Professional Documents

Culture Documents

BIR Form 1914 Application

Uploaded by

Francisco TaquioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR Form 1914 Application

Uploaded by

Francisco TaquioCopyright:

Available Formats

Republic of the Philippines

Department of Finance

Bureau of Internal Revenue

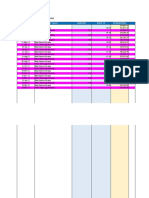

BIR Form No.

Application for Tax

1914 Credits/Refunds

April 2019 (ENCS) Enter all required information in CAPITAL LETTERS using BLACK ink. Mark all applicable

boxes with an “X”. Two copies MUST be filed with the BIR and one held by the Taxpayer. 1914 04/19ENCS

Part I – Background Information

1 Taxpayer Identification Number (TIN) - - - 2 RDO Code

3 Taxpayer’s Name (Last Name, First Name, Middle Name for Individual OR Registered Name for Non-Individual)

4 Registered Address (Indicate complete address. If branch, indicate the branch address. If the registered address is different from the current address, go to the RDO to update registered address by using BIR Form No. 1905)

4A ZIP Code

5 Contact Number 6 Email Address

Part II – Details of Tax Credits/Refunds

7 Tax Type 8 Period Covered (MM/DD/YYYY) 9 Mode of Claim

(From) (To)

Tax Refund Tax Credit Certificate

10 Claim Amount

10A Bureau of Internal Revenue (BIR) .

10B Bureau of Customs (BOC) .

11 Total Claim Amount (Sum of Items 10A to 10B) .

Part III – Reason for Filing

12 Reason for Filing the Claim

12A Refunds or Tax Credits of Input Tax 12D Overpayment

12B Claim Arising from Special Laws / Tax Treaties 12E Regular Excise Claims

12C Claim Arising from Erroneous Payment of Taxes 12F Others (please specify)

Part IV - Legal Provision

13 Legal Basis

I/We declare under the penalties of perjury that this application has been made in good faith, verified by me/us, and to the best of my/our Stamp of Receiving

knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations Office

issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information as contemplated under the *Data (RO's Signature)

Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes. (If Authorized Representative, attach Authorization Letter)

For Individual: For Non-Individual:

Signature over Printed Name of Taxpayer/Authorized Signature over Printed Name of President/Vice President/Authorized Officer

Representative/Tax Agent (Indicate Title/Designation and TIN) or Representative/Tax Agent (Indicate Title/Designation and TIN)

Agent Acc. No./

Date of Issuance Date of Expiry

Attorney’s Roll No. (MM/DD/YYYY) (MM/DD/YYYY)

(if applicable)

*NOTE: Please read the BIR Data Privacy Policy found in the BIR website (www.bir.gov.ph)

You might also like

- 2250 Laws Against Business DebtDocument6 pages2250 Laws Against Business DebtWong AngelinaNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Philippines Capital Gains Tax Return Form 1707Document2 pagesPhilippines Capital Gains Tax Return Form 1707Anne VallaritNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Bir 1701a FormDocument2 pagesBir 1701a FormChe CacatianNo ratings yet

- 1604CDocument1 page1604CNguyen LinhNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Innovation Management Principles From Iso 50500 SeriesDocument15 pagesInnovation Management Principles From Iso 50500 SeriesEduardo Girón AguirreNo ratings yet

- The Global Pharmaceutical IndustryDocument8 pagesThe Global Pharmaceutical IndustryVelan10No ratings yet

- Introducing Base CorrelationsDocument4 pagesIntroducing Base CorrelationsLatoya AndersonNo ratings yet

- 37-BIR (1945) Certificate of Tax Exemption For CooperativeDocument2 pages37-BIR (1945) Certificate of Tax Exemption For CooperativeEditha Valenzuela67% (3)

- CIR v. Algue, Inc., G.R. No. L-28896Document1 pageCIR v. Algue, Inc., G.R. No. L-28896fay garneth buscato100% (2)

- Bir Form No. 1914Document1 pageBir Form No. 1914Mark Lord Morales BumagatNo ratings yet

- APPLICATION Tax Credits/Refunds FormDocument1 pageAPPLICATION Tax Credits/Refunds FormJoshua FortunoNo ratings yet

- Tax Amnesty Return On DelinquenciesDocument3 pagesTax Amnesty Return On DelinquenciesIML2016No ratings yet

- Acceptance Payment Form: Tax Amnesty On DelinquenciesDocument1 pageAcceptance Payment Form: Tax Amnesty On DelinquenciesJennyMariedeLeonNo ratings yet

- 33 Bir (1914)Document1 page33 Bir (1914)Kimberly MayNo ratings yet

- Application For Tax Credits / Refunds: Kawanihan NG Rentas InternasDocument1 pageApplication For Tax Credits / Refunds: Kawanihan NG Rentas InternasVincent Ryan TabarNo ratings yet

- Acceptance Payment Form Estate Tax AmnestyDocument1 pageAcceptance Payment Form Estate Tax AmnestyAlvin III SiapianNo ratings yet

- Annex A - 1701A Jan 2018Document2 pagesAnnex A - 1701A Jan 2018jeffrey josol100% (2)

- Bir FormsDocument25 pagesBir FormsAngel Mae ToreniadoNo ratings yet

- 1913 Final2 03.2023434341 2Document1 page1913 Final2 03.2023434341 2LandsNo ratings yet

- Annex C 0621-EADocument1 pageAnnex C 0621-EAMELLICENT LIANZANo ratings yet

- Documentary Stamp Tax BIR Form 200-OTDocument1 pageDocumentary Stamp Tax BIR Form 200-OTNGITPANo ratings yet

- BIR Form 1904 Application RegistrationDocument2 pagesBIR Form 1904 Application Registrationregine rose bantilanNo ratings yet

- BIR Form 1701A Filing GuideDocument3 pagesBIR Form 1701A Filing GuideRhon MarlNo ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Games NathanNo ratings yet

- Form 1945 - Application For Certificate of Tax Exemption For CooperativesDocument4 pagesForm 1945 - Application For Certificate of Tax Exemption For CooperativesDarryl Jay Medina100% (1)

- 1604-C Jan 2018 Final Annex A PDFDocument1 page1604-C Jan 2018 Final Annex A PDFAs Li NahNo ratings yet

- Annex A - 1701A Jan 2018 - RMC 17-2019Document2 pagesAnnex A - 1701A Jan 2018 - RMC 17-2019Joe75% (4)

- Annual Income Tax Return: Yes No Yes NoDocument4 pagesAnnual Income Tax Return: Yes No Yes NoRichelle Ann RodriguezNo ratings yet

- RMC No. 73-2019 - Annex ADocument1 pageRMC No. 73-2019 - Annex ALeo R.No ratings yet

- 1601 eDocument3 pages1601 eJulius Sangalang100% (1)

- BIR Form 1904 Application RegistrationDocument1 pageBIR Form 1904 Application RegistrationMariko DavidNo ratings yet

- Documentary Stamp Tax Declaration/ReturnDocument4 pagesDocumentary Stamp Tax Declaration/ReturnPajarillo Kathy AnnNo ratings yet

- BIR Payment Form for No Audit ProgramDocument1 pageBIR Payment Form for No Audit ProgramTzuyu TchaikovskyNo ratings yet

- 0619-E Jan 2018 Rev Final-1-1Document8 pages0619-E Jan 2018 Rev Final-1-1cahiligjoyceNo ratings yet

- Bir 1701Document4 pagesBir 1701Vanesa Calimag ClementeNo ratings yet

- Tax Amnesty Return: Pursuant To Republic Act No. 9480 For Taxable Year 2005 and Prior YearsDocument6 pagesTax Amnesty Return: Pursuant To Republic Act No. 9480 For Taxable Year 2005 and Prior Yearssoon2blawyer100% (2)

- 1600Document9 pages1600jbabellarNo ratings yet

- For BIR Use Only Capital Gains Tax ReturnDocument2 pagesFor BIR Use Only Capital Gains Tax ReturnMaricor TambalNo ratings yet

- BIR FORM 1604-F New FormDocument2 pagesBIR FORM 1604-F New FormJhen S. DomingoNo ratings yet

- 1604E Jan 2018 ENCS Final Annex BDocument2 pages1604E Jan 2018 ENCS Final Annex BFeds100% (1)

- Monthly Remittance Return of Withheld TaxesDocument3 pagesMonthly Remittance Return of Withheld TaxesJaime II LustadoNo ratings yet

- Pagsinag RA Forms March 2022Document15 pagesPagsinag RA Forms March 2022Angelica Perlyn AurelioNo ratings yet

- Application For Registration: Burce, Maryen Ammiel AbacanDocument1 pageApplication For Registration: Burce, Maryen Ammiel AbacanLalyn PasaholNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument1 pageApplication For Registration: Kawanihan NG Rentas InternasRyan TamondongNo ratings yet

- 1904 Jan 2000 Encs PDFDocument1 page1904 Jan 2000 Encs PDFRyan TamondongNo ratings yet

- BIR Form 1701-Jan-2018-Encs.-FinalDocument6 pagesBIR Form 1701-Jan-2018-Encs.-FinalJosent Marie FranciscoNo ratings yet

- Bir Form 1600Document44 pagesBir Form 1600Jerel John CalanaoNo ratings yet

- 1601E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pages1601E Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Ivan ChuaNo ratings yet

- Monthly Remittance Form: For Creditable Income Taxes Withheld (Expanded)Document1 pageMonthly Remittance Form: For Creditable Income Taxes Withheld (Expanded)Jonalyn BalerosNo ratings yet

- Monthly Remittance Return for VAT and Percentage TaxesDocument9 pagesMonthly Remittance Return for VAT and Percentage TaxesVincent De GuzmanNo ratings yet

- RMC No. 3-2020 Annex A - 1702Q 2018 PDFDocument3 pagesRMC No. 3-2020 Annex A - 1702Q 2018 PDFJemila Paula DialaNo ratings yet

- Certificate of Creditable Tax Withheld at SourceDocument36 pagesCertificate of Creditable Tax Withheld at SourceProbinsyana KoNo ratings yet

- RefundDocument1 pageRefundrichO991No ratings yet

- Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded)Document3 pagesMonthly Remittance Return of Creditable Income Taxes Withheld (Expanded)appipinnim100% (2)

- Monthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)Document2 pagesMonthly Remittance Form: of Creditable Income Taxes Withheld (Expanded)Derick MoranteNo ratings yet

- EWT For The OCT-23 PeriodDocument12 pagesEWT For The OCT-23 Periodqhi.cgmacatiagNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument1 pageApplication For Registration: Kawanihan NG Rentas InternasGorgeousNo ratings yet

- New Regular Contractor's License (SOLE - PROP) - 11192018Document27 pagesNew Regular Contractor's License (SOLE - PROP) - 11192018Francisco TaquioNo ratings yet

- EWB - App Form 07012020Document2 pagesEWB - App Form 07012020Francisco TaquioNo ratings yet

- RCBC Home Loan BrochureDocument2 pagesRCBC Home Loan BrochureRochelle VelezNo ratings yet

- SME Business Loan Application FormDocument2 pagesSME Business Loan Application FormFrancisco TaquioNo ratings yet

- Annual General Information Sheet for Stock CorporationDocument12 pagesAnnual General Information Sheet for Stock Corporationedgar sean galvezNo ratings yet

- RCBC Home Loan BrochureDocument2 pagesRCBC Home Loan BrochureRochelle VelezNo ratings yet

- Rule 1020 New Establishment RegistrationDocument1 pageRule 1020 New Establishment RegistrationFrancisco TaquioNo ratings yet

- MEMORANDUM CIRCULAR No. 2020-0030Document13 pagesMEMORANDUM CIRCULAR No. 2020-0030Francisco TaquioNo ratings yet

- Files Turned Over: Timpuyog Dagiti Umanamong Iti Benguet State University Internal Guarantee Systems IncDocument2 pagesFiles Turned Over: Timpuyog Dagiti Umanamong Iti Benguet State University Internal Guarantee Systems IncFrancisco TaquioNo ratings yet

- Office of The Secretary: Administrative OrderDocument15 pagesOffice of The Secretary: Administrative OrderFrancisco TaquioNo ratings yet

- The Difference Between IncDocument2 pagesThe Difference Between IncFrancisco TaquioNo ratings yet

- EWB - App Form 07012020Document2 pagesEWB - App Form 07012020Francisco TaquioNo ratings yet

- United Urban Indigent Farmers Organization, Inc. Purok Mangitit, Camp 7, Baguio CityDocument3 pagesUnited Urban Indigent Farmers Organization, Inc. Purok Mangitit, Camp 7, Baguio CityFrancisco TaquioNo ratings yet

- Registry of Establishments: Department of Labor and EmploymentDocument2 pagesRegistry of Establishments: Department of Labor and EmploymentFrancisco TaquioNo ratings yet

- 2306 Jan 2018 ENCS v4Document2 pages2306 Jan 2018 ENCS v4Mary Ann Pacariem100% (4)

- Registry of Establishments: Department of Labor and EmploymentDocument2 pagesRegistry of Establishments: Department of Labor and EmploymentFrancisco TaquioNo ratings yet

- RCBC Home Loan BrochureDocument2 pagesRCBC Home Loan BrochureRochelle VelezNo ratings yet

- 2307 Jan 2018 ENCS v3 Annex BDocument2 pages2307 Jan 2018 ENCS v3 Annex BAnonymous Z37BIV88% (24)

- MEMORANDUM CIRCULAR No. 2020-0030Document13 pagesMEMORANDUM CIRCULAR No. 2020-0030Francisco TaquioNo ratings yet

- Rule 1020 New Establishment RegistrationDocument1 pageRule 1020 New Establishment RegistrationgarduzeNo ratings yet

- Rule 1020 New Establishment RegistrationDocument1 pageRule 1020 New Establishment RegistrationgarduzeNo ratings yet

- Swot Analysis OF A CompanyDocument34 pagesSwot Analysis OF A CompanyJacob PruittNo ratings yet

- Supply Chain Management - Module 4Document41 pagesSupply Chain Management - Module 4sandeep kumarNo ratings yet

- Chapter I: Management and The Nature of Management AccountingDocument11 pagesChapter I: Management and The Nature of Management AccountingMark ManuntagNo ratings yet

- China's Economic Growth and Foreign Business Environment in 40 CharactersDocument23 pagesChina's Economic Growth and Foreign Business Environment in 40 CharactersAsad BilalNo ratings yet

- PAS 1 - Presentation of Financial Statements-1Document24 pagesPAS 1 - Presentation of Financial Statements-1Krizzia DizonNo ratings yet

- NO Page Number: 1 Executive Summary 1-2Document26 pagesNO Page Number: 1 Executive Summary 1-2AMITaXWINo ratings yet

- Customer FocusDocument17 pagesCustomer Focussanjai yadavNo ratings yet

- 10-X08-Budgeting (1) ZSDDocument46 pages10-X08-Budgeting (1) ZSDLOUIEVIE MAY SAJULGANo ratings yet

- Financial Investment ExercisesDocument16 pagesFinancial Investment ExercisesBội Ngọc100% (1)

- Pakistan's Ghost Kitchen Industry AnalysisDocument4 pagesPakistan's Ghost Kitchen Industry AnalysisHaiqa SheikhNo ratings yet

- IFC and Partners Invest $1.1 Billion To Build The Largest Solar Plant and Wind Farm in EgyptDocument4 pagesIFC and Partners Invest $1.1 Billion To Build The Largest Solar Plant and Wind Farm in EgyptviNo ratings yet

- Sample HR Interview QuestionsDocument74 pagesSample HR Interview Questionssumitvfx87No ratings yet

- Almc - Cash Position - 11may2021Document246 pagesAlmc - Cash Position - 11may2021ACYATAN & CO., CPAs 2020No ratings yet

- Inventory management key processes and termsDocument17 pagesInventory management key processes and termsVishnu Kumar SNo ratings yet

- UGBA 103 Syllabus Fall 2016Document6 pagesUGBA 103 Syllabus Fall 2016Ye Jun Lee100% (1)

- STFC X15Document7 pagesSTFC X15Kajol Keshri100% (1)

- SMChap 004Document49 pagesSMChap 004Rola KhouryNo ratings yet

- Eddy Mata: San Diego CA 626 922 8310Document1 pageEddy Mata: San Diego CA 626 922 8310Eddy MataNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument2 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledMikka MonesNo ratings yet

- Chapter 2 AbvDocument52 pagesChapter 2 AbvVienne MaceNo ratings yet

- Accounting Equation and Double Entry BookkeepingDocument29 pagesAccounting Equation and Double Entry BookkeepingArvin ToraldeNo ratings yet

- Globalism and Informationalism in the Digital AgeDocument9 pagesGlobalism and Informationalism in the Digital AgePrecilla Dela Cruz100% (1)

- Running Head: Case Study Coca Cola Company 1Document12 pagesRunning Head: Case Study Coca Cola Company 1Larbi JosephNo ratings yet

- Banking Notes The Primary Function of A Central BankDocument4 pagesBanking Notes The Primary Function of A Central Banknatafilip10No ratings yet

- Economics Project AmanDocument18 pagesEconomics Project AmanAman KumarNo ratings yet