Professional Documents

Culture Documents

ACCOUNTING3

Uploaded by

Cj Serna0 ratings0% found this document useful (0 votes)

88 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

88 views3 pagesACCOUNTING3

Uploaded by

Cj SernaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

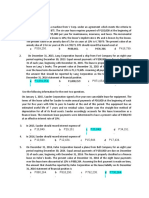

31. Use the following information for questions 31 and 32.

On January 1, 2021, Ogleby Corporation signed a five-year noncancelable lease for

equipment. The terms of the

lease called for Ogleby to make annual payments of P60,000 at the end of each year for five

years with title to pass

to Ogleby at the end of this period. The equipment has an estimated useful life of 7 years and

no residual value.

Ogleby uses the straight-line method of depreciation for all of its fixed assets. Ogleby

accordingly accounts for this

lease transaction as a finance lease. The minimum lease payments were determined to have a

present value of

P227,448 at an effective interest rate of 10%.

With respect to this capitalized lease, for 2021 Ogleby should record

a. rent expense of P60,000.

b. interest expense of P22,745 and depreciation expense of P45,489.

45

c. interest expense of P22,745 and depreciation expense of P32,493.

d. interest expense of P30,000 and depreciation expense of P45,489.

32. With respect to this capitalized lease, for 2022 Ogleby should record

a. interest expense of P22,745 and depreciation expense of P32,493.

b. interest expense of P20,469 and depreciation expense of P32,493.

c. interest expense of P19,019 and depreciation expense of P32,493.

d. interest expense of P14,469 and depreciation expense of P32,493.

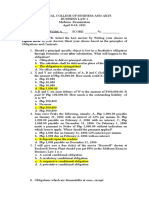

33. Emporia Corporation is a lessee with a finance lease. The asset is recorded at P450,000

and has an economic life of

8 years. The lease term is 5 years. The asset is expected to have a fair value of P150,000 at the

end of 5 years, and

a fair value of P50,000 at the end of 8 years. The lease agreement provides for the transfer of

title of the asset to the

lessee at the end of the lease term. What amount of depreciation expense would the lessee

record for the first year

of the lease?

a. P90,000

b. P80,000

c. P60,000

d. P50,000

34. Pisa, Inc. leased equipment from Tower Company under a four-year lease requiring equal

annual

payments of P86,038, with the first payment due at lease inception. The lease does not

transfer

ownership, nor is there a bargain purchase option. The equipment has a 4-year useful life and

no

residual value. If Pisa, Inc.’s incremental borrowing rate is 10% and the rate implicit in the

lease

(which is known by Pisa, Inc.) is 8%, what is the amount recorded for the leased asset at the

lease inception?

PV Annuity Due PV Ordinary Annuity

8%, 4 periods 3.57710 3.31213

10%, 4 periods 3.48685 3.16986

a. P307,767

b. P272,728

c. P284,969

d. P300,000

35. Pisa, Inc. leased equipment from Tower Company under a four-year lease requiring equal

annual

payments of P86,038, with the first payment due at lease inception. The lease does not

transfer

ownership, nor is there a bargain purchase option. The equipment has a 4-year useful life and

no

residual value. Pisa, Inc.’s incremental borrowing rate is 10% and the rate implicit in the lease

(which is known by Pisa, Inc.) is 8%. Assuming that this lease is properly classified as a

finance

lease, what is the amount of interest expense recorded by Pisa, Inc. in the first year of the

asset’s life?

PV Annuity Due PV Ordinary Annuity

8%, 4 periods 3.57710 3.31213

10%, 4 periods 3.48685 3.16986

a. P0

b. P24,621

c. P17,738

d. P22,798

36. Pisa, Inc. leased equipment from Tower Company under a four-year lease requiring equal

annual

payments of P86,038, with the first payment due at lease inception. The lease does not

transfer

ownership, nor is there a bargain purchase option. The equipment has a 4 year useful life and

no

residual value. Pisa, Inc.’s incremental borrowing rate is 10% and the rate implicit in the lease

(which is known by Pisa, Inc.) is 8%. Assuming that this lease is properly classified as a

finance

lease, what is the amount of principal reduction recorded when the second lease payment is

made in Year 2?

PV Annuity Due PV Ordinary Annuity

8%, 4 periods 3.57710 3.31213

10%, 4 periods 3.48685 3.16986

a. P86,038

b. P61,417

c. P63,240

d. P68,3006

37. Pisa, Inc. leased equipment from Tower Company under a four-year lease requiring equal

annual

payments of P86,038, with the first payment due at lease inception. The lease does not

transfer

ownership, nor is there a bargain purchase option. The equipment has a 4-year useful life and

no

residual value. Pisa, Inc.’s incremental borrowing rate is 10% and the rate implicit in the lease

(which is known by Pisa, Inc.) is 8%. Pisa, Inc. uses the straight-line method to depreciate

similar

assets. What is the amount of depreciation expense recorded by Pisa, Inc. in the first year of

the

asset’s life?

PV Annuity Due PV Ordinary Annuity

8%, 4 periods 3.57710 3.31213

10%, 4 periods 3.48685 3.16986

a. P0 because the asset is depreciated by Tower Company.

b. P71,242

c. P76,942

d. P75,000

38. Which of the following lease-related revenue and expense items would be recorded by

Yates if the lease is

accounted for as an operating lease?

a. Rental Revenue

b. Interest Income

c. Depreciation Expense

d. Rental Revenue and Depreciation Expense

39. Assume that Leicester Ltd. leased equipment that was carried at a cost P159,769 to

Wentworth Company. The

term of the lease is 6 years beginning January 1, 2022, with equal rental payments of P32,000

at the beginning

of each year. All executory costs are paid by Wentworth directly to third parties. The fair

value of the

equipment at the inception of the lease is P159,767. The equipment has a useful life of 6 years

with no

residual value. The lease has an implicit interest rate of 8%, no bargain purchase option, and

no transfer

of title. Based on this information, Leicester’s January 1,2022, journal entries at the inception

of the

lease would include:

a. A debit to Equipment for P159,767

b. A credit to Lease Receivable for P32,000

c. A credit to Cash for P159,767

d. A debit to Lease Receivable for P32,000

40. Mays Company has a machine with a cost of P400,000 which also is its fair value on the

date the machine is leased

to Park Company. The lease is for 6 years and the machine is estimated to have an

unguaranteed residual value of

P40,000. If the lessor's interest rate implicit in the lease is 12%, the six beginning-of-the-year

lease payments

would be

a. P92,361

b. P82,465

c. P78,180

d. P66,667

You might also like

- Analyzing Primark Financial Performance Using Financial Ratios Models CaseDocument14 pagesAnalyzing Primark Financial Performance Using Financial Ratios Models CaseSamNo ratings yet

- p2 - Guerrero Ch7Document35 pagesp2 - Guerrero Ch7JerichoPedragosa66% (38)

- How To Adjusted BalanceDocument4 pagesHow To Adjusted BalanceAnya Daniella80% (5)

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Intacc Chapt 11 18 NoneDocument24 pagesIntacc Chapt 11 18 NoneSean AustinNo ratings yet

- Orca Share Media1577676523240Document4 pagesOrca Share Media1577676523240Jayr BVNo ratings yet

- Intacc Finals Sw&QuizzesDocument57 pagesIntacc Finals Sw&QuizzesIris FenelleNo ratings yet

- Financial Management ExercisesDocument6 pagesFinancial Management ExercisesLeanne Quinto100% (1)

- Unit 14: Banking: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkDocument9 pagesUnit 14: Banking: Section 1: Reading Pre-Reading Tasks Discussion - Pair WorkThanh TúNo ratings yet

- CHAPTER 2 - Nature and Effect of Obligations (Arts. 1163-1178)Document30 pagesCHAPTER 2 - Nature and Effect of Obligations (Arts. 1163-1178)Kaye Rabadon100% (1)

- SCFS23 Day 1 - Full Day SlidesDocument39 pagesSCFS23 Day 1 - Full Day SlidesJoaquin DuranyNo ratings yet

- MC Questions For LeaseDocument6 pagesMC Questions For LeaseJPNo ratings yet

- Inacct3 Module 3 QuizDocument7 pagesInacct3 Module 3 QuizGemNo ratings yet

- 65Document25 pages65Mark RevarezNo ratings yet

- Quizzes Midterm To Finals OnlyDocument40 pagesQuizzes Midterm To Finals OnlyMikasa MikasaNo ratings yet

- SEATWORK 04 - Leases: Multiple ChoiceDocument9 pagesSEATWORK 04 - Leases: Multiple ChoiceLilii DsNo ratings yet

- Lease Problem With SolutionDocument19 pagesLease Problem With SolutionJeane Mae Boo100% (1)

- Lessee Lecture Notes Lessee Lecture NotesDocument8 pagesLessee Lecture Notes Lessee Lecture NotesDahyun KimNo ratings yet

- Mary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Document5 pagesMary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Angela TuazonNo ratings yet

- Module 8-OPERATING LESSEE-LESSORDocument5 pagesModule 8-OPERATING LESSEE-LESSORJeanivyle CarmonaNo ratings yet

- (Pfrs/Ifrs 16) LeasesDocument11 pages(Pfrs/Ifrs 16) LeasesBromanineNo ratings yet

- RM - Lessor Accounting & SLBDocument3 pagesRM - Lessor Accounting & SLBPoru SenpiiNo ratings yet

- 2 - ACG015 - Intermediate Accounting Part 3 - QuestionnaireDocument5 pages2 - ACG015 - Intermediate Accounting Part 3 - Questionnairedavis lizardaNo ratings yet

- LEASESDocument5 pagesLEASESHappy MagdangalNo ratings yet

- Assignment 02 Leases - Solution - OportoDocument4 pagesAssignment 02 Leases - Solution - OportoDevina OportoNo ratings yet

- Finance Lease - Lessee: Aklan Catholic CollegeDocument9 pagesFinance Lease - Lessee: Aklan Catholic CollegeLouiseNo ratings yet

- Assignment 02 Leases-SolutionDocument7 pagesAssignment 02 Leases-SolutionJaziel SestosoNo ratings yet

- 23232424Document15 pages23232424JV De Vera100% (1)

- Chapter 12 Ia2Document18 pagesChapter 12 Ia2JM Valonda Villena, CPA, MBA0% (1)

- Ho1-Leases (Student's Copy)Document11 pagesHo1-Leases (Student's Copy)Carl Dhaniel Garcia SalenNo ratings yet

- PRELEC1 Final ExamDocument4 pagesPRELEC1 Final ExamAramina Cabigting BocNo ratings yet

- Lease and Accounting For Income Tax DrillsDocument3 pagesLease and Accounting For Income Tax DrillsmarygraceomacNo ratings yet

- IFRS 16 Lease - Out-Of-Class practice-ENDocument8 pagesIFRS 16 Lease - Out-Of-Class practice-ENDAN NGUYEN THE100% (1)

- Applied Auditing Leases MC QuestionsDocument7 pagesApplied Auditing Leases MC Questionsshinebakayero hojillaNo ratings yet

- Soal Kuis Minggu 11Document7 pagesSoal Kuis Minggu 11Natasya ZahraNo ratings yet

- Leases - Brief ExercisesDocument5 pagesLeases - Brief ExercisesPeachyNo ratings yet

- Chapter 11 FinAcc2Document13 pagesChapter 11 FinAcc2Kariz Codog0% (2)

- Intermediate Accounting 2 Finals SolvingsDocument24 pagesIntermediate Accounting 2 Finals SolvingsColeen BiocalesNo ratings yet

- Leases Problems Part2Document2 pagesLeases Problems Part221100959No ratings yet

- On January 1, 2-WPS OfficeDocument4 pagesOn January 1, 2-WPS OfficeSanta-ana Jerald JuanoNo ratings yet

- Lessor Sample ProbDocument24 pagesLessor Sample ProbCzarina Jean ConopioNo ratings yet

- PF (B) - Compound, Notes, Debt Restruct, LeasesDocument4 pagesPF (B) - Compound, Notes, Debt Restruct, LeasesVencint LaranNo ratings yet

- Problem 1: True or FalseDocument4 pagesProblem 1: True or FalseJohn Ace Madriaga50% (6)

- Chapter 8 - Leases Part 2Document5 pagesChapter 8 - Leases Part 2JEFFERSON CUTE100% (1)

- Accounting For Leases by J. GonzalesDocument7 pagesAccounting For Leases by J. GonzalesGonzales JhayVeeNo ratings yet

- Rayos, Lyka Mae A - Ia3 CompilationsDocument7 pagesRayos, Lyka Mae A - Ia3 CompilationsKayeNo ratings yet

- Accounting For LeasesDocument6 pagesAccounting For LeasesJohn Ferd M. FerminNo ratings yet

- Orca Share Media1577676537770-1Document3 pagesOrca Share Media1577676537770-1Jayr BV100% (1)

- 6988 Finance Lease LesseeDocument2 pages6988 Finance Lease LesseeFREE MOVIESNo ratings yet

- MC LeasesDocument19 pagesMC LeasesJaynalyn Mae MonasterialNo ratings yet

- This Study Resource Was: Fellowship Baptist College College of Business and AccountancyDocument5 pagesThis Study Resource Was: Fellowship Baptist College College of Business and AccountancyNah HamzaNo ratings yet

- Unit 4 - LeasesDocument6 pagesUnit 4 - LeasesJean Pierre IsipNo ratings yet

- Leases Test Bank PDFDocument5 pagesLeases Test Bank PDFAB CloydNo ratings yet

- ACCT203 LeaseDocument4 pagesACCT203 LeaseSweet Emme100% (1)

- MCQ - LeasesDocument5 pagesMCQ - LeasesMakita BatitaNo ratings yet

- Lease Accounting 2021Document5 pagesLease Accounting 2021Just JhexNo ratings yet

- Theories LeasesDocument11 pagesTheories LeasesMinie KimNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- Only US$2.99/monthDocument3 pagesOnly US$2.99/monthKath LeynesNo ratings yet

- Leases ProblemsDocument4 pagesLeases ProblemsCunanan, Malakhai JeuNo ratings yet

- 24U Lease Accounting StudentDocument17 pages24U Lease Accounting Studentvee viajeroNo ratings yet

- LeasesDocument5 pagesLeasesElla Montefalco50% (2)

- IA2 Finals Retake Reviewer For PracticeDocument5 pagesIA2 Finals Retake Reviewer For PracticeLoro AdrianNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismFrom EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting MechanismNo ratings yet

- Quiz 3 - GuidelinesDocument3 pagesQuiz 3 - GuidelinesCj SernaNo ratings yet

- Serna, CJ - Activity 4Document2 pagesSerna, CJ - Activity 4Cj SernaNo ratings yet

- Serna, CJ DC. - Assignment1Document6 pagesSerna, CJ DC. - Assignment1Cj SernaNo ratings yet

- Sustainability and Strategic AuditDocument1 pageSustainability and Strategic AuditCj SernaNo ratings yet

- Stakeholder InclusivenessDocument1 pageStakeholder InclusivenessCj SernaNo ratings yet

- EconomicDocument1 pageEconomicCj SernaNo ratings yet

- Procurement PracticesDocument1 pageProcurement PracticesCj SernaNo ratings yet

- 19 - 7test Bank For Intermediate Accounting, Thirteenth EditionDocument3 pages19 - 7test Bank For Intermediate Accounting, Thirteenth EditionCj SernaNo ratings yet

- Enron Case StudyDocument5 pagesEnron Case StudyhhhNo ratings yet

- Management ApproachDocument1 pageManagement ApproachCj SernaNo ratings yet

- Task 1 - DiscussionDocument1 pageTask 1 - DiscussionCj SernaNo ratings yet

- ITDocument2 pagesITCj SernaNo ratings yet

- Final ConceptDocument2 pagesFinal ConceptCj SernaNo ratings yet

- PM Report RefDocument14 pagesPM Report RefCj SernaNo ratings yet

- Multiple Choice: - CPA AdaptedDocument3 pagesMultiple Choice: - CPA AdaptedCj SernaNo ratings yet

- Accounting For Income TaxesDocument5 pagesAccounting For Income TaxesCj SernaNo ratings yet

- 19 - 7test Bank For Intermediate Accounting, Thirteenth EditionDocument3 pages19 - 7test Bank For Intermediate Accounting, Thirteenth EditionCj SernaNo ratings yet

- Which of The Following Is Not A Database Management Task? SummarizationDocument3 pagesWhich of The Following Is Not A Database Management Task? SummarizationCj SernaNo ratings yet

- Budget CycleDocument4 pagesBudget CycleJoy OrtegaNo ratings yet

- AIS Essay QuizDocument5 pagesAIS Essay QuizCj SernaNo ratings yet

- QuestionsDocument1 pageQuestionsCj SernaNo ratings yet

- The Enron Case Study: History, Ethics and Governance FailuresDocument1 pageThe Enron Case Study: History, Ethics and Governance FailuresCj SernaNo ratings yet

- LEASEDocument2 pagesLEASECj SernaNo ratings yet

- Presentation Software Is Application SoftwareDocument4 pagesPresentation Software Is Application SoftwareCj SernaNo ratings yet

- EnterpriseDocument8 pagesEnterpriseCj SernaNo ratings yet

- QUESDocument2 pagesQUESCj SernaNo ratings yet

- If The Lease Were NonrenewableDocument2 pagesIf The Lease Were NonrenewableChris Tian FlorendoNo ratings yet

- ACCODocument2 pagesACCOCj SernaNo ratings yet

- BWR MicrofinanceReport FinalDocument13 pagesBWR MicrofinanceReport FinalHarsh KumarNo ratings yet

- On January 2 2017 Ti Enters Into A Contract With PDFDocument1 pageOn January 2 2017 Ti Enters Into A Contract With PDFDoreenNo ratings yet

- Key Uni 1 Activities Lessons 2 3Document20 pagesKey Uni 1 Activities Lessons 2 3Leslie Mae Vargas ZafeNo ratings yet

- ACC 3113 SolutionDocument7 pagesACC 3113 Solutionhaseeb ahmedNo ratings yet

- Limited Partnership NotesDocument9 pagesLimited Partnership NotesJelly BeanNo ratings yet

- Insurance Midterms ReviewerDocument28 pagesInsurance Midterms ReviewerMichaela SarmientoNo ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- Mardia Chemicals Ltd. v. U.O.I. & Ors., (2004) 4 SCC 311Document22 pagesMardia Chemicals Ltd. v. U.O.I. & Ors., (2004) 4 SCC 311DEV PORUS SURNo ratings yet

- Module 1 FABM2Document7 pagesModule 1 FABM2Thriztan Andrei BaluyutNo ratings yet

- Capital Letter in Your Answer Sheet Your Choice Based On The Principles ofDocument8 pagesCapital Letter in Your Answer Sheet Your Choice Based On The Principles ofXiu MinNo ratings yet

- Understanding The Impact of Zambias Growing Debt On Different StakeholdersDocument10 pagesUnderstanding The Impact of Zambias Growing Debt On Different StakeholdersDavid TaongaNo ratings yet

- School of LAW Name of The Faculty Member POOJA AGRAWATDocument10 pagesSchool of LAW Name of The Faculty Member POOJA AGRAWATKathuria AmanNo ratings yet

- A Review of The Accounting CycleDocument44 pagesA Review of The Accounting CycleBelle PenneNo ratings yet

- Hup Seng IndustryDocument4 pagesHup Seng IndustryMuhamad Uzayr Syahmi RohaizamNo ratings yet

- Recording Business Transactions: © 2016 Pearson Education, LTDDocument53 pagesRecording Business Transactions: © 2016 Pearson Education, LTDEce BarlasNo ratings yet

- Conceptual QuestionsDocument5 pagesConceptual QuestionsSarwanti PurwandariNo ratings yet

- Fabm 2 Week 1Document60 pagesFabm 2 Week 1Camille Cornelio100% (1)

- ACCTG 105 Midterm - Quiz No. 02 - Accounting Changes and Errors (Answers)Document2 pagesACCTG 105 Midterm - Quiz No. 02 - Accounting Changes and Errors (Answers)Lucas BantilingNo ratings yet

- AP 9502 - LiabilitiesDocument12 pagesAP 9502 - Liabilitiesrandel10caneteNo ratings yet

- Accounting Equation & Accounting Classification: Prepared By: Nurul Hassanah Binti HamzahDocument12 pagesAccounting Equation & Accounting Classification: Prepared By: Nurul Hassanah Binti HamzahNur Amira NadiaNo ratings yet

- Fiduciary Escrow Assignment Re118290495us Ascension ST JohnDocument8 pagesFiduciary Escrow Assignment Re118290495us Ascension ST Johnkingtbrown50100% (1)

- FEBTC Vs Diaz RealtyDocument1 pageFEBTC Vs Diaz RealtyDaniela Erika Beredo InandanNo ratings yet

- (L) Chapter 5 Accounting Concepts - ConventionsDocument6 pages(L) Chapter 5 Accounting Concepts - ConventionsCHZE CHZI CHUAHNo ratings yet

- Week 3 - RTL PrelimsDocument13 pagesWeek 3 - RTL PrelimsmehNo ratings yet