Professional Documents

Culture Documents

Problems

Uploaded by

Faith Reyna Tan0 ratings0% found this document useful (0 votes)

1 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views1 pageProblems

Uploaded by

Faith Reyna TanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Ma. Faith R.

Tan May 24, 2021

BSA-2A | AEC10

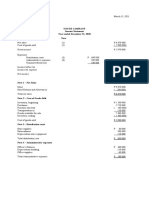

Problem no. 3

Sales (594 000 x 3/28) ₱ 63 642.86

Less: Sales returns (13 200 x 3/28) 1 414.29 ₱ 62 228.57

Deemed sales:

Payment to creditors 27 500

Consignment sales 34 100

Out on consignment 68 750

Goodwill to employees 11 000

Total 141 350

Multiply by 3/28 15 144.64

Output tax 77 373.21

Less: Input tax (253 000 x 3/28) 27 107.14

VAT payable ₱ 50 266.07

Problem no. 4

Domestic sales (1 452 000 x 3/28) ₱ 155 571.43

Export sales (1 815 000 x 0%) -

Output tax 155 571.43

Less: Input tax

Purchases – export (422 000 x 3/28) ₱ 45 214.28

Purchases – domestic (618 200 x 3/28) 66 235.71

Purchases – supplies (254 100 x 3/28) 27 225.00 138 674.99

VAT payable ₱ 16 896.44

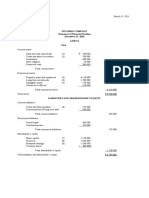

Problem no. 5

Actual VAT paid ₱ 365 000

Two percent (2%) of inventory:

Goods for resale ₱ 1 350 000

Goods manufactured 1 562 000

Goods in process of production 616 000

Goods purchased for processing 429 000

Total 3 957 000

Multiply by 2% 79 140

Transitional input tax (higher) ₱ 365 000

Problem no. 6

Total purchases of sugar cane ₱ 1 000 000

Portion produced into refined sugar:

White sugar 60%

Bagasse 5% 65%

Purchases produced into refined sugar & bagasse 650 000

Rate 4%

Presumptive input tax ₱ 26 000

Output tax (2 000 000 x 12%) ₱ 240 000

Less: Input tax

On purchases ₱ 35 000

Presumptive input tax 26 000 61 000

VAT payable ₱ 179 000

Problem no. 7

Output Tax (1000 000 x 3/28) ₱ 107 142.86

Less: Input Tax

Purchases, VAT (448 000 x 3/28) ₱ 48 000

Purchases, VAT & Non-VAT (110 880 x 3/28) 11 880

Allocation based on sales:

Sales, VAT ₱ 1 000 000

Sales, Non-VAT 500 000

Total 1 500 000

(1,000,000/1,500,000 x 11 880) 7 920 40 080

VAT payable ₱ 67 062.86

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A Case Study of Netflix Vs BlockbusterDocument6 pagesA Case Study of Netflix Vs BlockbusterCarlos kengaNo ratings yet

- Monzo Bank StatementDocument2 pagesMonzo Bank StatementAlpamis100% (1)

- Exercise No.4 (Acctg 7) - TanDocument1 pageExercise No.4 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Linear Programming Models: Graphical and Computer MethodsDocument91 pagesLinear Programming Models: Graphical and Computer MethodsFaith Reyna TanNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Chapter Test - Expenditure CycleDocument4 pagesChapter Test - Expenditure CycleFaith Reyna TanNo ratings yet

- FSAQ1Document1 pageFSAQ1Faith Reyna TanNo ratings yet

- AEC12 Chapter 4Document7 pagesAEC12 Chapter 4Faith Reyna TanNo ratings yet

- Chapter Test - Revenue CycleDocument3 pagesChapter Test - Revenue CycleFaith Reyna TanNo ratings yet

- Chapter Test - Gen Ledger & RPTG CycleDocument3 pagesChapter Test - Gen Ledger & RPTG CycleFaith Reyna TanNo ratings yet

- Chapter Test - Production CycleDocument3 pagesChapter Test - Production CycleFaith Reyna TanNo ratings yet

- Chapter Test - HRM&Payroll CycleDocument3 pagesChapter Test - HRM&Payroll CycleFaith Reyna TanNo ratings yet

- Chapter01 IntroductionToComputerProgrammingDocument23 pagesChapter01 IntroductionToComputerProgrammingFaith Reyna TanNo ratings yet

- Disclaimer: College of Information and Communications TechnologyDocument33 pagesDisclaimer: College of Information and Communications TechnologyFaith Reyna TanNo ratings yet

- Exercise No.3 (Acctg 7) - TanDocument2 pagesExercise No.3 (Acctg 7) - TanFaith Reyna TanNo ratings yet

- Priyanka MiniprojectDocument56 pagesPriyanka Miniprojectkrishnarao kalidasuNo ratings yet

- The Impact of Stock Market On Indian Economy Introduction: Conference PaperDocument11 pagesThe Impact of Stock Market On Indian Economy Introduction: Conference PaperfunnyNo ratings yet

- SBA Loan InformationDocument2 pagesSBA Loan InformationNews 5 WCYBNo ratings yet

- Solar Power World 01 2021Document100 pagesSolar Power World 01 2021Sorin PiciuNo ratings yet

- Disturbing Questions: INCOME PROTECTION: Ideal For Young Couples Starting Up A FamilyDocument7 pagesDisturbing Questions: INCOME PROTECTION: Ideal For Young Couples Starting Up A FamilyCherryber UrdanetaNo ratings yet

- Chopra Scm7ge Inppt 06Document74 pagesChopra Scm7ge Inppt 06Natasha BataynehNo ratings yet

- Chapter 1 Evolution and Fundamental of BusinessDocument211 pagesChapter 1 Evolution and Fundamental of BusinessDr. Nidhi KumariNo ratings yet

- St. Mary'S University School of Graduate Studies Department of General MbaDocument39 pagesSt. Mary'S University School of Graduate Studies Department of General MbaAsheberNo ratings yet

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleDocument6 pagesReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleSamyuktha RaoNo ratings yet

- 9.-Jordi Gali - El Modelo Neokeynesiano)Document62 pages9.-Jordi Gali - El Modelo Neokeynesiano)VÍCTOR ALONSO ZAMBRANO ORÉNo ratings yet

- Chapter 2 Accounting For Budgetary AccountsDocument33 pagesChapter 2 Accounting For Budgetary AccountsRia BagoNo ratings yet

- Final CBR 21Document142 pagesFinal CBR 21Prashant TiwariNo ratings yet

- Saffron Heritage Site of Kashmir in India GIAHS Saffron Site Report (Part-2) 31 May, 2012Document39 pagesSaffron Heritage Site of Kashmir in India GIAHS Saffron Site Report (Part-2) 31 May, 2012jahanNo ratings yet

- Major Stakeholders in HCSDocument13 pagesMajor Stakeholders in HCSVeeresh TopalakattiNo ratings yet

- Domino's Pizza:: Writing The Recipe For Digital MasteryDocument12 pagesDomino's Pizza:: Writing The Recipe For Digital MasteryHarsh Vardhan AgrawalNo ratings yet

- Unit 2 Banking Innovations: Evolution of Banking in IndiaDocument8 pagesUnit 2 Banking Innovations: Evolution of Banking in IndiaAnitha RNo ratings yet

- Supply Under GSTDocument14 pagesSupply Under GSTTreesa Mary RejiNo ratings yet

- vAJ1-Graham Formula Spreadsheet FreeDocument2 pagesvAJ1-Graham Formula Spreadsheet FreeCm ShegrafNo ratings yet

- The Beauty of Put Option Selling: by Joe RossDocument60 pagesThe Beauty of Put Option Selling: by Joe RossŞamil CeyhanNo ratings yet

- ACCO TestDocument6 pagesACCO TestvrindadevigtmNo ratings yet

- Preqin Report Alternative Investments ConsultantsDocument9 pagesPreqin Report Alternative Investments Consultantshttp://besthedgefund.blogspot.comNo ratings yet

- Customer Preference Towards Traditional and Ulip Products With Respect To Shri Ram Life InsuranceDocument7 pagesCustomer Preference Towards Traditional and Ulip Products With Respect To Shri Ram Life InsuranceAbhay kumarNo ratings yet

- XXXXXX: Principal Cardholder InformationDocument1 pageXXXXXX: Principal Cardholder InformationBoy GuapoNo ratings yet

- Sr. No. Category Fixed Charges Energy Charges Domestic: AnnexureDocument5 pagesSr. No. Category Fixed Charges Energy Charges Domestic: AnnexureAam aadmiNo ratings yet

- Invoice To Kimbraly A Hostetter - #96-935975Document1 pageInvoice To Kimbraly A Hostetter - #96-935975Imalka PriyadarshaniNo ratings yet

- Excersie ETDocument2 pagesExcersie ETdaoviethung29No ratings yet

- Cost Theory and Estimation PDFDocument14 pagesCost Theory and Estimation PDFAngie BobierNo ratings yet

- ULOd - Role of Financial Manager - 0Document4 pagesULOd - Role of Financial Manager - 0pam pamNo ratings yet