Professional Documents

Culture Documents

IRS Form 1040-SS Filing for 2019 Tax Year

Uploaded by

Noemi DíazOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRS Form 1040-SS Filing for 2019 Tax Year

Uploaded by

Noemi DíazCopyright:

Available Formats

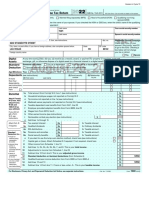

Recibo de Radicación IRS

Año

2019

Forma

1040-SS

RADICADO ELECTRONICAMENTE

Fecha de Radicación Electrónica

2020-02-06 20:48:14

Información de Pago

Numero de Ruta

Número de Cuenta de Banco

Tipo de Cuenta

Cantidad de Pago

Fecha de Pago

Teléfono de Contacto

9392555840

NUMERO DE CONFIRMACION:: 1006322020037d046408 FECHA:2020-02-06 20:48:14AST

Form 1040-SS U.S. Self-Employment Tax Return (Including the Additional Child Tax

Credit for Bona Fide Residents of Puerto Rico)

OMB No. 1545-0090

Department of the Treasury

U.S. Virgin Islands, Guam, American Samoa, the Commonwealth of the Northern Mariana Islands, or Puerto Rico.

For the year Jan. 1–Dec. 31, 2019, or other tax year beginning , 2019, and ending , 20 . 2019

Internal Revenue Service Go to www.irs.gov/Form1040SS for instructions and the latest information.

Your first name and initial Last name Your social security number

elizabeth santiago diaz 583-97-9101

If a joint return, spouse’s first name and initial Last name Spouse’s social security number

Please type or print

Present home address (number, street, and apt. no., or rural route)

urbanizacion el torito calle 6 e 22

RADICADO ELECTRONICAMENTE

City, town or post office, commonwealth or territory, and ZIP code

cayey PR 00736

Foreign country name Foreign province/state/county Foreign postal code

Part I Total Tax and Credits

1 Filing status. Check the box for your filing status (see instructions).

Single

Married filing jointly

Married filing separately. Enter spouse’s social security no. above and full name here.

2 Qualifying children. Complete only if you are a bona fide resident of Puerto Rico and you are claiming the additional child

tax credit (see instructions).

(b) Child’s (c) Child’s

(a) First name Last name social security number relationship to you

Kellyanis N Bowen Santiago 599-84-9076 DAUGHTER

Elymarie Lopez Santiago 599-92-5647 DAUGHTER

Dereck M Colon Santiago 599-78-9164 NEPHEW

3 Self-employment tax from Part V, line 12 . . . . . . . . . . . . . . . . . . . . 3 0

4 Household employment taxes (see instructions). Attach Schedule H (Form 1040 or 1040-SR) . . . 4

5 Additional Medicare Tax. Attach Form 8959 . . . . . . . . . . . . . . . . . . . 5 0

6 Total tax. Add lines 3 through 5 (see instructions) . . . . . . . . . . . . . . . . . 6 0

7 2019 estimated tax payments (see instructions) . . . . . . . . . . 7

8 Excess social security tax withheld (see instructions) . . . . . . . . 8 0

9 Additional child tax credit from Part II, line 3 . . . . . . . . . . . 9 3884

10 Health coverage tax credit. Attach Form 8885 . . . . . . . . . . . 10 0

11 Total payments and credits (see instructions) . . . . . . . . . . . . . . . . . . 11 3884

12 If line 11 is more than line 6, subtract line 6 from line 11. This is the amount you overpaid . . . . 12 3884

13a Amount of line 12 you want refunded to you. If Form 8888 is attached, check here . . . . 13a 3884

b Routing Number 0 2 1 5 0 2 0 1 1 c Type: Checking Savings

d Account Number 3 3 9 0 8 2 7 9 9

14 Amount of line 12 you want applied to 2020 estimated tax . . . . . 14

15 Amount you owe. If line 6 is more than line 11, subtract line 11 from line 6. For details on how to pay,

see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15 0

Do you want to allow another person to discuss this return with the IRS (see instructions)? Yes. Complete the following. No

Third Party Personal Identification

Designee’s Phone

Designee name no. Number (PIN)

Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief, they are true, correct, and complete. Declaration of preparer (other than the taxpayer) is based on all information of which the preparer has

Here any knowledge.

Joint Return? Your signature Date Daytime phone number If the IRS sent you an Identity Protection PIN, enter

See instructions. FIRMADO ELECTRONICAMENTE 2020-02-06 9392555840 it here (see inst.) 3 0 0 4 5 3

Keep a copy

Spouse’s signature. If a joint return, both must sign. Date

for your

records.

Print/Type preparer’s name Preparer’s signature Date PTIN

Paid Check if

self-employed

Preparer

Firm’s name Firm’s EIN

Use Only

Firm’s address Phone no.

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see instructions. Cat. No. 17184B Form 1040-SS (2019)

NUMERO DE CONFIRMACION:: 1006322020037d046408 FECHA:2020-02-06 20:48:14AST

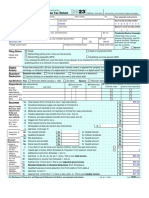

Form 1040-SS (2019) Page 2

Part II Bona Fide Residents of Puerto Rico Claiming Additional Child Tax Credit—See instructions.

Caution: You must have three or more qualifying children to claim the additional child tax credit.

1 Income derived from sources within Puerto Rico . . . . . . . . . . . . . . . . . . 1 49379

2 Withheld social security, Medicare, and Additional Medicare taxes from Puerto Rico Form(s) 499R-2/

W-2PR (attach copy of form(s)). If married filing jointly, include your spouse’s amounts with yours . 2 3884

3 Additional child tax credit. Use the worksheet in the instructions to figure the amount to enter here

and in Part I, line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 3884

Part III Profit or Loss From Farming—See the Instructions for Schedule F (Form 1040 or 1040-SR).

RADICADO ELECTRONICAMENTE

Name of proprietor Social security number

Note: If you are filing a joint return and both you and your spouse had a profit or loss from a farming business, see Joint returns and

Business Owned and Operated by Spouses in the instructions for more information.

Section A—Farm Income—Cash Method

Complete Sections A and B. (Accrual method taxpayers, complete Sections B and C, and Section A, line 11.)

Don't include sales of livestock held for draft, breeding, sport, or dairy purposes (see instructions).

1 Sales of livestock and other items you bought for resale . . . . . . . 1

2 Cost or other basis of livestock and other items reported on line 1 . . . . 2

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Sales of livestock, produce, grains, and other products you raised . . . . . . . . . . . . 4

5a Total cooperative distributions (Form(s) 1099-PATR) 5a 5b Taxable amount 5b

6 Agricultural program payments received . . . . . . . . . . . . . . . . . . . . . 6

7 Commodity Credit Corporation (CCC) loans reported under election (or forfeited) . . . . . . . 7

8 Crop insurance proceeds . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Custom hire (machine work) income . . . . . . . . . . . . . . . . . . . . . . 9

10 Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Gross farm income. Add amounts in the right column for lines 3 through 10. If accrual method

taxpayer, enter the amount from Section C, line 50 . . . . . . . . . . . . . . . . 11

Section B—Farm Expenses—Cash and Accrual Method

Don't include personal or living expenses (such as taxes, insurance, or repairs on your home) that didn't produce farm income.

Reduce the amount of your farm expenses by any reimbursements before entering the expenses below.

12 Car and truck expenses 25

Pension and profit-sharing plans

(see instructions) . . . . . 12 . . . . . . . . . . . 25

13 Chemicals . . . . . . . 13 26 Rent or lease:

14 Conservation expenses . . . 14 a Vehicles, machinery, and

15 Custom hire (machine work) . . 15 equipment . . . . . . . . 26a

16 Depreciation and section 179 b Other (land, animals, etc.) . . . 26b

expense deduction not claimed 27 Repairs and maintenance . . . 27

elsewhere (Attach Form 4562 if 28 Seeds and plants purchased . . 28

required.) . . . . . . . . 16 29 Storage and warehousing . . 29

17 Employee benefit programs 30 Supplies purchased . . . . 30

other than on line 25 . . . . 17 31 Taxes . . . . . . . . . 31

18 Feed purchased . . . . . . 18 32 Utilities . . . . . . . . . 32

19 Fertilizers and lime . . . . . 19 33 Veterinary, breeding, and

20 Freight and trucking . . . . 20 medicine . . . . . . . . 33

21 Gasoline, fuel, and oil . . . . 21 34 Other expenses (specify):

22 Insurance (other than health) . 22 a 34a

23 Interest (see instructions): b 34b

a Mortgage (paid to banks, etc.) . 23a c 34c

b Other . . . . . . . . . 23b d 34d

24 Labor hired . . . . . . . 24 e 34e

35 Total expenses. Add lines 12 through 34e . . . . . . . . . . . . . . . . . . . 35

36 Net farm profit or (loss). Subtract line 35 from line 11. Enter the result here and in Part V, line 1a . 36

Form 1040-SS (2019)

NUMERO DE CONFIRMACION:: 1006322020037d046408 FECHA:2020-02-06 20:48:14AST

Additional Child Tax Credit Worksheet—Part II, Line 3 Keep for Your Records

1. Do you have three or more qualifying children under age 17 with the required SSN?

No. Stop. You can't claim the credit.

Yes. Go to line 2.

2. Number of qualifying children _______3 × $1,400. Enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2. 4200

3. Enter the amount from Part II, line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3. 49379

4. Enter the amount shown below for your filing status . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4. 200000

RADICADO ELECTRONICAMENTE

• Married filing jointly – $400,000

• All other filing statuses – $200,000

5. Is the amount on line 3 more than the amount on line 4?

■No. Leave line 5 blank. Enter the amount from line 2 on line 11, and go to line 12.

Yes. Subtract line 4 from line 3. If the result isn't a multiple of $1,000, increase it to the next

multiple of $1,000 (for example, increase $425 to $1,000, increase $1,025 to $2,000, etc.) . . . . . . 5.

6. Multiply the amount on line 5 by 5% (.05). Enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Number of qualifying children from line 2 x $2,000. Enter the result . . . . . . . . . . . . . . . . . . . . . . . . . 7.

8. Number of other dependents, including children who are not under age 17 ________ x $500.

Enter the result. See the Line 8 instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8.

9. Add lines 7 and 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. Is the amount on line 9 more than the amount on line 6?

No. Stop. You can't claim the credit.

Yes. Subtract line 6 from line 9. Enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.

11. Enter the smaller of line 2 or line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11. 4200

12. Enter the total, if any, of:

• One-half of Part V, line 12, self-employment tax plus

• One-half of the Additional Medicare Tax you paid on self-employment income (Form 8959,

line 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12. 0

13. Enter the total of any:

• Amount from Part II, line 2, plus

• Employee social security and Medicare tax on tips not reported to employer from Form 4137

and shown on the dotted line next to Part I, line 6, plus

• Uncollected employee social security and Medicare tax on wages from Form 8919 shown on

the dotted line next to Part I, line 6, plus

• Uncollected employee social security tax and Medicare tax on tips and group-term life

insurance (see instructions for Part I, line 6) shown on the dotted line next to Part I, line 6, plus

• Amount on Form 8959, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13. 3884

14. Add lines 12 and 13. Enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14. 3884

15. Enter the amount, if any, of Additional Medicare Tax withheld (Form 8959, line 22) . . . . . . . . . . . . 15. 0

16. Subtract line 15 from line 14. Enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16. 3884

17. Enter the amount, if any, from Part I, line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17. 0

18. Is the amount on line 16 more than the amount on line 17?

No. Stop. You can't claim the credit.

Yes. Subtract line 17 from line 16. Enter the result . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18. 3884

19. Additional child tax credit. Enter the smaller of line 11 or line 18 here and on Form 1040-SS, Part II,

line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19. 3884

SS-8 Instructions for Form 1040-SS (2019)

NUMERO DE CONFIRMACION:: 1006322020037d046408 FECHA:2020-02-06 20:48:14AST

You might also like

- Planilla Federal Keyla 2021Document2 pagesPlanilla Federal Keyla 2021Keyla VelezNo ratings yet

- FTF 2023-01-11 1673425648918Document12 pagesFTF 2023-01-11 1673425648918Charles Goodwin100% (1)

- HRBlockDocument7 pagesHRBlocksusu ultra menNo ratings yet

- 2020 TaxReturnDocument2 pages2020 TaxReturnlindamariejohnson1981No ratings yet

- FTF 2023-08-12 1691895826386Document7 pagesFTF 2023-08-12 1691895826386El Guero CastroNo ratings yet

- 2022 Victor Tamayo YourDocument9 pages2022 Victor Tamayo YourCiber 13100% (3)

- FTF 2022-04-19 1650352670778Document11 pagesFTF 2022-04-19 1650352670778Charles Goodwin100% (3)

- FTF 2022-08-12 1660313817374Document8 pagesFTF 2022-08-12 1660313817374S100% (1)

- Planilla Fed 2021Document4 pagesPlanilla Fed 2021zsanta1317No ratings yet

- Yesebel Rivera Alomar 2023Document9 pagesYesebel Rivera Alomar 2023yesebelrNo ratings yet

- f1040MADocument2 pagesf1040MAqueennykaayaNo ratings yet

- Actividad 7 1040 FormDocument2 pagesActividad 7 1040 FormKevin ÁlvarezNo ratings yet

- Captura de Pantalla T 2023-05-28 A La(s) 22.18.24Document69 pagesCaptura de Pantalla T 2023-05-28 A La(s) 22.18.24rozaj519No ratings yet

- YAMIDocument12 pagesYAMIStephany PolancoNo ratings yet

- Irs Gov Forms-SignedDocument2 pagesIrs Gov Forms-SignedKeller Brown JnrNo ratings yet

- Melinda Flowers 1040 PDFDocument2 pagesMelinda Flowers 1040 PDFCHRISTIAN RODRIGUEZ50% (4)

- Consent To Disclose Your Information For The Credit Karma OfferDocument4 pagesConsent To Disclose Your Information For The Credit Karma OfferDonald PetersonNo ratings yet

- US 1040 Main Information Sheet 2021: Email Taxpayer Occupation Spouse Occupation Filing StatusDocument7 pagesUS 1040 Main Information Sheet 2021: Email Taxpayer Occupation Spouse Occupation Filing StatusRaquel Carrero100% (2)

- 2022 TaxReturnDocument6 pages2022 TaxReturnLALLOUS KHOURY100% (3)

- U.S. Individual Income Tax Return: Standard DeductionDocument12 pagesU.S. Individual Income Tax Return: Standard DeductionBajan Beauty100% (1)

- Activity Example 1040 TaxDocument2 pagesActivity Example 1040 TaxKevin ÁlvarezNo ratings yet

- Electronic Filing Instructions For Your 2020 Federal Tax ReturnDocument16 pagesElectronic Filing Instructions For Your 2020 Federal Tax Returnann laijas57% (7)

- Oddo Brothers Cpas: William & Regina LittleDocument30 pagesOddo Brothers Cpas: William & Regina Littlebill littleNo ratings yet

- Time For TaxDocument108 pagesTime For TaxCj johnson100% (1)

- Ma Tax ReturnDocument11 pagesMa Tax ReturnMark ThomasNo ratings yet

- U.S. Individual Income Tax Return: Filing Status XDocument8 pagesU.S. Individual Income Tax Return: Filing Status XTehone Teketelew100% (1)

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusSara barker100% (1)

- 2020FTFCS 2022-02-26 1645943726435Document5 pages2020FTFCS 2022-02-26 1645943726435Mark Bagliani100% (1)

- STF 2023-03-20 1679339081483Document4 pagesSTF 2023-03-20 1679339081483ayogboloNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusKenneth Schackai100% (1)

- STF_2023-06-11_1686467951443Document6 pagesSTF_2023-06-11_1686467951443Sato KasuNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument28 pagesU.S. Individual Income Tax Return: Filing StatusSenae Lopez100% (3)

- Doug Baber 2023 Tax ReturnDocument17 pagesDoug Baber 2023 Tax ReturnjpneebNo ratings yet

- Novice PDFDocument23 pagesNovice PDFabeatty34No ratings yet

- UI Online - Doc - 20210110165828Document2 pagesUI Online - Doc - 20210110165828Mark ThomasNo ratings yet

- Sample Tax Return Robb Stark:: Robb's Swarthmore Account Information: 2012 13 2013 14Document5 pagesSample Tax Return Robb Stark:: Robb's Swarthmore Account Information: 2012 13 2013 14Andrew BookerNo ratings yet

- 2020 Tax Return Documents (KELLY DAVID F - Client Copy)Document5 pages2020 Tax Return Documents (KELLY DAVID F - Client Copy)Toomuch0% (1)

- Internal Use Only Draft As of August 26, 2022: U.S. Individual Income Tax ReturnDocument2 pagesInternal Use Only Draft As of August 26, 2022: U.S. Individual Income Tax ReturnTrish HitNo ratings yet

- File 1040 US Individual Income Tax ReturnDocument2 pagesFile 1040 US Individual Income Tax ReturnJohn Bean100% (1)

- Report Excess Estate or Trust Deductions on Form 1040Document6 pagesReport Excess Estate or Trust Deductions on Form 1040shahabNo ratings yet

- 2020 Federal Tax Return Documents (PATEL ASHOKBHAI and CHE)Document7 pages2020 Federal Tax Return Documents (PATEL ASHOKBHAI and CHE)atul0070No ratings yet

- 2019 Tax Return Documents (VERAS MELQUISEDED)Document7 pages2019 Tax Return Documents (VERAS MELQUISEDED)Edison Estrada100% (2)

- STF_2024-04-09_1712652417557Document6 pagesSTF_2024-04-09_1712652417557Sato KasuNo ratings yet

- Blank Tax OrganizerDocument14 pagesBlank Tax Organizerapi-344263788No ratings yet

- Dustincates2021 TaxesDocument15 pagesDustincates2021 TaxesIllest Alive20650% (2)

- Final Tax Jose Serpa 2021Document39 pagesFinal Tax Jose Serpa 2021Sarahi Payan100% (1)

- IRS Form f1040sDocument4 pagesIRS Form f1040sofficeNo ratings yet

- f1040BDocument2 pagesf1040BqueennykaayaNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusScottPattersonNo ratings yet

- Screenshot 2022-04-15 at 9.52.17 PMDocument13 pagesScreenshot 2022-04-15 at 9.52.17 PMMalachov Andrew100% (1)

- 2023_TaxReturnDocument27 pages2023_TaxReturnLuiNo ratings yet

- 2020 Tax 1040 Form MistyDocument2 pages2020 Tax 1040 Form Mistypatrick11470% (1)

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Document4 pagesCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezNo ratings yet

- Fext 2022-04-17 1650241773772 PDFDocument2 pagesFext 2022-04-17 1650241773772 PDFFera PetersonNo ratings yet

- 2307 ISECO CalumbayaDocument62 pages2307 ISECO Calumbayaleo BacuadenNo ratings yet

- f1040Document2 pagesf1040raheemtimo1No ratings yet

- U.S. Individual Income Tax Return: Standard DeductionDocument26 pagesU.S. Individual Income Tax Return: Standard Deductionnischal.khatri07No ratings yet

- X Macey Slonaker Crystal L Slonaker 292-84-7018: U.S. Individual Income Tax ReturnDocument12 pagesX Macey Slonaker Crystal L Slonaker 292-84-7018: U.S. Individual Income Tax ReturnjonathanNo ratings yet

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Document2 pagesFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waitesNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- STIPULATION To Stay ProceedingsDocument7 pagesSTIPULATION To Stay Proceedingsjamesosborne77-1No ratings yet

- SOP 1-023 Rev. 16 EPA 547 GlyphosateDocument20 pagesSOP 1-023 Rev. 16 EPA 547 GlyphosateMarco QuinoNo ratings yet

- DXR Series Refrigerated Air Dryers: Operator'S Instruction ManualDocument48 pagesDXR Series Refrigerated Air Dryers: Operator'S Instruction ManualDavid BarrientosNo ratings yet

- Nikhil ResumeDocument2 pagesNikhil ResumeJaikumar KrishnaNo ratings yet

- Pri Dlbt1201182enDocument2 pagesPri Dlbt1201182enzaheerNo ratings yet

- BIR Rule on Taxing Clubs OverturnedDocument2 pagesBIR Rule on Taxing Clubs OverturnedLucky JavellanaNo ratings yet

- List of All Premium Contents, We've Provided. - TelegraphDocument5 pagesList of All Premium Contents, We've Provided. - TelegraphARANIABDNo ratings yet

- Purpose: IT System and Services Acquisition Security PolicyDocument12 pagesPurpose: IT System and Services Acquisition Security PolicysudhansuNo ratings yet

- Datasheet Hitec HS-311 ServoDocument1 pageDatasheet Hitec HS-311 ServoMilo LatinoNo ratings yet

- Fundamentals of Cyber Law 2021 t6hzxpREDocument97 pagesFundamentals of Cyber Law 2021 t6hzxpREshivraj satavNo ratings yet

- Special power attorneyDocument4 pagesSpecial power attorneyYen Estandarte Gulmatico0% (1)

- 1 s2.0 S0021979718302352 MainDocument6 pages1 s2.0 S0021979718302352 MainShuvam PawarNo ratings yet

- Communication Barriers - Effects On Employees EfficiencyDocument27 pagesCommunication Barriers - Effects On Employees Efficiencyvanquish lassNo ratings yet

- HUT-A Hydraulic Universal Testing Machine 2018.6.26 PDFDocument6 pagesHUT-A Hydraulic Universal Testing Machine 2018.6.26 PDFSoup PongsakornNo ratings yet

- Kamor Ul Islam Jakoan Kobir Riad Omar Faruk Iqramul Hasan MD Abdur Rahman MD Kamrul Hasan FahimDocument16 pagesKamor Ul Islam Jakoan Kobir Riad Omar Faruk Iqramul Hasan MD Abdur Rahman MD Kamrul Hasan FahimRezoan FarhanNo ratings yet

- Gauge BlockDocument32 pagesGauge Blocksava88100% (1)

- 05.10.20 - SR - CO-SUPERCHAINA - Jee - MAIN - CTM-8 - KEY & SOL PDFDocument8 pages05.10.20 - SR - CO-SUPERCHAINA - Jee - MAIN - CTM-8 - KEY & SOL PDFManju ReddyNo ratings yet

- ChatroomsDocument4 pagesChatroomsAhmad NsNo ratings yet

- Schools Division Office of BenguetDocument1 pageSchools Division Office of BenguetAna ConseNo ratings yet

- Customers' Role in Service Delivery & Self-Service TechDocument32 pagesCustomers' Role in Service Delivery & Self-Service TechSubhani KhanNo ratings yet

- P200(2页)Document2 pagesP200(2页)guwniarzykNo ratings yet

- Oracle Mock Test at 4Document9 pagesOracle Mock Test at 4Prince JainNo ratings yet

- Liedtka, J. M. (1998) - Strategic Thinking. Can It Be TaughtDocument10 pagesLiedtka, J. M. (1998) - Strategic Thinking. Can It Be TaughtOscarAndresPinillaCarreñoNo ratings yet

- TLB ResumeDocument1 pageTLB Resumeapi-486218138No ratings yet

- WAPU Kufqr PDFDocument2 pagesWAPU Kufqr PDFAri TanjungNo ratings yet

- Updating The Network Controller Server CertificateDocument4 pagesUpdating The Network Controller Server CertificateNavneetMishraNo ratings yet

- Labour Welfare Management at Piaggio vehicles Pvt. LtdDocument62 pagesLabour Welfare Management at Piaggio vehicles Pvt. Ltdnikhil kumarNo ratings yet

- Modern Particle Characterization Techniques Image AnalysisDocument46 pagesModern Particle Characterization Techniques Image AnalysisSONWALYOGESHNo ratings yet

- Buildings Construction Final EXAM . 7/06/2006 ... Dr. Haitham Ayyad Time:2:30 MinDocument4 pagesBuildings Construction Final EXAM . 7/06/2006 ... Dr. Haitham Ayyad Time:2:30 MinHaitham AyyadNo ratings yet

- Cover Letter EdtDocument2 pagesCover Letter Edtapi-279882071No ratings yet