Professional Documents

Culture Documents

Bank Reconciliation

Bank Reconciliation

Uploaded by

April Manalo0 ratings0% found this document useful (0 votes)

21 views6 pagesgd

Original Title

430035076 Bank Reconciliation

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgd

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views6 pagesBank Reconciliation

Bank Reconciliation

Uploaded by

April Manalogd

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

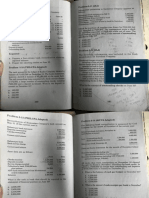

Z z ‘a monthly bank reconciliation, which of the

PROBLEM Fitems would be added to the balance per bank

parva the cnet cath balance?

Problem 4-1 Multiple choice ° “es

prvi charge

1A bank reconciliation is Sai

note collected by the bank on behalf of

4 A formal Snaeial sateen

account bale en

{merger fo sink hk paring a bank reconciliation, bank credits are

© Astatement sent by the b

basis, 7 to the bank statement balance,

A schedule that acount Jedueted from the bank statement balance.

fan entity's cash balance a % to the balance per book.

and the cash balance ha Dedlueted from the balance per book:

2. Which of the following ite Dpalance shown on an entity's bank statement is leas

balance per ledger inp the correct cash balance and neither the entity nor

‘ends with adjusted cash Tse mado any errors, thore must be

Note receivable eo

depositor and erdited

NSF customer chock

Service charge

Erroneous bank

credited by the bank but not yet recorded by

charges not yet recorded by the entity

i fash balance shown on af entity's accounting records

statement balance in than the eorrect cash balance and neither the entity

fends with adjusted Dank has made any errors, there must be

sits credited by the bank but not yet recorded by

‘entity

8. Bank re

‘ais to identi aap eaeoa sna monn, nada

ae ae ny ak fei nro, sear x bas onion

Part of the depositor shall cing the adjusted balance method. Also, prepare

a nae ’ ae on th boa of Apathy Compe

error, outetanding rots

. Campeny Connie) ___

‘Check No. Withdrawal Deposits Balance

5 109000 100,000,

ee :

a _ Bee on Se

1.000

130,000

— 100,

208,000,

‘Are taken from the "

‘May include a debit to of

anes i Des. & Check No 101 5.600"

May include a credit Check No. 102 16,000

customer check, 8 Check No. 103 40,000

May include a debit tp D x & Chek No-t0s 1000)

‘customer check. 14 Chesk No. 106 25,000

9. The adjusting entries for @

25 Check No. 107 56,000,

10, Which ofthe following

1. Blank service hay ‘made by the bank on December 29 represents the

ledger to be ig ef a ote received fm a customer which was even

ther thing m by the entity on Devember 26.

all other things snk for ealletion by the entity on Ds

43 (IAA)

ledger account is a copy of the bank account in

‘Company.

‘SECOND BAN}

YY

Rien: 1LCPA Adapted)

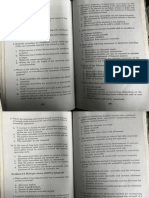

Problem 4-15 (AICPA Adapted) ~ ee CPA Sdapted)

ing the audit of Emphatic Company on December 21, 2012,

the

In preparing ite August 31, 20) Ws data are gathered

Adorable Company has made

information

Balance perbanktatement

Depot in trentt

Return ef antomerchck or

Outstandingchecke

Bank serie chorge for Augurt

(On August 81, 2012, what i th

Problem 4-16 (AICPA.

Company provided the following data forthe purpose

In preparing its bank res the eash balance por book with the cash balance

Cardinal Company has statement on December 31, 2012;

Balance per bank statement 2,000,000

Deposit intranit é 150,000

‘Amount eronea

ng heck Gling ca £100,000) 50,000

ad checkofP190,00) $00.00

Aerator OFF =D.

rodeposied and cata hy Dsemles 2) 150,000

ditto Endemic account, representing

“ . 7 ga.000

7,000

fash in bank to be reported in the December 31,

of financial postion?

Problem 4-19 (AA)

ony» bank statement forthe month of April

Adversary Company keeps all itt Ps

An examination of the entity's a or ps

atemene forthe month coded

‘olowing information

‘The cash balance per bok

© A deposit o¢ POO ound acsiner chek for P35,000)payabe

depecttory on dame 90 da Be Company thst Haas been depend an

nea Gerebrded The gneral edgar anova

of PO20,000, What in tho aajuted cash in

Tho bank salen ‘pn 30?

nto for Advernry Co Rs,

of P9500 vo the en

* Chocks outstanding on June

Adversary Company dis e

SJune for P200,000 in payment 4-21 (PHILCPA Adapted)

a ing information pertains to Beacon Company on

* Included with the June Bie Bt 2012:

‘for P250,000 that Ad er hank statement 4.000¢

‘customer on June essaning cling cited bck 100.00) Soe

ote colectc by bane for Bescon 150.000

* The bank statement. of ustomers returned by bank, 200,000

n benice charge shown in December bank statement “600

june P by Beacon in recordingacheck that) 2)

the bakin Decenber check was draw |

What isthe cash in ba ber forP100,000 but recorded at PI0.000)"” | 90,000

financial positon on eal 1,300,000

aa Be nf aaron Dect, 2012

‘9,000,000 9,000

ie

Problem 4-22 (CGA0) 4 HILCPA Adapted)

On March 81, 2012, Decent Compan the cash ncounts of Gaiety Company on

Statement. A' bank seconeliatog i Fae ENG che talowing iiormation in nvalable:

following available information: ata! rid

73100 000

February 28 book balance

Neeaicced peat 00000

ineretentedeons “ioe

Notched staan Aa

Boer cra NS ck Vato 7

Other bank service charges ‘s#,.000

Outstanding coe = tom

Bea ay 2k pone

1 rons 24. % 190,000 7 pps,

What isthe enah bullice por acc 1000 7

1,495,000

by 1.533.000

& 1/338,000

1,557,000

Problem 4-28 (IAA)

Sapphire Coupe

the month of December

Balance per bank tatament

Bank sorice charge fr

Interest paid by bank ela Weposit of P230,Q00 made on the last day of the

Deposits ada bateoeg The bank statement showed a coletion by the bank

(Checks written but nt yee 4,000 and a customer's check for P32,000 returned

ue was NSE. A customers check for 249,000 vas

Sapphite Company fon the books as P54,000, and a check written for

erroneously recorded a A recorded as P97,000. What is the correct balance

been. recorded for PO h account?

edger-on December 3

a 2,500,000

B. 2,520,000

‘e. 2,540,000

d. 2,800,000

\

Problem 4.26 (PHILCPA Ad

The bookkeoper of

following aa recon om

Balance per bank statement

Posi in ennai,

(Ghecktook printing charge

Brror madeby Factor rcoding ©

“seved in December

NSF check

Outstanding check

‘Note collected by bank including PIO

Balance per book

Bsoterie Company has P200, ae 4

31, 2012, What total ation is acalled. “to-date” because it

December 31, 20122 o

jane followed for a onesdate reconciliation are the

a. 2,980,000

{6-7 3,095,000 {wo-date reconciliation.

2,895,000

a. 3,130,000 conciiation becomes complicated only when certain

Ser omitted henoe the necessity for computing them.

Froblem «77 0G the facts are available, thon reconciliation statements

stom Company's moni i prepare as of he two ater rose

balance of P3,600,000, 0

1,200,000, a depot dikor, the omitted information may be any one oF a

find a check for P50,000¥8 ‘ofthe flowing:

SMainot the account

tcount a month-end? tlanc — beginning and ending

‘ Beginning and ending

jis in transit ~ beginning ond ending

2,750,000

2,850,000 fanding checks ~ beginning and ending

2,050,000

4,350,000 Balances are not given, the following formas

beginning balances are omitted, the formulas

be reversed or just work back,

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- BSMAC 2019 FlowchartDocument1 pageBSMAC 2019 FlowchartMikaela SamonteNo ratings yet

- Section 3 Obligations of The Partners With Regard To Third Persons PDFDocument16 pagesSection 3 Obligations of The Partners With Regard To Third Persons PDFMikaela SamonteNo ratings yet

- NDNDJDDocument15 pagesNDNDJDMikaela SamonteNo ratings yet

- Section 3 Obligations of The Partners With Regard To Third Persons PDFDocument16 pagesSection 3 Obligations of The Partners With Regard To Third Persons PDFMikaela SamonteNo ratings yet

- Revised Corp. Code PDFDocument9 pagesRevised Corp. Code PDFMikaela SamonteNo ratings yet

- Chapter 3 Dissolution and Winding UpDocument20 pagesChapter 3 Dissolution and Winding UpMikaela SamonteNo ratings yet

- Structure of Interest Rates PDFDocument6 pagesStructure of Interest Rates PDFMikaela SamonteNo ratings yet

- Specific Format 1. Tables and Figures Must Fit Within MarginDocument3 pagesSpecific Format 1. Tables and Figures Must Fit Within MarginMikaela SamonteNo ratings yet

- Correlational Research - Definition With Examples - QuestionProDocument5 pagesCorrelational Research - Definition With Examples - QuestionProMikaela SamonteNo ratings yet

- BSA SubjectsDocument4 pagesBSA SubjectsMikaela SamonteNo ratings yet

- Chap03 Time Value of MoneyDocument9 pagesChap03 Time Value of MoneyMikaela SamonteNo ratings yet

- 1st Quiz Intacc5Document37 pages1st Quiz Intacc5Mikaela SamonteNo ratings yet

- Proof of CashDocument4 pagesProof of CashMikaela Samonte100% (1)

- BSA 2019 FlowchartDocument1 pageBSA 2019 FlowchartMikaela SamonteNo ratings yet

- Former Cfo of Autonomy Guilty of Accounting FraudDocument3 pagesFormer Cfo of Autonomy Guilty of Accounting FraudMikaela SamonteNo ratings yet

- Accounts ReceivableDocument11 pagesAccounts ReceivableMikaela SamonteNo ratings yet

- Cash and Cash Equivalents PDFDocument10 pagesCash and Cash Equivalents PDFMikaela SamonteNo ratings yet

- Chapt 23 Current LiabilitiesDocument47 pagesChapt 23 Current LiabilitiesMikaela SamonteNo ratings yet

- Safari - Aug 9, 2019 at 7:11 AM PDFDocument1 pageSafari - Aug 9, 2019 at 7:11 AM PDFMikaela SamonteNo ratings yet

- Safari - Aug 9, 2019 at 7:13 AMDocument1 pageSafari - Aug 9, 2019 at 7:13 AMMikaela SamonteNo ratings yet

- Reviewer in Buslaw FinalsDocument9 pagesReviewer in Buslaw FinalsMikaela SamonteNo ratings yet

- GHHDocument1 pageGHHMikaela SamonteNo ratings yet

- There Were Real Heroes in The Philippine American WarDocument3 pagesThere Were Real Heroes in The Philippine American WarMikaela SamonteNo ratings yet