution. The amount of scholarships or grants for the

for Form 1040. Also, for more information, go to www.irs.gov/Credits- calendar year (including those not reported by the institution) may reduce the

Deductions/Individuals/Qualified-Ed-Expenses. amount of the education credit you claim for the year.

TIP: You may be able to increase the combined value of an education credit and

Your institution must include its name, address, and information certain educational assistance (including Pell Grants) if the student includes some

contact telephone number on this statement. It may also include contact or all of the educational assistance in income in the year it is received. For details,

information for a service provider. Although the filer or the service see Pub. 970.

provider may be able to answer certain questions about the statement,

do not contact the filer or the service provider for explanations of the Box 6. Shows adjustments to scholarships or grants for a prior year. This amount

requirements for (and how to figure) any education credit that you may may affect the amount of any allowable tuition and fees deduction or education

claim. credit that you claimed for the prior year. You may have to file an amended

income tax return (Form 1040-X) for the prior year.

Student's taxpayer identification number (TIN). For your protection,

this form may show only the last four digits of your TIN (SSN, ITIN, ATIN, Box 7. Shows whether the amount in box 1 includes amounts for an academic

or EIN). However, the issuer has reported your complete TIN to the IRS. period beginning January-March 2023. See Pub. 970 for how to report these

Caution: If your TIN is not shown in this box, your school was not able to amounts.

provide it. Contact your school if you have questions.

Box 8. Shows whether you are considered to be carrying at least one-half the

Account number. May show an account or other unique number the filer normal full-time workload for your course of study at the reporting institution.

assigned to distinguish your account.

Box 9. Shows whether you are considered to be enrolled in a program leading to

Box 1. Shows the total payments received by an eligible educational a graduate degree, graduate-level certificate, or other recognized graduate-level

institution in 2022 from any source for qualified tuition and related educational credential.

expenses less any reimbursements or refunds made during 2022 that

relate to those payments received during 2022. Box 10. Shows the total amount of reimbursements or refunds of qualified tuition

and related expenses made by an insurer. The amount of reimbursements or

Box 2. Reserved for future use. refunds for the calendar year may reduce the amount of any education credit you

Box 3. Reserved for future use. can claim for the year (may result in an increase in tax liability for the year of the

refund).

Future developments. For the latest information about developments related to

Form 1098-T and its instructions, such as legislation enacted after they were

published, go to www.irs.gov/Form1098T.

Free File Program. Go to www.irs.gov/FreeFile to see if you qualify for no-cost

online federal tax preparation, e-filing, and direct deposit or payment options.

You might also like

- 1099-R tax form detailsDocument3 pages1099-R tax form detailsRichy FeeneyNo ratings yet

- Kansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869Document4 pagesKansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869ChuckNo ratings yet

- 2022 Uber 1099-NECDocument2 pages2022 Uber 1099-NECmwgageNo ratings yet

- Gov. Walz 2020 Tax Returns - RedactedDocument19 pagesGov. Walz 2020 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- ShowDocument2 pagesShowPaige BurgosNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- 2020 Tuition Statement for Emma GouiranDocument2 pages2020 Tuition Statement for Emma GouiranDavid GouiranNo ratings yet

- Ilq 1 Bjxrypizq 2 Lvy 3 SMTBTWDocument1 pageIlq 1 Bjxrypizq 2 Lvy 3 SMTBTWMark Aaron WilsonNo ratings yet

- 104722130ilq1bjxrypizq2lvy3smtbtw PDFDocument1 page104722130ilq1bjxrypizq2lvy3smtbtw PDFMark Aaron WilsonNo ratings yet

- Corrected Tuition Statement SummaryDocument2 pagesCorrected Tuition Statement Summaryed redfNo ratings yet

- Tuition Statement Provides Tax InfoDocument2 pagesTuition Statement Provides Tax InfoJonathan EllisNo ratings yet

- CORRECTED 1098-TDocument2 pagesCORRECTED 1098-TVampire LadyNo ratings yet

- Corrected: Brigham Young University 7195.00 Brigham Young University A153A ASBDocument2 pagesCorrected: Brigham Young University 7195.00 Brigham Young University A153A ASBNathan MonsonNo ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- ShowDocument2 pagesShowBrianna Jean-BaptisteNo ratings yet

- Please To Do Not Use The Back ButtonDocument2 pagesPlease To Do Not Use The Back ButtonDavid MillerNo ratings yet

- ShowDocument2 pagesShowBrian williamNo ratings yet

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDocument1 pageMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNo ratings yet

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- SSF SS 1098T PDFDocument1 pageSSF SS 1098T PDFJoseph FabreNo ratings yet

- IRS Form 1098-T Tax Filing GuideDocument6 pagesIRS Form 1098-T Tax Filing GuideLou DraitNo ratings yet

- f1098t PDFDocument6 pagesf1098t PDFashley valdiviaNo ratings yet

- Attention:: IRS - Gov/form1099Document4 pagesAttention:: IRS - Gov/form1099nantenaina randrianarisonNo ratings yet

- 1098 T UWM 2017 PDFDocument2 pages1098 T UWM 2017 PDFsolrak9113No ratings yet

- f1098t PDFDocument6 pagesf1098t PDFLou DraitNo ratings yet

- IRS Form 1098-T Tuition Statement Filing InstructionsDocument6 pagesIRS Form 1098-T Tuition Statement Filing InstructionsrochelleNo ratings yet

- f1098t 2021Document6 pagesf1098t 2021Batman Arkham Kinght™️No ratings yet

- 1098T17Document2 pages1098T17RegrubdiupsNo ratings yet

- 1098Document1 page1098lozisai167No ratings yet

- Tuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceDocument4 pagesTuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceGeozzzyNo ratings yet

- 2020 1099necDocument2 pages2020 1099necgi silNo ratings yet

- US Internal Revenue Service: f1098t - 2005Document6 pagesUS Internal Revenue Service: f1098t - 2005IRSNo ratings yet

- 1099-r FREEDocument11 pages1099-r FREEItzFire2kNo ratings yet

- DocumentsDocument2 pagesDocumentsswanbernard56No ratings yet

- Ecorrespondence726707662 DoDocument1 pageEcorrespondence726707662 Do16baezmcNo ratings yet

- 1099-r FREE PDFDocument11 pages1099-r FREE PDFVenkatSridharan0% (1)

- DocumentsDocument2 pagesDocumentstracyreneejonesemailNo ratings yet

- Ashley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305Document2 pagesAshley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305ashcat227 DNo ratings yet

- Naresh Advani 3049987365Document2 pagesNaresh Advani 3049987365Thomas Sheffield100% (1)

- MABOTRUCKINGLLC22Document2 pagesMABOTRUCKINGLLC22Alex RojasNo ratings yet

- Student loan interest statementDocument2 pagesStudent loan interest statementMaikeru ShogunnateMusa MNo ratings yet

- Instructions For Recipient: Copy BDocument2 pagesInstructions For Recipient: Copy Bjohana150218No ratings yet

- My 1099 NecDocument1 pageMy 1099 Nectomiwande6No ratings yet

- 1099-NEC Tax Form for Nonemployee Compensation under 40 CharactersDocument1 page1099-NEC Tax Form for Nonemployee Compensation under 40 Charactersmaria rodriguezNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document11 pagesAttention:: WWW - Irs.gov/form1099kishoreNo ratings yet

- Tax Form Template 21 Page1 0001Document1 pageTax Form Template 21 Page1 0001ayesha mihiraniNo ratings yet

- 1099-R Copy B: CORRECTED (If Checked)Document6 pages1099-R Copy B: CORRECTED (If Checked)Dave MNo ratings yet

- Form 1099GDocument2 pagesForm 1099GMarcus KreseNo ratings yet

- 1099-r Taxable Amount Example - Google SearchDocument1 page1099-r Taxable Amount Example - Google SearchAnthony KevinNo ratings yet

- IRS Form 1040-SS Filing for 2019 Tax YearDocument4 pagesIRS Form 1040-SS Filing for 2019 Tax YearNoemi DíazNo ratings yet

- Form 1099-NEC Tax Filing DetailsDocument2 pagesForm 1099-NEC Tax Filing DetailsOlga PopazuNo ratings yet

- Kansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869Document4 pagesKansas Public Employees Retirement System 611 S Kansas Ave Suite 100 TOPEKA KS 66603 - 3869ChuckNo ratings yet

- Form 1099-NEC Tax SummaryDocument2 pagesForm 1099-NEC Tax SummaryNathalin De IsoldiNo ratings yet

- Us 1099 2022Document4 pagesUs 1099 2022mks12No ratings yet

- 2020 1099NECkDocument2 pages2020 1099NECkJessica ZhicayNo ratings yet

- Documents (942,202212311058, F99NEE)Document2 pagesDocuments (942,202212311058, F99NEE)LertoraNo ratings yet

- UI Online - Doc - 20210110165828Document2 pagesUI Online - Doc - 20210110165828Mark ThomasNo ratings yet

- 1099 HsuxixfkrDocument1 page1099 HsuxixfkrhayyandaiNo ratings yet

- John Steele Gordon Provides A Short History On The National Debt - WSJ - Com 2Document3 pagesJohn Steele Gordon Provides A Short History On The National Debt - WSJ - Com 2Liliya PanayevNo ratings yet

- BYMA Tabla CEDEAR 20190923 PDFDocument8 pagesBYMA Tabla CEDEAR 20190923 PDFMarcosConocenteNo ratings yet

- Société Profit Stockholders' Equity Valeur de MarchéDocument2 pagesSociété Profit Stockholders' Equity Valeur de MarchéMarcus BlackNo ratings yet

- Fortress Power Dealer FormDocument3 pagesFortress Power Dealer FormJuan Esteban HenaoNo ratings yet

- Acquisition Proposal - Teledyne TechnologiesDocument110 pagesAcquisition Proposal - Teledyne TechnologiesAri EngberNo ratings yet

- Request Letter For Compromise - KbindustrialDocument1 pageRequest Letter For Compromise - KbindustrialJedah Ibarra VillaflorNo ratings yet

- Description: Tags: ColoradoDocument4 pagesDescription: Tags: Coloradoanon-131843No ratings yet

- How to identify a real check from a sample checkDocument1 pageHow to identify a real check from a sample checkfreeman p. donNo ratings yet

- The Fiscal Cliff ExplainedDocument14 pagesThe Fiscal Cliff ExplainedasfawmNo ratings yet

- Tax FormsDocument2 pagesTax FormsBridget May Cruz100% (1)

- Earnings Statement: Nesseif William 160 E Sidney Ave Mount Vernon, Ny 10552Document1 pageEarnings Statement: Nesseif William 160 E Sidney Ave Mount Vernon, Ny 10552Curtis EmeryNo ratings yet

- IRS Issues Guidance On State Tax Payments To Help TaxpayersDocument2 pagesIRS Issues Guidance On State Tax Payments To Help TaxpayersMeaghan BellavanceNo ratings yet

- A1309899874 - 14142 - 22 - 2022 - Academic Task Number 2Document5 pagesA1309899874 - 14142 - 22 - 2022 - Academic Task Number 2Atul KumarNo ratings yet

- Earnings: Hourly Ot Sick Cctips Mealper Prempay RetailcomDocument1 pageEarnings: Hourly Ot Sick Cctips Mealper Prempay Retailcomalfredo velezNo ratings yet

- SPP Capital Market Update July 2023Document10 pagesSPP Capital Market Update July 2023Jake RoseNo ratings yet

- MLB 150 ACCSDocument11 pagesMLB 150 ACCSok na ata toNo ratings yet

- Dow JonesDocument191 pagesDow JonesJose SancaNo ratings yet

- Amy Klobuchar (D) Minnesota Senator - Contributions 1997-2012 (Full List)Document2,392 pagesAmy Klobuchar (D) Minnesota Senator - Contributions 1997-2012 (Full List)Kirk BurbackNo ratings yet

- COVID-19 PaperDocument3 pagesCOVID-19 PaperJacob SheridanNo ratings yet

- Payment Order Instructions-1Document1 pagePayment Order Instructions-1Savage NatoNo ratings yet

- Wallstreetjournal 20191129 TheWallStreetJournalDocument44 pagesWallstreetjournal 20191129 TheWallStreetJournalNehaNo ratings yet

- Adult Use DispensariesDocument8 pagesAdult Use DispensariesRomeeNo ratings yet

- Spotify - HitsDocument9 pagesSpotify - HitsEsteban Ante RamosNo ratings yet

- BarclaysDocument1 pageBarclaysEtherikal CommanderNo ratings yet

- Midwest Protouch CleaningDocument3 pagesMidwest Protouch CleaningalisellsrealestateNo ratings yet

- Top 400 ContractorsDocument3 pagesTop 400 Contractorshany seifNo ratings yet

- ConsumerReport Q2 2020Document99 pagesConsumerReport Q2 2020JAGUAR GAMINGNo ratings yet

- Philadelphia Trumpet MagazineDocument40 pagesPhiladelphia Trumpet MagazinejoeNo ratings yet

- 04 17 2022 Paystub - 1Document1 page04 17 2022 Paystub - 1Destiny SmithNo ratings yet