Professional Documents

Culture Documents

SSF SS 1098T PDF

Uploaded by

Joseph FabreOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSF SS 1098T PDF

Uploaded by

Joseph FabreCopyright:

Available Formats

CORRECTED

FILER'S name, street address, city or town, state or province, country, ZIP or 1 Payments received for OMB No. 1545-1574

foreign postal code, and telephone number qualified tuition and related

expenses

2018

Miami Dade College

11011 SW 104th Street $ 3242.72 Tuition

2 Statement

Miami FL 33176-3330

Student Financial Services 305/237-2441 Form 1098-T

FILER'S employer identification no. STUDENT'S TIN 3 If this box is checked, your educational institution changed Copy B

its reporting method for 2018

591210485 *****7210 For Student

STUDENT'S name 4 Adjustments made for a 5 Scholarships or grants

prior year This is important

Joseph Fabre tax information

$ $ 4459.64 and is being

furnished to the

Street address (including apt. no.) 6 Adjustments to 7 Checked if the amount

in box 1 includes IRS. This form

10066 NW 127th Terrace scholarships or grants

must be used to

for a prior year amounts for an

academic period complete Form 8863

City or town, state or province, country, and ZIP or foreign postal code

beginning January— to claim education

Hialeah Gardens FL 33018-7443 USA $ March 2019 ✔ credits. Give it to the

tax preparer or use it to

Service Provider/Acct. No. (see instr.) 8 Check if at least 9 Checked if a graduate 10 Ins. contract reimb./refund

prepare the tax return.

4000133309 half-time student ✔ student $

Form 1098-T (keep for your records) www.irs.gov/Form1098T Department of the Treasury - Internal Revenue Service

An eligible educational institution, such as Miami Dade College (MDC), that received Qualified Tuition and Related Expenses on your behalf is

required to file Form 1098-T, above, with the Internal Revenue Service (IRS). A copy of Form 1098-T must be furnished to you. The information

being reported to the IRS verifies your enrollment with regard to certain eligibility criteria for the American Opportunity Credit, Hope Credit and

Lifetime Learning Credit. IF YOU ARE CLAIMED AS A DEPENDENT ON ANOTHER PERSON’S TAX RETURN (i.e. YOUR PARENTS’ RETURN),

THAT PERSON MAY BE ELIGIBLE TO CLAIM THE TAX CREDITS. GIVE THIS NOTICE TO THAT PERSON.

Box 1. Shows the total payments received for qualified tuition and related expenses less any related reimbursements or refunds. These are

payments received during 2018 for academic terms Spring 2018, Summer 2018, Fall 2018 and Spring 2019.

Box 2. Shows the total amounts billed for qualified tuition and related expenses less any related reductions. No information will be shown in Box 2

since MDC is completing Box 1.

Box 3. This box is used to notify you of a change in reporting method for 2018. This box will not be checked since MDC has not changed its

reporting method.

Box 4. Shows any adjustment made for prior years for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This

amount may reduce any allowable educational credit you may claim for the prior year. See Form 8863 or IRS Publication 970 for more information.

Box 5. Shows the total of all scholarships or grants administered and processed by MDC. The amount of scholarships or grants may reduce the

amount of any allowable tuition and fees deduction or education credit you may claim for the year.

Box 6. Shows adjustments to scholarships or grants for prior years. This amount may affect the amount of any allowable tuition and fees deduction

or education credit you may claim for the prior year. See Form 8863 for how to report these amounts.

Box 7. If this box is checked, the amount in box 1 includes payments received for qualified tuition and related expenses for academic term Spring

2019. See IRS Publication 970 for how to report these amounts.

Box 8. If this box is checked, MDC considers that you were registered at least halftime (6 credits) for the Spring 2018, Summer 2018 or Fall 2018

term(s).

Box 9. Shows whether you are considered to have enrolled in a program leading to a graduate degree, or any other recognized graduate-level

educational credentials at MDC during the reporting calendar year. This box will not be checked since MDC does not offer graduate-level programs.

Box 10. Shows the total amount of reimbursements or refunds of qualified tuition and related expenses made by an insurer. No information will be

shown in Box 10 as MDC is not an insurer.

Amounts listed above reflect current records of MDC. It is the responsibility of the tax filers to report accurate information on their tax returns, using

this data in conjunction with their own records. For specific information about the American Opportunity, Hope and Lifetime Learning tax credits,

please refer to IRS Pub. 17 ‘Your Federal Income Tax’ and Pub. 970 ‘Tax Benefits for Higher Education’. These publications, as well as IRS Form

8863 Education Credits, can be found at the IRS web site, www.irs.gov or by calling the IRS at 1-800-829-1040, and/or your tax advisor/preparer. If

you have questions specific to the amounts listed above, you may contact MDC at 305-237-2441.

FOR ADDITIONAL INFORMATION, PLEASE REFER TO THE 1098T FREQUENTLY ASKED QUESTIONS LINK ON https://student.mdc.edu/

You might also like

- 1040 ArmstrongDocument2 pages1040 Armstrongapi-458373647No ratings yet

- 9 Sinaq 8Document2 pages9 Sinaq 8Murad QuliyevNo ratings yet

- CalVet Pre-Approval Form 8.1-2Document3 pagesCalVet Pre-Approval Form 8.1-2Maria maciasNo ratings yet

- Claimant/Job Seeker: Jimmy Burt Claimant ID Number: 0001729376 245 Brown RD Lake Charles, LA 70611-5312Document1 pageClaimant/Job Seeker: Jimmy Burt Claimant ID Number: 0001729376 245 Brown RD Lake Charles, LA 70611-5312Jimmy BurtNo ratings yet

- LG FFDocument1 pageLG FFfeem743No ratings yet

- Semir Demiri 50 14Th ST North Edgartown Ma 02539Document2 pagesSemir Demiri 50 14Th ST North Edgartown Ma 02539SemirNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document3 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09gary hays100% (1)

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationAnonymous YGChV39tfD100% (1)

- USCIS Form I-9: Employment Eligibility VerificationDocument2 pagesUSCIS Form I-9: Employment Eligibility VerificationL vallejo15No ratings yet

- 2019 W-2 Gregorio MartinezDocument2 pages2019 W-2 Gregorio Martinezporhj perraNo ratings yet

- Instructions For Recipient: Statement FOR Recipients OF Unemployment InsuranceDocument13 pagesInstructions For Recipient: Statement FOR Recipients OF Unemployment InsuranceChristian RiveraNo ratings yet

- Vampire Stories in GreeceDocument21 pagesVampire Stories in GreeceΓιώργος ΣάρδηςNo ratings yet

- Fax Cover SheetDocument7 pagesFax Cover Sheettarijt240% (1)

- F 1099 MSCDocument8 pagesF 1099 MSCVenkatapavan SinagamNo ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- Default AshxDocument17 pagesDefault Ashxanon-3445500% (1)

- Guide to Preparing STEM Fellowship ApplicationsDocument14 pagesGuide to Preparing STEM Fellowship ApplicationsNurrahmiNo ratings yet

- App A - Enlistment or Appointment ApplicationDocument9 pagesApp A - Enlistment or Appointment ApplicationMark CheneyNo ratings yet

- U.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010Document6 pagesU.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010victor liuNo ratings yet

- W9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFDocument1 pageW9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFAnonymous 6ZE5pGNo ratings yet

- Hynum Greg Angela - 20i - CCDocument76 pagesHynum Greg Angela - 20i - CCAdmin OfficeNo ratings yet

- Request For Taxpayer Identification Number and CertificationDocument4 pagesRequest For Taxpayer Identification Number and CertificationMarlena Anne GusmanoNo ratings yet

- Form W-4 (2018) : Specific InstructionsDocument4 pagesForm W-4 (2018) : Specific InstructionsRony MartinezNo ratings yet

- 05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDocument3 pages05a6eb82-1bcd-4d3d-a087-8c5a61bf3a7fDonna WoodallNo ratings yet

- Webull Tax DocumentDocument10 pagesWebull Tax DocumentHimer VerdeNo ratings yet

- IBR FormDocument3 pagesIBR FormBlayne MozisekNo ratings yet

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- Planilla Federal Keyla 2021Document2 pagesPlanilla Federal Keyla 2021Keyla VelezNo ratings yet

- Lucid Dreaming Fast TrackDocument3 pagesLucid Dreaming Fast TrackWulan Funblogger50% (2)

- Request for Taxpayer ID FormDocument4 pagesRequest for Taxpayer ID FormMichael RamirezNo ratings yet

- Repayment Application DocumentDocument10 pagesRepayment Application DocumentPratham TiwariNo ratings yet

- TGDocument2 pagesTGpr995No ratings yet

- Young Acc 137 Kongai, Tsate 1040Document26 pagesYoung Acc 137 Kongai, Tsate 1040Kathy YoungNo ratings yet

- 2019 California Tax Return RefundDocument18 pages2019 California Tax Return RefundPolo PoloNo ratings yet

- Identity and Employment Authorization Identity Employment AuthorizationDocument3 pagesIdentity and Employment Authorization Identity Employment AuthorizationAnonymous olIRceaUNo ratings yet

- Analyzing Potential Audit Client LakesideDocument22 pagesAnalyzing Potential Audit Client LakesideLet it be100% (1)

- VA Attendant EnrollmentDocument2 pagesVA Attendant EnrollmentJeannie ArringtonNo ratings yet

- MyComputerCareercom at Raleigh LLC-Aretha J BosireDocument1 pageMyComputerCareercom at Raleigh LLC-Aretha J BosireAretha JBNo ratings yet

- Please To Do Not Use The Back ButtonDocument2 pagesPlease To Do Not Use The Back ButtonDavid MillerNo ratings yet

- Tuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceDocument4 pagesTuition Statement: This Is Important Tax Information and Is Being Furnished To The Internal Revenue ServiceGeozzzyNo ratings yet

- Driver Record Screening Disclosure: Authorization For Release of Information For Employment ScreeningDocument1 pageDriver Record Screening Disclosure: Authorization For Release of Information For Employment ScreeningMucho FacerapeNo ratings yet

- Duplicate: Certain Government PaymentsDocument2 pagesDuplicate: Certain Government PaymentsPrincewill OdenigboNo ratings yet

- Signature Card InfoDocument1 pageSignature Card Infosadik lawanNo ratings yet

- DocumentDocument1 pageDocumentMulletHawkSunshyneBrownNo ratings yet

- DSP Inc 1099-11 Print - CFMDocument1 pageDSP Inc 1099-11 Print - CFMKenneth BarcottNo ratings yet

- P010 636211442428322820 T14385011dupD1 PDFDocument1 pageP010 636211442428322820 T14385011dupD1 PDFAnonymous pY5EUXUpaNo ratings yet

- New Jersey Amended Resident Income Tax Return: A / / B / / C / / DDocument3 pagesNew Jersey Amended Resident Income Tax Return: A / / B / / C / / DЛена КиселеваNo ratings yet

- 0LH47 0LH47 0429 20180101 1095report 001Document1 page0LH47 0LH47 0429 20180101 1095report 001charly4877No ratings yet

- Unemployment compensation and state tax infoDocument1 pageUnemployment compensation and state tax infoJackson kaylaNo ratings yet

- Reset Password Request FormDocument1 pageReset Password Request Formblon majorsNo ratings yet

- 1099 Ssdi 2010Document1 page1099 Ssdi 2010Gary McclainNo ratings yet

- 0LH47 0LH47 0429 20180101 W2Report W2Report 001Document2 pages0LH47 0LH47 0429 20180101 W2Report W2Report 001charly4877No ratings yet

- Print FormsDocument2 pagesPrint FormsJulia DrewNo ratings yet

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDocument7 pages2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNo ratings yet

- Desmand Whitson 7423 Groveoak Dr. Orlando, Florida 32810: ND NDDocument2 pagesDesmand Whitson 7423 Groveoak Dr. Orlando, Florida 32810: ND NDRed RaptureNo ratings yet

- P.O. Box 9046, Olympia, WA 98507 unemployment benefits and tax documentsDocument2 pagesP.O. Box 9046, Olympia, WA 98507 unemployment benefits and tax documentsJoshua PrimacioNo ratings yet

- ICF FORMDocument4 pagesICF FORMFrank ValenzuelaNo ratings yet

- Vba 21 4192 AreDocument2 pagesVba 21 4192 AreGene GloverNo ratings yet

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDocument3 pagesTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNo ratings yet

- Preview W8 W9 PDFDocument1 pagePreview W8 W9 PDFEugene ChoiNo ratings yet

- Oji 2Document2 pagesOji 2brent_barthanyNo ratings yet

- Important Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Document1 pageImportant Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Victor ErazoNo ratings yet

- GKEDC Form 990 Page 1 For 2013 Through 2019Document7 pagesGKEDC Form 990 Page 1 For 2013 Through 2019Don MooreNo ratings yet

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalNo ratings yet

- Corrected: Brigham Young University 7195.00 Brigham Young University A153A ASBDocument2 pagesCorrected: Brigham Young University 7195.00 Brigham Young University A153A ASBNathan MonsonNo ratings yet

- The Basic Caruso WebDocument10 pagesThe Basic Caruso WebqlfjlkjlNo ratings yet

- Wellness, Fitness and Aquatics - Online Membership Registration (NORTH CAMPUS)Document1 pageWellness, Fitness and Aquatics - Online Membership Registration (NORTH CAMPUS)Joseph FabreNo ratings yet

- Live Performance Template - Mul 1010 - (Fall-2015!Document4 pagesLive Performance Template - Mul 1010 - (Fall-2015!Joseph FabreNo ratings yet

- Modeli InvoicesDocument1 pageModeli InvoicesJoseph FabreNo ratings yet

- 35th Bar Council of India Moot Court MemorialDocument17 pages35th Bar Council of India Moot Court MemorialHarshit Mangal100% (3)

- IEC 61850 Configuration of A Phoenix Contact IED: User ManualDocument68 pagesIEC 61850 Configuration of A Phoenix Contact IED: User ManualHarold PuinNo ratings yet

- ASSESSMENTS Module 1 - Cortezano, ZyraDocument1 pageASSESSMENTS Module 1 - Cortezano, ZyraZyra Mae Cortezano100% (1)

- 9 Measures of Variability DisperseDocument14 pages9 Measures of Variability DisperseSourabh ChavanNo ratings yet

- Chapter 3 The Life of Jose Rizal PDFDocument11 pagesChapter 3 The Life of Jose Rizal PDFMelanie CaplayaNo ratings yet

- Sun Temple, Modhera: Gudhamandapa, The Shrine Hall Sabhamandapa, The AssemblyDocument11 pagesSun Temple, Modhera: Gudhamandapa, The Shrine Hall Sabhamandapa, The AssemblyShah PrachiNo ratings yet

- Monitoring Mouse ActivityDocument4 pagesMonitoring Mouse ActivityrehnaNo ratings yet

- Oscillator Types and CharacteristicsDocument4 pagesOscillator Types and Characteristicspriyadarshini212007No ratings yet

- 7vk61 Catalog Sip E6Document18 pages7vk61 Catalog Sip E6Ganesh KCNo ratings yet

- An Essay For The Glass Menagerie PDFDocument11 pagesAn Essay For The Glass Menagerie PDFBily ManNo ratings yet

- Neco Catlog 4 FoldDocument2 pagesNeco Catlog 4 FoldSanket PhatangareNo ratings yet

- The Concept of Social Capital: A Critical Review: Sophie Ponthieux ( )Document23 pagesThe Concept of Social Capital: A Critical Review: Sophie Ponthieux ( )Ali Muhtarom LilikNo ratings yet

- CECB School Profile 23122020 1Document6 pagesCECB School Profile 23122020 1Anas SaadaNo ratings yet

- Quam SingulariDocument2 pagesQuam SingulariMichael WurtzNo ratings yet

- Cad MCQ Unit 5Document3 pagesCad MCQ Unit 5ddeepak123No ratings yet

- Liquichek Specialty Immunoassay Control Levels LTA, 1, 2 and 3Document6 pagesLiquichek Specialty Immunoassay Control Levels LTA, 1, 2 and 3clinicalbiochemistryNo ratings yet

- A Study On Customer Satisfaction of TVS Apache RTR 160Document11 pagesA Study On Customer Satisfaction of TVS Apache RTR 160Manajit BhowmikNo ratings yet

- Nilai Murni PKN XII Mipa 3Document8 pagesNilai Murni PKN XII Mipa 3ilmi hamdinNo ratings yet

- Intro to Phenomenological ApproachesDocument11 pagesIntro to Phenomenological ApproachesToshi ToshiNo ratings yet

- Power2 Leading The Way in Two-Stage TurbochargingDocument4 pagesPower2 Leading The Way in Two-Stage TurbochargingМаксим АгеевNo ratings yet

- ITC Gardenia LavendreriaDocument6 pagesITC Gardenia LavendreriaMuskan AgarwalNo ratings yet

- All About The Hathras Case - IpleadersDocument1 pageAll About The Hathras Case - IpleadersBadhon Chandra SarkarNo ratings yet

- Edexcel iGCSE ICT Software MindmapDocument1 pageEdexcel iGCSE ICT Software MindmapPaul ZambonNo ratings yet

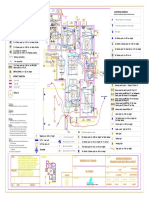

- Varun Valanjeri Electrical Layout-3Document1 pageVarun Valanjeri Electrical Layout-3ANOOP R NAIRNo ratings yet

- KETTLITZ-Pertac/GR: - Technical LeafletDocument1 pageKETTLITZ-Pertac/GR: - Technical LeafletFatehNo ratings yet