Professional Documents

Culture Documents

Facts: On July 5, 1995, Respondent

Uploaded by

Raina Phia Pantaleon0 ratings0% found this document useful (0 votes)

4 views7 pagesOriginal Title

Notes_210422_214929

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views7 pagesFacts: On July 5, 1995, Respondent

Uploaded by

Raina Phia PantaleonCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

Facts:

On July 5, 1995, respondent

Wilfred N. Chiok (Chiok) bought

US$1,022,288.50 dollars from

Gonzalo B. Nuguid (Nuguid) where

Chiok deposited the three

manager’s checks (Asian Bank MC

Nos. 025935 and 025939, and

Metrobank CC No. 003380), with an

aggregate value of ₱26,068,350.00

in Nuguid’s account with petitioner

Bank of the Philippine Islands (BPI).

Nuguid, however, failed to deliver

the dollar equivalent of the three

checks as agreed upon, prompting

Chiok to request that payment on

the three checks be stopped. On

the following day, July 6, 1995,

Chiok filed a Complaint for

damages with application for ex

parte restraining order and/or

preliminary injunction with the

Regional Trial Court (RTC) of

Quezon City against the spouses

Gonzalo and Marinella Nuguid, and

the depositary banks, Asian Bank

and Metrobank. On July 25, 1995,

the

RTC issued an Order directing the

issuance of a writ of preliminary

prohibitory injunction. When checks

were presented for payment, Asian

Bank refused to honor MC Nos.

025935 and 025939 in deference to

the TRO.

Issue: Whether or not payment of

manager’s and cashier’s checks are

subject to the condition that the

payee thereof should comply with

his obligations to the purchaser of

the checks.

Held: No. A manager’s check, like a

cashier’s check, is an order of the

bank to pay, drawn upon itself,

committing in effect its total

resources, integrity, and honor

behind its issuance. By its peculiar

character and general use in

commerce, a

manager’s check or a cashier’s

check is regarded substantially to

be as good as the money it

represents. While manager’s and

cashier’s checks are still subject to

clearing, they cannot be

countermanded for being drawn

against a closed account, for being

drawn against insufficient funds, or

for similar reasons such as a

condition not appearing on the face

of the check. Long standing and

accepted banking practices do not

countenance the countermanding of

manager’s and cashier’s checks on

the basis of a mere allegation of

failure of the payee to comply with

its obligations towards the

purchaser. Therefore, when Nuguid

failed to deliver the agreed amount

to Chiok, the latter had a cause of

action against Nuguid to ask for the

rescission of their contract; but,

Chiok did not have a cause of

action against Metrobank and

Global Bank that would

allow him to rescind the contracts of

sale of the manager’s or cashier’s

checks, which would have resulted

in the crediting of the amounts

thereof back to his accounts.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Adelaida Soriano V People of The PhilippinesDocument2 pagesAdelaida Soriano V People of The PhilippinesRaina Phia PantaleonNo ratings yet

- Lafarge Cement Vs Continental CementDocument9 pagesLafarge Cement Vs Continental CementRaina Phia PantaleonNo ratings yet

- Cda Red FR 003 Rev7 CaprDocument32 pagesCda Red FR 003 Rev7 CaprRaina Phia PantaleonNo ratings yet

- Dela Cruz Vs ComelecDocument24 pagesDela Cruz Vs ComelecRaina Phia PantaleonNo ratings yet

- A Compilation of Cases in Partial Fulfillment of The Requirement On Obligations and ContractDocument165 pagesA Compilation of Cases in Partial Fulfillment of The Requirement On Obligations and ContractRaina Phia PantaleonNo ratings yet

- Oblicon Cases - ContractsDocument14 pagesOblicon Cases - ContractsRaina Phia PantaleonNo ratings yet

- Contracts Case DigestsDocument25 pagesContracts Case DigestsRaina Phia PantaleonNo ratings yet

- Tests To Determine Confusing Similarity Between Marks: TrademarksDocument13 pagesTests To Determine Confusing Similarity Between Marks: TrademarksRaina Phia PantaleonNo ratings yet

- Oblicon Contracts - CasesDocument10 pagesOblicon Contracts - CasesRaina Phia PantaleonNo ratings yet

- Consti Final Exam AnswersDocument2 pagesConsti Final Exam AnswersRaina Phia PantaleonNo ratings yet

- Election Law Cases - p2Document135 pagesElection Law Cases - p2Raina Phia PantaleonNo ratings yet

- Tests To Determine Confusing Similarity Between Marks: TrademarksDocument12 pagesTests To Determine Confusing Similarity Between Marks: TrademarksRaina Phia PantaleonNo ratings yet

- Kauffman vs. PNB, 42 Phil 182, Sept. 29, 1921Document45 pagesKauffman vs. PNB, 42 Phil 182, Sept. 29, 1921Raina Phia PantaleonNo ratings yet

- Tests To Determine Confusing Similarity Between Marks: TrademarksDocument12 pagesTests To Determine Confusing Similarity Between Marks: TrademarksRaina Phia PantaleonNo ratings yet

- Acquisition OF Ownership of Trade NameDocument12 pagesAcquisition OF Ownership of Trade NameRaina Phia PantaleonNo ratings yet

- Oblicon CasesDocument18 pagesOblicon CasesRaina Phia PantaleonNo ratings yet

- Vdocuments - MX - Criminal Procedure Case DigestsdocDocument6 pagesVdocuments - MX - Criminal Procedure Case DigestsdocRaina Phia PantaleonNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Mastercard AssignmentDocument37 pagesMastercard AssignmentAnastasia EgorovaNo ratings yet

- Mortgage Foreclosure RecoupmentDocument28 pagesMortgage Foreclosure Recoupmentjvo197077% (13)

- منافذ الصيرفة الإلكترونية في الجزائر -حالة بنك التنمية المحلية BDLDocument18 pagesمنافذ الصيرفة الإلكترونية في الجزائر -حالة بنك التنمية المحلية BDLRADOUANE ALLOUNo ratings yet

- Assignment On Brac BankDocument15 pagesAssignment On Brac Bankakhtar140100% (1)

- Long-Term Liabilities: Intermediate Accounting 12th Edition Kieso, Weygandt, and WarfieldDocument41 pagesLong-Term Liabilities: Intermediate Accounting 12th Edition Kieso, Weygandt, and WarfieldYunus Alfani100% (1)

- Ring Fencing What Is It and How Will It Affect Banks and Their CustomersDocument9 pagesRing Fencing What Is It and How Will It Affect Banks and Their CustomersTijana DoberšekNo ratings yet

- Cash and Cash EquivalentsDocument17 pagesCash and Cash EquivalentsNobu NobuNo ratings yet

- Loan EMI CalculatorDocument6 pagesLoan EMI Calculatorjiguparmar1516No ratings yet

- Banking Awareness-Live - Credit Rating AgenciesDocument2 pagesBanking Awareness-Live - Credit Rating AgenciesyugandharNo ratings yet

- Cash Management of Icici BankDocument19 pagesCash Management of Icici BankBassam QureshiNo ratings yet

- Forex Study Material PDFDocument48 pagesForex Study Material PDFGaurav SharmaNo ratings yet

- Engineering Economy Course Student 2Document21 pagesEngineering Economy Course Student 2Ashraf BestawyNo ratings yet

- FMI7e ch09Document44 pagesFMI7e ch09lehoangthuchien100% (1)

- Internship Report On UBLDocument75 pagesInternship Report On UBLBashir Ahmad0% (2)

- 28x VenmoDocument1 page28x Venmorckmvp6c8qNo ratings yet

- RevenueRecognitionExecution - Revenue Recognition Execution ReportDocument2 pagesRevenueRecognitionExecution - Revenue Recognition Execution ReportbishwabengalitolaNo ratings yet

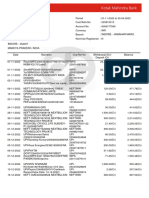

- POSB Payroll Account-9Document5 pagesPOSB Payroll Account-9Krishna Chaitanya KolluNo ratings yet

- Transactions May23Document1 pageTransactions May23John FarrellNo ratings yet

- U03 - Additional Practise QuestionsDocument8 pagesU03 - Additional Practise QuestionsnemeNo ratings yet

- Punjab National Bank Punjab National Bank Punjab National BankDocument1 pagePunjab National Bank Punjab National Bank Punjab National BankHarsh ChaudharyNo ratings yet

- Alishba Internship ReportDocument48 pagesAlishba Internship ReportAlishba NadeemNo ratings yet

- Dobrinčić Ivan 06-07.07.2017.Document2 pagesDobrinčić Ivan 06-07.07.2017.Ivan DobrinčićNo ratings yet

- Iob Losing Public Money 30L EpisodeDocument6 pagesIob Losing Public Money 30L EpisodeNavnit NarayananNo ratings yet

- Fake Bank StamentDocument7 pagesFake Bank StamentGovind DhiwarNo ratings yet

- Interview Question and AnswersDocument7 pagesInterview Question and AnswersDvd NitinNo ratings yet

- Regulatory Framework For Business Transactions: Atty. Kenneth B. Fabila, CPADocument95 pagesRegulatory Framework For Business Transactions: Atty. Kenneth B. Fabila, CPAKris Van HalenNo ratings yet

- Statement of Axis Account No:923010024537354 For The Period (From: 15-05-2023 To: 16-06-2023)Document2 pagesStatement of Axis Account No:923010024537354 For The Period (From: 15-05-2023 To: 16-06-2023)PRAMOD KUMARNo ratings yet

- Group 1 Exercise 1.Document4 pagesGroup 1 Exercise 1.Thi Hong Nhung DauNo ratings yet

- DiscountDocument5 pagesDiscountMark Christian Cortez EstrellaNo ratings yet

- Acct Statement XX8988 01102021Document1 pageAcct Statement XX8988 01102021punit GroverNo ratings yet