Professional Documents

Culture Documents

Diagnosis of Public Sector Units in India: What Is PSU?

Uploaded by

CritiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Diagnosis of Public Sector Units in India: What Is PSU?

Uploaded by

CritiCopyright:

Available Formats

Diagnosis of Public Sector Units in India

What is PSU?

Public sector Unit (PSU) or Central Public Sector Enterprise (CPSE) is the company that is owned by

the government of India and the government holds 51% of the stake or more in them.

In 1969, the banks were nationalised because firstly, the private sector banks were biased and

worked with a sole intention of generating profits giving least attention to the social sectors of the

nation. Secondly, nationalisation of banks was done with an intention to bring rural lending and

reach out to the rural areas to increase credit availability to poor by banks. Thirdly, the purpose to

set up PSU’s was to strengthen the core sectors of the economy like rural, agriculture, small and

medium enterprises, generate employment and income for the people of India. There are 300 PSU’s

in India as on March 2019 and gives employment to 15 lakh employees. PSU’s in India hold key

position in sectors like Power, Petroleum, Railways, Coal, Mines, Telecom, Civil Aviation, banks.

Bruised PSU:

PSU’s had been facing problems in India:

Poor policy making and execution

Over constrained due to government restrictions

Lack of flexibility in the market

Over staffing adding more costs

Lack of vision and motivation for self-improvement

Wastage / under- utilisation of resources

Abnormal surge in Non-performing Assets of Public sector banks.

Resolution:

According to the announcement made in Tranche 5 of stimulus package in 2020, the government of

India is framing a new public sector enterprise (PSE) policy in which it will categorise strategic and

non-strategic sectors on the basis of industrial policy, 1991 (under which 90% of the companies were

inclined towards private sector and rest 10% into PSU). Under strategic sector like defence, railways,

medicine, at least, 1 and maximum of 4 should be PSU and also there would be private sector

allowed. While, in non-strategic sector like insurance, mining, discoms and power distribution

companies, PSU’s will be privatised based on feasibility and are open to consolidation. Gradually, the

government is reducing its ownership below 51% and allowing the PSU’s to go private and gain more

competitiveness. Privatisation is aimed at improving the foreign direct investment (FDI) or

investment in sectors that require technological advancements thereby providing a boost to the

economy.

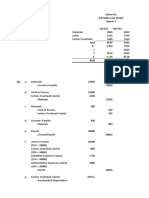

Key strategic disinvestment steps taken:

The government approves strategic disinvestment of 5 PSU’s along with management

control namely, Bharat Petroleum Corporation Limited (BPCL), Shipping Corporation of India

(SCI), Container Corporation of India (CONCOR), North Eastern Electric Power Corporation

(NEEPCO) and Tehri Hydro Development Corporation in India (THDCIL).

Government stake of 53.2% in BPCL along with the management control will be sold to a

strategic buyer.

Government stake of 63.75% in SCI along with management control will be sold to a

strategic buyer.

Government stake of 30.8% in CONCOR with management control will be sold to a strategic

buyer.

The government has 74.32 % stake in THDICL and 100% stake in NEEPCO will be sold to NTPC

along with the management control.

However, the sale of the stake in BPCL, SCI and CONCOR will fetch around 78,400 crore to the

government, moving closer to their disinvestment target for the year. This will give a boost to their

disinvestment programme for CPSE’s and the resources that will unlock from such strategic

disinvestment/privatisation would be used to finance the developmental programmes of

government benefiting the public.

Mixed opinion of experts:

The government officials and market experts suggest that the government must distance

itself from PSU governance in order to give PSU’s a better perception of more flexibility in

the market and make them independent of any government restrictions so that PSU

management can take decisions with more ease and no political interference.

The government must transfer its stake to a holding company and professional board

amendments to ensure effective governance.

Dual regulation of government and Ministry of Finance (MoF) should stop micromanaging

PSU’s and set them free of constraints like lending, management compensation and

recruitment.

They also assert that if PSU’s are privatised, the private players eventually would think only

about profits and least about the development of core sectors of the economy.

Concluding Thoughts:

Privatisation of PSU’s have its good and bad points. Therefore, the government must adopt a

balanced approach wherein they can retain their stake in the PSU’s and also do not let them

completely go in to the hands of private players. Their retained stake and intact management

control helps the government to monitor and keep a tight vigilance in case of any manipulative and

unlawful activities occur within the institutions.

You might also like

- Market Capitalisation of Pharma Companies (Crores)Document12 pagesMarket Capitalisation of Pharma Companies (Crores)CritiNo ratings yet

- Liquidity Injection - A Real Solution To The Current Crisis in India?Document4 pagesLiquidity Injection - A Real Solution To The Current Crisis in India?CritiNo ratings yet

- Blemishing GDP Quarterly ResultsDocument4 pagesBlemishing GDP Quarterly ResultsCritiNo ratings yet

- Indices Leap Forward: What's Souping Up Indian Bourses Amid Crisis - ?Document4 pagesIndices Leap Forward: What's Souping Up Indian Bourses Amid Crisis - ?CritiNo ratings yet

- What Is in Store For India in RCEPDocument3 pagesWhat Is in Store For India in RCEPCritiNo ratings yet

- Fuel Prices Roaring in IndiaDocument10 pagesFuel Prices Roaring in IndiaCritiNo ratings yet

- 31 The Upscaling Business of Private EquityDocument12 pages31 The Upscaling Business of Private EquityCritiNo ratings yet

- Indian Bankruptcy CodeDocument3 pagesIndian Bankruptcy CodeCritiNo ratings yet

- A Gradual Shift From Socialism To CapitalismDocument1 pageA Gradual Shift From Socialism To CapitalismCritiNo ratings yet

- Npa 7Document2 pagesNpa 7CritiNo ratings yet

- Indian Pharmaceuticals - We Trust: Demand SidedDocument2 pagesIndian Pharmaceuticals - We Trust: Demand SidedCritiNo ratings yet

- How Can Gold Play A Fundamental Role For Indian Investment Portfolio???Document3 pagesHow Can Gold Play A Fundamental Role For Indian Investment Portfolio???CritiNo ratings yet

- Economic FalloutDocument2 pagesEconomic FalloutCritiNo ratings yet

- Micro, Small and Medium Enterprises RedefinedDocument3 pagesMicro, Small and Medium Enterprises RedefinedCritiNo ratings yet

- DHFL CrisisDocument2 pagesDHFL CrisisCritiNo ratings yet

- Growing Appetite For GoldDocument2 pagesGrowing Appetite For GoldCritiNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- YÖKDİL Sosyal Phrasal Verb Soru Tipi PDFDocument6 pagesYÖKDİL Sosyal Phrasal Verb Soru Tipi PDFTunahan KüçükerNo ratings yet

- Project Problem One: Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsDocument6 pagesProject Problem One: Chapter 3 Problem 15: Aquatic Supplies Co. INCOME STATEMENT ($ Millions) 2017 AssumptionsShaharyar AsifNo ratings yet

- S.form 2Document3 pagesS.form 2miracle123No ratings yet

- Cma TemplateDocument25 pagesCma TemplateSavoir PenNo ratings yet

- Glascoat 2Document84 pagesGlascoat 2MoinNo ratings yet

- Customer Preference Towards Private Vs Public Sector Banks During The Curren Ttime of RecessionDocument75 pagesCustomer Preference Towards Private Vs Public Sector Banks During The Curren Ttime of Recessionswatisabherwal80% (5)

- ALC Test BankDocument12 pagesALC Test BankJsn Pl Cabg-sNo ratings yet

- CSE - Dividends Updated 21-12-2020Document4 pagesCSE - Dividends Updated 21-12-2020nandikaNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document5 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNo ratings yet

- Grade 11 ACC Session 4 LN PDFDocument4 pagesGrade 11 ACC Session 4 LN PDFrealbutterfly100% (1)

- ProjectDocument24 pagesProjectLohith Sunny Reddy KaipuNo ratings yet

- Sale of Mortgage PropertyDocument16 pagesSale of Mortgage PropertyzainabcheemaNo ratings yet

- Defence Works Procedure 2007: Published by Engineer in Chief Branch Intregated HQ of Mod (Army)Document68 pagesDefence Works Procedure 2007: Published by Engineer in Chief Branch Intregated HQ of Mod (Army)Yamuna jeyaramNo ratings yet

- Juarez Inc Job Order Cost Sheets (1) March 1 Job 621 Job 622Document3 pagesJuarez Inc Job Order Cost Sheets (1) March 1 Job 621 Job 622ramaNo ratings yet

- Bamimo 0001Document1 pageBamimo 0001sarha sharma0% (1)

- ProjectDocument53 pagesProjectsiddhant jainNo ratings yet

- Objectives and Research Methodology: ObjectiveDocument82 pagesObjectives and Research Methodology: ObjectiveRahul RanjanNo ratings yet

- Solution Manual For Principles of Taxation For Business and Investment Planning 16th Edition by JonesDocument5 pagesSolution Manual For Principles of Taxation For Business and Investment Planning 16th Edition by JonesThanhTrúcc100% (1)

- Job WorkDocument2 pagesJob WorkPragasNo ratings yet

- Share Buy-Back by Companies in NigeriaDocument8 pagesShare Buy-Back by Companies in NigeriaTope Adebayo LLPNo ratings yet

- Sample Appellee's BriefDocument21 pagesSample Appellee's Briefclaesguerra0% (1)

- Saura Vs DBPDocument5 pagesSaura Vs DBPmifajNo ratings yet

- Impulse Wave PatternDocument13 pagesImpulse Wave Patternpuplu123No ratings yet

- CHAPTER 3: Fundamental Concepts and Tools of Business FinanceDocument19 pagesCHAPTER 3: Fundamental Concepts and Tools of Business FinancePhia TeoNo ratings yet

- Sensata Technologies Holland B.V: InvoiceDocument2 pagesSensata Technologies Holland B.V: InvoiceDayana IvanovaNo ratings yet

- DHYANIDocument2 pagesDHYANIVinodeshwar GandlaNo ratings yet

- MFE Study GuideDocument17 pagesMFE Study Guideahpohy100% (1)

- Articles of Association As Per New Companies Act 2013Document14 pagesArticles of Association As Per New Companies Act 2013greeshmaNo ratings yet

- Open Letter From The Deputy Director General, Budget, Personnel and Management Systems Department, Asian Development BankDocument4 pagesOpen Letter From The Deputy Director General, Budget, Personnel and Management Systems Department, Asian Development BankBryan ChingNo ratings yet

- 2017 Sec 4E5N Prelim Paper 2 - AnsDocument7 pages2017 Sec 4E5N Prelim Paper 2 - AnsDamien SeowNo ratings yet