Professional Documents

Culture Documents

PF (B) - Compound, Notes, Debt Restruct, Leases

Uploaded by

Vencint Laran0 ratings0% found this document useful (0 votes)

135 views4 pagesOriginal Title

PF (B)-COMPOUND, NOTES, DEBT RESTRUCT, LEASES.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

135 views4 pagesPF (B) - Compound, Notes, Debt Restruct, Leases

Uploaded by

Vencint LaranCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

PREFINAL EXAM – ACCOUNTING 5 SET B DECEMBER 4, 2019

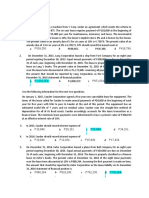

1. On January 1, 2013, Dean Corporation signed a ten-year

noncancelable lease for certain machinery. The terms of 5. The amount to be recorded as the cost of an asset under

the lease called for Dean to make annual payments of capital lease is equal to the

P200,000 at the end of each year for ten years with title a. present value of the minimum lease payments

to pass to Dean at the end of this period. The machinery plus the present value of any unguaranteed

has an estimated useful life of 15 years and no salvage residual value.

value. Dean uses the straight-line method of b. carrying value of the asset on the lessor's books.

depreciation for all of its fixed assets. Dean c. present value of the minimum lease payments.

accordingly accounted for this lease transaction as a d. present value of the minimum lease payments or the

capital lease. The lease payments were determined to fair value of the asset, whichever is lower.

have a present value of P1,342,016 at an effective

interest rate of 8%. With respect to this capitalized lease, 6. On January 1, 2012, Crown Company sold property to

Dean should record for 2013 Leary Company. There was no established exchange price

a. lease expense of P200,000. for the property, and Leary gave Crown a P3,000,000

b. interest expense of P91,362 and depreciation zero- interest-bearing note payable in 5 equal annual

expense of P134,202. installments of P600,000, with the first payment due

c. interest expense of P89,468 and depreciation December 31, 2012. The prevailing rate of interest for a

expense of P76,136. note of this type is 9%. The present value of the note at

d. interest expense of P107,361 and depreciation 9% was P2,163,000 at January 1, 2012. What should be

expense of P89,468. the balance of the Discount on Notes Payable account on

the books of Leary at December 31, 2012 after adjusting

2. Metcalf Company leases a machine from Vollmer Corp. entries are made, assuming that the effective-interest

under an agreement which meets the criteria to be a method is used?

capital lease for Metcalf. The six-year lease requires a. P0

payment of P170,000 at the beginning of each year, b. P669,600

including P25,000 per year for maintenance, insurance, c. P837,000

and taxes. The incremental borrowing rate for the lessee d. P642,330

is 10%; the lessor's implicit rate is 8% and is known by

the lessee. The present value of an annuity due of 1 for 7. On December 31, 2010, Nolte Co. is in financial difficulty

six years at 10% is 4.79079. The present value of an and cannot pay a note due that day. It is a P1,200,000

annuity due of 1 for six years at 8% is 4.99271. Metcalf note with P120,000 accrued interest payable to Piper,

should record the leased asset at Inc. Piper agrees to accept from Nolte equipment that

a. P723,943. has a fair value of P580,000, an original cost of P960,000,

b. P694,665. and accumulated depreciation of P460,000. Piper also

c. P848,760. forgives the accrued interest, extends the maturity date

d. P814,435. to December 31, 2013, reduces the face amount of the

note to P500,000, and reduces the interest rate to 6%,

3. On December 31, 2013, Lang Corporation leased a ship with interest payable at the end of each year. Nolte

from Fort Company for an eight- year period expiring should recognize a gain or loss on the transfer of the

December 30, 2021. Equal annual payments of P400,000 equipment of

are due on December 31 of each year, beginning with a. P120,000 gain.

December 31, 2013. The lease is properly classified as a b. P380,000 loss.

capital lease on Lang 's books. The present value at c. P0.

December 31, 2013 of the eight lease payments over the d. P80,000 gain.

lease term discounted at 10% is P2,347,370. Assuming all

payments are made on time, the amount that should be 8. (Refer to no. 7) Nolte should recognize a gain on the

reported by Lang Corporation as the total obligation partial settlement and restructure of the debt of

under capital leases on its December 31, 2014 balance a. P110,000.

sheet is b. P150,000.

a. P1,742,107. c. P0.

b. P2,400,000. d. P30,000.

c. P2,182,108.

d. P2,000,318. 9. (Refer to no. 7) Nolte should record interest expense for

2013 of

4. Mays Company has a machine with a cost of P600,000 a. P60,000.

which also is its fair value on the date the machine is b. P90,000.

leased to Park Company. The lease is for 6 years and the c. P0.

machine is estimated to have an unguaranteed residual d. P30,000.

value of P60,000. If the lessor's interest rate implicit in

the lease is 12%, the six beginning-of-the-year lease 10. When a note payable is issued for property, goods, or

payments would be services, the present value of the note is measured by

a. P117,270. a. using an imputed interest rate to discount all future

b. P100,000. payments on the note.

c. P138,541. b. any of these.

d. P123,698. c. the fair value of the property, goods, or services.

PREFINAL EXAM – ACCOUNTING 5 SET B DECEMBER 4, 2019

d. the fair value of the note.

16. How should the value of the warrants attached to a debt

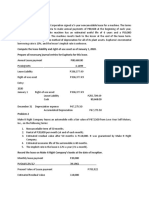

11. On January 1, 2012, Ann Price loaned P90,156 to Joe security be accounted for?

Kiger. A zero-interest-bearing note (face amount, a. a separate portion of paid in capital

P120,000) was exchanged solely for cash; no other rights b. a liability

or privileges were exchanged. The note is to be repaid on c. no value assigned

December 31, 2014. The prevailing rate of interest for a d. an appropriation of retained earnings

loan of this type is 10%. The present value of P120,000 at

10% for three years is P90,156. What amount of interest

income should Ms. Price recognize in 2012? 17. On April 30, 2019, White Corporation had outstanding

a. P36,000. 12% P1,000,000 face amount, convertible bonds

b. P27,048. maturing on April 30, 2023. Interest is payable on April

c. P9,016. 30 and October 31. On April 30, 2019, all these bonds

d. P12,000. were converted into 40,000 shares of P10 par common

stock. On the date of conversion:

12. On January 1, 2012, Jacobs Company sold property to Unamortized bond discount was P30,000.

Dains Company which originally cost Jacobs P950,000. Each bond had a market value of P1,080.

There was no established exchange price for this Each share of stock had a market price of P28.

property. Danis gave Jacobs a P1,500,000 zero-interest- What amount should White record as a loss on

bearing note payable in three equal annual conversion of bonds?

installments of P500,000 with the first payment due a. P30,000

December 31, 2012. The note has no ready market. The b. Zero

prevailing rate of interest for a note of this type is 10%. c. P150,000

The present value of a P1,500,000 note payable in three d. P110,000

equal annual installments of P500,000 at a 10% rate of

interest is P1,243,500. What is the amount of interest 18. On May 1, 2019, Hill issued P2,000,000, 20-year, 10%

income that should be recognized by Jacobs in 2012, bonds for P2,120,000. Each P1,000 bond had a

using the effective-interest method? detachable warrant eligible for the purchase of one share

a. P124,350. of Hill’s P50 par common stock for P60. Immediately

b. P150,000. after bonds were issued, Hill’s securities had the

c. P0. following market values:

d. P50,000. 10% bond without warrant P1,040

Warrant P20

13. A lessee with a capital lease containing a bargain Common stock, P50 par P56

purchase option should depreciate the leased asset over What amount should Hill credit to premium on bonds

the payable?

a. life of the asset or the term of the lease, whichever a. P40,000

is shorter. b. P0

b. life of the asset or the term of the lease, whichever c. P120,000

is longer. d. P80,000

c. asset's remaining economic life.

d. term of the lease. 19. If a company chooses the fair value option, a decrease in

the fair value of the liability is recorded by crediting

14. In a lease that is appropriately recorded as a direct- a. Unrealized Gain/Loss from change in fair value

financing lease by the lessor, unearned income b. None of these.

a. does not arise. c. Bonds Payable.

b. should be recognized at the lease's expiration. d. Gain on Restructuring of Debt.

c. should be amortized over the period of the lease

using the effective interest method. 20. A troubled debt restructuring will generally result in a

d. should be amortized over the period of the lease a. gain by both the debtor and the creditor.

using the straight-line method. b. gain by the debtor and a loss by the creditor

c. loss by the debtor and a gain by the creditor.

15. Mart issued P5,000,000 face value 12% convertible d. loss by both the debtor and the creditor.

bonds at 110 on January 1, 2009 maturing on January 1,

2014 and paying interest semiannually on January 1 and 21. Eddy Co. is indebted to Cole under a P600,000, 12%,

July 1. It is estimated that the bonds would sell only at three-year note dated December 31, 2011. Because of

103 without the conversion feature. Each P1,000 bond is Eddy's financial difficulties developing in 2013, Eddy

convertible into 10 ordinary shares with P100 par value. owed accrued interest of P72,000 on the note at

How much is the increase in shareholders’ equity arising December 31, 2013. Under a troubled debt restructuring,

from the issuance of the convertible bonds on January 1, on December 31, 2013, Cole agreed to settle the note

2009? and accrued interest for a tract of land having a fair value

a. P150,000 of P540,000. Eddy's acquisition cost of the land is

b. P 0 P435,000. Ignoring income taxes, on its 2013 income

c. P350,000 statement Eddy should report as a result of the troubled

d. P500,000 debt restructuring

PREFINAL EXAM – ACCOUNTING 5 SET B DECEMBER 4, 2019

Gain on Disposal Restructuring Gain 26. The excess of the fair value of leased property at the

a. P105,000 P60,000 inception of the lease over its cost or carrying amount

b. P105,000 P132,000 should be classified by the lessor as:

c. P237,000 P0 a. manufacturer’s or dealer’s profit from a sales

d. P165,000 P0 type lease

b. manufacturer’s or dealer’s profit from a direct

22. On December 31, 2015, Fire Company was experiencing financing lease

financial difficulties and entered into a debt restructuring c. unearned income from a sales type lease

agreement with the creditor. The creditor restructured d. unearned income from a direct financing lease

the obligation as follows:

Reduced the principal note payable from P5,000,000 27. On August 1, 2008, Metro Inc. leased a luxury apartment

to P4,500,000. unit to Centro. The parties signed a 1-year lease

Forgave P600,000 of accrued interest. beginning September 1, 2008 for a P100,000 monthly

Extended the maturity date from December 31, 2015 rent payable on the first day of the month. At the August

to December 31, 2003. 1 signing date, Metro collected P54,000 as a

Reduced the interest from 12% to 10%. Interest was nonrefundable fee for allowing Centro to sign a 1-year

payable annually on December 31, 2016, 2017 and lease (the normal lease term is 3 years) and P100,000

2018. rent for September. Centro has made timely payments

Fire should report loss on debt restructuring of: each month, but prepaid January’s rent on December 20.

a. P500,000 In Metro’s 2008 income statement, rent revenue should

b. P 0 be reported at:

c. P250,000 a. P400,000

d. P850,000 b. P418,000

c. P454,000

23. The following information pertains to the transfer of real d. P518,000

estate pursuant to a troubled debt restructuring by Knot

Company to Ton Company in full liquidation of Knot’s 28. Glade Company leases computer equipment to

liability to Ton: customers under direct financing leases. The equipment

Carrying amount of liability liquidated P150,000 has no residual value at the end of the lease and the

Carrying amount of real estate transferred 100,000 leases do not contain bargain purchase options. Glade

Fair value of real estate transferred 90,000 wishes to earn 8% interest on a 5-year of equipment with

What amount should Knot report as ordinary gain (loss) a fair value of P3,234,000. The present value of an

on transfer of real estate? annuity due of 1 at 8% for 5 years is 4.312. On January 1,

a. P50,000 2009, Glade leased the equipment to Blaze Company.

b. P60,000 What is the total amount of interest revenue that Glade

c. (P10,000) will earn over the life of the lease

d. P 0 a. P516,000

b. P750,000

24. (Refer to no. 23.)What amount should Knot report as c. P1,293,600

pretax extraordinary gain (loss) on restructuring of d. P1,394,500

payables?

a. P50,000 29. On January 1, 2009, Hooks Oil Company sold equipment

b. P60,000 with a carrying amount of P1,000,000, and a remaining

c. (P10,000) useful life of 10 years, to Maco Drilling for P1,500,000.

d. P0 Hooks immediately leased the equipment back under a

10 year capital lease with a present value of P1,500,000

25. For which of the following transactions would the use of and will depreciate the equipment using the straight-line

the present value of an annuity due (in advance) concept method. Hooks made the first annual lease payment of

be appropriate in calculating the present value of the P244,120 in December 2009. In Hooks’ December 31,

asset obtained or liability owed at the date of 2009 balance sheet, the unearned gain on equipment

incurrence? sale should be

a. a 10-year 8% bond is issued on January 2 with a. 255,880

interest payable semiannually on July 1 and b. 0

January 1 yielding 7% c. P500,000

b. a 10-year 8% bond is issued on January 2 with d. P450,000

interest payable semiannually on July 1 and

January 1 yielding 9% 30. Robin leased a machine from Ready. The lease qualifies

c. a capital lease is entered into with the initial as a capital lease and requires 10 annual payments of

lease payment due one month subsequent to P10,000 beginning immediately. The lease specifies an

the signing of the lease agreement interest rate of 12% and a purchase option of P10,000 at

d. a capital lease is entered into with the initial the end of the tenth year, even though the machine’s

lease payment due upon the signing of the lease estimated value on that date is P20,000. Robin’s

agreement incremental borrowing rate is 14%.

The present value of an annuity due of 1 at:

12% 6.328 14% 5.946

PREFINAL EXAM – ACCOUNTING 5 SET B DECEMBER 4, 2019

The present value of 1 at:

12% 0.322 14% 0.270

What amount should Robin record as lease liability at the

beginning of the lease term?

a. P66,500

b. P69,720

c. P62,160

d. P64,860

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Pf-Compound, Notes, Debt Restruct, LeasesDocument4 pagesPf-Compound, Notes, Debt Restruct, LeasesMai SamalcaNo ratings yet

- (Pfrs/Ifrs 16) LeasesDocument11 pages(Pfrs/Ifrs 16) LeasesBromanineNo ratings yet

- MC Questions For LeaseDocument6 pagesMC Questions For LeaseJPNo ratings yet

- FAR.3018 Loans and Receivables - Long TermDocument4 pagesFAR.3018 Loans and Receivables - Long TermJethro ConchaNo ratings yet

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- FAR.2919 - Loans and Receivables - Long TermDocument5 pagesFAR.2919 - Loans and Receivables - Long TermAJ Jahara GapateNo ratings yet

- FARDocument5 pagesFARoliveNo ratings yet

- Financial AccountingDocument7 pagesFinancial AccountingCristineNo ratings yet

- SEATWORK 04 - Leases: Multiple ChoiceDocument9 pagesSEATWORK 04 - Leases: Multiple ChoiceLilii DsNo ratings yet

- This Study Resource Was: F-ACADL-01Document8 pagesThis Study Resource Was: F-ACADL-01Marjorie PalmaNo ratings yet

- PRELEC1 Final ExamDocument4 pagesPRELEC1 Final ExamAramina Cabigting BocNo ratings yet

- Activity Debt Restructuring LeaseDocument2 pagesActivity Debt Restructuring LeaseLory Dela PeñaNo ratings yet

- 7.29.22 - PM - Loans and Receivables Long TermDocument4 pages7.29.22 - PM - Loans and Receivables Long TermAether SkywardNo ratings yet

- Mary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Document5 pagesMary The Queen College of Pampanga Department of Accountancy Intermediate Accounting 2Angela TuazonNo ratings yet

- This Study Resource Was: Fellowship Baptist College College of Business and AccountancyDocument5 pagesThis Study Resource Was: Fellowship Baptist College College of Business and AccountancyNah HamzaNo ratings yet

- 6988 Finance Lease LesseeDocument2 pages6988 Finance Lease LesseeFREE MOVIESNo ratings yet

- 2 - ACG015 - Intermediate Accounting Part 3 - QuestionnaireDocument5 pages2 - ACG015 - Intermediate Accounting Part 3 - Questionnairedavis lizardaNo ratings yet

- ENGINEERING ECONOMY PRACTICE PROBLEMSDocument2 pagesENGINEERING ECONOMY PRACTICE PROBLEMSRyan CalicaNo ratings yet

- Finance Lease - Lessee: Aklan Catholic CollegeDocument9 pagesFinance Lease - Lessee: Aklan Catholic CollegeLouiseNo ratings yet

- Bridging Instruction Program College of Accounting Education 1 Semester SY2021-2022Document8 pagesBridging Instruction Program College of Accounting Education 1 Semester SY2021-2022gelNo ratings yet

- ACCOUNTING3Document3 pagesACCOUNTING3Cj SernaNo ratings yet

- Intacc Finals Sw&QuizzesDocument57 pagesIntacc Finals Sw&QuizzesIris FenelleNo ratings yet

- ACCT203 LeaseDocument4 pagesACCT203 LeaseSweet Emme100% (1)

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Accounting Process 3Document2 pagesAccounting Process 3Glen JavellanaNo ratings yet

- Inacct3 Module 3 QuizDocument7 pagesInacct3 Module 3 QuizGemNo ratings yet

- Use The Following Information To Answer Items 1 To 4Document4 pagesUse The Following Information To Answer Items 1 To 4Chris Jay LatibanNo ratings yet

- Applied Auditing Leases MC QuestionsDocument7 pagesApplied Auditing Leases MC Questionsshinebakayero hojillaNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoRaymond RosalesNo ratings yet

- Answers - Lessor Accounting and SLBDocument10 pagesAnswers - Lessor Accounting and SLBPoru SenpiiNo ratings yet

- Intangibles QuizDocument4 pagesIntangibles QuizXytusNo ratings yet

- Level 1 Questions FinalDocument10 pagesLevel 1 Questions FinalExequielCamisaCrusperoNo ratings yet

- Ad2 1Document13 pagesAd2 1MarjorieNo ratings yet

- This Study Resource Was: Borrowing Cost, Impairment of Asset, Income TaxDocument6 pagesThis Study Resource Was: Borrowing Cost, Impairment of Asset, Income TaxNah HamzaNo ratings yet

- Sale and Leaseback Accounting QuestionsDocument28 pagesSale and Leaseback Accounting QuestionsEdrickLouise DimayugaNo ratings yet

- Module 9-DIRECT FINANCING LEASE - LESSORDocument10 pagesModule 9-DIRECT FINANCING LEASE - LESSORJeanivyle CarmonaNo ratings yet

- Assignment 02 Leases-SolutionDocument7 pagesAssignment 02 Leases-SolutionJaziel SestosoNo ratings yet

- Discussion Problems: FAR.2928-Notes Payable OCTOBER 2020Document3 pagesDiscussion Problems: FAR.2928-Notes Payable OCTOBER 2020John Nathan KinglyNo ratings yet

- INTAC3 McsDocument10 pagesINTAC3 Mcsrachel banana hammockNo ratings yet

- Mock Board Exam QuestionsDocument7 pagesMock Board Exam QuestionsKenneth Christian WilburNo ratings yet

- Lease AnalysisDocument5 pagesLease AnalysisJust JhexNo ratings yet

- FAR.2906 - PPE-Depreciation and Derecognition.Document4 pagesFAR.2906 - PPE-Depreciation and Derecognition.John Nathan KinglyNo ratings yet

- Guided Exercise1Document2 pagesGuided Exercise1Kim Nicole ReyesNo ratings yet

- MSU-CBA Finance Lease Accounting ConceptsDocument4 pagesMSU-CBA Finance Lease Accounting ConceptsJayr BVNo ratings yet

- LeasesDocument3 pagesLeasesAngelica Rome EnriquezNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- Long Quiz Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Document4 pagesLong Quiz Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesNo ratings yet

- Accounting For Leases by J. GonzalesDocument7 pagesAccounting For Leases by J. GonzalesGonzales JhayVeeNo ratings yet

- NFJPIA - Mockboard 2011 - P2 PDFDocument6 pagesNFJPIA - Mockboard 2011 - P2 PDFLei LucasNo ratings yet

- Case 1Document10 pagesCase 1Shawn VerzalesNo ratings yet

- Marine Engineering Problems Chapter 11 & 12Document24 pagesMarine Engineering Problems Chapter 11 & 12Sean AustinNo ratings yet

- NP & Debt Restructuring HO - 2064575149Document3 pagesNP & Debt Restructuring HO - 2064575149JOHANNANo ratings yet

- Usc Part 2020 (Far) - RetakeDocument25 pagesUsc Part 2020 (Far) - RetakeVince AbabonNo ratings yet

- Discussion Problems: FAR.2828-Notes Payable MAY 2020Document3 pagesDiscussion Problems: FAR.2828-Notes Payable MAY 2020stephen poncianoNo ratings yet

- Quizzes Midterm To Finals OnlyDocument40 pagesQuizzes Midterm To Finals OnlyMikasa MikasaNo ratings yet

- Afar 2019Document10 pagesAfar 2019Richard VictoriaNo ratings yet

- BFJPIA Cup Level 3 P1Document9 pagesBFJPIA Cup Level 3 P1Blessy Zedlav LacbainNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Why Catholic Church Study About MaryDocument1 pageWhy Catholic Church Study About MaryVencint LaranNo ratings yet

- Statistical TablesDocument10 pagesStatistical TablesramanatenaliNo ratings yet

- Laput AuditingDocument1 pageLaput AuditingVencint LaranNo ratings yet

- Subject Code Subject Name Time Days Instructor Room NumberDocument2 pagesSubject Code Subject Name Time Days Instructor Room NumberVencint LaranNo ratings yet

- Ǒ / N of Values The Sample NDocument2 pagesǑ / N of Values The Sample NVencint LaranNo ratings yet

- Comp 3 Introduction To Hypothesis TestingDocument11 pagesComp 3 Introduction To Hypothesis TestingVencint LaranNo ratings yet

- Ǒ / N of Values The Sample NDocument2 pagesǑ / N of Values The Sample NVencint LaranNo ratings yet

- PRO ED 10 - IM #1 - ChalkboardsDocument2 pagesPRO ED 10 - IM #1 - ChalkboardsMaricel SanchezNo ratings yet

- Auditing Problem Test Bank 1Document14 pagesAuditing Problem Test Bank 1EARL JOHN Rosales100% (5)

- ED TECH 10 - 1.2 (For CLASSROOM)Document3 pagesED TECH 10 - 1.2 (For CLASSROOM)Vencint LaranNo ratings yet

- Identify Errors in Sample Test QuestionnairesDocument6 pagesIdentify Errors in Sample Test QuestionnairesVencint LaranNo ratings yet

- Chapter 1: The Overview of AuditingDocument1 pageChapter 1: The Overview of AuditingVencint LaranNo ratings yet

- Audit of Intangible Assets ReportDocument10 pagesAudit of Intangible Assets ReportVencint LaranNo ratings yet

- Chapter 5. Using and Evaluating Instructional MaterialsDocument1 pageChapter 5. Using and Evaluating Instructional MaterialsVencint LaranNo ratings yet

- Jesus Christ: Mission and PersonDocument10 pagesJesus Christ: Mission and PersonVencint Laran100% (1)

- Marvin Basiao CRIM 1 - Theo MidtermDocument3 pagesMarvin Basiao CRIM 1 - Theo MidtermVencint LaranNo ratings yet

- Prayer Before Study: Saint Joseph College, Maasin, Leyte Maasin City, Southern Leyte College of Teacher EducationDocument4 pagesPrayer Before Study: Saint Joseph College, Maasin, Leyte Maasin City, Southern Leyte College of Teacher EducationVencint LaranNo ratings yet

- JV TheoDocument1 pageJV TheoVencint LaranNo ratings yet

- Theology Essay 10 CommandmentsDocument2 pagesTheology Essay 10 CommandmentsVencint LaranNo ratings yet

- III. Systematic Approach To TeachingDocument3 pagesIII. Systematic Approach To TeachingVencint LaranNo ratings yet

- CLINTDocument1 pageCLINTVencint LaranNo ratings yet

- Subject Code Subject Name Time Days Instructor Room NumberDocument2 pagesSubject Code Subject Name Time Days Instructor Room NumberVencint LaranNo ratings yet

- Audit Adjusting Entries 2Document1 pageAudit Adjusting Entries 2Vencint LaranNo ratings yet

- CLINTDocument1 pageCLINTVencint LaranNo ratings yet

- Laran ScriptDocument1 pageLaran ScriptVencint LaranNo ratings yet

- ScriptDocument1 pageScriptVencint LaranNo ratings yet

- Premid Laran Napuli Santoya Laput BSA 3-BDocument22 pagesPremid Laran Napuli Santoya Laput BSA 3-BVencint LaranNo ratings yet

- Vencint C. Laran BSA 2 B Quiz No. 4Document1 pageVencint C. Laran BSA 2 B Quiz No. 4Vencint LaranNo ratings yet

- Persuasive Essay Rubric: Screen Printrubric&Rubric - Id 1191700&phpsessidDocument2 pagesPersuasive Essay Rubric: Screen Printrubric&Rubric - Id 1191700&phpsessidVencint LaranNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- INTEREST & TIME VALUE OF MONEY (Part 1Document13 pagesINTEREST & TIME VALUE OF MONEY (Part 1Christelle PaulaNo ratings yet

- FINANCIAL INSTRUMENTS MCQNDocument3 pagesFINANCIAL INSTRUMENTS MCQNJoelo De Vera100% (1)

- FIN 4610 HW 3Document19 pagesFIN 4610 HW 3Michelle Lam50% (2)

- INVESTOR S PERCEPTION TOWARDS MUTUAL FUNDS Project ReportDocument53 pagesINVESTOR S PERCEPTION TOWARDS MUTUAL FUNDS Project ReportPallavi Pallu100% (1)

- Financial Instrument - (NEW)Document11 pagesFinancial Instrument - (NEW)AS Gaming100% (1)

- Frank Sillman Expert Report 9019 Filing in ResCap Bankruptcy 2013-10-18Document142 pagesFrank Sillman Expert Report 9019 Filing in ResCap Bankruptcy 2013-10-18Marie McDonnellNo ratings yet

- The Economic Times Wealth - July 4 2022Document26 pagesThe Economic Times Wealth - July 4 2022Persio AcevedoNo ratings yet

- MQF Syllabus 22 390 611Document3 pagesMQF Syllabus 22 390 611Economiks PanviewsNo ratings yet

- Banking and Insurance Laws Project AssigmentDocument7 pagesBanking and Insurance Laws Project AssigmentmandiraNo ratings yet

- Mutual Fund 700questions and Answers PDFDocument36 pagesMutual Fund 700questions and Answers PDFAishwarya Kumar Pandey82% (22)

- Workingcapitalmanagement-Lecture (Student)Document19 pagesWorkingcapitalmanagement-Lecture (Student)Christoper SalvinoNo ratings yet

- Mishkin Econ13e PPT 01Document35 pagesMishkin Econ13e PPT 01Omar 11No ratings yet

- Chapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationDocument27 pagesChapter 10 Test Bank Subsidiary Preferred Stock, Cosolidated Earnings Per Share, and Consolidated Income TaxationAlfi Wahyu TifaniNo ratings yet

- Chapter 26Document69 pagesChapter 26PenPencil123No ratings yet

- Case Summary Financial Management-II: "The Loewen Group, Inc. (Abridged) "Document4 pagesCase Summary Financial Management-II: "The Loewen Group, Inc. (Abridged) "Rishabh Kothari100% (1)

- Sources of Long Term FinanceDocument14 pagesSources of Long Term FinanceRakesh GuptaNo ratings yet

- Two Faces of Debt PDFDocument22 pagesTwo Faces of Debt PDFApril Clay0% (1)

- INDEMNITYBONDtemplateDocument2 pagesINDEMNITYBONDtemplateAlberto Martinez100% (1)

- APANIDocument682 pagesAPANIHaaaaardikNo ratings yet

- Important MCQDocument37 pagesImportant MCQParminder Singh55% (11)

- ACNOWLEDGEMENTDocument34 pagesACNOWLEDGEMENTÇhìràñjît KúmàrNo ratings yet

- Reliance Petroleum Project ReportDocument52 pagesReliance Petroleum Project ReportDNYANKUMAR SHENDENo ratings yet

- Articles of IncorporationDocument5 pagesArticles of IncorporationDave Lumasag CanumhayNo ratings yet

- Impact of Currency Fluctuations On Indian Stock MarketDocument5 pagesImpact of Currency Fluctuations On Indian Stock MarketShreyas LavekarNo ratings yet

- Chap 005Document11 pagesChap 005Mohammed FahadNo ratings yet

- 75766bos61307-P2 Important ThingsDocument26 pages75766bos61307-P2 Important ThingsVishal AgarwalNo ratings yet

- DBF SyllabusDocument14 pagesDBF SyllabuschakradharbhandariNo ratings yet

- General Math Module Week 1-8Document25 pagesGeneral Math Module Week 1-8Marylyn MirandaNo ratings yet

- Long-Term Liabilities Chapter SummaryDocument45 pagesLong-Term Liabilities Chapter SummaryMhmood Al-saadNo ratings yet

- FormulaDocument10 pagesFormulaAngel Alejo Acoba100% (1)