Professional Documents

Culture Documents

CIR vs Court of Appeals - Terminal leave pay tax exemption

Uploaded by

Benjie SalesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR vs Court of Appeals - Terminal leave pay tax exemption

Uploaded by

Benjie SalesCopyright:

Available Formats

G.R. No. 96016 October 17, 1991 COMMISSIONER OF INTERNAL REVENUE, petitioner, vs.

THE COURT OF APPEALS and EFREN P. CASTANEDA, respondents. PADILLA, J.:

FACTS: Efren P. Castaneda retired from the government service as Revenue Attache in the

Philippine Embassy in London, England. Upon retirement, he received, among other benefits,

terminal leave pay from which petitioner Commissioner of Internal Revenue withheld

P12,557.13 allegedly representing income tax thereon. Castaneda filed a formal written claim

with petitioner for a refund of the P12,557.13, contending that the cash equivalent of his terminal

leave is exempt from income tax. CTA ordered CIR to refund Castaneda the sum of P12,557.13

withheld as income tax which was affirmed by CA.

ISSUE: whether or not terminal leave pay received by a government official or employee on the

occasion of his compulsory retirement from the government service is subject to withholding

(income) tax.

RULING: In the case of Jesus N. Borromeo vs. The Hon. Civil Service Commission, et al., the

Court explained the rationale behind the employee's entitlement to an exemption from

withholding (income) tax on his terminal leave pay as follows: . . . commutation of leave credits,

more commonly known as terminal leave, is applied for by an officer or employee who retires,

resigns or is separated from the service through no fault of his own. In the exercise of sound

personnel policy, the Government encourages unused leaves to be accumulated. The

Government recognizes that for most public servants, retirement pay is always less than

generous if not meager and scrimpy. A modest nest egg which the senior citizen may look

forward to is thus avoided. Terminal leave payments are given not only at the same time but

also for the same policy considerations governing retirement benefits. In fine, not being part of

the gross salary or income of a government official or employee but a retirement benefit,

terminal leave pay is not subject to income tax.

You might also like

- In Re Atty Bernardo ZialcitaDocument3 pagesIn Re Atty Bernardo ZialcitaMCNo ratings yet

- Share For Share Under Section 40 CDocument13 pagesShare For Share Under Section 40 CCkey ArNo ratings yet

- Bir Rao 01 03Document3 pagesBir Rao 01 03Benedict Jonathan BermudezNo ratings yet

- Amendments to Revenue Regulations No. 2-98Document55 pagesAmendments to Revenue Regulations No. 2-98Cuayo JuicoNo ratings yet

- 1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Document24 pages1 BIR - TRAIN - TOT - Briefing - Introduction To TRAIN2Jordan Tagao ColcolNo ratings yet

- Estate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andDocument6 pagesEstate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andAngelyn SamandeNo ratings yet

- Revenue Regulations No. 10-96: August 7, 1996Document10 pagesRevenue Regulations No. 10-96: August 7, 1996APRIL ANN BIGAYNo ratings yet

- Expanded Withholding Taxes On Government Income PaymentsDocument172 pagesExpanded Withholding Taxes On Government Income PaymentsBien Bowie A. CortezNo ratings yet

- De Minimis and FringeDocument1 pageDe Minimis and FringeAlicia Jane NavarroNo ratings yet

- Management Prerogatives & Termination of EmploymentDocument34 pagesManagement Prerogatives & Termination of EmploymentJeromeo Hallazgo de LeonNo ratings yet

- Certification of Gross Sales PasigDocument2 pagesCertification of Gross Sales PasigCelestine AlexaNo ratings yet

- Tax Lectures TranscribeDocument29 pagesTax Lectures TranscribeNeri DelfinNo ratings yet

- F. CIR vs. Solidbank Corp., G.R. No. 148191, Nov. 25, 2003Document3 pagesF. CIR vs. Solidbank Corp., G.R. No. 148191, Nov. 25, 2003Rhenee Rose Reas SugboNo ratings yet

- Written Report in INCOME TAXATION MODULE 4 GROSS INCOMEDocument39 pagesWritten Report in INCOME TAXATION MODULE 4 GROSS INCOMEMark Kevin Dimalanta SicatNo ratings yet

- Rmo 01-90 - Amended Penalty ProvisionDocument14 pagesRmo 01-90 - Amended Penalty ProvisionRester John Nonato0% (1)

- Pbcom V CirDocument9 pagesPbcom V CirAbby ParwaniNo ratings yet

- Notes To Financial StatementsDocument9 pagesNotes To Financial StatementsCheryl FuentesNo ratings yet

- BTAC Course Provides Tax Basics for New BIR EmployeesDocument7 pagesBTAC Course Provides Tax Basics for New BIR EmployeesRommel Cabalhin100% (1)

- Philippine Wage and Benefits OverviewDocument6 pagesPhilippine Wage and Benefits OverviewMary InvencionNo ratings yet

- BIR Ruling 302-08 - Funeral AssistanceDocument13 pagesBIR Ruling 302-08 - Funeral AssistanceJerwin DaveNo ratings yet

- Business Taxes ExplainedDocument51 pagesBusiness Taxes ExplainedLuna CakesNo ratings yet

- Habeas Corpus Petition Dismissed by CADocument26 pagesHabeas Corpus Petition Dismissed by CAdonyacarlottaNo ratings yet

- General Principles of Taxation FundamentalsDocument43 pagesGeneral Principles of Taxation FundamentalsChristine Joy Rejas-TubianoNo ratings yet

- RMC No. 77-2008Document3 pagesRMC No. 77-2008James Susuki100% (1)

- Sample SMRDocument3 pagesSample SMRArjam B. BonsucanNo ratings yet

- 143-Western Minolco Corp. v. CIR, Et. Al. 124 SCRA 121Document6 pages143-Western Minolco Corp. v. CIR, Et. Al. 124 SCRA 121Jopan SJNo ratings yet

- WITHHOLDING TAX GUIDEDocument5 pagesWITHHOLDING TAX GUIDEKobe BullmastiffNo ratings yet

- Estate TaxationDocument4 pagesEstate TaxationThe Brain Dump PHNo ratings yet

- Capital Gains TaxDocument3 pagesCapital Gains TaxAJ Santos100% (2)

- GR No. 149636 - June 8, 2005 Double Taxation FWT - GRTDocument4 pagesGR No. 149636 - June 8, 2005 Double Taxation FWT - GRTMonica SorianoNo ratings yet

- RCC 1Document97 pagesRCC 1Ranz Nikko N PaetNo ratings yet

- Local and Real Property TaxDocument18 pagesLocal and Real Property TaxNori Lola100% (1)

- Fringe Benefit DeminimisDocument12 pagesFringe Benefit DeminimisMa. Angelica Celina MoralesNo ratings yet

- 8 TAX 1 Group 8 - Fringe Benefits Tax, 13th Month Pay and Other Benefits Excluded From GIDocument60 pages8 TAX 1 Group 8 - Fringe Benefits Tax, 13th Month Pay and Other Benefits Excluded From GIFC EstoestaNo ratings yet

- Tax Bulletin by SGV As of Oct 2014Document18 pagesTax Bulletin by SGV As of Oct 2014adobopinikpikanNo ratings yet

- Sworn Statement For Application of Permit To Use Loose Leaf Books of AccountsDocument1 pageSworn Statement For Application of Permit To Use Loose Leaf Books of AccountsTesston BullionNo ratings yet

- LifeBlood - Assessment Process Tax 2Document17 pagesLifeBlood - Assessment Process Tax 2Monjid AbpiNo ratings yet

- Annex (A1)Document1 pageAnnex (A1)Jana Jonathan0% (1)

- Transfer TaxesDocument8 pagesTransfer TaxesMikee TanNo ratings yet

- Cta 2D CV 09224 M 2019feb12 AssDocument17 pagesCta 2D CV 09224 M 2019feb12 AssMelan YapNo ratings yet

- Pledge of Confidentiality: Fortich Street, Malaybalay City, Bukidnon 8700Document2 pagesPledge of Confidentiality: Fortich Street, Malaybalay City, Bukidnon 8700Jeala mae JamisolaminNo ratings yet

- Basic Concepts of TaxationDocument5 pagesBasic Concepts of TaxationRhea Javed100% (1)

- Revenue Regulations on Minimum Corporate Income TaxDocument5 pagesRevenue Regulations on Minimum Corporate Income TaxKayzer SabaNo ratings yet

- RCBCDocument2 pagesRCBCfradz08No ratings yet

- Part II - On Strikes and Lock OutsDocument53 pagesPart II - On Strikes and Lock OutsJenifer PaglinawanNo ratings yet

- TaxDocument6 pagesTaxChristian GonzalesNo ratings yet

- DIGEST - Sitel Philippines Corp. v. CIRDocument3 pagesDIGEST - Sitel Philippines Corp. v. CIRAgatha ApolinarioNo ratings yet

- Gsis BenefitsDocument1 pageGsis BenefitsALIAHDAYNE POLIDARIO100% (1)

- CTA Ruling on Exchange Rate for Taxing Foreign IncomeDocument7 pagesCTA Ruling on Exchange Rate for Taxing Foreign IncomeAnne Marieline BuenaventuraNo ratings yet

- Research CAR and Nominal SharesDocument5 pagesResearch CAR and Nominal Sharesarkina_sunshineNo ratings yet

- Pagong BagalDocument1 pagePagong Bagaljuliet_emelinotmaestroNo ratings yet

- REHABILITATION OR LIQUIDATION OF FINANCIALLY DISTRESSED ENTERPRISESDocument19 pagesREHABILITATION OR LIQUIDATION OF FINANCIALLY DISTRESSED ENTERPRISESJAMAL ALINo ratings yet

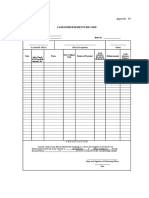

- Cash Disbursements Record: Appendix 40Document1 pageCash Disbursements Record: Appendix 40Hike and Surf LivingNo ratings yet

- Legal Opinion de MinimisDocument6 pagesLegal Opinion de MinimisjoyiveeongNo ratings yet

- WWW Studocu Com en Au Document Queensland University of Technology Introduction To Taxation Law Lecture Notes Tax Law Exam Notes Final 195771 ViewDocument2 pagesWWW Studocu Com en Au Document Queensland University of Technology Introduction To Taxation Law Lecture Notes Tax Law Exam Notes Final 195771 ViewSudip AdhikariNo ratings yet

- LTOM BOOK 1 CHAPTER 2 QUALIFICATIONSDocument2 pagesLTOM BOOK 1 CHAPTER 2 QUALIFICATIONSMarivic EspiaNo ratings yet

- YMCA Rental Income Subject to TaxDocument1 pageYMCA Rental Income Subject to TaxBeverly LegaspiNo ratings yet

- The amount of remuneration Plinky must report asincome in 2019 is:a. 12,000b. 0 c. 100 shares of stockd. FMV of stock when soldDocument37 pagesThe amount of remuneration Plinky must report asincome in 2019 is:a. 12,000b. 0 c. 100 shares of stockd. FMV of stock when soldAlyssa TolentinoNo ratings yet

- CIR Vs Toshiba Information EquipmentDocument1 pageCIR Vs Toshiba Information EquipmentKayee KatNo ratings yet

- Cir Vs CastanedaDocument2 pagesCir Vs CastanedaAyra CadigalNo ratings yet

- Prime White Cement Vs IacDocument2 pagesPrime White Cement Vs IacNegou Xian TeNo ratings yet

- Governance Chapter 1 & 2Document4 pagesGovernance Chapter 1 & 2Ashlie SulitNo ratings yet

- Handbook On Theories of GovernanceDocument16 pagesHandbook On Theories of GovernanceBenjie SalesNo ratings yet

- Dokumen - Tips Khan Vs SimbilloDocument31 pagesDokumen - Tips Khan Vs SimbilloBenjie SalesNo ratings yet

- Topic 1 - Moral PrincipleDocument4 pagesTopic 1 - Moral PrincipleBenjie SalesNo ratings yet

- PHILIPPINE TRUST COMPANY v. MARCIANO RIVERADocument2 pagesPHILIPPINE TRUST COMPANY v. MARCIANO RIVERABenjie SalesNo ratings yet

- Prime White Cement Vs IacDocument2 pagesPrime White Cement Vs IacNegou Xian TeNo ratings yet

- University of MindanaoDocument4 pagesUniversity of MindanaoBenjie SalesNo ratings yet

- Montelibano v Bacolod-Murcia Milling Co CaseDocument1 pageMontelibano v Bacolod-Murcia Milling Co CaseBenjie SalesNo ratings yet

- VIOLET MCGUIRE SUMACAD-NIL-liabilities of AcceptorDocument1 pageVIOLET MCGUIRE SUMACAD-NIL-liabilities of AcceptorBenjie SalesNo ratings yet

- Confederation For Unity, Recognition and Advancement of Government EmployeesDocument2 pagesConfederation For Unity, Recognition and Advancement of Government EmployeesBenjie SalesNo ratings yet

- Manila Remnant CoDocument2 pagesManila Remnant CoBenjie SalesNo ratings yet

- Lim v. Saban: G.R. No. 163720, 16 December 2004 FactsDocument2 pagesLim v. Saban: G.R. No. 163720, 16 December 2004 FactsBenjie SalesNo ratings yet

- AMEC Entitled to Moral Damages in Defamation CaseDocument1 pageAMEC Entitled to Moral Damages in Defamation CaseBenjie SalesNo ratings yet

- De Castro v. Court of Appeals: G.R. No. 115838, 18 July 2002 FactsDocument3 pagesDe Castro v. Court of Appeals: G.R. No. 115838, 18 July 2002 FactsBenjie SalesNo ratings yet

- Eurotech Industrial Technologies, Inc. v. CuizonDocument3 pagesEurotech Industrial Technologies, Inc. v. CuizonwuplawschoolNo ratings yet

- Workplace mental health policyDocument4 pagesWorkplace mental health policyBenjie Sales100% (5)

- Special Proceeding Reviewer (Regalado)Document36 pagesSpecial Proceeding Reviewer (Regalado)Faith Laperal91% (11)

- PNB Vs Picornell 46 Phil 716-NIL-liabiliies of DrawerDocument2 pagesPNB Vs Picornell 46 Phil 716-NIL-liabiliies of DrawerBenjie SalesNo ratings yet

- Department of Education: Republic of The PhilippinesDocument2 pagesDepartment of Education: Republic of The PhilippinesCaranay BillyNo ratings yet

- Atrium Management Corp VS-NIL-UltravIres DoctrineDocument2 pagesAtrium Management Corp VS-NIL-UltravIres DoctrineBenjie SalesNo ratings yet

- Fossum V Hermanos-NIL Case DigestDocument1 pageFossum V Hermanos-NIL Case DigestBenjie SalesNo ratings yet

- Corp Reviewer - LadiaDocument87 pagesCorp Reviewer - Ladiadpante100% (6)

- Ateneo Central Bar Operations 2007 Civil Law Summer ReviewerDocument15 pagesAteneo Central Bar Operations 2007 Civil Law Summer ReviewerMiGay Tan-Pelaez85% (13)

- Good Time Conduct AllowanceDocument12 pagesGood Time Conduct AllowanceBenjie SalesNo ratings yet

- Estate TaxDocument8 pagesEstate TaxIELTSNo ratings yet

- People of The Phil. vs. Fidel TanDocument3 pagesPeople of The Phil. vs. Fidel TanBenjie SalesNo ratings yet

- Legal Technique - Counter Affidavit For Qualified TheftDocument4 pagesLegal Technique - Counter Affidavit For Qualified Theftdrdacctg100% (5)