Notes by Dilpreet Kaur 9315976598; 9711899221

dks classes

BCOM III

Cost Accounting

Topic- Cost Sheet

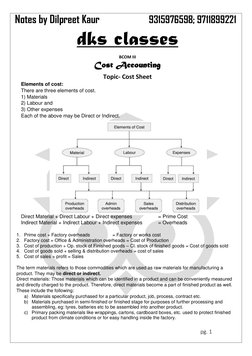

Elements of cost:

There are three elements of cost.

1) Materials

2) Labour and

3) Other expenses

Each of the above may be Direct or Indirect.

Direct Material + Direct Labour + Direct expenses = Prime Cost

Indirect Material + Indirect Labour + Indirect expenses = Overheads

1. Prime cost + Factory overheads = Factory or works cost

2. Factory cost + Office & Administration overheads = Cost of Production

3. Cost of production + Op. stock of Finished goods – Cl. stock of finished goods = Cost of goods sold

4. Cost of goods sold + selling & distribution overheads = cost of sales

5. Cost of sales + profit = Sales

The term materials refers to those commodities which are used as raw materials for manufacturing a

product. They may be direct or indirect.

Direct materials: Those materials which can be identified in a product and can be conveniently measured

and directly charged to the product. Therefore, direct materials become a part of finished product as well.

These include the following:

a) Materials specifically purchased for a particular product, job, process, contract etc.

b) Materials purchased in semi-finished or finished stage for purposes of further processing and

assembling, eg: tyres, batteries etc to be assembled into another product.

c) Primary packing materials like wrappings, cartons, cardboard boxes, etc. used to protect finished

product from climate conditions or for easy handling inside the factory.

pg. 1

�Notes by Dilpreet Kaur 9315976598; 9711899221

dks classes

Indirect materials: It refers to the material which we require to produce a product but is not directly

identifiable. It does not form a part of a finished product. For example, the use of nails to make a table,

oil and grease, lubricants, cotton waste, cleaning materials etc. The cost of indirect material does not

vary in the direct proportion of product.

Direct Labour: It refers to the amount which paid to the workers (both skilled and unskilled) who are

directly engaged in the production of goods. It varies directly with the level of output. Wages paid to

machine man, workers working in production department, workers of the assembly section, machine

operators etc. They are also called productive labour.

Indirect Labour: It represents the amount paid to workers who are indirectly engaged in the production

of goods. It does not vary directly with the level of output. Wages of storekeepers, foremen, time-

keepers, directors’ fee, salaries of salesmen etc.

Direct Expenses: It refers to the expenses that are specifically incurred by the enterprises to produce a

product. The production cannot take place without incurring these expenses. It varies directly with the

level of production.

These are:

a) Rental value of plant & machinery for a specific product.

b) Insurance charges for materials and equipments used for a specific product.

c) Cost of patents and royalties for a particular product.

d) Fee paid to architects, surveyors and other consultants for a specific contract.

e) Cost of special lay out, design or drawings.

f) Carriage inwards and freight charges on the materials purchased for a specific job or process.

Indirect Expenses: It represents the expenses that are incurred by the organization to produce a

product. These expenses cannot be easily identified accurately. For example, Power expenses for the

production of pens, factory rent, depreciation on plant, factory insurance etc.

Overhead: It refers to all indirect materials, indirect labour, or and indirect expenses.

Factory Overhead: Factory overhead or Production Overhead or Works Overhead refers to the

expenses which a firm incurs in the production area or within factory premises.

Indirect material, rent, rates and taxes of factory, canteen expenses etc.are example of factory

overhead.

Administration Overhead: Administrative or Office Overhead refers to the expenses which are incurred

in connection with the general administration of the organizations.

Salary of administrative staff, postage, telegram and telephone, stationery etc.are examples of

administration overhead.

Selling Overhead: All expenses that a firm incurs in connection with sales are selling overheads. Salary

of sales department staff, travelers’ commission, advertisement etc.are example of selling overhead.

Distribution Overhead: It represents all expenses incurred in connection with the delivery or distribution

of finished goods and services from the manufacturer to the consumer. Delivery van expenses. loading

and unloading, customs duty, the salary of deliverymen are examples of distribution overhead.

pg. 2

�Notes by Dilpreet Kaur 9315976598; 9711899221

dks classes

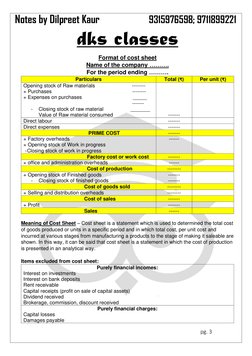

Format of cost sheet

Name of the company ……….

For the period ending ……….

Particulars Total (₹) Per unit (₹)

Opening stock of Raw materials --------

+ Purchases --------

+ Expenses on purchases _____

-------

- Closing stock of raw material _______

Value of Raw material consumed -------

Direct labour -------

Direct expenses -------

PRIME COST -------

+ Factory overheads ------

+ Opening stock of Work in progress

- Closing stock of work in progress

Factory cost or work cost -------

+ office and administration overheads ------

Cost of production --------

+ Opening stock of Finished goods -------

- Closing stock of finished goods -------

Cost of goods sold --------

+ Selling and distribution overheads --------

Cost of sales -------

+ Profit -------

Sales ------

Meaning of Cost Sheet – Cost sheet is a statement which is used to determined the total cost

of goods produced or units in a specific period and in which total cost, per unit cost and

incurred at various stages from manufacturing a products to the stage of making it saleable are

shown. In this way, it can be said that cost sheet is a statement in which the cost of production

is presented in an analytical way.

Items excluded from cost sheet:

Purely financial incomes:

Interest on investments

Interest on bank deposits

Rent receivable

Capital receipts (profit on sale of capital assets)

Dividend received

Brokerage, commission, discount received

Purely financial charges:

Capital losses

Damages payable

pg. 3

�Notes by Dilpreet Kaur 9315976598; 9711899221

dks classes

Expenses on transfer of company’s office

Interest on bank loan, debenture, mortgages etc

Discount on bonds, debentures, etc.

Losses on investments

Cash discounts

Income tax

Appropriation of profits

Appropriation to sinking fund

Dividends paid

Taxes on income and profits

Charitable donations

Transfer to general/ specific reserves

Amounts written off- goodwill, preliminary expenses, etc.

Any other item of Profit & Loss Appropriation A/c

Abnormal expenses and losses

Loss by theft

Loss by fire

Cost of abnormal idle time

Exceptional bad debts

Cost of abnormal wastage of materials

Practical Questions from past years

Q 1. From the following, prepare a cost sheet and quote a suitable price.

Total production 5,000 tonnes

Cost of raw materials ₹ 20,00,000

Carriage inwards ₹ 2,00,000

Direct wages ₹ 20,00,000

Indirect wages ₹ 1,00,000

Office expenses ₹ 10,00,000

Selling overheads ₹ 10,00,000

Payment of income tax ₹ 3,00,000

Dividend paid ₹ 5,00,000

A profit margin of 50% on cost is desired.

Q 2. From the following prepare a cost sheet.

Cost of materials @ ₹ 13 per unit

Labour cost @ ₹ 7.50 per unit

Factory overheads ₹ 45,000

Administration Overheads ₹ 50,000

Selling Overheads ₹ 2.50 per unit sold

Opening Stock of finished goods – 500 units @ ₹ 19.75

Closing stock of finished goods – 250 units

Sales – 10,250 units at a profit of 20% on sales.

Q 3. X Ltd. Has received an enquiry for the supply of 1,000 Premium Shirts.

The costs are estimated as under:

Raw Materials 2,500 Mtrs @ ₹ 40 per mtr

pg. 4

�Notes by Dilpreet Kaur 9315976598; 9711899221

dks classes

Direct Wages 10,000 Hrs @ ₹ 4 per hr

Variable overheads Factory ₹ 2.40 per labour hr

Selling and Distribution ₹ 16,000

Fixed Overheads Factory ₹ 6,000

Selling and Distribution ₹ 14,000

Prepare a cost sheet showing the price to be quoted per shirt which results in a profit of

20% on selling price.

Q 4. From the following, Prepare a cost sheet:

₹

Raw materials 6,000

Direct Wages 5,000

Factory Overheads 2,400

Opening Stock of Finished Goods 800 (200 kg)

Closing Stock of finished Goods …….(400 kg)

Sale of finished product 20,000 (3,000 kg)

Advertising and Selling Expenses 1,475

Profit desired is 30% on sales.

Q 5. Prepare a cost sheet from the following:

₹

Sales 8,00,000

Material 1-1-2008 40,000

Material 31-12-2008 32,000

Work-in-progress 1-1-2008 55,000

Work-in-progress 31-12-2008 72,000

Finished goods 1-1-2008 64,000

Finished goods 31-12-2008 1,51,000

Material purchased 1,52,000

Direct labour 1,45,000

Manufacturing overheads 1,08,000

Selling expenses 50,000

General office expenses 40,000

Q 6. The cost of sales of Product P is made up as follows:

₹

Materials used in manufacturing 54,000

Material used in primary packing 10,000

Material used in selling the product 1,500

Material used in factory 750

Material used in the office 1,250

Labour required in producing 10,000

Labour required for factory supervision 2,000

Direct expenses 5,000

Indirect expenses (factory) 1,000

Administration expenses 1,250

Depreciation on office building and equipment 750

Depreciation on factory building 1,750

pg. 5

�Notes by Dilpreet Kaur 9315976598; 9711899221

dks classes

Selling expenses 3,500

Freight on materials purchased 6,000

Advertising 1,250

Assuming that all the goods manufactured are sold, what should be the selling price to

obtain a profit of 20% on selling price?

Q 7. The following information has been taken from the costing records of a company

in respect of job number 123.

Materials ₹ 4,000

Wages:

Department A: 60 hours @ ₹ 3 per hour

Department B: 40 hours @ ₹ 2 per hour

Department C: 20 hours @ ₹ 5 per hour

Overheads for the three departments are estimated as follows:

Variable overheads:

Department A: ₹ 5,000 for 5,000 hours

Department B: ₹ 3,000 for 1,500 hours

Department C: ₹ 2,000 for 500 hours

Fixed Overheads:

₹ 14,000 for 7,000 hours.

You are required to calculate the cost of job number 123 and also calculate the price to

be charged so as to yield a profit of 25% on the selling price.

Q 8. The Sona Chemicals Company supplies you the following details from its cost

records:

₹

st

Stock of raw materials on 1 Jan, 2014 1,50,000

Stock of raw materials on 31st Jan, 2014 1,80,000

Direct wages 1,05,000

Indirect wages 6,000

Work in Progress 1-1-2014 56,000

Work in progress 31-1-2014 70,000

Purchase of raw materials 1,60,000

Factory rent, rates and power 30,000

Depreciation on plant and machinery 7,000

Carriage inward 3,000

Carriage outward 2,000

Advertising 5,000

Office rent 10,000

Traveler’s wages 12,000

Stock of finished goods on 1-1-2014 54,000

Stock of finished goods on 31-1-2014 ?

Bad debts 1,000

Interest on the hire-purchase instalment 2,000

Prepare a cost sheet giving the cost and profit. The company wants to have a profit of

25% on cost. The units manufactured during the month were 10,000 units.

pg. 6

�Notes by Dilpreet Kaur 9315976598; 9711899221

dks classes

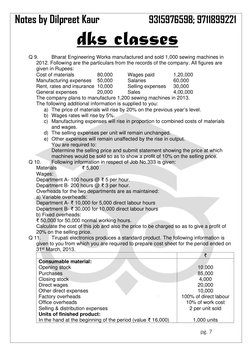

Q 9. Bharat Engineering Works manufactured and sold 1,000 sewing machines in

2012. Following are the particulars from the records of the company. All figures are

given in Rupees:

Cost of materials 80,000 Wages paid 1,20,000

Manufacturing expenses 50,000 Salaries 60,000

Rent, rates and insurance 10,000 Selling expenses 30,000

General expenses 20,000 Sales 4,00,000

The company plans to manufacture 1,200 sewing machines in 2013.

The following additional information is supplied to you:

a) The price of materials will rise by 20% on the previous year’s level.

b) Wages rates will rise by 5%.

c) Manufacturing expenses will rise in proportion to combined costs of materials

and wages.

d) The selling expenses per unit will remain unchanged.

e) Other expenses will remain unaffected by the rise in output.

You are required to:

Determine the selling price and submit statement showing the price at which

machines would be sold so as to show a profit of 10% on the selling price.

Q 10. Following information in respect of Job No.333 is given:

Materials ₹ 5,800

Wages:

Department A- 100 hours @ ₹ 5 per hour.

Department B- 200 hours @ ₹ 3 per hour.

Overheads for the two departments are as maintained:

a) Variable overheads:

Department A- ₹ 10,000 for 5,000 direct labour hours

Department B- ₹ 30,000 for 10,000 direct labour hours

b) Fixed overheads:

₹ 50,000 for 50,000 normal working hours.

Calculate the cost of this job and also the price to be charged so as to give a profit of

20% on the selling price.

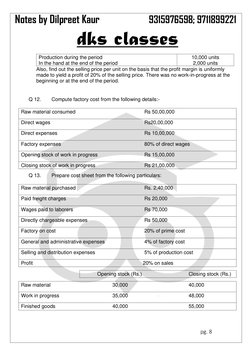

Q 11. Tirupati electronics produces a standard product. The following information is

given to you from which you are required to prepare cost sheet for the period ended on

31st March, 2013.

₹

Consumable material:

Opening stock 10,000

Purchases 85,000

Closing stock 4,000

Direct wages 20,000

Other direct expenses 10,000

Factory overheads 100% of direct labour

Office overheads 10% of work cost

Selling & distribution expenses 2 per unit sold

Units of finished product:

In the hand at the beginning of the period (value ₹ 16,000) 1,000 units

pg. 7

�Notes by Dilpreet Kaur 9315976598; 9711899221

dks classes

Production during the period 10,000 units

In the hand at the end of the period 2,000 units

Also, find out the selling price per unit on the basis that the profit margin is uniformly

made to yield a profit of 20% of the selling price. There was no work-in-progress at the

beginning or at the end of the period.

Q 12. Compute factory cost from the following details:-

Raw material consumed Rs 50,00,000

Direct wages Rs20,00,000

Direct expenses Rs 10,00,000

Factory expenses 80% of direct wages

Opening stock of work in progress Rs 15,00,000

Closing stock of work in progress Rs 21,00,000

Q 13. Prepare cost sheet from the following particulars:

Raw material purchased Rs. 2,40,000

Paid freight charges Rs 20,000

Wages paid to laborers Rs 70,000

Directly chargeable expenses Rs 50,000

Factory on cost 20% of prime cost

General and administrative expenses 4% of factory cost

Selling and distribution expenses 5% of production cost

Profit 20% on sales

Opening stock (Rs.) Closing stock (Rs.)

Raw material 30,000 40,000

Work in progress 35,000 48,000

Finished goods 40,000 55,000

pg. 8

�Notes by Dilpreet Kaur 9315976598; 9711899221

dks classes

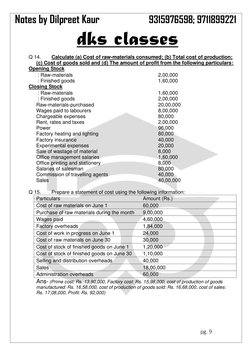

Q 14. Calculate (a) Cost of raw-materials consumed; (b) Total cost of production;

(c) Cost of goods sold and (d) The amount of profit from the following particulars:

Opening Stock

: Raw-materials 2,00,000

: Finished goods 1,60,000

Closing Stock

: Raw-materials 1,60,000

: Finished goods 2,00,000

Raw-materials-purchased 20,00,000

Wages paid to labourers 8,00,000

Chargeable expenses 80,000

Rent, rates and taxes 2,00,000

Power 96,000

Factory heating and lighting 80,000

Factory insurance 40,000

Experimental expenses 20,000

Sale of wastage of material 8,000

Office management salaries 1,60,000

Office printing and stationery 8,000

Salaries of salesman 80,000

Commission of travelling agents 40,000

Sales 40,00,000

Q 15. Prepare a statement of cost using the following information:

Particulars Amount (Rs.)

Cost of raw materials on June 1 60,000

Purchase of raw materials during the month 9,00,000

Wages paid 4,60,000

Factory overheads 1,84,000

Cost of work in progress on June 1 24,000

Cost of raw materials on June 30 30,000

Cost of stock of finished goods on June 1 1,20,000

Cost of stock of finished goods on June 30 1,10,000

Selling and distribution overheads 40,000

Sales 18,00,000

Administration overheads 60,000

Ans- (Prime cost: Rs. 13,90,000, Factory cost: Rs. 15,98,000, cost of production of goods

manufactured: Rs. 16,58,000, cost of production of goods sold: Rs. 16,68,000, cost of sales:

Rs. 17,08,000, Profit: Rs. 92,000)

pg. 9