Professional Documents

Culture Documents

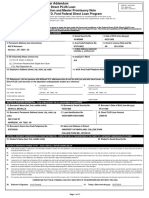

Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)

Uploaded by

eddie waitesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)

Uploaded by

eddie waitesCopyright:

Available Formats

Form Department of the Treasury-Internal Revenue Service (99)

1040 U.S. Individual Income Tax Return 2019 OMB No. 1545-0074IRS Use Only-Do not write or staple in this space.

Filing Single Married filing jointly Married filing separately (MFS)

Status X Head of household (HOH) Qualifying widow(er) (QW)

Check only one If you checked the MFS box, enter the name of spouse. If you checked the HOH or QW box, enter the child's

box.

name if the qualifying person is a child but not your dependent.

Your first name and middle initial Last name Your social security number

DAVID ADAMS 452-35-8049

If joint return, spouse's first name and middle initial Last name Spouse's social security number

Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign

Check here if you, or your spouse if filing

644 N DOWNING ST jointly, want $3 to go to this fund. Checking a

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions). box below will not change your tax or refund.

You Spouse

DENVER, CO 80218

Foreign country name Foreign province/state/county Foreign postal code If more than four dependents, see

inst. & check here

Standard Someone can claim: You as a dependent Your spouse as a dependent

Deduction Spouse itemizes on a separate return or you were a dual-status alien

You: Were born before January 2, 1955 Are blind

Age/Blindness

Spouse: Was born before January 2, 1955 Is blind

Dependents (see instructions): (2) Social security number (3) Relationship to you (4) check if qualifies for (see inst.):

(1) First name Last name Child tax Credit for other dependents

credit

1 Wages, salaries, tips, etc. Attach Form(s) W-2..........................................................................................1

76,144

2a Tax-exempt interest 2a

...... b Taxable interest............................2b

3a

3a Qualified dividends .......

Standard b Ordinary dividends.......................3b

4a

4a Deduction IRA distributions . .. .. .. .

b Taxable amount............................4b

4c 397

Single or Married

filing separately, c Pensions and annuities

$12,200

.... 5a d Taxable amount ....... 4d 0

Married filing

5a Social security benefits ..... b Taxable amount............................5b

jointly or

Qualifying 6 Capital gain or (loss). Attach Schedule D if required. If not required, check here .. 6

widow(er),

$24,400

Head of

household,

$18,350

If you checked

any box under

Standard 9

Deduction,

see instructions.

You might also like

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusjakelong82100% (1)

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusSara barker100% (1)

- 2020FTFCS 2022-02-26 1645943726435Document5 pages2020FTFCS 2022-02-26 1645943726435Mark Bagliani100% (1)

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- Captura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Document4 pagesCaptura de Pantalla 2022-02-05 A La(s) 4.03.49 A.M.Adriana AnsurezNo ratings yet

- File 1040 U.S. Individual Income Tax ReturnDocument2 pagesFile 1040 U.S. Individual Income Tax Returnmarcel100% (1)

- FTF1301242185129Document3 pagesFTF1301242185129Donna SchatzNo ratings yet

- Edgar JDocument2 pagesEdgar Japi-585014034No ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statusapi-581728153No ratings yet

- Form Accepted State 2020Document19 pagesForm Accepted State 2020Cristian BurnNo ratings yet

- File Your NJ Tax Return Online or by E-FileDocument68 pagesFile Your NJ Tax Return Online or by E-FileStephen HallickNo ratings yet

- Ezra Daniels TaxDocument11 pagesEzra Daniels TaxJulio Romero100% (1)

- Santos Return PDFDocument14 pagesSantos Return PDFMark Long75% (4)

- File by Mail Instructions For Your 2009 Federal Tax ReturnDocument11 pagesFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeNo ratings yet

- Make Necessary Changes in Only Orange Colored Fields.: Proceed To Calculation Will Be Initially "No"Document36 pagesMake Necessary Changes in Only Orange Colored Fields.: Proceed To Calculation Will Be Initially "No"xakilNo ratings yet

- Green Knight Economic Development Corporation IRS Form 990 For FY2015, Showing $20K in Community Grants On $1.8m of RevenueDocument27 pagesGreen Knight Economic Development Corporation IRS Form 990 For FY2015, Showing $20K in Community Grants On $1.8m of RevenueDickNo ratings yet

- Jeff Bell 2012 Tax ReturnDocument71 pagesJeff Bell 2012 Tax ReturnRaylene_No ratings yet

- (X) U.S. Citizen or National (2) Permanent Resident/Other Eligible Non-Citizen If (2), Alien Registration NoDocument11 pages(X) U.S. Citizen or National (2) Permanent Resident/Other Eligible Non-Citizen If (2), Alien Registration Nomdewald01No ratings yet

- BMO World Elite Mastercard Benefits Guide enDocument11 pagesBMO World Elite Mastercard Benefits Guide enTonyNo ratings yet

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDocument6 pagesIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNo ratings yet

- Calculate Federal and Provincial TaxesDocument36 pagesCalculate Federal and Provincial TaxesRyan YangNo ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument8 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramOsayameGaius-ObasekiNo ratings yet

- 1040 Tax Form SummaryDocument2 pages1040 Tax Form SummaryKevin RowanNo ratings yet

- Real 1040 1Document2 pagesReal 1040 1paul100% (1)

- Will Frost 2013 Tax Return - T13 - For - RecordsDocument146 pagesWill Frost 2013 Tax Return - T13 - For - RecordsjessicaNo ratings yet

- 2014 Form 1040 Individual Income Tax ReturnDocument9 pages2014 Form 1040 Individual Income Tax ReturnKuan ChenNo ratings yet

- US Tax ReturnDocument13 pagesUS Tax Returnjamo christineNo ratings yet

- Direct Loans MPN SummaryDocument15 pagesDirect Loans MPN Summarydog dogNo ratings yet

- ProblemC ch05Document5 pagesProblemC ch05Adan FakihNo ratings yet

- Income Tax Return - MHSO - 2022-23Document5 pagesIncome Tax Return - MHSO - 2022-23Mahbub SiddiqueNo ratings yet

- 2011 Income Tax ReturnDocument4 pages2011 Income Tax Returnsalazar17No ratings yet

- Beginning Practice Return Scenario 1: (Use Your Company's EFIN in Place of XX-XXXX)Document34 pagesBeginning Practice Return Scenario 1: (Use Your Company's EFIN in Place of XX-XXXX)Nancy GuerraNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09rose ownes100% (2)

- 2020 0605 Return MspaduaDocument1 page2020 0605 Return MspaduaEljoe VinluanNo ratings yet

- A082000109a0298508172c001c: Contact InformationDocument1 pageA082000109a0298508172c001c: Contact InformationYudo KunaNo ratings yet

- Loan AppDocument9 pagesLoan Appanon-209253No ratings yet

- W2 Preview titleDocument1 pageW2 Preview titlemrs merle westonNo ratings yet

- HRBlockDocument7 pagesHRBlocksusu ultra menNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusKenneth Schackai100% (1)

- Tax ReturnDocument4 pagesTax ReturncykablyatNo ratings yet

- LifeDocument11 pagesLifejasNo ratings yet

- Norma 2021Document13 pagesNorma 2021Norma MichelNo ratings yet

- Profit or Loss From Farming: Schedule FDocument2 pagesProfit or Loss From Farming: Schedule FJacen BondsNo ratings yet

- Form 1040A Tax Credit DetailsDocument3 pagesForm 1040A Tax Credit DetailsYosbanyNo ratings yet

- U.S. Individual Income Tax Return: See Separate InstructionsDocument4 pagesU.S. Individual Income Tax Return: See Separate InstructionsNewsTeam20100% (1)

- Au Pair Tax Filing: Form 1040 NR-EZ for Federal Income TaxDocument1 pageAu Pair Tax Filing: Form 1040 NR-EZ for Federal Income TaxMaru Aguirre ArizmendiNo ratings yet

- Income Tax Return 2019Document6 pagesIncome Tax Return 2019Cindy WheelerNo ratings yet

- FTF1299519215531Document3 pagesFTF1299519215531Leslie Washington100% (1)

- Taxes Amy PDFDocument7 pagesTaxes Amy PDFJsjs JsjsjjshshNo ratings yet

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- Tax Return - Mr. X - AY 2022-23Document12 pagesTax Return - Mr. X - AY 2022-23Rasel AshrafulNo ratings yet

- Rooksana Tax Return Form 2020-2021Document19 pagesRooksana Tax Return Form 2020-2021MITON CHOWDHURYNo ratings yet

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionFrom EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNo ratings yet

- The Ridiculously Simple Guide to Apple Watch Series 4: A Practical Guide to Getting Started with Apple Watch Series 4 and WatchOS 6From EverandThe Ridiculously Simple Guide to Apple Watch Series 4: A Practical Guide to Getting Started with Apple Watch Series 4 and WatchOS 6No ratings yet

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Document2 pagesFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waites100% (2)

- 4506t - WORD Version (Request For Transcript of Tax Returns)Document4 pages4506t - WORD Version (Request For Transcript of Tax Returns)Jeff ColeNo ratings yet

- 1041 Form: U.S. Income Tax Return for Estates and TrustsDocument2 pages1041 Form: U.S. Income Tax Return for Estates and TrustsLauren100% (2)

- Pay Stub Template 2Document1 pagePay Stub Template 2Antwain UtleyNo ratings yet

- Dayton's Revised BudgetDocument1 pageDayton's Revised Budgettom_scheckNo ratings yet

- Exhibit 1: House Price ChangeDocument7 pagesExhibit 1: House Price ChangeSudhir PrajapatiNo ratings yet

- Quiz Two: University of Hong Kong CCCH9007 China in The Global EconomyDocument3 pagesQuiz Two: University of Hong Kong CCCH9007 China in The Global EconomyChunming TangNo ratings yet

- Us Master BinDocument11 pagesUs Master BinPhan Văn Bình100% (1)

- Quality RequirementsDocument100 pagesQuality RequirementsAnonymous 0zVzjl50% (2)

- Adeccow 215Document2 pagesAdeccow 215ier362No ratings yet

- Traffic Light Offense DataDocument10 pagesTraffic Light Offense DataAnonymous Pb39klJNo ratings yet

- US Articles of Incorporation Timeline StudyDocument4 pagesUS Articles of Incorporation Timeline StudyFreeman LawyerNo ratings yet

- BoschDocument1 pageBoschShakir HussainNo ratings yet

- Soneri Bank Limited Balance SheetDocument3 pagesSoneri Bank Limited Balance SheetSaad Ur RehmanNo ratings yet

- American EconomyDocument40 pagesAmerican EconomyNabendu SahaNo ratings yet

- Income Lesson One - Plan Your FutureDocument1 pageIncome Lesson One - Plan Your FutureJOHN MENDOZA GALLEGOSNo ratings yet

- ACC 317 Homework CH 21Document1 pageACC 317 Homework CH 21leelee0302No ratings yet

- The Great Depression and The New DealDocument7 pagesThe Great Depression and The New DealRogelio LizarragaacedoNo ratings yet

- Earned Income Tax CreditDocument1 pageEarned Income Tax CreditkevinpadamsNo ratings yet

- ENTIRE Fall 2016 Symposium Slide ShowDocument102 pagesENTIRE Fall 2016 Symposium Slide ShowLydia DePillisNo ratings yet

- 6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDocument2 pages6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDeopito BarrettNo ratings yet

- SavingsAccount History 04052023092205 PDFDocument4 pagesSavingsAccount History 04052023092205 PDFRefiana LatipNo ratings yet

- By Kaushal Pal:: The List of Bins Card These Are Non VBV Cards Bins and BanksDocument13 pagesBy Kaushal Pal:: The List of Bins Card These Are Non VBV Cards Bins and BanksJaveed Ahamed100% (2)

- CC&Rs Belmonte Heights Homeowner's AssociationDocument48 pagesCC&Rs Belmonte Heights Homeowner's AssociationdpequignotNo ratings yet

- Surrender Request Form PDFDocument1 pageSurrender Request Form PDFsharonNo ratings yet

- Description: Tags: GprototypeDocument4 pagesDescription: Tags: Gprototypeanon-129489No ratings yet

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- JPMorgan ChaseDocument2 pagesJPMorgan ChaseRashed TariqueNo ratings yet

- Atwwi "Virtual" Trading Room Reference Document November 2, 2020Document4 pagesAtwwi "Virtual" Trading Room Reference Document November 2, 2020amisamiam2No ratings yet

- 2016 Email Blast List 3 17 16Document220 pages2016 Email Blast List 3 17 16amir420007No ratings yet

- US Tax Preparation Course - Orientation - 01 SepDocument18 pagesUS Tax Preparation Course - Orientation - 01 Sepadnan.riaz81155No ratings yet