Professional Documents

Culture Documents

Quiz 1

Uploaded by

Khatlene Acla0 ratings0% found this document useful (0 votes)

9 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views2 pagesQuiz 1

Uploaded by

Khatlene AclaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

1. What documents support the payment of an invoice?

Discuss where these documents

originate and the resulting control implications.

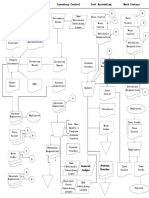

Response: The payment of an invoice may be supported by the purchase requisition, purchase

order, and receiving report. The purchase requisition originates from inventory control and

represents the inventory requirements. The purchase order originates from the purchasing

department and represents an order placed. The receiving report originates from the receiving

department and represents the quantity and types of goods received. Thus, the accounts

payable must determine that the goods ordered were requested by some department other

than purchasing, that purchasing ordered the goods from a valid vendor, and that the goods

were actually received. If all three conditions are met, the invoice should be paid. Further,

payments should be made for only those goods received in good shape.

2. You are conducting an end-of-year audit. Assume that the terms of trade between a buyer and

a seller are free on board (FOB) destination. What document provides evidence that a liability

exists and may be unrecorded?

Response: The Receiving Report serves as a proof/evidence that the items have been received

and a liability has been realized. By the end of the year, if the invoice did not come in, then the

liability may not have been recognized in the period under review.

3. Discuss the major control implications of batch systems with real-time data input. What

compensating procedures are available?

Response: The first control implication is that a fundamental separation between authorization

and transaction processing no longer exists. The computer programs both authorize and process

the orders and issue checks to the vendors. The compensating control is to provide transaction

listings and summary reports that describe the automated activities taken by the system to

management. In order for these controls to work, the managers must take the time to carefully

review these reports. The second control implication is that the accounting records as well as

the computer programs reside on magnetic disks. These disks should not be accessed by any

individuals not authorized to access them in any fashion. The compensating control is to employ

hardware, software, and procedural controls over the data stores.

4. Discuss some specific examples of how information systems can reduce time lags that

positively affect an organization.

Response: One example is by reducing the time it takes to record the receipt of inventory into

the inventory records that are used to inform customers whether or not their requested item is

available. Also, the inventory levels are also reduced more quickly for those inventories that are

being shipped. With a reduced time lag, the risk of promising to ship an item to another

customer when it is not available is greatly reduced. Further, the automated system will be less

likely to pay an invoice too early, while at the same time not missing the discount period. Thus,

cash management is improved.

5. How does the procedure for determining inventory requirements differ between a basic batch

processing system and batch processing with real-time data input of sales and receipts of

inventory?

Response: A system that employs real-time data entry of sales will have the inventory levels

updated more frequently. Thus, when a sale depletes the inventory level to the reorder point,

the system will flag it for reorder more quickly than if it had to wait for a batch update of the

inventory records. The sooner the item is ordered, the sooner it will be received. With respect to

the real-time receipt of inventory, the inventory will be updated immediately to show the

accurate amount that is on hand. A customer wishing to know how soon an item will be shipped

will receive more accurate information regarding the status of the firm’s inventory levels. Thus,

the customer benefits from better stocking of inventory and better information regarding the

inventory levels.

Term FOB shipping point:

a. Yes

b. The best evidence is provided by the Purchase Order and Bill of Lading

Purchase Order—is evidence that the item was ordered, but does not indicate when it was shipped.

Bill of Lading—reviewed post-period; will indicate when the goods were shipped

Receiving Report—prepared post-period; establishes possession but may not indicate when goods were

shipped

c. June 15

d. July 10

Term FOB destination:

e. No

f. N/A

g. July 5

h. July 15

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Group 2 - Schumpeter - The Creative Response in Economic HistoryDocument2 pagesGroup 2 - Schumpeter - The Creative Response in Economic Historymkmen100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Raya and The Last DragonDocument1 pageRaya and The Last DragonKhatlene Acla100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1a. PWC Article Exercise - The Four Worlds of Work in 2030Document6 pages1a. PWC Article Exercise - The Four Worlds of Work in 2030dffdf fdfg0% (1)

- Accounting Information SystemDocument3 pagesAccounting Information SystemKhatlene AclaNo ratings yet

- Activity 1 - Nature of MathematicsDocument4 pagesActivity 1 - Nature of MathematicsKhatlene AclaNo ratings yet

- Pantene Brand Audit ReportDocument3 pagesPantene Brand Audit ReportSaad RazaNo ratings yet

- Chap 8 Tanner - Recruitment and SelectionDocument23 pagesChap 8 Tanner - Recruitment and SelectionHopey Wan-KenobiNo ratings yet

- PM 1 Lesson 3 Discussion: Scriptural Models of Being A ChurchDocument6 pagesPM 1 Lesson 3 Discussion: Scriptural Models of Being A ChurchKhatlene AclaNo ratings yet

- PM 1 Lesson 3 Discussion: Church Models in History: 1st: Small Communities of Love and Sharing (33-100AD or 1st Century)Document7 pagesPM 1 Lesson 3 Discussion: Church Models in History: 1st: Small Communities of Love and Sharing (33-100AD or 1st Century)Khatlene AclaNo ratings yet

- Law On Obligations and ContractsDocument28 pagesLaw On Obligations and ContractsKhatlene AclaNo ratings yet

- Central Manufacturing System: Sales ForecastDocument1 pageCentral Manufacturing System: Sales ForecastKhatlene AclaNo ratings yet

- Quiz 2 (Diagram)Document2 pagesQuiz 2 (Diagram)Khatlene AclaNo ratings yet

- M6 Diag 3Document1 pageM6 Diag 3Khatlene AclaNo ratings yet

- Activity 4 - Continuation of Operations On SetsDocument2 pagesActivity 4 - Continuation of Operations On SetsKhatlene AclaNo ratings yet

- Activity 3 - Mathematics Language and SymbolsDocument5 pagesActivity 3 - Mathematics Language and SymbolsKhatlene AclaNo ratings yet

- Essay 1Document1 pageEssay 1Khatlene AclaNo ratings yet

- Fundamental of Group DynamicsDocument12 pagesFundamental of Group DynamicsKhatlene AclaNo ratings yet

- Raya and The Last DragonDocument1 pageRaya and The Last DragonKhatlene AclaNo ratings yet

- Differentiating Teams From Groups: IndexDocument17 pagesDifferentiating Teams From Groups: IndexKhatlene AclaNo ratings yet

- Tech ContractsDocument6 pagesTech ContractsGv AthvaidhNo ratings yet

- G. H. Bhakta Management Academy: A ON General Study OF at Surat Submitted ToDocument43 pagesG. H. Bhakta Management Academy: A ON General Study OF at Surat Submitted Toayush zadooNo ratings yet

- McKinsey Webinar FINAL PDFDocument31 pagesMcKinsey Webinar FINAL PDFdlokNo ratings yet

- Budgeted Lesson in Tle 6Document3 pagesBudgeted Lesson in Tle 6AlmarieSantiagoMallabo100% (1)

- Key TermsDocument10 pagesKey Termscuteserese roseNo ratings yet

- 22509-mcq-MAN-McQ 1Document13 pages22509-mcq-MAN-McQ 1RAVI kumar100% (2)

- British African F&I Terms and Fees 2021Document1 pageBritish African F&I Terms and Fees 2021EdidiongNo ratings yet

- Developing Marketing Strategies and PlansDocument43 pagesDeveloping Marketing Strategies and PlansYuvraj PathakNo ratings yet

- Creating A Model of Process Innovation For Reengineering of Business and ManufacturingDocument7 pagesCreating A Model of Process Innovation For Reengineering of Business and Manufacturingapi-3851548No ratings yet

- 167 Sep2019 PDFDocument13 pages167 Sep2019 PDFShah KhanNo ratings yet

- HS 019 Control of RecordsDocument13 pagesHS 019 Control of RecordsgrantNo ratings yet

- ISO 9001 AwarenessDocument1 pageISO 9001 AwarenessAnand Chavan Projects-QualityNo ratings yet

- UofMaryland Smith Finance Assoc Resume Book (1Y)Document46 pagesUofMaryland Smith Finance Assoc Resume Book (1Y)Jon CannNo ratings yet

- Logistics BlueprintDocument4 pagesLogistics BlueprintSamar FakihNo ratings yet

- The Marketing EnvironmentDocument66 pagesThe Marketing EnvironmentNoreen AlbrandoNo ratings yet

- Project Management ConceptsDocument19 pagesProject Management ConceptsarunlaldsNo ratings yet

- CertempDocument1 pageCertempjelidom22No ratings yet

- Assignment 3Document6 pagesAssignment 3salebanNo ratings yet

- INVESTMENT IN DEBT SECURITIES DiscussionDocument12 pagesINVESTMENT IN DEBT SECURITIES DiscussionKristine Kyle AgneNo ratings yet

- Case AnalysisssDocument19 pagesCase AnalysisssNadine SalcedoNo ratings yet

- Organizational Strategy - Apple Case StudyDocument31 pagesOrganizational Strategy - Apple Case StudyJamesNo ratings yet

- Sony ProjectDocument12 pagesSony ProjectfkkfoxNo ratings yet

- MKT1612 - LAW102 - Nguyễn Quỳnh Nga 3Document4 pagesMKT1612 - LAW102 - Nguyễn Quỳnh Nga 3Quỳnh VânNo ratings yet

- Csec CXC Pob Past Papers January 2010 Paper 02 PDFDocument5 pagesCsec CXC Pob Past Papers January 2010 Paper 02 PDFjohnny jamesNo ratings yet

- Business CommunicationDocument214 pagesBusiness Communicationrajeshpavan92% (13)

- Career Objective For A Fresher EngineerDocument4 pagesCareer Objective For A Fresher Engineerlisa arifaniaNo ratings yet