Professional Documents

Culture Documents

Sales Tax Question

Uploaded by

Khushi Singh0 ratings0% found this document useful (0 votes)

174 views3 pagesOriginal Title

SALES TAX QUESTION

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

174 views3 pagesSales Tax Question

Uploaded by

Khushi SinghCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

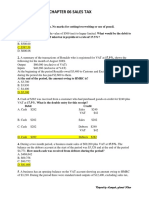

OSHWAL COLLEGE

ASSOCIATION OF CHARTERED CERTIFIED ACCOUNTANTS

(ACCA)

Foundation Level

FA2

Maintaining financial records

Revision questions and solutions

1. Janice buys a dress costing $120, shoes costing $60 and a jacket costing $190. These are all

gross figures, inclusive of sales tax at 17·5%.

How much sales tax in total has Janice paid?

A. $55·11

B. $64·75

C. $74·48

D. $68·51

Solution

Sales tax paid

Amount paid = 120+60+190 = $370------------ 117.5%

? --------- 17.5%

Sales tax paid=$55.10

Assignment

2. Sarah runs her own business and is registered for sales tax. This week her purchases were

$2,350 inclusive of sales tax and her sales were $1,000 exclusive of sales tax.

The rate of sales tax is 17·5%. At the end of the week what will the sales tax account in her

ledger show?

A. $350 receivable

B. $350 payable

C. $175 receivable

D. $175 payable

E.

3. Idris is a sales tax registered trader. On 1 October he purchases carpets for his new

showroom at the list price of $2,000. He is given a trade discount of 20% and the sales tax

rate is 17.5%.

What sum will Idris be invoiced, inclusive of sales tax?

A. $1,980

B. $2,350

C. $1,600

D. $1,880

Invoice price = ($2,000 x 80%) = 1,600(NET PRICE) X 117.5% = $1,880

Assignment

4. A sales tax registered business sells goods $1,200 plus $210 sales tax and purchases goods

costing $200 plus sales tax $35. Assuming these are the only transactions in the sales tax

period and that input tax is fully recoverable, how much sales tax is due/payable to/from

the government?

A. Payable $175

B. Recoverable $175

C. Payable $210

D. Payable $245

5. On 1 January 20X7, a business owed $6,500 in respect of sales tax (Liability)-CR. During the

quarter ended 31 March 20X7, the business made sales of $45,000 (excluding sales tax) and

made purchases amounting to $35,250 (including sales tax). If all transactions were subject

to sales tax at the rate of 17.5%, what was the balance on the sales tax account at 31 March

20X7?

A. $9,125 debit

B. $9,125 credit-----Sales tax payable

C. $8,207 debit

D. $8,207 credit

Solution

Output sales tax = 45,000 x 17.5% = $7,875

Input sales tax = 35,250----117.5%

? -17.5%

Input sales tax = 35,250 x 17.5/117.5 =$5,250

DR Sales tax account CR

Input sales tax 5,250 Balance b/d 6,500

Output sales tax 7,875

Sales tax payable(Bal c/d)-CR 9,125

14,375 14,375

You might also like

- Non Current Asset Questions For ACCADocument11 pagesNon Current Asset Questions For ACCAAiril RazaliNo ratings yet

- F3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Document31 pagesF3FFA Chapter 9 TANGIBLE NON CURRENT ASSET.Md Enayetur Rahman100% (1)

- ACCA F2 AC N MCDocument10 pagesACCA F2 AC N MCSamuel DwumfourNo ratings yet

- FA October 16Document37 pagesFA October 16AngelaNo ratings yet

- Seminar 2-3Document8 pagesSeminar 2-3Nguyen Hien0% (1)

- 13-ACCA-FA2-Chp 13Document22 pages13-ACCA-FA2-Chp 13SMS PrintingNo ratings yet

- All Fifty Questions CompulsoryDocument13 pagesAll Fifty Questions CompulsoryAngie Nguyen0% (1)

- SOLVED - IAS 7 Statement of Cash FlowsDocument16 pagesSOLVED - IAS 7 Statement of Cash FlowsMadu maduNo ratings yet

- F2 Mock 5Document9 pagesF2 Mock 5deepakNo ratings yet

- CAT T10 - 2010 - Dec - ADocument9 pagesCAT T10 - 2010 - Dec - AHussain MeskinzadaNo ratings yet

- Financial Accounting F3 25 August RetakeDocument12 pagesFinancial Accounting F3 25 August RetakeMohammed HamzaNo ratings yet

- F2 and FMA Full Specimen Exam Answers PDFDocument4 pagesF2 and FMA Full Specimen Exam Answers PDFSNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- Dipifr Int 2010 Dec A PDFDocument11 pagesDipifr Int 2010 Dec A PDFPiyal HossainNo ratings yet

- Assignment 3 (f5) 10341Document8 pagesAssignment 3 (f5) 10341Minhaj AlbeezNo ratings yet

- F2 Past Paper - Question06-2007Document13 pagesF2 Past Paper - Question06-2007ArsalanACCA100% (1)

- 3uk - 2007 - Dec - Q CAT T3Document10 pages3uk - 2007 - Dec - Q CAT T3asad19No ratings yet

- FA2 S20-A21 Examiner's ReportDocument6 pagesFA2 S20-A21 Examiner's ReportAreeb AhmadNo ratings yet

- caCAF 01 Suggested Solution Autumn 2014Document8 pagescaCAF 01 Suggested Solution Autumn 2014shahroozkhanNo ratings yet

- IPRO Mock Exam - 2021 - QDocument21 pagesIPRO Mock Exam - 2021 - QKevin Ch Li100% (1)

- Manufacturing process WIP calculationDocument6 pagesManufacturing process WIP calculationNasir Iqbal100% (1)

- F3 MOCK EXAM: KEY ACCOUNTING CONCEPTSDocument21 pagesF3 MOCK EXAM: KEY ACCOUNTING CONCEPTSMaja Jareno GomezNo ratings yet

- Fma Past Paper 3 (F2)Document24 pagesFma Past Paper 3 (F2)Shereka EllisNo ratings yet

- FFA Imp Questions-2Document20 pagesFFA Imp Questions-2Abdul Ahad YousafNo ratings yet

- 3int - 2008 - Jun - Ans CAT T3Document6 pages3int - 2008 - Jun - Ans CAT T3asad19No ratings yet

- F5 CKT Mock1Document8 pagesF5 CKT Mock1OMID_JJNo ratings yet

- BUSI 353 Assignment #5 General Instructions For All AssignmentsDocument3 pagesBUSI 353 Assignment #5 General Instructions For All AssignmentsTanNo ratings yet

- AccountingDocument7 pagesAccountingHà PhươngNo ratings yet

- FR Tutorials 2022 - Some Theory Question SolutionDocument26 pagesFR Tutorials 2022 - Some Theory Question SolutionLaud Listowell100% (2)

- T2 Mock Exam (Dec'08 Exam)Document12 pagesT2 Mock Exam (Dec'08 Exam)vasanthipuruNo ratings yet

- Practice Cases For Chapter 12 Case 1Document3 pagesPractice Cases For Chapter 12 Case 1Lê Minh TríNo ratings yet

- F2 Past Paper - Question12-2004Document13 pagesF2 Past Paper - Question12-2004ArsalanACCANo ratings yet

- Practice Qs Chap 13HDocument4 pagesPractice Qs Chap 13HSuy YanghearNo ratings yet

- Chapter 03Document12 pagesChapter 03Asim NazirNo ratings yet

- Practice Questions: Global Certified Management AccountantDocument23 pagesPractice Questions: Global Certified Management AccountantThiha WinNo ratings yet

- Toaz - Info Acca f3 LRP Questions PRDocument64 pagesToaz - Info Acca f3 LRP Questions PRArt and Fashion galleryNo ratings yet

- Preparing Financial StatementsDocument14 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- BUSI 353 S18 Assignment 3 All RevenueDocument5 pagesBUSI 353 S18 Assignment 3 All RevenueTanNo ratings yet

- Chap 2Document47 pagesChap 2ADITYA JAIN100% (1)

- Post Exam Guide May 2001 Exam: Business Law (FBLW)Document16 pagesPost Exam Guide May 2001 Exam: Business Law (FBLW)bub12345678No ratings yet

- 2007 - Jun - QUS CAT T3Document10 pages2007 - Jun - QUS CAT T3asad19No ratings yet

- Workshop F2 May 2011Document18 pagesWorkshop F2 May 2011roukaiya_peerkhanNo ratings yet

- Iandfct2exam201504 0Document8 pagesIandfct2exam201504 0Patrick MugoNo ratings yet

- 2006 - Dec - QUS CAT T3Document9 pages2006 - Dec - QUS CAT T3asad190% (1)

- Fa1 Mock 2Document9 pagesFa1 Mock 2smartlearning1977No ratings yet

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- ACCA F2 Revision Notes OpenTuition PDFDocument25 pagesACCA F2 Revision Notes OpenTuition PDFSaurabh KaushikNo ratings yet

- Marginal and Absorption CostingDocument8 pagesMarginal and Absorption CostingEniola OgunmonaNo ratings yet

- Accounts and Statistics 3Document41 pagesAccounts and Statistics 3BrightonNo ratings yet

- 17 Answers To All ProblemsDocument25 pages17 Answers To All ProblemsRaşitÖnerNo ratings yet

- 1-2 2002 Dec QDocument16 pages1-2 2002 Dec QSandhyaShresthaNo ratings yet

- Fundamentals Pilot Paper Knowledge Module AccountingDocument320 pagesFundamentals Pilot Paper Knowledge Module AccountingBELONG TO VIRGIN MARYNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Chapter 5 Sales TaxDocument5 pagesChapter 5 Sales Taxali_sattar15No ratings yet

- Sales Tax: Calculation of Sales Tax Double Entries Ledger Accounts of Sales Tax Practice Questions Answer BankDocument10 pagesSales Tax: Calculation of Sales Tax Double Entries Ledger Accounts of Sales Tax Practice Questions Answer BankUmar SageerNo ratings yet

- Sales Tax Chapter QuestionsDocument4 pagesSales Tax Chapter QuestionsBilal GouriNo ratings yet

- SAMPLE MidtermDocument2 pagesSAMPLE MidtermPatricia Ann GuetaNo ratings yet

- Exercise 3. Cash Flows Statements and WorkingDocument8 pagesExercise 3. Cash Flows Statements and WorkingQuang Dũng NguyễnNo ratings yet

- Which of The Following Is Not One of The Three Forms of Business OrganizationDocument4 pagesWhich of The Following Is Not One of The Three Forms of Business OrganizationGhada RaghebNo ratings yet

- Financial Statement Analysis Midterm Assignment AssignmentDocument5 pagesFinancial Statement Analysis Midterm Assignment AssignmentHaidar NuraNo ratings yet

- Corporate Finance Exercises: Calculating OCF, NWC, Net Income & MoreDocument7 pagesCorporate Finance Exercises: Calculating OCF, NWC, Net Income & MoreNelson NofantaNo ratings yet

- BM1805 Service Costing and Retail Inventory MethodDocument5 pagesBM1805 Service Costing and Retail Inventory MethodMaria Anndrea MendozaNo ratings yet

- Business Economics Midterm ML53 No Data Provided Answers 1Document13 pagesBusiness Economics Midterm ML53 No Data Provided Answers 1hoanganhlee1024No ratings yet

- Table of Contents - Valuation and Common Sense (8th Edition)Document13 pagesTable of Contents - Valuation and Common Sense (8th Edition)meditationinstitute.netNo ratings yet

- Problem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesDocument6 pagesProblem 9 - Buying On Margin Problem 11 - Buying On Margin Problem 10 - Short Sales Problem 12 - Short SalesBona Christanto SiahaanNo ratings yet

- Swing pivots – Trend identification methodology using 15-min Nifty chartDocument10 pagesSwing pivots – Trend identification methodology using 15-min Nifty chartKL RoyNo ratings yet

- Spread Worksheet LockedDocument8 pagesSpread Worksheet LockedJack ToutNo ratings yet

- Union Pearson ExpressDocument6 pagesUnion Pearson ExpressJohn ClarkNo ratings yet

- Women's rights movement faced major obstaclesDocument4 pagesWomen's rights movement faced major obstaclesSheila CBNo ratings yet

- 3 - Introduction To Fixed Income Valuation-UnlockedDocument53 pages3 - Introduction To Fixed Income Valuation-UnlockedAditya NugrohoNo ratings yet

- Intensive Group Case Study William Oliver BootmakerDocument11 pagesIntensive Group Case Study William Oliver Bootmakerparmeet kaurNo ratings yet

- Cost-Volume-Profit AnalysisDocument56 pagesCost-Volume-Profit AnalysisAgatNo ratings yet

- Case MP - Week 6 - IKEADocument9 pagesCase MP - Week 6 - IKEAKGGGGNo ratings yet

- Chapter One - Marketing Management OverviewDocument31 pagesChapter One - Marketing Management Overviewtemesgen abetoNo ratings yet

- Developing Pricing Strategies and ProgramsDocument33 pagesDeveloping Pricing Strategies and ProgramsKonal ChaudharyNo ratings yet

- Chryss John T. Querol BSBA-2 (Financial Management 1) Journal Critique I. CitationDocument3 pagesChryss John T. Querol BSBA-2 (Financial Management 1) Journal Critique I. CitationChryss John QuerolNo ratings yet

- ECO 201 Project FinalDocument9 pagesECO 201 Project FinalHugs100% (2)

- Bond and Stock ValuationDocument5 pagesBond and Stock ValuationCh SibNo ratings yet

- Managerial Economics - PT 2015Document4 pagesManagerial Economics - PT 2015Samvid JhinganNo ratings yet

- Examples of Maximum PricesDocument3 pagesExamples of Maximum Pricesdoudou liuNo ratings yet

- Technical AnalysisDocument28 pagesTechnical Analysishany seifNo ratings yet

- Lecturer 5 - Chapter 4 Analysing Market, Competition and Co-Operation - BDADocument34 pagesLecturer 5 - Chapter 4 Analysing Market, Competition and Co-Operation - BDAPhương Lê ThanhNo ratings yet

- Journal 8 Yong112Document10 pagesJournal 8 Yong112Lisa AmruNo ratings yet

- Cost Accounting WASSCE Syllabus SummaryDocument6 pagesCost Accounting WASSCE Syllabus Summarysalifu mansarayNo ratings yet

- The 8-Figure Samurai Sword Sales ScriptDocument25 pagesThe 8-Figure Samurai Sword Sales ScriptArnold Roger Curry89% (19)

- Important Formulas For Break - Even Analysis: Selling Price Per Unit - Variable Cost Per UnitDocument4 pagesImportant Formulas For Break - Even Analysis: Selling Price Per Unit - Variable Cost Per UnitDevika GopiNo ratings yet

- Branch accounting cost methodDocument3 pagesBranch accounting cost methodNicole TaylorNo ratings yet

- Chap 8 Lecture NoteDocument4 pagesChap 8 Lecture NoteCloudSpireNo ratings yet

- Module 11-13 (April 26-27, 2023)Document10 pagesModule 11-13 (April 26-27, 2023)Paulo Emmanuel SantosNo ratings yet

- UNIT 27 - International TradeDocument10 pagesUNIT 27 - International TradeTran AnhNo ratings yet

- Module 3: National Income Accounting: Lecture NotesDocument24 pagesModule 3: National Income Accounting: Lecture NotesEthan John PaguntalanNo ratings yet