Professional Documents

Culture Documents

M

Uploaded by

Remedios Capistrano CatacutanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M

Uploaded by

Remedios Capistrano CatacutanCopyright:

Available Formats

Jerald Jay C. Catacutan.

Strategic Cost Management

BSA-2B. Chapter 9: Review Questions

1. What is meant by the term decentralisation.

Decentralisation refers to tire systematic effort to delegate to the lowest levels all authority except that

which can only be exercised at central points.”Decentralisation is referred to as a form of an

organisational structure where there is the delegation of authority by the top management to the

middle and lower levels of management in an organisation. In this type of organisation structure, the

duty of daily operations and minor decision-making capabilities are transferred to the middle and lower

levels which allow top-level management to focus more on major decisions like business expansion,

diversification etc. Delegation refers to the assigning a portion of work and the associated responsibility

by a superior to a subordinate. In simple words, when delegation is expanded on an organisational level,

it is called decentralisation.

2. What benefits are felt to result from decentralization in an organization.

Advantages of decentralized organizations include increased expertise at each division, quicker

decisions, better use of time at top management levels, and increased motivation of division managers.

3. Identify three business practices that hinder proper cost assignment to segments of a company.

These three practices are (i) omission of some costs in the assignment process, (ii) the use of improper

methods for allocating costs among segments, and (iii) assignment of costs to segments that are really

common costs of the entire organization.

4. Explain how the segment margin differs from the contribution margin Which concept is most useful to

the manager? Why?

The contribution margin represents the portion of sales revenue remainingafter deducting variable

expenses. The segment margin represents themargin still remaining after deducting traceable fixed

expenses from thecontribution margin. Generally speaking, the contribution margin is mostuseful as a

planning tool in the short run, when fixed costs don’t change. Thesegment margin is most useful as a

planning tool in the long run, when fixedcosts will be changing, and as a tool for evaluating long-run

segmentperformance. One concept is no more useful to management than the other;the two concepts

simply relate to different planning horizon.

5. What is a segment of an organization? Give several examples of segments.

A segment is any part or activity of an organization about which a managerseeks cost, revenue, or profit

data. Examples of segments includedepartments, operations, sales territories, divisions, product lines,

and soforth.

6.What costs are assigned to a segment under the contribution approach?

Under the contribution approach, costs are assigned to a segment if and onlyif the costs are traceable to

the segment (i.e., could be avoided if thesegment were eliminated). Common costs are not allocated to

segmentsunder the contribution approach.

7.Distinguish between traceable cost and a common cost. Give several examples of each.

A traceable cost of a segment is a cost that arises specifically because of theexistence of that segment. If

the segment were eliminated, the cost woulddisappear. A common cost, by contrast, is a cost that

supports more than onesegment, but is not traceable in whole or in part to any one of the segments.If

the departments of a company are treated as segments, then examples ofthe traceable costs of a

department would include the salary of thedepartment’s supervisor, depreciation of machines used

exclusively by thedepartment, and the costs of supplies used by the department. Examples ofcommon

costs would include the salary of the general counsel of the entirecompany, the lease cost of the

headquarters building, corporate imageadvertising, and periodic depreciation of machines shared by

severaldepartments.

You might also like

- Chapter 5 SolutionsDocument22 pagesChapter 5 SolutionsLisa Cumbee0% (1)

- Valuation HandbookDocument2 pagesValuation HandbookPedro DiasNo ratings yet

- Project Report On Comparative Analysis of Public and Private Sector Steel Companies in IndiaDocument48 pagesProject Report On Comparative Analysis of Public and Private Sector Steel Companies in IndiaHillary RobinsonNo ratings yet

- Learning Resource 9: Lessor Accounting: Lesson 1: Operating LeaseDocument6 pagesLearning Resource 9: Lessor Accounting: Lesson 1: Operating LeaseRemedios Capistrano Catacutan0% (1)

- HINDUSTAN UNILEVER Limited Final ProjectDocument78 pagesHINDUSTAN UNILEVER Limited Final ProjectNeeta MohanNo ratings yet

- MGT 410 HW1Document3 pagesMGT 410 HW1Mindaou_Gu_3146No ratings yet

- QANT520 Problems 0706 CH 6Document6 pagesQANT520 Problems 0706 CH 6Rahil VermaNo ratings yet

- Cruise Line IndustryDocument6 pagesCruise Line IndustryMedhat Abd ElwhabNo ratings yet

- Strategic Cost Management AssignmentDocument3 pagesStrategic Cost Management AssignmentDimaano CharleneNo ratings yet

- Segment ReportingDocument20 pagesSegment ReportingNick254No ratings yet

- Cost and Management Accounting II Chapter 7Document10 pagesCost and Management Accounting II Chapter 7Ali WakoNo ratings yet

- Performance Evaluation in A Divisionalised OrganisationDocument12 pagesPerformance Evaluation in A Divisionalised Organisationmoza salimNo ratings yet

- SCM Chap-9 Group-4 PDFDocument5 pagesSCM Chap-9 Group-4 PDFHannah CapidosNo ratings yet

- Acc423 Performance Evaluation in A Divisionalized OrganisationDocument13 pagesAcc423 Performance Evaluation in A Divisionalized OrganisationChristopher NakpodiaNo ratings yet

- Ch18.Outline ShareDocument9 pagesCh18.Outline ShareCahyo PriyatnoNo ratings yet

- Waweru Organizational DesignDocument6 pagesWaweru Organizational DesignfensiNo ratings yet

- Chapter Seven Decentralisation, Transfer Pricing and Responsibility Centers DecentralizationDocument9 pagesChapter Seven Decentralisation, Transfer Pricing and Responsibility Centers DecentralizationEid AwilNo ratings yet

- Chapter 12Document2 pagesChapter 12Faye GoodwinNo ratings yet

- 09 Handout 1Document7 pages09 Handout 1Katelyn SungcangNo ratings yet

- Adv Cost Assgn-2Document6 pagesAdv Cost Assgn-2Fiseha TadesseNo ratings yet

- CH 10 ImaimDocument24 pagesCH 10 Imaimkevin echiverriNo ratings yet

- Unit 3 - Strategic Performance Measurement111Document130 pagesUnit 3 - Strategic Performance Measurement111Art IslandNo ratings yet

- Rangkuman OB Chapter 15 by MSS FEUIDocument7 pagesRangkuman OB Chapter 15 by MSS FEUICahyaning SatykaNo ratings yet

- Final Report On Cost Center. 6thDocument19 pagesFinal Report On Cost Center. 6thMilind GhateNo ratings yet

- RMK 9 - Groups 3 - Divisional Financial Performance MeasuresDocument9 pagesRMK 9 - Groups 3 - Divisional Financial Performance MeasuresdinaNo ratings yet

- Responsibility AccountingDocument16 pagesResponsibility AccountingSruti Pujari100% (3)

- RMK 3 Divisional Financial Performance MeasuresDocument7 pagesRMK 3 Divisional Financial Performance MeasuresdinaNo ratings yet

- OTB - Lecture Notes 5 - Organizational Structure - NewDocument9 pagesOTB - Lecture Notes 5 - Organizational Structure - Newadan awaleNo ratings yet

- Modul Akuntansi Manajemen (TM9)Document11 pagesModul Akuntansi Manajemen (TM9)Aurelique NatalieNo ratings yet

- Cpar MAS: Decentralization and Performance EvaluationDocument15 pagesCpar MAS: Decentralization and Performance EvaluationAlliah Gianne Jacela100% (1)

- Module IvDocument5 pagesModule IvJoselito DepalubosNo ratings yet

- 123 ReportingDocument45 pages123 Reportingtryingacc2No ratings yet

- Responsibility AccountingDocument2 pagesResponsibility AccountingJane OmbrosaNo ratings yet

- Chapter 20 - AnswerDocument4 pagesChapter 20 - AnsweragnesNo ratings yet

- Decentralization and Segment ReportingDocument3 pagesDecentralization and Segment ReportingYousuf SoortyNo ratings yet

- Responsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesDocument3 pagesResponsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesAriel DicoreñaNo ratings yet

- Cost Center & Segement Performance MeasurementDocument7 pagesCost Center & Segement Performance Measurementabid746No ratings yet

- Strategy 1Document9 pagesStrategy 1Amar YesunNo ratings yet

- Designing Organization StructureDocument10 pagesDesigning Organization StructureKeerthy Thazhathuveedu T RNo ratings yet

- Divisional Performance ManagementDocument8 pagesDivisional Performance ManagementADEYANJU AKEEMNo ratings yet

- ManAccP2 - Responsibility AccountingDocument5 pagesManAccP2 - Responsibility AccountingGeraldette BarutNo ratings yet

- DepartmentationDocument5 pagesDepartmentationShabbirAhmad0% (1)

- Money MattersDocument6 pagesMoney MattersiquabertNo ratings yet

- Organization DevelopmentDocument19 pagesOrganization DevelopmentMasood BhattiNo ratings yet

- Chapter 7 Performance Measurement and Evaluation PDFDocument83 pagesChapter 7 Performance Measurement and Evaluation PDFSmriti MohtaNo ratings yet

- 9.0 Responsibility Accounting 2018Document14 pages9.0 Responsibility Accounting 2018Emily SongNo ratings yet

- Responsibility AccountingDocument25 pagesResponsibility AccountingAndrew MirandaNo ratings yet

- Strategic Operations ManagementDocument3 pagesStrategic Operations ManagementAl Joshua Ü PidlaoanNo ratings yet

- Segment ReportingDocument12 pagesSegment ReportingChloe Miller100% (1)

- Responsibility Centers: Revenue and Expense CentersDocument21 pagesResponsibility Centers: Revenue and Expense CentersMohammad Sabbir Hossen SamimNo ratings yet

- Types of Responsibility Center and BREAK EVENDocument12 pagesTypes of Responsibility Center and BREAK EVENRATHER ASIFNo ratings yet

- ORGANISINGDocument71 pagesORGANISINGPriyanshu SrivastavaNo ratings yet

- Lec 05Document9 pagesLec 05Drama LlamaNo ratings yet

- Per MeasurmentDocument90 pagesPer Measurmentthotasravani 1997No ratings yet

- Strategic NotesDocument11 pagesStrategic NotesjannatNo ratings yet

- Organizational StructureDocument2 pagesOrganizational StructureSinthya Chakma RaisaNo ratings yet

- OM Chapter 6 OrganizingDocument63 pagesOM Chapter 6 OrganizingKie LlanetaNo ratings yet

- Responsiblity AccountingDocument30 pagesResponsiblity AccountingMarl Vinzi Tacastacas EducNo ratings yet

- From Top DownDocument13 pagesFrom Top DownZainab AamirNo ratings yet

- Management 111204015409 Phpapp01Document12 pagesManagement 111204015409 Phpapp01syidaluvanimeNo ratings yet

- Chapter 7cost IIDocument6 pagesChapter 7cost IITammy 27No ratings yet

- Conflicts Between Divisional HeadsDocument5 pagesConflicts Between Divisional HeadscarladelrosarioNo ratings yet

- HBO - Organizational StructureDocument35 pagesHBO - Organizational StructureDewdrop Mae RafananNo ratings yet

- Part One: Economic Foundations of Strategy: Supplier Power Entry Substitutes Buyer PowerDocument10 pagesPart One: Economic Foundations of Strategy: Supplier Power Entry Substitutes Buyer PowerRutger WentzelNo ratings yet

- Performance MeasurementDocument6 pagesPerformance Measurementcherrymia canomayNo ratings yet

- John LouieDocument2 pagesJohn LouieJohn Louie LagunaNo ratings yet

- Lesson 9 - Strategic Cost ManagementDocument6 pagesLesson 9 - Strategic Cost ManagementellishNo ratings yet

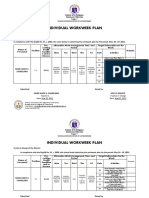

- Individual Workweek Plan: Schools Division Office of CatanduanesDocument4 pagesIndividual Workweek Plan: Schools Division Office of CatanduanesRemedios Capistrano CatacutanNo ratings yet

- LM HHDocument3 pagesLM HHRemedios Capistrano CatacutanNo ratings yet

- Self-Assessment Questions 4-1: 1. Discuss The Stages in The Program Development Process (10 PTS)Document1 pageSelf-Assessment Questions 4-1: 1. Discuss The Stages in The Program Development Process (10 PTS)Remedios Capistrano CatacutanNo ratings yet

- KDocument2 pagesKRemedios Capistrano CatacutanNo ratings yet

- Self-Assessment Questions 3-1: Jerald Jay C. CatacutanDocument4 pagesSelf-Assessment Questions 3-1: Jerald Jay C. CatacutanRemedios Capistrano CatacutanNo ratings yet

- Activity 2.2. Journals and LedgersDocument2 pagesActivity 2.2. Journals and LedgersRemedios Capistrano CatacutanNo ratings yet

- Self-Assessment Questions 1-1: 1. Briefly Discuss The History of Computer Programming. (10 PTS.)Document3 pagesSelf-Assessment Questions 1-1: 1. Briefly Discuss The History of Computer Programming. (10 PTS.)Remedios Capistrano CatacutanNo ratings yet

- Self-Assessment Questions 1-1: 1. Briefly Discuss The History of Computer Programming. (10 PTS.)Document4 pagesSelf-Assessment Questions 1-1: 1. Briefly Discuss The History of Computer Programming. (10 PTS.)Remedios Capistrano CatacutanNo ratings yet

- Learning Resource 12. Lesson 1Document8 pagesLearning Resource 12. Lesson 1Remedios Capistrano CatacutanNo ratings yet

- Learning Resource 11 Jerald Jay CatacutanDocument8 pagesLearning Resource 11 Jerald Jay CatacutanRemedios Capistrano CatacutanNo ratings yet

- Learning ResourceDocument5 pagesLearning ResourceRemedios Capistrano CatacutanNo ratings yet

- Learning Resource 12: Accounting For Employee BenefitsDocument6 pagesLearning Resource 12: Accounting For Employee BenefitsRemedios Capistrano CatacutanNo ratings yet

- CH 16Document29 pagesCH 16JadeNo ratings yet

- MBA-2 Sem-III: Management of Financial ServicesDocument17 pagesMBA-2 Sem-III: Management of Financial ServicesDivyang VyasNo ratings yet

- Investment 101 Beginners Guide To Investing For Pinoy 1Document29 pagesInvestment 101 Beginners Guide To Investing For Pinoy 1MARY JOY B. CALINAONo ratings yet

- Acceptable Source of Funds For BorrowerDocument27 pagesAcceptable Source of Funds For Borrowerapi-196037134No ratings yet

- Universal Credit ReportDocument21 pagesUniversal Credit ReportGail Ward80% (5)

- Glaxo Smith Kline (GSK) PLC PESTEL and Environment AnalysisDocument16 pagesGlaxo Smith Kline (GSK) PLC PESTEL and Environment Analysisvipul tutejaNo ratings yet

- Cotract Costing Project TopicDocument17 pagesCotract Costing Project TopicShravani Shrav100% (1)

- Strategy, Balanced Scorecard and Strategic Profitability AnalysisDocument33 pagesStrategy, Balanced Scorecard and Strategic Profitability AnalysisemmyindraNo ratings yet

- Purchasing Power Parity & The Big Mac IndexDocument9 pagesPurchasing Power Parity & The Big Mac Indexpriyankshah_bkNo ratings yet

- B8af108 Audit Solutions Summer 2018Document21 pagesB8af108 Audit Solutions Summer 2018Eizam Ben JetteyNo ratings yet

- Case StudyDocument6 pagesCase Studydavidkecelyn06No ratings yet

- Summer Intership ReportDocument42 pagesSummer Intership Reportnikitha n reddyNo ratings yet

- Bidding On The Yell Group - TemplateDocument7 pagesBidding On The Yell Group - TemplateVaibhav SinghNo ratings yet

- BSRM Report Final VersionDocument24 pagesBSRM Report Final VersionGakiya SultanaNo ratings yet

- Project Cost ManagementDocument75 pagesProject Cost ManagementChaitanya Reddy G100% (3)

- Operation Flood White RevolutionDocument22 pagesOperation Flood White Revolutionaliballi50% (2)

- Mba Wto NotesDocument7 pagesMba Wto NotesAbhishek SinghNo ratings yet

- 4 Branch AccountsDocument18 pages4 Branch AccountsBAZINGA100% (1)

- Loan Application Form: XXXXXXX X XXXXXXXXDocument10 pagesLoan Application Form: XXXXXXX X XXXXXXXXgopikiran6No ratings yet

- J-CAPS-03 (MAT+SSC) Class X (12th To 18th June 2020) by AAKASH InstituteDocument4 pagesJ-CAPS-03 (MAT+SSC) Class X (12th To 18th June 2020) by AAKASH InstitutemuscularindianNo ratings yet

- International Journals Call For Paper HTTP://WWW - Iiste.org/journalsDocument12 pagesInternational Journals Call For Paper HTTP://WWW - Iiste.org/journalsAlexander DeckerNo ratings yet

- c12.2023 - Rubber & Op Wage RateDocument3 pagesc12.2023 - Rubber & Op Wage RateiraNo ratings yet

- IELTS Actual Test 05 - 12 - 2020Document2 pagesIELTS Actual Test 05 - 12 - 2020billbill92No ratings yet