Professional Documents

Culture Documents

Indian Bankruptcy Code

Uploaded by

Criti0 ratings0% found this document useful (0 votes)

6 views3 pagesIBC ensures that the management which drives company into insolvency exits and a new transparent management is selected thereby ensuring there is no political interference in it. Indian bankruptcy law is a new law that has shown its success through improvement in recovering debt yet it will have to keep re-organising itself according to the various challenges going forward in our economic environment.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIBC ensures that the management which drives company into insolvency exits and a new transparent management is selected thereby ensuring there is no political interference in it. Indian bankruptcy law is a new law that has shown its success through improvement in recovering debt yet it will have to keep re-organising itself according to the various challenges going forward in our economic environment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesIndian Bankruptcy Code

Uploaded by

CritiIBC ensures that the management which drives company into insolvency exits and a new transparent management is selected thereby ensuring there is no political interference in it. Indian bankruptcy law is a new law that has shown its success through improvement in recovering debt yet it will have to keep re-organising itself according to the various challenges going forward in our economic environment.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

NEW BANKRUPTCY CODE IS REFORMING INDIAN BUSINESS

INDIAN BANKRUPTCY CODE – AN INSOLVENCY REGIME

The new insolvency regime -

Banks run on the loans given to borrowers and the interest that comes on the loans given increases the profit

margins and increase the bank’s capability to lend more. But if the debtor does not pay money back to bank,

insolvency sets in and they are unable to repay their outstanding debt. During 2008-2014, the banks had

indiscriminately lent to borrowers that led to a rise in Non-Performing Assets. Therefore, Indian Bankruptcy

law was introduced in 2016 as a new bankruptcy law through an act of Parliament regulated by Insolvency and

Bankruptcy Board of India (IBBI) to rescue the failing business and in speedy and effective resolution of the

company and recover debt. If the company insolvency is failed to be resolved in a time bound manner, then

the company is set for liquidation. This law has consolidated the existing framework of insolvency and

bankruptcy acts to supersede them since those failed to contain the rising NPA problem in India.

How does IBC work?

Creditors can initiate insolvency proceeding with National company law tribunal (NCLT)/Debt

Recovery Tribunal (DRT) and NCLT/DRT have to accept the appeal within 14 days.

Once the case is admitted, a committee of financial creditors is formed and appoint Insolvency

professional and the insolvency professional runs the company in the interim period.

The financial creditors committee will make debt recast plan and lenders will then conclude on the

final resolution.

If lenders agree to the debt recast plan, then the insolvency case will be resolved within 180 or 270

days otherwise the borrower’s assets will be liquidated to recover money and distributed to

beneficiaries.

How has IBC been able to get debt recovery faster?

There is a pre-admission out of court settlement happening in which the promoters are now paying

before the company is registered with National Company Law Tribunal (NCLT) for insolvency because

once the company comes under NCLT, the promoters lose their control over the management and

face difficulties. This helps in early identification of stressed assets.

Companies are paying up their loans in anticipation of not being referred to NCLT after introduction of

Section 29-A which barred promoters of defaulting assets to buy back or bidding for their assets

removed.

Banks are also recovering money from debtors in anticipation of default. When the banks recover

money back from debtors it increases the circulation of money with banks that improves the credit

culture of India.

The asset reconstruction companies buy a major portion of bad loans from banks and make them

productive again leaving the smaller portion as haircut for banks.

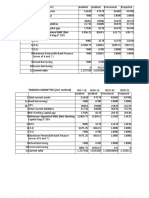

Facts show IBC a success -

By the end of 2018,

1332 cases have been admitted by NCLT

452 cases have been disposed at pre admission stage and managed to get 2.02 lakh crore from them

before registering with NCLT.

66 cases resolved after adjudication by NCLT/DRT.

260 cases were set for liquidation.

Presently,

As a result of IBC, the ease of doing business ranking for India has improved from 142 in 2015 to 52 in

2019.

There has been 40 % recovery seen under IBC compared to 15% recovery seen under SARFAESI Act.

How has IBC helped eEconomy?

The time bound resolution of insolvency cases has improved the ease of doing business in India. The

ranking has improved from 142 in 2015 to 52 in 2019. When the other countries notice that

insolvency cases are speedily resolved, the foreign investors increase their investments in India and

gives a boom to Indian economy with their capital inflows. The investors observe that the ease of exit

in the Indian market is becoming smoother.

Secondly, the NPA levels in banks are reducing and the debt is recovered back. This gives rise to the

profitability of banks and the banks are able to lend more giving rise to credit growth giving boost to

Indian economy.

An example that proves the authenticityunquestionable existence of IBC lLaw -

Essar Steel was amongst the top 12 defaulters in Indian banking system. Essar Steel owes 54,500 crores to

creditors and has been put on block under IBC. It is a big established steel manufacturer and started to suffer

losses in 2010. It borrowed crores of rupees and saddled with financial dues exceeding 54,000 crores. Banks

however lent in anticipation that Essar Steel would pick up once again but it did not happen. SBI and Standard

Chartered bank filed a petition against Essar in NCLT and was soon admitted under IBC. Nevertheless, Arcelor

Mittal offered to buy Essar Steel and pay back its debt. NCLT approved Arcelor’s 42,000 crore bid for Essar

Steel. Then, Supreme Court giving supremacy to financial creditors over operational creditors ordered Arcelor

to repay the debt. This way under IBC, the 91.2% of the outstanding debt was said to be recovered. This way

the PSB's would have their NPA's low and put less pressure on government on recapitalisation terms. This hails

the success story of this one comprehensive law, Indian bankruptcy code.

This way under IBC, the 91.2% of the outstanding debt was recovered and hails the success story of this one

comprehensive law, Indian bankruptcy code.

Behavioural changes brought by IBC -

The debtors are now taking corrective measures as soon as the companies land into stress as

compared to the situation before IBC where the debtors used to wait till the last tunnel to be

registered for insolvency. This has fairly resolved the insolvency cases. Due to the IBC, the people are

resolving the cases outside the court and this has reduced the burden on judiciary.

IBC has changed the relationship between the creditors and debtors. The debtors are no longer

chasing creditors but vice versa.

Issues with IBC -

The insolvency cases are facing delays from admission of the case to final approval of NCLT and the

cases are not resolved within 270 days and are dragged to litigation. This questions the efficiency of

the law. The government can further streamline the IBC process to avoid any delays in resolution of

the cases. As of June 2018, 977 cases were admitted for corporate resolution process, out of which 34

cases are successful, 91 cases were closed on appeal, 136 cases were ordered for liquidation and 716

cases have crossed more than 180 days of resolution process.

Critics also express that investment in infrastructure is needed to build more NCLT courts and more

human resources are required to manage the increasing number of cases.

Recent changes in IBC Bill -

IBC Amendment Bill 2019 - adds the resolution process must be completed within 330 days and can

be extended by the bill should be resolved within 90 days for resolution of the case..

Key developments in IBC 2020 -

i) Insolvency proceedings extended by 6 months : Insolvency proceedings would not be initiated

and stands to suspend Section 7, 9 and 10 for "any default arising on or after March 25, 2020

for a period of six months or such further period, not exceeding one year from such date” amid

coronavirus outbreak. This is positive for companies giving them a big relief defaulting on loans

but the companies who are already stressed and could have found resolution in these 6 months

would now have to wait for their resolutions.

ii) Threshold for default increased: The default threshold for stressed companies is increased to 1

crore from 1 lakh which largely insulates MSME’s which means that companies can initiate

insolvency proceedings on occurrence of default of minimum Rs 1 crore. However, the

coronavirus debt will be excluded from definition of default.

Final Words -

IBC ensures that the management which drives company into insolvency exits and a new transparent

management is selected thereby ensuring there is no political interference in it. Indian bankruptcy law is a

new law that has shown its success through improvement in recovering debt yet it will have to keep re-

organising itself according to the various challenges going forward in our economic environment.

You might also like

- ACCA REVISION MOCK EXAMDocument14 pagesACCA REVISION MOCK EXAMGyanu Khatri100% (3)

- Berkshire 2022ltrDocument10 pagesBerkshire 2022ltrZerohedge100% (1)

- Construction Project Finance Module 2019 LATEST2111Document88 pagesConstruction Project Finance Module 2019 LATEST2111Trevor T ParazivaNo ratings yet

- Chapter 6 Business ImplementationDocument16 pagesChapter 6 Business Implementationxy mczeen83% (6)

- ML PointsDocument196 pagesML Pointsapi-3744156100% (8)

- Study of The Insolvency and Bankruptcy Code 2016Document15 pagesStudy of The Insolvency and Bankruptcy Code 2016Devansh DoshiNo ratings yet

- A Resolve For ResolutionDocument18 pagesA Resolve For ResolutionSuraj KumarNo ratings yet

- Guide to SARFAESI Act Procedures for Debt RecoveryDocument43 pagesGuide to SARFAESI Act Procedures for Debt Recoveryamithasnani100% (3)

- Project Reports On Non Performing Assets (NPAs) in Banking IndustryDocument70 pagesProject Reports On Non Performing Assets (NPAs) in Banking IndustryShivam Yadav79% (14)

- Project Report On NPADocument24 pagesProject Report On NPANavkiran Kinni90% (30)

- Insolvency and Bankruptcy Code 2016Document14 pagesInsolvency and Bankruptcy Code 2016Parth SharmaNo ratings yet

- IBC Ecosystem in India & Experience So FarDocument36 pagesIBC Ecosystem in India & Experience So Farmedha mishraNo ratings yet

- Value Addition Notes - Indian EconomyDocument6 pagesValue Addition Notes - Indian Economynikitash1222No ratings yet

- Icb & LVB: Commercial Bank ManagementDocument3 pagesIcb & LVB: Commercial Bank ManagementSaurabh SainisNo ratings yet

- IBC Amendment Bill 2021 UPSC NotesDocument5 pagesIBC Amendment Bill 2021 UPSC NotesAvik PodderNo ratings yet

- Insolvancy Bankruptcy Code 2016Document6 pagesInsolvancy Bankruptcy Code 2016Navya GurjarNo ratings yet

- Company Law Assignment: Insolvency in IbcDocument10 pagesCompany Law Assignment: Insolvency in Ibcpriyanka_kajlaNo ratings yet

- Insolvency and Bankruptcy Code A Report Card of 16 Months PerformanceDocument3 pagesInsolvency and Bankruptcy Code A Report Card of 16 Months PerformanceJanaki JoshiNo ratings yet

- Submitted By: S Mouneesh: (17040142015) - BBA - LLB (HONS) 2017-22Document13 pagesSubmitted By: S Mouneesh: (17040142015) - BBA - LLB (HONS) 2017-22MouneeshNo ratings yet

- IBC and BanksDocument23 pagesIBC and BanksAnonymous VFyoCxNo ratings yet

- What Are Non Performing Assets?Document9 pagesWhat Are Non Performing Assets?Rizul96 GuptaNo ratings yet

- IBC Code Overview and ObjectivesDocument5 pagesIBC Code Overview and ObjectivesAananya DanielNo ratings yet

- Ias 12-12-19 PDFDocument19 pagesIas 12-12-19 PDFsamNo ratings yet

- Insolvency and Bankrutpcy CodeDocument8 pagesInsolvency and Bankrutpcy CodeAnkur SharmaNo ratings yet

- Mediation PaperDocument6 pagesMediation PaperYuvraj SinghNo ratings yet

- Assignment 3Document2 pagesAssignment 3shilpaNo ratings yet

- INSOLVENY AND BANKRUPTCY CODEDocument4 pagesINSOLVENY AND BANKRUPTCY CODESING ALONGNo ratings yet

- COmpany LAw-1Document11 pagesCOmpany LAw-1Suruchi SinghNo ratings yet

- Ibc End Term Semester 9Document18 pagesIbc End Term Semester 9BADDAM PARICHAYA REDDYNo ratings yet

- IBC Code Resolves India's Banking NPAsDocument6 pagesIBC Code Resolves India's Banking NPAsJitesh KhuranaNo ratings yet

- Indian Banks Cut NPAs to Lowest Since 2016Document44 pagesIndian Banks Cut NPAs to Lowest Since 2016ParthNo ratings yet

- Resolution of NPA and Insolvency and Bankruptcy Code, 2016Document7 pagesResolution of NPA and Insolvency and Bankruptcy Code, 2016AkashNo ratings yet

- NPA Management by Indian Banks- LATESTDocument40 pagesNPA Management by Indian Banks- LATESTdev mhaispurkarNo ratings yet

- IBC Code ExplainedDocument4 pagesIBC Code ExplainedAashish mishraNo ratings yet

- Insolvency and Bankruptcy CODE 2016 Regulatory Framework For Distressed M&As Under IBC 2016Document60 pagesInsolvency and Bankruptcy CODE 2016 Regulatory Framework For Distressed M&As Under IBC 2016IIM RohtakNo ratings yet

- Why Was Ibc Introduced and How Is It Different From The Earlier Regime?Document7 pagesWhy Was Ibc Introduced and How Is It Different From The Earlier Regime?bips99No ratings yet

- THE IBC, 2016 SymbiosisDocument35 pagesTHE IBC, 2016 SymbiosisNavya TomerNo ratings yet

- Introduction and Overview of IBCDocument3 pagesIntroduction and Overview of IBCArushi JindalNo ratings yet

- MSME IBC2 FootDocument26 pagesMSME IBC2 FootPriyadarshan NairNo ratings yet

- What Is Insolvency and Bankruptcy CodeDocument9 pagesWhat Is Insolvency and Bankruptcy CodeJosef AnthonyNo ratings yet

- Shadda KaporDocument25 pagesShadda KaporAyushi MehtaNo ratings yet

- Corporate LawDocument36 pagesCorporate LawJahnnavi SarkhelNo ratings yet

- Recent Measures To Tackle NPADocument3 pagesRecent Measures To Tackle NPAJyotiNo ratings yet

- IBC - Paradigm Shift From 'Debtor-In-Possession' To 'Creditor-In-Control'Document7 pagesIBC - Paradigm Shift From 'Debtor-In-Possession' To 'Creditor-In-Control'Jai SoniNo ratings yet

- Key Amendments to IBC: Eligibility, Voting and MSMEsDocument30 pagesKey Amendments to IBC: Eligibility, Voting and MSMEsgunjanjoshi07No ratings yet

- Sap Id: Roll No: Open Book - Through Blackboard Learning Management SystemDocument4 pagesSap Id: Roll No: Open Book - Through Blackboard Learning Management SystemAkshita ShrivastavaNo ratings yet

- NPA Recovery ManagementDocument31 pagesNPA Recovery ManagementSantoshi AravindNo ratings yet

- COMPANY Law II pROJECTDocument7 pagesCOMPANY Law II pROJECTpriyanka_kajlaNo ratings yet

- Insolvency and Bankruptcy Code 2016Document4 pagesInsolvency and Bankruptcy Code 2016Tanima SoodNo ratings yet

- Definition of Npas: A NPA Is A Loan or An Advance WhereDocument30 pagesDefinition of Npas: A NPA Is A Loan or An Advance WheremulchandranaNo ratings yet

- Manik Dev 2Document19 pagesManik Dev 2BADDAM PARICHAYA REDDYNo ratings yet

- Tri LegalDocument4 pagesTri LegalShreyashkarNo ratings yet

- Article On Debt Recovery Tribunal - FinalDocument6 pagesArticle On Debt Recovery Tribunal - Finalvasantharao venkataraoNo ratings yet

- Rishav Patwari (Roll No.-56) (Insolvency & Bankruptcy Code, 2016)Document3 pagesRishav Patwari (Roll No.-56) (Insolvency & Bankruptcy Code, 2016)Rishav PatwariNo ratings yet

- Guidelines for settling bank dues through Lok AdalatsDocument3 pagesGuidelines for settling bank dues through Lok AdalatsMahesh Prasad PandeyNo ratings yet

- Discuss The Recent Regulatory Changes Adopted For The Better Governance of Nbfcs in India. (Pradeeba C 215119061)Document5 pagesDiscuss The Recent Regulatory Changes Adopted For The Better Governance of Nbfcs in India. (Pradeeba C 215119061)Pradeeba ChinnaduraiNo ratings yet

- Presentation On NPA Problem: by Anshika AditiDocument18 pagesPresentation On NPA Problem: by Anshika AditiAnshika SharmaNo ratings yet

- Pre-Pack Insolvency Resolution Process: A Critical AnalysisDocument20 pagesPre-Pack Insolvency Resolution Process: A Critical AnalysisShivani SrivastavaNo ratings yet

- RBSA Evolution of IBC 2016Document34 pagesRBSA Evolution of IBC 2016ezioNo ratings yet

- RBI Governor On IBCDocument15 pagesRBI Governor On IBCyashs-pgdm-2022-24No ratings yet

- Management of Non-Performing Assets: Presentation by Mr. S. RaviDocument29 pagesManagement of Non-Performing Assets: Presentation by Mr. S. RaviRajesh MaddiNo ratings yet

- Corporate Accounting Assignment-IiDocument3 pagesCorporate Accounting Assignment-IiTIRUNAGIRI PRANAV SAINo ratings yet

- New Microsoft Excel WorksheetDocument1 pageNew Microsoft Excel WorksheetCritiNo ratings yet

- Rural DemandDocument1 pageRural DemandCritiNo ratings yet

- GST Revenue ShortfallDocument3 pagesGST Revenue ShortfallCritiNo ratings yet

- Indian Automobile Sector Going Through A Rough Patch: Growth PathDocument2 pagesIndian Automobile Sector Going Through A Rough Patch: Growth PathCritiNo ratings yet

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentCritiNo ratings yet

- Liquidity Injection - A Real Solution To The Current Crisis in India?Document4 pagesLiquidity Injection - A Real Solution To The Current Crisis in India?CritiNo ratings yet

- Top Indian Pharma Companies Market CapitalizationDocument12 pagesTop Indian Pharma Companies Market CapitalizationCritiNo ratings yet

- India Gaining Resilience Over China 14Document3 pagesIndia Gaining Resilience Over China 14CritiNo ratings yet

- Stimulus 20 Lac Crore MathsDocument1 pageStimulus 20 Lac Crore MathsCritiNo ratings yet

- India China Trade FactsDocument4 pagesIndia China Trade FactsCritiNo ratings yet

- Diagnosis of Public Sector Units in India: What Is PSU?Document2 pagesDiagnosis of Public Sector Units in India: What Is PSU?CritiNo ratings yet

- Is Bad Bank A Complete Solution To NPAsDocument3 pagesIs Bad Bank A Complete Solution To NPAsCritiNo ratings yet

- MSME ClassificationDocument1 pageMSME ClassificationCritiNo ratings yet

- Indian Pharmaceuticals - We Trust: Demand SidedDocument2 pagesIndian Pharmaceuticals - We Trust: Demand SidedCritiNo ratings yet

- Economic FalloutDocument2 pagesEconomic FalloutCritiNo ratings yet

- What Is in Store For India in RCEPDocument3 pagesWhat Is in Store For India in RCEPCritiNo ratings yet

- Micro, Small and Medium Enterprises RedefinedDocument3 pagesMicro, Small and Medium Enterprises RedefinedCritiNo ratings yet

- A Gradual Shift From Socialism To CapitalismDocument1 pageA Gradual Shift From Socialism To CapitalismCritiNo ratings yet

- DHFL CrisisDocument2 pagesDHFL CrisisCritiNo ratings yet

- Blemishing GDP Quarterly ResultsDocument4 pagesBlemishing GDP Quarterly ResultsCritiNo ratings yet

- Fuel Prices Roaring in IndiaDocument10 pagesFuel Prices Roaring in IndiaCritiNo ratings yet

- India Seek Permanency at UNSCDocument2 pagesIndia Seek Permanency at UNSCCritiNo ratings yet

- Is Minimum Coporate Tax JustifiedDocument1 pageIs Minimum Coporate Tax JustifiedCritiNo ratings yet

- Is Minimum Coporate Tax JustifiedDocument1 pageIs Minimum Coporate Tax JustifiedCritiNo ratings yet

- What Is in Store For India in RCEPDocument3 pagesWhat Is in Store For India in RCEPCritiNo ratings yet

- 31 The Upscaling Business of Private EquityDocument12 pages31 The Upscaling Business of Private EquityCritiNo ratings yet

- Diagnosis of Public Sector Units in India: What Is PSU?Document2 pagesDiagnosis of Public Sector Units in India: What Is PSU?CritiNo ratings yet

- Npa 7Document2 pagesNpa 7CritiNo ratings yet

- Indices Leap Forward: What's Souping Up Indian Bourses Amid Crisis - ?Document4 pagesIndices Leap Forward: What's Souping Up Indian Bourses Amid Crisis - ?CritiNo ratings yet

- Diagnosis of Public Sector Units in India: What Is PSU?Document2 pagesDiagnosis of Public Sector Units in India: What Is PSU?CritiNo ratings yet

- FAR Finals ReviewerDocument5 pagesFAR Finals ReviewerJulie Anne DanteNo ratings yet

- Ifrs 8 Operating SegmentsDocument1 pageIfrs 8 Operating SegmentsMark Lord Morales BumagatNo ratings yet

- Foreign Currency Translation and ConsolidationDocument15 pagesForeign Currency Translation and ConsolidationYing LiuNo ratings yet

- Mba 202 PDFDocument2 pagesMba 202 PDFSimanta KalitaNo ratings yet

- Solution To Chapter 23Document11 pagesSolution To Chapter 23Cindy Pausanos Paradela100% (1)

- Primary Dealer System - A Comparative StudyDocument5 pagesPrimary Dealer System - A Comparative Studyprateek.karaNo ratings yet

- Financial Accounting and ReportingDocument6 pagesFinancial Accounting and ReportingCedric MepuaNo ratings yet

- Edexcel Level 5Document6 pagesEdexcel Level 5Raja NarenNo ratings yet

- Economic Issues IGCSE (Business Studies)Document4 pagesEconomic Issues IGCSE (Business Studies)an4No ratings yet

- Learning Objective: Daftar Komponen Biaya PensiunDocument3 pagesLearning Objective: Daftar Komponen Biaya Pensiuntes doangNo ratings yet

- Mod 3Document3 pagesMod 3Margarette ManaigNo ratings yet

- Auto Rickshaw - Business PlanDocument28 pagesAuto Rickshaw - Business PlanAbhishek1881100% (1)

- MPBF Other MethodsDocument10 pagesMPBF Other Methodskaren sunilNo ratings yet

- The Global Capitalist Crisis:: Its Origins, Nature and ImpactDocument45 pagesThe Global Capitalist Crisis:: Its Origins, Nature and Impactanmol149No ratings yet

- General Liability QuestionnaireDocument2 pagesGeneral Liability QuestionnaireKenny LeBlancNo ratings yet

- Akshat Ratio AnanlysisDocument8 pagesAkshat Ratio AnanlysisAshutosh GuptaNo ratings yet

- Working Capital BrandixDocument89 pagesWorking Capital BrandixSaisanthosh Kumar SharmaNo ratings yet

- Chapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisDocument4 pagesChapter 12. Tool Kit For Cash Flow Estimation and Risk AnalysisHerlambang PrayogaNo ratings yet

- Vulture CapitalistDocument2 pagesVulture Capitalistjosh321No ratings yet

- Microsoft Dynamics 365 Finance and Operation: ConsolidationDocument9 pagesMicrosoft Dynamics 365 Finance and Operation: ConsolidationSherif KeshtaNo ratings yet

- Maintaining Price Stability Ensuring Adequate Flow of Credit To The Productive Sectors of The Economy To Support Economic Growth Financial StabilityDocument54 pagesMaintaining Price Stability Ensuring Adequate Flow of Credit To The Productive Sectors of The Economy To Support Economic Growth Financial Stabilityfrancis reddyNo ratings yet

- 2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document4 pages2018 March B.com CBCSS Fifth Sem Special Accounting Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- The Wall Street Journal March 17 TH 2023Document42 pagesThe Wall Street Journal March 17 TH 2023Jorge Antonio PichardoNo ratings yet

- Individual Work: Subject: The New York Stock Exchange: Market Capitalization, TrendsDocument8 pagesIndividual Work: Subject: The New York Stock Exchange: Market Capitalization, TrendsArina SapovalovaNo ratings yet

- Financial Analysis Tools and Techniques GuideDocument22 pagesFinancial Analysis Tools and Techniques GuideCamille G.No ratings yet