Professional Documents

Culture Documents

A) Income From Salary (U/s 21) : Computation of Income Tax

Uploaded by

Sarwar GolamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A) Income From Salary (U/s 21) : Computation of Income Tax

Uploaded by

Sarwar GolamCopyright:

Available Formats

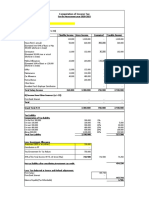

Computation of Income Tax

For the Assessment year 2020-2021

Name: GOLAM SARWAR

TIN:

A) Income from Salary (u/s 21)

Particulars Monthly Income Gross Income Exempted Taxable Amount

Basic (annual) 110,000 1,320,000 - 1,320,000

House Rent ( annual) 55,000 660,000 300,000 360,000

(Exempted rent 50% of Basic or Max

300,000 whichever is lower)

Conveyance 11,000 132,000 30,000 102,000

(Exempted 30,000 max or actual

whichever is lower)

Medical Allowances 22,000 264,000 120,000 144,000

(Exempted 10% of Basic or 120,000

whichever is lower)

Utility 11,000 132,000 - 132,000

-

Maintenance 11,000 132,000 - 132,000

Car Allowance 40,000 480,000 - 480,000

Festival Bonus 260,000 - 260,000

Other Bonus - -

Provident Fund -Employer Contribution - -

Total Salary Income 260,000 3,380,000 450,000 2,930,000

B) Income from Other Sources: (u/s 33)

From Bank Interest - - -

Total - - -

Grand Total A+B 3,380,000 450,000 2,930,000

Tax Liability

Computation of Tax liability

On the First 300,000 300,000 0% -

On next 100,000 100,000 5% 5,000

On next 300,000 300,000 10% 30,000

On next 400,000 400,000 15% 60,000

On next 500,000 500,000 20% 100,000

Above 500,000 1,330,000 25% 332,500

Total Tax Liability 2,930,000 527,500

Less, Investment Allowance

Investment (BSP or any others) 750,000

Contribution to PF -

Total Investment for Tax Rebate 750,000

25% of the Total Income OR Tk.1.5 Crore (Max) 732,500 732,500 73,250

Net tax liability after considering investment tax credit 454,250

Less: Tax deducted at Source and Refund adjustment:

From Salary 447,744

From Bank Interest -

447,744

Balance Payable/(Tax Refundable) 6,506

You might also like

- Cascading SelectDocument3 pagesCascading SelectSarwar GolamNo ratings yet

- Club Member Interview ErrorDocument75 pagesClub Member Interview ErrorSarwar GolamNo ratings yet

- Club Member Interview ErrorDocument75 pagesClub Member Interview ErrorSarwar GolamNo ratings yet

- Club Member Interview - ErrorDocument115 pagesClub Member Interview - ErrorSarwar GolamNo ratings yet

- Club Member Interview ErrorDocument75 pagesClub Member Interview ErrorSarwar GolamNo ratings yet

- Club Member Interview ErrorDocument75 pagesClub Member Interview ErrorSarwar GolamNo ratings yet

- InstallationDocument1 pageInstallationSarwar GolamNo ratings yet

- Data Protection Reform & The General Data Protection RegulationDocument60 pagesData Protection Reform & The General Data Protection RegulationSarwar GolamNo ratings yet

- Buy/Sale Order Book Is Not Signed.: Sector Exposure in %Document1 pageBuy/Sale Order Book Is Not Signed.: Sector Exposure in %Sarwar GolamNo ratings yet

- Geo Historical Map of BangladeshDocument1 pageGeo Historical Map of BangladeshSarwar GolamNo ratings yet

- Claim Form: Name of The Organization BRAC, BangladeshDocument1 pageClaim Form: Name of The Organization BRAC, BangladeshSarwar GolamNo ratings yet

- Agile Product Backlog: Task Name Story Sprint Ready Priority Status Story Points Assigned To SprintDocument2 pagesAgile Product Backlog: Task Name Story Sprint Ready Priority Status Story Points Assigned To SprintSarwar GolamNo ratings yet

- Presentation 112Document2 pagesPresentation 112Sarwar GolamNo ratings yet

- CollegeDocument256 pagesCollegeলিওনার্ড কোহেনNo ratings yet

- A) Income From Salary (U/s 21) : Computation of Income TaxDocument1 pageA) Income From Salary (U/s 21) : Computation of Income TaxSarwar GolamNo ratings yet

- Comprehension 1Document1 pageComprehension 1Sarwar GolamNo ratings yet

- Project Name: Change Request Cost (CAPEX) Multi Country CR (Man - Days)Document12 pagesProject Name: Change Request Cost (CAPEX) Multi Country CR (Man - Days)Sarwar GolamNo ratings yet

- Sentrifugo 3.0 Import GuideDocument12 pagesSentrifugo 3.0 Import GuideStaceanniNo ratings yet

- Head of ProgramDocument4 pagesHead of ProgramSarwar GolamNo ratings yet

- 16nov DWHv2Document4 pages16nov DWHv2Sarwar GolamNo ratings yet

- Raci Sysdes MTRXDocument4 pagesRaci Sysdes MTRXSarwar GolamNo ratings yet

- Meeting Minutes: Action Points: SL No Description of The Agenda Information Decision Share Answer Responsible Due DateDocument3 pagesMeeting Minutes: Action Points: SL No Description of The Agenda Information Decision Share Answer Responsible Due DateSarwar GolamNo ratings yet

- A) Income From Salary (U/s 21) : Computation of Income TaxDocument1 pageA) Income From Salary (U/s 21) : Computation of Income TaxSarwar GolamNo ratings yet

- 1531 01400341200 16089641 7FC45XXHW4Document1 page1531 01400341200 16089641 7FC45XXHW4Sarwar GolamNo ratings yet

- Project Charter TemplateDocument1 pageProject Charter TemplateSarwar GolamNo ratings yet

- Sprint Story Estimate 1 Apr-11: Release June 1Document5 pagesSprint Story Estimate 1 Apr-11: Release June 1Sarwar GolamNo ratings yet

- Lankabangla Securities LTD.: Trade Confirmation Note (Summary)Document1 pageLankabangla Securities LTD.: Trade Confirmation Note (Summary)Sarwar GolamNo ratings yet

- Lankabangla Securities LTD.: Trade Confirmation Note (Summary)Document1 pageLankabangla Securities LTD.: Trade Confirmation Note (Summary)Sarwar GolamNo ratings yet

- Buy/Sale Order Book Is Not Signed.: Sector Exposure in %Document1 pageBuy/Sale Order Book Is Not Signed.: Sector Exposure in %Sarwar GolamNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 1.1.1 Political StabilityDocument3 pages1.1.1 Political StabilityCuong VUongNo ratings yet

- The Economic Impacts of International Migration: A Case Study On The PhilippinesDocument5 pagesThe Economic Impacts of International Migration: A Case Study On The PhilippinesElijah MendozaNo ratings yet

- Press Release - Citi Indonesia and Djarum Group's Subsidiaries Sign Credit Facility PartnershipDocument2 pagesPress Release - Citi Indonesia and Djarum Group's Subsidiaries Sign Credit Facility PartnershipNinuk SaskiawardaniNo ratings yet

- Autonomy of Reserve Bank of IndiaDocument3 pagesAutonomy of Reserve Bank of Indiacyril georgeNo ratings yet

- MNC Cash ManagementDocument25 pagesMNC Cash ManagementbitunmouNo ratings yet

- 2023 Oshkosh Business Outlook SurveyDocument3 pages2023 Oshkosh Business Outlook SurveyFOX 11 NewsNo ratings yet

- QMAG Presentation 2008Document19 pagesQMAG Presentation 2008tamtran_cnuNo ratings yet

- Case Study China To Float or Not To FloatDocument6 pagesCase Study China To Float or Not To FloatShaniah IturraldeNo ratings yet

- Industries in DehradunDocument6 pagesIndustries in DehradunSoumyadip SarkarNo ratings yet

- Calendar Forex FactoryDocument1 pageCalendar Forex FactoryRoli MaulidiansyahNo ratings yet

- Wah Seong Expands Renewable Energy Division, Aims To Build Biomass Power Plants Globally (Read)Document2 pagesWah Seong Expands Renewable Energy Division, Aims To Build Biomass Power Plants Globally (Read)lpamgt_674780425No ratings yet

- List of Banks With IFSC and Short Name PDFDocument1 pageList of Banks With IFSC and Short Name PDFRaj YadavNo ratings yet

- CH 13 Salvatore PppsDocument20 pagesCH 13 Salvatore PppsKhuất Bạch DươngNo ratings yet

- MNC's Role in International TradeDocument14 pagesMNC's Role in International Tradechandan2030% (1)

- BRICSDocument10 pagesBRICSabdotamlakoutan40No ratings yet

- G7 and BricsDocument25 pagesG7 and BricsDr.Yogesh BhowteNo ratings yet

- History of Pakistan EconomyDocument6 pagesHistory of Pakistan Economyzubdasyeda8No ratings yet

- E-Trade Marketing Private Limited: Party DetailsDocument1 pageE-Trade Marketing Private Limited: Party DetailsSandeepNo ratings yet

- Group 5 The North South DivideDocument6 pagesGroup 5 The North South DivideRia IgnacioNo ratings yet

- Chapter 02 The Dynamic Environment of International TradeDocument15 pagesChapter 02 The Dynamic Environment of International TradeSaraNo ratings yet

- PWC Brexit Monitor TradeDocument11 pagesPWC Brexit Monitor TradeNICU ZAMFIRNo ratings yet

- 1967 - 202223 - REVISED - Revised 1 - Statement of IncomeDocument2 pages1967 - 202223 - REVISED - Revised 1 - Statement of IncomeSmita desaiNo ratings yet

- Global Divide - North & SouthDocument13 pagesGlobal Divide - North & SouthJohn Carlo Faderon93% (30)

- SBPDocument15 pagesSBPAisha javedNo ratings yet

- Economics Problems in PakistanDocument8 pagesEconomics Problems in Pakistanabhishek choudharyNo ratings yet

- Business Tutorial 3 (For August) Chapter (8-12)Document3 pagesBusiness Tutorial 3 (For August) Chapter (8-12)Scrypted XDNo ratings yet

- India's BOP and Foreign ExchangeDocument7 pagesIndia's BOP and Foreign ExchangeSuria UnnikrishnanNo ratings yet

- Chapter 04: Exchange Rate Determination: Page 1Document20 pagesChapter 04: Exchange Rate Determination: Page 1Lê ChíNo ratings yet

- Invoice of Sample RR Inc. 4600 14.05.2016Document1 pageInvoice of Sample RR Inc. 4600 14.05.2016Samiul BariNo ratings yet

- NPF - Superpower Showdown - Lovely 2020Document24 pagesNPF - Superpower Showdown - Lovely 2020National Press FoundationNo ratings yet