Professional Documents

Culture Documents

Closed Bank Under Receivership Must Sue Through PDIC

Uploaded by

Angelicka Jane Resurreccion0 ratings0% found this document useful (0 votes)

92 views1 page1) When Banco Filipino Savings and Mortgage Bank was placed under receivership by the Bangko Sentral ng Pilipinas, control of the bank shifted to the Philippine Deposit Insurance Corporation (PDIC) as receiver.

2) As receiver, only the PDIC has the authority to file lawsuits on behalf of the closed bank. However, the petition was filed by Banco Filipino's Executive Vice Presidents without joining the PDIC.

3) As such, the petition was considered an unauthorized pleading and the Supreme Court did not acquire valid jurisdiction over the case. The petition was therefore dismissed.

Original Description:

Original Title

GR No. 200678

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) When Banco Filipino Savings and Mortgage Bank was placed under receivership by the Bangko Sentral ng Pilipinas, control of the bank shifted to the Philippine Deposit Insurance Corporation (PDIC) as receiver.

2) As receiver, only the PDIC has the authority to file lawsuits on behalf of the closed bank. However, the petition was filed by Banco Filipino's Executive Vice Presidents without joining the PDIC.

3) As such, the petition was considered an unauthorized pleading and the Supreme Court did not acquire valid jurisdiction over the case. The petition was therefore dismissed.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

92 views1 pageClosed Bank Under Receivership Must Sue Through PDIC

Uploaded by

Angelicka Jane Resurreccion1) When Banco Filipino Savings and Mortgage Bank was placed under receivership by the Bangko Sentral ng Pilipinas, control of the bank shifted to the Philippine Deposit Insurance Corporation (PDIC) as receiver.

2) As receiver, only the PDIC has the authority to file lawsuits on behalf of the closed bank. However, the petition was filed by Banco Filipino's Executive Vice Presidents without joining the PDIC.

3) As such, the petition was considered an unauthorized pleading and the Supreme Court did not acquire valid jurisdiction over the case. The petition was therefore dismissed.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

G.R. No.

200678, June 4, 2018

Banco Filipino Savings and Mortgage Bank v. Bangko When petitioner was placed under receivership, the

Sentral ng Pilipinas powers of its Board of Directors and its officers were

suspended. Thus, its Board of Directors could not have

A closed bank under receivership can only sue or be sued validly authorized its Executive Vice Presidents to file the

through its receiver, the Philippine Deposit Insurance suit on its behalf. The Petition, not having been properly

Corporation (PDIC). Hence, the petition filed by the verified, is considered an unsigned pleading. A defect in

petitioner bank which has been placed under receivership the certification of non-forum shopping is likewise fatal to

is dismissible as it did not join PDIC as a party to the case. petitioner's cause. Considering that the Petition was led by

signatories who were not validly authorized to do so, the

FACTS: Petition does not produce any legal effect. Being an

Petitioner bank has been placed under receivership when unauthorized pleading, this Court never validly acquired

it filed a Petition for Certiorari with the Supreme Court. jurisdiction over the case. The Petition, therefore, must be

Said Petition was assailed by the respondent that dismissed.

contended that the same should be dismissed outright for

being led without Philippine Deposit Insurance

Corporation's authority. It asserts that petitioner was

placed under receivership on March 17, 2011, and thus,

petitioner's Executive Committee would have had no

authority to sign for or on behalf of petitioner absent the

authority of its receiver, Philippine Deposit Insurance

Corporation. They also point out that both the Philippine

Deposit Insurance Corporation Charter and Republic Act

No. 7653 categorically state that the authority to file suits or

retain counsels for closed banks is vested in the receiver.

Thus, the verification and certification of non-forum

shopping signed by petitioner's Executive Committee has

no legal effect.

Issue:

Whether or not petitioner Banco Filipino, as a closed bank

under receivership, could file this Petition for Review

without joining its statutory receiver, the Philippine Deposit

Insurance Corporation, as a party to the case.

Ruling:

No. A closed bank under receivership can only sue or be

sued through its receiver, the Philippine Deposit Insurance

Corporation. Under Republic Act No. 7653, when the

Monetary Board finds a bank insolvent, it may "summarily

and without need for prior hearing forbid the institution from

doing business in the Philippines and designate the

Philippine Deposit Insurance Corporation as receiver of the

banking institution."

The relationship between the Philippine Deposit Insurance

Corporation and a closed bank is fiduciary in nature.

Section 30 of Republic Act No. 7653 directs the receiver of

a closed bank to "immediately gather and take charge of all

the assets and liabilities of the institution" and "administer

the same for the benefit of its creditors." The law likewise

grants the receiver "the general powers of a receiver under

the Revised Rules of Court." Under Rule 59, Section 6 of

the Rules of Court, "a receiver shall have the power to

bring and defend, in such capacity, actions in his [or her]

own name." Thus, Republic Act No. 7653 provides that the

receiver shall also "in the name of the institution, and with

the assistance of counsel as [it] may retain, institute such

actions as may be necessary to collect and recover

accounts and assets of, or defend any action against, the

institution." Considering that the receiver has the power to

take charge of all the assets of the closed bank and to

institute for or defend any action against it, only the

receiver, in its fiduciary capacity, may sue and be sued on

behalf of the closed bank.

You might also like

- BANCO DE ORO V REPUBLICDocument2 pagesBANCO DE ORO V REPUBLICJoanna Reyes100% (1)

- Central Bank, Citytrust Share Liability for Fraudulent Check CashingDocument3 pagesCentral Bank, Citytrust Share Liability for Fraudulent Check CashingTriccie MangueraNo ratings yet

- Final Judicial AffidavitDocument8 pagesFinal Judicial AffidavitLalaland P.R.No ratings yet

- Air Canada v. Commissioner of Internal Revenue, G.R. 169507, January, 11 201Document25 pagesAir Canada v. Commissioner of Internal Revenue, G.R. 169507, January, 11 201Paul SarangayaNo ratings yet

- Mayon Investment vs. Union InsuranceDocument2 pagesMayon Investment vs. Union InsuranceAlexylle Garsula de ConcepcionNo ratings yet

- Annulment of Defective Certificate on Non-Forum ShoppingDocument3 pagesAnnulment of Defective Certificate on Non-Forum ShoppingNrnNo ratings yet

- Republic of the Philippines Supreme Court ruling on constitutionality of EO 378Document16 pagesRepublic of the Philippines Supreme Court ruling on constitutionality of EO 378Rebecca ChanNo ratings yet

- G.R. No. 230443Document13 pagesG.R. No. 230443Ran Ngi100% (1)

- PICOP Petition Challenges Ruling on Managerial Employee StatusDocument219 pagesPICOP Petition Challenges Ruling on Managerial Employee StatusReuben EscarlanNo ratings yet

- Qanda 2023 EthicsDocument388 pagesQanda 2023 EthicsJoe SolimanNo ratings yet

- 36.alhambra Cigar & Cigarette Manufacturing Co., Inc. vs. Securities and Exchange CommissionDocument9 pages36.alhambra Cigar & Cigarette Manufacturing Co., Inc. vs. Securities and Exchange Commissionvince005No ratings yet

- Petition: Regional Trial Court of ManilaDocument11 pagesPetition: Regional Trial Court of ManilaJc AlvarezNo ratings yet

- INSURANCE POLICY INTERPRETATION GUIDEDocument16 pagesINSURANCE POLICY INTERPRETATION GUIDELiene Lalu NadongaNo ratings yet

- GR - 208912 - Perlas-BernabeDocument15 pagesGR - 208912 - Perlas-BernabeTerele Aeron OnateNo ratings yet

- Trust Receipts Remedies (3) PNB Vs PINEDADocument3 pagesTrust Receipts Remedies (3) PNB Vs PINEDAAlejandro de LeonNo ratings yet

- Supreme Court Rules on Origination of Revenue BillsDocument180 pagesSupreme Court Rules on Origination of Revenue BillsJohnde MartinezNo ratings yet

- RBSM vs MB closure order upheldDocument2 pagesRBSM vs MB closure order upheldCaitlin KintanarNo ratings yet

- CIAC Form 001 Request for AdjudicationDocument10 pagesCIAC Form 001 Request for AdjudicationRaffyLaguesmaNo ratings yet

- Tambunting Vs CaDocument3 pagesTambunting Vs CaElla B.No ratings yet

- Nadal Et Al vs. CA and Ureta - DigestDocument1 pageNadal Et Al vs. CA and Ureta - DigestArvin Antonio OrtizNo ratings yet

- Philippine Journalists Inc V CIR GR No 162852Document2 pagesPhilippine Journalists Inc V CIR GR No 162852crizaldedNo ratings yet

- PVTA vs. de Los AngelesDocument1 pagePVTA vs. de Los AngelesRaymond RoqueNo ratings yet

- Advocates For Truth Vs Bangko SentralDocument2 pagesAdvocates For Truth Vs Bangko SentralSamuel Terseis100% (4)

- Angeles Univ Foundation v. City of AngelesDocument2 pagesAngeles Univ Foundation v. City of AngelesGlenn Mark Frejas RinionNo ratings yet

- UCPB vs EGI: Court of Appeals has jurisdiction over BSP Monetary Board rulingsDocument3 pagesUCPB vs EGI: Court of Appeals has jurisdiction over BSP Monetary Board rulingsKrizzle de la Peña0% (1)

- Judicial Admissions Binding in Toshiba vs CIRDocument5 pagesJudicial Admissions Binding in Toshiba vs CIRMaiti LagosNo ratings yet

- Prudential Bank V Chonney LimDocument1 pagePrudential Bank V Chonney LimKayee KatNo ratings yet

- Borlongan vs. ReyesDocument3 pagesBorlongan vs. ReyesChristle CorpuzNo ratings yet

- G.R. NO. 214866, October 02, 2017 - Apex Bancrights Holdings, Inc. vs. Bangko Sentral NG PilipinasDocument2 pagesG.R. NO. 214866, October 02, 2017 - Apex Bancrights Holdings, Inc. vs. Bangko Sentral NG PilipinasFrancis Coronel Jr.No ratings yet

- RCBC vs. CIR (GR No. 170257, September 7, 2011)Document2 pagesRCBC vs. CIR (GR No. 170257, September 7, 2011)Arnold JoseNo ratings yet

- Vda de Borromeo v. PogoyDocument1 pageVda de Borromeo v. Pogoyvirvsha IndolozNo ratings yet

- Procter & Gamble Asia PTE LTD., Petitioner vs. Commissioner of Internal Revenue (CIR)Document2 pagesProcter & Gamble Asia PTE LTD., Petitioner vs. Commissioner of Internal Revenue (CIR)Cessy Ciar KimNo ratings yet

- Monetary Board vs. Philippine Veterans Bank, G.R. No. 189571, January 21, 2015Document1 pageMonetary Board vs. Philippine Veterans Bank, G.R. No. 189571, January 21, 2015Al Jay MejosNo ratings yet

- Rivera-Pascual V LimDocument3 pagesRivera-Pascual V LimRose De JesusNo ratings yet

- Richards Vs AsoyDocument5 pagesRichards Vs AsoyMaria Cherrylen Castor QuijadaNo ratings yet

- Session 14 Digest CHARLES LEE V CADocument3 pagesSession 14 Digest CHARLES LEE V CAAnna Marie DayanghirangNo ratings yet

- Meralco Vs YatcoDocument4 pagesMeralco Vs YatcoArkhaye SalvatoreNo ratings yet

- Liban v. Sen. Gordon DigestDocument1 pageLiban v. Sen. Gordon DigestCieloMarieNo ratings yet

- IX. Q. B. DBP vs. Licuanan (Duron)Document2 pagesIX. Q. B. DBP vs. Licuanan (Duron)Krizea Marie Duron100% (1)

- Request to Include Unaccrued Special Allowance DeniedDocument12 pagesRequest to Include Unaccrued Special Allowance Deniedsabrina gayoNo ratings yet

- RTMC Liable for Loan Payments Despite Warehouse Fire Destroying GoodsDocument1 pageRTMC Liable for Loan Payments Despite Warehouse Fire Destroying GoodsTeff QuibodNo ratings yet

- Sps. Isidro Abel Cruz vs. Sps. Florencio and Amparo CaraosDocument2 pagesSps. Isidro Abel Cruz vs. Sps. Florencio and Amparo CaraosKaemy MalloNo ratings yet

- 4 - MELECIO R. DOMINGO vs. HON. LORENZO C. GARLITOS - DelfinDocument2 pages4 - MELECIO R. DOMINGO vs. HON. LORENZO C. GARLITOS - DelfinElla CanuelNo ratings yet

- Obligations10 - Chinatrust vs. TurnerDocument2 pagesObligations10 - Chinatrust vs. TurnerJerone Karl Grospe BustamanteNo ratings yet

- BSP Monetary Board has power to close banks without noticeDocument2 pagesBSP Monetary Board has power to close banks without noticeLeo Felicilda100% (2)

- CA G.R. No. 11578; March 19, 2002 - Kho v. SummervilleDocument2 pagesCA G.R. No. 11578; March 19, 2002 - Kho v. SummervillePaulo Salanguit0% (1)

- Digest - REPUBLIC OF THE PHILIPPINES, REPRESENTED BY THE PRESIDENTIAL COMMISSION ON GOOD GOVERNMENT, Petitioners, v. LEGAL HEIRS OF JOSE L. AFRICA, Respondents.Document8 pagesDigest - REPUBLIC OF THE PHILIPPINES, REPRESENTED BY THE PRESIDENTIAL COMMISSION ON GOOD GOVERNMENT, Petitioners, v. LEGAL HEIRS OF JOSE L. AFRICA, Respondents.Admin Division100% (1)

- Saura Import & Export Co., Inc V. Development Bank of The PhilippinesDocument2 pagesSaura Import & Export Co., Inc V. Development Bank of The PhilippinesJzevNo ratings yet

- Tax - BPI Vs CIR GR No 139736 October 17, 2005 DigestDocument9 pagesTax - BPI Vs CIR GR No 139736 October 17, 2005 DigestDyannah Alexa Marie RamachoNo ratings yet

- Delpher Trades Corp. v. Intermediate Appellate CourtDocument10 pagesDelpher Trades Corp. v. Intermediate Appellate CourtKTNo ratings yet

- Pnoc Vs KeppelDocument6 pagesPnoc Vs KeppeljessapuerinNo ratings yet

- Development Bank of The Philippines v. COADocument4 pagesDevelopment Bank of The Philippines v. COAf919No ratings yet

- Atok Finance Corporation vs. Court of AppealsDocument3 pagesAtok Finance Corporation vs. Court of AppealsAngelica Abalos100% (1)

- Rights Conferred by Well-Known Trademarks on Unrelated GoodsDocument2 pagesRights Conferred by Well-Known Trademarks on Unrelated GoodsSarah100% (1)

- Vda. de Camilo v. Arcamo FactsDocument4 pagesVda. de Camilo v. Arcamo FactsMark Abragan0% (1)

- Supreme Court Rules Against Notary for Improper Affidavit NotarizationDocument6 pagesSupreme Court Rules Against Notary for Improper Affidavit NotarizationNikki Tricia Reyes SantosNo ratings yet

- Digest Antonino Vs Register of DeedsDocument1 pageDigest Antonino Vs Register of DeedsmunirahNo ratings yet

- Banco Filipino Savings and MortgageDocument2 pagesBanco Filipino Savings and MortgageBrokenNo ratings yet

- 7 Banko Filipino vs. BSPDocument1 page7 Banko Filipino vs. BSPmei atienzaNo ratings yet

- PDIC authority requiredDocument2 pagesPDIC authority requiredApple Ke-eNo ratings yet

- Republic Act No. 10906Document4 pagesRepublic Act No. 10906Angelicka Jane ResurreccionNo ratings yet

- GR No. 230037Document2 pagesGR No. 230037Angelicka Jane ResurreccionNo ratings yet

- GR No. 176438Document2 pagesGR No. 176438Angelicka Jane Resurreccion50% (2)

- GR No. 230037Document2 pagesGR No. 230037Angelicka Jane ResurreccionNo ratings yet

- Banco Filipino Closure ChallengedDocument2 pagesBanco Filipino Closure ChallengedAngelicka Jane Resurreccion100% (1)

- RA 9710 An Act Providing For Magna Carta of WomenDocument24 pagesRA 9710 An Act Providing For Magna Carta of Womenzhu banNo ratings yet

- Republic Act No. 10906Document4 pagesRepublic Act No. 10906Angelicka Jane ResurreccionNo ratings yet

- Judicial Affidavit RuleDocument4 pagesJudicial Affidavit RuleCaroline DulayNo ratings yet

- Maceda LawDocument1 pageMaceda LawAlverastine AnNo ratings yet

- Pacific BankingDocument6 pagesPacific BankingAngelicka Jane ResurreccionNo ratings yet

- R.A. 7877 (Anti-Sexual Harassment Act of 1995) - 3pagesDocument4 pagesR.A. 7877 (Anti-Sexual Harassment Act of 1995) - 3pagesArkhaye SalvatoreNo ratings yet

- Judicial Affidavit RuleDocument4 pagesJudicial Affidavit RuleCaroline DulayNo ratings yet

- SeagullDocument1 pageSeagullAngelicka Jane ResurreccionNo ratings yet

- Place WellDocument1 pagePlace WellAngelicka Jane ResurreccionNo ratings yet

- Inter OrientDocument1 pageInter OrientAngelicka Jane ResurreccionNo ratings yet

- JMM Promotions and Management Inc V NLRCDocument1 pageJMM Promotions and Management Inc V NLRCAngelicka Jane ResurreccionNo ratings yet

- Insular Bank of Asia V InciongDocument1 pageInsular Bank of Asia V InciongAngelicka Jane Resurreccion0% (1)

- LIMDocument1 pageLIMAngelicka Jane ResurreccionNo ratings yet

- First AsiaDocument2 pagesFirst AsiaAngelicka Jane ResurreccionNo ratings yet

- Oral DefamationDocument3 pagesOral DefamationAngelicka Jane ResurreccionNo ratings yet

- PDIC authority requiredDocument2 pagesPDIC authority requiredApple Ke-eNo ratings yet

- Central BankDocument4 pagesCentral BankAngelicka Jane ResurreccionNo ratings yet

- People of The PhilippinesDocument1 pagePeople of The PhilippinesAngelicka Jane ResurreccionNo ratings yet

- Republic of The PhilippinesDocument1 pageRepublic of The PhilippinesAngelicka Jane ResurreccionNo ratings yet

- LACSONDocument1 pageLACSONAngelicka Jane Resurreccion0% (1)

- PEREZDocument1 pagePEREZAngelicka Jane ResurreccionNo ratings yet

- International Exchange BankDocument1 pageInternational Exchange BankAngelicka Jane ResurreccionNo ratings yet

- DIMATULACDocument1 pageDIMATULACAngelicka Jane ResurreccionNo ratings yet

- ARTURODocument1 pageARTUROAngelicka Jane ResurreccionNo ratings yet

- Ermiyas TeshomeDocument129 pagesErmiyas Teshomeshambel asfawNo ratings yet

- Strategies for Customer Relationship ManagementDocument26 pagesStrategies for Customer Relationship Managementprince100% (3)

- New 1st Semester English (MCO-01,04,05,21) M.com AssignmentDocument8 pagesNew 1st Semester English (MCO-01,04,05,21) M.com AssignmentRajni KumariNo ratings yet

- Sourcing Winning Products Ebook by Warrick KernesDocument17 pagesSourcing Winning Products Ebook by Warrick KernesMusa MathyeNo ratings yet

- Resolve GST Implementation Issues in SAP with these Solution NotesDocument2 pagesResolve GST Implementation Issues in SAP with these Solution Notescharan raoNo ratings yet

- Cost Accounting Individual Assignmnet ECSUDocument5 pagesCost Accounting Individual Assignmnet ECSUGETAHUN ASSEFA ALEMUNo ratings yet

- Continuous Improvement Policy and ProcedureDocument3 pagesContinuous Improvement Policy and ProcedureCandiceNo ratings yet

- Staples IncDocument4 pagesStaples IncNo nameNo ratings yet

- CHP 1 - GlobalizationDocument10 pagesCHP 1 - GlobalizationSITI0% (1)

- Sap Product Costing Configuration DocumentDocument16 pagesSap Product Costing Configuration Documentguru_vkg75% (4)

- E5-E6 CIVIL Part-I Chapter-11 Understanding-Financia-StatementDocument14 pagesE5-E6 CIVIL Part-I Chapter-11 Understanding-Financia-StatementNarendra Kumar KumawatNo ratings yet

- Unit 6 WorkbookDocument194 pagesUnit 6 WorkbookMary Bernadette SandigNo ratings yet

- Pooya, A., Mehran, A.K. and Ghouzhdi, S.G., 2020.Document19 pagesPooya, A., Mehran, A.K. and Ghouzhdi, S.G., 2020.Eduardo CastañedaNo ratings yet

- Witness Affidavit Motorcycle Installment Purchase DeceptionDocument2 pagesWitness Affidavit Motorcycle Installment Purchase DeceptionFeisty LionessNo ratings yet

- Calculating Consolidated Balance Sheet AmountsDocument6 pagesCalculating Consolidated Balance Sheet AmountsBryan LukeNo ratings yet

- Saipem Sustainability 2018Document72 pagesSaipem Sustainability 2018dandiar1No ratings yet

- Calculate Branch Inventory Cost and Profits for Home Office MarkupsDocument6 pagesCalculate Branch Inventory Cost and Profits for Home Office Markupsangela arcedoNo ratings yet

- Order Letter TemplateDocument9 pagesOrder Letter TemplateDara SeptalianaNo ratings yet

- Case Stud1Document2 pagesCase Stud1Raj KumarNo ratings yet

- For Student Grade Xi Try Out 1 (Persiapan Pat Big Xi 2023)Document13 pagesFor Student Grade Xi Try Out 1 (Persiapan Pat Big Xi 2023)Cindy Anggun LNo ratings yet

- Change Management at Dell CorporationDocument21 pagesChange Management at Dell CorporationimuffysNo ratings yet

- FindsDocument8 pagesFindsdan4oNo ratings yet

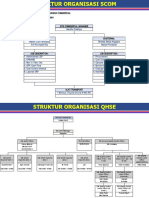

- Struktur Organisasi - Sem, Scarm, Som, Sam, SqhseDocument2 pagesStruktur Organisasi - Sem, Scarm, Som, Sam, SqhseOloyNo ratings yet

- IAR Auditing ConclusionDocument23 pagesIAR Auditing Conclusionmarlout.sarita100% (1)

- International Financial Reporting StandardsDocument16 pagesInternational Financial Reporting StandardsRizuanul MustafaNo ratings yet

- Booklet - Business Immersion Program 2023Document34 pagesBooklet - Business Immersion Program 2023Kenneth ChandrawidjajaNo ratings yet

- Assam Handicrafts ResearchDocument28 pagesAssam Handicrafts Researchdilraj singhNo ratings yet

- Department of Business Administration: Assignment OnDocument13 pagesDepartment of Business Administration: Assignment OnRubyat SharminNo ratings yet

- Application For Approval of A Watt-Hour Meter Product: Energy Regulatory CommissionDocument2 pagesApplication For Approval of A Watt-Hour Meter Product: Energy Regulatory CommissionChristian EstebanNo ratings yet

- DM Salary Structure (22 June) - BAHASA VERSIONDocument2 pagesDM Salary Structure (22 June) - BAHASA VERSIONyulian GreesandoNo ratings yet