Professional Documents

Culture Documents

Assignment Question: Important: The File Should Be Opened in Excel

Uploaded by

Nikesh SapkotaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Question: Important: The File Should Be Opened in Excel

Uploaded by

Nikesh SapkotaCopyright:

Available Formats

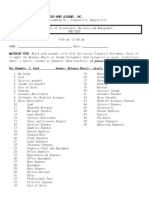

Student # 12000746 Step 1: Select your student number from the drop down list

Krishna LAMA Step 2: Check your Name to ensure you have selected your student number correctly

Step 3: Find your following assignment question and follow the directions .

Important: The file should be opened Step 4: Prepare your assignment in Microsoft Word.

in Excel Step 5: Upload your assignment in Moodle before the due date.

The assignment must be typed, use Arial font, 12, to avoid plagiarism, make sure you do proper referencing, a WORD format file soft copy to be submitted in Moodle before the due date. Please ensure you provide your

ID numbers and full name at the first page. Late assignments will be penalised, 5%of total available marks deduction per day.

Assignment Question

Melissa Ltd purchased all the issued shares of Soren Ltd for $1078000 on 1 July 2020 when the equity of Soren Ltd was as follows;

Share capital 431200

General reserve 323400

Asset revaluation

surpluss 161700 916300

At this date, Soren Ltd had not recorded any goodwill, and all identifiable assets and liabilities were recorded at fair value except for the followings;

Account Cost Carrying Amount Fair value Further life(Years)

Inventories $32,300 $35,500

Land $81,000 $89,000

Machinery $125,000 $100,000 $120,000 8

Soren Ltd identified at acquisition date a lawsuit

Contingent Liability where Soren Ltd was sued by a former supplier with

the Fairvalue of: $13,000

Unrecorded Asset Soren Ltd had unrecorded and internally generated

Patent with the FairValue of: $32,000

Soren Ltd had unrecorded and internally generated

Unrecorded Asset in-process research and development with the

FairValue of: $24,000

40% of inventory were sold by 30 June 2021. Further life of the assets are listed on the above table. Tax rate:30%.

Required

1.Prepare the acquisition analysis at acquisition date.

2.Prepare adjusting journal entries for the consolidation worksheet at acquisition date.

3.Prepare adjusting journal entries for the consolidation worksheet on 30 June 2021.

If Melissa Ltd purchased just 96% of the issued shares of Soren Ltd , partial goodwill method is under use and the NCI at acquisition date is measured based on the proportionate share of the

identifiable assets and liabilities in Soren Ltd.

Required

4. Prepare the acquisition analysis at acquisition date.

5. Prepare the business combination valuation entries and pre-acquisition entry at acquisition date.

6. Prepare the journal entry to recognise NCI at acquisition date.

7. Prepare the consolidation worksheet entries at 30 June 2021. Assume a profit for Soren Ltd for the year ended 30 June 2021 of $1096200 and no other changes in Soren

Ltd’s equity since the acquisition date.

8. Explain in details;

a)Why is it necessary to make consolidated worksheet adjustments?

b)How often is it necessary to make consolidated worksheet adjustments?

c)Where should consolidated worksheet adjustment journals be posted?

9. List and explain the accounting standards issues relevant to the consolidation process both for full control and NCI.

You might also like

- Assessment 2 4025Document24 pagesAssessment 2 4025Nikesh Sapkota50% (2)

- Accounting 1 Review QuizDocument6 pagesAccounting 1 Review QuizAikalyn MangubatNo ratings yet

- F7 FR Jun21 Mock QuestionDocument19 pagesF7 FR Jun21 Mock QuestionAnuj ShethNo ratings yet

- Business Combi and Conso FSDocument56 pagesBusiness Combi and Conso FSlachimolaluv chim50% (12)

- 3.1 Multiple Choice Questions: Chapter 3 An Introduction To Consolidated Financial StatementsDocument32 pages3.1 Multiple Choice Questions: Chapter 3 An Introduction To Consolidated Financial StatementsGaith1 AldaajahNo ratings yet

- 2 Lozano v. Martinez (Digest)Document2 pages2 Lozano v. Martinez (Digest)Emmanuel C. Dumayas100% (1)

- Bank and NBFCDocument21 pagesBank and NBFCManika AggarwalNo ratings yet

- Specification Requirements For Conveyor Pulleys and ShaftsDocument15 pagesSpecification Requirements For Conveyor Pulleys and Shaftsjonodo8967% (3)

- C B E M: WWW - Isap.edu - PH Adminoffice@isap - Edu.phDocument5 pagesC B E M: WWW - Isap.edu - PH Adminoffice@isap - Edu.phJohn Mark PalapuzNo ratings yet

- Advanced Accounting Testbank For Final 6eDocument35 pagesAdvanced Accounting Testbank For Final 6etoto100% (1)

- BSMM 8110 First Quiz Winter 2020 SolutionsDocument4 pagesBSMM 8110 First Quiz Winter 2020 SolutionsHibibiNo ratings yet

- ACC 291 Final Exam: ACC 291 Week 5 Final Exam Answers - Transweb E TutorsDocument9 pagesACC 291 Final Exam: ACC 291 Week 5 Final Exam Answers - Transweb E Tutorstranswebetutors3No ratings yet

- ACT1205 Audit of InvestmentDocument7 pagesACT1205 Audit of InvestmentAybe MarceloNo ratings yet

- LAB 2 - LatihanDocument9 pagesLAB 2 - LatihanAlvira FajriNo ratings yet

- Tutorial 2 Journalizing PostingDocument5 pagesTutorial 2 Journalizing Postinglalala lalalaNo ratings yet

- Comment Test 2Document6 pagesComment Test 2AirasNo ratings yet

- Mock Paper-1 (WIth Answer)Document13 pagesMock Paper-1 (WIth Answer)RNo ratings yet

- DMC College Foundation, Inc. Sta. Filomena, Dipolog City 2 Semester SY: 2021-2022 School of Business and AccountancyDocument9 pagesDMC College Foundation, Inc. Sta. Filomena, Dipolog City 2 Semester SY: 2021-2022 School of Business and AccountancyMitch RegenciaNo ratings yet

- EM - Buss - T1 - G11 - I, II PP Ans - 2018Document15 pagesEM - Buss - T1 - G11 - I, II PP Ans - 2018Nipuni PereraNo ratings yet

- AccountingDocument3 pagesAccountingVirginia Concepcion JobliNo ratings yet

- 202 Practice Exam SOLUTIONS Spring 2016Document25 pages202 Practice Exam SOLUTIONS Spring 2016MaxNo ratings yet

- Dissolution 2024 SPCC PDFDocument66 pagesDissolution 2024 SPCC PDFdollpees01No ratings yet

- Prequalifying Exam Level 1 Set B AK FSUU AccountingDocument9 pagesPrequalifying Exam Level 1 Set B AK FSUU AccountingRobert CastilloNo ratings yet

- ACCO320Midterm Winter2013V02Sol - 281 - 29 PDFDocument16 pagesACCO320Midterm Winter2013V02Sol - 281 - 29 PDFzzNo ratings yet

- Balance SheetDocument8 pagesBalance SheetAbhishek BaliarsinghNo ratings yet

- Abm 2 Evaluation Week 1Document3 pagesAbm 2 Evaluation Week 1Christel Fermia RosimoNo ratings yet

- F7 - IPRO - Mock 1 - QuestionsDocument20 pagesF7 - IPRO - Mock 1 - QuestionscrazymoneyNo ratings yet

- Lesson Plan in Abm: Curriculum Guide)Document5 pagesLesson Plan in Abm: Curriculum Guide)Laarni GomezNo ratings yet

- Cases ChapterDocument13 pagesCases Chaptermariam.ahmed03No ratings yet

- Questions No 1 PB 7.1Document2 pagesQuestions No 1 PB 7.1L iNo ratings yet

- 1.BBALLB CORPORATE LAW 2018 - SEM VITH - COMPANY LAW II - CLCC3006 Answer Sheet 500071323Document5 pages1.BBALLB CORPORATE LAW 2018 - SEM VITH - COMPANY LAW II - CLCC3006 Answer Sheet 500071323Aryan DevNo ratings yet

- Financial Accounting Solutions 1 CommentsDocument5 pagesFinancial Accounting Solutions 1 CommentsvarshavishuNo ratings yet

- CH 2 3 ReviewDocument3 pagesCH 2 3 ReviewKiệt Mai AnhNo ratings yet

- Ca Exm Fa1 2012 09 PDFDocument20 pagesCa Exm Fa1 2012 09 PDFJerlin PreethiNo ratings yet

- Liquidators Circular To Creditors No 1Document4 pagesLiquidators Circular To Creditors No 1MarioNo ratings yet

- Apollo Shoes Case AssignmentDocument68 pagesApollo Shoes Case AssignmentxusmkxfngNo ratings yet

- Acctg.222 Exam - Questionnaire FINALDocument7 pagesAcctg.222 Exam - Questionnaire FINALAnonymous dbNSSxXPBNo ratings yet

- Prelim - Intacc 1BDocument32 pagesPrelim - Intacc 1BMartha Nicole MaristelaNo ratings yet

- How Is The Cash Outflow of An Entity Related To ExDocument2 pagesHow Is The Cash Outflow of An Entity Related To ExL iNo ratings yet

- Advance Accounting Materials 2Document4 pagesAdvance Accounting Materials 2Andrea Lyn Salonga CacayNo ratings yet

- Mid Advanced Acc. First09-10Document4 pagesMid Advanced Acc. First09-10Carl Adrian ValdezNo ratings yet

- QuizDocument14 pagesQuizYusuf Khan0% (3)

- Accounting 202 Chapter 12 TestDocument2 pagesAccounting 202 Chapter 12 TestLương Thế CườngNo ratings yet

- Mock Paper-2 (With Answer)Document13 pagesMock Paper-2 (With Answer)RNo ratings yet

- Midterm Exam F2012 FinalDocument12 pagesMidterm Exam F2012 FinalMiruna CiteaNo ratings yet

- PRE TEST ABM ClassDocument3 pagesPRE TEST ABM ClassGood News Worldwide MissionNo ratings yet

- AC 12 PFRS 3 Assignment No. 1Document4 pagesAC 12 PFRS 3 Assignment No. 1Betty SantiagoNo ratings yet

- Solved Refer To The Data in Starter 11 1 Show What MissionDocument1 pageSolved Refer To The Data in Starter 11 1 Show What MissionAnbu jaromiaNo ratings yet

- Aah 9886Document14 pagesAah 9886Rajiv MehraNo ratings yet

- Fabm2 Learning-Activity-1Document7 pagesFabm2 Learning-Activity-1Cha Eun WooNo ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- Solved Ellsworth Enterprises Borrowed 425 000 On An 8 Interest Bearing Note OnDocument1 pageSolved Ellsworth Enterprises Borrowed 425 000 On An 8 Interest Bearing Note OnAnbu jaromiaNo ratings yet

- Mock Paper-4 (With Answer)Document18 pagesMock Paper-4 (With Answer)RNo ratings yet

- BUS 251 - Homework SolutionsDocument46 pagesBUS 251 - Homework SolutionsJerry He0% (2)

- Super Test-2Document6 pagesSuper Test-2RitikaNo ratings yet

- Problem 3 5 6 Special TransactionDocument5 pagesProblem 3 5 6 Special TransactionBabyann BallaNo ratings yet

- Data Center College of The PhilippinesDocument2 pagesData Center College of The PhilippinesCjhay MarcosNo ratings yet

- CA Final Law Solution Nov 2015 by CS Tejpal ShethDocument9 pagesCA Final Law Solution Nov 2015 by CS Tejpal ShethAnjana AvoodaiappanNo ratings yet

- Acc EqnDocument8 pagesAcc EqnMalinima RanuthmiNo ratings yet

- Final Exam - Acc115Document7 pagesFinal Exam - Acc115angelapearlrNo ratings yet

- Baker Chap 1Document37 pagesBaker Chap 1Kristine DominiqueNo ratings yet

- SS 07 Quiz 2Document82 pagesSS 07 Quiz 2Van Le Ha100% (1)

- Gfia - 10 1Document55 pagesGfia - 10 1Dan Lachica NarcisoNo ratings yet

- Plan and Cost Basic Menus SITHKOP002Document41 pagesPlan and Cost Basic Menus SITHKOP002Nikesh SapkotaNo ratings yet

- HI5004 Group Assignment Guideline T1.2021Document15 pagesHI5004 Group Assignment Guideline T1.2021Nikesh SapkotaNo ratings yet

- Use Simple Relational DatabasesDocument7 pagesUse Simple Relational DatabasesNikesh SapkotaNo ratings yet

- Standard Recipe Card: Low-Carb Cauliflower Hash BrownsDocument12 pagesStandard Recipe Card: Low-Carb Cauliflower Hash BrownsNikesh SapkotaNo ratings yet

- SITHKOP002 Plan and Cost Basic MenusDocument11 pagesSITHKOP002 Plan and Cost Basic MenusNikesh SapkotaNo ratings yet

- Pra 371Document3 pagesPra 371Nikesh SapkotaNo ratings yet

- DTS-X Vs Dolby AtmosDocument3 pagesDTS-X Vs Dolby Atmoskar_21182No ratings yet

- CSE-SS Unit 3 QBDocument43 pagesCSE-SS Unit 3 QBJKNo ratings yet

- API and ISO Gas-Lift Recommended Practices PDFDocument47 pagesAPI and ISO Gas-Lift Recommended Practices PDFcarlosNo ratings yet

- Large Scale Solar Power System DesignDocument90 pagesLarge Scale Solar Power System Design김동욱No ratings yet

- Q250 SM Pneumatic Spinning WrenchDocument11 pagesQ250 SM Pneumatic Spinning WrenchH 8CNo ratings yet

- Mastering Listening and Non Verbal Communication Skills and Communicating in Teams Chp2Document32 pagesMastering Listening and Non Verbal Communication Skills and Communicating in Teams Chp2soldastersNo ratings yet

- Cadmium Telluride/Cadmium Sulfide Thin Films Solar Cells: A ReviewDocument10 pagesCadmium Telluride/Cadmium Sulfide Thin Films Solar Cells: A ReviewLong HoàngNo ratings yet

- Agriculture Is Not The Magic Solution - Simon KolawoleDocument3 pagesAgriculture Is Not The Magic Solution - Simon KolawoleIk Einstein OjoganNo ratings yet

- PUN Hlaing, Hsu Yadanar AungDocument2 pagesPUN Hlaing, Hsu Yadanar AungHsu Yadanar AungNo ratings yet

- Hyundai Led4 InstruccionesDocument5 pagesHyundai Led4 InstruccionesEncep ZaenalNo ratings yet

- Descriptive Research Design: Survey and Observation: Sadhu 1Document20 pagesDescriptive Research Design: Survey and Observation: Sadhu 1ak5775No ratings yet

- MGT3102 Case StudyDocument2 pagesMGT3102 Case StudyMon LuffyNo ratings yet

- Modeling and Simulation of EHV (402034MJ) : Unit 4: Electric Vehicle ConfigurationDocument90 pagesModeling and Simulation of EHV (402034MJ) : Unit 4: Electric Vehicle Configurationsagar kordeNo ratings yet

- Health Promotion UnitDocument121 pagesHealth Promotion UnitsolacespunkyNo ratings yet

- 20 Securities Selection and Portfolio Construction and EvaluationDocument24 pages20 Securities Selection and Portfolio Construction and EvaluationShaikh Saifullah KhalidNo ratings yet

- NasdaqDocument135 pagesNasdaqShivam AggarwalNo ratings yet

- Problems 1Document6 pagesProblems 1Russel BarquinNo ratings yet

- Question Bank For Prelims Exam - 2019: Fill in The BlanksDocument11 pagesQuestion Bank For Prelims Exam - 2019: Fill in The BlanksAlpha CollegeNo ratings yet

- ACH130 AM Edition BrochureDocument17 pagesACH130 AM Edition BrochuremarcusdeburcaNo ratings yet

- Entrepreneurship SchemesDocument6 pagesEntrepreneurship SchemesSADENT2100% (1)

- Server 2019Document41 pagesServer 2019sundar anandanNo ratings yet

- CSS Code - New - 2022Document54 pagesCSS Code - New - 2022kaushikNo ratings yet

- Notice: Human Drugs: Prescription Drug User Fee Cover Sheet (FDA Form 3397) and User Fee Payment Identification Number Electronic AvailabilityDocument1 pageNotice: Human Drugs: Prescription Drug User Fee Cover Sheet (FDA Form 3397) and User Fee Payment Identification Number Electronic AvailabilityJustia.comNo ratings yet

- McDonald's Generic Strategy & Intensive Growth Strategies - Panmore InstituteDocument3 pagesMcDonald's Generic Strategy & Intensive Growth Strategies - Panmore InstituteLayyinahNo ratings yet

- Wiring Diagram of Front SAM Control Unit With Fuse and Relay Module (N10 - 1) 2Document5 pagesWiring Diagram of Front SAM Control Unit With Fuse and Relay Module (N10 - 1) 2Сергей АзаренкоNo ratings yet

- H940C PartsDocument388 pagesH940C PartsRildo ChavesNo ratings yet

- Jurnal Resti: Implementasi Algoritma A-Star Untuk Pencarian Ruteterdekat Titik Shelter Evakuasi TsunamiDocument6 pagesJurnal Resti: Implementasi Algoritma A-Star Untuk Pencarian Ruteterdekat Titik Shelter Evakuasi Tsunamipinkyboy79No ratings yet