Professional Documents

Culture Documents

Calculate Capital Gains Tax on Property Sale

Uploaded by

yusuf_jtOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Calculate Capital Gains Tax on Property Sale

Uploaded by

yusuf_jtCopyright:

Available Formats

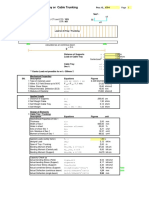

Capital Gains Tax Calculator for Property

www.ApnaPlan.com

Purchase Price 1,800,000 Fill only Orange Cells

Month & Year of Purchase Apr-2003 4 2003 2003

Sale Price 6,000,000

Month & Year of Sale Nov-2017 11 2017 2017

No of Years 14.5

As your Investment Period is MORE than 2 Years your gains/losses

qualify for LONG Term Capital Gains/Losses

Associated cost while buying (Brokrage, Stamp Duty, etc) 100,000

Month & Year of above Cost Apr-2003 4 2003 2003

Cost of Repair 1 30,000

Month & Year of Repair1 Mar-2008 3 2008 2007

Cost of Repair 2 50,000

Month & Year of Repair2 Apr-2010 4 2010 2010

Cost of Repair 3 100,000

Month & Year of Repair3 Jun-2012 6 2012 2012

YOU ARE COVERED UNDER = LTCG

LONG TERM CAPITAL GAIN CALCULATION (LTCG) SHORT TERM CAPITAL GAIN CALCULATION (STCG)

Purchase CII 109

Sale CII 272

Associated Cost CII 109 In case of Property, STCG is added to income from other sources, and

a taxpayer pays tax at the rate applicable to him/her. There is NO

Repair 2 CII 129 indexation benefit available

Repair 3 CII 167

Repair 4 CII 200

Indexed Purchase Price 4,491,743 Purchase Price NA

Associated Cost While Purchase 249,541 Associated Cost While Purchase NA

Indexed Repair1 Cost 63,256 Total Repair Cost NA

Indexed Repair2 Cost 81,437 Sale Price NA

Indexed Repair3 Cost 136,000 Short Term Capital Gains NA

Total Indexed Repair Cost 280,693 Tax @ 10% slab NA

Total Cost 5,021,977 Tax @ 20% slab NA

Long Term Capital Gain 978,023 Tax @ 30% slab NA

Tax with Indexation @ 20% 195,605

Cess @ 3% 5,868

Total Capital Gains Tax 201,473 Click here

If you Want to Save Tax on

your Long Term Capital Gains

1/23/2017 AXP Internal 1

For any Queries write to -

apnaplan.com@gmail.com

As your Investment Period is LESS than 2 Years your gains/losses qualify for SHORT Term Capital G

SL. NO. FINANCIAL YEAR COST INFLATION INDEX (CII) As your Investment Period is MORE than 2 Years your gains/losses qualify for LONG Term Capital

1 2001 - 2002 100

2 2002 - 2003 105

3 2003 - 2004 109

4 2004 - 2005 113

5 2005 - 2006 117

6 2006 - 2007 122

7 2007 - 2008 129

8 2008 - 2009 137

9 2009 - 2010 148

10 2010 - 2011 167

11 2011 - 2012 184

12 2012 - 2013 200

13 2013 - 2014 220

14 2014 - 2015 240

15 2015 - 2016 254

16 2016 - 2017 264

17 2017 - 2018 272

18 2018 - 2019 280

19 2019 - 2020

20 2020 - 2021

1/23/2017 AXP Internal 1

ses qualify for SHORT Term Capital Gains/Losses

sses qualify for LONG Term Capital Gains/Losses

1/23/2017 AXP Internal 1

You might also like

- Capital Gains Tax Calculator For Property: Purchase Price 55,000 Fill Only Orange Cells Month & Year of PurchaseDocument10 pagesCapital Gains Tax Calculator For Property: Purchase Price 55,000 Fill Only Orange Cells Month & Year of Purchaseyusuf_jtNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Capital Gains Calculator PropertyDocument9 pagesCapital Gains Calculator Propertyajayparmar_inNo ratings yet

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- Improvement: Aggregate FollowingDocument18 pagesImprovement: Aggregate FollowingGauravNo ratings yet

- Departmental Accounts - E-Notes - Udesh Regular - Group 1Document28 pagesDepartmental Accounts - E-Notes - Udesh Regular - Group 1Shubham KumarNo ratings yet

- Ass Intacc 3 - GonzagaDocument12 pagesAss Intacc 3 - GonzagaLalaine Keendra GonzagaNo ratings yet

- FAR ND-2023 QuestionDocument4 pagesFAR ND-2023 QuestionMd HasanNo ratings yet

- CHB Mar19 PDFDocument14 pagesCHB Mar19 PDFSajeetha MadhavanNo ratings yet

- JK Tyres - 20020141022 - 20020141004Document80 pagesJK Tyres - 20020141022 - 20020141004AKANSH ARORANo ratings yet

- Balance Sheet: Assets Value Liabilities ValueDocument32 pagesBalance Sheet: Assets Value Liabilities ValueomernoumanNo ratings yet

- Investors Guide To Ril: By: Miss - Pallavi Akole Roll No: 02Document19 pagesInvestors Guide To Ril: By: Miss - Pallavi Akole Roll No: 02miteshpathNo ratings yet

- CA IPCC Accounting Guideline Answers May 2015Document24 pagesCA IPCC Accounting Guideline Answers May 2015Prashant PandeyNo ratings yet

- FY2022 H1 Financial Highlights for Mitsubishi UFJ Financial GroupDocument19 pagesFY2022 H1 Financial Highlights for Mitsubishi UFJ Financial GroupAlain Ali PerezNo ratings yet

- JM Fy2019Document35 pagesJM Fy2019Krishna ParikhNo ratings yet

- Amtek Auto LTD: 3Q FY10 ResultsDocument5 pagesAmtek Auto LTD: 3Q FY10 Resultsgaurav.m09No ratings yet

- CP9 - Contract CostingDocument15 pagesCP9 - Contract CostingesaiinternalauditNo ratings yet

- Class 8Document48 pagesClass 8NkNo ratings yet

- Capital Leases Impact Financials Appear FootnotesDocument3 pagesCapital Leases Impact Financials Appear FootnotesLove RabbytNo ratings yet

- AP Module 01 - Accounting Changes and ErrorsDocument10 pagesAP Module 01 - Accounting Changes and ErrorsjasfNo ratings yet

- Chap 4 (Fix)Document11 pagesChap 4 (Fix)Misu NguyenNo ratings yet

- Finance Management - 2 Group Project AnalysisDocument17 pagesFinance Management - 2 Group Project AnalysisAnshuman Singh PariharNo ratings yet

- Individual/Group Assignments (Optional) Assignment 1Document3 pagesIndividual/Group Assignments (Optional) Assignment 1Robin GhotiaNo ratings yet

- Final Accounts Notes and Numericals 2023 To Be Solved in ClassDocument8 pagesFinal Accounts Notes and Numericals 2023 To Be Solved in ClassDishuNo ratings yet

- Applied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDocument7 pagesApplied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDesire PiRah GriffinsNo ratings yet

- Chapter 5 Answers to Problems and Financial AnalysisDocument11 pagesChapter 5 Answers to Problems and Financial AnalysisEvan AzizNo ratings yet

- Financial Study LunaDocument9 pagesFinancial Study LunaNia LunaNo ratings yet

- Assessment Task - Tutorial Questions Assignment Unit Code: HA3042 Unit Name: Taxation LawDocument6 pagesAssessment Task - Tutorial Questions Assignment Unit Code: HA3042 Unit Name: Taxation LawJaydeep KushwahaNo ratings yet

- Retirement Plan 8 Year CycleDocument4 pagesRetirement Plan 8 Year CyclesultanNo ratings yet

- Exercise 9.1 1Document10 pagesExercise 9.1 1NavinNo ratings yet

- Analyzing Long Term AssetsDocument18 pagesAnalyzing Long Term AssetsJähäñ ShërNo ratings yet

- Salient Features of Income Tax Act 2023Document79 pagesSalient Features of Income Tax Act 2023Md. Abdullah Al ImranNo ratings yet

- FINC 301 Assignment 2023 1 (1)Document8 pagesFINC 301 Assignment 2023 1 (1)kd5d26xw5rNo ratings yet

- 21IB334 Shivanshu Sharma MMDocument5 pages21IB334 Shivanshu Sharma MMSHIVANSHUNo ratings yet

- Macro BTS Deployment for Cargill IndonesiaDocument11 pagesMacro BTS Deployment for Cargill IndonesiaEvie KemanNo ratings yet

- Chapter 4: Adjusting The Accounts and Preparing The Financial StatementsDocument5 pagesChapter 4: Adjusting The Accounts and Preparing The Financial Statementschi_nguyen_100No ratings yet

- India Bulls Housing Finance LimitedDocument67 pagesIndia Bulls Housing Finance LimitedslohariNo ratings yet

- FSA Tutorial 1Document2 pagesFSA Tutorial 1KHOO TAT SHERN DEXTONNo ratings yet

- Cost Accounting Budgets Case BookDocument10 pagesCost Accounting Budgets Case Bookms23a036No ratings yet

- Chapter 3 - Measuring and Reporting Financial Performance: Discussion Questions - Easy 3.5 LO5Document4 pagesChapter 3 - Measuring and Reporting Financial Performance: Discussion Questions - Easy 3.5 LO5Yosua SaroinsongNo ratings yet

- Accounting Level 3/ Series 4 2008 (3001)Document19 pagesAccounting Level 3/ Series 4 2008 (3001)Hein Linn Kyaw100% (1)

- BHEL FY2009 Flash Result UpdateDocument5 pagesBHEL FY2009 Flash Result UpdateFirdaus JahanNo ratings yet

- Ch4 Spreadsheets Update 2 13Document19 pagesCh4 Spreadsheets Update 2 13Toàn ĐìnhNo ratings yet

- Arpia Lovely Quiz Chapter 8 Leases Part 2Document5 pagesArpia Lovely Quiz Chapter 8 Leases Part 2Lovely ArpiaNo ratings yet

- Lecture 1. Basic Costing CVPDocument14 pagesLecture 1. Basic Costing CVPTân NguyênNo ratings yet

- Adi Sarana Armada: Anteraja's Collaboration With Grab and GojekDocument7 pagesAdi Sarana Armada: Anteraja's Collaboration With Grab and Gojekbobby prayogoNo ratings yet

- AFO+ +Mock+TestDocument12 pagesAFO+ +Mock+TestArrow NagNo ratings yet

- Economics For BusinessDocument14 pagesEconomics For BusinessgodwinNo ratings yet

- Economic Aspects on Condensate to Gasoline Invesment ProjectDocument23 pagesEconomic Aspects on Condensate to Gasoline Invesment Projectsbjtcms98No ratings yet

- Unit 2 - Accountingformanager - AnanduDocument52 pagesUnit 2 - Accountingformanager - Ananducraziestidiot31No ratings yet

- Nyse Cas 2010Document94 pagesNyse Cas 2010gaja babaNo ratings yet

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- Fictitious Philippines Inc General Ledger July 2019Document4 pagesFictitious Philippines Inc General Ledger July 2019Adrian ContilloNo ratings yet

- Solution - Audit of InvestmentDocument4 pagesSolution - Audit of InvestmentMJ YaconNo ratings yet

- Individual Assignment 2B - Aisyah Nuralam 29123362Document5 pagesIndividual Assignment 2B - Aisyah Nuralam 29123362Aisyah NuralamNo ratings yet

- Engineering Management Case StudiesDocument13 pagesEngineering Management Case StudiesJohn Ryan ToledoNo ratings yet

- Lease Modules ContinuedDocument8 pagesLease Modules ContinuedMariz RapadaNo ratings yet

- Lease Modules ContinuedDocument8 pagesLease Modules ContinuedKenneth Marcial Ege0% (1)

- A2 - Longterm, Installment, FranchiseDocument1 pageA2 - Longterm, Installment, FranchiseAirille CarlosNo ratings yet

- GRR Study MSA TemplateDocument20 pagesGRR Study MSA Templateyusuf_jtNo ratings yet

- 5S Audit SheetDocument3 pages5S Audit SheetRamiro G. J. ChavarriaNo ratings yet

- Column Base Design:: Input DataDocument4 pagesColumn Base Design:: Input Datayusuf_jtNo ratings yet

- SWOT Analysis TemplateDocument2 pagesSWOT Analysis Templateyusuf_jtNo ratings yet

- Earthquake Analysis Results Per ASCE 7-2005: Input ValuesDocument1 pageEarthquake Analysis Results Per ASCE 7-2005: Input ValueswhngomjNo ratings yet

- Application Form Institutional Member IMDocument3 pagesApplication Form Institutional Member IMyusuf_jtNo ratings yet

- Two Pile GroupDocument12 pagesTwo Pile GroupJammy KingNo ratings yet

- Brochure Vibration Isolation For Staircases and Landings ENDocument4 pagesBrochure Vibration Isolation For Staircases and Landings ENyusuf_jtNo ratings yet

- Column Base Design:: Input DataDocument4 pagesColumn Base Design:: Input Datayusuf_jtNo ratings yet

- Staircase Details APPROVEDDocument1 pageStaircase Details APPROVEDyusuf_jtNo ratings yet

- BUS PARKlDocument1 pageBUS PARKlyusuf_jtNo ratings yet

- BS 140-2 Wall Ties Design PDFDocument23 pagesBS 140-2 Wall Ties Design PDF23-12-1974No ratings yet

- 100 Keto Swaps - Keto MasterclassDocument7 pages100 Keto Swaps - Keto Masterclassyusuf_jtNo ratings yet

- File Cap 1Document1 pageFile Cap 1yusuf_jtNo ratings yet

- Pile Cap Design SolutionDocument42 pagesPile Cap Design Solutionkhantha velNo ratings yet

- Online Civil: Start Download - View PDFDocument4 pagesOnline Civil: Start Download - View PDFJaga Ch50% (2)

- Pile Cap Design SolutionDocument42 pagesPile Cap Design Solutionkhantha velNo ratings yet

- Earthquake Analysis Results Per ASCE 7-2005: Input ValuesDocument1 pageEarthquake Analysis Results Per ASCE 7-2005: Input ValueswhngomjNo ratings yet

- 101 Keto RecipesDocument148 pages101 Keto Recipesnakarsha67% (3)

- 20 Keto Minutes in 30 Minutes or Less: by Claudia J. CaldwellDocument23 pages20 Keto Minutes in 30 Minutes or Less: by Claudia J. CaldwellCristina MateiNo ratings yet

- Artificial GrassDocument4 pagesArtificial Grassyusuf_jtNo ratings yet

- Steel cable tray design and load calculationsDocument6 pagesSteel cable tray design and load calculationsyusuf_jtNo ratings yet

- Sipmlified RCC Column DesignDocument67 pagesSipmlified RCC Column Designyusuf_jtNo ratings yet

- Isoloated Footing DesignDocument7 pagesIsoloated Footing Designvijay moreNo ratings yet

- National Education Policy 2020 IndiaDocument66 pagesNational Education Policy 2020 IndiaDisability Rights Alliance100% (1)

- 64 AnwarUl-HamidCESTSSAtmCorr17Feb2017Document7 pages64 AnwarUl-HamidCESTSSAtmCorr17Feb2017yusuf_jtNo ratings yet

- Piles DesignDocument15 pagesPiles Designvenkatesh19701No ratings yet

- Architectural Design and Management: R.G. GuptaDocument10 pagesArchitectural Design and Management: R.G. GuptaManikanta SharmaNo ratings yet

- Checked Plate Cale Tray 16Document1 pageChecked Plate Cale Tray 16yusuf_jtNo ratings yet

- Astha Enterprises New CatalogueDocument4 pagesAstha Enterprises New Catalogueyusuf_jtNo ratings yet

- Mercedes Vs BMWDocument12 pagesMercedes Vs BMWRitu0% (1)

- M2 Jornal, Subsidiary, Leadger PracticalDocument7 pagesM2 Jornal, Subsidiary, Leadger Practicalsimran.patilNo ratings yet

- India Tire Industry Analysis: Dominated by Local Players, Growing Automobile Sector Drives DemandDocument6 pagesIndia Tire Industry Analysis: Dominated by Local Players, Growing Automobile Sector Drives DemandKavish BarapatreNo ratings yet

- Quant Checklist 360 by Aashish Arora For Bank Exams 2023Document95 pagesQuant Checklist 360 by Aashish Arora For Bank Exams 2023crazy SNo ratings yet

- Africas Power Infrastructure 2011Document352 pagesAfricas Power Infrastructure 2011Giho KimNo ratings yet

- AC557 W5 HW Questions/AnswersDocument5 pagesAC557 W5 HW Questions/AnswersDominickdad100% (3)

- QM Revision TestsDocument2 pagesQM Revision TestsDawood Shahid100% (1)

- Weekly Options Digital Guide PDFDocument48 pagesWeekly Options Digital Guide PDFGaro Ohanoglu100% (4)

- Business Valuation MethodsDocument10 pagesBusiness Valuation Methodsraj28_999No ratings yet

- Singapor Autopass - Card - System - Brochure PDFDocument44 pagesSingapor Autopass - Card - System - Brochure PDFJason TanNo ratings yet

- 130 Common Mistakes in EnglishDocument32 pages130 Common Mistakes in EnglishMahmood HassanNo ratings yet

- Business Studiess Booklet - UNIT 1 - 2Document9 pagesBusiness Studiess Booklet - UNIT 1 - 2Giuliano SambinaNo ratings yet

- Micro CA Exercise Chap 3Document4 pagesMicro CA Exercise Chap 3Trâm ÁiNo ratings yet

- Hul PPT FinalDocument11 pagesHul PPT Finaldhiraj_sonawane_1No ratings yet

- Credit CardsDocument3 pagesCredit Cardsapi-371057922No ratings yet

- Luchetti FullDocument35 pagesLuchetti FullRohith GirishNo ratings yet

- Chapter 1 - Overview: Specific Type of Opportunity CostDocument17 pagesChapter 1 - Overview: Specific Type of Opportunity CostFTU.CS2 Nghiêm Mai Yến NhiNo ratings yet

- Elwy Melina-Sarah MHCDocument7 pagesElwy Melina-Sarah MHCpalak32No ratings yet

- Informe OCDE 2004Document46 pagesInforme OCDE 2004CarlosPerez-galvezGetaNo ratings yet

- Component AccountingDocument2 pagesComponent AccountingtouseefNo ratings yet

- Ricardian Model ExplainedDocument37 pagesRicardian Model ExplainedLiễu Uyên VũNo ratings yet

- Break Even Analysis Guide for ProfitabilityDocument4 pagesBreak Even Analysis Guide for ProfitabilitymichaelurielNo ratings yet

- Rock Hopper - Sea Lion - ValuationDocument1 pageRock Hopper - Sea Lion - ValuationSynNo ratings yet

- HTH 587 - Individual ProjectDocument10 pagesHTH 587 - Individual Projectwan aisya100% (3)

- James Alm 2Document41 pagesJames Alm 2Jsjs JsjsjjshshNo ratings yet

- VARIABLE MOCK EXAM Questionnaire and Answer Key 08172021.doc 1Document11 pagesVARIABLE MOCK EXAM Questionnaire and Answer Key 08172021.doc 1TANTAN TV100% (1)

- Lecture Chapter 10 Determination of Vat Still DueDocument24 pagesLecture Chapter 10 Determination of Vat Still DueChristian PelimcoNo ratings yet

- E Auction For Tea - The Indian ExperienceDocument40 pagesE Auction For Tea - The Indian ExperienceAnil Kumar Singh67% (3)

- Chap 3 Problem SolutionsDocument31 pagesChap 3 Problem SolutionsAhmed FahmyNo ratings yet