Professional Documents

Culture Documents

Compare 3 Investment Options NPVs Ranging 22-27€m

Uploaded by

James CassidyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Compare 3 Investment Options NPVs Ranging 22-27€m

Uploaded by

James CassidyCopyright:

Available Formats

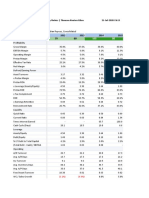

Option 1

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

€m €m €m €m €m €m

Plant (9.0) 1.0

Sales 24.0 30.8 39.6 26.4 10.0

Variable Costs (11.2) (19.6) (25.2) (16.8) (7.0)

Fixed Costs (Ex. Dep) (0.8) (0.8) (0.8) (0.8) (0.8)

W. Capital (3.0) 3.0

Opportunity Costs (0.1) (0.1) (0.1) (0.1) (0.1)

(12.0) 11.9 10.3 13.5 8.7 6.1

Discount Factor 10% 1 .909 .826 .751 .683 .621

Present Value (12.0) 10.82 8.51 10.14 5.94 3.79

NPV = 27.2

Option 2

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

€m €m €m €m €m €m

Royalties 4.4 7.7 9.9 6.6 2.8

Discount Factor 10% 1 .909 .826 .751 .683 .621

Present Value 4.0 6.4 7.4 4.5 1.7

NPV = 24.0

Option 3

Year 0 Year 2

Instalments 12.0 12.0

Discount Factor 10% 1 .826

Present Value 12 10.0

NPV = 22.0

b) Before making a final decision, the board should consider the following

factors:

The long-term competitiveness of the business mat be affected by the sale of

the patents

At present, the business is not involved in manufacturing and marketing

products.

The business will probably have to buy in the skills necessary to produce the

product itself.

How accurate are the forecasts made and how valid are the assumptions on

which they are based?

c) Option 2 has the highest NPV and therefore the most attractive to

shareholders. However, the accuracy of the forecasts should be checked

before a final decision is made.

You might also like

- BCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMEDocument5 pagesBCC620 Business Finance Management Main (JAN) E1 - JUL 2022 - ANSWER SCHEMERukshani RefaiNo ratings yet

- Strategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideFrom EverandStrategic Asset Allocation in Fixed Income Markets: A Matlab Based User's GuideNo ratings yet

- ALRAYAN Electronics Finance Graduate AnalysisDocument7 pagesALRAYAN Electronics Finance Graduate AnalysisِAli IsmailNo ratings yet

- Quantitative Finance: Its Development, Mathematical Foundations, and Current ScopeFrom EverandQuantitative Finance: Its Development, Mathematical Foundations, and Current ScopeNo ratings yet

- Efficient market insider dealing regulationsDocument9 pagesEfficient market insider dealing regulationsBadihah Mat SaudNo ratings yet

- Model Structures 2019Document5 pagesModel Structures 2019Krish ShahNo ratings yet

- By: Vinit Mishra SirDocument109 pagesBy: Vinit Mishra SirgimNo ratings yet

- Masonite Corp DCF Analysis FinalDocument5 pagesMasonite Corp DCF Analysis FinaladiNo ratings yet

- Investment Decision Rules: © 2019 Pearson Education LTDDocument22 pagesInvestment Decision Rules: © 2019 Pearson Education LTDLeanne TehNo ratings yet

- Nerolac - On Ratio - SolvedDocument6 pagesNerolac - On Ratio - Solvedricha krishnaNo ratings yet

- Problem Set-Cost of Capital and Decision CriteriaDocument9 pagesProblem Set-Cost of Capital and Decision CriteriasaadullahNo ratings yet

- Byjus Base ModelDocument8 pagesByjus Base Modelsharma.kunal70No ratings yet

- Chapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument21 pagesChapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesJITIN ARORANo ratings yet

- Slides - Capital Budgeting - 2Document8 pagesSlides - Capital Budgeting - 2Anish AdhikariNo ratings yet

- Intrinsic Value Calculation Formula Sven Carlin 4Document24 pagesIntrinsic Value Calculation Formula Sven Carlin 4januar baharuliNo ratings yet

- Company Name LBO Model | July 25, 2022Document12 pagesCompany Name LBO Model | July 25, 2022ousmaneNo ratings yet

- Company Name LBO Model Summary & ReturnsDocument13 pagesCompany Name LBO Model Summary & ReturnsGabriel AntonNo ratings yet

- DDM CAPM ECM Cost of EquityDocument5 pagesDDM CAPM ECM Cost of EquityDevia SuswodijoyoNo ratings yet

- DDM CAPM ECM Cost of EquityDocument5 pagesDDM CAPM ECM Cost of Equitynatya lakshitaNo ratings yet

- Complete Private Equity ModelDocument16 pagesComplete Private Equity ModelMichel MaryanovichNo ratings yet

- PG 208: Vegetron Case: Assumptions Implementation Period (1 Yr) 0Document36 pagesPG 208: Vegetron Case: Assumptions Implementation Period (1 Yr) 0Deepannita ChakrabortyNo ratings yet

- AFM - Mock Exam Answers - Dec18Document21 pagesAFM - Mock Exam Answers - Dec18David LeeNo ratings yet

- Mark Plan and Examiner'S Commentary: Total Marks: General CommentsDocument10 pagesMark Plan and Examiner'S Commentary: Total Marks: General Commentscima2k15No ratings yet

- Texas Instruments Stock Selection Guide AnalysisDocument2 pagesTexas Instruments Stock Selection Guide AnalysisMayank PatelNo ratings yet

- Solved Problems Chapter 11Document6 pagesSolved Problems Chapter 11nagendra reddy panyamNo ratings yet

- Syndicate 3 - Nike-Case 7 - YP64ADocument7 pagesSyndicate 3 - Nike-Case 7 - YP64ADimas Kusuma AndanuNo ratings yet

- Assigment IiDocument18 pagesAssigment IiIsuu JobsNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Osjdioahfnlk, MNLKJLDocument10 pagesOsjdioahfnlk, MNLKJLAlex NievaNo ratings yet

- Davis Industries Financial Summary 2015-2017Document10 pagesDavis Industries Financial Summary 2015-2017Aaron Pool0% (2)

- Free Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15Document9 pagesFree Cash Flow Estimate (In INR CRS) : The Discounted Cash Flow (DCF) Model Module 3, Chapter 15MBA grievanceNo ratings yet

- Base Case Equipment Costs, Sales, and Cash Flow AnalysisDocument7 pagesBase Case Equipment Costs, Sales, and Cash Flow AnalysisPaula AntonioNo ratings yet

- Sfm-Mpe Mock Solution-1Document6 pagesSfm-Mpe Mock Solution-1Abdul BasitNo ratings yet

- DCF AnalysisDocument3 pagesDCF AnalysisJerry YoungNo ratings yet

- Mattel - Financial ModelDocument13 pagesMattel - Financial Modelharshwardhan.singh202No ratings yet

- Solution To Case 12: What Are We Really Worth?Document4 pagesSolution To Case 12: What Are We Really Worth?khalil rebato100% (1)

- Cryptoassets: The Financial MetaverseDocument125 pagesCryptoassets: The Financial MetaverseTom ChoiNo ratings yet

- You Have To Answer Each Section Separately, Handwritten Submission Shall Be PenalisedDocument6 pagesYou Have To Answer Each Section Separately, Handwritten Submission Shall Be PenalisedDavid ViksarNo ratings yet

- Corporate Accounting ExcelDocument6 pagesCorporate Accounting ExcelshrishtiNo ratings yet

- (More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsDocument4 pages(More Like This) : KEY FIGURES (Latest Twelve Months - LTM) Balance Sheet (At A Glance) in MillionsKrishna JalanNo ratings yet

- Name: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureDocument8 pagesName: Course: SEGI Course Code: UCLAN Module Code: Registration Number Institution: Lecturer: Due Date: Student SignatureErick KinotiNo ratings yet

- The Warren Buffett Spreadsheet v16 - PreviewDocument589 pagesThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNo ratings yet

- What Is Capital Budgeting?Document12 pagesWhat Is Capital Budgeting?Sanket DhumeNo ratings yet

- Financial Management FM Final PaperDocument13 pagesFinancial Management FM Final PaperSaqib AliNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- Chapter09 SMDocument17 pagesChapter09 SMkert1234No ratings yet

- Volcom Financial Analysis PresentationDocument27 pagesVolcom Financial Analysis PresentationKipley_Pereles_59490% (1)

- Solutions to Chapter 11 QuestionsDocument3 pagesSolutions to Chapter 11 QuestionssajedulNo ratings yet

- Term Valued CFDocument14 pagesTerm Valued CFEl MemmetNo ratings yet

- 4-Year DCF Spreadsheet Valuation Model in USD MillionsDocument2 pages4-Year DCF Spreadsheet Valuation Model in USD MillionshoifishNo ratings yet

- Whirlpool SpreadsheetsDocument9 pagesWhirlpool SpreadsheetsBowen QinNo ratings yet

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal0% (4)

- Luehrman With ValuesDocument4 pagesLuehrman With ValuesTejdeep ReddyNo ratings yet

- Manaal - Commercial Banking W J.P MorganDocument9 pagesManaal - Commercial Banking W J.P Morganmanaal.murtaza1No ratings yet

- Mgmt2023: Financial Management April/May 2009 Answer KeyDocument2 pagesMgmt2023: Financial Management April/May 2009 Answer Keyshaneice_lewisNo ratings yet

- Canada Packers - Exhibits + Valuation - FionaDocument63 pagesCanada Packers - Exhibits + Valuation - Fiona/jncjdncjdn100% (1)

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2deepika0% (1)

- Appendix 1 Conservative Approach: (In FFR Million)Document6 pagesAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaNo ratings yet

- Solution To Mini Case (SAPM)Document8 pagesSolution To Mini Case (SAPM)Snigdha IndurtiNo ratings yet

- Customer Relations - Self Learning Material 4Document16 pagesCustomer Relations - Self Learning Material 4Shayne Candace QuizonNo ratings yet

- "Narayana Engineering Cllleie::Nelllrea.: Exam: MID-IDocument8 pages"Narayana Engineering Cllleie::Nelllrea.: Exam: MID-ICH ANIL VARMANo ratings yet

- Hoshin Kanri and A3 - A Proposal For Integrating Variability Into The Policy Deployment ProcessDocument18 pagesHoshin Kanri and A3 - A Proposal For Integrating Variability Into The Policy Deployment ProcessNoé HumbertoNo ratings yet

- Resume Sample BankingDocument2 pagesResume Sample BankingGordonNo ratings yet

- MGNT1010 - Business Justification (Group 2)Document6 pagesMGNT1010 - Business Justification (Group 2)Lai Ka ChunNo ratings yet

- JD - Human ResourcesDocument2 pagesJD - Human ResourcesSHRESTI ANDENo ratings yet

- Nabua National High School Business Plan RubricDocument3 pagesNabua National High School Business Plan RubricMarykay BermeoNo ratings yet

- Ch06 Equivalent UnitsDocument51 pagesCh06 Equivalent Unitsvenkataramanan_thiruNo ratings yet

- The 7 Systems That Every Business Must Have To Be SuccessfulDocument6 pagesThe 7 Systems That Every Business Must Have To Be SuccessfulFloraNo ratings yet

- C-Tpat Administration: Roles and ResponsibilitiesDocument1 pageC-Tpat Administration: Roles and ResponsibilitiesCarlos Moreno100% (1)

- 2021 Guide To Effective ProxiesDocument483 pages2021 Guide To Effective ProxiesValter FariaNo ratings yet

- HSE MANAGEMENT PLAN 2019-Rev1Document4 pagesHSE MANAGEMENT PLAN 2019-Rev1Nadiatul Aisyah Mohd Amirul Hakim85% (13)

- MANUFACTURING AND NON-MANUFACTURING ENTITIES FINAL ACCOUNTSDocument13 pagesMANUFACTURING AND NON-MANUFACTURING ENTITIES FINAL ACCOUNTSRahul NegiNo ratings yet

- Customers Are Better Strategists Than ManagersDocument4 pagesCustomers Are Better Strategists Than ManagersCarol MoralesNo ratings yet

- Assignment #2 - EMI and The CT Scanner Group CDocument2 pagesAssignment #2 - EMI and The CT Scanner Group Cmohsen bukNo ratings yet

- Chap 006Document18 pagesChap 006Abhi KumarNo ratings yet

- Project Purchase GoodsDocument13 pagesProject Purchase GoodsGorkhali GamingNo ratings yet

- Inventory ControlDocument9 pagesInventory ControlAbhijeetLaturkarNo ratings yet

- Chapter 3 Specifying Quality For Tourism and Hospitality ServicesDocument24 pagesChapter 3 Specifying Quality For Tourism and Hospitality ServicesMaureen AlmazarNo ratings yet

- Mckinsey & CompanyDocument6 pagesMckinsey & CompanyLohith KumarNo ratings yet

- RVL 2-02-03 Digital Additional PracticeDocument3 pagesRVL 2-02-03 Digital Additional PracticeHajer MannaiNo ratings yet

- Sjmsom Iitb Casebook - 2021Document148 pagesSjmsom Iitb Casebook - 2021Sarthak JainNo ratings yet

- Abbas Khalil EEDocument4 pagesAbbas Khalil EEAbas KhalelNo ratings yet

- SUMMARY REPORT InternDocument3 pagesSUMMARY REPORT Internnur amanina ayuniNo ratings yet

- Lesson Plan Sem Mac - Aug2023 (MGT657)Document7 pagesLesson Plan Sem Mac - Aug2023 (MGT657)NURSAIRAH SHAZANA RAZMANNo ratings yet

- Greinfield Manufacturing Plant For VELO Job Safety Analysis & Risk Assessment for Scrapping and Grading Activity (Rev-00Document1 pageGreinfield Manufacturing Plant For VELO Job Safety Analysis & Risk Assessment for Scrapping and Grading Activity (Rev-00Azhar Mushtaq100% (1)

- Client Research Report Revised Vertis HolmesDocument8 pagesClient Research Report Revised Vertis Holmesapi-665648997No ratings yet

- Startbucks Mini Case 8th April 2021Document9 pagesStartbucks Mini Case 8th April 2021Nirvana ShresthaNo ratings yet

- Special Trans Activity 2Document15 pagesSpecial Trans Activity 2Rachelle JoseNo ratings yet

- 4 PDFDocument330 pages4 PDFMadalina Nina100% (1)