Professional Documents

Culture Documents

Annex A.1 Checklist of Mandatory Requirements

Annex A.1 Checklist of Mandatory Requirements

Uploaded by

Kimberly MayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annex A.1 Checklist of Mandatory Requirements

Annex A.1 Checklist of Mandatory Requirements

Uploaded by

Kimberly MayCopyright:

Available Formats

Annex “A.

1”

REPUBLIC OF THE PHILIPPINES

Bureau of Internal Revenue

(Name of Processing/Investigating Office)

Revised Checklist of Mandatory Requirements on Claims for VAT Refund

Pursuant to Section 112(A) of the Tax Code of 1997, as Amended by R.A. No. 10963

Name of Claimant Period of Claim .

Taxpayer Identification No. (TIN) Amount of Claim Php

Address Number of Folders:

Main

Name of Authorized Representative Supporting

Tel. No. / Fax No.

Note: a. Indicate √ for documents submitted and NA for documents not applicable on the space provided for.

b. All required schedules shall be in MS Excel format and in hard and soft copies (stored in flash drive/memory stick).

c. Certifications and affidavits from the claimant or its authorized representative shall be the original document

d. Documents obtained from other sources (government agencies and corporations or individuals) shall be certified by the issuing agency or person

e. All documents obtained abroad shall be consularized with English transalation in case the document is written in foreign language other than English

1. FOR INITIAL APPLICANTS ONLY (Permanent files in a separate folder) 3.3 For sale of services to non-resident foreign corporation (NRFC) covered

1.1 Copy of SEC Reg./Articles of Incorporation and By-Laws (for under Sec. 108(B)(2), proofs that the NRFC-buyer of the services is not

corporation/partnership) doing business in the Philippines particularly the certification from the

1.2 DTI Registration (for single proprietorship) SEC that the NRFC is not a registered corporation in the Philippines and

2. GENERAL REQUIREMENTS certificate of foreign registration/incorporation/association of the NRFC

2.1 Copy of payment of Annual Registration Fee for the period of claim 3.4 For sale of services to companies engaged in international shipping or air

2.2 Latest General Information Sheet duly received by SEC transport under Sec.108(B)(4), certification from the appropriate

2.3 3 Copies of Application for Tax Credit/Refund (BIR Form No. 1914), with duly government agency/ies, copy of the certificate of foreign

notarized affidavit as to the breakdown of claim between local purchases and registration/incorporation/association of the NRFC, and service contracts

importation, if applicable or other acceptable documents to prove that the shipping

2.4 Copy of the following quarterly VAT returns, duly certified by the BIR Office agency/manning agency is dealing with foreign principals and clients

where the claimant is registered (except for returns filed through eFPS): that are engaged in international shipping or air transport

2.4.1 corresponding to the period of claim 3.5 Copy of BIR Authority to Print/Pemit to use:

2.4.2 corresponding to the quarter showing the deduction of TCC/refund 3.5.1 Loose-leaf sales invoices and other accountable forms

claim from the available input tax which must be filed on or before the 3.5.2 Printed and bound sales invoices, ORs and other accountable forms

date of application of the VAT refund 3.5.3 Computerized Accounting System, Computerized Books of

2.5 Certified true copy of Annual Income Tax Return (AITR)/Quarterly Income Accounts (CBAs) and components thereof with system-generated

Tax Return (QITR), whichever is applicable (Except for tax return filed accountable forms

through eFPS, the above AITR/QITR should be certified by the BIR Office 4. LOCAL PURCHASES OF GOODS AND SERVICES

where the taxpayer/claimant is registered.) 4.1 Schedule of Purchases (Master Schedule with input tax for the period of

2.6 Audited Financial Statements (AFS) with complete Notes to AFS covering the claim with details following the prescribed format in Annex A.1.6)

year of claim, certified as "true copy" by the Accounting Manager, Finance 4.2 Photocopies of Sales Invoices for purchase of goods or ORs with

Officer or any authorized responsible officer of the taxpayer/claimant. For Statements of Account/Billing Statements/equivalent documents for

quarterly claims where an Annual AFS has not yet been issued, Interim purchase of services (arranged in accordance with the schedule required

Financial Statement covering the period covered by the claim duly signed by under 4.1)

the company's Finance Officer or Accounting Officer and/or with attestation 4.3 Schedule of Big-Ticket purchases classified per supplier and in the same

from an external auditor format prescribed under 4.1 together with the proof of payment for "big

2.7 Sworn statement by the claimant certifying the following: ticket" purchases, such as but not limited to cancelled paid

a. The amount of sales declared with breakdown as to amount of zero-rated, checks/certified copy of bank statements or equivalent documents

taxable and exempt sales; (arranged in accordance with the chronology of purchases as shown in

b. The company did not file any and/or will not file any similar claim from the schedule)

another BIR office and/or the DOF-OSS (for claims with importation); and 5. FOREIGN CURRENCY REMITTANCES

c. The ending inventory as of close of the period being claimed has been used 5.1 Reconciliation of Export Sales and Foreign Currency Remittances with

directly/indirectly in the products exported, if applicable documentary proofs of inward remittance of foreign currency from

2.8 Delinquency Verification Certificate [valid for six (6) months]: export sale of goods/services following the format prescribed in Annexes

a. For non-Large Taxpayers: (1) Collection Division of the respective region A.1.7 or A.1.8, whichever is applicable

and (2) Accounts Receivable Monitoring Division 5.2 Schedule of off-setting of receivables and payables if company has off-

b. For Large Taxpayers: (1) LT Collection Enforcement Division/LT setting agreement with foreign affiliates/companies, with supporting

Division Cebu/Davao and (2) Accounts Receivable Monitoring Division documents

2.9 For claims with input VAT on importation, certification from DOF-OSS Center 6. IMPORTATION OF GOODS [in two (2) sets to include the requirement for BOC]

that the claimant has not filed a similar claim(s) covering the same period 6.1 Schedule of Importations for the period of claim with details following the

2.10 For effectively zero-rated transactions, copy of the approved application for format prescribed in Annex A.1.9

zero-rating issued by the appropriate BIR office, if applicable 6.2 VAT Payment Certification issued by the BOC Revenue Accounting

2.11 Notarized Secretary's Certificate (for corporate claimant)/Special Power of Division for importation in the current year, including the amortized

Attorney (for individual claimant) stating the authorized representatives to portion of input VAT, if no previous certification was issued, on

file, sign documents on behalf of the company and/or follow-up VAT refund importation of capital goods exceeding the P1M threshold

claims together with at least one (1) valid government-issued ID 6.3 Import Entry and Internal Revenue Declarations (IERD) and/or Single

2.12 Notarized sworn declaration of taxpayer's profile (Annex A.1.1) Administrative Document (SAD), Statement of Settlement of Duties and

2.13 Notarized sworn certification as to the completeness of the documents Taxes (SSDT) and Commercial Invoices duly authenticated by the BOC

submitted (Annex "B") 7. SERVICES RENDERED BY NON-RESIDENTS

2.14 Sworn statement stating the completeness and authenticity of the following: 7.1 Schedule of income payments to non-residents as supported with BIR

a. Sales Invoices and AWB/BL for sale of goods, or Official Receipts with Form No. 1600 with proof of payment

Billing Statements/Statements of Account with Service Contracts/Job Order 8. FOR INDIRECT EXPORTERS/TAXPAYERS ENGAGED IN RENEWABLE

or any equivalent document to support the OR issued for sale of services; ENERGY (RE)

b. Sales Invoices for purchase of goods or ORs with Statement of 8.1 Registration Certificate with latest Annual Letter of Incentives of customer

Accounts/Billing Statements with Service Contracts/Job Order or any registered with BOI/PEZA/other Investment Promotion Agencies

equivalent document for purchase of services; and 8.2 Certificate of Registration of the claimant with other government agencies

c. If the claim includes input VAT on importations, Import Entry and Internal stating the exemption from VAT, if applicable

Revenue Declarations (IERD) and/or Single Administrative Document 8.3 For RE Claimants, the following documents are required on a per

(SAD), Statement of Settlement of Duties and Taxes (SSDT) and transaction or project basis:

Commercial Invoices a. Certificate of Registration and Accreditation issued by the

3. SALE OF GOODS OR SERVICES Department of Energy (DOE); and

3.1 Schedule of Zero-Rated, Exempt and Taxable Sales with details following the b. Certificate of Endorsement from the DOE, through the RE

prescribed format in Annexes A.1.2, A.1.3, A.1.4 and A.1.5 Management Bureau

3.2 Photocopies of Sales Invoices and Airway Bill/Bill of Lading for sale of goods, 9. OTHER REQUIREMENTS

or Official Receipts with Billing Statements/Statements of Account with 9.1 Schedule of Other Income, if applicable

Service Contracts/Job Order or any equivalent document to support the OR 9.2 Schedule of Property, Plant & Equipment (PPE) Additions per FS

issued for sale of services (arranged in accordance with the schedule required following the prescribed format in Annex A.1.10

under 3.1). For sales of goods to special economic zones, copy of the 9.3 Copy of support for Creditable VAT Withheld, if applicable

corresponding delivery receipt is required.

CHECKED BY ACKNOWLEDGED BY:

Signature Over Printed Name Date Claimant's Authorized Representative Date

You might also like

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Federal Rules of Civil Procedure: Hyperlinked, #2From EverandFederal Rules of Civil Procedure: Hyperlinked, #2Rating: 5 out of 5 stars5/5 (1)

- English Society 1580-1680Document229 pagesEnglish Society 1580-1680reditis100% (3)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Rmo 32-01Document5 pagesRmo 32-01matinikkiNo ratings yet

- English SlangDocument76 pagesEnglish SlangticosmNo ratings yet

- DOLE - DO 174 RenewalDocument5 pagesDOLE - DO 174 Renewalamadieu50% (4)

- Lesson-Elections and Party System-Philippine Politics and GovernanceDocument42 pagesLesson-Elections and Party System-Philippine Politics and GovernanceBrynn EnriquezNo ratings yet

- Change of Business Name & Status Form - 10192017Document21 pagesChange of Business Name & Status Form - 10192017successonthemaking100% (1)

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Shaban Advice From Kanz Al Najah Wal SuroorDocument5 pagesShaban Advice From Kanz Al Najah Wal SuroorDawudIsrael1No ratings yet

- Application Form For End User Certificate UnderDocument4 pagesApplication Form For End User Certificate Underakashaggarwal88No ratings yet

- Check List For Redemption-EODC - Advance AuthorisationDocument3 pagesCheck List For Redemption-EODC - Advance AuthorisationChintan Shah /CEO's Office /SreiNo ratings yet

- RMO 072-2010 - Application of Tax Treaty ReliefDocument18 pagesRMO 072-2010 - Application of Tax Treaty ReliefEmil A. MolinaNo ratings yet

- PCAB LicenseDocument8 pagesPCAB LicenseJaypee OrtizNo ratings yet

- Delay and Disruption Claims Martin Waldron BL March 2014 PDFDocument32 pagesDelay and Disruption Claims Martin Waldron BL March 2014 PDFMumthaz ahamedNo ratings yet

- BIR Ruling DA - VAT-021 121-10Document3 pagesBIR Ruling DA - VAT-021 121-10Jemila Paula Diala100% (1)

- Provisional Work Permit (PWP)Document1 pageProvisional Work Permit (PWP)Enika GarciaNo ratings yet

- Final TYBMS Black BookDocument102 pagesFinal TYBMS Black Booknisha shetty100% (1)

- The Economics of Honey ProductionDocument69 pagesThe Economics of Honey ProductionJoseph Antony StiglitzNo ratings yet

- IAS PROFESSION KP Analysis PDFDocument5 pagesIAS PROFESSION KP Analysis PDFProfessorAsim Kumar Mishra100% (2)

- Annex A.1 - Checklist Per Sec 112ADocument1 pageAnnex A.1 - Checklist Per Sec 112AGlaze LlagasNo ratings yet

- Annex A.1 - Checklist Per Sec 112ADocument4 pagesAnnex A.1 - Checklist Per Sec 112AJhovanny Guillermo GacusanaNo ratings yet

- RMC No. 71-2023 Annex A.1Document2 pagesRMC No. 71-2023 Annex A.1Ron Andi RamosNo ratings yet

- 19996-2010-Guidelines On The Processing of Tax Treaty20210424-12-O8b2ssDocument14 pages19996-2010-Guidelines On The Processing of Tax Treaty20210424-12-O8b2ssAlea MalabananNo ratings yet

- Rmo 72-2010Document9 pagesRmo 72-2010alexandra_lorenceNo ratings yet

- X For Documents Not Submitted and NA For Documents Not ApplicableDocument1 pageX For Documents Not Submitted and NA For Documents Not ApplicableGedan TanNo ratings yet

- 19996-2010-Guidelines On The Processing of Tax Treaty20190214-5466-V0i80v PDFDocument12 pages19996-2010-Guidelines On The Processing of Tax Treaty20190214-5466-V0i80v PDFCarla CucuecoNo ratings yet

- Bir 072-10Document25 pagesBir 072-10Emil A. MolinaNo ratings yet

- Rmo 72-2010 PDFDocument18 pagesRmo 72-2010 PDFJill b.No ratings yet

- Rmo 72 2010Document11 pagesRmo 72 2010Alyssa BorjaNo ratings yet

- Dots Amendment MMT v2Document19 pagesDots Amendment MMT v2mikhailNo ratings yet

- Rmo 72-2010Document19 pagesRmo 72-2010Abigail JamiasNo ratings yet

- ANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)Document4 pagesANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)akashaggarwal88No ratings yet

- Upgrading of Category Application Form - 11192018Document24 pagesUpgrading of Category Application Form - 11192018Maria Ana Velez CruzNo ratings yet

- New Special License by A Foreign Contractor Application: Checklist of Requirements RemarksDocument19 pagesNew Special License by A Foreign Contractor Application: Checklist of Requirements RemarksLenin Rey PolonNo ratings yet

- PCABDocument19 pagesPCABAmapola BulusanNo ratings yet

- New Special License by A Foreign Contractor Application: Checklist of Requirements RemarksDocument19 pagesNew Special License by A Foreign Contractor Application: Checklist of Requirements RemarksLouis LeeNo ratings yet

- Documents Which Must Be Submitted Cornersteel Systems Corporation Per RMC 47Document2 pagesDocuments Which Must Be Submitted Cornersteel Systems Corporation Per RMC 47JT GalNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707 Capital Gains Tax ReturnJenel ChuNo ratings yet

- Tax Sparing - List of Documentary Requirements (RMC 46-20)Document3 pagesTax Sparing - List of Documentary Requirements (RMC 46-20)Hailin QuintosNo ratings yet

- Chklist dm2 2020Document16 pagesChklist dm2 2020Bennur Rajib Arajam BarraquiasNo ratings yet

- Documents Required For Registration Under Service TaxDocument7 pagesDocuments Required For Registration Under Service TaxVinay SinghNo ratings yet

- Securities and Exchange Commission: Endorsement From Department of Energy For Energy Related Business ActivityDocument8 pagesSecurities and Exchange Commission: Endorsement From Department of Energy For Energy Related Business Activityrenzenzo92No ratings yet

- S40 Checklist Annex BDocument2 pagesS40 Checklist Annex BTootsieNo ratings yet

- Renewal of Special License by A Foreign Contractor ApplicationDocument18 pagesRenewal of Special License by A Foreign Contractor ApplicationLenin Rey PolonNo ratings yet

- Application Form For Commercial Broadcasting Licence March 2017Document15 pagesApplication Form For Commercial Broadcasting Licence March 2017francisNo ratings yet

- Application Form For Landing Rights Broadcasting LicenceDocument13 pagesApplication Form For Landing Rights Broadcasting LicenceKCSE REVISIONNo ratings yet

- Requirements Involving Land TransactionsDocument3 pagesRequirements Involving Land TransactionsRAPHY T ALANNo ratings yet

- Registration of Debt or Equity SecuritiesDocument5 pagesRegistration of Debt or Equity SecuritiesNoel CarpioNo ratings yet

- Application For Redemption / No Bond CertificateDocument4 pagesApplication For Redemption / No Bond Certificateakashaggarwal88100% (1)

- Checklist of Requirements If Dividend Is Exempt in The Country of DomicileDocument1 pageChecklist of Requirements If Dividend Is Exempt in The Country of DomicileAlea MalabananNo ratings yet

- Application Form FOR Commercial Broadcasting Service LicenceDocument16 pagesApplication Form FOR Commercial Broadcasting Service LicenceKCSE REVISIONNo ratings yet

- Processing of Application For Registration 1Document37 pagesProcessing of Application For Registration 1Rhea Mae A. SibalaNo ratings yet

- SEC Amendment - Increase in Authorized CapitalDocument4 pagesSEC Amendment - Increase in Authorized CapitalGerryNo ratings yet

- SEBI Non Linked Schemes Under Us GovtDocument23 pagesSEBI Non Linked Schemes Under Us GovtPSPLNo ratings yet

- ChecklistDocument2 pagesChecklistRizafe RamosNo ratings yet

- Annex B4Document1 pageAnnex B4Idan AguirreNo ratings yet

- Do 174Document4 pagesDo 174Marissa QuevedoNo ratings yet

- Application For Authority To Use Computerized Accounting System or Components Thereof/ Loose-Leaf Books of AccountsDocument4 pagesApplication For Authority To Use Computerized Accounting System or Components Thereof/ Loose-Leaf Books of AccountsJoy Superales SalaoNo ratings yet

- RMC 77-21 (Checklist - Business Profits)Document2 pagesRMC 77-21 (Checklist - Business Profits)Hailin QuintosNo ratings yet

- HLF065 ChecklistOfRequirements Window1 V04Document2 pagesHLF065 ChecklistOfRequirements Window1 V04Alex Olivar, Jr.No ratings yet

- Checklist of Requirements For Pag-Ibig Home Rehabilitation/Reconstruction Loan Program (Regular)Document2 pagesChecklist of Requirements For Pag-Ibig Home Rehabilitation/Reconstruction Loan Program (Regular)Jireh DuhinaNo ratings yet

- HLF452 ChecklistRequirementsHRRLRegular V03 PDFDocument2 pagesHLF452 ChecklistRequirementsHRRLRegular V03 PDFFirmament DevelopmentNo ratings yet

- Supplemental To The Citizen - S Charter 2021 EditionDocument4 pagesSupplemental To The Citizen - S Charter 2021 EditionChristian Romar H. DacanayNo ratings yet

- BIR Form No. 0901-D DividendsDocument2 pagesBIR Form No. 0901-D DividendsKoji ZerofourNo ratings yet

- New Contractor's License Application Form - 101920172Document25 pagesNew Contractor's License Application Form - 101920172Aljohn SebucNo ratings yet

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaNo ratings yet

- BIR List of Top Tax Payers Inclusiton Non-Individual F Page 7Document1 pageBIR List of Top Tax Payers Inclusiton Non-Individual F Page 7Jemila Paula DialaNo ratings yet

- Is A PHL Tax Residency Certificate Relevant To My CorporationDocument4 pagesIs A PHL Tax Residency Certificate Relevant To My CorporationJemila Paula DialaNo ratings yet

- Is A PHL Tax Residency Certificate Relevant To My CorporationDocument4 pagesIs A PHL Tax Residency Certificate Relevant To My CorporationJemila Paula DialaNo ratings yet

- Denied VAT Refund Application Alternatives - RMCs and RulingsDocument2 pagesDenied VAT Refund Application Alternatives - RMCs and RulingsJemila Paula DialaNo ratings yet

- Pestilos vs. GenerosoDocument10 pagesPestilos vs. GenerosoTin Tin0% (1)

- Fuqua School of Business: Mbamission'S Insider'S GuideDocument71 pagesFuqua School of Business: Mbamission'S Insider'S GuidepnkNo ratings yet

- Detail Section: Trough UrinalDocument1 pageDetail Section: Trough UrinalmarkeesNo ratings yet

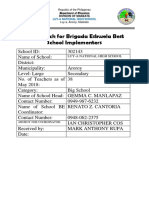

- 2018 Search For Brigada Eskwela Best School Implementers: Luy-A National High SchoolDocument1 page2018 Search For Brigada Eskwela Best School Implementers: Luy-A National High SchoolMarah CedilloNo ratings yet

- DropboxDocument3 pagesDropboxilies claudiaNo ratings yet

- Full Download Test Bank For General Organic and Biological Chemistry Structures of Life 6th Edition Karen C Timberlake PDF Full ChapterDocument21 pagesFull Download Test Bank For General Organic and Biological Chemistry Structures of Life 6th Edition Karen C Timberlake PDF Full Chapterhastilyslockingdott0o100% (16)

- Annexure To Trading & Demat Account Opening Form: Power of Attorney (This Document Is Voluntary)Document3 pagesAnnexure To Trading & Demat Account Opening Form: Power of Attorney (This Document Is Voluntary)Consultant NowFoundationNo ratings yet

- Internship Report ANURAG NewDocument32 pagesInternship Report ANURAG NewMusic LoverNo ratings yet

- Business Studies ProjectDocument2 pagesBusiness Studies ProjectRupalNo ratings yet

- The Importance of Cost ControlDocument36 pagesThe Importance of Cost ControlfajarNo ratings yet

- Chapter 14Document3 pagesChapter 14omar anwarNo ratings yet

- Assignment On HR ViolationDocument18 pagesAssignment On HR ViolationFahim IstiakNo ratings yet

- FBDC v. CIRDocument16 pagesFBDC v. CIRNester MendozaNo ratings yet

- Tan Boon Bee V JarencioDocument2 pagesTan Boon Bee V JarencioPeperoniiNo ratings yet

- Full Jet Powered by Baozun - 2021 China EC Digital ReportDocument12 pagesFull Jet Powered by Baozun - 2021 China EC Digital Reportzackandrian25No ratings yet

- LogDocument36 pagesLogNica SeradNo ratings yet

- Winston Farm Scoping Document August 2022Document50 pagesWinston Farm Scoping Document August 2022Daily FreemanNo ratings yet

- I. Confucius (551-479 BCE) : (206 BCE-220 CE), Tang (618-907 CE), and Song (960-1296 CE)Document6 pagesI. Confucius (551-479 BCE) : (206 BCE-220 CE), Tang (618-907 CE), and Song (960-1296 CE)Diane RamentoNo ratings yet

- Directors ProfileDocument8 pagesDirectors ProfileSyed Ahmed ShahNo ratings yet

- Meynard Aguilar-Mapping of CurriculumDocument7 pagesMeynard Aguilar-Mapping of CurriculumMeynard AguilarNo ratings yet

- Certainty in An Uncertain WorldDocument29 pagesCertainty in An Uncertain WorldPeter John IntapayaNo ratings yet

- Unit6 Competitions: Stay Carry Get Break Be Hunt Invite Cause Take Live Deliver Study Close Drive AttendDocument12 pagesUnit6 Competitions: Stay Carry Get Break Be Hunt Invite Cause Take Live Deliver Study Close Drive AttendMayphotocopycanon SecondhandNo ratings yet