Professional Documents

Culture Documents

Illustration

Uploaded by

vyasmusicOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration

Uploaded by

vyasmusicCopyright:

Available Formats

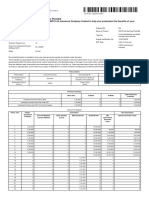

23-02-2021

Quote No : aijejzbmkkg

Benefit Illustration for HDFC Life Sanchay Plus

This Illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your

HDFC Life Sanchay Plus

DETAILS

Name of the Prospect/Policyholder: Proposal No: NA

Age: 35 Name of Product: HDFC Life Sanchay Plus

A non-participating non-linked savings

Name of Life Assured: Tag Line:

insurance plan

Age: 35 Unique Identification No: 101N134V08

Policy Term: 10 Years GST Rate: 4.5% for first year

2.25% second year

Premium Paying Term: 5 Years

onwards

Amount of Instalment Premium

Rs.30000

(Without GST):

Mode: Annual

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

"Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers

guaranteed benefits then these will be clearly marked "guaranteed" in the illustration table on this page. If your policy offers variable benefits then the illustrations on this page will

show two different rates of assumed future investment returns, of 8% p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits

of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance."

Policy Details

Policy Option Guaranteed Maturity Sum Assured Rs. 150000

Guaranteed Payout Sum Assured on Death (at

NA 360000

Freqency inception of the policy) Rs.

Guaranteed Payout Payout Term

NA NA

Amount (years)

Premium Summary

PP PP Total

Base Plan CI Rider IB Rider PP Rider (PAC) Rider Rider Instalment

(ADC) (CC) Premium

Instalment Premium without GST 30,000 0 0 0 0 0 30,000

Instalment Premium with First Year GST 31,350 0 0 0 0 0 31,350

Instalment Premium with GST 2nd Year Onwards 30,675 0 0 0 0 0 30,675

(Amount in Rupees)

Policy Year Single/ Guaranteed Non Guaranteed

Annualized

Survival Benefits / Other benefits Maturity Benefit Death Benefit Min Special Surrender Value

Premium

Loyalty Additions (if any) Guaranteed

Surrender

Value

1 30,000 0 0 0 3,60,000 0 0

2 30,000 0 0 0 3,60,000 18,000 18,000

3 30,000 0 0 0 3,60,000 31,500 31,500

4 30,000 0 0 0 3,60,000 60,000 60,000

5 30,000 0 0 0 3,60,000 75,000 96,375

6 0 0 0 0 3,69,570 77,871 1,12,018

7 0 0 0 0 3,79,140 80,742 1,29,713

8 0 0 0 0 3,88,710 1,21,113 1,49,723

9 0 0 0 0 3,98,280 1,46,484 1,72,333

10 0 0 0 1,97,850 4,07,850 1,49,355 1,97,850

Notes: Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods & Service Tax.

I , have explained the premiums charges and benefits under the product fully to the I ,having received the information with respect to the above, have understood the

prospect / policy holder. above statement before entering into the contract.

Place:

Date: Signature of Agent /Intermediary / Official Date: Signature of Prospect / Policyholder

Note: Kindly note that name of the company has changed from "HDFC Standard Life Insurance Company Limited" to "HDFC Life Insurance Company Limited".

You might also like

- Trading Options Income: Strangle vs Double Ratio SpreadDocument1 pageTrading Options Income: Strangle vs Double Ratio Spreadsergiob63No ratings yet

- CLC Selecting HR MetricsDocument5 pagesCLC Selecting HR Metricsdreea_mNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- NagalandDocument39 pagesNagalandPrathap AnNo ratings yet

- Internal Customer Satisfaction Leads To External Customers SatisfactionDocument21 pagesInternal Customer Satisfaction Leads To External Customers Satisfactionumerfarooqmba88% (16)

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- Illustration 5Document2 pagesIllustration 5Phanindra GaddeNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- HDFC Life Sanchay Plus benefit illustrationDocument2 pagesHDFC Life Sanchay Plus benefit illustrationsarthakNo ratings yet

- Illustration - 2022-08-30T164443.287Document2 pagesIllustration - 2022-08-30T164443.287Soumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- IllustrationDocument2 pagesIllustrationAshfaq hussainNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- IllustrationDocument2 pagesIllustrationashverya agrawalNo ratings yet

- IllustrationDocument2 pagesIllustrationsukh37949No ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- Illustration Qatkwl5gp3chlDocument2 pagesIllustration Qatkwl5gp3chlRahul DipaliNo ratings yet

- HDFC Life Sanchay Plus benefit illustrationDocument2 pagesHDFC Life Sanchay Plus benefit illustrationNeerja M GuhathakurtaNo ratings yet

- DOC-20240413-WA0009.Document2 pagesDOC-20240413-WA0009.Dhana sekarNo ratings yet

- Illustration - 2022-03-17T111744.362Document2 pagesIllustration - 2022-03-17T111744.362shubham gaundNo ratings yet

- IllustrationDocument2 pagesIllustrationCHANDRAKANT RANANo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- HDFC Life Sanchay Plus benefit illustrationDocument2 pagesHDFC Life Sanchay Plus benefit illustrationVamsi Krishna BNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- Illustration - 2022-12-21T143227.841Document2 pagesIllustration - 2022-12-21T143227.841Ashher UsmaniNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- HDFC Life Sanchay benefits for 27 year oldDocument2 pagesHDFC Life Sanchay benefits for 27 year oldKiran NNo ratings yet

- IllustrationDocument2 pagesIllustrationRajnandan shindeNo ratings yet

- Illustration Qbhlvjke4x8v0Document2 pagesIllustration Qbhlvjke4x8v0Akshay ChaudhryNo ratings yet

- IllustrationDocument2 pagesIllustrationamitkumar.nayek28101989No ratings yet

- Sanchy Plus - Long Term Income 1 LDocument2 pagesSanchy Plus - Long Term Income 1 LVen NatNo ratings yet

- Illustration 990Document2 pagesIllustration 990prachididwania13No ratings yet

- Illustration - 2022-08-26T182737.117Document2 pagesIllustration - 2022-08-26T182737.117Soumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- Illustration - 2022-08-26T182831.858Document2 pagesIllustration - 2022-08-26T182831.858Soumen BeraNo ratings yet

- Illustration - 2024-01-04T213945.722Document2 pagesIllustration - 2024-01-04T213945.722Rishavdar ClassNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- HDFC Life Sanchay Plus benefitsDocument2 pagesHDFC Life Sanchay Plus benefitsShashikumar RajkumarNo ratings yet

- IllustrationDocument2 pagesIllustrationvishnuNo ratings yet

- Illustration Qbf3d3k7xr0p2Document2 pagesIllustration Qbf3d3k7xr0p2Akshay ChaudhryNo ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- IllustrationDocument2 pagesIllustrationestrade1112No ratings yet

- Illustration PDFDocument2 pagesIllustration PDFArvind HarikrishnanNo ratings yet

- IllustrationDocument2 pagesIllustrationVivek SinghalNo ratings yet

- Benefit Illustration for HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration for HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- IllustrationDocument2 pagesIllustrationnikhilraoNo ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Illustration Qc0n0t6y4j58fDocument3 pagesIllustration Qc0n0t6y4j58fNavneet PandeyNo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- HDFC Life Sanchay Par Advantage Benefit IllustrationDocument3 pagesHDFC Life Sanchay Par Advantage Benefit IllustrationSoumen BeraNo ratings yet

- How To Read and Understand This Benefit Illustration?: Proposal NoDocument2 pagesHow To Read and Understand This Benefit Illustration?: Proposal NoDINESH JYOTHINo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationvishnuNo ratings yet

- Vinoth - HDFC ParDocument3 pagesVinoth - HDFC ParVinodh VijayakumarNo ratings yet

- Illustration Qbh72erqqhuwfDocument3 pagesIllustration Qbh72erqqhuwfNagendra Kumar VNo ratings yet

- Illustration Qbuh70x89xxnnDocument2 pagesIllustration Qbuh70x89xxnnKiran JohnNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Illustration - 2022-10-11T115742.458Document3 pagesIllustration - 2022-10-11T115742.458BLOODY ASHHERNo ratings yet

- Indian metals and mining sector sub-sectors, stocks and performanceDocument6 pagesIndian metals and mining sector sub-sectors, stocks and performancevyasmusicNo ratings yet

- Address Contact Details Change Form PDFDocument2 pagesAddress Contact Details Change Form PDFtarun_akkuNo ratings yet

- Family Consent1Document2 pagesFamily Consent1vyasmusicNo ratings yet

- Acquisitions by Robert Bruner For A Discussion of This Analysis. To Use The Model, PleaseDocument17 pagesAcquisitions by Robert Bruner For A Discussion of This Analysis. To Use The Model, PleasevyasmusicNo ratings yet

- Integrated Financial Statements Exercise 2013Document1 pageIntegrated Financial Statements Exercise 2013Nicholas TanNo ratings yet

- Medium Term Call - Glenmark PharmaDocument5 pagesMedium Term Call - Glenmark PharmavyasmusicNo ratings yet

- Integrated Financial Statements Exercise 2013Document1 pageIntegrated Financial Statements Exercise 2013Nicholas TanNo ratings yet

- VashiDocument5 pagesVashivyasmusicNo ratings yet

- ThaneDocument7 pagesThanevyasmusicNo ratings yet

- Weighted Average Cost of Capital (WACC) Calculator: Strictly ConfidentialDocument3 pagesWeighted Average Cost of Capital (WACC) Calculator: Strictly Confidentialvyasmusic0% (1)

- GorakhpurDocument15 pagesGorakhpurvyasmusicNo ratings yet

- FOREX IN B Amp IDocument61 pagesFOREX IN B Amp IvyasmusicNo ratings yet

- Venture Capital in IndiaDocument50 pagesVenture Capital in Indiavyasmusic100% (1)

- Climate Profile of ChennaiDocument129 pagesClimate Profile of ChennaiAparna KumarNo ratings yet

- Technology (FromDocument10 pagesTechnology (FromvyasmusicNo ratings yet

- FOREX IN B Amp IDocument61 pagesFOREX IN B Amp IvyasmusicNo ratings yet

- Customer Relationship Management in Banking Sector: A StudyDocument13 pagesCustomer Relationship Management in Banking Sector: A StudyPARADIGM SHIFTS IN MANAGEMENT PRACTICESNo ratings yet

- DeAngelo : The Irrelevance of The MM Dividend Irrelevance TheoremDocument23 pagesDeAngelo : The Irrelevance of The MM Dividend Irrelevance TheoremAndreas WidhiNo ratings yet

- Question Revision A182Document5 pagesQuestion Revision A182Ke TingNo ratings yet

- Tell Me Why Co. Is Expected To Maintain A Constant...Document2 pagesTell Me Why Co. Is Expected To Maintain A Constant...awaisNo ratings yet

- FSA - End Term Qs Paper - BFS Prof. Sachin Choudhry (6450)Document2 pagesFSA - End Term Qs Paper - BFS Prof. Sachin Choudhry (6450)sandeep mishraNo ratings yet

- Garima Chaudhary Report On Export Clusters of IndiaDocument20 pagesGarima Chaudhary Report On Export Clusters of Indiasiddhant.18062003No ratings yet

- Chap 004Document16 pagesChap 004Ela PelariNo ratings yet

- Incoterms Guide TFGDocument38 pagesIncoterms Guide TFGRamona Ion100% (1)

- The Evolution of CSR - RELOSA, DANILO CDocument25 pagesThe Evolution of CSR - RELOSA, DANILO CDan RelosaNo ratings yet

- Community Engagement and InvestmentDocument30 pagesCommunity Engagement and InvestmentCharlene KronstedtNo ratings yet

- Sustainable Use and Management of Natural Resources: EEA Report No 9/2005Document72 pagesSustainable Use and Management of Natural Resources: EEA Report No 9/2005Vethavarnaa SundaramoorthyNo ratings yet

- AHMEDABAD MUNICIPAL CORPORATION PROPERTY TAX BILLDocument1 pageAHMEDABAD MUNICIPAL CORPORATION PROPERTY TAX BILLEng SvshahNo ratings yet

- Introduction Voucher ConceptDocument9 pagesIntroduction Voucher Conceptnagesh dashNo ratings yet

- Fundamentals of the Indian Capital MarketDocument37 pagesFundamentals of the Indian Capital MarketBharat TailorNo ratings yet

- Report On IFIC Bank LimitedDocument34 pagesReport On IFIC Bank LimitedGazi Shahbaz Mohammad0% (1)

- Accounts HeadDocument7 pagesAccounts HeadRobiul khanNo ratings yet

- Case Study in Industrialized Building System (IBS)Document17 pagesCase Study in Industrialized Building System (IBS)Mohamed A. SattiNo ratings yet

- Uber - Competing As A Market Leader in The USA Vs Being A Distant Second in ChinaDocument9 pagesUber - Competing As A Market Leader in The USA Vs Being A Distant Second in ChinaTrúc Ngân NguyễnNo ratings yet

- Module 8. BLDG - EnhancingDocument12 pagesModule 8. BLDG - EnhancingCristherlyn DabuNo ratings yet

- Drain of WealthDocument9 pagesDrain of WealthAjay KumarNo ratings yet

- Monthly Portfolio As On 30th June 2021Document367 pagesMonthly Portfolio As On 30th June 2021muhsinNo ratings yet

- Eureka Forbes Case: Managing Sales EffortsDocument6 pagesEureka Forbes Case: Managing Sales EffortsPradeep PradeepNo ratings yet

- Bms Model Question Papers 2021-22Document3 pagesBms Model Question Papers 2021-22Vinod Kumar100% (1)

- Bad Hanim Ut Master ThesisDocument91 pagesBad Hanim Ut Master ThesisS DNo ratings yet

- Business Strategy - Case Study of WalmartDocument30 pagesBusiness Strategy - Case Study of WalmartOwais JunaidNo ratings yet

- Payroll Workshop: Alaras, Arla Gabrielle (A0012)Document15 pagesPayroll Workshop: Alaras, Arla Gabrielle (A0012)Eloisa Joy MoredoNo ratings yet