Professional Documents

Culture Documents

Review of Financial Accounting Theory and Practice

Uploaded by

Mary Jullianne Caile SalcedoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Review of Financial Accounting Theory and Practice

Uploaded by

Mary Jullianne Caile SalcedoCopyright:

Available Formats

Page 1 of 2

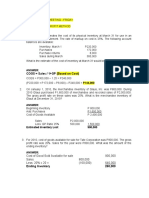

REVIEW OF FINANCIAL ACCOUNTING THEORY AND PRACTICE

INVENTORY ESTIMATION

1. Benguet Company’s accounting records indicated the following for 2005:

Inventory, January 1 P6,000,000

Purchases 20,000,000

Sales 30,000,000

A physical inventory taken on December 31, 2005 resulted in an ending inventory of

P4,500,000. The gross profit on sales remained constant at 30% in recent years.

Benguet suspects some inventory may have been taken by a new employee. At

December 31, 2005 what is the estimated cost of missing inventory?

a. P5,000,000 c. P500,000

b. P4,500,000 d. P 0

2. The Atok Corporation was organized on January 1, 2004. On December 31, 2005, the

corporation lost most of its inventory in a warehouse fire just before the year-end count

of inventory was to take place. Data from the records disclosed the following:

2004 2005

Beginning inventory, January 1 P 0 P1,020,000

Purchases 4,300,000 3,460,000

Purchases returns and allowances 230,600 323,000

Sales 3,940,000 4,180,000

Sales returns and allowances 80,000 100,000

On January 1, 2005, the Corporation’s pricing policy was changed so that the gross

profit rate would be three percentage points higher than the one earned in 2004.

Salvaged undamaged merchandise was marked to sell at P120,000 while damaged

merchandise was marked to sell at P80,000 had an estimated realizable value of

P18,000.

How much is the inventory loss due to fire?

a. P918,200 c. P856,200

b. P947,000 d. P824,600

3. The work-in-process inventory of Bakun Company were completely destroyed by fire

on June 1, 2005. You were able to establish physical inventory figures as follows:

January 1, 2005 June 1, 2005

Raw materials P 60,000 P120,000

Work-in-process 200,000 -

Finished goods 280,000 240,000

Sales from January 1 to May 31, were P546,750. Purchases of raw materials were

P200,000 and freight on purchases, P30,000. Direct labor during the period was

P160,000. It was agreed with insurance adjusters than an average gross profit rate of

35% based on cost be used and that direct labor cost was 160% of factory overhead.

The work in process inventory destroyed as computed by the adjuster

a. P314,612 c. P185,000

b. P366,000 d. P265,000

Page 2 of 2

4. Tublay uses the retail inventory method to approximate the lower of average cost or

market. The following information is available for the current year:

Cost Retail

Beginning inventory P 1,300,000 P 2,600,000

Purchases 18,000,000 29,200,000

Freight in 400,000

Purchase returns 600,000 1,000,000

Purchase allowances 300,000

Departmental transfer in 400,000 600,000

Net markups 600,000

Net markdowns 2,000,000

Sales 24,400,000

Sales discounts 200,000

Employee discounts 600,000

What should be reported as the estimated cost of inventory at the end of the current

year?

a. P3,120,000 c. P3,000,000

b. P3,200,000 d. P3,840,000

5. Trinidad Company uses the average cost retail method to estimate its inventory. Data

relating to the inventory at December 31, 2005 are:

Cost Retail

Inventory, January 1 P 2,000,000 P3,000,000

Purchases 10,600,000 14,000,000

Net markups 1,600,000

Net markdowns 600,000

Sales 12,000,000

Estimated normal shoplifting losses 400,000

Estimated normal shrinkage is 5% of sales

Trinidad’s cost of goods sold for the year ended December 31, 2004 is

a. P9,100,000 c. P8,400,000

b. P8,680,000 d. P7,700,000

6. Mankayan Company uses the first-in, first-out retail method of inventory valuation. The

following information is available:

Cost Retail

Beginning inventory P 2,500,000 4,000,000

Purchases 13,500,000 16,000,000

Net markups 3,000,000

Net markdowns 1,000,000

Sales 15,000,000

What would be the estimated cost of the ending inventory?

a. P7,000,000 c. P5,110,000

b. P5,250,000 d. P4,750,000

- end -

You might also like

- Freelance Contract AgreementDocument10 pagesFreelance Contract AgreementGayathri Prajit100% (1)

- Ap RmycDocument16 pagesAp RmycJoseph Bayo BasanNo ratings yet

- Handouts For Inventories: A. This Fact Must Be DisclosedDocument7 pagesHandouts For Inventories: A. This Fact Must Be DisclosedDenver Legarda100% (1)

- QuizDocument15 pagesQuizMark Domingo Mendoza100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Inventory With SolutionDocument11 pagesInventory With SolutionjjabarquezNo ratings yet

- (Problems) - Audit of CashDocument33 pages(Problems) - Audit of CashPraise Buenaflor14% (7)

- (Problems) - Audit of CashDocument33 pages(Problems) - Audit of CashPraise Buenaflor14% (7)

- Bodie8ce FormulaSheet PDFDocument24 pagesBodie8ce FormulaSheet PDFSandini Dharmasena PereraNo ratings yet

- XDocument2 pagesXjaymark canayaNo ratings yet

- Review of Financial Accounting Theory and PracticeDocument2 pagesReview of Financial Accounting Theory and PracticeMary Jullianne Caile SalcedoNo ratings yet

- 08 - Inventory EstimationDocument2 pages08 - Inventory EstimationROMAR A. PIGANo ratings yet

- 08 - Inventory EstimationDocument2 pages08 - Inventory EstimationROMAR A. PIGANo ratings yet

- This Study Resource Was: Review of Financial Accounting Theory and PracticeDocument2 pagesThis Study Resource Was: Review of Financial Accounting Theory and PracticeKez MaxNo ratings yet

- Intermediate Accounting 1 - Inventories Part 2Document5 pagesIntermediate Accounting 1 - Inventories Part 2Lien LaurethNo ratings yet

- 37 - Income StatementDocument2 pages37 - Income StatementROMAR A. PIGANo ratings yet

- Inventory Problems (Continuation)Document5 pagesInventory Problems (Continuation)Eleina Bea BernardoNo ratings yet

- Inventory Valuation and Gross Profit MethodDocument3 pagesInventory Valuation and Gross Profit MethodLuiNo ratings yet

- Audit of Inventories - Part 2Document4 pagesAudit of Inventories - Part 2Mark Lawrence YusiNo ratings yet

- Week 09 - Inventory EstimationsDocument3 pagesWeek 09 - Inventory EstimationsPj ManezNo ratings yet

- M4.1-M4.5 Exercise ProblemsDocument5 pagesM4.1-M4.5 Exercise ProblemsMerecci Angela De ChavezNo ratings yet

- Inventory, Biological & InvestmentDocument4 pagesInventory, Biological & InvestmentShaira BugayongNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- P1 - Inventory Valuation and GP MethodDocument2 pagesP1 - Inventory Valuation and GP MethodJoanna Caballero100% (1)

- 04 Inventory EstimationDocument5 pages04 Inventory EstimationWinnie ToribioNo ratings yet

- Gross Profit and Retail MethodDocument2 pagesGross Profit and Retail MethodMary Dale Joie BocalaNo ratings yet

- Gross Profit and Retail MethodDocument2 pagesGross Profit and Retail MethodMary Dale Joie Bocala0% (1)

- Sample Problems For InventoryDocument3 pagesSample Problems For Inventorytough mamaNo ratings yet

- Notes PayableDocument9 pagesNotes Payablerencelor21No ratings yet

- Quiz 1 Inventory and InvestmentsDocument7 pagesQuiz 1 Inventory and InvestmentsMark Lawrence YusiNo ratings yet

- Inventory EstimationDocument2 pagesInventory Estimationralphalonzo100% (1)

- Batch 19 1st Preboard (P1)Document12 pagesBatch 19 1st Preboard (P1)Mike Oliver Nual100% (1)

- Inventory Sample Exercise - 2Document8 pagesInventory Sample Exercise - 2jangjangNo ratings yet

- B. It May Be Used To Estimate Inventories For Annual StatementsDocument2 pagesB. It May Be Used To Estimate Inventories For Annual StatementsGray JavierNo ratings yet

- 8-Inventory EstimationDocument5 pages8-Inventory EstimationYulrir Alesteyr HiroshiNo ratings yet

- Quiz On Inventories Set ADocument4 pagesQuiz On Inventories Set AJerico Mamaradlo0% (2)

- Methods of Estimating The Amount of Inventory:: Sales DiscountDocument4 pagesMethods of Estimating The Amount of Inventory:: Sales Discountellaine villafaniaNo ratings yet

- Financial Accounting P 1 Quiz 3 KeyDocument6 pagesFinancial Accounting P 1 Quiz 3 KeyJei CincoNo ratings yet

- AaaaDocument11 pagesAaaaJessica JaroNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument2 pagesCpa Review School of The Philippines Mani LaJustine CruzNo ratings yet

- Illustrative Examples 9Document2 pagesIllustrative Examples 9Willyn LachicaNo ratings yet

- 1909 Gross Profit and Retail MethodDocument3 pages1909 Gross Profit and Retail MethodCykee Hanna Quizo Lumongsod50% (4)

- Inventories Quiz 2Document5 pagesInventories Quiz 2Kasey PastorNo ratings yet

- D11 - P OneDocument12 pagesD11 - P OneAnalie Mendez100% (2)

- FAR - Inventory Estimation - No AnsDocument2 pagesFAR - Inventory Estimation - No AnsJacob Raphael100% (1)

- PRAC TWO QuestionnaireDocument18 pagesPRAC TWO Questionnairekarina gayosNo ratings yet

- Pract 2, March 2010Document8 pagesPract 2, March 2010jjjjjjjjjjjjjjjNo ratings yet

- Drills Acc 106Document2 pagesDrills Acc 106brmo.amatorio.uiNo ratings yet

- Problem No.1: D. P147,000 C. P349,000 C. P639,000Document6 pagesProblem No.1: D. P147,000 C. P349,000 C. P639,000debate ddNo ratings yet

- Activity Inventory Cost Flow and LCNRVDocument3 pagesActivity Inventory Cost Flow and LCNRVGinalyn BisongaNo ratings yet

- Problems - Inventory Estimation: Gross Profit MethodDocument13 pagesProblems - Inventory Estimation: Gross Profit MethodmercyvienhoNo ratings yet

- 8 Inventory EstimationDocument3 pages8 Inventory EstimationJorufel PapasinNo ratings yet

- Problems On Gross Profit Method and ManufacturingDocument5 pagesProblems On Gross Profit Method and Manufacturingcriszel4sobejanaNo ratings yet

- Inventories, Biological Assets, Etc.Document3 pagesInventories, Biological Assets, Etc.Jobelle Candace Flores AbreraNo ratings yet

- Henri Emanuel Reforba - Learning Task #2Document6 pagesHenri Emanuel Reforba - Learning Task #2Rhea BernabeNo ratings yet

- Problems Inventories - Quizbowl 1Document8 pagesProblems Inventories - Quizbowl 1Anna AldaveNo ratings yet

- HO 11 - Inventory EstimationDocument4 pagesHO 11 - Inventory EstimationMakoy BixenmanNo ratings yet

- Applied - 3 MidtermDocument7 pagesApplied - 3 MidtermMarjorieNo ratings yet

- Assignment InventoriesDocument7 pagesAssignment InventoriesKristine TiuNo ratings yet

- INVENTORY PROBLEMS AND CONCEPTS QUE and ANSDocument11 pagesINVENTORY PROBLEMS AND CONCEPTS QUE and ANSMALICDEM, CharizNo ratings yet

- P 1Document13 pagesP 1Ryan Joseph Agluba DimacaliNo ratings yet

- C - 12 LCNRV - Multiple Choice Problem-1 PDFDocument2 pagesC - 12 LCNRV - Multiple Choice Problem-1 PDFJeza Mae Carno FuentesNo ratings yet

- Forest Products: Advanced Technologies and Economic AnalysesFrom EverandForest Products: Advanced Technologies and Economic AnalysesNo ratings yet

- Ias 16 Property Plant and EquipmentDocument28 pagesIas 16 Property Plant and EquipmentEminnece O. OlusegunNo ratings yet

- Chapter 8 Good LifeDocument5 pagesChapter 8 Good LifeMary Jullianne Caile SalcedoNo ratings yet

- Chapter 6 and 7: The Human Person Flourishing in Terms of Science and TechnologyDocument10 pagesChapter 6 and 7: The Human Person Flourishing in Terms of Science and TechnologyRoxanne Mae VillacoraNo ratings yet

- Chapter 4 STSDocument7 pagesChapter 4 STSMary Jullianne Caile SalcedoNo ratings yet

- CHAPTER 3 STS Reading Materials 2nd SemDocument6 pagesCHAPTER 3 STS Reading Materials 2nd SemMary Jullianne Caile SalcedoNo ratings yet

- Summary of PAS 8 (Accounting Policies, Changes in Accounting Estimates and Errors)Document3 pagesSummary of PAS 8 (Accounting Policies, Changes in Accounting Estimates and Errors)Mary Jullianne Caile SalcedoNo ratings yet

- STS CHAPTER 5 2nd Sem SY 2020-2021Document18 pagesSTS CHAPTER 5 2nd Sem SY 2020-2021Mary Jullianne Caile SalcedoNo ratings yet

- Summary OutlineDocument5 pagesSummary OutlineMary Jullianne Caile SalcedoNo ratings yet

- Summary OutlineDocument5 pagesSummary OutlineMary Jullianne Caile SalcedoNo ratings yet

- ch09tbpdf PDFDocument25 pagesch09tbpdf PDFPauline Keith Paz ManuelNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsMary Jullianne Caile SalcedoNo ratings yet

- Bank ReconciliationDocument1 pageBank ReconciliationMary Jullianne Caile SalcedoNo ratings yet

- Introduction To Cost AccountingDocument2 pagesIntroduction To Cost AccountingMary Jullianne Caile SalcedoNo ratings yet

- Bank ReconciliationDocument1 pageBank ReconciliationMary Jullianne Caile SalcedoNo ratings yet

- Introduction To Cost AccountingDocument2 pagesIntroduction To Cost AccountingMary Jullianne Caile SalcedoNo ratings yet

- Summary OutlineDocument5 pagesSummary OutlineMary Jullianne Caile SalcedoNo ratings yet

- Monopolistic Competition: Team Kwik-KwikDocument7 pagesMonopolistic Competition: Team Kwik-KwikMary Jullianne Caile SalcedoNo ratings yet

- Maneesh Misra CV - 1Document3 pagesManeesh Misra CV - 1Rohit KarhadeNo ratings yet

- CodeDocument2 pagesCodeJoao BatistaNo ratings yet

- Kompresi MobilDocument58 pagesKompresi Mobilfatah hamid100% (1)

- Sample Resume FinalDocument2 pagesSample Resume FinalSyed Asad HussainNo ratings yet

- NISE3600EDocument2 pagesNISE3600ENgo CuongNo ratings yet

- Books Confirmation - Sem VII - 2020-2021 PDFDocument17 pagesBooks Confirmation - Sem VII - 2020-2021 PDFRaj Kothari MNo ratings yet

- Introduction To Risk Management and Insurance 10th Edition Dorfman Test BankDocument26 pagesIntroduction To Risk Management and Insurance 10th Edition Dorfman Test BankMichelleBellsgkb100% (50)

- Case 2:09-cv-02445-WBS-AC Document 625-1 Filed 01/21/15 Page 1 of 144Document144 pagesCase 2:09-cv-02445-WBS-AC Document 625-1 Filed 01/21/15 Page 1 of 144California Judicial Branch News Service - Investigative Reporting Source Material & Story Ideas100% (2)

- Philippine Metal Foundries v. CADocument2 pagesPhilippine Metal Foundries v. CAMarcus AureliusNo ratings yet

- Azhar Marketing Final PPRDocument9 pagesAzhar Marketing Final PPRafnain rafiNo ratings yet

- Bugreport Fog - in SKQ1.211103.001 2023 04 10 19 23 21 Dumpstate - Log 9097Document32 pagesBugreport Fog - in SKQ1.211103.001 2023 04 10 19 23 21 Dumpstate - Log 9097chandrakanth reddyNo ratings yet

- Micro Link Information Technology Business College: Department of Software EngineeringDocument34 pagesMicro Link Information Technology Business College: Department of Software Engineeringbeki4No ratings yet

- Share Purchase Agreement Short FormDocument7 pagesShare Purchase Agreement Short FormGerald HansNo ratings yet

- Encryption LessonDocument2 pagesEncryption LessonKelly LougheedNo ratings yet

- " My Heart Will Go On ": Vocal: Celine DionDocument8 pages" My Heart Will Go On ": Vocal: Celine DionLail Nugraha PratamaNo ratings yet

- Electricity at Work - Safe Working Practices HSG85Document27 pagesElectricity at Work - Safe Working Practices HSG85Sivakumar NatarajanNo ratings yet

- PR Status ReportDocument28 pagesPR Status ReportMascheny ZaNo ratings yet

- Beer Distribution Game - Wikipedia, The Free EncyclopediaDocument3 pagesBeer Distribution Game - Wikipedia, The Free EncyclopediaSana BhittaniNo ratings yet

- Sop ECUDocument5 pagesSop ECUSumaira CheemaNo ratings yet

- Divisional Sec. Contact Details 2019-03-01-UpdateDocument14 pagesDivisional Sec. Contact Details 2019-03-01-Updatedotr9317No ratings yet

- Yosys+Nextpnr: An Open Source Framework From Verilog To Bitstream For Commercial FpgasDocument4 pagesYosys+Nextpnr: An Open Source Framework From Verilog To Bitstream For Commercial FpgasFutsal AlcoletgeNo ratings yet

- Internship ReportDocument2 pagesInternship ReportFoxyNo ratings yet

- Global Competitiveness ReportDocument7 pagesGlobal Competitiveness ReportSHOIRYANo ratings yet

- COO Direct Response Marketing in Miami FL Resume Mark TaylorDocument2 pagesCOO Direct Response Marketing in Miami FL Resume Mark TaylorMarkTaylor1No ratings yet

- Agricultural Extension System in Sudan FinalDocument52 pagesAgricultural Extension System in Sudan FinalMohamed Saad AliNo ratings yet

- Oil & Grease CatalogDocument4 pagesOil & Grease Catalogmanoj983@gmail.comNo ratings yet

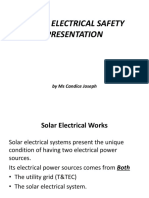

- Solar Electrical Safety Presentation 1PDFDocument34 pagesSolar Electrical Safety Presentation 1PDFblueboyNo ratings yet

- MITSUBISHI I-MievDocument297 pagesMITSUBISHI I-Mievtavaelromo84No ratings yet